Key Insights

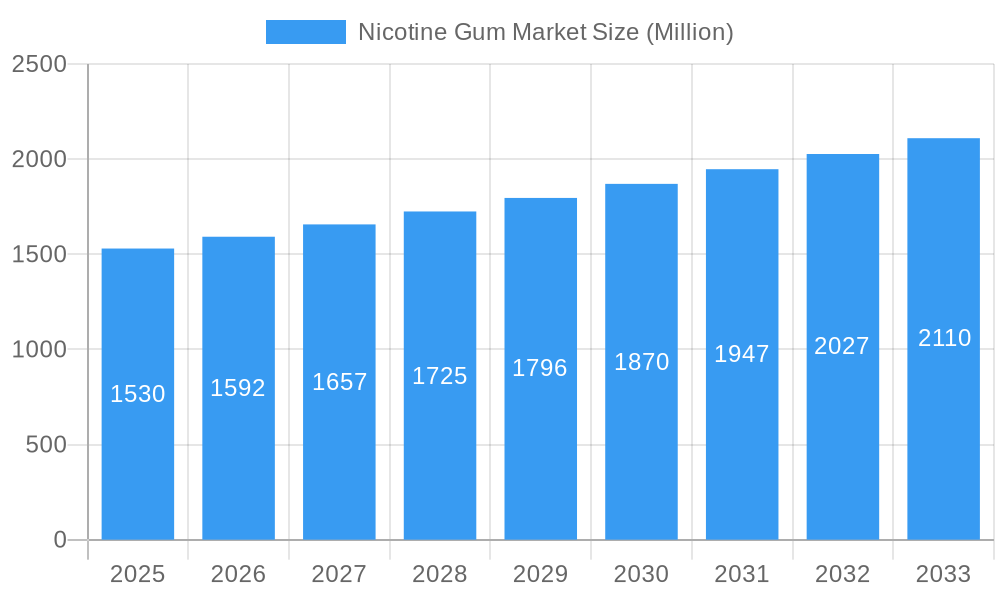

The global nicotine gum market, valued at $1.53 billion in 2025, is projected to experience steady growth, driven by rising smoking cessation rates and increasing awareness of the health risks associated with traditional tobacco products. The market's Compound Annual Growth Rate (CAGR) of 4.11% from 2019 to 2024 suggests a continued expansion through 2033. Key drivers include the growing prevalence of smoking-related diseases, government initiatives promoting smoking cessation, and the increasing availability of nicotine replacement therapies (NRTs) like nicotine gum in various distribution channels, including supermarkets, convenience stores, and online retailers. The market is segmented by nicotine strength (2mg and 4mg gums) offering varying levels of support for smokers attempting to quit. Major players like Philip Morris International, Johnson & Johnson, and British American Tobacco contribute significantly to market growth through their established brands and extensive distribution networks. The North American market currently holds a substantial share, driven by high smoking prevalence and robust healthcare infrastructure. However, emerging markets in Asia Pacific are anticipated to show significant growth potential in the coming years due to rising disposable incomes and increasing awareness of healthier alternatives. While some regional variations exist, the overall market trajectory points towards sustained growth, influenced by evolving consumer preferences and regulatory changes surrounding tobacco control. The continued innovation in nicotine delivery systems and the expansion of product offerings will further shape the market landscape in the forecast period.

Nicotine Gum Market Market Size (In Billion)

The competitive landscape is characterized by both large multinational pharmaceutical companies and specialized consumer healthcare businesses. Successful players leverage their brand recognition, research and development capabilities, and strategic partnerships to gain market share. The evolving regulatory environment related to nicotine products will continue to be a crucial factor influencing market dynamics. Factors such as pricing strategies, product differentiation, and targeted marketing campaigns will play a crucial role in determining future market leadership. The increasing demand for convenient and effective smoking cessation aids will continue to fuel market growth, making nicotine gum a vital component of public health initiatives aimed at reducing tobacco-related harm. Expansion into new markets and the exploration of innovative formulations will further contribute to the market’s evolution.

Nicotine Gum Market Company Market Share

Nicotine Gum Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the global Nicotine Gum market, encompassing market size, growth trends, competitive landscape, and future outlook. With a study period spanning from 2019 to 2033, and a focus on the base year 2025, this report is an invaluable resource for industry professionals, investors, and researchers seeking to understand this dynamic market segment within the broader Nicotine Replacement Therapy (NRT) and Smoking Cessation Aids market. The report offers a granular view of market segments, key players, and significant industry developments, providing actionable insights for strategic decision-making. The estimated market size in 2025 is valued at XX Million units.

Nicotine Gum Market Market Dynamics & Structure

The global nicotine gum market exhibits a moderately consolidated structure with several key players holding significant market share. Market concentration is influenced by factors like brand recognition, distribution network strength, and regulatory approvals. Technological innovation plays a crucial role, with advancements focusing on improved taste, faster absorption rates, and enhanced efficacy. Stringent regulatory frameworks governing the sale and distribution of nicotine products significantly impact market dynamics. The presence of competitive substitutes, such as nicotine patches and lozenges, influences consumer choices. The end-user demographics are primarily adult smokers seeking cessation aids, with significant variations across geographical regions. Mergers and acquisitions (M&A) activity reflects the industry’s consolidation trend, as larger players seek to expand their product portfolios and market reach.

- Market Concentration: Moderately consolidated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on improved formulation, taste masking, and digital health integration. Innovation barriers include regulatory hurdles and R&D costs.

- Regulatory Framework: Stringent regulations on nicotine product marketing and sales vary across regions.

- Competitive Substitutes: Nicotine patches, lozenges, vaping devices, and prescription medications.

- End-User Demographics: Primarily adult smokers aged 25-55, with regional variations.

- M&A Activity: Significant M&A activity observed in recent years, driven by market consolidation and expansion strategies. The total deal volume in the last 5 years was approximately xx Million units.

Nicotine Gum Market Growth Trends & Insights

The nicotine gum market has witnessed consistent growth over the historical period (2019-2024), driven by rising awareness of smoking-related health risks, increasing demand for effective cessation aids, and favorable regulatory support in certain regions. The market's Compound Annual Growth Rate (CAGR) during 2019-2024 was xx%, reaching XX million units. This positive growth trend is expected to continue during the forecast period (2025-2033), propelled by technological advancements, increased consumer preference for NRT products, and expansion into emerging markets. Market penetration has increased steadily, but significant untapped potential remains, particularly in developing countries with high smoking rates. Technological disruptions, such as the integration of digital health platforms, offer new opportunities for market expansion and enhanced user engagement. Consumer behavior shifts towards healthier lifestyles further bolster the market’s growth prospects. The projected CAGR for 2025-2033 is estimated to be xx%.

Dominant Regions, Countries, or Segments in Nicotine Gum Market

The North American and European markets currently dominate the global nicotine gum market, driven by high smoking prevalence rates, strong regulatory frameworks supporting NRT products, and well-established distribution channels. Within these regions, the United States and Germany represent key markets with substantial growth potential. The 4 mg Nicotine Gum segment holds a larger market share compared to the 2 mg segment, reflecting consumer preference for stronger cessation support. Supermarkets/Hypermarkets and Convenience Stores/Tobacco Stores are the leading distribution channels, benefiting from widespread accessibility and established consumer purchasing habits. Online retail channels show significant growth potential, driven by increased e-commerce adoption and convenient home delivery.

- Leading Regions: North America and Europe.

- Key Countries: United States, Germany, United Kingdom.

- Dominant Segment (Type): 4 mg Nicotine Gum.

- Leading Distribution Channels: Supermarkets/Hypermarkets, Convenience Stores/Tobacco Stores.

- Growth Drivers: High smoking prevalence, strong regulatory support for NRT products, widespread distribution networks, and rising health awareness.

Nicotine Gum Market Product Landscape

The nicotine gum market offers a range of products with varying nicotine strengths (2mg and 4mg), flavors, and formulations. Product innovation focuses on improving taste, reducing side effects, and enhancing absorption rates. Many manufacturers are incorporating digital health technologies to provide smokers with additional support and resources to aid their quit journey. Key performance metrics include nicotine delivery rate, user satisfaction, and cessation success rates. Unique selling propositions often revolve around improved taste, enhanced convenience, and the inclusion of digital support tools.

Key Drivers, Barriers & Challenges in Nicotine Gum Market

Key Drivers:

- Increasing awareness about the health hazards of smoking.

- Growing demand for effective smoking cessation therapies.

- Favorable regulatory environments in certain regions.

- Technological advancements leading to improved product formulations.

- Rise in health consciousness and wellness trends.

Challenges and Restraints:

- Intense competition from alternative nicotine replacement therapies and smoking cessation products.

- Stringent regulations and approvals required for new product launches.

- Potential side effects associated with nicotine gum usage can hinder adoption.

- Supply chain disruptions and price volatility of raw materials can impact profitability.

- The illicit trade of nicotine products poses a challenge to market growth.

Emerging Opportunities in Nicotine Gum Market

Emerging opportunities are evident in the expansion into developing markets with high smoking rates but limited access to effective cessation aids. The integration of digital health technologies into nicotine gum products presents a significant opportunity to enhance user engagement and improve cessation success rates. Innovative product formulations, such as flavored gums or gums with improved bioavailability, can attract new consumers and increase market share. Evolving consumer preferences towards personalized healthcare and convenient solutions drive demand for customized nicotine gum offerings and subscription services.

Growth Accelerators in the Nicotine Gum Market Industry

Technological advancements, particularly in the development of more effective and palatable nicotine formulations, represent a significant growth accelerator. Strategic partnerships between pharmaceutical companies and digital health platforms will further enhance market growth by expanding access to resources and improving user engagement. Market expansion into untapped regions and the introduction of innovative product formats will contribute to long-term market expansion.

Key Players Shaping the Nicotine Gum Market Market

- Die betapharm Arzneimittel GmbH

- Alkalon A/S

- Haleon Group of Companies

- Philip Morris International Inc

- Rubicon Research (Rubicon Consumer Healthcare)

- Alchem International Pvt Limited

- Cipla Limited

- Johnson & Johnson

- Perrigo Company plc

- British American Tobacco

- ITC Limited

Notable Milestones in Nicotine Gum Market Sector

- July 2021: Philip Morris International Inc. acquired Fertin Pharma for USD 813.1 million, significantly expanding its presence in the NRT market.

- February 2022: betapharm Arzneimittel GmbH launched generic nicotine chewing gum in Germany, increasing competition and access to affordable NRT options.

- March 2022: Johnson & Johnson launched a digital ecosystem for its Nicorette and NicoDerm products, enhancing user support and engagement.

In-Depth Nicotine Gum Market Market Outlook

The future of the nicotine gum market is promising, driven by continuous innovation in product formulations, the expansion of digital health integration, and increased awareness of smoking-related health risks. Strategic partnerships and market expansion into developing economies offer significant growth opportunities. The integration of data analytics and personalized medicine will further refine product offerings and improve cessation success rates. The market is poised for sustainable growth, driven by the growing global health consciousness and the increasing adoption of NRT products as effective smoking cessation tools.

Nicotine Gum Market Segmentation

-

1. Type

- 1.1. 2 mg Nicotine Gum

- 1.2. 4 mg Nicotine Gum

-

2. Distribution Channels

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores/Tobacco Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Nicotine Gum Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Nicotine Gum Market Regional Market Share

Geographic Coverage of Nicotine Gum Market

Nicotine Gum Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Social Media Marketing; Lower-risk Factor Associated with the Use of E-Cigarettes Compared to Conventional/Combustible Cigarettes

- 3.3. Market Restrains

- 3.3.1. Government Initiatives to Ban Disposable E-Cigarettes

- 3.4. Market Trends

- 3.4.1. Rising Awareness Regarding Health Hazards Associated with Smoking

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nicotine Gum Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. 2 mg Nicotine Gum

- 5.1.2. 4 mg Nicotine Gum

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores/Tobacco Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Nicotine Gum Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. 2 mg Nicotine Gum

- 6.1.2. 4 mg Nicotine Gum

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores/Tobacco Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Nicotine Gum Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. 2 mg Nicotine Gum

- 7.1.2. 4 mg Nicotine Gum

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores/Tobacco Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Nicotine Gum Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. 2 mg Nicotine Gum

- 8.1.2. 4 mg Nicotine Gum

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores/Tobacco Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Nicotine Gum Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. 2 mg Nicotine Gum

- 9.1.2. 4 mg Nicotine Gum

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores/Tobacco Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Nicotine Gum Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. 2 mg Nicotine Gum

- 10.1.2. 4 mg Nicotine Gum

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores/Tobacco Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Die betapharm Arzneimittel GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Alkalon A/S*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Haleon Group of Companies

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Philip Morris International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Rubicon Research (Rubicon Consumer Healthcare)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Alchem International Pvt Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cipla Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Johnson & Johnson

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Perrigo Company plc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 British American Tobacco

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ITC Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Die betapharm Arzneimittel GmbH

List of Figures

- Figure 1: Global Nicotine Gum Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Nicotine Gum Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Nicotine Gum Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Nicotine Gum Market Revenue (Million), by Distribution Channels 2025 & 2033

- Figure 5: North America Nicotine Gum Market Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 6: North America Nicotine Gum Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Nicotine Gum Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Nicotine Gum Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Nicotine Gum Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Nicotine Gum Market Revenue (Million), by Distribution Channels 2025 & 2033

- Figure 11: Europe Nicotine Gum Market Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 12: Europe Nicotine Gum Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Nicotine Gum Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Nicotine Gum Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Nicotine Gum Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Nicotine Gum Market Revenue (Million), by Distribution Channels 2025 & 2033

- Figure 17: Asia Pacific Nicotine Gum Market Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 18: Asia Pacific Nicotine Gum Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Nicotine Gum Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Nicotine Gum Market Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Nicotine Gum Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Nicotine Gum Market Revenue (Million), by Distribution Channels 2025 & 2033

- Figure 23: South America Nicotine Gum Market Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 24: South America Nicotine Gum Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Nicotine Gum Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Nicotine Gum Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Nicotine Gum Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Nicotine Gum Market Revenue (Million), by Distribution Channels 2025 & 2033

- Figure 29: Middle East and Africa Nicotine Gum Market Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 30: Middle East and Africa Nicotine Gum Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Nicotine Gum Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Nicotine Gum Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Nicotine Gum Market Revenue Million Forecast, by Distribution Channels 2020 & 2033

- Table 3: Global Nicotine Gum Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Nicotine Gum Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Nicotine Gum Market Revenue Million Forecast, by Distribution Channels 2020 & 2033

- Table 6: Global Nicotine Gum Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Nicotine Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Nicotine Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Nicotine Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Nicotine Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Nicotine Gum Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Nicotine Gum Market Revenue Million Forecast, by Distribution Channels 2020 & 2033

- Table 13: Global Nicotine Gum Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Spain Nicotine Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Nicotine Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Nicotine Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Nicotine Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Nicotine Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Russia Nicotine Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Nicotine Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Nicotine Gum Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Nicotine Gum Market Revenue Million Forecast, by Distribution Channels 2020 & 2033

- Table 23: Global Nicotine Gum Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Nicotine Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Nicotine Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Nicotine Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Nicotine Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Nicotine Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Nicotine Gum Market Revenue Million Forecast, by Type 2020 & 2033

- Table 30: Global Nicotine Gum Market Revenue Million Forecast, by Distribution Channels 2020 & 2033

- Table 31: Global Nicotine Gum Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Nicotine Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Nicotine Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Nicotine Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Nicotine Gum Market Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Nicotine Gum Market Revenue Million Forecast, by Distribution Channels 2020 & 2033

- Table 37: Global Nicotine Gum Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South Africa Nicotine Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: United Arab Emirates Nicotine Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Nicotine Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nicotine Gum Market?

The projected CAGR is approximately 4.11%.

2. Which companies are prominent players in the Nicotine Gum Market?

Key companies in the market include Die betapharm Arzneimittel GmbH, Alkalon A/S*List Not Exhaustive, Haleon Group of Companies, Philip Morris International Inc, Rubicon Research (Rubicon Consumer Healthcare), Alchem International Pvt Limited, Cipla Limited, Johnson & Johnson, Perrigo Company plc, British American Tobacco, ITC Limited.

3. What are the main segments of the Nicotine Gum Market?

The market segments include Type, Distribution Channels.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.53 Million as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Social Media Marketing; Lower-risk Factor Associated with the Use of E-Cigarettes Compared to Conventional/Combustible Cigarettes.

6. What are the notable trends driving market growth?

Rising Awareness Regarding Health Hazards Associated with Smoking.

7. Are there any restraints impacting market growth?

Government Initiatives to Ban Disposable E-Cigarettes.

8. Can you provide examples of recent developments in the market?

March 2022: Johnson & Johnson's Nicorette and NicoDerm launched a digital ecosystem, a website that offers support for smokers on their quit journey. The website is equipped with various resources and tools, including education, motivation, and support, to make quitting smoking easier. The company has designed this new strategy as a portfolio of nicotine replacement therapy (NRT) solutions to combine various options to help smokers quit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nicotine Gum Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nicotine Gum Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nicotine Gum Market?

To stay informed about further developments, trends, and reports in the Nicotine Gum Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence