Key Insights

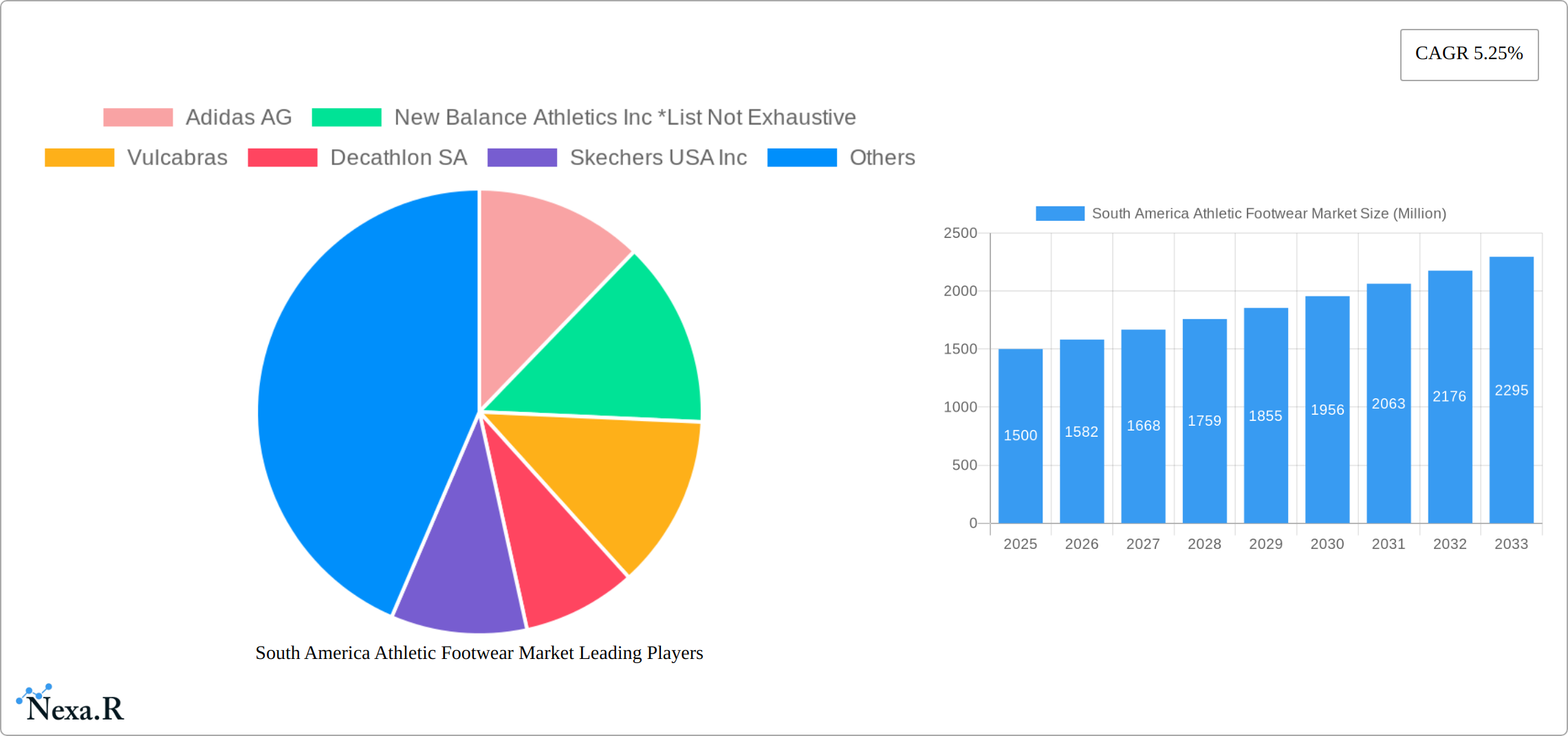

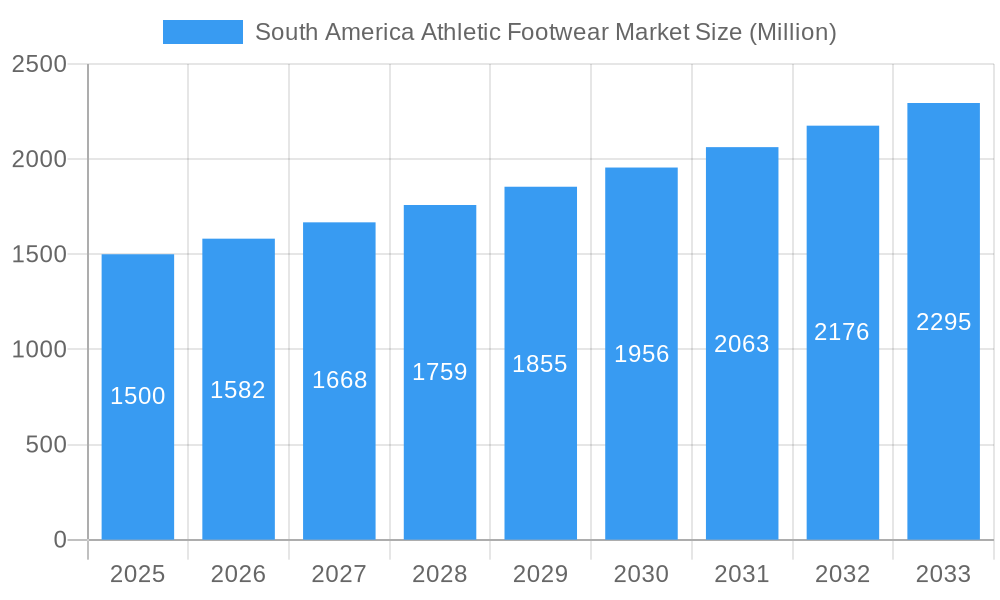

The South American athletic footwear market, valued at approximately $X million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.25% from 2025 to 2033. This expansion is driven by several key factors. Increasing health consciousness among consumers, coupled with rising disposable incomes and a burgeoning middle class across countries like Brazil and Argentina, are fueling demand for athletic footwear. Furthermore, the growing popularity of various sports and fitness activities, including running, hiking, and team sports, significantly contributes to market growth. The influence of social media and celebrity endorsements further amplify consumer interest and drive purchases. The market is segmented by distribution channels (supermarkets/hypermarkets, online retail stores, others), product types (running shoes, sports shoes, trekking/hiking shoes, others), and end-users (men, women, children). Online retail channels are experiencing particularly rapid growth, benefiting from improved e-commerce infrastructure and enhanced consumer trust in online transactions. While the market faces potential restraints such as economic volatility and fluctuating exchange rates, the overall growth trajectory remains positive, particularly within the key segments of running shoes and the expanding online retail sector. Brazil and Argentina represent the largest markets within South America, reflecting their higher populations and stronger economies.

South America Athletic Footwear Market Market Size (In Billion)

The competitive landscape is characterized by a mix of international giants like Adidas, Nike, and Puma, alongside regional players and local brands. These companies are increasingly focusing on product innovation, targeted marketing campaigns, and strategic partnerships to strengthen their market positions. The introduction of innovative materials, sustainable manufacturing processes, and technologically advanced footwear are all contributing to the market's dynamism. The ongoing expansion of sports infrastructure and the rise of fitness-oriented lifestyle choices promise further growth prospects for the South American athletic footwear market in the coming years. This positive outlook indicates significant opportunities for existing players and new entrants aiming to capture market share within this dynamic and expanding sector.

South America Athletic Footwear Market Company Market Share

This in-depth report provides a comprehensive analysis of the South America athletic footwear market, encompassing market dynamics, growth trends, key players, and future outlook. With a detailed examination of the parent market (athletic footwear) and its child markets (running shoes, sport shoes, etc.), this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year. The report projects the market size in million units and analyzes key segments by distribution channel, product type, and end-user.

South America Athletic Footwear Market Dynamics & Structure

The South American athletic footwear market is characterized by a moderately concentrated landscape, with key players like Nike Inc, Adidas AG, and Puma SE holding significant market share. However, regional players and emerging brands are increasingly challenging the dominance of established multinational corporations. Technological innovations, particularly in material science and performance enhancement, are driving product differentiation and consumer preference. Regulatory frameworks regarding product safety and environmental impact are evolving, influencing manufacturing practices and supply chains. The market also witnesses competition from substitute products, such as casual sneakers and sandals, depending on the specific product type and consumer preference. End-user demographics, with a growing young population and rising disposable incomes in certain regions, significantly influence market demand. Furthermore, the market has seen several mergers and acquisitions (M&A) activities in recent years.

- Market Concentration: xx% held by top 5 players in 2024.

- Technological Innovation Drivers: Focus on lightweight materials, improved cushioning, and data-driven performance analysis.

- Regulatory Frameworks: Increasing emphasis on sustainable manufacturing and ethical sourcing.

- Competitive Product Substitutes: Casual footwear poses a significant competition for certain segments.

- End-User Demographics: Growing young population driving demand for athletic footwear, particularly in Brazil and Colombia.

- M&A Trends: xx M&A deals recorded between 2019-2024, with a focus on expanding distribution networks and product portfolios.

South America Athletic Footwear Market Growth Trends & Insights

The South American athletic footwear market demonstrated robust growth during the historical period (2019-2024), exhibiting a Compound Annual Growth Rate (CAGR) of **[Insert Historical CAGR %]**. Projections indicate continued expansion, with the market anticipated to grow at a CAGR of **[Insert Forecast CAGR %]** during the forecast period (2025-2033), reaching an estimated **[Insert Market Value in Million Units]** million units by 2033. This upward trajectory is significantly influenced by a confluence of factors, including rising disposable incomes across key economies, a burgeoning health and wellness consciousness among consumers, and a notable surge in participation across a diverse range of sports and fitness activities throughout the region.

Technological advancements are acting as powerful catalysts, with the introduction of innovative products such as smart athletic footwear equipped with integrated fitness tracking capabilities and the increasing personalization of fitness solutions, all of which are actively reshaping market dynamics and consumer engagement. Consequently, consumer preferences are demonstrably shifting towards premium, performance-oriented, and specialized athletic footwear, underscoring a growing demand for products that deliver superior functionality and athlete support. The market penetration of athletic footwear is poised for significant augmentation, particularly within emerging economies where factors such as affordability and enhanced accessibility are paramount to broader adoption.

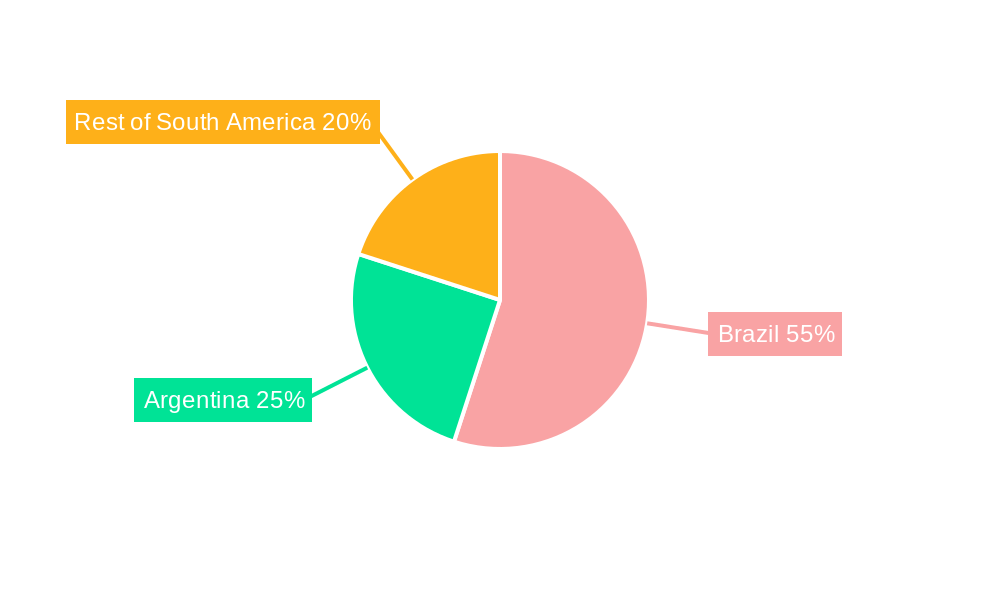

Dominant Regions, Countries, or Segments in South America Athletic Footwear Market

Brazil continues to hold a dominant position in the South American athletic footwear market, representing approximately **[Insert Brazil's Market Share %]**% of the total market value in 2024. This leadership is underpinned by its substantial population base, high engagement in sporting activities, and a well-developed and extensive retail infrastructure. Colombia and Argentina are also emerging as critical growth markets, displaying strong potential and significant expansion opportunities.

By Distribution Channel: The online retail sector is experiencing substantial and accelerated growth, propelled by increasing internet penetration rates and the widespread adoption of e-commerce platforms across the region. While online channels are gaining traction, supermarkets and hypermarkets continue to be a prevalent and dominant distribution channel, particularly for mass-market brands and broader consumer accessibility.

By Product Type: Running shoes remain the largest and most dominant product segment within the athletic footwear market. Following closely are general sport shoes and, with growing interest, trekking and hiking footwear, indicating a diversification of consumer needs.

By End-user: The male demographic currently commands the largest share of the athletic footwear market, with women's and children's segments also demonstrating steady growth and increasing market presence.

- Key Drivers in Brazil: A substantial population base, consistently high participation rates in diverse sports, and a robust and mature retail infrastructure are the primary drivers of Brazil's market leadership.

- Key Drivers in Colombia: The expansion of the middle class, a steady rise in disposable incomes, and a pronounced increase in health and fitness consciousness are fueling growth in Colombia.

- Key Drivers in Argentina: Significant e-commerce expansion, coupled with the growing popularity of various fitness activities, is a key accelerator for the Argentinian market.

- Online Retail Growth Drivers: Factors such as enhanced internet accessibility, improvements in logistical networks and delivery services, and the availability of attractive online promotions and discounts are contributing to the surge in online retail for athletic footwear.

South America Athletic Footwear Market Product Landscape

The athletic footwear market is witnessing continuous innovation in materials, design, and technology. Manufacturers are focusing on lightweight, breathable, and durable materials, incorporating advanced cushioning systems and enhanced stability features to cater to diverse user needs and preferences. Smart shoes with integrated sensors and fitness tracking capabilities are gaining traction, appealing to tech-savvy consumers who value data-driven performance insights. Unique selling propositions include specialized footwear for specific sports (e.g., running, basketball, football), sustainable and ethically sourced materials, and customized fit options.

Key Drivers, Barriers & Challenges in South America Athletic Footwear Market

Key Drivers: Rising disposable incomes, increasing health awareness, growing popularity of fitness activities, and technological advancements in footwear technology are major drivers. Government initiatives promoting sports and fitness also contribute.

Key Challenges: Economic instability in some regions, fluctuations in currency exchange rates, and supply chain disruptions due to geopolitical events can significantly impact the market. High import tariffs and taxes can affect affordability and market access. Strong competition from established international brands and the emergence of local brands create price pressure. Counterfeit products also pose a challenge.

Emerging Opportunities in South America Athletic Footwear Market

Significant untapped market potential exists within smaller South American nations that are experiencing economic growth and possess youthful, dynamic populations. These markets represent fertile ground for new entrants and for brands looking to diversify their reach. Furthermore, substantial opportunities lie in the development and promotion of specialized athletic footwear tailored for niche sports and specific activities, catering to unique regional preferences and demands. The market for athletic footwear that is produced sustainably and ethically is also poised for considerable expansion, driven by a growing consumer awareness and demand for environmentally responsible and socially conscious products.

Growth Accelerators in the South America Athletic Footwear Market Industry

Key growth accelerators for the South America athletic footwear market include the formation of strategic partnerships between prominent footwear brands and influential sports organizations, thereby enhancing brand visibility and credibility. The expansion of distribution networks into previously underserved or remote regions will unlock new consumer bases. Furthermore, the adept utilization of digital marketing strategies and advanced e-commerce platforms is crucial for reaching a wider and more engaged audience. Continuous technological breakthroughs in materials science, leading to the development of lighter, more durable, and performance-enhancing materials, alongside innovations in manufacturing processes that contribute to increased efficiency and reduced production costs, are also vital growth accelerators.

Key Players Shaping the South America Athletic Footwear Market Market

- Adidas AG

- New Balance Athletics Inc

- Vulcabras

- Decathlon SA

- Skechers USA Inc

- Puma SE

- Under Armour Inc

- Mizuno Corporation

- Nike Inc

- ASICS Corporation

Notable Milestones in South America Athletic Footwear Market Sector

- 2019 (Month unavailable): Iconix Brand Group extends Umbro's licensing agreement with Grupo Dass in Brazil, Argentina, and Paraguay.

- 2021 (Month unavailable): Nike Inc. transitions its business in Brazil, Argentina, Chile, and Uruguay to strategic distributor partnerships.

- 2022 (Month unavailable): PUMA SE partners with the Brazilian Confederation of Athletics to sponsor national teams.

In-Depth South America Athletic Footwear Market Market Outlook

The South American athletic footwear market is poised for continued growth, driven by several factors including rising disposable incomes, increasing health consciousness, and the adoption of innovative technologies. Strategic opportunities exist for brands focusing on sustainability, personalization, and e-commerce expansion. The market's potential is vast, particularly in untapped regions, representing a significant opportunity for both established and emerging players. Further consolidation through M&A activity can also be anticipated.

South America Athletic Footwear Market Segmentation

-

1. Product Type

- 1.1. Running Shoes

- 1.2. Sport Shoes

- 1.3. Trekking/Hiking Shoes

- 1.4. Other Product Types

-

2. End user

- 2.1. Men

- 2.2. Women

- 2.3. Children

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Online Retail Stores

- 3.3. Others

-

4. Geography

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

South America Athletic Footwear Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Athletic Footwear Market Regional Market Share

Geographic Coverage of South America Athletic Footwear Market

South America Athletic Footwear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Social Media Influence and Aggressive Marketing Fueling Market Demand; Augmented Expenditure on Advertisement and Promotional Activities by Key players

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfiet Products

- 3.4. Market Trends

- 3.4.1. Expanding Sports Sector with Strong Support from Governing Bodies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Athletic Footwear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Running Shoes

- 5.1.2. Sport Shoes

- 5.1.3. Trekking/Hiking Shoes

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End user

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Children

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Online Retail Stores

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Argentina

- 5.5.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Athletic Footwear Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Running Shoes

- 6.1.2. Sport Shoes

- 6.1.3. Trekking/Hiking Shoes

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End user

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Children

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Online Retail Stores

- 6.3.3. Others

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.4.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Athletic Footwear Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Running Shoes

- 7.1.2. Sport Shoes

- 7.1.3. Trekking/Hiking Shoes

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End user

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Children

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Online Retail Stores

- 7.3.3. Others

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Argentina

- 7.4.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America Athletic Footwear Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Running Shoes

- 8.1.2. Sport Shoes

- 8.1.3. Trekking/Hiking Shoes

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End user

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Children

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Online Retail Stores

- 8.3.3. Others

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Argentina

- 8.4.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Adidas AG

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 New Balance Athletics Inc *List Not Exhaustive

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Vulcabras

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Decathlon SA

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Skechers USA Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Puma SE

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Under Armour Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Mizuno Corporation

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Nike Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 ASICS Corporation

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Adidas AG

List of Figures

- Figure 1: South America Athletic Footwear Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Athletic Footwear Market Share (%) by Company 2025

List of Tables

- Table 1: South America Athletic Footwear Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: South America Athletic Footwear Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: South America Athletic Footwear Market Revenue undefined Forecast, by End user 2020 & 2033

- Table 4: South America Athletic Footwear Market Volume K Units Forecast, by End user 2020 & 2033

- Table 5: South America Athletic Footwear Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: South America Athletic Footwear Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 7: South America Athletic Footwear Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: South America Athletic Footwear Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 9: South America Athletic Footwear Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 10: South America Athletic Footwear Market Volume K Units Forecast, by Region 2020 & 2033

- Table 11: South America Athletic Footwear Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 12: South America Athletic Footwear Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 13: South America Athletic Footwear Market Revenue undefined Forecast, by End user 2020 & 2033

- Table 14: South America Athletic Footwear Market Volume K Units Forecast, by End user 2020 & 2033

- Table 15: South America Athletic Footwear Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 16: South America Athletic Footwear Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 17: South America Athletic Footwear Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 18: South America Athletic Footwear Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 19: South America Athletic Footwear Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: South America Athletic Footwear Market Volume K Units Forecast, by Country 2020 & 2033

- Table 21: South America Athletic Footwear Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 22: South America Athletic Footwear Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 23: South America Athletic Footwear Market Revenue undefined Forecast, by End user 2020 & 2033

- Table 24: South America Athletic Footwear Market Volume K Units Forecast, by End user 2020 & 2033

- Table 25: South America Athletic Footwear Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 26: South America Athletic Footwear Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 27: South America Athletic Footwear Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: South America Athletic Footwear Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 29: South America Athletic Footwear Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: South America Athletic Footwear Market Volume K Units Forecast, by Country 2020 & 2033

- Table 31: South America Athletic Footwear Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 32: South America Athletic Footwear Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 33: South America Athletic Footwear Market Revenue undefined Forecast, by End user 2020 & 2033

- Table 34: South America Athletic Footwear Market Volume K Units Forecast, by End user 2020 & 2033

- Table 35: South America Athletic Footwear Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 36: South America Athletic Footwear Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 37: South America Athletic Footwear Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 38: South America Athletic Footwear Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: South America Athletic Footwear Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: South America Athletic Footwear Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Athletic Footwear Market?

The projected CAGR is approximately 2.43%.

2. Which companies are prominent players in the South America Athletic Footwear Market?

Key companies in the market include Adidas AG, New Balance Athletics Inc *List Not Exhaustive, Vulcabras, Decathlon SA, Skechers USA Inc, Puma SE, Under Armour Inc, Mizuno Corporation, Nike Inc, ASICS Corporation.

3. What are the main segments of the South America Athletic Footwear Market?

The market segments include Product Type, End user, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Social Media Influence and Aggressive Marketing Fueling Market Demand; Augmented Expenditure on Advertisement and Promotional Activities by Key players.

6. What are the notable trends driving market growth?

Expanding Sports Sector with Strong Support from Governing Bodies.

7. Are there any restraints impacting market growth?

Availability of Counterfiet Products.

8. Can you provide examples of recent developments in the market?

In 2022, PUMA Se partnered up with the Brazilian Confederation of Athletics to sponsor their national teams. This partnership also includes sponsoring 24 adult and youth teams.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Athletic Footwear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Athletic Footwear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Athletic Footwear Market?

To stay informed about further developments, trends, and reports in the South America Athletic Footwear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence