Key Insights

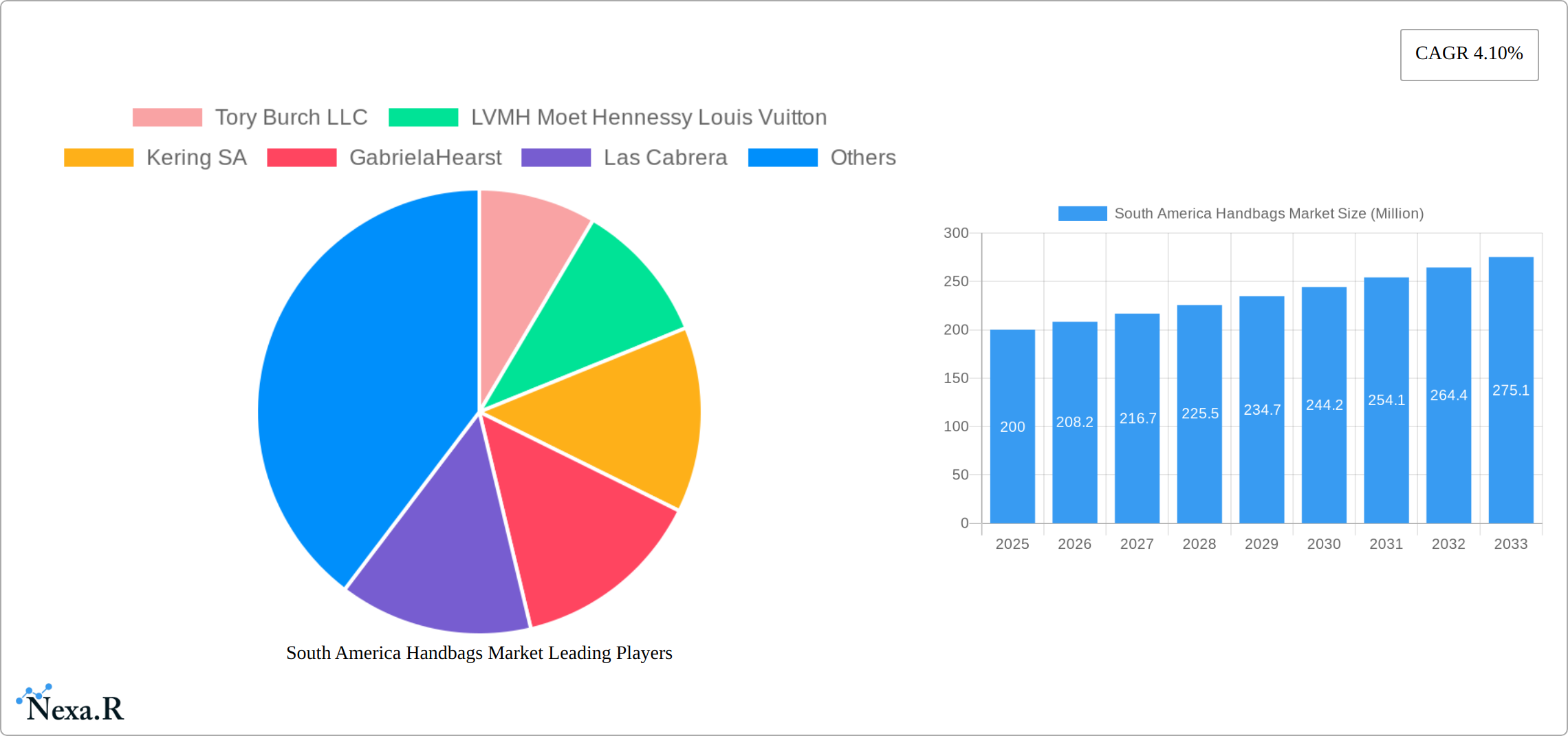

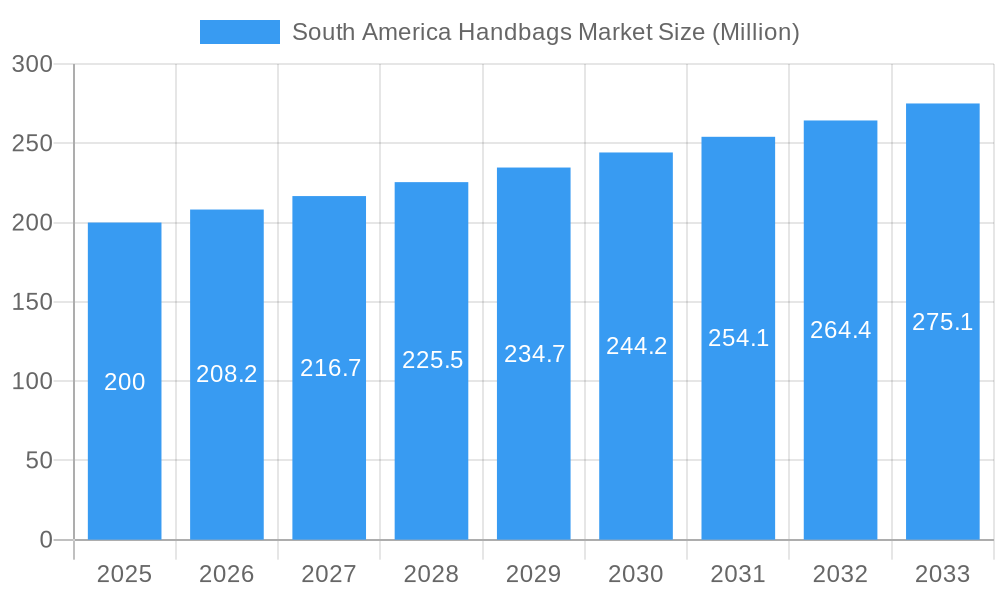

The South American handbags market, currently valued at approximately $XX million (assuming a reasonable market size based on global trends and regional economic factors), is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.10% from 2025 to 2033. This growth is fueled by several key drivers, including rising disposable incomes, particularly within the burgeoning middle class of Brazil and Argentina. Increased fashion consciousness among younger consumers and the influence of social media trends are further stimulating demand for diverse handbag styles, from satchels and clutches to totes and sling bags. The popularity of online retail channels presents significant opportunities for market expansion, offering wider product access and convenience to consumers across diverse geographic locations. However, economic volatility in certain regions of South America and the potential impact of fluctuating exchange rates pose challenges to sustained growth. Competition among established international brands and emerging local labels also contributes to a dynamic market landscape. The market segmentation reveals a strong preference for various styles catering to different needs and occasions, with a notable presence of both online and offline distribution channels reflecting the evolving consumer preferences.

South America Handbags Market Market Size (In Million)

The segment breakdown suggests that while the “Others” category may capture a smaller share of the market currently, its growth potential is noteworthy due to the increasing demand for unique and personalized handbag designs. Brazil and Argentina, as the largest economies in South America, represent significant market hubs, driving a substantial portion of the total regional sales. The substantial forecast period extending to 2033 highlights the long-term growth potential in this region, which is likely to see further development in e-commerce infrastructure and enhanced consumer spending power, driving sustained market expansion over the next decade. The presence of both international luxury brands and local designers suggests a vibrant and diverse market catering to various price points and consumer tastes.

South America Handbags Market Company Market Share

South America Handbags Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South America handbags market, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and market entrants seeking to understand and capitalize on opportunities within this dynamic sector. The market is segmented by type (Satchel, Clutch, Tote Bag, Sling Bag, Others) and distribution channel (Online Stores, Offline Stores). The total market size is projected to reach xx Million units by 2033.

South America Handbags Market Dynamics & Structure

The South America handbags market is characterized by a mix of established international luxury brands and burgeoning local designers. Market concentration is moderate, with a few dominant players alongside a large number of smaller brands. Technological innovation, primarily in materials and manufacturing processes, is a key driver, although access to advanced technologies presents a barrier for some smaller players. Regulatory frameworks vary across countries, impacting import/export and labeling requirements. Competitive product substitutes include other accessories and fashion items. The end-user demographic is broad, encompassing diverse age groups and income levels, with a significant focus on the growing middle class. Mergers and acquisitions (M&A) activity has been relatively limited in recent years (xx deals between 2019-2024), but strategic partnerships are increasingly common.

- Market Concentration: Moderate, with top 5 players holding xx% market share in 2024.

- Technological Innovation: Focus on sustainable materials and smart manufacturing processes.

- Regulatory Framework: Varies across countries, impacting import/export regulations.

- Competitive Substitutes: Wallets, jewelry, other fashion accessories.

- End-User Demographics: Diverse age groups and income levels; growing middle class driving demand.

- M&A Activity: Relatively low in recent years, with a focus on strategic partnerships.

South America Handbags Market Growth Trends & Insights

The South America handbags market has demonstrated robust growth historically (2019-2024), propelled by increasing consumer purchasing power, accelerating urbanization, and a burgeoning appreciation for fashion accessories. The Compound Annual Growth Rate (CAGR) during this period stood at xx%. Projections indicate a sustained, strong growth trajectory for the forecast period (2025-2033), with an anticipated CAGR of xx%. This expansion will be significantly influenced by the expanding reach of online retail, the continued growth of the luxury segment, and the pervasive impact of social media trends. Furthermore, technological innovations, such as the integration of 3D printing for bespoke designs and the utilization of augmented reality for immersive virtual try-on experiences, are actively reshaping consumer engagement and purchasing decisions.

Industry data underscores a notable surge in online handbag sales across major South American urban centers. This trend is closely aligned with the widespread adoption of smartphones and the growing consumer preference for convenient and accessible shopping channels. Consumer purchasing habits are also being shaped by heightened brand awareness and an increased inclination towards investing in premium and luxury products.

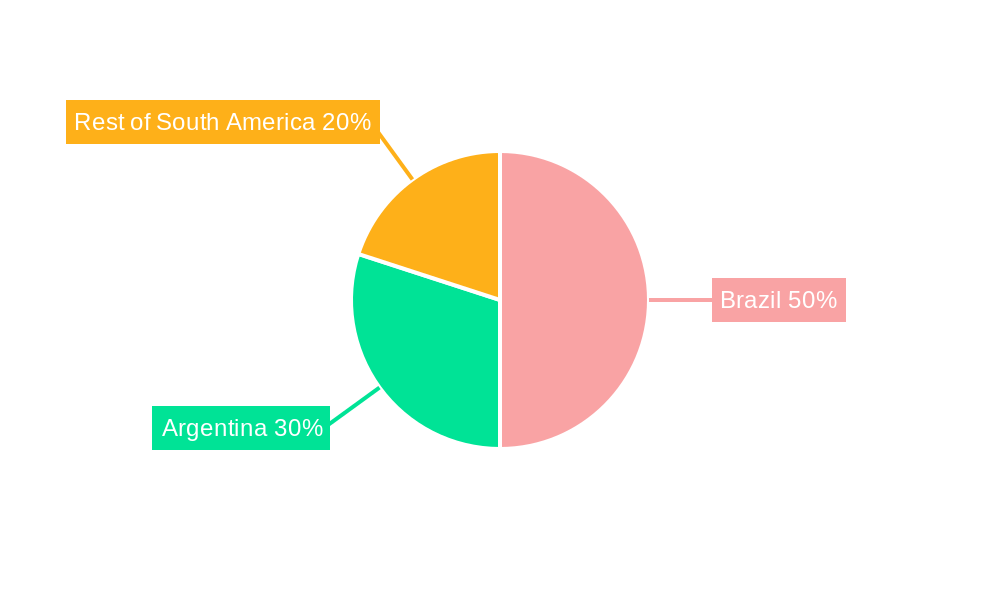

Dominant Regions, Countries, or Segments in South America Handbags Market

Brazil represents the largest market for handbags in South America, accounting for xx% of total market value in 2024, followed by Colombia (xx%) and Argentina (xx%). The dominance of Brazil is attributed to its large population, higher purchasing power, and established fashion retail infrastructure. Within the product segments, tote bags and satchels exhibit higher demand due to their versatility and functionality, holding xx% and xx% market share respectively in 2024. Offline stores remain the dominant distribution channel, commanding xx% of the market, while online channels are experiencing rapid growth, expected to reach xx% by 2033.

- Key Drivers in Brazil: Large population, high purchasing power, well-developed retail infrastructure.

- Key Drivers in Colombia: Growing middle class, rising disposable incomes, increased online shopping adoption.

- Key Drivers in Argentina: Growing fashion-conscious consumer base, and the growing adoption of online shopping.

- Dominant Segments: Tote Bags and Satchels owing to practicality and functionality.

- Dominant Distribution Channel: Offline stores, followed by rapidly growing online sales.

South America Handbags Market Product Landscape

The South American handbag market is characterized by its rich product diversity, spanning from economically accessible, everyday essentials to opulent, high-fashion luxury pieces. Innovation is a key theme, evident in the growing adoption of sustainable materials such as recycled leather and the development of avant-garde designs that seamlessly blend functionality with aesthetic appeal. Market performance is significantly influenced by crucial factors including product durability, superior craftsmanship, and the established reputation of brands. Unique Selling Propositions (USPs) frequently revolve around exclusive design collections, strategic collaborations with celebrated artists, and a strong commitment to ethical and environmentally conscious production practices. Technological advancements are continuously enhancing manufacturing processes, leading to improvements in product quality and optimizing production costs.

Key Drivers, Barriers & Challenges in South America Handbags Market

Key Drivers: A rising tide of disposable incomes, the expansion of the middle-class demographic, ongoing urbanization trends, the burgeoning e-commerce landscape, and the substantial influence of social media platforms.

Challenges: Economic instability prevalent in certain South American nations, significant fluctuations in currency exchange rates, the imposition of high import tariffs in specific regions, the persistent issue of counterfeiting, and intense competition from more affordably priced alternatives. These combined factors collectively present a potential constraint on market expansion, estimated to be around xx% during the forecast period.

Emerging Opportunities in South America Handbags Market

Promising avenues for growth include the burgeoning online luxury market, an escalating demand for handbags that are both sustainable and ethically produced, the increasing popularity of personalized and customized offerings, and strategic market entry into smaller, currently underserved regions within South America. Untapped potential exists within countries like Peru and Ecuador, offering considerable prospects for significant market expansion.

Growth Accelerators in the South America Handbags Market Industry

Long-term growth will be accelerated by strategic partnerships between international luxury brands and local designers, technological advancements in manufacturing and design, expansion into new markets, and increased focus on sustainability and ethical sourcing. Investment in logistics and e-commerce infrastructure will further enhance market reach and efficiency.

Key Players Shaping the South America Handbags Market Market

- Tory Burch LLC

- LVMH Moet Hennessy Louis Vuitton [LVMH Website]

- Kering SA [Kering Website]

- Gabriela Hearst

- Las Cabrera

- Colombian Label Co

- Carla Busso

- Catarina Mina Brand

- Michael Kors (USA) Inc [Michael Kors Website]

- Prada Holding SpA [Prada Website]

Notable Milestones in South America Handbags Market Sector

- April 2021: Balenciaga opens its first store in South America (São Paulo, Brazil), signaling increased investment in the region.

- January 2022: LVMH opens a second Dior store in São Paulo, Brazil, demonstrating the growing appeal of luxury brands.

In-Depth South America Handbags Market Market Outlook

The South America handbags market is poised for continued growth, driven by a confluence of factors including increasing disposable incomes, evolving consumer preferences, and technological advancements. Strategic partnerships and investments in e-commerce will play a crucial role in shaping future market dynamics. The market presents significant opportunities for both established players and new entrants seeking to capitalize on the region’s growing fashion-conscious consumer base. Further expansion into untapped markets and focus on sustainability are likely to unlock considerable long-term potential.

South America Handbags Market Segmentation

-

1. Type

- 1.1. Satchel

- 1.2. Clutch

- 1.3. Tote Bag

- 1.4. Sling Bag

- 1.5. Others

-

2. Distribution Channel

- 2.1. Online Stores

- 2.2. Offline Stores

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Handbags Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Handbags Market Regional Market Share

Geographic Coverage of South America Handbags Market

South America Handbags Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Product Innovations to Drive Demand for Watches; Rising Demand for Premium Fashion Items

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Popularity of Leather Handbags

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Satchel

- 5.1.2. Clutch

- 5.1.3. Tote Bag

- 5.1.4. Sling Bag

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online Stores

- 5.2.2. Offline Stores

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Satchel

- 6.1.2. Clutch

- 6.1.3. Tote Bag

- 6.1.4. Sling Bag

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Online Stores

- 6.2.2. Offline Stores

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Satchel

- 7.1.2. Clutch

- 7.1.3. Tote Bag

- 7.1.4. Sling Bag

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Online Stores

- 7.2.2. Offline Stores

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Satchel

- 8.1.2. Clutch

- 8.1.3. Tote Bag

- 8.1.4. Sling Bag

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Online Stores

- 8.2.2. Offline Stores

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Tory Burch LLC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 LVMH Moet Hennessy Louis Vuitton

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Kering SA

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 GabrielaHearst

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Las Cabrera

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Colombian Label Co

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Carla Busso*List Not Exhaustive

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Catarina Mina Brand

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Michael Kors (USA) Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Prada Holding SpA

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Tory Burch LLC

List of Figures

- Figure 1: South America Handbags Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Handbags Market Share (%) by Company 2025

List of Tables

- Table 1: South America Handbags Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: South America Handbags Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: South America Handbags Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: South America Handbags Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: South America Handbags Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: South America Handbags Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 7: South America Handbags Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: South America Handbags Market Volume K Units Forecast, by Region 2020 & 2033

- Table 9: South America Handbags Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: South America Handbags Market Volume K Units Forecast, by Type 2020 & 2033

- Table 11: South America Handbags Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: South America Handbags Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 13: South America Handbags Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: South America Handbags Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 15: South America Handbags Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: South America Handbags Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: South America Handbags Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: South America Handbags Market Volume K Units Forecast, by Type 2020 & 2033

- Table 19: South America Handbags Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 20: South America Handbags Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 21: South America Handbags Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: South America Handbags Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 23: South America Handbags Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: South America Handbags Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: South America Handbags Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: South America Handbags Market Volume K Units Forecast, by Type 2020 & 2033

- Table 27: South America Handbags Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: South America Handbags Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 29: South America Handbags Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: South America Handbags Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 31: South America Handbags Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: South America Handbags Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Handbags Market?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the South America Handbags Market?

Key companies in the market include Tory Burch LLC, LVMH Moet Hennessy Louis Vuitton, Kering SA, GabrielaHearst, Las Cabrera, Colombian Label Co, Carla Busso*List Not Exhaustive, Catarina Mina Brand, Michael Kors (USA) Inc, Prada Holding SpA.

3. What are the main segments of the South America Handbags Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Product Innovations to Drive Demand for Watches; Rising Demand for Premium Fashion Items.

6. What are the notable trends driving market growth?

Popularity of Leather Handbags.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In January 2022, LVMH opened a second Dior store in Shops Jardins Shopping Center in São Paulo, Brazil. The store features ready-to-wear, handbags, small leather goods, exotic leathers, jewelry, footwear, accessories, and sunglasses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Handbags Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Handbags Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Handbags Market?

To stay informed about further developments, trends, and reports in the South America Handbags Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence