Key Insights

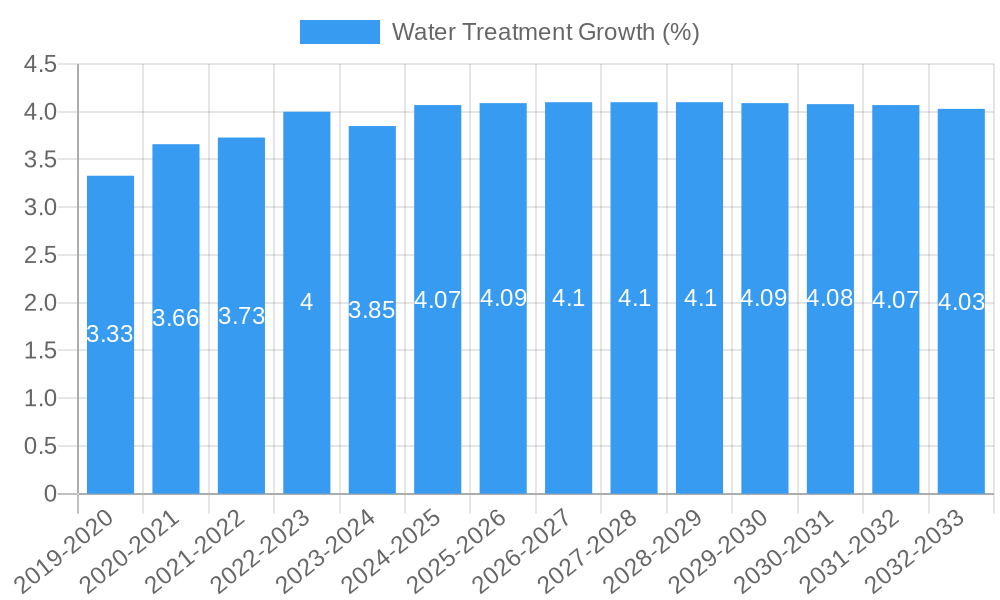

The global water treatment market is poised for significant expansion, projected to reach a substantial market size, driven by an escalating Compound Annual Growth Rate (CAGR) of XX%. This growth is primarily fueled by increasing industrialization across key sectors like Municipal, Power Generation, Chemical, Oil & Gas, and Metals & Mining. Growing concerns over water scarcity, stringent environmental regulations mandating efficient wastewater management, and the rising demand for purified industrial process water are acting as powerful catalysts. The "Others" application segment, encompassing diverse industrial needs and emerging technologies, is also expected to contribute significantly to market dynamics. Furthermore, the constant innovation and adoption of advanced water treatment technologies, including Physical Treatment, Chemical Treatment, and advanced Membrane Treatment solutions, are critical in meeting the ever-evolving quality standards and sustainability goals.

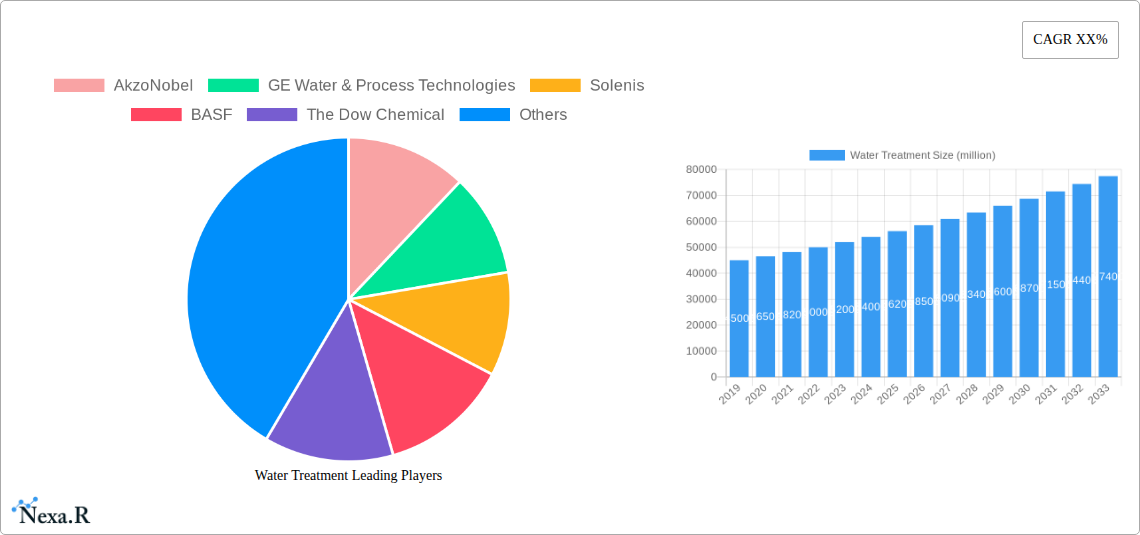

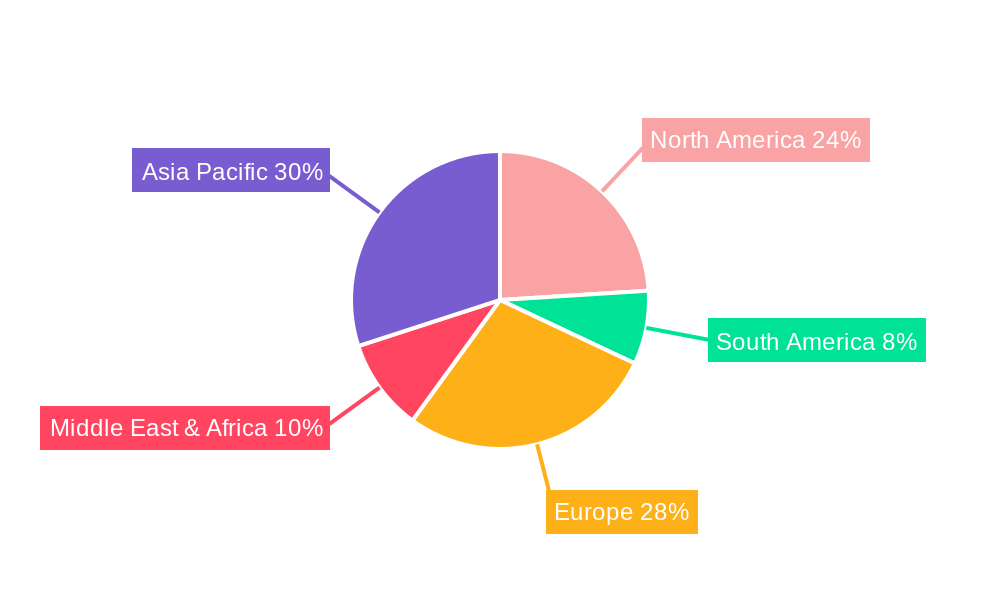

The market's trajectory is further bolstered by a series of favorable trends. The increasing adoption of smart water management systems, leveraging IoT and AI for real-time monitoring and optimization, is revolutionizing operational efficiency. Circular economy principles are gaining traction, with a growing emphasis on water reuse and resource recovery from wastewater, presenting new revenue streams and reducing overall operational costs. Despite the positive outlook, certain restraints, such as high initial investment costs for advanced infrastructure and the complex regulatory landscape in some regions, may pose challenges. However, strategic collaborations between leading companies like AkzoNobel, GE Water & Process Technologies, Solenis, BASF, and Ecolab, alongside significant investments in research and development, are expected to mitigate these restraints and accelerate market penetration. The Asia Pacific region, particularly China and India, is anticipated to emerge as a dominant force due to rapid industrial development and a burgeoning population.

Here's a comprehensive, SEO-optimized report description for the Water Treatment market, designed for industry professionals and maximizing search visibility:

Water Treatment Market Dynamics & Structure

The global water treatment market is characterized by a moderate concentration, with leading players like Ecolab, The Dow Chemical, and GE Water & Process Technologies holding significant shares, though the landscape is increasingly diversified by specialized solution providers. Technological innovation is a primary driver, fueled by the escalating demand for advanced purification techniques to address water scarcity and stringent environmental regulations. These frameworks, particularly in North America and Europe, mandate cleaner discharge and advanced treatment for industrial wastewater, creating a sustained need for sophisticated solutions. Competitive product substitutes, ranging from conventional filtration to advanced membrane technologies, continuously push innovation boundaries. End-user demographics reveal a strong reliance on municipal and industrial sectors, with Power Generation and Chemical industries being major consumers of specialized water treatment chemicals and technologies. Mergers and Acquisitions (M&A) activity remains a strategic avenue for market consolidation and technology acquisition, with an estimated xx deal volumes in the historical period, further shaping the competitive environment and market concentration.

- Market Concentration: Moderate, with a mix of large multinational corporations and niche players.

- Innovation Drivers: Stringent regulations, water scarcity, industrial growth, and sustainability initiatives.

- Regulatory Frameworks: Increasing global emphasis on water quality, wastewater discharge standards, and resource management.

- Competitive Product Substitutes: Range from physical and chemical treatments to advanced membrane and biological solutions.

- End-User Demographics: Dominated by Municipal, Power Generation, Chemical, Oil & Gas, and Metals & Mining sectors.

- M&A Trends: Strategic acquisitions for technology integration, market expansion, and portfolio enhancement.

Water Treatment Growth Trends & Insights

The global water treatment market is poised for robust expansion, projected to reach an estimated USD 125,000 million by 2033, exhibiting a compound annual growth rate (CAGR) of xx% from 2025 to 2033. This growth trajectory is underpinned by escalating global water stress, increasing industrialization across emerging economies, and a growing awareness of water's critical role in public health and economic development. Technological disruptions are playing a pivotal role, with advancements in membrane technologies such as reverse osmosis and ultrafiltration offering enhanced efficiency and reduced energy consumption for desalination and wastewater reuse applications. Furthermore, the adoption of smart water management systems, integrating IoT and AI for real-time monitoring and control, is gaining momentum, optimizing treatment processes and minimizing operational costs.

Consumer behavior is also shifting, with a greater emphasis on sustainability and the circular economy driving demand for water recycling and reuse solutions. Industries are increasingly recognizing the economic and environmental benefits of minimizing freshwater intake and treating wastewater to a standard suitable for reuse, thereby reducing their ecological footprint and operational expenses. The municipal sector, driven by growing populations and aging infrastructure, requires significant investment in upgrading water treatment facilities to meet evolving quality standards and ensure public safety.

In the Parent Market (Water Treatment), key growth drivers include:

- Market Size Evolution: From an estimated USD 98,000 million in 2025 to a projected USD 125,000 million by 2033.

- CAGR: xx% during the forecast period 2025–2033.

- Adoption Rates: Increasing for advanced technologies like membrane treatment and digital solutions.

- Technological Disruptions: Innovations in membrane technology, IoT-enabled monitoring, and advanced chemical treatments.

- Consumer Behavior Shifts: Growing demand for water recycling, reuse, and sustainable water management practices.

Within the Child Market (e.g., Industrial Water Treatment), specific growth insights include:

- High Demand in Manufacturing: Power Generation and Chemical industries are significant contributors due to stringent effluent standards and the need for process water purity.

- Oil & Gas Sector Needs: Focus on produced water treatment and water for hydraulic fracturing operations.

- Metals & Mining Applications: Emphasis on efficient wastewater treatment to reduce environmental impact and recover valuable resources.

- Emerging Economies: Rapid industrialization in Asia-Pacific and Latin America is driving substantial demand for water treatment solutions.

The overall market penetration of advanced water treatment solutions is expected to rise, driven by the confluence of regulatory pressures, technological advancements, and a growing understanding of water's intrinsic value. The focus is shifting from merely treating water to actively managing water resources for long-term sustainability.

Dominant Regions, Countries, or Segments in Water Treatment

North America and Europe currently lead the global water treatment market, driven by stringent environmental regulations, high industrial output, and significant investments in infrastructure modernization. The Municipal application segment stands out as a dominant force, accounting for a substantial market share due to the universal need for safe drinking water and wastewater management for growing urban populations. In North America, the United States, with its advanced industrial base and robust regulatory framework, commands a significant portion of the market. High demand from the Power Generation and Chemical sectors, coupled with continuous upgrades to aging municipal water systems, fuels this dominance.

- Dominant Region: North America

- Dominant Country: United States

- Dominant Application Segment: Municipal

Key Drivers for Dominance in North America (Municipal Application):

- Aging Infrastructure: Extensive need for upgrades and replacements of existing water and wastewater treatment facilities.

- Stringent Regulations: Federal and state mandates on water quality, disinfection byproducts, and wastewater discharge limits.

- Population Growth: Increasing demand for potable water and adequate wastewater treatment capacity in urban centers.

- Technological Adoption: High receptivity to advanced treatment technologies, including membrane filtration and UV disinfection, for improved efficiency and safety.

- Economic Policies: Government funding and incentives for water infrastructure projects.

In terms of Types, Chemical Treatment remains a cornerstone, indispensable across nearly all applications, from disinfection in municipal systems to process water conditioning in industries. However, Membrane Treatment is witnessing exceptional growth due to its effectiveness in desalination, wastewater reuse, and high-purity water production, particularly in water-scarce regions and for specialized industrial needs within the Chemical and Oil & Gas sectors.

- Dominant Type (Historically): Chemical Treatment

- Fastest Growing Type: Membrane Treatment

Analysis of Dominance Factors:

The Municipal segment's dominance stems from its fundamental necessity for public health and urban development, making it a consistently large market. The United States' leadership is attributed to its well-established industrial economy, advanced technological capabilities, and proactive regulatory approach. The dominance of Chemical Treatment is due to its versatility and application across a broad spectrum of water treatment challenges. The surge in Membrane Treatment signifies a global shift towards more advanced, efficient, and sustainable water purification methods, driven by increasing water stress and the growing demand for high-quality treated water for diverse industrial processes and potable reuse. The growth potential for membrane technologies is immense, particularly in regions facing acute water scarcity and those with ambitious water reuse targets.

Water Treatment Product Landscape

The water treatment product landscape is continuously evolving with innovations focused on enhanced efficiency, sustainability, and cost-effectiveness. Advanced coagulants and flocculants offer improved removal of suspended solids and organic matter with lower dosage requirements. Novel membrane materials and configurations are enabling greater water recovery rates and energy savings in desalination and wastewater recycling. Furthermore, smart sensors and automated dosing systems are revolutionizing chemical treatment, allowing for precise application based on real-time water quality monitoring, thereby optimizing performance and minimizing chemical consumption. These advancements are crucial for meeting increasingly stringent environmental discharge standards and for enabling water reuse across various industries.

Key Drivers, Barriers & Challenges in Water Treatment

Key Drivers:

- Growing Water Scarcity: Increasing global demand for potable and industrial water necessitates advanced treatment and reuse solutions.

- Stringent Environmental Regulations: Mandates for improved water quality and reduced pollution drive adoption of sophisticated technologies.

- Industrial Expansion: Growth in sectors like chemical, oil & gas, and power generation creates sustained demand for process water and wastewater treatment.

- Technological Advancements: Innovations in membranes, chemicals, and digital solutions enhance efficiency and sustainability.

- Focus on Sustainability: Corporate and governmental initiatives promoting water conservation and circular economy principles.

Key Barriers & Challenges:

- High Capital Investment: Initial costs for advanced water treatment infrastructure can be substantial, particularly for developing economies.

- Operational Complexity: Sophisticated technologies may require specialized expertise and training for effective operation and maintenance.

- Energy Consumption: Certain treatment processes, like reverse osmosis, can be energy-intensive, posing operational cost challenges.

- Regulatory Inconsistencies: Varying standards and enforcement across regions can create market access hurdles.

- Supply Chain Disruptions: Availability of specialized chemicals and equipment can be impacted by global events.

Emerging Opportunities in Water Treatment

Emerging opportunities lie in the development of cost-effective decentralized water treatment solutions for remote and underserved communities. The increasing focus on resource recovery from wastewater, such as nutrient recycling and energy generation (biogas), presents a significant growth avenue. Advancements in artificial intelligence and machine learning for predictive maintenance and process optimization in water treatment plants also offer substantial potential. Furthermore, the growing demand for microplastic removal and pharmaceutical contaminant treatment in wastewater is creating a niche for innovative filtration and advanced oxidation processes.

Growth Accelerators in the Water Treatment Industry

Catalysts for long-term growth in the water treatment industry include breakthroughs in advanced oxidation processes for recalcitrant pollutant removal, and the development of more robust and energy-efficient membrane technologies. Strategic partnerships between technology providers and end-users, particularly in co-developing customized solutions for complex industrial challenges, are accelerating adoption. Market expansion into emerging economies, driven by increasing industrialization and a growing awareness of water's value, coupled with governmental support for water infrastructure development, will be a significant growth accelerator.

Key Players Shaping the Water Treatment Market

- AkzoNobel

- GE Water & Process Technologies

- Solenis

- BASF

- The Dow Chemical

- Ecolab

- Kemira Chemicals

- Lonza

- Buckman Laboratories International

- BAW Water Additives U.K.

Notable Milestones in Water Treatment Sector

- 2019: Launch of advanced membrane bioreactor (MBR) technology offering higher effluent quality.

- 2020: Increased investment in digital water solutions and IoT-enabled monitoring systems.

- 2021: Major acquisitions in the specialty chemical segment to enhance product portfolios.

- 2022: Global focus on wastewater reuse technologies gains momentum due to persistent droughts.

- 2023: Development of novel materials for more efficient and sustainable membrane filtration.

- 2024: Growing emphasis on AI-driven optimization for water treatment plant operations.

In-Depth Water Treatment Market Outlook

The future of the water treatment market is exceptionally promising, driven by an unyielding global imperative to secure clean and sustainable water resources. Growth accelerators such as revolutionary advancements in membrane technology promising ultra-low energy consumption and highly efficient contaminant removal, alongside the widespread integration of AI and IoT for intelligent water management, will redefine operational paradigms. Strategic collaborations and market penetration in rapidly industrializing regions, supported by favorable government policies aimed at water security and environmental protection, will unlock substantial new revenue streams. The market is shifting towards a holistic approach, emphasizing not just treatment but also resource recovery and water circularity.

Water Treatment Segmentation

-

1. Application

- 1.1. Municipal

- 1.2. Power Generation

- 1.3. Chemical

- 1.4. Oil & Gas

- 1.5. Metals & Mining

- 1.6. Others

-

2. Types

- 2.1. Physical Treatment

- 2.2. Chemical Treatment

- 2.3. Membrane Treatment

- 2.4. Others

Water Treatment Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Water Treatment REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Water Treatment Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Municipal

- 5.1.2. Power Generation

- 5.1.3. Chemical

- 5.1.4. Oil & Gas

- 5.1.5. Metals & Mining

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Physical Treatment

- 5.2.2. Chemical Treatment

- 5.2.3. Membrane Treatment

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Water Treatment Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Municipal

- 6.1.2. Power Generation

- 6.1.3. Chemical

- 6.1.4. Oil & Gas

- 6.1.5. Metals & Mining

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Physical Treatment

- 6.2.2. Chemical Treatment

- 6.2.3. Membrane Treatment

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Water Treatment Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Municipal

- 7.1.2. Power Generation

- 7.1.3. Chemical

- 7.1.4. Oil & Gas

- 7.1.5. Metals & Mining

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Physical Treatment

- 7.2.2. Chemical Treatment

- 7.2.3. Membrane Treatment

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Water Treatment Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Municipal

- 8.1.2. Power Generation

- 8.1.3. Chemical

- 8.1.4. Oil & Gas

- 8.1.5. Metals & Mining

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Physical Treatment

- 8.2.2. Chemical Treatment

- 8.2.3. Membrane Treatment

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Water Treatment Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Municipal

- 9.1.2. Power Generation

- 9.1.3. Chemical

- 9.1.4. Oil & Gas

- 9.1.5. Metals & Mining

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Physical Treatment

- 9.2.2. Chemical Treatment

- 9.2.3. Membrane Treatment

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Water Treatment Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Municipal

- 10.1.2. Power Generation

- 10.1.3. Chemical

- 10.1.4. Oil & Gas

- 10.1.5. Metals & Mining

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Physical Treatment

- 10.2.2. Chemical Treatment

- 10.2.3. Membrane Treatment

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 AkzoNobel

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 GE Water & Process Technologies

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Solenis

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BASF

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Dow Chemical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ecolab

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kemira Chemicals

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lonza

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Buckman Laboratories International

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BAW Water Additives U.K.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 AkzoNobel

List of Figures

- Figure 1: Global Water Treatment Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Water Treatment Revenue (million), by Application 2024 & 2032

- Figure 3: North America Water Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Water Treatment Revenue (million), by Types 2024 & 2032

- Figure 5: North America Water Treatment Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Water Treatment Revenue (million), by Country 2024 & 2032

- Figure 7: North America Water Treatment Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Water Treatment Revenue (million), by Application 2024 & 2032

- Figure 9: South America Water Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Water Treatment Revenue (million), by Types 2024 & 2032

- Figure 11: South America Water Treatment Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Water Treatment Revenue (million), by Country 2024 & 2032

- Figure 13: South America Water Treatment Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Water Treatment Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Water Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Water Treatment Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Water Treatment Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Water Treatment Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Water Treatment Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Water Treatment Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Water Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Water Treatment Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Water Treatment Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Water Treatment Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Water Treatment Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Water Treatment Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Water Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Water Treatment Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Water Treatment Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Water Treatment Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Water Treatment Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Water Treatment Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Water Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Water Treatment Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Water Treatment Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Water Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Water Treatment Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Water Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Water Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Water Treatment Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Water Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Water Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Water Treatment Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Water Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Water Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Water Treatment Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Water Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Water Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Water Treatment Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Water Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Water Treatment Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Water Treatment?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Water Treatment?

Key companies in the market include AkzoNobel, GE Water & Process Technologies, Solenis, BASF, The Dow Chemical, Ecolab, Kemira Chemicals, Lonza, Buckman Laboratories International, BAW Water Additives U.K..

3. What are the main segments of the Water Treatment?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Water Treatment," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Water Treatment report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Water Treatment?

To stay informed about further developments, trends, and reports in the Water Treatment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence