Key Insights

The global Liquid Chromatography Purification market is experiencing robust growth, projected to reach a substantial market size. This expansion is driven by the increasing demand for high-purity compounds in pharmaceutical research, diagnostics, and biotechnology sectors. The pharmaceutical industry's continuous quest for novel drug discovery and development necessitates precise purification techniques, with liquid chromatography standing out as a cornerstone. Advancements in LC technologies, including the development of more efficient stationary phases, sensitive detectors, and automated systems, are further fueling market adoption. The growing complexity of biomolecules and the stringent quality control requirements for therapeutics and diagnostics are also significant catalysts for market expansion. Furthermore, the burgeoning biopharmaceutical sector and the increasing outsourcing of R&D activities by pharmaceutical companies are contributing to the sustained upward trajectory of the market.

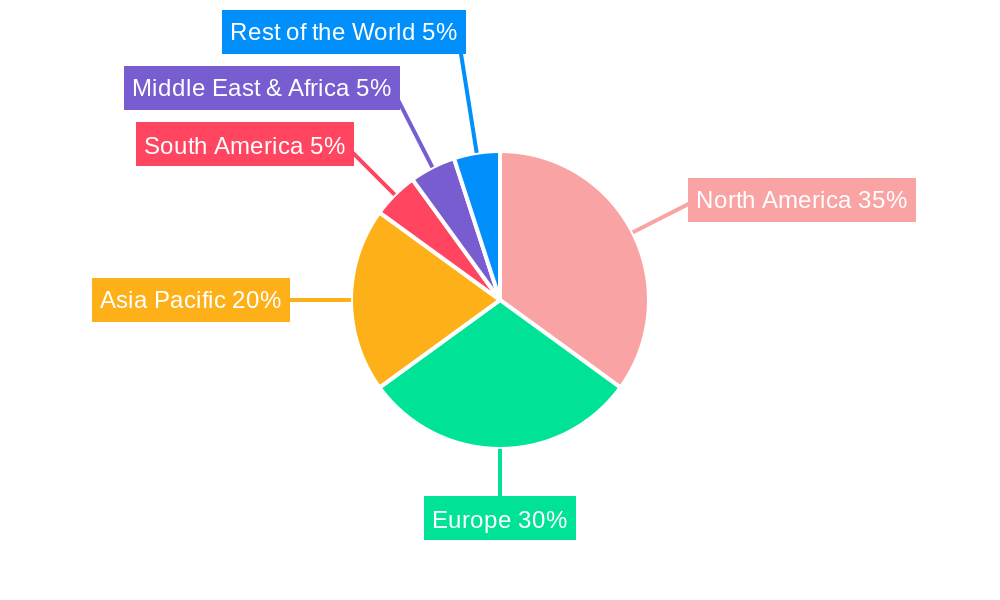

The market is segmented by both application and type, reflecting diverse industry needs. In terms of application, Clinical Research, Diagnostics, and Biotechnology represent the dominant segments, owing to their critical reliance on accurate and reproducible purification processes. The "Other Applications" segment, encompassing areas like food and beverage analysis and environmental testing, is also showing steady growth. By type, while Single-Step Purification methods are prevalent for less complex samples, the increasing sophistication of analytical demands is driving a notable shift towards Multiple-Step Purification techniques, which offer enhanced resolution and purity for challenging separations. Geographically, North America and Europe currently lead the market due to their well-established pharmaceutical and biotechnology infrastructure and significant investments in R&D. However, the Asia Pacific region is poised for substantial growth, driven by the expanding biopharmaceutical industry in countries like China and India, coupled with increasing government support for research and development initiatives. The market is characterized by a competitive landscape with key players focusing on technological innovation, strategic collaborations, and product portfolio expansion to capture market share.

Liquid Chromatography Purification Market Report: Comprehensive Analysis & Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the global Liquid Chromatography Purification market, a critical segment within the broader chromatography and life sciences industries. We explore market dynamics, growth trends, regional dominance, product innovations, key drivers, barriers, and emerging opportunities, with a focus on the period between 2019 and 2033, including a base year of 2025 and a forecast period extending to 2033. This report integrates high-traffic keywords such as "liquid chromatography," "LC purification," "chromatography consumables," "biopharmaceutical purification," "drug discovery," "clinical diagnostics," and "laboratory equipment" to maximize search engine visibility and attract industry professionals. We also delve into the parent and child markets, offering a holistic view of the industry's interconnectedness. The report presents all quantitative values in million units.

Liquid Chromatography Purification Market Dynamics & Structure

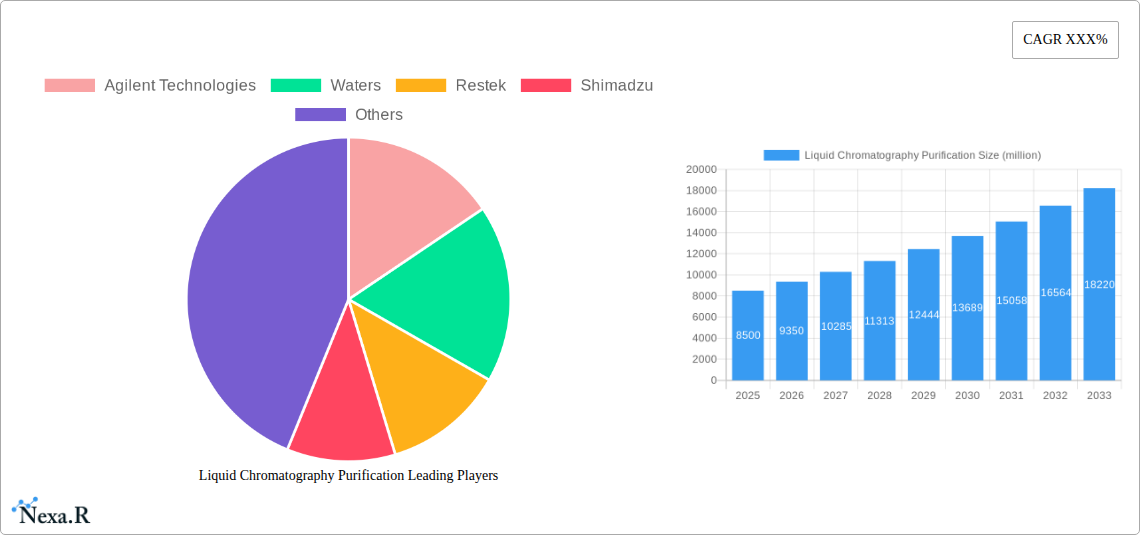

The global Liquid Chromatography Purification market exhibits a moderate to high market concentration, with established players like Agilent Technologies, Waters, and Shimadzu holding significant shares. Technological innovation is a primary driver, fueled by the continuous demand for higher purity compounds in biotechnology, pharmaceutical research, and diagnostics. Advancements in stationary phases, detector technologies, and automation are pushing the boundaries of purification efficiency and speed. Regulatory frameworks, particularly those governing drug development and clinical trials, play a crucial role in dictating market requirements and product validation. Competitive product substitutes, such as other separation techniques like electrophoresis or membrane filtration, pose a challenge, but LC purification remains indispensable for high-resolution separations. End-user demographics span academic research institutions, contract research organizations (CROs), and large pharmaceutical and biotechnology companies, each with distinct needs and purchasing power. Mergers and acquisitions (M&A) are becoming increasingly prevalent as companies seek to expand their product portfolios, gain market access, and consolidate their positions. For instance, the historical period saw several strategic acquisitions aimed at bolstering capabilities in specific application areas.

- Market Concentration: Dominated by key global manufacturers with a focus on advanced instrumentation and consumables.

- Technological Innovation: Driven by the need for increased throughput, higher resolution, and miniaturization in LC systems and consumables.

- Regulatory Frameworks: Strict FDA and EMA guidelines significantly influence product development and validation, especially for pharmaceutical and clinical applications.

- Competitive Landscape: Competition from alternative separation technologies, but LC purification's versatility ensures its continued relevance.

- End-User Demographics: Diverse user base including academic, government, and private research laboratories, as well as industrial quality control departments.

- M&A Trends: Growing consolidation to enhance product offerings and market reach, particularly in specialized areas of purification.

Liquid Chromatography Purification Growth Trends & Insights

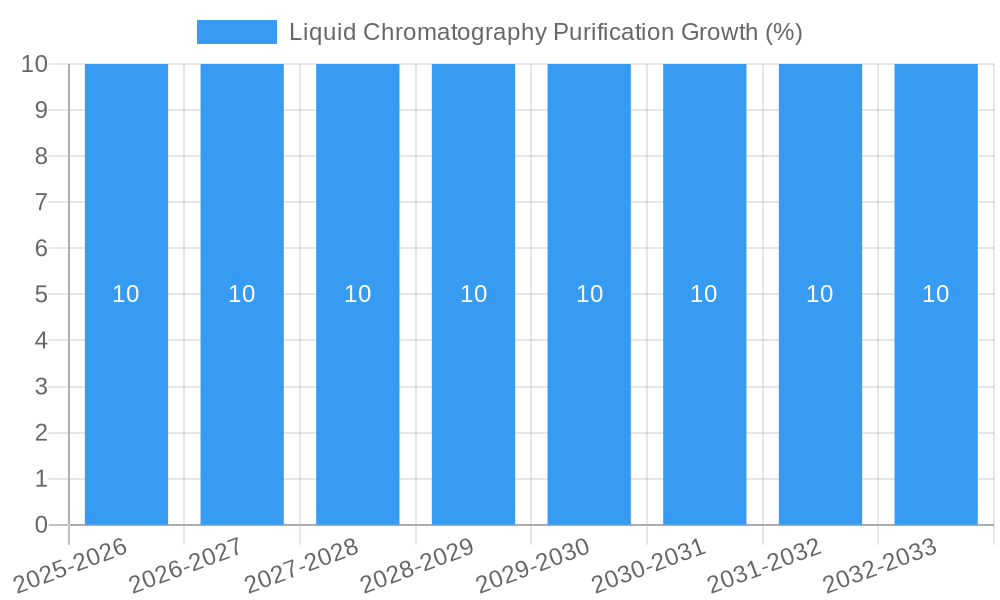

The Liquid Chromatography Purification market is poised for substantial growth, projected to expand at a robust Compound Annual Growth Rate (CAGR) of approximately 7.8% from 2025 to 2033. This growth is underpinned by increasing R&D investments in the biopharmaceutical sector, the burgeoning field of personalized medicine, and the rising demand for advanced analytical techniques in clinical research and diagnostics. The market size for liquid chromatography purification systems and consumables is estimated to reach $5,500 million by 2025 and is projected to grow to $9,900 million by 2033. Adoption rates of advanced LC purification techniques are on the rise, driven by their ability to deliver highly purified biomolecules and small molecules crucial for drug development, vaccine production, and disease marker identification. Technological disruptions, such as the integration of artificial intelligence (AI) for method optimization and the development of novel stationary phases offering enhanced selectivity and efficiency, are key growth catalysts. Consumer behavior shifts are also evident, with researchers increasingly demanding user-friendly, automated, and high-throughput purification solutions that reduce time-to-result and minimize manual intervention. The expanding applications in areas like antibody-drug conjugates (ADCs), gene therapy, and cell therapy further contribute to the upward trajectory of the market. The increasing complexity of therapeutic molecules necessitates sophisticated purification methods, solidifying LC's position. The market penetration of advanced LC purification solutions is expected to deepen as cost-effectiveness improves and performance benefits become more widely recognized across various research and industrial settings.

Dominant Regions, Countries, or Segments in Liquid Chromatography Purification

The Liquid Chromatography Purification market is experiencing significant growth across multiple segments and regions, with North America currently emerging as the dominant region. This dominance is propelled by a strong presence of leading pharmaceutical and biotechnology companies, substantial government funding for life sciences research, and a well-established ecosystem of academic institutions and contract research organizations (CROs). The Application: Biotechnology segment is a major growth driver within this region, accounting for an estimated 40% of the total market share in 2025. Within biotechnology, the purification of monoclonal antibodies, recombinant proteins, and gene therapy vectors are critical applications demanding high-resolution LC purification. The Type: Multiple-Step Purification segment is also witnessing robust growth, reflecting the increasing complexity of target molecules and the need for stringent purity standards in advanced therapeutic development.

- Dominant Region: North America: Driven by robust R&D expenditure, a strong pharmaceutical and biotech industry, and advanced healthcare infrastructure.

- Leading Application Segment: Biotechnology: Essential for the purification of a wide range of biopharmaceuticals, including antibodies, enzymes, and vaccines.

- Key Country: United States: Leads in drug discovery and development, requiring sophisticated purification techniques for preclinical and clinical trials.

- Growing Application Segment: Clinical Research: Increasing demand for accurate and reliable purification of biomarkers and diagnostic agents.

- Dominant Type: Multiple-Step Purification: Essential for achieving high purity levels required for complex biomolecules and novel therapeutics.

- Market Share Dominance Drivers: Significant investments in R&D, favorable government policies, and the presence of major pharmaceutical players.

- Growth Potential: Continued innovation and expanding applications in areas like personalized medicine and regenerative therapies.

Liquid Chromatography Purification Product Landscape

The Liquid Chromatography Purification product landscape is characterized by continuous innovation, focusing on enhanced resolution, faster run times, and greater automation. Key product developments include the introduction of novel stationary phases with improved selectivity and capacity, such as advanced C18, HILIC, and ion-exchange chemistries, catering to a wider range of analytes. Pre-packed columns with optimized particle sizes and pore structures are increasingly popular for their convenience and reproducibility. Furthermore, advancements in automated purification systems, including preparative HPLC and flash chromatography systems, are significantly improving throughput and reducing manual labor. The integration of mass spectrometry detectors with LC purification systems offers real-time monitoring and confirmation of compound purity, a critical advantage in drug discovery and development. Performance metrics like resolution, peak capacity, and recovery rates are consistently being optimized.

Key Drivers, Barriers & Challenges in Liquid Chromatography Purification

Key Drivers: The Liquid Chromatography Purification market is primarily propelled by the accelerating pace of drug discovery and development, particularly in the biopharmaceutical sector, leading to an escalating demand for high-purity therapeutic molecules. The expanding applications in diagnostics and the growing need for accurate biomarker identification further fuel market growth. Technological advancements in LC instrumentation and consumables, offering improved resolution, throughput, and automation, are also significant drivers.

- Increasing R&D in Biopharmaceuticals: Drives demand for efficient purification of complex biomolecules.

- Growing Diagnostics Market: Necessitates high-purity reagents and standards.

- Technological Innovations: Enhanced LC systems and consumables improve performance and user experience.

- Demand for Personalized Medicine: Requires purification of specific patient-derived molecules.

Barriers & Challenges: Supply chain disruptions, particularly for specialized consumables, can lead to production delays and increased costs. Stringent and evolving regulatory requirements for drug manufacturing and quality control necessitate significant investment in validation and compliance. The high initial cost of advanced LC purification systems can be a barrier for smaller research institutions and emerging markets. Intense competition among established players and the threat of emerging alternative separation technologies also present ongoing challenges.

- Supply Chain Vulnerabilities: Potential for shortages of critical consumables.

- Regulatory Hurdles: Complex and time-consuming validation processes.

- High Capital Investment: Cost of advanced instrumentation can be prohibitive.

- Intense Competition: Market saturation in certain segments.

Emerging Opportunities in Liquid Chromatography Purification

Emerging opportunities in the Liquid Chromatography Purification market lie in the burgeoning fields of cell and gene therapy, where precise purification of viral vectors and nucleic acids is paramount. The growing demand for advanced purification solutions in the production of biosimilars and antibody-drug conjugates (ADCs) presents a significant growth avenue. Furthermore, the expansion of clinical research applications, particularly in the development of novel diagnostic tools and personalized medicine approaches, is creating new markets for specialized LC purification techniques and consumables. Untapped markets in developing economies with improving healthcare infrastructure also offer substantial growth potential.

Growth Accelerators in the Liquid Chromatography Purification Industry

Long-term growth in the Liquid Chromatography Purification industry is being significantly accelerated by breakthroughs in materials science, leading to the development of novel chromatography resins and stationary phases with superior selectivity and capacity. Strategic partnerships between instrument manufacturers and consumable providers are fostering integrated solutions that enhance efficiency and ease of use. Market expansion strategies, including the development of more affordable and scalable purification systems, are making advanced LC purification accessible to a wider range of users. The increasing adoption of automation and digital solutions, such as AI-driven method optimization and data analysis, is further streamlining purification workflows and driving productivity.

Key Players Shaping the Liquid Chromatography Purification Market

- Agilent Technologies

- Waters

- Restek

- Shimadzu

- Thermo Fisher Scientific

- GE Healthcare

- Danaher Corporation (Cytiva)

- Sartorius AG

- Merck KGaA

- Bio-Rad Laboratories

Notable Milestones in Liquid Chromatography Purification Sector

- 2019-2020: Introduction of novel, high-resolution stationary phases for preparative chromatography, enabling faster and more efficient purification of complex biomolecules.

- 2021: Significant advancements in automated flash chromatography systems, enhancing throughput and simplifying workflow for drug discovery laboratories.

- 2022: Increased focus on sustainable chromatography consumables, with the development of recyclable and environmentally friendly materials.

- 2023: Integration of AI and machine learning algorithms into LC purification software, optimizing method development and reducing purification time.

- 2024: Growing market activity in purification solutions for cell and gene therapies, with key acquisitions and product launches targeting this rapidly expanding sector.

In-Depth Liquid Chromatography Purification Market Outlook

The future outlook for the Liquid Chromatography Purification market is exceptionally bright, driven by persistent innovation and expanding application frontiers. Growth accelerators such as the development of ultra-high performance liquid chromatography (UHPLC) preparative systems, advanced resin technologies, and intelligent automation will continue to redefine purification capabilities. The increasing investment in biologics, vaccines, and personalized therapies will sustain robust demand for high-purity compounds. Strategic opportunities lie in further penetrating emerging markets, developing more cost-effective solutions for academic and smaller research groups, and expanding the application of LC purification in areas beyond traditional pharmaceuticals, such as food safety and environmental analysis. The market is well-positioned for continued expansion, offering significant potential for stakeholders investing in cutting-edge technology and customer-centric solutions.

Liquid Chromatography Purification Segmentation

-

1. Application

- 1.1. Clinical Research

- 1.2. Diagnostics

- 1.3. Biotechnology

- 1.4. Other Applications

-

2. Type

- 2.1. Single-Step Purification

- 2.2. Multiple-Step Purification

Liquid Chromatography Purification Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Liquid Chromatography Purification REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Liquid Chromatography Purification Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Clinical Research

- 5.1.2. Diagnostics

- 5.1.3. Biotechnology

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Single-Step Purification

- 5.2.2. Multiple-Step Purification

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Liquid Chromatography Purification Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Clinical Research

- 6.1.2. Diagnostics

- 6.1.3. Biotechnology

- 6.1.4. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Single-Step Purification

- 6.2.2. Multiple-Step Purification

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Liquid Chromatography Purification Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Clinical Research

- 7.1.2. Diagnostics

- 7.1.3. Biotechnology

- 7.1.4. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Single-Step Purification

- 7.2.2. Multiple-Step Purification

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Liquid Chromatography Purification Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Clinical Research

- 8.1.2. Diagnostics

- 8.1.3. Biotechnology

- 8.1.4. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Single-Step Purification

- 8.2.2. Multiple-Step Purification

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Liquid Chromatography Purification Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Clinical Research

- 9.1.2. Diagnostics

- 9.1.3. Biotechnology

- 9.1.4. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Single-Step Purification

- 9.2.2. Multiple-Step Purification

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Liquid Chromatography Purification Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Clinical Research

- 10.1.2. Diagnostics

- 10.1.3. Biotechnology

- 10.1.4. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Single-Step Purification

- 10.2.2. Multiple-Step Purification

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Agilent Technologies

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Waters

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Restek

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Shimadzu

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.1 Agilent Technologies

List of Figures

- Figure 1: Global Liquid Chromatography Purification Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Liquid Chromatography Purification Revenue (million), by Application 2024 & 2032

- Figure 3: North America Liquid Chromatography Purification Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Liquid Chromatography Purification Revenue (million), by Type 2024 & 2032

- Figure 5: North America Liquid Chromatography Purification Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Liquid Chromatography Purification Revenue (million), by Country 2024 & 2032

- Figure 7: North America Liquid Chromatography Purification Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Liquid Chromatography Purification Revenue (million), by Application 2024 & 2032

- Figure 9: South America Liquid Chromatography Purification Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Liquid Chromatography Purification Revenue (million), by Type 2024 & 2032

- Figure 11: South America Liquid Chromatography Purification Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Liquid Chromatography Purification Revenue (million), by Country 2024 & 2032

- Figure 13: South America Liquid Chromatography Purification Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Liquid Chromatography Purification Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Liquid Chromatography Purification Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Liquid Chromatography Purification Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Liquid Chromatography Purification Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Liquid Chromatography Purification Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Liquid Chromatography Purification Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Liquid Chromatography Purification Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Liquid Chromatography Purification Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Liquid Chromatography Purification Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Liquid Chromatography Purification Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Liquid Chromatography Purification Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Liquid Chromatography Purification Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Liquid Chromatography Purification Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Liquid Chromatography Purification Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Liquid Chromatography Purification Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Liquid Chromatography Purification Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Liquid Chromatography Purification Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Liquid Chromatography Purification Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Liquid Chromatography Purification Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Liquid Chromatography Purification Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Liquid Chromatography Purification Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Liquid Chromatography Purification Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Liquid Chromatography Purification Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Liquid Chromatography Purification Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Liquid Chromatography Purification Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Liquid Chromatography Purification Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Liquid Chromatography Purification Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Liquid Chromatography Purification Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Liquid Chromatography Purification Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Liquid Chromatography Purification Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Liquid Chromatography Purification Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Liquid Chromatography Purification Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Liquid Chromatography Purification Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Liquid Chromatography Purification Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Liquid Chromatography Purification Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Liquid Chromatography Purification Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Liquid Chromatography Purification Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Liquid Chromatography Purification Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Liquid Chromatography Purification?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Liquid Chromatography Purification?

Key companies in the market include Agilent Technologies, Waters, Restek, Shimadzu.

3. What are the main segments of the Liquid Chromatography Purification?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Liquid Chromatography Purification," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Liquid Chromatography Purification report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Liquid Chromatography Purification?

To stay informed about further developments, trends, and reports in the Liquid Chromatography Purification, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence