Key Insights

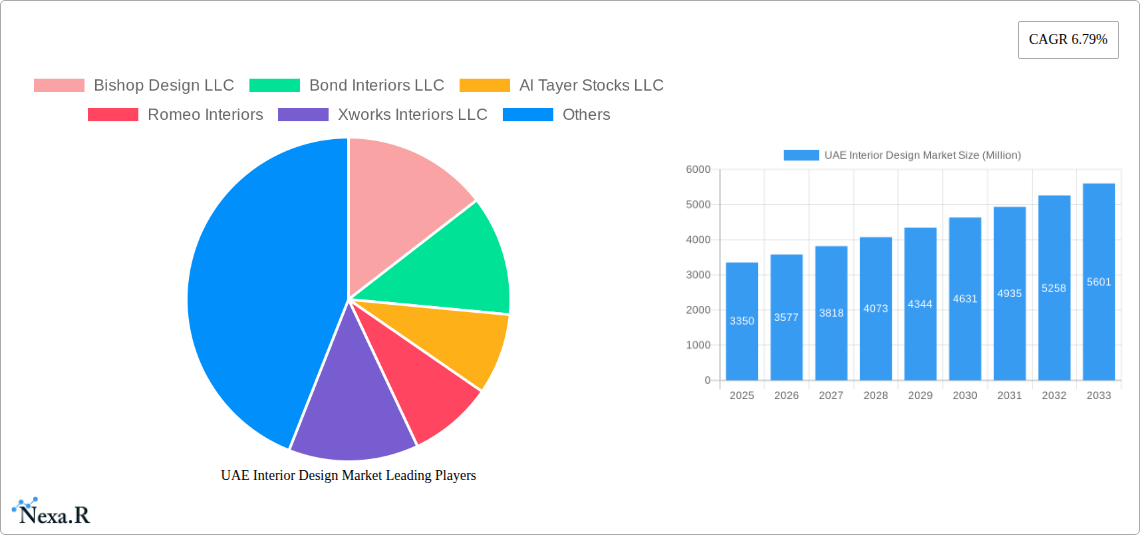

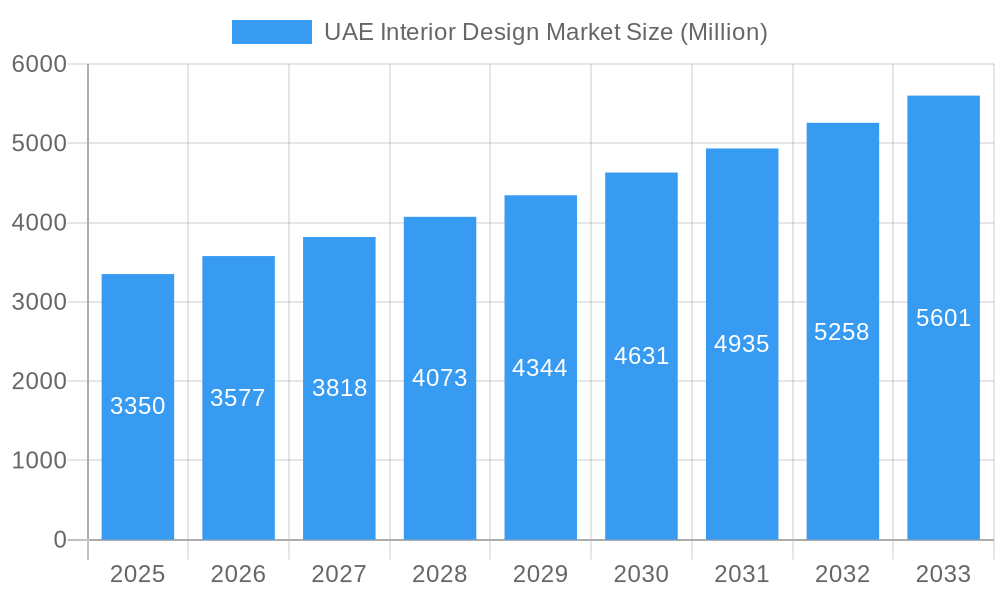

The UAE Interior Design Market is poised for robust expansion, projected to reach a significant valuation by the end of the forecast period. The market's current size of USD 3.35 billion is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.79% from 2025 to 2033. This impressive growth trajectory is fueled by a confluence of strategic national initiatives, a thriving real estate sector, and an increasing demand for aesthetically pleasing and functional spaces across various project types. Key drivers include the UAE's ambitious infrastructure development plans, particularly in sectors like hospitality and tourism, which necessitate extensive interior fit-out and refurbishment. The government's focus on economic diversification and attracting foreign investment further stimulates the demand for premium commercial and residential spaces, thereby boosting the interior design market. Moreover, a rising disposable income and a growing expatriate population are contributing to the demand for sophisticated and personalized residential interiors. Emerging trends such as the integration of smart home technologies, a heightened emphasis on sustainable and eco-friendly design solutions, and the rise of biophilic design principles are reshaping the market and offering new avenues for growth.

UAE Interior Design Market Market Size (In Billion)

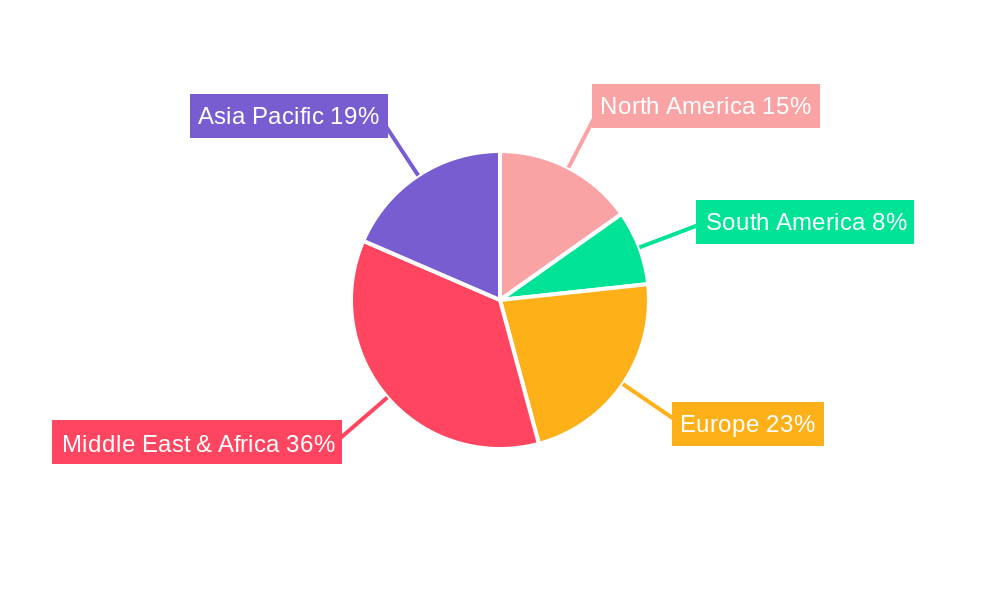

The market's dynamism is further evidenced by its diverse segmentation. The Residential segment continues to be a dominant force, driven by ongoing urban development and a desire for modern living. Simultaneously, the Commercial segment, encompassing retail, hotels, education, office, and healthcare facilities, presents substantial growth opportunities. The significant investments in healthcare infrastructure and the expansion of educational institutions, coupled with the continuous evolution of retail and hospitality experiences, are key contributors to this segment's expansion. Leading companies within the UAE's interior design landscape, including Bishop Design LLC, Bond Interiors LLC, and Al Tayer Stocks LLC, are instrumental in shaping market trends through their innovative designs and project executions. Geographically, while the GCC region within the Middle East & Africa will represent a substantial portion of the market, significant contributions will also emerge from North America and Asia Pacific, reflecting global design influences and investment flows. However, the market may encounter restraints such as escalating material costs and potential fluctuations in construction project timelines, which could impact profitability and project delivery.

UAE Interior Design Market Company Market Share

UAE Interior Design Market Report: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a granular analysis of the UAE Interior Design Market, offering critical insights for stakeholders including interior designers, architects, real estate developers, material suppliers, and investors. Delving into market dynamics, growth trends, regional dominance, product innovation, and competitive landscapes, this report equips you with the data and foresight necessary to navigate and capitalize on opportunities within this rapidly evolving sector. With a focus on high-traffic keywords and structured data presentation, this report is designed for maximum SEO visibility and immediate industry application.

UAE Interior Design Market Market Dynamics & Structure

The UAE interior design market exhibits a moderately concentrated structure, with a notable presence of established, large-scale fit-out companies alongside a vibrant ecosystem of smaller, specialized design studios. Technological innovation is a significant driver, with advancements in 3D visualization, Building Information Modeling (BIM), and sustainable materials rapidly being adopted. Regulatory frameworks, particularly those related to building codes, safety standards, and sustainability mandates, play a crucial role in shaping design practices and material choices. Competitive product substitutes primarily emerge from advancements in material science and the increasing availability of prefabricated solutions. End-user demographics are diverse, ranging from ultra-high-net-worth individuals for luxury residential projects to large corporations and government entities for commercial and institutional spaces. Mergers and acquisitions (M&A) trends, while not as prevalent as in more mature markets, are present as established players seek to expand their capabilities and market reach.

- Market Concentration: Dominated by key players but with significant room for niche specialists.

- Technological Drivers: BIM, AI-powered design tools, virtual reality (VR) for client presentations.

- Regulatory Influence: Strict adherence to Dubai Municipality and Abu Dhabi Department of Municipalities and Transport regulations.

- Competitive Landscape: Intense competition driven by quality, cost-effectiveness, and innovation.

- M&A Activity: Increasing strategic acquisitions for capability enhancement and market share consolidation.

UAE Interior Design Market Growth Trends & Insights

The UAE interior design market is projected to witness robust growth, driven by sustained economic development, ambitious urban expansion projects, and a burgeoning tourism sector. The market size is estimated to grow from approximately $12,500 million in 2024 to an anticipated $22,000 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of roughly 6.5% during the forecast period. Adoption rates for innovative design solutions and smart technologies are accelerating as developers and end-users prioritize efficiency, sustainability, and enhanced user experiences. Technological disruptions, such as the increasing use of AI in design conceptualization and project management, are streamlining workflows and enabling more personalized design outcomes. Consumer behavior shifts are evident, with a growing demand for eco-friendly materials, biophilic design principles, and spaces that promote well-being and flexibility, especially in the post-pandemic era. The residential segment continues to be a major contributor, fueled by expatriate influx and the demand for luxury living spaces. Simultaneously, the commercial sector, encompassing retail, hospitality, and office spaces, is undergoing significant transformations to meet evolving business and consumer needs.

Dominant Regions, Countries, or Segments in UAE Interior Design Market

Within the UAE interior design market, the Commercial segment, specifically Retail and Hotels, is poised to be the dominant force, propelled by strategic government initiatives aimed at diversifying the economy and bolstering tourism. Dubai, with its global reputation as a hub for luxury retail and world-class hospitality, leads in driving demand for high-end interior design services. Abu Dhabi, with its focus on cultural tourism and business expansion, also presents substantial opportunities. The UAE's vision for sustainable development and the creation of smart cities further fuels demand for innovative and efficient interior solutions across all commercial sub-segments.

- Retail: The UAE's status as a premier shopping destination, coupled with the constant evolution of retail concepts, necessitates continuous investment in attractive and functional store designs. This includes a strong demand for luxury retail fit-outs, experiential retail spaces, and pop-up stores.

- Hotels: With ambitious tourism targets and a continuous influx of international visitors, the UAE's hospitality sector consistently requires sophisticated and aesthetically pleasing interior designs for new hotel developments and renovations. Focus is on creating unique guest experiences, incorporating local cultural elements, and embracing sustainable hospitality practices.

- Office: The post-pandemic era has spurred a demand for flexible, collaborative, and technologically integrated office spaces, driving significant renovation and new fit-out projects.

- Residential: Sustained population growth and the demand for premium housing continue to make the residential segment a significant contributor.

UAE Interior Design Market Product Landscape

The UAE interior design market is characterized by a burgeoning landscape of innovative products and applications. Designers are increasingly leveraging sustainable materials such as recycled timber, bamboo, and low-VOC paints to meet environmental regulations and client preferences. Advancements in smart home technology, integrated lighting systems, and customizable furniture solutions are enhancing functionality and user experience. Performance metrics are often gauged by durability, aesthetic appeal, energy efficiency, and ease of maintenance. Unique selling propositions are found in designs that blend traditional Emirati aesthetics with contemporary minimalism, offering clients exclusive and culturally resonant spaces.

Key Drivers, Barriers & Challenges in UAE Interior Design Market

Key Drivers:

- Economic Diversification: Government initiatives promoting tourism, retail, and entertainment sectors.

- Infrastructure Development: Continuous investment in new residential, commercial, and hospitality projects.

- Expatriate Population Growth: Driving demand for diverse housing and lifestyle spaces.

- Sustainability Focus: Increasing adoption of eco-friendly materials and energy-efficient designs.

- Technological Advancements: Integration of smart home technologies and advanced visualization tools.

Barriers & Challenges:

- Supply Chain Disruptions: Global and regional logistics can impact material availability and project timelines.

- Cost Fluctuations: Volatility in raw material prices can affect project budgets.

- Skilled Labor Shortages: Finding and retaining highly skilled interior designers and fit-out professionals.

- Intense Competition: A crowded market with varying service quality and pricing structures.

- Regulatory Compliance: Navigating complex building codes and obtaining necessary permits.

Emerging Opportunities in UAE Interior Design Market

Emerging opportunities within the UAE interior design market lie in the burgeoning wellness and biophilic design sectors, catering to the growing demand for healthy and sustainable living and working environments. The development of smart and sustainable residential communities presents a significant avenue for designers specializing in integrated technology and eco-conscious solutions. Furthermore, the experiential retail design segment, focusing on creating immersive brand experiences, is rapidly expanding. The niche market for customized and bespoke furniture and fixtures, leveraging advanced manufacturing techniques, also offers substantial potential.

Growth Accelerators in the UAE Interior Design Market Industry

Key growth accelerators for the UAE interior design market include the ongoing ambitious government vision for infrastructure development and economic diversification, particularly in tourism, culture, and technology sectors. Strategic partnerships between design firms and technology providers are fostering the adoption of innovative digital tools, enhancing design efficiency and client engagement. Furthermore, the increasing emphasis on sustainable design practices and the circular economy is creating new market segments and driving demand for eco-friendly materials and solutions. Market expansion strategies, such as targeting emerging sectors like healthcare and education fit-outs, will also contribute to sustained growth.

Key Players Shaping the UAE Interior Design Market Market

- Bishop Design LLC

- Bond Interiors LLC

- Al Tayer Stocks LLC

- Romeo Interiors

- Xworks Interiors LLC

- Horton Tech Interiors

- Summertown Interiors LLC

- BW Interiors

- Plafond Fit Out LLC

- Al Nabooda Interiors LLC

Notable Milestones in UAE Interior Design Market Sector

- 2020: Increased adoption of virtual design consultations and remote project management tools due to global pandemic.

- 2021: Growing emphasis on sustainable materials and green building certifications in new developments.

- 2022: Significant growth in the hospitality sector fit-outs driven by Dubai Expo 2020 and subsequent tourism boom.

- 2023: Rise in demand for flexible and adaptive office spaces post-pandemic, focusing on collaboration and well-being.

- Ongoing: Continuous integration of smart home technology and AI-driven design solutions across various project types.

In-Depth UAE Interior Design Market Market Outlook

The future outlook for the UAE interior design market remains exceptionally bright, underpinned by powerful growth accelerators. The nation's unwavering commitment to becoming a global hub for business, tourism, and innovation ensures a sustained demand for high-quality, contemporary, and sustainable interior environments. Strategic investments in real estate, coupled with a forward-thinking regulatory landscape that embraces technological advancements and environmental consciousness, will continue to propel the market forward. The evolving preferences of a diverse population and an increasing focus on creating inspirational and functional spaces across residential, commercial, and hospitality sectors present a fertile ground for design innovation and profitable ventures.

UAE Interior Design Market Segmentation

-

1. Project Type

- 1.1. Residential

-

1.2. Commercial

- 1.2.1. Retail

- 1.2.2. Hotels

- 1.2.3. Education

- 1.2.4. Office

- 1.2.5. Hospitals

- 1.2.6. Others

UAE Interior Design Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Interior Design Market Regional Market Share

Geographic Coverage of UAE Interior Design Market

UAE Interior Design Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Space Interior Design Projects are Pacing in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Interior Design Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Project Type

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.2.1. Retail

- 5.1.2.2. Hotels

- 5.1.2.3. Education

- 5.1.2.4. Office

- 5.1.2.5. Hospitals

- 5.1.2.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Project Type

- 6. North America UAE Interior Design Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Project Type

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.2.1. Retail

- 6.1.2.2. Hotels

- 6.1.2.3. Education

- 6.1.2.4. Office

- 6.1.2.5. Hospitals

- 6.1.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Project Type

- 7. South America UAE Interior Design Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Project Type

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.2.1. Retail

- 7.1.2.2. Hotels

- 7.1.2.3. Education

- 7.1.2.4. Office

- 7.1.2.5. Hospitals

- 7.1.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Project Type

- 8. Europe UAE Interior Design Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Project Type

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.2.1. Retail

- 8.1.2.2. Hotels

- 8.1.2.3. Education

- 8.1.2.4. Office

- 8.1.2.5. Hospitals

- 8.1.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Project Type

- 9. Middle East & Africa UAE Interior Design Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Project Type

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.2.1. Retail

- 9.1.2.2. Hotels

- 9.1.2.3. Education

- 9.1.2.4. Office

- 9.1.2.5. Hospitals

- 9.1.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Project Type

- 10. Asia Pacific UAE Interior Design Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Project Type

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.2.1. Retail

- 10.1.2.2. Hotels

- 10.1.2.3. Education

- 10.1.2.4. Office

- 10.1.2.5. Hospitals

- 10.1.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Project Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bishop Design LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bond Interiors LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Al Tayer Stocks LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Romeo Interiors

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Xworks Interiors LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Horton Tech Interiors

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Summertown Interiors LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BW Interiors

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Plafond Fit Out LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Al Nabooda Interiors LLC*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bishop Design LLC

List of Figures

- Figure 1: Global UAE Interior Design Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global UAE Interior Design Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America UAE Interior Design Market Revenue (Million), by Project Type 2025 & 2033

- Figure 4: North America UAE Interior Design Market Volume (Billion), by Project Type 2025 & 2033

- Figure 5: North America UAE Interior Design Market Revenue Share (%), by Project Type 2025 & 2033

- Figure 6: North America UAE Interior Design Market Volume Share (%), by Project Type 2025 & 2033

- Figure 7: North America UAE Interior Design Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America UAE Interior Design Market Volume (Billion), by Country 2025 & 2033

- Figure 9: North America UAE Interior Design Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America UAE Interior Design Market Volume Share (%), by Country 2025 & 2033

- Figure 11: South America UAE Interior Design Market Revenue (Million), by Project Type 2025 & 2033

- Figure 12: South America UAE Interior Design Market Volume (Billion), by Project Type 2025 & 2033

- Figure 13: South America UAE Interior Design Market Revenue Share (%), by Project Type 2025 & 2033

- Figure 14: South America UAE Interior Design Market Volume Share (%), by Project Type 2025 & 2033

- Figure 15: South America UAE Interior Design Market Revenue (Million), by Country 2025 & 2033

- Figure 16: South America UAE Interior Design Market Volume (Billion), by Country 2025 & 2033

- Figure 17: South America UAE Interior Design Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America UAE Interior Design Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe UAE Interior Design Market Revenue (Million), by Project Type 2025 & 2033

- Figure 20: Europe UAE Interior Design Market Volume (Billion), by Project Type 2025 & 2033

- Figure 21: Europe UAE Interior Design Market Revenue Share (%), by Project Type 2025 & 2033

- Figure 22: Europe UAE Interior Design Market Volume Share (%), by Project Type 2025 & 2033

- Figure 23: Europe UAE Interior Design Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe UAE Interior Design Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe UAE Interior Design Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe UAE Interior Design Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Middle East & Africa UAE Interior Design Market Revenue (Million), by Project Type 2025 & 2033

- Figure 28: Middle East & Africa UAE Interior Design Market Volume (Billion), by Project Type 2025 & 2033

- Figure 29: Middle East & Africa UAE Interior Design Market Revenue Share (%), by Project Type 2025 & 2033

- Figure 30: Middle East & Africa UAE Interior Design Market Volume Share (%), by Project Type 2025 & 2033

- Figure 31: Middle East & Africa UAE Interior Design Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Middle East & Africa UAE Interior Design Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa UAE Interior Design Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East & Africa UAE Interior Design Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific UAE Interior Design Market Revenue (Million), by Project Type 2025 & 2033

- Figure 36: Asia Pacific UAE Interior Design Market Volume (Billion), by Project Type 2025 & 2033

- Figure 37: Asia Pacific UAE Interior Design Market Revenue Share (%), by Project Type 2025 & 2033

- Figure 38: Asia Pacific UAE Interior Design Market Volume Share (%), by Project Type 2025 & 2033

- Figure 39: Asia Pacific UAE Interior Design Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Asia Pacific UAE Interior Design Market Volume (Billion), by Country 2025 & 2033

- Figure 41: Asia Pacific UAE Interior Design Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific UAE Interior Design Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Interior Design Market Revenue Million Forecast, by Project Type 2020 & 2033

- Table 2: Global UAE Interior Design Market Volume Billion Forecast, by Project Type 2020 & 2033

- Table 3: Global UAE Interior Design Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global UAE Interior Design Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Global UAE Interior Design Market Revenue Million Forecast, by Project Type 2020 & 2033

- Table 6: Global UAE Interior Design Market Volume Billion Forecast, by Project Type 2020 & 2033

- Table 7: Global UAE Interior Design Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global UAE Interior Design Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: United States UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Canada UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Global UAE Interior Design Market Revenue Million Forecast, by Project Type 2020 & 2033

- Table 16: Global UAE Interior Design Market Volume Billion Forecast, by Project Type 2020 & 2033

- Table 17: Global UAE Interior Design Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global UAE Interior Design Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Brazil UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Brazil UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Argentina UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Argentina UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of South America UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Global UAE Interior Design Market Revenue Million Forecast, by Project Type 2020 & 2033

- Table 26: Global UAE Interior Design Market Volume Billion Forecast, by Project Type 2020 & 2033

- Table 27: Global UAE Interior Design Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global UAE Interior Design Market Volume Billion Forecast, by Country 2020 & 2033

- Table 29: United Kingdom UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Germany UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: France UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: France UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Italy UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Italy UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Spain UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Spain UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Russia UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Russia UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Benelux UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Benelux UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Nordics UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Nordics UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of Europe UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Europe UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Global UAE Interior Design Market Revenue Million Forecast, by Project Type 2020 & 2033

- Table 48: Global UAE Interior Design Market Volume Billion Forecast, by Project Type 2020 & 2033

- Table 49: Global UAE Interior Design Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global UAE Interior Design Market Volume Billion Forecast, by Country 2020 & 2033

- Table 51: Turkey UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Turkey UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Israel UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Israel UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: GCC UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: GCC UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: North Africa UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: North Africa UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: South Africa UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Africa UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East & Africa UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Middle East & Africa UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Global UAE Interior Design Market Revenue Million Forecast, by Project Type 2020 & 2033

- Table 64: Global UAE Interior Design Market Volume Billion Forecast, by Project Type 2020 & 2033

- Table 65: Global UAE Interior Design Market Revenue Million Forecast, by Country 2020 & 2033

- Table 66: Global UAE Interior Design Market Volume Billion Forecast, by Country 2020 & 2033

- Table 67: China UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: China UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: India UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: India UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 71: Japan UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Japan UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: South Korea UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Korea UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: ASEAN UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: ASEAN UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 77: Oceania UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Oceania UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 79: Rest of Asia Pacific UAE Interior Design Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: Rest of Asia Pacific UAE Interior Design Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Interior Design Market?

The projected CAGR is approximately 6.79%.

2. Which companies are prominent players in the UAE Interior Design Market?

Key companies in the market include Bishop Design LLC, Bond Interiors LLC, Al Tayer Stocks LLC, Romeo Interiors, Xworks Interiors LLC, Horton Tech Interiors, Summertown Interiors LLC, BW Interiors, Plafond Fit Out LLC, Al Nabooda Interiors LLC*List Not Exhaustive.

3. What are the main segments of the UAE Interior Design Market?

The market segments include Project Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.35 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Space Interior Design Projects are Pacing in the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Interior Design Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Interior Design Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Interior Design Market?

To stay informed about further developments, trends, and reports in the UAE Interior Design Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence