Key Insights

The global Waste Handling Equipment Market is projected to reach USD 224.9 million by 2025, with a CAGR of 9.38%. This growth is driven by increasing waste generation, stringent environmental regulations, and heightened public awareness of sustainable waste management. Demand for efficient waste disposal, recycling, and sorting equipment is a key factor, as industries invest in technologies for material recovery and reduced landfill reliance, supporting a circular economy. Managing hazardous and non-hazardous waste across industrial and municipal sectors presents significant opportunities, with a focus on advanced industrial waste management and municipal solid waste processing solutions.

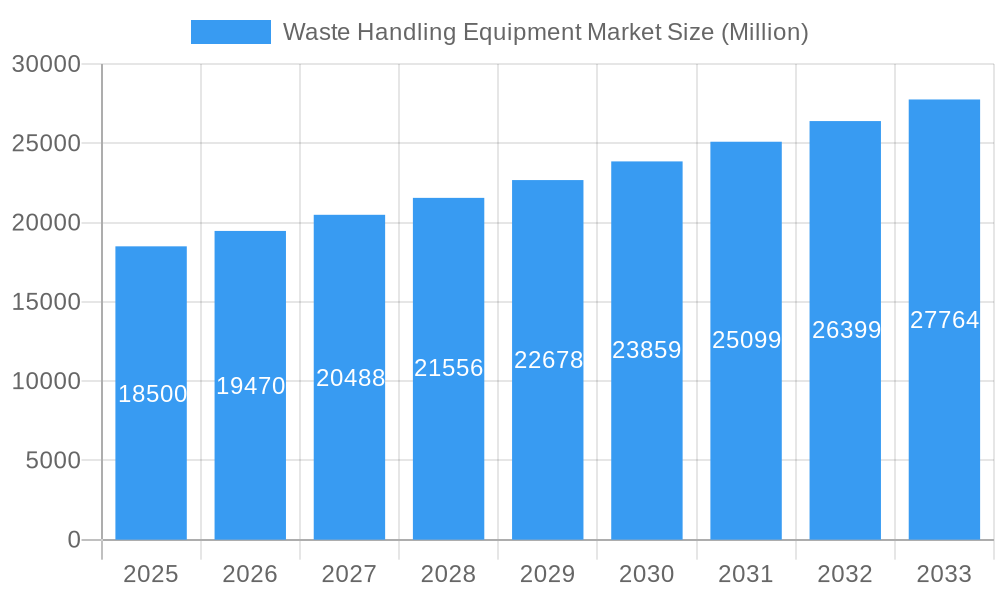

Waste Handling Equipment Market Market Size (In Million)

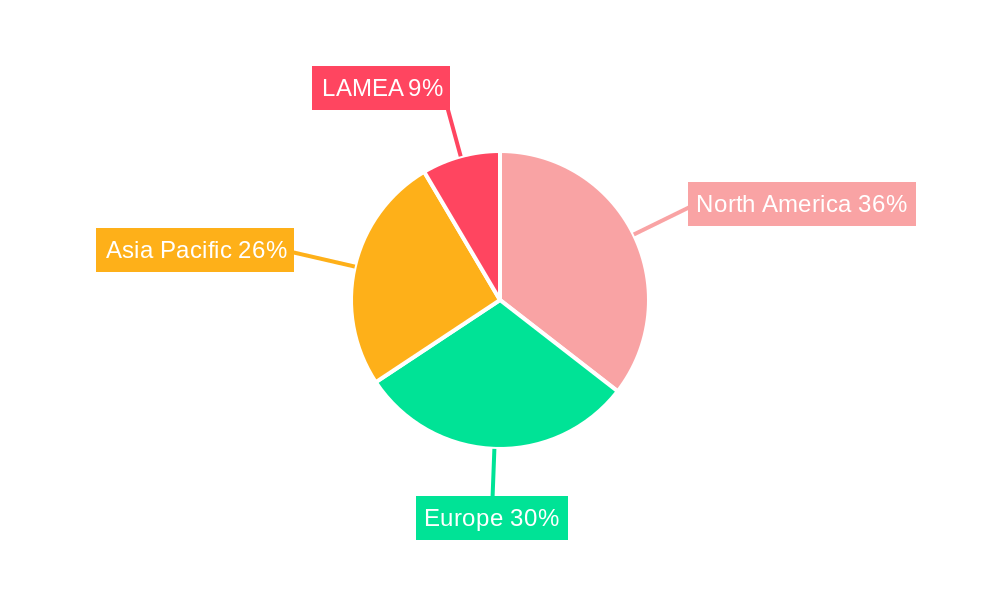

Emerging trends such as IoT and AI integration for optimized operations, automated sorting, and waste-to-energy solutions are enhancing efficiency and sustainability. High initial investment costs and inconsistent infrastructure in developing regions pose challenges. However, governmental and organizational commitments to sustainability, alongside technological advancements from leading companies, are expected to sustain market growth. North America and Europe lead the market, with Asia Pacific anticipated for the fastest growth due to rapid urbanization, industrialization, and infrastructure investment.

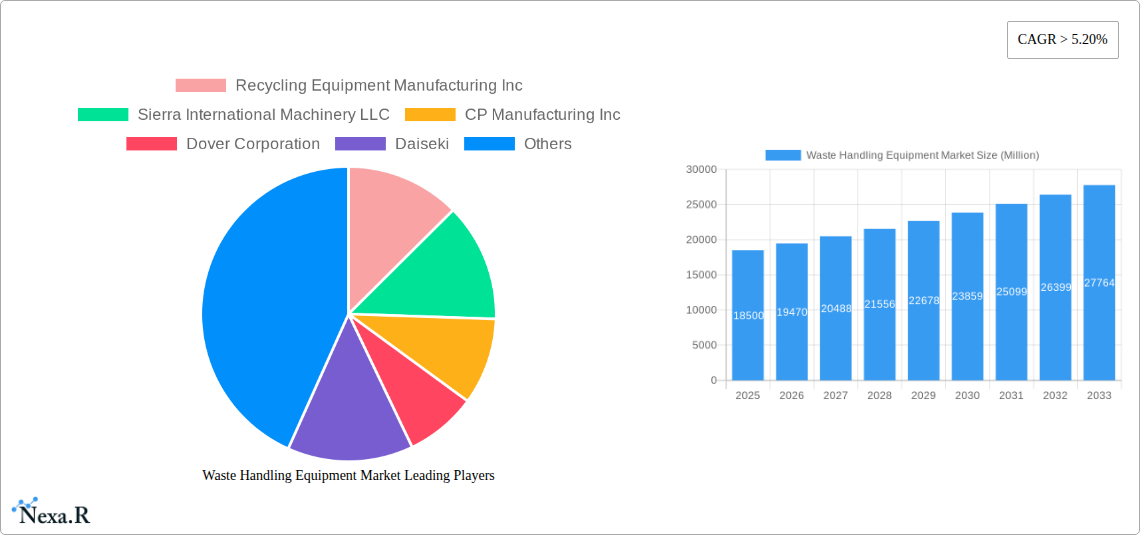

Waste Handling Equipment Market Company Market Share

Comprehensive Waste Handling Equipment Market Report: Insights, Trends, and Future Outlook (2019-2033)

This in-depth report delivers a critical analysis of the global Waste Handling Equipment Market, offering granular insights into its dynamics, growth trajectories, and future potential. Covering the extensive Study Period: 2019–2033, with Base Year: 2025 and Forecast Period: 2025–2033, this research provides an unparalleled understanding of the Waste Disposal Equipment Market and the Waste Recycling & Sorting Equipment Market. Navigate market complexities, identify strategic opportunities, and gain a competitive edge in this rapidly evolving sector. Discover critical data points and actionable intelligence designed for industry leaders, investors, and policymakers.

Waste Handling Equipment Market Market Dynamics & Structure

The Waste Handling Equipment Market is characterized by a moderately concentrated structure, with key players investing heavily in technological innovation to address stringent environmental regulations and evolving end-user demands. Driven by global initiatives for sustainable waste management, the market witnesses continuous advancements in automation, IoT integration, and advanced sorting technologies for both Hazardous Waste and Non-Hazardous Waste. Regulatory frameworks, such as Extended Producer Responsibility (EPR) schemes and landfill diversion mandates, act as significant drivers for market adoption. Competitive product substitutes are emerging, particularly in advanced recycling technologies and waste-to-energy solutions, pushing manufacturers to differentiate through efficiency and environmental performance. End-user demographics, spanning Industrial Waste and Municipal Waste applications, are increasingly prioritizing cost-effectiveness and environmental compliance. Mergers & Acquisitions (M&A) trends indicate a consolidation phase, with larger entities acquiring innovative startups to expand their technology portfolios and market reach. For instance, the Wastequip LLC and Blue Group strategic alignments highlight this trend. Innovation barriers primarily stem from the high capital investment required for advanced equipment and the need for skilled labor in operation and maintenance.

Waste Handling Equipment Market Growth Trends & Insights

The global Waste Handling Equipment Market is projected for robust growth, fueled by increasing environmental consciousness, stringent regulations, and the growing volume of waste generated globally. Our analysis leverages extensive market data to present a comprehensive outlook on market size evolution. The market is estimated to have reached approximately $XX Billion units in 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the Forecast Period: 2025–2033. Adoption rates for advanced waste recycling and sorting equipment are rapidly increasing, driven by the economic benefits of resource recovery and the imperative to reduce landfill dependency. Technological disruptions, such as AI-powered sorting systems, advanced compactor technologies, and efficient waste-to-energy solutions, are reshaping the industry landscape. Consumer behavior shifts towards sustainable consumption patterns are indirectly influencing waste generation and, consequently, the demand for sophisticated handling equipment. The increasing focus on circular economy principles further accentuates the need for efficient waste management infrastructure. The market penetration of specialized equipment for Industrial Waste and Municipal Waste is expected to see significant expansion, driven by policy incentives and a growing understanding of the long-term economic and environmental advantages of effective waste management.

Dominant Regions, Countries, or Segments in Waste Handling Equipment Market

The Waste Recycling & Sorting Equipment segment, particularly within the Municipal Waste application, is currently the dominant force driving growth in the global Waste Handling Equipment Market. Regions like North America and Europe are at the forefront of this dominance, owing to their established waste management infrastructure, progressive environmental policies, and high public awareness regarding recycling and waste reduction. The economic policies in these regions actively encourage the adoption of advanced recycling technologies and investments in modern waste processing facilities. Infrastructure development plays a crucial role, with significant investments in state-of-the-art Material Recovery Facilities (MRFs) and centralized sorting centers. Countries such as the United States, Germany, and the United Kingdom lead in the adoption of sophisticated waste handling solutions. The market share for Waste Recycling & Sorting Equipment is estimated to be around XX% in 2025, with a projected growth rate that outpaces other segments. The increasing volume of electronic waste and plastic waste further bolsters the demand for specialized recycling and sorting equipment. The growth potential in emerging economies in Asia-Pacific is also substantial, driven by rapid urbanization and industrialization, presenting significant future opportunities for market expansion.

Waste Handling Equipment Market Product Landscape

The product landscape of the Waste Handling Equipment Market is characterized by continuous innovation focused on enhancing efficiency, reducing operational costs, and improving environmental impact. Key product types include advanced Waste Disposal Equipment, such as high-capacity balers and compactors, and sophisticated Waste Recycling & Sorting Equipment, featuring automated optical sorters and robotic sorting arms. Applications range from handling bulky Industrial Waste to managing diverse streams of Municipal Waste. Performance metrics are increasingly focused on processing speed, energy efficiency, material recovery rates, and a reduced footprint. Unique selling propositions often lie in the integration of smart technologies, such as real-time data analytics and remote monitoring capabilities, enabling optimized operations and predictive maintenance. Technological advancements are continually pushing the boundaries of what is achievable in waste processing.

Key Drivers, Barriers & Challenges in Waste Handling Equipment Market

Key Drivers:

- Stringent Environmental Regulations: Growing global mandates for waste reduction, recycling, and landfill diversion are primary market accelerators.

- Technological Advancements: Innovations in automation, AI, and IoT are driving demand for more efficient and intelligent waste handling solutions.

- Circular Economy Initiatives: The global push towards a circular economy necessitates advanced equipment for effective resource recovery and waste valorization.

- Increasing Waste Generation: Rapid urbanization and industrial growth worldwide are leading to a consistent rise in waste volumes, creating sustained demand.

- Economic Incentives: Government subsidies, tax credits, and grants for adopting sustainable waste management practices encourage investment in new equipment.

Key Barriers & Challenges:

- High Initial Investment Costs: The upfront capital required for advanced waste handling equipment can be a significant barrier for smaller entities.

- Regulatory Complexity: Navigating diverse and evolving waste management regulations across different regions presents a challenge.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of raw materials and finished equipment.

- Skilled Labor Shortage: The operation and maintenance of sophisticated waste handling machinery require specialized skills, leading to a potential labor gap.

- Public Perception and Acceptance: Overcoming public resistance to new waste processing technologies or facilities can be challenging.

Emerging Opportunities in Waste Handling Equipment Market

Emerging opportunities in the Waste Handling Equipment Market lie in the untapped potential of specialized recycling for niche waste streams, such as e-waste and bioplastics. The development of modular and scalable waste processing solutions for decentralized waste management in developing regions presents a significant avenue for growth. Evolving consumer preferences for products with minimal environmental impact are also indirectly driving demand for advanced recycling technologies that can handle complex material compositions. The integration of waste handling equipment with smart city initiatives and the Internet of Things (IoT) offers further opportunities for optimizing urban waste management systems.

Growth Accelerators in the Waste Handling Equipment Market Industry

Catalysts driving long-term growth in the Waste Handling Equipment Market industry are deeply rooted in technological breakthroughs and strategic market expansion. The continuous evolution of Artificial Intelligence (AI) and Machine Learning (ML) in sorting technologies, enabling higher purity rates and recovery of valuable materials, will be a major accelerator. Strategic partnerships between equipment manufacturers and waste management companies, as well as collaborations with research institutions, are fostering innovation and accelerating the development of next-generation solutions. Market expansion strategies targeting regions with nascent waste management infrastructure, coupled with policy advocacy for stronger environmental regulations, will further fuel sustained growth.

Key Players Shaping the Waste Handling Equipment Market Market

- Recycling Equipment Manufacturing Inc

- Sierra International Machinery LLC

- CP Manufacturing Inc

- Dover Corporation

- Daiseki

- Hitachi Zosen

- Morita Holding Corporation

- Tomra Systems ASA

- Wastequip LLC

- Blue Group

Notable Milestones in Waste Handling Equipment Market Sector

- June 2022: Bakersfield, California-based Sierra International Machinery initiated its expansion project at its manufacturing facility in Jesup, Georgia, adding 24,000 square feet to increase production capacity and meet demand.

- June 2022: Belgium-based metals and recycling company Umicore hinted at further investments in recycling as part of its 'Umicore 2030 - RISE' strategic plan, anticipating electronics and EV recycling as critical components, projecting a tripling of its addressable mobility market by 2030.

In-Depth Waste Handling Equipment Market Market Outlook

The future outlook for the Waste Handling Equipment Market is exceptionally promising, driven by a confluence of accelerating forces. The increasing global commitment to sustainability, coupled with the economic imperatives of resource recovery, positions this market as a critical component of the future global economy. Strategic opportunities abound in the development of smart, interconnected waste management systems that leverage data analytics for optimized operations and enhanced environmental performance. The continued investment in research and development for advanced recycling technologies, particularly for complex waste streams, will unlock new market segments and revenue streams. The collaborative efforts between industry stakeholders, governments, and research institutions will be pivotal in driving innovation and ensuring widespread adoption of efficient and sustainable waste handling practices, solidifying the market's trajectory for substantial growth.

Waste Handling Equipment Market Segmentation

-

1. Product Type

- 1.1. Waste Disposal Equipment

- 1.2. Waste Recycling & Sorting Equipment

-

2. Waste Type

- 2.1. Hazardous

- 2.2. Non-Hazardous

-

3. Application

- 3.1. Industrial Waste

- 3.2. Municipal Waste

- 3.3. Others

Waste Handling Equipment Market Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Spain

- 2.2. Germany

- 2.3. France

- 2.4. UK

- 2.5. Portugal

- 2.6. Greece

- 2.7. Italy

- 2.8. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. India

- 3.5. Rest of Asia Pacific

-

4. LAMEA

- 4.1. UAE

- 4.2. Saudi Arabia

- 4.3. Brazil

- 4.4. South Africa

- 4.5. Rest of LAMEA

Waste Handling Equipment Market Regional Market Share

Geographic Coverage of Waste Handling Equipment Market

Waste Handling Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising global waste generation is likely to result in the need of waste management equipment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Waste Handling Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Waste Disposal Equipment

- 5.1.2. Waste Recycling & Sorting Equipment

- 5.2. Market Analysis, Insights and Forecast - by Waste Type

- 5.2.1. Hazardous

- 5.2.2. Non-Hazardous

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Industrial Waste

- 5.3.2. Municipal Waste

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. LAMEA

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Waste Handling Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Waste Disposal Equipment

- 6.1.2. Waste Recycling & Sorting Equipment

- 6.2. Market Analysis, Insights and Forecast - by Waste Type

- 6.2.1. Hazardous

- 6.2.2. Non-Hazardous

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Industrial Waste

- 6.3.2. Municipal Waste

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Waste Handling Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Waste Disposal Equipment

- 7.1.2. Waste Recycling & Sorting Equipment

- 7.2. Market Analysis, Insights and Forecast - by Waste Type

- 7.2.1. Hazardous

- 7.2.2. Non-Hazardous

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Industrial Waste

- 7.3.2. Municipal Waste

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Waste Handling Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Waste Disposal Equipment

- 8.1.2. Waste Recycling & Sorting Equipment

- 8.2. Market Analysis, Insights and Forecast - by Waste Type

- 8.2.1. Hazardous

- 8.2.2. Non-Hazardous

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Industrial Waste

- 8.3.2. Municipal Waste

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. LAMEA Waste Handling Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Waste Disposal Equipment

- 9.1.2. Waste Recycling & Sorting Equipment

- 9.2. Market Analysis, Insights and Forecast - by Waste Type

- 9.2.1. Hazardous

- 9.2.2. Non-Hazardous

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Industrial Waste

- 9.3.2. Municipal Waste

- 9.3.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Recycling Equipment Manufacturing Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sierra International Machinery LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 CP Manufacturing Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Dover Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Daiseki

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hitachi Zosen

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Morita Holding Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Tomra Systems ASA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Wastequip LLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Blue Group**List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Recycling Equipment Manufacturing Inc

List of Figures

- Figure 1: Global Waste Handling Equipment Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Waste Handling Equipment Market Revenue (million), by Product Type 2025 & 2033

- Figure 3: North America Waste Handling Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Waste Handling Equipment Market Revenue (million), by Waste Type 2025 & 2033

- Figure 5: North America Waste Handling Equipment Market Revenue Share (%), by Waste Type 2025 & 2033

- Figure 6: North America Waste Handling Equipment Market Revenue (million), by Application 2025 & 2033

- Figure 7: North America Waste Handling Equipment Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Waste Handling Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America Waste Handling Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Waste Handling Equipment Market Revenue (million), by Product Type 2025 & 2033

- Figure 11: Europe Waste Handling Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Waste Handling Equipment Market Revenue (million), by Waste Type 2025 & 2033

- Figure 13: Europe Waste Handling Equipment Market Revenue Share (%), by Waste Type 2025 & 2033

- Figure 14: Europe Waste Handling Equipment Market Revenue (million), by Application 2025 & 2033

- Figure 15: Europe Waste Handling Equipment Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Waste Handling Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 17: Europe Waste Handling Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Waste Handling Equipment Market Revenue (million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Waste Handling Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Waste Handling Equipment Market Revenue (million), by Waste Type 2025 & 2033

- Figure 21: Asia Pacific Waste Handling Equipment Market Revenue Share (%), by Waste Type 2025 & 2033

- Figure 22: Asia Pacific Waste Handling Equipment Market Revenue (million), by Application 2025 & 2033

- Figure 23: Asia Pacific Waste Handling Equipment Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Waste Handling Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific Waste Handling Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: LAMEA Waste Handling Equipment Market Revenue (million), by Product Type 2025 & 2033

- Figure 27: LAMEA Waste Handling Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: LAMEA Waste Handling Equipment Market Revenue (million), by Waste Type 2025 & 2033

- Figure 29: LAMEA Waste Handling Equipment Market Revenue Share (%), by Waste Type 2025 & 2033

- Figure 30: LAMEA Waste Handling Equipment Market Revenue (million), by Application 2025 & 2033

- Figure 31: LAMEA Waste Handling Equipment Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: LAMEA Waste Handling Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 33: LAMEA Waste Handling Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Waste Handling Equipment Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Global Waste Handling Equipment Market Revenue million Forecast, by Waste Type 2020 & 2033

- Table 3: Global Waste Handling Equipment Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: Global Waste Handling Equipment Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Waste Handling Equipment Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 6: Global Waste Handling Equipment Market Revenue million Forecast, by Waste Type 2020 & 2033

- Table 7: Global Waste Handling Equipment Market Revenue million Forecast, by Application 2020 & 2033

- Table 8: Global Waste Handling Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: US Waste Handling Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Waste Handling Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Waste Handling Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Waste Handling Equipment Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 13: Global Waste Handling Equipment Market Revenue million Forecast, by Waste Type 2020 & 2033

- Table 14: Global Waste Handling Equipment Market Revenue million Forecast, by Application 2020 & 2033

- Table 15: Global Waste Handling Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Spain Waste Handling Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Germany Waste Handling Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: France Waste Handling Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: UK Waste Handling Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Portugal Waste Handling Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Greece Waste Handling Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Waste Handling Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Waste Handling Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Global Waste Handling Equipment Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 25: Global Waste Handling Equipment Market Revenue million Forecast, by Waste Type 2020 & 2033

- Table 26: Global Waste Handling Equipment Market Revenue million Forecast, by Application 2020 & 2033

- Table 27: Global Waste Handling Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 28: China Waste Handling Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Japan Waste Handling Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Waste Handling Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: India Waste Handling Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Waste Handling Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: Global Waste Handling Equipment Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 34: Global Waste Handling Equipment Market Revenue million Forecast, by Waste Type 2020 & 2033

- Table 35: Global Waste Handling Equipment Market Revenue million Forecast, by Application 2020 & 2033

- Table 36: Global Waste Handling Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 37: UAE Waste Handling Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Saudi Arabia Waste Handling Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: Brazil Waste Handling Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Waste Handling Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: Rest of LAMEA Waste Handling Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Waste Handling Equipment Market?

The projected CAGR is approximately 9.38%.

2. Which companies are prominent players in the Waste Handling Equipment Market?

Key companies in the market include Recycling Equipment Manufacturing Inc, Sierra International Machinery LLC, CP Manufacturing Inc, Dover Corporation, Daiseki, Hitachi Zosen, Morita Holding Corporation, Tomra Systems ASA, Wastequip LLC, Blue Group**List Not Exhaustive.

3. What are the main segments of the Waste Handling Equipment Market?

The market segments include Product Type, Waste Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 224.9 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising global waste generation is likely to result in the need of waste management equipment.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2022: Bakersfield, California-based Sierra International Machinery, initiated its expansion project at its manufacturing facility in Jesup, Georgia. The expansion will add 24,000 square feet of space to its manufacturing facility there. The expansion will allow Sierra to increase its production capacity and meet the steady demand for the Sierra product line.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Waste Handling Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Waste Handling Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Waste Handling Equipment Market?

To stay informed about further developments, trends, and reports in the Waste Handling Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence