Key Insights

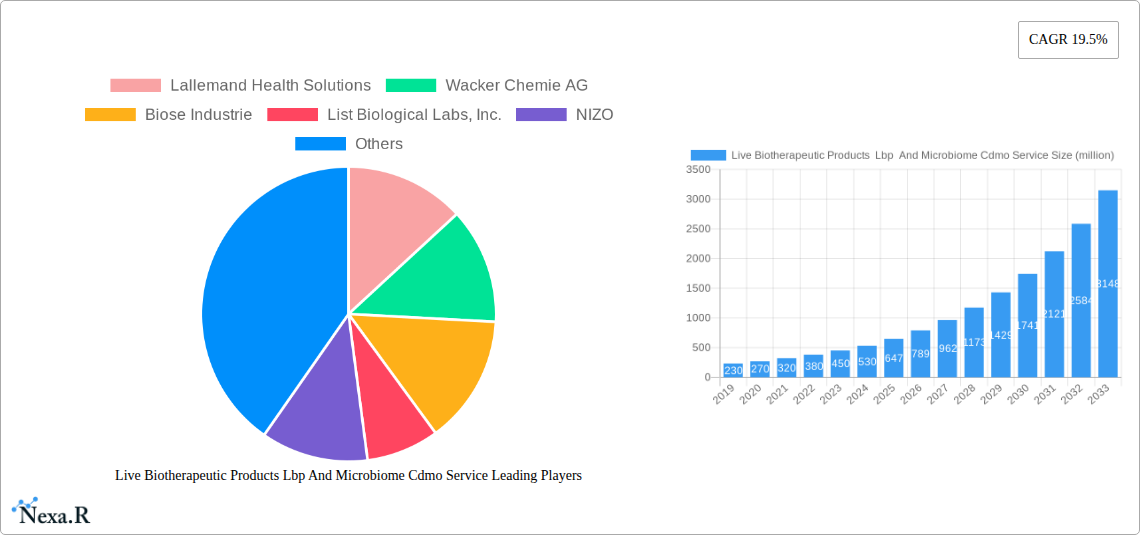

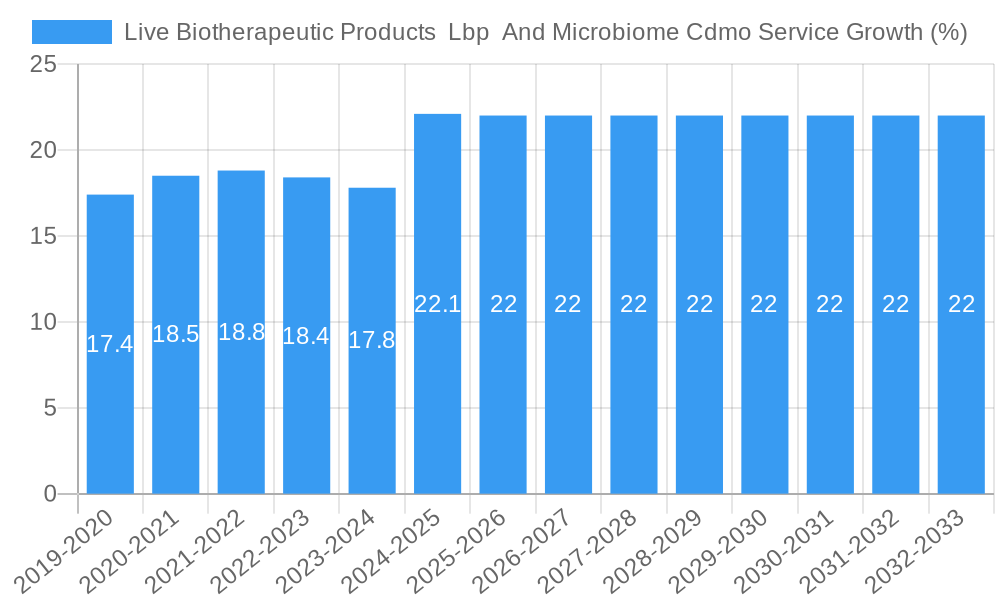

The Live Biotherapeutic Products (LBP) and Microbiome CDMO Service market is poised for remarkable expansion, projected to reach approximately $647 million by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 19.5%, signaling a significant and sustained upward trajectory. The increasing understanding of the microbiome's profound impact on human health is a primary catalyst, driving demand for specialized development and manufacturing services. Applications are diverse and expanding, with Digestive System Diseases and Immune System Diseases emerging as key areas of focus due to the direct influence of microbial balance on these conditions. Metabolic diseases also represent a substantial opportunity, as research increasingly links the gut microbiome to metabolic health and disorders. The market predominantly caters to Solid Dosage Forms, reflecting the established and efficient delivery methods for LBPs, with Liquid Dosage Forms also holding potential for specific applications.

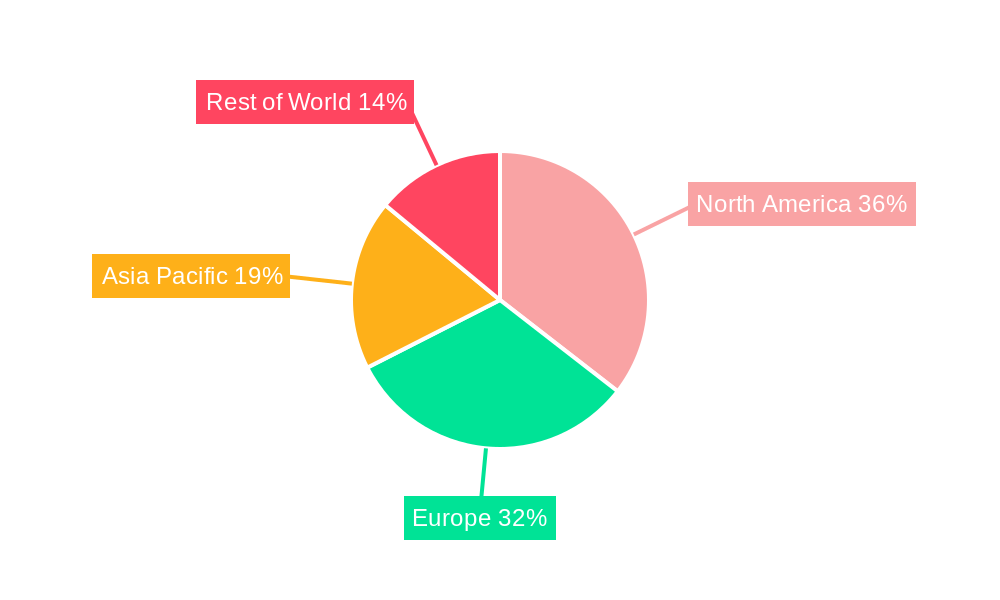

The competitive landscape features a blend of established biopharmaceutical giants and specialized microbiome CDMOs, including Lallemand Health Solutions, Wacker Chemie AG, and Lonza (through Bacthera). These players are investing heavily in research and development, process optimization, and capacity expansion to meet the growing demand. Geographically, North America and Europe are expected to lead the market, driven by advanced healthcare infrastructure, significant R&D investments, and a high prevalence of microbiome-related research. The Asia Pacific region, particularly China and India, presents a significant growth opportunity due to a burgeoning pharmaceutical industry and a large patient pool. Restraints, such as regulatory hurdles for novel LBPs and the complexity of microbiome research, are being addressed through collaborative efforts and advancements in analytical and manufacturing technologies. The continued innovation in LBP development and the increasing outsourcing of complex manufacturing processes to specialized CDMOs will be critical in navigating these challenges and capitalizing on the immense market potential.

This report provides an in-depth analysis of the Live Biotherapeutic Products (LBP) and Microbiome Contract Development and Manufacturing Organization (CDMO) services market. It explores market dynamics, growth trends, regional dominance, product landscapes, key drivers and barriers, emerging opportunities, growth accelerators, competitive intelligence, and significant milestones. The analysis covers the historical period from 2019-2024, with a base year of 2025 and a forecast period extending to 2033, offering actionable insights for industry stakeholders.

Live Biotherapeutic Products (LBP) & Microbiome CDMO Services Market Dynamics & Structure

The Live Biotherapeutic Products (LBP) and Microbiome CDMO services market is characterized by dynamic growth and increasing complexity, driven by a burgeoning understanding of the human microbiome's role in health and disease. Market concentration varies across different segments, with specialized CDMOs catering to niche therapeutic areas or specific manufacturing needs. Technological innovation is a primary driver, encompassing advancements in strain selection, fermentation processes, formulation technologies, and analytical methods for characterizing complex microbial consortia. The regulatory landscape is evolving, with agencies like the FDA and EMA developing frameworks for LBP approval, creating both opportunities and challenges for manufacturers. Competitive product substitutes include traditional pharmaceuticals and other microbiome-based interventions. End-user demographics are broad, encompassing patients with digestive system diseases, immune system diseases, metabolic diseases, and other conditions. Mergers and acquisitions (M&A) are prevalent as larger pharmaceutical companies seek to enter the microbiome space and CDMOs consolidate to offer end-to-end services. For example, the past five years have seen an estimated 15-20 significant M&A deals valued at over $50 million each, reflecting industry consolidation and strategic expansion. Innovation barriers include the high cost of R&D, lengthy clinical trial durations, and the inherent complexity of biological systems.

- Market Concentration: Moderate to high in specialized manufacturing niches, with a trend towards consolidation.

- Technological Innovation Drivers: Advanced fermentation, strain engineering, bioinformatics, and novel delivery systems.

- Regulatory Frameworks: Evolving guidelines for LBP approval, requiring significant investment in compliance.

- Competitive Product Substitutes: Traditional small molecules, biologics, and prebiotics/probiotics.

- End-User Demographics: Patients with chronic diseases and conditions responsive to microbiome modulation.

- M&A Trends: Significant activity to gain market share and expand service offerings.

Live Biotherapeutic Products (LBP) & Microbiome CDMO Services Growth Trends & Insights

The global Live Biotherapeutic Products (LBP) and Microbiome CDMO services market is poised for substantial expansion, driven by a confluence of scientific advancements, unmet medical needs, and increasing investment. Projections indicate a robust Compound Annual Growth Rate (CAGR) of approximately 25-30% from 2025 to 2033. The market size, estimated to be around $2,500 million in 2025, is anticipated to reach over $10,000 million by 2033. This growth is fueled by a deeper understanding of the microbiome's intricate role in human health, impacting areas from gut health and immunity to neurological disorders and metabolic syndromes. The escalating prevalence of chronic diseases, coupled with the limitations of conventional therapies, is creating a fertile ground for microbiome-based interventions. Adoption rates for LBPs are steadily increasing as clinical trial data matures and regulatory pathways become clearer. Technological disruptions are at the forefront, with advancements in gene editing, synthetic biology, and personalized medicine enabling the development of more targeted and effective LBPs. Consumer behavior is also shifting, with a growing awareness and demand for natural and holistic approaches to health and wellness, further propelling the market for microbiome-based solutions. The market penetration of LBPs, currently in its nascent stages for many indications, is expected to witness exponential growth as more products move through the clinical pipeline and gain market approval.

Dominant Regions, Countries, or Segments in Live Biotherapeutic Products (LBP) & Microbiome CDMO Services

North America, particularly the United States, currently dominates the Live Biotherapeutic Products (LBP) and Microbiome CDMO services market, accounting for an estimated 45% of the global market share in 2025. This dominance is attributed to a robust research and development ecosystem, significant venture capital funding, a well-established regulatory framework for biologics, and a high prevalence of chronic diseases. Key drivers include government initiatives supporting microbiome research, the presence of leading academic institutions, and a strong pipeline of LBP candidates in clinical development. The Application segment of Digestive System Diseases is a significant growth engine, representing approximately 40% of the market in 2025, driven by conditions like inflammatory bowel disease (IBD), irritable bowel syndrome (IBS), and Clostridioides difficile (C. diff) infections. The Immune System Diseases segment, including allergies and autoimmune disorders, is a rapidly growing area, with an estimated market share of 25% in 2025 and a projected CAGR exceeding 30%. The Metabolic Diseases segment, encompassing conditions like obesity and type 2 diabetes, is also showing strong growth potential. From a Type perspective, Solid Dosage Forms currently hold a larger market share due to established manufacturing processes and ease of administration, representing roughly 60% of the market. However, Liquid Dosage Forms are gaining traction for specific applications and patient populations, offering advantages in bioavailability and patient compliance. Europe, with its strong academic research and increasing investment in biotechnology, is the second-largest market, followed by Asia-Pacific, which is expected to witness the highest growth rate in the coming years due to expanding healthcare infrastructure and rising R&D activities.

- Leading Region: North America (primarily the United States).

- Key Application Driver: Digestive System Diseases.

- Fastest Growing Application: Immune System Diseases.

- Dominant Type: Solid Dosage Form.

- Emerging Type: Liquid Dosage Form.

- Key Growth Factors: R&D funding, regulatory clarity, disease prevalence, and consumer demand.

Live Biotherapeutic Products (LBP) & Microbiome CDMO Services Product Landscape

The product landscape within the Live Biotherapeutic Products (LBP) and Microbiome CDMO services market is characterized by innovation and a focus on specific therapeutic targets. Companies are developing LBPs with well-defined microbial strains, often single strains or well-characterized consortia, to address particular diseases. Unique selling propositions include enhanced potency, targeted delivery mechanisms, and improved safety profiles. Technological advancements are central to product differentiation, with ongoing research in areas like metabolic engineering of microbial strains to produce therapeutic molecules, encapsulation techniques for enhanced stability and targeted release, and advanced sequencing and bioinformatics for identifying novel microbial targets. Performance metrics are evaluated based on efficacy in preclinical and clinical trials, safety profiles, patient adherence, and manufacturing scalability. The market also sees a growing demand for contract manufacturing services that can handle the complexities of producing these novel biological products consistently and at scale.

Key Drivers, Barriers & Challenges in Live Biotherapeutic Products (LBP) & Microbiome CDMO Services

Key Drivers:

- Scientific Advancement: Deepening understanding of the microbiome's influence on health and disease.

- Unmet Medical Needs: Growing demand for novel therapies for chronic and complex conditions.

- Investor Interest: Significant venture capital and pharmaceutical investment in the microbiome space.

- Regulatory Evolution: Development of clear pathways for LBP approval.

- Technological Innovation: Advances in strain engineering, fermentation, and delivery systems.

Barriers & Challenges:

- High R&D Costs: Extensive research, development, and clinical trial expenses.

- Regulatory Hurdles: Evolving and sometimes complex approval processes.

- Manufacturing Complexity: Challenges in scaling up consistent and high-quality LBP production.

- Long Clinical Trial Durations: Time-consuming and resource-intensive validation of efficacy and safety.

- Public Perception: Educating the public and healthcare providers about the potential of LBPs.

- Supply Chain Vulnerabilities: Ensuring the integrity and viability of live microbial products throughout the supply chain.

- Competition: Intense competition from traditional pharmaceuticals and other microbiome-based products.

Emerging Opportunities in Live Biotherapeutic Products (LBP) & Microbiome CDMO Services

Emerging opportunities in the Live Biotherapeutic Products (LBP) and Microbiome CDMO services market are diverse and rapidly expanding. Untapped markets include the development of LBPs for neurological disorders, such as Parkinson's disease and Alzheimer's, and for a broader range of dermatological conditions. Innovative applications are emerging in preventative health and wellness, beyond therapeutic indications. Evolving consumer preferences for personalized and precision medicine are creating demand for tailored microbiome interventions. Furthermore, the integration of LBPs with other therapeutic modalities, like immunotherapies, presents a significant growth avenue. The expansion of CDMO services to include advanced analytics, formulation development, and late-stage clinical trial support also represents a key opportunity.

Growth Accelerators in the Live Biotherapeutic Products (LBP) & Microbiome CDMO Services Industry

Long-term growth in the Live Biotherapeutic Products (LBP) and Microbiome CDMO services industry is being catalyzed by several factors. Technological breakthroughs in areas such as CRISPR for strain engineering and AI-driven microbiome analysis are accelerating product discovery and development. Strategic partnerships between biotechnology companies, pharmaceutical giants, and academic institutions are fostering innovation and de-risking investments. Market expansion strategies include focusing on global regulatory harmonization to streamline approvals and targeting emerging economies with growing healthcare needs. The increasing commoditization of manufacturing processes through advanced CDMO capabilities will also drive down costs and increase accessibility.

Key Players Shaping the Live Biotherapeutic Products (LBP) & Microbiome CDMO Services Market

- Lallemand Health Solutions

- Wacker Chemie AG

- Biose Industrie

- List Biological Labs, Inc.

- NIZO

- SGS (Quay Pharmaceuticals)

- Assembly Biosciences, Inc.

- Recipharm (Arranta Bio)

- Bacthera (Novonesis+Lonza)

- Smaltis

- Lonza

- vermicon AG

Notable Milestones in Live Biotherapeutic Products (LBP) & Microbiome CDMO Services Sector

- 2019: Approval of VSL#3 (now Visbiome) by the FDA for specific medical uses, signaling increasing regulatory acceptance.

- 2020: Significant increase in venture capital funding for microbiome therapeutics, reaching over $1 billion globally.

- 2021: FDA grants Orphan Drug Designation for multiple LBPs targeting rare diseases, accelerating development.

- 2022: Novonesis acquires Chr. Hansen and divides its business, leading to the formation of Bacthera as a significant microbiome CDMO player.

- 2023: Lonza and Novozymes merge their microbiome businesses to form Bacthera, creating a formidable integrated CDMO.

- 2024: Multiple Phase 2 and Phase 3 clinical trial initiations for LBPs targeting a range of indications, demonstrating pipeline maturity.

- Ongoing: Continuous advancements in fermentation technologies and strain engineering capabilities by leading CDMOs.

In-Depth Live Biotherapeutic Products (LBP) & Microbiome CDMO Services Market Outlook

- 2019: Approval of VSL#3 (now Visbiome) by the FDA for specific medical uses, signaling increasing regulatory acceptance.

- 2020: Significant increase in venture capital funding for microbiome therapeutics, reaching over $1 billion globally.

- 2021: FDA grants Orphan Drug Designation for multiple LBPs targeting rare diseases, accelerating development.

- 2022: Novonesis acquires Chr. Hansen and divides its business, leading to the formation of Bacthera as a significant microbiome CDMO player.

- 2023: Lonza and Novozymes merge their microbiome businesses to form Bacthera, creating a formidable integrated CDMO.

- 2024: Multiple Phase 2 and Phase 3 clinical trial initiations for LBPs targeting a range of indications, demonstrating pipeline maturity.

- Ongoing: Continuous advancements in fermentation technologies and strain engineering capabilities by leading CDMOs.

In-Depth Live Biotherapeutic Products (LBP) & Microbiome CDMO Services Market Outlook

The future outlook for the Live Biotherapeutic Products (LBP) and Microbiome CDMO services market is exceptionally bright, driven by a robust pipeline of innovative therapies and increasing demand for specialized manufacturing expertise. Growth accelerators, including advancements in synthetic biology and the establishment of comprehensive regulatory frameworks, will continue to fuel market expansion. Strategic opportunities lie in addressing unmet needs in areas like neurological and metabolic disorders, as well as expanding the application of LBPs into preventative health. The consolidation of CDMO capabilities and the increasing focus on end-to-end service offerings will further strengthen the market. The integration of AI in microbiome research and development will unlock new therapeutic targets and optimize product design. The market is projected to witness sustained high growth, making it a pivotal sector in the future of healthcare.

Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Segmentation

-

1. Application

- 1.1. Digestive System Diseases

- 1.2. Immune System Diseases

- 1.3. Metabolic Diseases

- 1.4. Other

-

2. Type

- 2.1. Solid Dosage Form

- 2.2. Liquid Dosage Form

Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Live Biotherapeutic Products Lbp And Microbiome Cdmo Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 19.5% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Digestive System Diseases

- 5.1.2. Immune System Diseases

- 5.1.3. Metabolic Diseases

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Solid Dosage Form

- 5.2.2. Liquid Dosage Form

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Digestive System Diseases

- 6.1.2. Immune System Diseases

- 6.1.3. Metabolic Diseases

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Solid Dosage Form

- 6.2.2. Liquid Dosage Form

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Digestive System Diseases

- 7.1.2. Immune System Diseases

- 7.1.3. Metabolic Diseases

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Solid Dosage Form

- 7.2.2. Liquid Dosage Form

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Digestive System Diseases

- 8.1.2. Immune System Diseases

- 8.1.3. Metabolic Diseases

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Solid Dosage Form

- 8.2.2. Liquid Dosage Form

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Digestive System Diseases

- 9.1.2. Immune System Diseases

- 9.1.3. Metabolic Diseases

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Solid Dosage Form

- 9.2.2. Liquid Dosage Form

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Digestive System Diseases

- 10.1.2. Immune System Diseases

- 10.1.3. Metabolic Diseases

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Solid Dosage Form

- 10.2.2. Liquid Dosage Form

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Lallemand Health Solutions

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Wacker Chemie AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Biose Industrie

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 List Biological Labs Inc.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NIZO

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SGS (Quay Pharmaceuticals)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Assembly Biosciences Inc.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Recipharm (Arranta Bio)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bacthera (Novonesis+Lonza)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Smaltis

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Lonza

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 vermicon AG

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Lallemand Health Solutions

List of Figures

- Figure 1: Global Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million), by Type 2024 & 2032

- Figure 5: North America Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million), by Type 2024 & 2032

- Figure 11: South America Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Live Biotherapeutic Products Lbp And Microbiome Cdmo Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Live Biotherapeutic Products Lbp And Microbiome Cdmo Service?

The projected CAGR is approximately 19.5%.

2. Which companies are prominent players in the Live Biotherapeutic Products Lbp And Microbiome Cdmo Service?

Key companies in the market include Lallemand Health Solutions, Wacker Chemie AG, Biose Industrie, List Biological Labs, Inc., NIZO, SGS (Quay Pharmaceuticals), Assembly Biosciences, Inc., Recipharm (Arranta Bio), Bacthera (Novonesis+Lonza), Smaltis, Lonza, vermicon AG.

3. What are the main segments of the Live Biotherapeutic Products Lbp And Microbiome Cdmo Service?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 647 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Live Biotherapeutic Products Lbp And Microbiome Cdmo Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Live Biotherapeutic Products Lbp And Microbiome Cdmo Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Live Biotherapeutic Products Lbp And Microbiome Cdmo Service?

To stay informed about further developments, trends, and reports in the Live Biotherapeutic Products Lbp And Microbiome Cdmo Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence