Key Insights

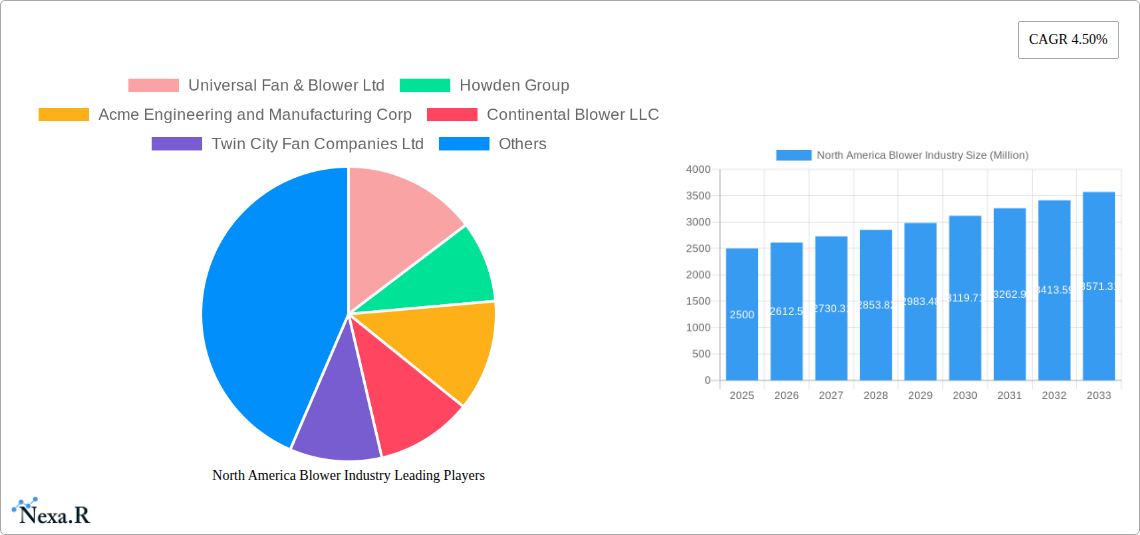

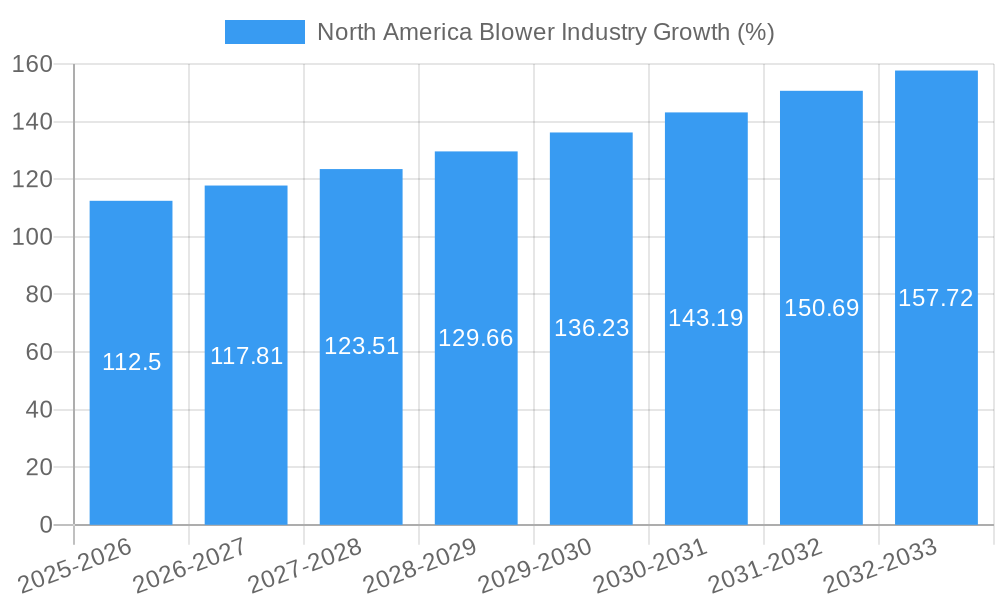

The North American blower industry, currently valued at approximately $X billion in 2025 (assuming a reasonable market size based on global trends and the provided CAGR), is projected to experience steady growth with a compound annual growth rate (CAGR) of 4.50% from 2025 to 2033. This growth is fueled by several key drivers. Increased industrial automation across various sectors, including manufacturing, HVAC, and food processing, is creating significant demand for blowers of varying types and capacities. Furthermore, the rising adoption of energy-efficient technologies, such as centrifugal and axial blowers, is contributing to market expansion. Stringent environmental regulations promoting cleaner and more efficient industrial processes are also incentivizing the adoption of advanced blower systems. The market segmentation shows a significant demand for both commercial and industrial applications, with industrial applications likely holding a larger market share due to increased automation and production needs. Key players like Universal Fan & Blower Ltd, Howden Group, and Greenheck Fan Corporation are strategically focusing on innovation and technological advancements to maintain their competitive edge within this dynamic market.

The market segmentation reveals a strong preference for centrifugal and axial blower technologies, reflecting the prevalent need for high-efficiency solutions. Within the deployment segments, the industrial sector holds the larger share, driven by the growth in manufacturing and processing industries. While the commercial sector represents a significant portion, its growth may be marginally slower compared to its industrial counterpart. However, the increasing focus on energy efficiency in commercial buildings and infrastructure could lead to a notable uptick in commercial blower adoption in the coming years. Potential restraints include fluctuating raw material prices and the economic sensitivity of certain industrial sectors, which might influence investment decisions impacting market growth during periods of economic downturn. Nonetheless, the long-term prospects of the North American blower industry remain positive, driven by robust technological advancements and continued industrial expansion.

North America Blower Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North American blower industry, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report utilizes a robust methodology incorporating both quantitative and qualitative data to deliver actionable insights for industry professionals. This report covers both parent market (HVAC equipment) and child market (industrial blowers). Market size is presented in million units.

North America Blower Industry Market Dynamics & Structure

This section analyzes the North American blower market's structure, exploring market concentration, technological advancements, regulatory landscape, competitive dynamics, and end-user trends. The analysis incorporates both quantitative data (market share, M&A activity) and qualitative factors (innovation barriers). The market is characterized by a moderately consolidated structure with several major players and a significant number of smaller niche players.

- Market Concentration: The top five players hold an estimated xx% market share in 2025, indicating moderate concentration. Smaller players account for the remaining xx%.

- Technological Innovation: Key drivers include advancements in energy efficiency (e.g., variable frequency drives), material science (e.g., lighter, more durable materials), and intelligent controls (e.g., IoT integration). Barriers include high R&D costs and the need for stringent testing and certification.

- Regulatory Framework: Environmental regulations (e.g., emission standards) are increasingly influential, driving demand for high-efficiency blower technologies. Safety standards also play a significant role.

- Competitive Landscape: Competition is intense, driven by price, performance, and technological differentiation. Product substitution is a factor, particularly from alternative ventilation technologies.

- M&A Activity: The industry has witnessed xx M&A deals between 2019 and 2024, primarily driven by consolidation efforts and expansion into new market segments. The average deal size was approximately xx million USD.

- End-User Demographics: The industrial sector dominates the market, followed by the commercial sector. Growth is expected across both segments, driven by infrastructure development and increasing adoption of energy-efficient HVAC systems.

North America Blower Industry Growth Trends & Insights

This section provides a comprehensive analysis of the North American blower market's growth trajectory. Utilizing both internal and external data sources, it examines market size evolution, adoption rates, technological disruptions, and shifting consumer behavior. Key metrics, such as Compound Annual Growth Rate (CAGR) and market penetration rates, are utilized to illustrate market trends. The market experienced a CAGR of xx% between 2019 and 2024, and is projected to grow at a CAGR of xx% from 2025 to 2033, reaching xx million units by 2033. This growth is driven by several factors, including increased industrial activity, rising urbanization, and a growing focus on energy efficiency in buildings. Technological advancements in blower technology have further propelled market expansion. The adoption rate of energy-efficient blowers is steadily increasing, reflecting a shift towards sustainability. Changes in consumer preferences towards quieter, more efficient ventilation systems are also playing a crucial role.

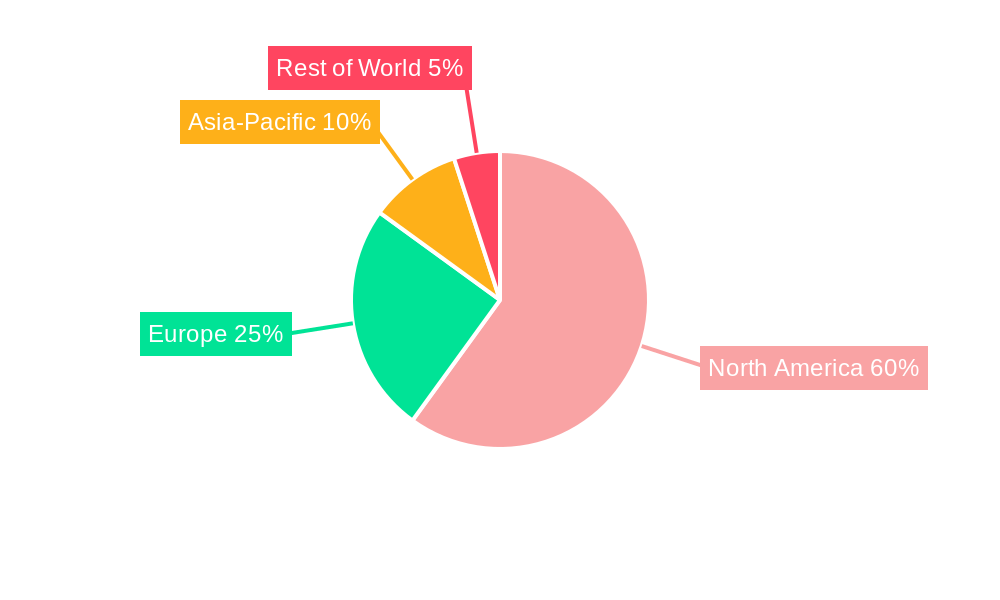

Dominant Regions, Countries, or Segments in North America Blower Industry

The report identifies leading regions, countries, and segments within the North American blower market, focusing on factors driving their dominance. The analysis incorporates market share data and growth potential assessments. The industrial segment holds the largest market share, driven by its high demand in manufacturing, energy, and other sectors. Among technologies, centrifugal blowers are dominant due to their versatile applications. The key factors include continued investment in manufacturing and infrastructure development.

- Dominant Region: The industrial segment continues to lead market growth across all regions. The Southeast and Midwest regions of the United States are projected to show the highest growth rate due to increased industrial development.

- Key Drivers: Economic growth and infrastructure development are key drivers in both the industrial and commercial sectors.

- Dominant Technology: Centrifugal blowers maintain market dominance due to their higher efficiency and broader application range.

- Dominant Deployment: The industrial segment remains dominant due to high volume requirements in manufacturing and processing industries.

North America Blower Industry Product Landscape

The North American blower market offers a diverse range of products characterized by ongoing innovation. Centrifugal and axial blowers dominate, each with specific applications. Recent advancements include improved efficiency, reduced noise levels, and enhanced control systems. Unique selling propositions often center on energy savings, durability, and ease of maintenance. The adoption of smart technologies is becoming increasingly prevalent.

Key Drivers, Barriers & Challenges in North America Blower Industry

Several factors drive market growth, including increasing industrialization, rising energy efficiency standards, and the development of innovative blower technologies. Conversely, challenges include supply chain disruptions, the escalating cost of raw materials, and competitive intensity.

Key Drivers:

- Increased industrialization

- Stringent energy efficiency standards

- Advancements in blower technology

- Growing infrastructure spending

Key Challenges:

- Supply chain volatility impacting material availability and costs

- Intense competition leading to price pressure

- Regulatory compliance requirements

Emerging Opportunities in North America Blower Industry

The North American blower industry presents several emerging opportunities, including expanding into niche markets (e.g., specialized industrial processes), adopting smart technologies to enhance efficiency and control, and focusing on sustainable and environmentally friendly solutions. These areas represent significant growth potential.

Growth Accelerators in the North America Blower Industry

Several factors can accelerate long-term growth, such as technological breakthroughs in energy efficiency, strategic collaborations between blower manufacturers and end-users to optimize system design, and expansion into new geographical markets or application areas. These factors offer substantial market potential.

Key Players Shaping the North America Blower Industry Market

- Universal Fan & Blower Ltd

- Howden Group

- Acme Engineering and Manufacturing Corp

- Continental Blower LLC

- Twin City Fan Companies Ltd

- Airmaster Fan Company Inc

- Munters Group AB

- New York Blower Company

- Loren Cook Company

- S&P USA Ventilation Systems LLC

- Flakt Group

- Greenheck Fan Corporation

- Hitachi Ltd

- Gardner Denver Holdings Inc

Notable Milestones in North America Blower Industry Sector

- 2021: Greenheck Fan Corporation launched a new line of high-efficiency centrifugal blowers.

- 2022: Howden Group acquired a smaller blower manufacturer, expanding its market share.

- 2023: New regulations on blower energy efficiency came into effect in several states.

- 2024: Universal Fan & Blower Ltd invested heavily in R&D for improved blower technology.

In-Depth North America Blower Industry Market Outlook

The North American blower industry exhibits robust growth potential driven by sustained industrial expansion, ongoing investment in infrastructure development, and the increasing adoption of energy-efficient solutions. Strategic partnerships and technological advancements will further shape the market landscape. The forecast indicates continued market expansion, presenting significant opportunities for established players and new entrants.

North America Blower Industry Segmentation

-

1. Technology

- 1.1. Centrifugal

- 1.2. Axial

-

2. Deployment

- 2.1. Commercial

-

2.2. Industrial

- 2.2.1. Power Generation

- 2.2.2. Oil and Gas

- 2.2.3. Mining, Metal Manufacturing, and Processing

- 2.2.4. Cement Industry

- 2.2.5. Other Industrial Deployments

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America Blower Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Blower Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Adoption Of Electric Vehicles4.; Growing Concern for Battery Waste Disposal and Stringent Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Recycling Operations

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Commercial Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Blower Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Centrifugal

- 5.1.2. Axial

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Commercial

- 5.2.2. Industrial

- 5.2.2.1. Power Generation

- 5.2.2.2. Oil and Gas

- 5.2.2.3. Mining, Metal Manufacturing, and Processing

- 5.2.2.4. Cement Industry

- 5.2.2.5. Other Industrial Deployments

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. United States North America Blower Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Centrifugal

- 6.1.2. Axial

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. Commercial

- 6.2.2. Industrial

- 6.2.2.1. Power Generation

- 6.2.2.2. Oil and Gas

- 6.2.2.3. Mining, Metal Manufacturing, and Processing

- 6.2.2.4. Cement Industry

- 6.2.2.5. Other Industrial Deployments

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Canada North America Blower Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Centrifugal

- 7.1.2. Axial

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. Commercial

- 7.2.2. Industrial

- 7.2.2.1. Power Generation

- 7.2.2.2. Oil and Gas

- 7.2.2.3. Mining, Metal Manufacturing, and Processing

- 7.2.2.4. Cement Industry

- 7.2.2.5. Other Industrial Deployments

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Rest of North America North America Blower Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Centrifugal

- 8.1.2. Axial

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. Commercial

- 8.2.2. Industrial

- 8.2.2.1. Power Generation

- 8.2.2.2. Oil and Gas

- 8.2.2.3. Mining, Metal Manufacturing, and Processing

- 8.2.2.4. Cement Industry

- 8.2.2.5. Other Industrial Deployments

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. United States North America Blower Industry Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Blower Industry Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Blower Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Blower Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Universal Fan & Blower Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Howden Group

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Acme Engineering and Manufacturing Corp

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Continental Blower LLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Twin City Fan Companies Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Airmaster Fan Company Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Munters Group AB

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 New York Blower Company

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Loren Cook Company

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 S&P USA Ventilation Systems LLC

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Flakt Group

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Greenheck Fan Corporation

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Hitachi Ltd*List Not Exhaustive

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Gardner Denver Holdings Inc

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.1 Universal Fan & Blower Ltd

List of Figures

- Figure 1: North America Blower Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Blower Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Blower Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Blower Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: North America Blower Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: North America Blower Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Blower Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Blower Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Blower Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Blower Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Blower Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Blower Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Blower Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 12: North America Blower Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 13: North America Blower Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Blower Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Blower Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 16: North America Blower Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 17: North America Blower Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Blower Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Blower Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 20: North America Blower Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 21: North America Blower Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Blower Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Blower Industry?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the North America Blower Industry?

Key companies in the market include Universal Fan & Blower Ltd, Howden Group, Acme Engineering and Manufacturing Corp, Continental Blower LLC, Twin City Fan Companies Ltd, Airmaster Fan Company Inc, Munters Group AB, New York Blower Company, Loren Cook Company, S&P USA Ventilation Systems LLC, Flakt Group, Greenheck Fan Corporation, Hitachi Ltd*List Not Exhaustive, Gardner Denver Holdings Inc.

3. What are the main segments of the North America Blower Industry?

The market segments include Technology, Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Adoption Of Electric Vehicles4.; Growing Concern for Battery Waste Disposal and Stringent Government Policies.

6. What are the notable trends driving market growth?

Increasing Demand from Commercial Sector.

7. Are there any restraints impacting market growth?

4.; High Cost of Recycling Operations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Blower Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Blower Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Blower Industry?

To stay informed about further developments, trends, and reports in the North America Blower Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence