Key Insights

Oman's power market, projected to reach $3.21 billion by 2024 (based on a CAGR of 7.3%), is poised for substantial growth. This expansion is driven by escalating energy demands, fueled by robust economic development and population increases across the Sultanate. Oman's strategic commitment to infrastructure development, particularly in the tourism and manufacturing sectors, requires a dependable and expansive power infrastructure, significantly contributing to market expansion. Furthermore, the nation's proactive diversification of its energy portfolio, with a strong emphasis on renewable energy sources, addresses environmental imperatives and bolsters energy security, creating significant avenues for investment and growth within the renewable energy domain. Key industry participants, including United Power Company (SAOC), Majan Electricity Distribution Company (SAOC), and OPWP, are central to this transformative phase, influencing the competitive dynamics.

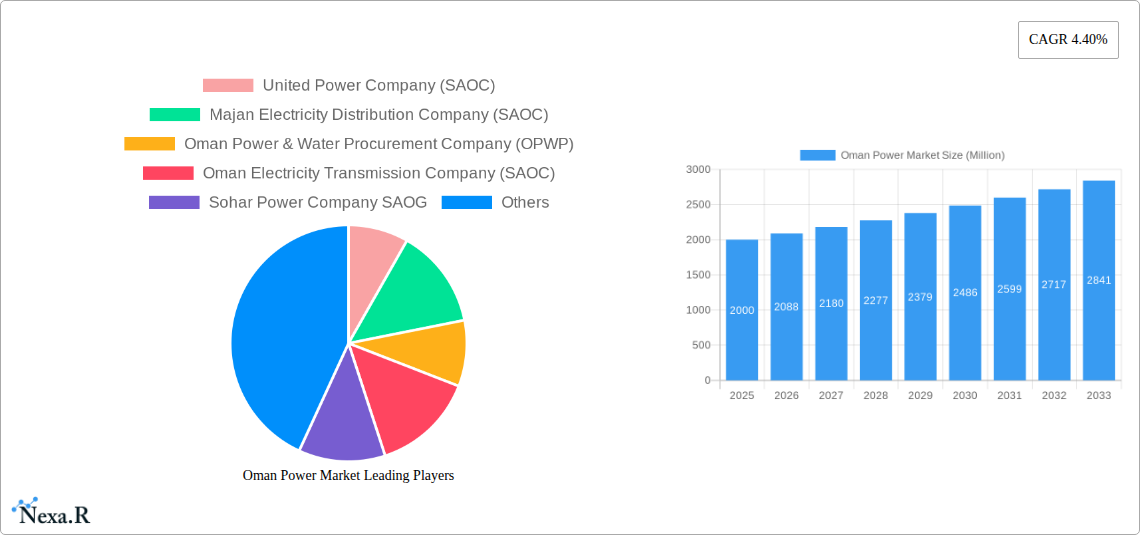

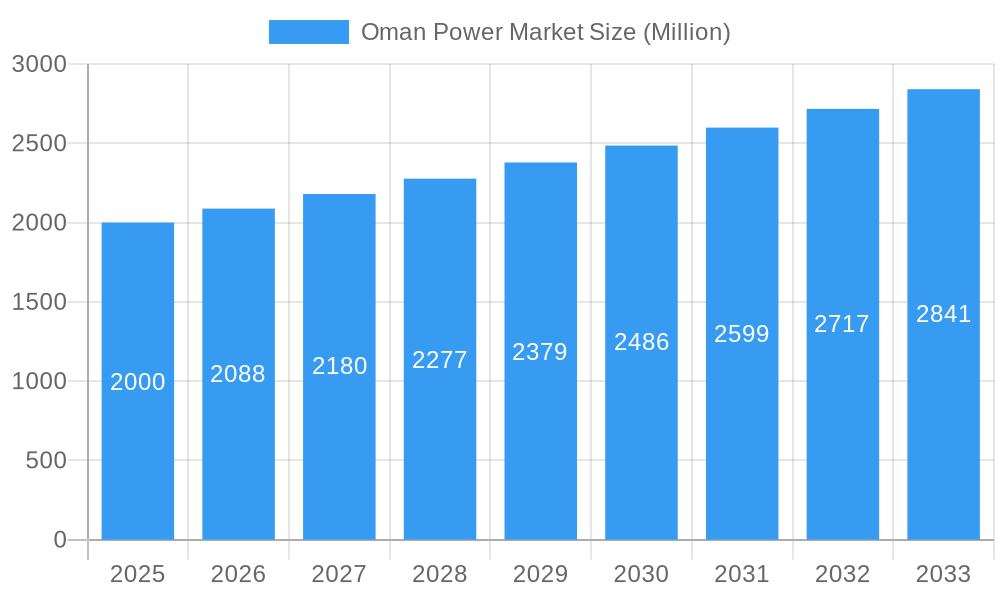

Oman Power Market Market Size (In Billion)

Despite positive growth prospects, certain factors may temper market expansion. Volatility in global oil prices can influence governmental investment strategies, and potential delays in large-scale infrastructure projects could impact the pace of market growth. The successful integration of renewable energy technologies into the national grid, alongside the resolution of associated technical and logistical hurdles, will be paramount for sustained expansion in this sector. Market segmentation indicates a current reliance on natural gas and oil, with renewables anticipated to gain prominence, progressively reshaping Oman's power generation landscape. This evolving dynamic highlights the critical need for strategic investments and effective regulatory frameworks to facilitate the transition towards a sustainable and diversified energy infrastructure in Oman.

Oman Power Market Company Market Share

Oman Power Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Oman power market, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on the parent market (Oman Energy Sector) and child market (Power Generation), this report offers crucial insights for industry professionals, investors, and policymakers. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. Market values are presented in million units.

Oman Power Market Market Dynamics & Structure

This section analyzes the structure and dynamics of Oman's power market, considering market concentration, technological advancements, regulatory frameworks, competitive landscape, and M&A activities. The Oman power market exhibits a moderately concentrated structure, with key players holding significant market shares. The market is characterized by a mix of state-owned and privately held companies. Technological innovation is driven by the need to enhance efficiency, improve reliability, and integrate renewable energy sources. The regulatory framework, primarily overseen by the Authority for Electricity Regulation Oman (AER), plays a crucial role in shaping market dynamics and encouraging investments. The increasing adoption of renewable energy technologies is creating a competitive environment, and M&A activities are expected to further consolidate the market.

- Market Concentration: xx% concentrated in top 5 players.

- Technological Innovation: Focus on renewable energy integration, smart grid technologies, and energy storage solutions.

- Regulatory Framework: AER's policies influence investment and growth, encouraging diversification and sustainability.

- Competitive Substitutes: Limited direct substitutes, but competition exists in terms of cost-efficiency and sustainability.

- End-User Demographics: Primarily residential, commercial, and industrial consumers, with varying demands.

- M&A Trends: Moderate M&A activity, primarily focused on consolidation and expansion into renewables. Estimated deal volume in 2024: xx Million USD.

Oman Power Market Growth Trends & Insights

The Oman power market has witnessed significant growth over the historical period (2019-2024), driven primarily by increasing energy demand from a growing population and industrial sector. The market size is projected to experience robust growth during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is fueled by ongoing investments in new power generation capacity, particularly in renewable energy sources. Technological disruptions, such as the increasing adoption of smart grid technologies and energy storage systems, are further accelerating market expansion. Consumer behavior shifts toward energy efficiency and sustainability are also influencing market trends. Market penetration of renewable energy is expected to increase significantly, reaching xx% by 2033.

Dominant Regions, Countries, or Segments in Oman Power Market

The power generation segment is dominated by Natural Gas, followed by Oil, and a rapidly growing Renewables sector. While data specifics for region-wise breakdown aren't readily available, the Muscat Governorate and other major urban areas are expected to be the dominant regions due to high energy consumption. The government's commitment to diversifying the energy mix and promoting renewable energy sources is a key driver.

- Natural Gas: Dominant fuel source for power generation, accounting for xx% of the market share. Key drivers include existing infrastructure and relatively low cost.

- Oil: Significant contribution to power generation, particularly in areas with limited natural gas infrastructure. Market share: xx%

- Renewables: Fastest-growing segment, driven by government policies supporting solar and wind energy projects. Market share: xx% and projected growth of xx% CAGR.

- Key Drivers: Government initiatives promoting renewable energy, investments in grid infrastructure, and increasing energy demand.

Oman Power Market Product Landscape

The Oman power market features a diverse product landscape, encompassing traditional thermal power plants fueled by natural gas and oil, along with increasingly prevalent renewable energy sources, such as solar and wind power. Technological advancements are driving the integration of smart grid technologies and energy storage solutions to enhance efficiency, reliability, and grid stability. Products are differentiated based on their capacity, efficiency, fuel type, and environmental impact. Unique selling propositions center around efficiency, cost-effectiveness, and sustainability.

Key Drivers, Barriers & Challenges in Oman Power Market

Key Drivers: The Oman power market is driven by rising energy demand from growing industrial and residential sectors, government initiatives to diversify the energy mix, and investments in renewable energy infrastructure. Furthermore, the development of smart grid technologies and energy storage solutions is driving further growth.

Key Challenges & Restraints: Challenges include the high initial investment costs associated with renewable energy projects, the need to upgrade existing grid infrastructure to accommodate renewable energy integration, and potential regulatory hurdles. Furthermore, fluctuating global oil and gas prices can impact the cost-competitiveness of traditional thermal power plants. Supply chain disruptions can affect project timelines and increase costs.

Emerging Opportunities in Oman Power Market

Emerging opportunities exist in the expansion of renewable energy projects, including large-scale solar and wind farms. The integration of smart grid technologies presents significant opportunities for enhanced grid management and efficiency. Energy storage solutions are becoming increasingly important in addressing the intermittency of renewable energy sources. Furthermore, there are opportunities for developing energy-efficient technologies and improving energy conservation practices across various sectors.

Growth Accelerators in the Oman Power Market Industry

Long-term growth in the Oman power market is anticipated to be accelerated by continued government support for renewable energy development, technological advancements in energy storage and grid management, and the increasing focus on energy efficiency. Strategic partnerships between domestic and international players are also expected to play a crucial role. The expansion of industrial activities and a growing population will further stimulate demand.

Key Players Shaping the Oman Power Market Market

- United Power Company (SAOC)

- Majan Electricity Distribution Company (SAOC)

- Oman Power & Water Procurement Company (OPWP)

- Oman Electricity Transmission Company (SAOC)

- Sohar Power Company SAOG

- Dhofar Generation Company (DGC)

- Muscat Electricity Distribution Company

- ACWA Power

- Mazoon Electricity Distribution Company

Notable Milestones in Oman Power Market Sector

- 2022: Launch of several large-scale solar power projects.

- 2023: Implementation of new regulations promoting energy efficiency.

- 2024: Completion of significant grid infrastructure upgrades.

In-Depth Oman Power Market Market Outlook

The Oman power market is poised for significant growth over the next decade, driven by a combination of factors including increasing energy demand, government support for renewable energy, and technological innovation. Strategic partnerships and investments in grid modernization are expected to unlock further growth potential. The market is projected to experience robust expansion, with substantial opportunities for both domestic and international players. The focus on sustainability and diversification of the energy mix will shape the future trajectory of the market.

Oman Power Market Segmentation

-

1. Power Generation Source

- 1.1. Natural Gas

- 1.2. Oil

- 1.3. Renewables

- 2. Power Transmission and Distribution (T&D)

Oman Power Market Segmentation By Geography

- 1. Oman

Oman Power Market Regional Market Share

Geographic Coverage of Oman Power Market

Oman Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Upcoming New Renewable Projects in the Country4.; Expansions of Transmission and Distribution Network

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Private Participation in the Country's Power Sector

- 3.4. Market Trends

- 3.4.1. Renewable Power Generation Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Power Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 5.1.1. Natural Gas

- 5.1.2. Oil

- 5.1.3. Renewables

- 5.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution (T&D)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 United Power Company (SAOC)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Majan Electricity Distribution Company (SAOC)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Oman Power & Water Procurement Company (OPWP)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Oman Electricity Transmission Company (SAOC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sohar Power Company SAOG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dhofar Generation Company (DGC)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Muscat Electricity Distribution Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ACWA Power

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mazoon Electricity Distribution Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 United Power Company (SAOC)

List of Figures

- Figure 1: Oman Power Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Oman Power Market Share (%) by Company 2025

List of Tables

- Table 1: Oman Power Market Revenue billion Forecast, by Power Generation Source 2020 & 2033

- Table 2: Oman Power Market Volume gigawatt Forecast, by Power Generation Source 2020 & 2033

- Table 3: Oman Power Market Revenue billion Forecast, by Power Transmission and Distribution (T&D) 2020 & 2033

- Table 4: Oman Power Market Volume gigawatt Forecast, by Power Transmission and Distribution (T&D) 2020 & 2033

- Table 5: Oman Power Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Oman Power Market Volume gigawatt Forecast, by Region 2020 & 2033

- Table 7: Oman Power Market Revenue billion Forecast, by Power Generation Source 2020 & 2033

- Table 8: Oman Power Market Volume gigawatt Forecast, by Power Generation Source 2020 & 2033

- Table 9: Oman Power Market Revenue billion Forecast, by Power Transmission and Distribution (T&D) 2020 & 2033

- Table 10: Oman Power Market Volume gigawatt Forecast, by Power Transmission and Distribution (T&D) 2020 & 2033

- Table 11: Oman Power Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Oman Power Market Volume gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Power Market?

The projected CAGR is approximately 7.3%.

2. Which companies are prominent players in the Oman Power Market?

Key companies in the market include United Power Company (SAOC), Majan Electricity Distribution Company (SAOC), Oman Power & Water Procurement Company (OPWP), Oman Electricity Transmission Company (SAOC), Sohar Power Company SAOG, Dhofar Generation Company (DGC), Muscat Electricity Distribution Company, ACWA Power, Mazoon Electricity Distribution Company.

3. What are the main segments of the Oman Power Market?

The market segments include Power Generation Source, Power Transmission and Distribution (T&D).

4. Can you provide details about the market size?

The market size is estimated to be USD 3.21 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Upcoming New Renewable Projects in the Country4.; Expansions of Transmission and Distribution Network.

6. What are the notable trends driving market growth?

Renewable Power Generation Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Lack of Private Participation in the Country's Power Sector.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Power Market?

To stay informed about further developments, trends, and reports in the Oman Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence