Key Insights

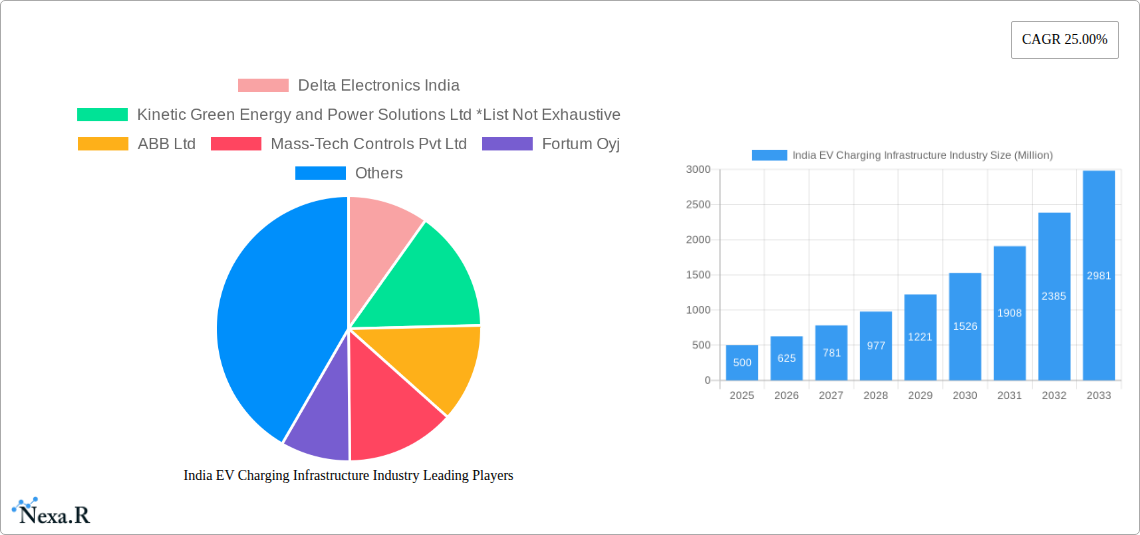

The Indian Electric Vehicle (EV) charging infrastructure market is poised for significant expansion. Driven by government mandates for EV adoption and escalating consumer interest in electric two- and four-wheelers, the market is projected for robust growth. With an estimated market size of $1.56 million in 2025, the industry is anticipated to experience a Compound Annual Growth Rate (CAGR) of 22.2%. Key growth catalysts include favorable government initiatives like the FAME scheme, increased environmental consciousness, declining battery costs, and technological advancements enhancing charging efficiency and reliability. The market is segmented by power output (rapid, fast, slow) and electrical phase (single, three-phase), catering to diverse charging requirements and grid capacities nationwide. Despite substantial opportunities, challenges persist, including uneven station distribution, especially in rural areas, network interoperability issues, and the necessity for considerable grid infrastructure investment.

India EV Charging Infrastructure Industry Market Size (In Million)

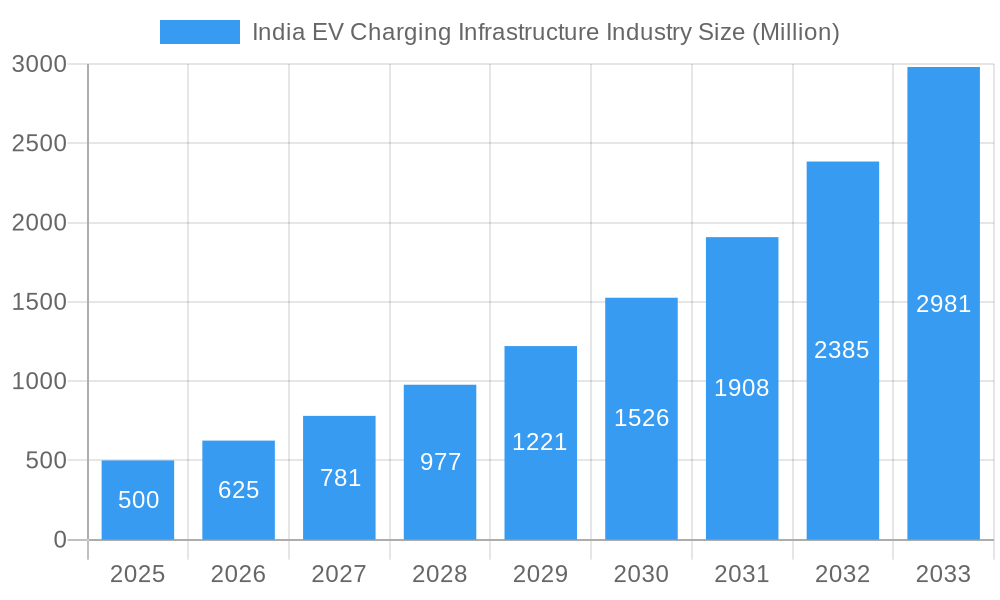

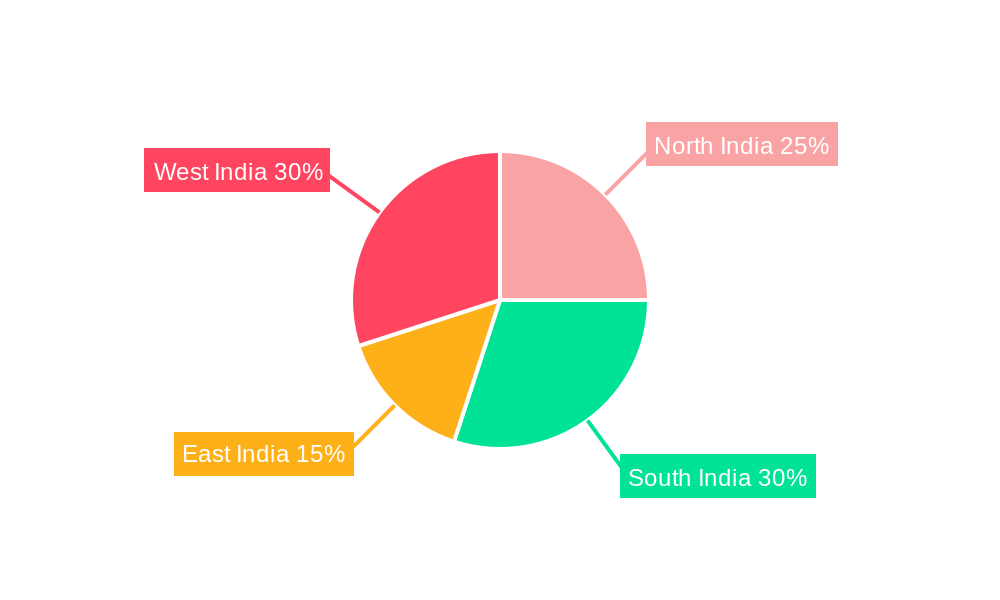

Geographically, market distribution varies across India. States leading in EV adoption, such as Maharashtra, Gujarat, and Karnataka, are expected to hold larger market shares. Leading market participants, including Delta Electronics India, Kinetic Green Energy, ABB Ltd., and Tata Power Company Limited, are actively expanding their charging networks and innovating charging solutions. However, the market faces potential restraints such as high initial investment, a lack of standardization, and concerns regarding electricity supply reliability in select regions. Addressing these obstacles is vital for unlocking the market's full potential and ensuring sustained success.

India EV Charging Infrastructure Industry Company Market Share

India EV Charging Infrastructure Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning India EV charging infrastructure market, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering valuable insights for investors, industry professionals, and policymakers. The study delves into parent and child markets, providing granular data on various segments including power output (rapid, fast, slow chargers) and phases (single, three-phase).

India EV Charging Infrastructure Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market consolidation within the Indian EV charging infrastructure sector. We examine market concentration, identifying key players and their market share percentages. The analysis includes a detailed examination of M&A activity, including deal volumes and their impact on market structure. We also explore the role of technological innovation, regulatory frameworks (both supportive and hindering), and the presence of competitive product substitutes. Finally, end-user demographics and their influence on market demand are considered.

- Market Concentration: xx% dominated by top 5 players in 2024, expected to consolidate further by 2033.

- Technological Innovation: Focus on smart charging technologies, V2G (Vehicle-to-Grid) integration, and AI-driven optimization. Barriers include high initial investment costs and lack of standardized technologies.

- Regulatory Framework: Government incentives and supportive policies are driving growth, while challenges remain in land acquisition and grid infrastructure limitations.

- M&A Activity: xx major M&A deals recorded between 2019-2024, with an anticipated increase to xx deals by 2033.

India EV Charging Infrastructure Industry Growth Trends & Insights

This section provides a detailed analysis of the market size evolution, adoption rates, and technological disruptions shaping the Indian EV charging infrastructure market. We leverage extensive primary and secondary research to provide quantitative insights into CAGR, market penetration rates, and consumer behavior shifts. The analysis encompasses the impact of technological advancements (e.g., faster charging technologies, improved battery life) and the influence of government policies.

- Market Size Evolution: The market size expanded from xx Million units in 2019 to xx Million units in 2024, projecting a CAGR of xx% during the forecast period.

- Adoption Rates: Increasing EV adoption rates are driving demand for charging infrastructure, particularly in urban centers.

- Technological Disruptions: The emergence of ultra-fast charging technologies and innovative battery chemistries is transforming the market dynamics.

- Consumer Behavior: Consumer preferences are shifting towards convenient, accessible, and reliable charging solutions.

Dominant Regions, Countries, or Segments in India EV Charging Infrastructure Industry

This section identifies the leading regions, countries, or segments within the Indian EV charging infrastructure market, focusing on power output (rapid, fast, slow chargers) and phases (single, three-phase). We analyze the dominance factors, including market share, growth potential, and key drivers (economic policies, infrastructure development).

- Dominant Segment: Fast chargers (Three-Phase) segment currently leads the market, driven by increasing demand for rapid charging solutions in urban areas.

- Key Drivers: Government incentives (e.g., FAME-II scheme), growing EV sales, and improving grid infrastructure are key growth drivers.

- Regional Dominance: Metropolitan cities such as Mumbai, Delhi, Bangalore, and Chennai are witnessing the fastest growth in EV charging infrastructure.

India EV Charging Infrastructure Industry Product Landscape

This section offers a concise overview of the product innovations, applications, and performance metrics within the Indian EV charging infrastructure market. We highlight unique selling propositions (USPs) of various charging solutions and analyze the impact of technological advancements on product performance, efficiency, and reliability.

Key Drivers, Barriers & Challenges in India EV Charging Infrastructure Industry

This section outlines the key factors driving market growth and identifies the major challenges and restraints hindering its expansion.

Key Drivers:

- Increasing EV adoption

- Government support through subsidies and policies

- Growing investment in charging infrastructure

- Technological advancements leading to improved efficiency and cost reduction.

Challenges and Restraints:

- High initial investment costs for setting up charging stations

- Lack of standardized charging technologies

- Limited grid capacity in many areas

- Concerns regarding grid stability with increased EV adoption.

Emerging Opportunities in India EV Charging Infrastructure Industry

This section explores emerging opportunities within the Indian EV charging infrastructure market.

- Untapped markets in rural areas

- Growing demand for charging solutions in commercial and industrial sectors

- Development of smart charging technologies and V2G solutions

- Potential for integrating renewable energy sources with charging infrastructure.

Growth Accelerators in the India EV Charging Infrastructure Industry Industry

Technological advancements, particularly in battery technology and charging speeds, are primary growth catalysts. Strategic partnerships between EV manufacturers, charging infrastructure providers, and energy companies will play a crucial role in expanding market reach and accelerating adoption. Market expansion strategies focused on underserved regions and demographics will also contribute significantly to market growth.

Key Players Shaping the India EV Charging Infrastructure Industry Market

- Delta Electronics India

- Kinetic Green Energy and Power Solutions Ltd

- ABB Ltd

- Mass-Tech Controls Pvt Ltd

- Fortum Oyj

- Tata Power Company Limited

- Automovil

- Bright Blu

- Charzer Tech Pvt Ltd

- Exicom Telesystems Ltd

Notable Milestones in India EV Charging Infrastructure Industry Sector

- March 2022: Automovil plans to establish 500 EV charging stations across 11 Indian cities.

- March 2022: Exicom installs approximately 5000 EV charging stations in 200 cities, including 3600 AC and 1400 DC fast chargers.

In-Depth India EV Charging Infrastructure Industry Market Outlook

The Indian EV charging infrastructure market is poised for significant growth, driven by supportive government policies, increasing EV adoption, and technological advancements. Strategic partnerships and investments in innovative charging solutions will unlock substantial market potential, particularly in underserved areas. The focus on integrating renewable energy sources and developing smart charging technologies will further enhance the sustainability and efficiency of the sector.

India EV Charging Infrastructure Industry Segmentation

-

1. Power Output

- 1.1. Rapid Chargers

- 1.2. Fast Chargers

- 1.3. Slow Chargers

-

2. Phase

- 2.1. Single Phase

- 2.2. Three Phase

India EV Charging Infrastructure Industry Segmentation By Geography

- 1. India

India EV Charging Infrastructure Industry Regional Market Share

Geographic Coverage of India EV Charging Infrastructure Industry

India EV Charging Infrastructure Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources

- 3.3. Market Restrains

- 3.3.1. 4.; The Recycling Rate of Waste in Germany

- 3.4. Market Trends

- 3.4.1. Slow Chargers Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India EV Charging Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Output

- 5.1.1. Rapid Chargers

- 5.1.2. Fast Chargers

- 5.1.3. Slow Chargers

- 5.2. Market Analysis, Insights and Forecast - by Phase

- 5.2.1. Single Phase

- 5.2.2. Three Phase

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Power Output

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Delta Electronics India

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kinetic Green Energy and Power Solutions Ltd *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ABB Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mass-Tech Controls Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fortum Oyj

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tata Power Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Automovil

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bright Blu

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Charzer Tech Pvt Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Exicom Telesystems Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Delta Electronics India

List of Figures

- Figure 1: India EV Charging Infrastructure Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India EV Charging Infrastructure Industry Share (%) by Company 2025

List of Tables

- Table 1: India EV Charging Infrastructure Industry Revenue million Forecast, by Power Output 2020 & 2033

- Table 2: India EV Charging Infrastructure Industry Volume K Units Forecast, by Power Output 2020 & 2033

- Table 3: India EV Charging Infrastructure Industry Revenue million Forecast, by Phase 2020 & 2033

- Table 4: India EV Charging Infrastructure Industry Volume K Units Forecast, by Phase 2020 & 2033

- Table 5: India EV Charging Infrastructure Industry Revenue million Forecast, by Region 2020 & 2033

- Table 6: India EV Charging Infrastructure Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 7: India EV Charging Infrastructure Industry Revenue million Forecast, by Power Output 2020 & 2033

- Table 8: India EV Charging Infrastructure Industry Volume K Units Forecast, by Power Output 2020 & 2033

- Table 9: India EV Charging Infrastructure Industry Revenue million Forecast, by Phase 2020 & 2033

- Table 10: India EV Charging Infrastructure Industry Volume K Units Forecast, by Phase 2020 & 2033

- Table 11: India EV Charging Infrastructure Industry Revenue million Forecast, by Country 2020 & 2033

- Table 12: India EV Charging Infrastructure Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India EV Charging Infrastructure Industry?

The projected CAGR is approximately 22.2%.

2. Which companies are prominent players in the India EV Charging Infrastructure Industry?

Key companies in the market include Delta Electronics India, Kinetic Green Energy and Power Solutions Ltd *List Not Exhaustive, ABB Ltd, Mass-Tech Controls Pvt Ltd, Fortum Oyj, Tata Power Company Limited, Automovil, Bright Blu, Charzer Tech Pvt Ltd, Exicom Telesystems Ltd.

3. What are the main segments of the India EV Charging Infrastructure Industry?

The market segments include Power Output, Phase.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.56 million as of 2022.

5. What are some drivers contributing to market growth?

4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources.

6. What are the notable trends driving market growth?

Slow Chargers Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Recycling Rate of Waste in Germany.

8. Can you provide examples of recent developments in the market?

In March 2022, Automovil, the mobility start-up in India, announced that it has planned to establish 500 EV charging stations in 11 cities in India. The company has partnered with Midgard Electric as the EV charging partner to install Bharat AC-001 and DC-001 EV chargers for the Automovil's outlets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India EV Charging Infrastructure Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India EV Charging Infrastructure Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India EV Charging Infrastructure Industry?

To stay informed about further developments, trends, and reports in the India EV Charging Infrastructure Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence