Key Insights

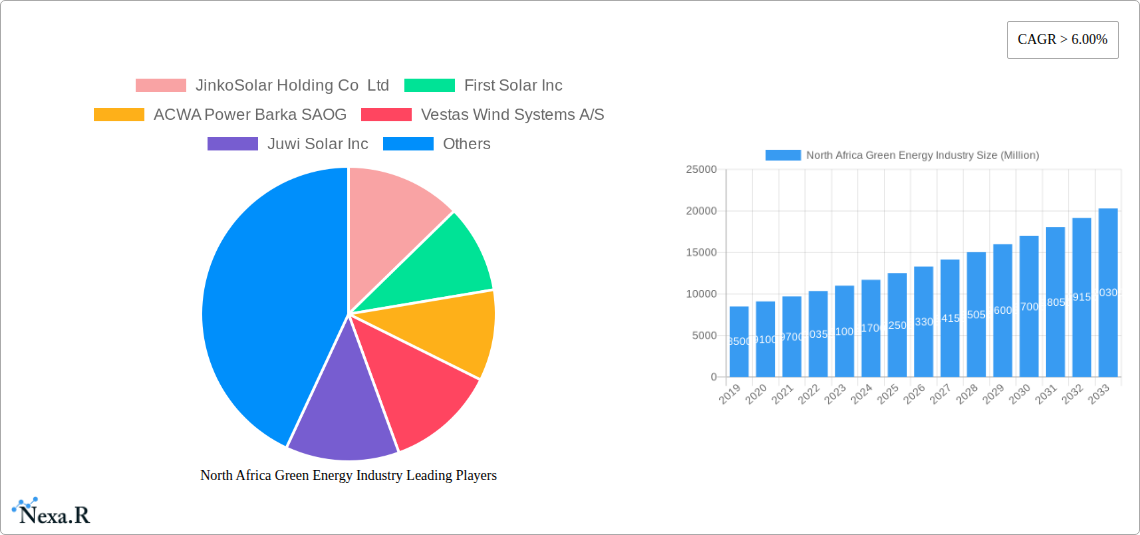

The North Africa Green Energy Industry is poised for substantial growth, projected to reach an estimated market size of approximately $15,000 million by 2025, and is expected to expand at a Compound Annual Growth Rate (CAGR) exceeding 6.00% through 2033. This robust expansion is primarily fueled by a confluence of compelling drivers. The region's abundant solar irradiation and significant wind potential present a natural advantage for renewable energy development. Furthermore, supportive government policies, including renewable energy targets and incentives, are actively encouraging investment and project deployment across key markets like Morocco, Egypt, and Algeria. Growing concerns about climate change and the imperative to diversify energy sources away from fossil fuels are also accelerating the adoption of green energy solutions. The increasing affordability of solar and wind technologies, coupled with advancements in energy storage, are further enhancing the economic viability and attractiveness of renewable energy projects in North Africa.

North Africa Green Energy Industry Market Size (In Billion)

Emerging trends within the North Africa Green Energy Industry include a pronounced shift towards large-scale solar and wind farm development, with significant investments anticipated in utility-scale projects. There's also a growing focus on distributed generation, particularly rooftop solar installations for both commercial and residential consumers, driven by the desire for energy independence and cost savings. The integration of smart grid technologies and advanced energy management systems is becoming increasingly crucial to ensure grid stability and optimize the utilization of intermittent renewable sources. While the outlook is overwhelmingly positive, certain restraints could temper the pace of growth. These include challenges related to grid infrastructure limitations, the need for skilled labor and technical expertise, and the complexities of regulatory frameworks in some areas. Nevertheless, the inherent potential and the strong impetus for sustainable development position the North Africa Green Energy Industry for a dynamic and prosperous future.

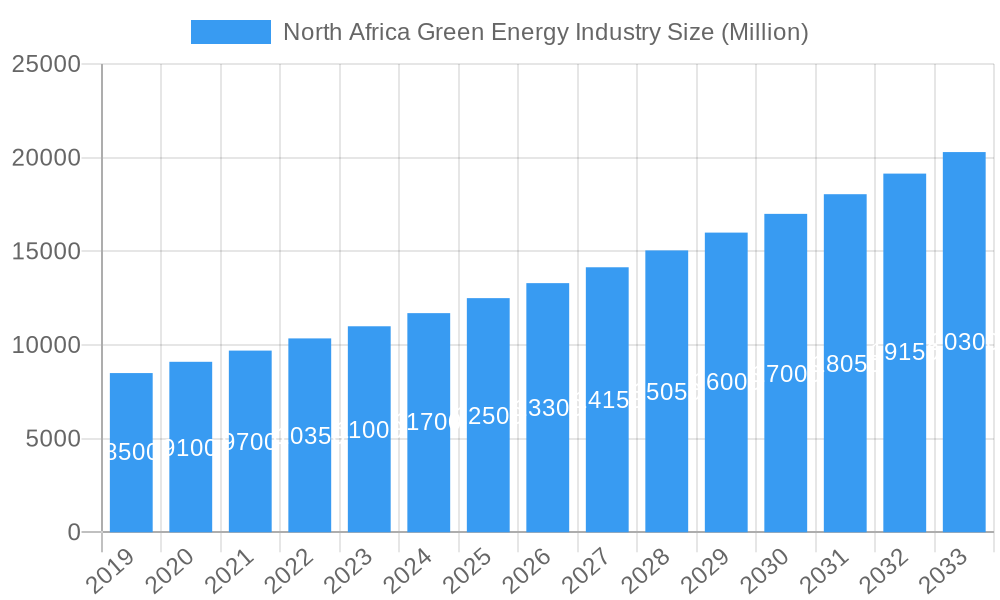

North Africa Green Energy Industry Company Market Share

Here is a compelling, SEO-optimized report description for the North Africa Green Energy Industry, designed for maximum search engine visibility and industry professional engagement. All values are presented in Million units, and the report is structured for immediate use without modification.

Report Title: North Africa Green Energy Industry: Market Size, Share, Trends, and Forecast (2019-2033)

Report Description:

Unlock the immense potential of the North Africa Green Energy Industry with this comprehensive market research report. Covering the period from 2019 to 2033, with a detailed base and estimated year of 2025, this study offers an in-depth analysis of the rapidly expanding solar energy market and wind energy market across key geographies including Morocco, Egypt, and Algeria. Gain critical insights into market dynamics, growth trends, dominant regions, product landscape, key drivers, emerging opportunities, and strategic collaborations shaping this dynamic sector.

This report provides granular data on market segmentation by source (Solar, Wind, Others), geographical focus, and key industry developments. Featuring analysis of leading companies such as JinkoSolar Holding Co Ltd, First Solar Inc, ACWA Power Barka SAOG, Vestas Wind Systems A/S, and many others, it serves as an indispensable resource for investors, policymakers, and industry stakeholders aiming to capitalize on the burgeoning green energy revolution in North Africa. Discover future market potential, competitive strategies, and growth accelerators designed to inform your strategic decision-making in this vital industry.

North Africa Green Energy Industry Market Dynamics & Structure

The North Africa Green Energy Industry is characterized by a dynamic and evolving market structure, driven by a confluence of factors including supportive government policies, increasing private sector investment, and a growing demand for sustainable energy solutions. Market concentration varies across segments, with the solar energy market exhibiting significant activity due to abundant sunshine. Technological innovation is a primary driver, with advancements in photovoltaic efficiency and wind turbine technology constantly pushing the boundaries of economic viability. Regulatory frameworks are becoming more conducive, with governments actively promoting renewable energy adoption through incentives and renewable energy targets. Competitive product substitutes are limited, as green energy solutions offer distinct environmental and long-term cost advantages over traditional fossil fuels. End-user demographics are shifting towards industrial and commercial sectors seeking to reduce operational costs and carbon footprints, alongside growing residential demand. Mergers and acquisitions (M&A) are on the rise as larger players consolidate their market positions and new entrants seek strategic partnerships to enter the burgeoning market.

- Market Concentration: Moderate to high in solar, evolving in wind.

- Technological Innovation Drivers: Enhanced solar panel efficiency, advanced wind turbine designs, smart grid integration solutions.

- Regulatory Frameworks: Favorable feed-in tariffs, power purchase agreements (PPAs), and renewable energy quotas.

- Competitive Product Substitutes: Limited due to inherent sustainability and cost-effectiveness of renewables.

- End-User Demographics: Industrial, commercial, and residential sectors.

- M&A Trends: Increasing consolidation and strategic partnerships.

North Africa Green Energy Industry Growth Trends & Insights

The North Africa Green Energy Industry is poised for robust growth, with projections indicating a significant market size evolution driven by sustained adoption rates and impactful technological disruptions. The solar energy market, benefiting from exceptional irradiance levels and declining panel costs, is expected to lead this expansion. Wind energy is also a crucial component, with ongoing developments in offshore and onshore wind farms contributing to the overall clean power capacity. Consumer behavior is shifting demonstrably towards green energy solutions, influenced by both environmental consciousness and the economic benefits of reduced energy expenses. Adoption rates for solar rooftop installations are accelerating in commercial and residential sectors, while utility-scale projects are attracting substantial international investment. Technological disruptions, such as improved energy storage solutions and enhanced grid integration technologies, are further bolstering the reliability and accessibility of renewable energy, paving the way for higher market penetration. The industry is witnessing a steady upward trajectory, with a projected Compound Annual Growth Rate (CAGR) expected to be substantial over the forecast period.

The market is significantly influenced by global decarbonization efforts and the pressing need to diversify energy sources away from fossil fuels, particularly in regions heavily reliant on oil and gas exports. This impetus is driving substantial investment into renewable energy infrastructure, creating a fertile ground for growth. The development of large-scale solar and wind farms is not only meeting domestic energy demands but also positioning North African countries as potential exporters of green electricity to Europe, a trend exemplified by projects aiming to connect North Africa to European grids. This export potential further amplifies the economic incentives for developing domestic green energy capacities.

Furthermore, policy support remains a critical growth accelerator. Governments across North Africa are increasingly implementing ambitious renewable energy targets and providing financial incentives, such as tax breaks and streamlined permitting processes, to attract private investment. The presence of international financial institutions, like the International Finance Corporation (IFC), in backing major projects signifies a strong vote of confidence and provides crucial financial leverage for the industry's expansion.

The increasing integration of digital technologies, including AI and IoT for grid management and predictive maintenance of renewable assets, is enhancing operational efficiency and reducing downtime. This technological advancement is key to ensuring the consistent and reliable supply of green energy, which is essential for widespread adoption and market growth. As the cost of renewable energy technologies continues to decline, making them increasingly competitive with conventional energy sources, the adoption rates are expected to accelerate further.

Dominant Regions, Countries, or Segments in North Africa Green Energy Industry

The solar energy segment is currently the dominant force driving the North Africa Green Energy Industry, largely due to the region's exceptional solar irradiance and declining photovoltaic (PV) technology costs. Within this broader context, Egypt has emerged as a leading country, characterized by a strong government commitment to renewable energy, ambitious targets, and significant project development, including both solar and wind initiatives. The country's large population and growing industrial base further fuel the demand for clean power.

Morocco is another key player, leveraging its strategic location and proactive policies to become a hub for solar and wind energy projects. Its commitment to renewable energy has positioned it as a leader in the continent's green transition, with substantial investments in large-scale solar power plants like the Noor Ouarzazate complex. Algeria, while historically reliant on hydrocarbons, is increasingly diversifying its energy mix and exploring its vast solar potential, with significant investment planned to harness this resource. The "Rest of North Africa," encompassing countries like Tunisia and Libya, also holds considerable, albeit less developed, potential for renewable energy growth, with Tunisia actively pursuing solar projects with export ambitions.

- Dominant Segment: Solar Energy, driven by high irradiance and cost-effectiveness.

- Key Drivers: Abundant solar resources, decreasing solar panel prices, supportive government policies.

- Leading Country: Egypt, characterized by ambitious renewable targets and IFC-backed projects.

- Key Drivers: Large market demand, government incentives, significant project pipeline.

- Key Contributor: Morocco, a pioneer in large-scale solar and wind development.

- Key Drivers: Strategic location, proactive policy frameworks, international investment attraction.

- Emerging Potential: Algeria and Tunisia, with substantial untapped solar and wind resources.

- Key Drivers: Diversification of energy mix, export opportunities, growing awareness of sustainability.

- Market Share Dynamics: The solar segment commands a significant market share, followed by wind energy. Other renewable sources are nascent but hold future growth potential.

- Growth Potential: All regions show substantial growth potential, with Egypt and Morocco leading in current project execution and investment.

North Africa Green Energy Industry Product Landscape

The product landscape within the North Africa Green Energy Industry is primarily defined by advancements in solar photovoltaic (PV) modules and wind turbine technologies. Innovations focus on enhancing energy conversion efficiency, improving durability in harsh environmental conditions, and reducing manufacturing costs. Bifacial solar panels, which capture sunlight from both sides, are gaining traction, maximizing energy yield. Advanced inverter technologies and smart grid-compatible solutions are crucial for seamless integration and grid stability. In the wind sector, larger rotor diameters and taller towers are employed to capture more wind energy, even at lower wind speeds. Energy storage solutions, particularly lithium-ion batteries and emerging technologies, are becoming integral to the product ecosystem, addressing the intermittency of renewable sources and enabling reliable power supply.

Key Drivers, Barriers & Challenges in North Africa Green Energy Industry

The North Africa Green Energy Industry is propelled by powerful drivers including abundant renewable resources (solar and wind), increasing global demand for decarbonization, supportive government policies and targets, and declining technology costs that enhance economic viability. The desire for energy independence and diversification away from fossil fuels also plays a significant role.

Conversely, significant barriers and challenges persist. These include the need for substantial upfront capital investment for large-scale projects, underdeveloped grid infrastructure in some areas, and potential regulatory complexities or bureaucratic hurdles. Political and economic instability in certain sub-regions can deter foreign investment. Furthermore, skilled labor shortages for installation and maintenance, supply chain disruptions for critical components, and the need for robust energy storage solutions to manage intermittency remain key challenges that require continuous attention and innovative solutions.

Emerging Opportunities in North Africa Green Energy Industry

Emerging opportunities in the North Africa Green Energy Industry lie in the development of green hydrogen production, leveraging abundant renewable electricity. The expansion of offshore wind farms, particularly in countries with extensive coastlines, presents significant untapped potential. Furthermore, smart grid technologies and energy storage solutions are ripe for innovation and deployment, enhancing grid reliability and enabling higher renewable penetration. The potential for exporting green electricity to Europe, facilitated by interconnector projects, offers a substantial economic opportunity. There is also a growing niche for decentralized renewable energy systems and off-grid solutions in remote areas, improving energy access and stimulating local economies.

Growth Accelerators in the North Africa Green Energy Industry Industry

Several catalysts are accelerating the growth of the North Africa Green Energy Industry. Technological breakthroughs in solar PV efficiency and wind turbine design are continuously improving the cost-effectiveness of these solutions. Strategic partnerships between international developers, local companies, and financial institutions are crucial for mobilizing capital and expertise for large-scale projects. Government initiatives, including ambitious renewable energy targets and streamlined permitting processes, are vital for creating an enabling environment. Market expansion strategies, such as fostering regional cooperation for cross-border energy trade and investing in robust grid infrastructure, will further unlock the sector's immense potential. The growing global focus on sustainability and ESG (Environmental, Social, and Governance) investing also acts as a significant growth accelerator, attracting substantial foreign direct investment.

Key Players Shaping the North Africa Green Energy Industry Market

- JinkoSolar Holding Co Ltd

- First Solar Inc

- ACWA Power Barka SAOG

- Vestas Wind Systems A/S

- Juwi Solar Inc

- SkyPower Ltd

- Siemens Gamesa Renewable Energy SA

- Canadian Solar Inc

- Scatec Solar ASA

Notable Milestones in North Africa Green Energy Industry Sector

- December 2022: British company Xlinks announced the installation of a 10.5 GWh solar power plant.

- December 2022: TuNur, a renewable energy developer, announced plans to generate 4.5 GWh of electricity from a solar power plant in Tunisia and export it to Italy, France, and Malta, aiming to reduce European CO2 emissions.

- November 2022: Egypt signed agreements to construct two wind and solar projects with a combined cost exceeding USD 1 billion, backed by the International Finance Corporation (IFC), to rapidly boost the country's clean power development.

In-Depth North Africa Green Energy Industry Market Outlook

The North Africa Green Energy Industry is characterized by robust future market potential, driven by a confluence of strong governmental commitment, significant untapped renewable resources, and increasing international investment. Strategic opportunities abound in the development of integrated energy systems, encompassing solar, wind, and advanced energy storage solutions to ensure grid stability and reliability. The burgeoning green hydrogen sector presents a transformative opportunity for the region to become a global leader in clean fuel production. Continued focus on cross-border interconnections and regional energy cooperation will further enhance market integration and export capabilities, solidifying North Africa's position as a key player in the global energy transition. Investing in skilled workforce development and fostering innovation in localized manufacturing of renewable energy components will ensure sustainable and inclusive growth.

North Africa Green Energy Industry Segmentation

-

1. Source

- 1.1. Solar

- 1.2. Wind

- 1.3. Others

-

2. Geogrpahy

- 2.1. Morocco

- 2.2. Egypt

- 2.3. Algeria

- 2.4. Rest of North Africa

North Africa Green Energy Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

North Africa Green Energy Industry Regional Market Share

Geographic Coverage of North Africa Green Energy Industry

North Africa Green Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Demand for Solar Photovoltaic Installations4.; Growing Investments

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Wind Energy Installations

- 3.4. Market Trends

- 3.4.1. Solar Energy is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North Africa Green Energy Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Solar

- 5.1.2. Wind

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Geogrpahy

- 5.2.1. Morocco

- 5.2.2. Egypt

- 5.2.3. Algeria

- 5.2.4. Rest of North Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. North America North Africa Green Energy Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Solar

- 6.1.2. Wind

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Geogrpahy

- 6.2.1. Morocco

- 6.2.2. Egypt

- 6.2.3. Algeria

- 6.2.4. Rest of North Africa

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. South America North Africa Green Energy Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Solar

- 7.1.2. Wind

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Geogrpahy

- 7.2.1. Morocco

- 7.2.2. Egypt

- 7.2.3. Algeria

- 7.2.4. Rest of North Africa

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Europe North Africa Green Energy Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Solar

- 8.1.2. Wind

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Geogrpahy

- 8.2.1. Morocco

- 8.2.2. Egypt

- 8.2.3. Algeria

- 8.2.4. Rest of North Africa

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. Middle East & Africa North Africa Green Energy Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source

- 9.1.1. Solar

- 9.1.2. Wind

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Geogrpahy

- 9.2.1. Morocco

- 9.2.2. Egypt

- 9.2.3. Algeria

- 9.2.4. Rest of North Africa

- 9.1. Market Analysis, Insights and Forecast - by Source

- 10. Asia Pacific North Africa Green Energy Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Source

- 10.1.1. Solar

- 10.1.2. Wind

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Geogrpahy

- 10.2.1. Morocco

- 10.2.2. Egypt

- 10.2.3. Algeria

- 10.2.4. Rest of North Africa

- 10.1. Market Analysis, Insights and Forecast - by Source

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 JinkoSolar Holding Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 First Solar Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ACWA Power Barka SAOG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Vestas Wind Systems A/S

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Juwi Solar Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SkyPower Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Siemens Gamesa Renewable Energy SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Canadian Solar Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Scatec Solar ASA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 JinkoSolar Holding Co Ltd

List of Figures

- Figure 1: Global North Africa Green Energy Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global North Africa Green Energy Industry Volume Breakdown (Gigawatte, %) by Region 2025 & 2033

- Figure 3: North America North Africa Green Energy Industry Revenue (Million), by Source 2025 & 2033

- Figure 4: North America North Africa Green Energy Industry Volume (Gigawatte), by Source 2025 & 2033

- Figure 5: North America North Africa Green Energy Industry Revenue Share (%), by Source 2025 & 2033

- Figure 6: North America North Africa Green Energy Industry Volume Share (%), by Source 2025 & 2033

- Figure 7: North America North Africa Green Energy Industry Revenue (Million), by Geogrpahy 2025 & 2033

- Figure 8: North America North Africa Green Energy Industry Volume (Gigawatte), by Geogrpahy 2025 & 2033

- Figure 9: North America North Africa Green Energy Industry Revenue Share (%), by Geogrpahy 2025 & 2033

- Figure 10: North America North Africa Green Energy Industry Volume Share (%), by Geogrpahy 2025 & 2033

- Figure 11: North America North Africa Green Energy Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: North America North Africa Green Energy Industry Volume (Gigawatte), by Country 2025 & 2033

- Figure 13: North America North Africa Green Energy Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America North Africa Green Energy Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: South America North Africa Green Energy Industry Revenue (Million), by Source 2025 & 2033

- Figure 16: South America North Africa Green Energy Industry Volume (Gigawatte), by Source 2025 & 2033

- Figure 17: South America North Africa Green Energy Industry Revenue Share (%), by Source 2025 & 2033

- Figure 18: South America North Africa Green Energy Industry Volume Share (%), by Source 2025 & 2033

- Figure 19: South America North Africa Green Energy Industry Revenue (Million), by Geogrpahy 2025 & 2033

- Figure 20: South America North Africa Green Energy Industry Volume (Gigawatte), by Geogrpahy 2025 & 2033

- Figure 21: South America North Africa Green Energy Industry Revenue Share (%), by Geogrpahy 2025 & 2033

- Figure 22: South America North Africa Green Energy Industry Volume Share (%), by Geogrpahy 2025 & 2033

- Figure 23: South America North Africa Green Energy Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: South America North Africa Green Energy Industry Volume (Gigawatte), by Country 2025 & 2033

- Figure 25: South America North Africa Green Energy Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America North Africa Green Energy Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe North Africa Green Energy Industry Revenue (Million), by Source 2025 & 2033

- Figure 28: Europe North Africa Green Energy Industry Volume (Gigawatte), by Source 2025 & 2033

- Figure 29: Europe North Africa Green Energy Industry Revenue Share (%), by Source 2025 & 2033

- Figure 30: Europe North Africa Green Energy Industry Volume Share (%), by Source 2025 & 2033

- Figure 31: Europe North Africa Green Energy Industry Revenue (Million), by Geogrpahy 2025 & 2033

- Figure 32: Europe North Africa Green Energy Industry Volume (Gigawatte), by Geogrpahy 2025 & 2033

- Figure 33: Europe North Africa Green Energy Industry Revenue Share (%), by Geogrpahy 2025 & 2033

- Figure 34: Europe North Africa Green Energy Industry Volume Share (%), by Geogrpahy 2025 & 2033

- Figure 35: Europe North Africa Green Energy Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe North Africa Green Energy Industry Volume (Gigawatte), by Country 2025 & 2033

- Figure 37: Europe North Africa Green Energy Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe North Africa Green Energy Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa North Africa Green Energy Industry Revenue (Million), by Source 2025 & 2033

- Figure 40: Middle East & Africa North Africa Green Energy Industry Volume (Gigawatte), by Source 2025 & 2033

- Figure 41: Middle East & Africa North Africa Green Energy Industry Revenue Share (%), by Source 2025 & 2033

- Figure 42: Middle East & Africa North Africa Green Energy Industry Volume Share (%), by Source 2025 & 2033

- Figure 43: Middle East & Africa North Africa Green Energy Industry Revenue (Million), by Geogrpahy 2025 & 2033

- Figure 44: Middle East & Africa North Africa Green Energy Industry Volume (Gigawatte), by Geogrpahy 2025 & 2033

- Figure 45: Middle East & Africa North Africa Green Energy Industry Revenue Share (%), by Geogrpahy 2025 & 2033

- Figure 46: Middle East & Africa North Africa Green Energy Industry Volume Share (%), by Geogrpahy 2025 & 2033

- Figure 47: Middle East & Africa North Africa Green Energy Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa North Africa Green Energy Industry Volume (Gigawatte), by Country 2025 & 2033

- Figure 49: Middle East & Africa North Africa Green Energy Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa North Africa Green Energy Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific North Africa Green Energy Industry Revenue (Million), by Source 2025 & 2033

- Figure 52: Asia Pacific North Africa Green Energy Industry Volume (Gigawatte), by Source 2025 & 2033

- Figure 53: Asia Pacific North Africa Green Energy Industry Revenue Share (%), by Source 2025 & 2033

- Figure 54: Asia Pacific North Africa Green Energy Industry Volume Share (%), by Source 2025 & 2033

- Figure 55: Asia Pacific North Africa Green Energy Industry Revenue (Million), by Geogrpahy 2025 & 2033

- Figure 56: Asia Pacific North Africa Green Energy Industry Volume (Gigawatte), by Geogrpahy 2025 & 2033

- Figure 57: Asia Pacific North Africa Green Energy Industry Revenue Share (%), by Geogrpahy 2025 & 2033

- Figure 58: Asia Pacific North Africa Green Energy Industry Volume Share (%), by Geogrpahy 2025 & 2033

- Figure 59: Asia Pacific North Africa Green Energy Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific North Africa Green Energy Industry Volume (Gigawatte), by Country 2025 & 2033

- Figure 61: Asia Pacific North Africa Green Energy Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific North Africa Green Energy Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global North Africa Green Energy Industry Revenue Million Forecast, by Source 2020 & 2033

- Table 2: Global North Africa Green Energy Industry Volume Gigawatte Forecast, by Source 2020 & 2033

- Table 3: Global North Africa Green Energy Industry Revenue Million Forecast, by Geogrpahy 2020 & 2033

- Table 4: Global North Africa Green Energy Industry Volume Gigawatte Forecast, by Geogrpahy 2020 & 2033

- Table 5: Global North Africa Green Energy Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global North Africa Green Energy Industry Volume Gigawatte Forecast, by Region 2020 & 2033

- Table 7: Global North Africa Green Energy Industry Revenue Million Forecast, by Source 2020 & 2033

- Table 8: Global North Africa Green Energy Industry Volume Gigawatte Forecast, by Source 2020 & 2033

- Table 9: Global North Africa Green Energy Industry Revenue Million Forecast, by Geogrpahy 2020 & 2033

- Table 10: Global North Africa Green Energy Industry Volume Gigawatte Forecast, by Geogrpahy 2020 & 2033

- Table 11: Global North Africa Green Energy Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global North Africa Green Energy Industry Volume Gigawatte Forecast, by Country 2020 & 2033

- Table 13: United States North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 15: Canada North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 17: Mexico North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 19: Global North Africa Green Energy Industry Revenue Million Forecast, by Source 2020 & 2033

- Table 20: Global North Africa Green Energy Industry Volume Gigawatte Forecast, by Source 2020 & 2033

- Table 21: Global North Africa Green Energy Industry Revenue Million Forecast, by Geogrpahy 2020 & 2033

- Table 22: Global North Africa Green Energy Industry Volume Gigawatte Forecast, by Geogrpahy 2020 & 2033

- Table 23: Global North Africa Green Energy Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global North Africa Green Energy Industry Volume Gigawatte Forecast, by Country 2020 & 2033

- Table 25: Brazil North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 27: Argentina North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 31: Global North Africa Green Energy Industry Revenue Million Forecast, by Source 2020 & 2033

- Table 32: Global North Africa Green Energy Industry Volume Gigawatte Forecast, by Source 2020 & 2033

- Table 33: Global North Africa Green Energy Industry Revenue Million Forecast, by Geogrpahy 2020 & 2033

- Table 34: Global North Africa Green Energy Industry Volume Gigawatte Forecast, by Geogrpahy 2020 & 2033

- Table 35: Global North Africa Green Energy Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global North Africa Green Energy Industry Volume Gigawatte Forecast, by Country 2020 & 2033

- Table 37: United Kingdom North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 39: Germany North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 41: France North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 43: Italy North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 45: Spain North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 47: Russia North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 49: Benelux North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 51: Nordics North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 55: Global North Africa Green Energy Industry Revenue Million Forecast, by Source 2020 & 2033

- Table 56: Global North Africa Green Energy Industry Volume Gigawatte Forecast, by Source 2020 & 2033

- Table 57: Global North Africa Green Energy Industry Revenue Million Forecast, by Geogrpahy 2020 & 2033

- Table 58: Global North Africa Green Energy Industry Volume Gigawatte Forecast, by Geogrpahy 2020 & 2033

- Table 59: Global North Africa Green Energy Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global North Africa Green Energy Industry Volume Gigawatte Forecast, by Country 2020 & 2033

- Table 61: Turkey North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 63: Israel North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 65: GCC North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 67: North Africa North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 69: South Africa North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 73: Global North Africa Green Energy Industry Revenue Million Forecast, by Source 2020 & 2033

- Table 74: Global North Africa Green Energy Industry Volume Gigawatte Forecast, by Source 2020 & 2033

- Table 75: Global North Africa Green Energy Industry Revenue Million Forecast, by Geogrpahy 2020 & 2033

- Table 76: Global North Africa Green Energy Industry Volume Gigawatte Forecast, by Geogrpahy 2020 & 2033

- Table 77: Global North Africa Green Energy Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global North Africa Green Energy Industry Volume Gigawatte Forecast, by Country 2020 & 2033

- Table 79: China North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 81: India North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 83: Japan North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 85: South Korea North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 87: ASEAN North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 89: Oceania North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific North Africa Green Energy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific North Africa Green Energy Industry Volume (Gigawatte) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North Africa Green Energy Industry?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the North Africa Green Energy Industry?

Key companies in the market include JinkoSolar Holding Co Ltd, First Solar Inc, ACWA Power Barka SAOG, Vestas Wind Systems A/S, Juwi Solar Inc, SkyPower Ltd, Siemens Gamesa Renewable Energy SA, Canadian Solar Inc, Scatec Solar ASA.

3. What are the main segments of the North Africa Green Energy Industry?

The market segments include Source, Geogrpahy.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Demand for Solar Photovoltaic Installations4.; Growing Investments.

6. What are the notable trends driving market growth?

Solar Energy is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Wind Energy Installations.

8. Can you provide examples of recent developments in the market?

December 2022: a British company, Xlinks, has announced the installation of a 10.5 GWh solar power plant. Similarly, TuNur, a renewable energy developer, announced its plans to generate 4.5 GWh of electricity from a solar power plant in Tunisia and export it to export to Italy, France, and Malta with an aim to reduce European CO emissions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatte.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North Africa Green Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North Africa Green Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North Africa Green Energy Industry?

To stay informed about further developments, trends, and reports in the North Africa Green Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence