Key Insights

The North American oil and gas storage tank market is poised for substantial expansion, projected to reach $10.8 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.8% through 2033. This robust growth is underpinned by increasing energy demand and the critical need for efficient storage infrastructure. Key growth drivers include escalating oil and gas production, particularly in the United States, and ongoing investments in energy sector infrastructure. While traditional materials like steel and carbon steel remain prevalent due to their durability and cost-effectiveness, the increasing adoption of fiberglass-reinforced plastic (FRP) tanks highlights a trend towards lightweight and corrosion-resistant solutions. Despite potential headwinds from volatile commodity prices and stringent environmental regulations, the market presents significant opportunities across various product segments, including crude oil and LNG, and material types. Leading companies are actively driving innovation and competition, contributing to the market's dynamic nature. Regional analysis centers on the United States, Canada, and Mexico, reflecting their pivotal roles in the region's energy landscape.

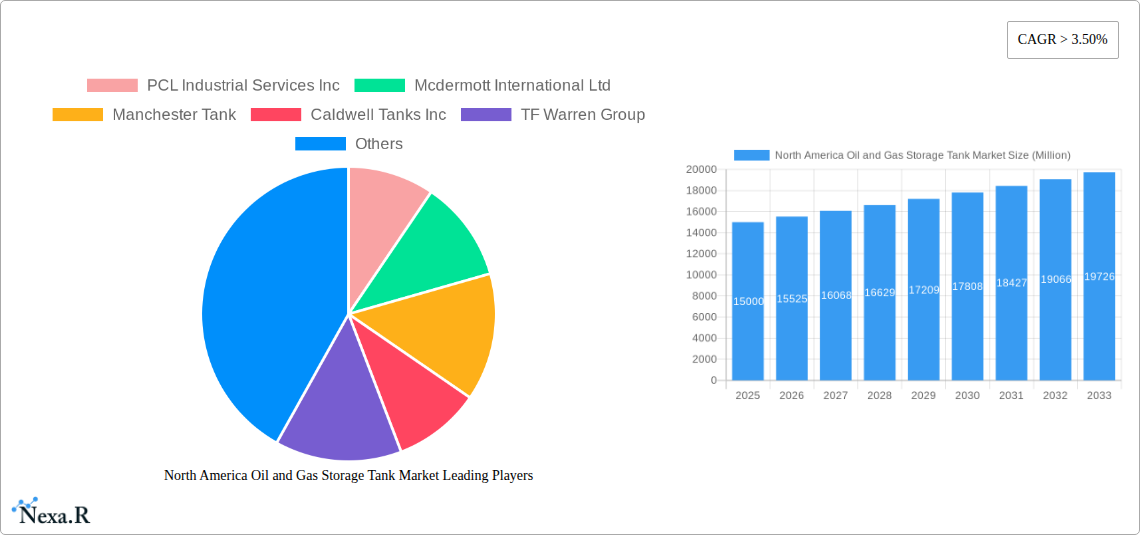

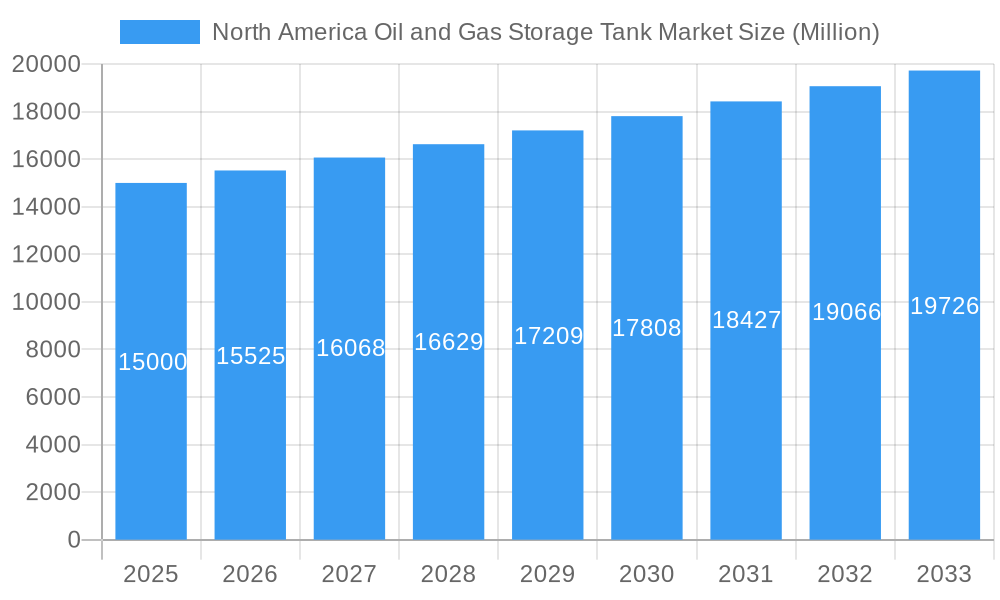

North America Oil and Gas Storage Tank Market Market Size (In Billion)

The forecast period of 2025-2033 anticipates sustained market growth, propelled by expanding shale gas production, government efforts to enhance energy independence, and growing Liquefied Natural Gas (LNG) export capabilities. Advancements in tank design, material science, safety, efficiency, and environmental sustainability will further shape the market. Challenges related to regulatory compliance and the management of aging infrastructure persist, yet the long-term outlook for the North American oil and gas storage tank market remains highly positive, driven by persistent energy demand and continued sector development.

North America Oil and Gas Storage Tank Market Company Market Share

North America Oil & Gas Storage Tank Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America oil and gas storage tank market, encompassing market dynamics, growth trends, regional analysis, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the forecast period 2025-2033 and base year 2025. It serves as an invaluable resource for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic market. The parent market is the broader North American energy infrastructure sector, while the child market is specifically oil and gas storage solutions.

North America Oil and Gas Storage Tank Market Market Dynamics & Structure

The North American oil and gas storage tank market is characterized by a moderately consolidated structure with several major players and numerous smaller regional operators. Market concentration is influenced by factors such as economies of scale, technological capabilities, and geographical reach. Technological innovation, driven by advancements in materials science (e.g., advanced steel alloys, fiberglass-reinforced plastics) and automation, is a key growth driver. Stringent environmental regulations and safety standards significantly impact market dynamics, shaping design specifications and operational protocols. Competitive substitutes, such as underground storage caverns and pipelines, influence market share. The end-user demographic comprises oil and gas producers, refiners, distributors, and storage terminal operators, with their specific needs affecting demand. M&A activity in the sector is moderate, reflecting consolidation trends and strategic acquisitions to expand market reach and enhance service offerings. Over the study period (2019-2024), approximately xx M&A deals were recorded, with a total value of approximately $xx million.

- Market Concentration: Moderately consolidated, with a Herfindahl-Hirschman Index (HHI) estimated at xx.

- Technological Innovation: Focus on corrosion resistance, leak detection, and automated monitoring systems.

- Regulatory Landscape: Stringent environmental and safety regulations driving demand for advanced tank designs.

- Competitive Substitutes: Underground storage and pipelines pose a competitive threat.

- End-User Demographics: Oil and gas producers, refiners, distributors, and storage terminal operators.

- M&A Activity: Moderate level of mergers and acquisitions, driven by consolidation and strategic expansion.

North America Oil and Gas Storage Tank Market Growth Trends & Insights

The North American oil and gas storage tank market experienced a period of moderate growth during 2019-2024, influenced by fluctuating energy prices and fluctuating demand. However, the market is projected to witness robust expansion during the forecast period (2025-2033), driven by increased investments in energy infrastructure, particularly LNG facilities and growing demand for refined petroleum products. The adoption of advanced tank technologies, focused on improving safety, efficiency, and environmental performance, is accelerating. Consumer behavior shifts, driven by sustainability concerns, are encouraging the adoption of environmentally friendly tank materials and solutions. The market is expected to achieve a Compound Annual Growth Rate (CAGR) of xx% during 2025-2033, reaching a market size of $xx million by 2033, from $xx million in 2025. Market penetration of advanced materials such as fiberglass-reinforced plastics is projected to increase from xx% in 2025 to xx% by 2033. Technological disruptions, such as the deployment of IoT-enabled monitoring systems, are enhancing operational efficiency and safety.

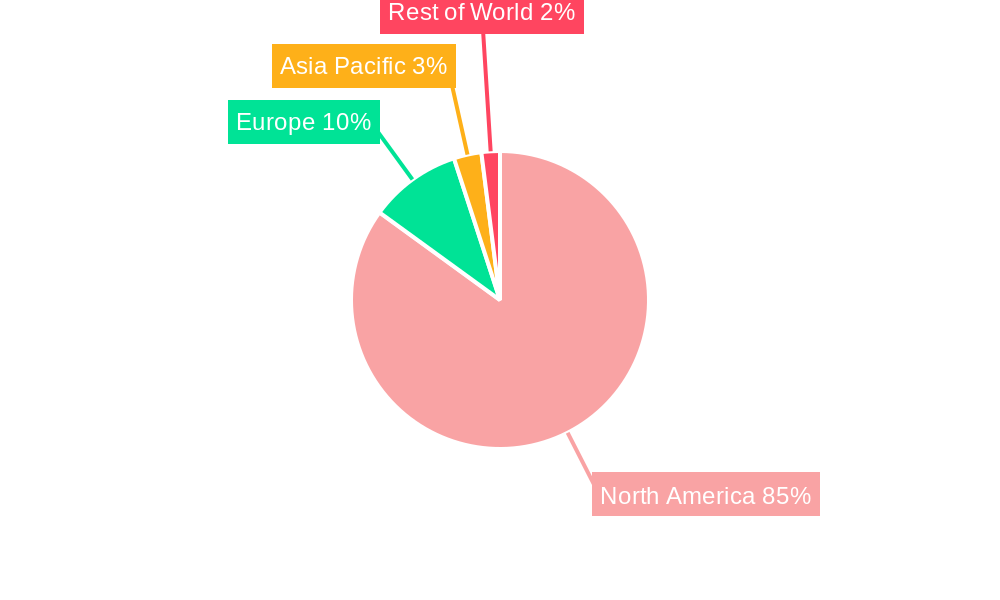

Dominant Regions, Countries, or Segments in North America Oil and Gas Storage Tank Market

The Gulf Coast region of the United States, particularly Texas and Louisiana, represents the dominant market segment for oil and gas storage tanks in North America. This dominance is attributed to the high concentration of oil and gas refineries, production facilities, and export terminals in the area. Canada, particularly Alberta and Saskatchewan, also constitutes a significant market due to its oil sands production. Within the product segment, crude oil storage tanks hold the largest market share, followed by LNG and LPG storage. The preference for steel and carbon steel remains high due to their strength and cost-effectiveness, though fiberglass-reinforced plastic is gaining traction in niche applications due to its corrosion resistance.

- Key Drivers in the Gulf Coast Region: High concentration of oil and gas infrastructure, proximity to export terminals, and government incentives.

- Key Drivers in Canada: Oil sands production, and growing demand for energy transportation and storage infrastructure.

- Dominant Product Segment: Crude oil storage tanks, driven by continued production and refining activity.

- Dominant Material Segment: Steel and Carbon Steel, owing to cost-effectiveness and strength.

North America Oil and Gas Storage Tank Market Product Landscape

The oil and gas storage tank market offers a range of products tailored to specific needs and applications. Innovations include improved corrosion-resistant coatings, advanced leak detection systems, and integrated monitoring capabilities. These advancements enhance safety, extend tank lifespan, and optimize operational efficiency. Fiberglass-reinforced plastic tanks are gaining prominence due to their lightweight nature and resistance to corrosion, particularly in environments with aggressive chemicals. Unique selling propositions include increased storage capacity, reduced maintenance costs, and enhanced environmental performance. Technological advancements continuously improve materials, design, and automation to cater to the evolving needs of the industry.

Key Drivers, Barriers & Challenges in North America Oil and Gas Storage Tank Market

Key Drivers:

- Growing demand for oil and gas storage capacity fueled by energy production and consumption.

- Increased investments in pipeline infrastructure and storage terminals.

- Technological advancements leading to improved tank design and materials.

- Government incentives and supportive regulatory frameworks.

Key Challenges:

- Fluctuating energy prices impacting investment decisions.

- Stringent environmental regulations increasing compliance costs.

- Supply chain disruptions affecting material availability and project timelines.

- Intense competition among established and emerging players. This leads to price pressures and limits profit margins, estimated to be a xx% impact on market growth.

Emerging Opportunities in North America Oil and Gas Storage Tank Market

- Growth in LNG infrastructure: Expanding demand for LNG storage drives opportunities for specialized tank designs.

- Adoption of sustainable materials: Increased use of fiberglass and other eco-friendly materials.

- Integration of digital technologies: IoT sensors and remote monitoring for enhanced operational efficiency.

- Expansion into new markets: Growth in renewable energy and hydrogen storage creates new applications.

Growth Accelerators in the North America Oil and Gas Storage Tank Market Industry

The North American oil and gas storage tank market's long-term growth is fueled by several key accelerators. Technological innovation, particularly the development of advanced materials and automation systems, enhances efficiency and safety. Strategic partnerships between tank manufacturers and energy companies are driving adoption of innovative solutions and optimizing supply chains. Expansion into new markets such as LNG storage and renewable energy infrastructure creates new opportunities. Government policies supporting energy infrastructure development and environmental sustainability also contribute to market growth.

Key Players Shaping the North America Oil and Gas Storage Tank Market Market

- PCL Industrial Services Inc

- Mcdermott International Ltd

- Manchester Tank

- Caldwell Tanks Inc

- TF Warren Group

- Hassco Industries

- Imperial Industries Inc

- Matrix NAC

- Shawcor

- Heatec Inc

Notable Milestones in North America Oil and Gas Storage Tank Market Sector

- February 2022: McDermott International Ltd. secured a contract for engineering and construction of two 200,000 cubic-meter LNG storage tanks for the Plaquemines LNG project in Louisiana, USA. This signifies growing investment in LNG infrastructure and strengthens McDermott's position in the market.

In-Depth North America Oil and Gas Storage Tank Market Market Outlook

The future of the North American oil and gas storage tank market appears promising, driven by a confluence of factors. Continued investment in energy infrastructure, particularly for LNG and refined petroleum products, will fuel market demand. Technological advancements focused on enhanced safety, efficiency, and environmental sustainability will drive product innovation and adoption. Strategic partnerships and mergers and acquisitions will reshape the competitive landscape. The market's long-term growth is expected to remain robust, presenting significant opportunities for both established players and new entrants. The market is expected to witness significant growth in the next decade, further solidifying its position as a critical component of the North American energy infrastructure.

North America Oil and Gas Storage Tank Market Segmentation

-

1. Product

- 1.1. Crude Oil

- 1.2. Liquefied Natural Gas (LNG)

- 1.3. Diesel

- 1.4. Gasoline

- 1.5. Kerosene

- 1.6. Liquefied Petroleum Gas (LPG)

- 1.7. Other Products

-

2. Material

- 2.1. Steel

- 2.2. Carbon Steel

- 2.3. Fiberglass-reinforced Plastic

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Oil and Gas Storage Tank Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Oil and Gas Storage Tank Market Regional Market Share

Geographic Coverage of North America Oil and Gas Storage Tank Market

North America Oil and Gas Storage Tank Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Upcoming New Renewable Projects in the Country4.; Expansions of Transmission and Distribution Network

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Private Participation in the Country's Power Sector

- 3.4. Market Trends

- 3.4.1. Liquefied Natural Gas (LNG) Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Oil and Gas Storage Tank Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Crude Oil

- 5.1.2. Liquefied Natural Gas (LNG)

- 5.1.3. Diesel

- 5.1.4. Gasoline

- 5.1.5. Kerosene

- 5.1.6. Liquefied Petroleum Gas (LPG)

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Steel

- 5.2.2. Carbon Steel

- 5.2.3. Fiberglass-reinforced Plastic

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America Oil and Gas Storage Tank Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Crude Oil

- 6.1.2. Liquefied Natural Gas (LNG)

- 6.1.3. Diesel

- 6.1.4. Gasoline

- 6.1.5. Kerosene

- 6.1.6. Liquefied Petroleum Gas (LPG)

- 6.1.7. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Steel

- 6.2.2. Carbon Steel

- 6.2.3. Fiberglass-reinforced Plastic

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Canada North America Oil and Gas Storage Tank Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Crude Oil

- 7.1.2. Liquefied Natural Gas (LNG)

- 7.1.3. Diesel

- 7.1.4. Gasoline

- 7.1.5. Kerosene

- 7.1.6. Liquefied Petroleum Gas (LPG)

- 7.1.7. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Steel

- 7.2.2. Carbon Steel

- 7.2.3. Fiberglass-reinforced Plastic

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Mexico North America Oil and Gas Storage Tank Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Crude Oil

- 8.1.2. Liquefied Natural Gas (LNG)

- 8.1.3. Diesel

- 8.1.4. Gasoline

- 8.1.5. Kerosene

- 8.1.6. Liquefied Petroleum Gas (LPG)

- 8.1.7. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Steel

- 8.2.2. Carbon Steel

- 8.2.3. Fiberglass-reinforced Plastic

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 PCL Industrial Services Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Mcdermott International Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Manchester Tank

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Caldwell Tanks Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 TF Warren Group

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Hassco Industries

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Imperial Industries Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Matrix NAC

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Shawcor

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Heatec Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 PCL Industrial Services Inc

List of Figures

- Figure 1: North America Oil and Gas Storage Tank Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Oil and Gas Storage Tank Market Share (%) by Company 2025

List of Tables

- Table 1: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Material 2020 & 2033

- Table 4: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Material 2020 & 2033

- Table 5: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Product 2020 & 2033

- Table 10: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 11: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Material 2020 & 2033

- Table 12: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Material 2020 & 2033

- Table 13: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Product 2020 & 2033

- Table 18: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 19: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Material 2020 & 2033

- Table 20: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Material 2020 & 2033

- Table 21: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Product 2020 & 2033

- Table 26: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 27: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Material 2020 & 2033

- Table 28: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Material 2020 & 2033

- Table 29: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 31: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Oil and Gas Storage Tank Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the North America Oil and Gas Storage Tank Market?

Key companies in the market include PCL Industrial Services Inc, Mcdermott International Ltd, Manchester Tank, Caldwell Tanks Inc, TF Warren Group, Hassco Industries, Imperial Industries Inc, Matrix NAC, Shawcor, Heatec Inc.

3. What are the main segments of the North America Oil and Gas Storage Tank Market?

The market segments include Product, Material, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.8 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Upcoming New Renewable Projects in the Country4.; Expansions of Transmission and Distribution Network.

6. What are the notable trends driving market growth?

Liquefied Natural Gas (LNG) Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Lack of Private Participation in the Country's Power Sector.

8. Can you provide examples of recent developments in the market?

February 2022: Mcdermott bagged a new contract for the engineering of two LNG storage tanks for the Plaquemines LNG project, located on the Mississippi River, to the south of New Orleans, United States. The company was contracted to build two 200,000 cubic-meter LNG storage tanks for Venture Global.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Oil and Gas Storage Tank Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Oil and Gas Storage Tank Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Oil and Gas Storage Tank Market?

To stay informed about further developments, trends, and reports in the North America Oil and Gas Storage Tank Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence