Key Insights

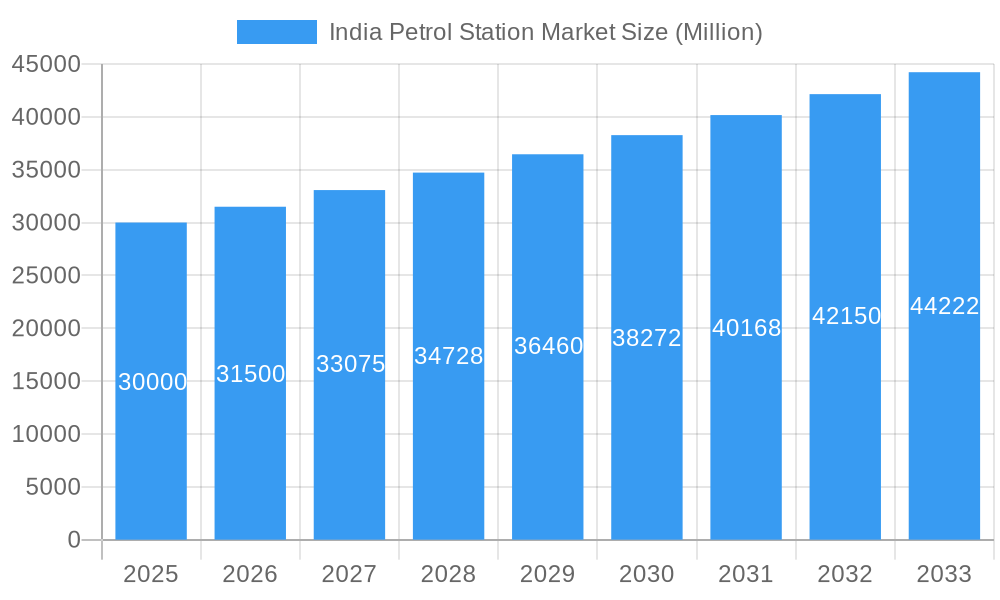

The Indian petrol station market is poised for significant expansion, projected to reach USD 5.79 million by 2025, with a compound annual growth rate (CAGR) of 3.9% through 2033. Key growth drivers include India's expanding economy, rising vehicle ownership in urban areas, and government-led infrastructure development, which enhances accessibility and fuel demand. While electric vehicle adoption is increasing, its current impact on the market remains minimal. Evolving consumer preferences for integrated services, such as convenience stores and quick-service restaurants, are also diversifying and driving market growth.

India Petrol Station Market Market Size (In Million)

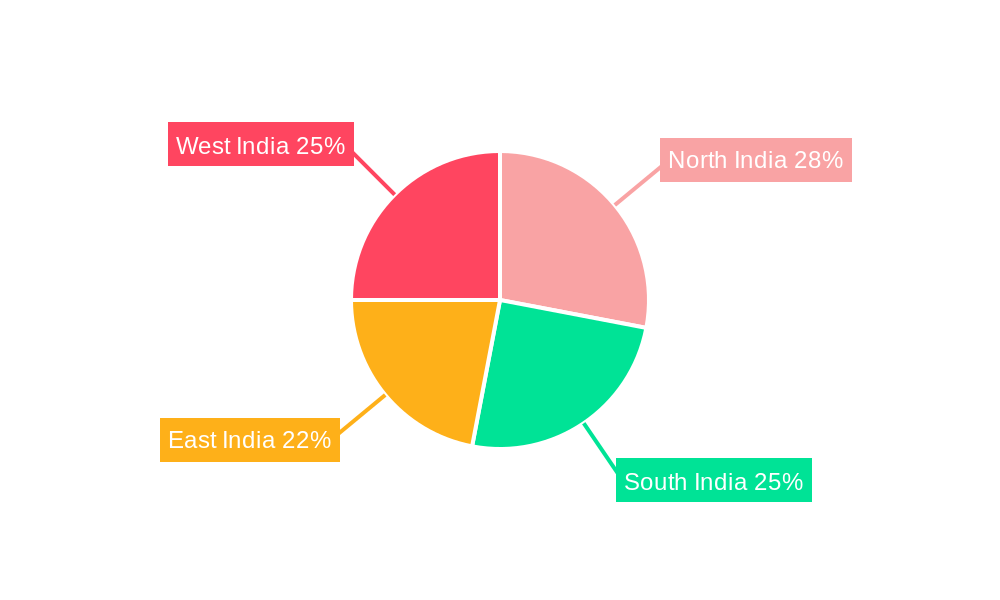

Despite these opportunities, the market confronts several challenges. Volatile global crude oil prices directly affect fuel pricing and operator profitability. Stringent environmental regulations and a push for reduced carbon emissions may necessitate substantial investments in infrastructure and alternative fuel technologies. Intense competition among major players, including Indian Oil Corporation, Reliance Industries, and Bharat Petroleum, continues. The market is segmented by ownership (public and private) and end-user (public and private sectors). The private sector is anticipated to experience accelerated growth, fueled by increasing private vehicle ownership and subsequent fuel consumption. Higher growth is expected in rapidly urbanizing regions of North and West India.

India Petrol Station Market Company Market Share

India Petrol Station Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India petrol station market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategic decision-makers. The report analyzes the parent market (Energy Sector) and child market (Retail Fuel Distribution) to provide a holistic view.

India Petrol Station Market Dynamics & Structure

The Indian petrol station market is characterized by a dynamic interplay of market concentration, technological advancements, regulatory frameworks, and competitive pressures. The market is dominated by a few large players, with significant market share held by Public Sector Undertakings (PSUs). However, the presence of private players is steadily increasing, fostering competition and innovation. Technological advancements, such as digital payment integration and automated fuel dispensing systems, are transforming the market landscape. Stringent regulatory frameworks concerning environmental protection and safety standards further shape market dynamics. The competitive landscape includes various types of fuel and alternative energy sources, impacting overall market share.

- Market Concentration: High, with top 5 players holding approximately xx% of the market share (2024).

- Technological Innovation: Focus on digitalization, automation, and integration of renewable energy sources.

- Regulatory Framework: Stringent environmental and safety regulations influencing operations and investments.

- Competitive Substitutes: Growing adoption of electric vehicles and alternative fuels poses a challenge.

- M&A Activity: xx deals recorded between 2019-2024, with a focus on expanding retail networks and geographical reach.

- End-User Demographics: Shift towards private vehicle ownership driving demand in private-sector fuel consumption.

India Petrol Station Market Growth Trends & Insights

The India petrol station market experienced significant growth during the historical period (2019-2024), driven by rising vehicle ownership, increasing disposable incomes, and robust economic growth. The market is expected to maintain a healthy CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the adoption of cashless transactions and loyalty programs, are reshaping consumer behavior. Growth is also propelled by government initiatives promoting infrastructure development and fuel efficiency. Market penetration rates are expected to increase significantly by xx% by 2033, driven largely by increasing urbanization and rising demand for personal transportation in Tier 2 and Tier 3 cities.

Dominant Regions, Countries, or Segments in India Petrol Station Market

The Indian petrol station market exhibits significant regional variations in growth and market share. Urban areas, particularly in major metropolitan cities, demonstrate higher market penetration and growth rates compared to rural areas. Public Sector Undertakings (PSUs) continue to dominate the market, holding a larger share than privately-owned stations. However, private sector growth is rapidly gaining momentum fueled by aggressive expansion strategies and innovative offerings. The private-sector end-user segment contributes significantly to overall market growth due to increasing private vehicle ownership and consumption.

- Key Growth Drivers (Public Sector): Extensive network, established brand trust, and government support.

- Key Growth Drivers (Private Sector): Aggressive expansion, innovative business models, and focused customer service.

- Key Growth Drivers (Urban Areas): High vehicle density, increased consumer spending, and superior infrastructure.

- Market Share: Public Sector Undertakings hold approximately xx% market share, while Private Owned stations account for xx%. The Private Sector is anticipated to achieve a xx% share by 2033.

India Petrol Station Market Product Landscape

The petrol station market offers a variety of products and services beyond fuel. Value-added services such as convenience stores, ATMs, and car washes are increasingly common. Technological advancements focus on improved fuel dispensing systems, digital payment options, and loyalty programs to enhance customer experience. The emphasis is on superior customer service and creating a convenient stop for motorists.

Key Drivers, Barriers & Challenges in India Petrol Station Market

Key Drivers:

- Rising vehicle ownership and increasing fuel consumption.

- Expanding road networks and infrastructure development.

- Government initiatives to improve fuel efficiency and reduce emissions.

Key Challenges:

- Fluctuating fuel prices and their impact on profitability.

- Intense competition from both public and private sector players.

- Stringent environmental regulations and their compliance costs.

- Supply chain disruptions and their effect on fuel availability (estimated xx% impact in 2024).

Emerging Opportunities in India Petrol Station Market

- Expansion into rural and underserved markets.

- Integration of electric vehicle charging stations.

- Development of innovative retail offerings and customer loyalty programs.

- Partnerships with logistics and delivery service providers.

Growth Accelerators in the India Petrol Station Market Industry

The long-term growth of the Indian petrol station market is poised to be fueled by strategic investments in infrastructure, technological innovations in fuel dispensing and retail services, and the continued expansion of the vehicle fleet across both urban and rural areas. Furthermore, partnerships between fuel retailers and other service providers to create a comprehensive and convenient customer experience will be a key driver of future growth.

Key Players Shaping the India Petrol Station Market Market

- TotalEnergies SA

- Hindustan Petroleum Corporation Limited

- Reliance Industries Limited

- Bharat Petroleum Corp Ltd

- Nayara Energy Limited

- Royal Dutch Shell PLC

- Indian Oil Corporation Ltd

Notable Milestones in India Petrol Station Market Sector

- November 2021: Launch of the Model Retail Outlet Scheme and Darpan@PetrolPump digital customer feedback program by IOCL, BPCL, and HPCL. This initiative significantly improved service standards and customer experience.

In-Depth India Petrol Station Market Market Outlook

The future of the India petrol station market appears bright, driven by consistent economic growth, rising vehicle ownership, and continued investments in infrastructure. Strategic partnerships, technological innovations, and expansion into underserved markets present significant opportunities for growth. The market is expected to witness further consolidation with mergers and acquisitions among existing players. The integration of electric vehicle charging infrastructure will further reshape the market landscape, creating new avenues for growth and innovation.

India Petrol Station Market Segmentation

-

1. Ownership

- 1.1. Public Sector Undertakings

- 1.2. Private Owned

-

2. End-User

- 2.1. Public-Sector

- 2.2. Private-Sector

India Petrol Station Market Segmentation By Geography

- 1. India

India Petrol Station Market Regional Market Share

Geographic Coverage of India Petrol Station Market

India Petrol Station Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Renewable Energy Generation 4.; Supportive Government Policies Towards Green Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Challenges In Installing Renewable Power in the Circulated Structure

- 3.4. Market Trends

- 3.4.1. The Private Owned Segment is Expected to be the Fastest-Growing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Petrol Station Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Public Sector Undertakings

- 5.1.2. Private Owned

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Public-Sector

- 5.2.2. Private-Sector

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 TotalEnergies SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hindustan Petroleum Corporation Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Reliance Industries Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bharat Petroleum Corp Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nayara Energy Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Royal Dutch Shell PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Indian Oil Corporation Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 TotalEnergies SA

List of Figures

- Figure 1: India Petrol Station Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Petrol Station Market Share (%) by Company 2025

List of Tables

- Table 1: India Petrol Station Market Revenue million Forecast, by Ownership 2020 & 2033

- Table 2: India Petrol Station Market Revenue million Forecast, by End-User 2020 & 2033

- Table 3: India Petrol Station Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: India Petrol Station Market Revenue million Forecast, by Ownership 2020 & 2033

- Table 5: India Petrol Station Market Revenue million Forecast, by End-User 2020 & 2033

- Table 6: India Petrol Station Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Petrol Station Market?

The projected CAGR is approximately 3.9%.

2. Which companies are prominent players in the India Petrol Station Market?

Key companies in the market include TotalEnergies SA, Hindustan Petroleum Corporation Limited, Reliance Industries Limited, Bharat Petroleum Corp Ltd, Nayara Energy Limited, Royal Dutch Shell PLC, Indian Oil Corporation Ltd.

3. What are the main segments of the India Petrol Station Market?

The market segments include Ownership, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.79 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Renewable Energy Generation 4.; Supportive Government Policies Towards Green Energy.

6. What are the notable trends driving market growth?

The Private Owned Segment is Expected to be the Fastest-Growing Market.

7. Are there any restraints impacting market growth?

4.; Challenges In Installing Renewable Power in the Circulated Structure.

8. Can you provide examples of recent developments in the market?

In November 2021, Indian Oil Corporation (IOCL), Bharat Petroleum Corporation Limited (BPCL), and Hindustan Petroleum Corporation Limited (HPCL) announced the launch of the Model Retail Outlet Scheme and Digital Customer Feedback Program called Darpan@PetrolPump. Three oil PSUs have joined to launch Model Retail Outlets to enhance service standards and amenities across their fuel station networks, serving over six crore consumers daily.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Petrol Station Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Petrol Station Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Petrol Station Market?

To stay informed about further developments, trends, and reports in the India Petrol Station Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence