Key Insights

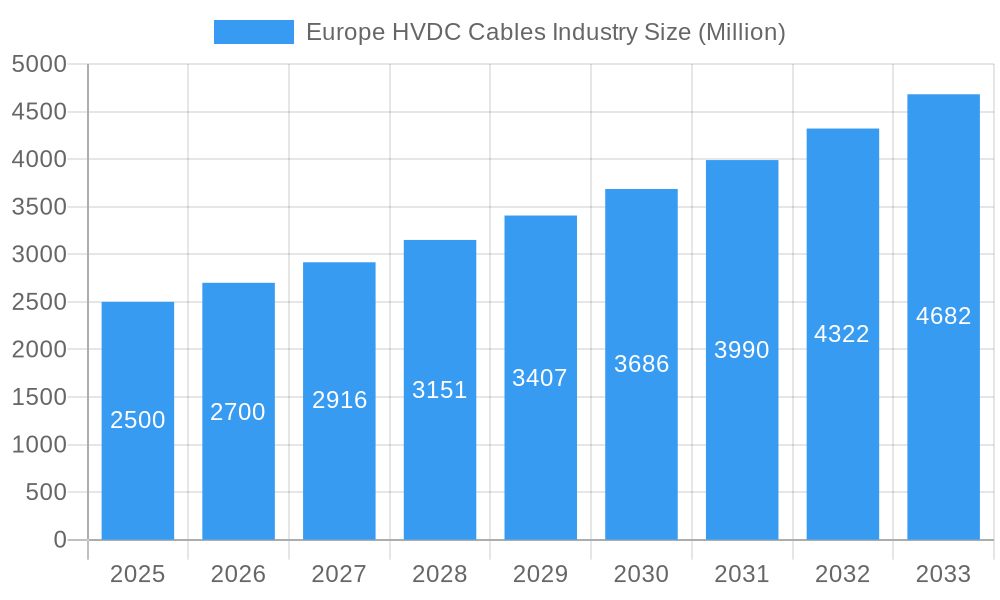

The European High Voltage Direct Current (HVDC) cables market is experiencing significant expansion, driven by the escalating need for efficient, long-distance power transmission solutions. Europe's strategic focus on integrating renewable energy sources and modernizing its aging grid infrastructure is spurring substantial investments in HVDC technology. Submarine HVDC transmission systems are a critical segment, enabling the connection of offshore wind farms and facilitating cross-border power exchange. Advancements in cable materials and design are further boosting market growth by enhancing performance, increasing voltage capacity, and improving reliability. Leading companies such as Hitachi Energy, Siemens Energy, and Nexans are strategically investing in research and development and expanding manufacturing capabilities to address this rising demand. Despite challenges like regulatory complexities and high upfront costs, the superior energy efficiency and grid stability offered by HVDC technology are driving market adoption. The forecast period (2025-2033) anticipates sustained growth, with a projected Compound Annual Growth Rate (CAGR) of over 8%, leading to a substantial market size increase. This growth is expected across all segments, including converter stations and various cable types, with particular momentum in submarine and underground cables due to their crucial role in connecting offshore renewables. Europe's ongoing energy transition and decarbonization efforts will continue to be primary catalysts for market expansion throughout the forecast horizon.

Europe HVDC Cables Industry Market Size (In Billion)

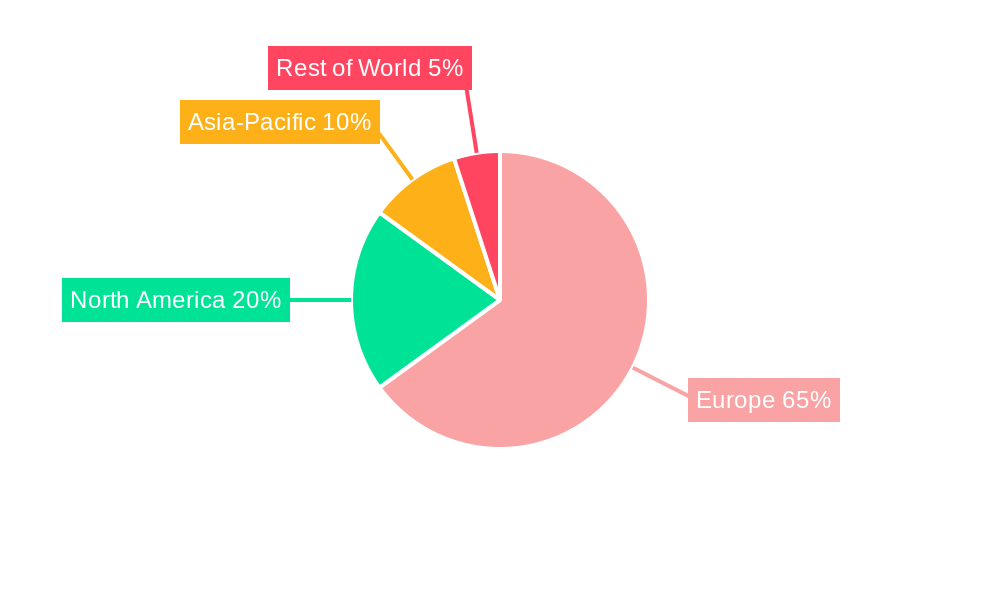

Geographically, the European HVDC cables market is characterized by significant contributions from Germany, France, the UK, and other major European nations. While each country's unique regulatory and energy policies influence HVDC cable adoption rates, the overarching trend points to consistent upward momentum, fueled by investments in renewables, grid modernization initiatives, and the development of smart grids. Intense competition among key players is driving innovation, strategic collaborations, and geographic expansion to secure competitive advantages. The European HVDC cables market demonstrates a promising outlook with robust growth anticipated over the next decade, underscoring the persistent drive towards a more sustainable and resilient energy infrastructure.

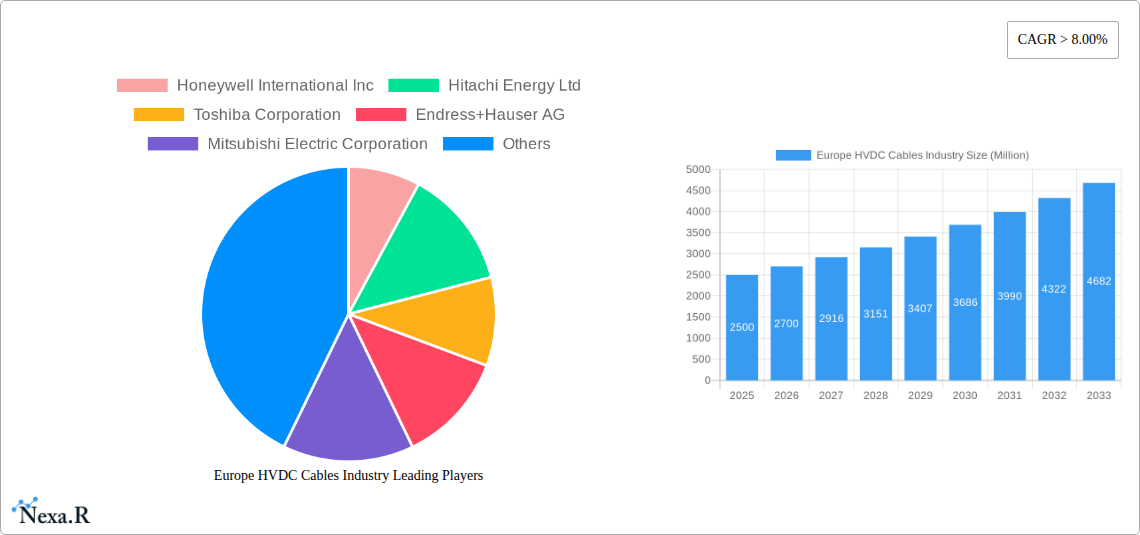

Europe HVDC Cables Industry Company Market Share

European HVDC Cables Market Overview: Size, Growth, and Forecast (2025-2033)

This comprehensive report delivers an in-depth analysis of the European HVDC Cables industry, covering market dynamics, growth trajectories, key participants, and future projections. The analysis spans the period from 2019 to 2033, with 2025 designated as the base and estimated year. The market is segmented by transmission type (Submarine HVDC Transmission System, HVDC Overhead Transmission System, HVDC Underground Transmission System) and component (Converter Stations, Transmission Medium (Cables)), offering granular insights into segment performance and growth potential. Key industry players, including Honeywell International Inc, Hitachi Energy Ltd, Toshiba Corporation, Endress+Hauser AG, Mitsubishi Electric Corporation, Eaton Corporation PLC, Siemens Energy AG, and General Electric Company, are profiled, providing a thorough competitive landscape assessment. The market size is estimated at $9.7 billion, with a CAGR of 24.3%.

Europe HVDC Cables Industry Market Dynamics & Structure

The European HVDC Cables market is characterized by moderate concentration, with a few major players holding significant market share. Technological innovation, particularly in cable materials and converter station design, is a crucial driver. Stringent regulatory frameworks concerning grid stability and environmental impact influence market growth. Competitive substitutes, such as HVAC transmission lines, exist, but HVDC's advantages in long-distance transmission are driving its adoption. The end-user demographics are primarily utilities and energy companies investing in renewable energy integration and grid modernization. M&A activity has been moderate, with strategic acquisitions focused on enhancing technological capabilities and expanding geographical reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on increasing transmission capacity, improving cable lifespan, and reducing environmental impact.

- Regulatory Framework: Stringent standards and certifications influence market dynamics.

- Competitive Substitutes: HVAC transmission lines offer competition but are less efficient for long-distance transmission.

- End-User Demographics: Primarily utilities and renewable energy companies.

- M&A Trends: Strategic acquisitions to strengthen technology and market presence. XX M&A deals were recorded between 2019-2024.

Europe HVDC Cables Industry Growth Trends & Insights

The European HVDC Cables market experienced robust growth during the historical period (2019-2024), driven by the increasing demand for renewable energy integration and cross-border electricity trade. The market size is estimated at XX million in 2025 and is projected to reach XX million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the adoption of advanced cable materials and digital monitoring systems, are accelerating market growth. Consumer behavior shifts towards sustainability and renewable energy are creating significant opportunities.

Dominant Regions, Countries, or Segments in Europe HVDC Cables Industry

The Submarine HVDC Transmission System segment dominates the market due to the rising demand for offshore wind energy integration and interconnections across European countries. Germany, the UK, and the Netherlands are leading countries, driven by substantial investments in offshore wind farms and cross-border electricity grids.

- Key Drivers:

- Significant investments in renewable energy infrastructure.

- Government support and policies promoting grid modernization and interconnection.

- Growing demand for long-distance power transmission.

- Dominance Factors:

- Higher capacity compared to overhead and underground transmission.

- Suitable for offshore wind farm integration.

- Government incentives for renewable energy projects.

The high market share of submarine cables is attributed to the increasing number of offshore wind farms and the necessity to transport electricity generated far from land. Germany and the UK have seen significant growth, boosted by governmental support for renewable energy infrastructure and cross-border connections with neighboring countries. The expected growth is mainly propelled by upcoming projects like the BorWin6 and Harmony Link.

Europe HVDC Cables Industry Product Landscape

The HVDC cable market features a range of products with varying voltage ratings, conductor materials, and insulation technologies. Innovations focus on enhancing capacity, improving reliability, and reducing environmental impact. Key features include advanced insulation materials, increased conductor sizes and improved monitoring systems. Unique selling propositions include enhanced longevity, superior power transmission, and environmental responsibility. Technological advancements center around material science, creating lighter, stronger, and more efficient cables.

Key Drivers, Barriers & Challenges in Europe HVDC Cables Industry

Key Drivers:

- Increasing demand for renewable energy integration.

- Growth in cross-border electricity trade.

- Government initiatives promoting grid modernization.

Key Challenges:

- High initial investment costs.

- Complex installation procedures.

- Supply chain disruptions impacting material availability.

- Regulatory hurdles and permitting processes.

- Intense competition from established players.

Emerging Opportunities in Europe HVDC Cables Industry

- Expanding applications in onshore and offshore wind farms.

- Growth in hybrid AC/DC grids.

- Demand for high-voltage DC cables in data centers and power electronics.

- Opportunities in developing countries with growing energy demands.

Growth Accelerators in the Europe HVDC Cables Industry Industry

Technological advancements in cable materials and manufacturing processes, along with strategic partnerships between cable manufacturers and renewable energy developers, are key growth accelerators. Government policies promoting renewable energy integration and grid modernization further accelerate market growth. Expanding into new markets and developing innovative applications for HVDC cables are driving long-term growth prospects.

Key Players Shaping the Europe HVDC Cables Industry Market

Notable Milestones in Europe HVDC Cables Industry Sector

- February 2022: McDermott International awarded a major contract for the BorWin6 980 MW HVDC project.

- June 2021: PSE SA and Litgrid approved investments in the 700-MW Harmony Link interconnector project.

In-Depth Europe HVDC Cables Industry Market Outlook

The European HVDC Cables market is poised for continued strong growth, driven by the accelerating shift towards renewable energy and the need for efficient long-distance power transmission. Strategic investments in grid modernization and cross-border interconnections, coupled with technological advancements in cable materials and designs, will drive market expansion. The continued growth of offshore wind energy will remain a substantial growth driver. Opportunities exist for companies to capitalize on innovative solutions and strategic partnerships to capture market share.

Europe HVDC Cables Industry Segmentation

-

1. Transmission Type

- 1.1. Submarine HVDC Transmission System

- 1.2. HVDC Ovehead Transmission System

- 1.3. HVDC Underground Transmission System

-

2. Component

- 2.1. Converter Stations

- 2.2. Transmission Medium (Cables)

Europe HVDC Cables Industry Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. Italy

- 4. France

- 5. Netherlands

- 6. Rest of Europe

Europe HVDC Cables Industry Regional Market Share

Geographic Coverage of Europe HVDC Cables Industry

Europe HVDC Cables Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand For Power Quality In Industrial And Manufacturing Sectors4.; Increase In Smart Grid Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; High Costs Of Power Quality Equipment

- 3.4. Market Trends

- 3.4.1. Submarine HVDC Transmission System Type to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe HVDC Cables Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 5.1.1. Submarine HVDC Transmission System

- 5.1.2. HVDC Ovehead Transmission System

- 5.1.3. HVDC Underground Transmission System

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Converter Stations

- 5.2.2. Transmission Medium (Cables)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. Italy

- 5.3.4. France

- 5.3.5. Netherlands

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 6. United Kingdom Europe HVDC Cables Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Transmission Type

- 6.1.1. Submarine HVDC Transmission System

- 6.1.2. HVDC Ovehead Transmission System

- 6.1.3. HVDC Underground Transmission System

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Converter Stations

- 6.2.2. Transmission Medium (Cables)

- 6.1. Market Analysis, Insights and Forecast - by Transmission Type

- 7. Germany Europe HVDC Cables Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Transmission Type

- 7.1.1. Submarine HVDC Transmission System

- 7.1.2. HVDC Ovehead Transmission System

- 7.1.3. HVDC Underground Transmission System

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Converter Stations

- 7.2.2. Transmission Medium (Cables)

- 7.1. Market Analysis, Insights and Forecast - by Transmission Type

- 8. Italy Europe HVDC Cables Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Transmission Type

- 8.1.1. Submarine HVDC Transmission System

- 8.1.2. HVDC Ovehead Transmission System

- 8.1.3. HVDC Underground Transmission System

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Converter Stations

- 8.2.2. Transmission Medium (Cables)

- 8.1. Market Analysis, Insights and Forecast - by Transmission Type

- 9. France Europe HVDC Cables Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Transmission Type

- 9.1.1. Submarine HVDC Transmission System

- 9.1.2. HVDC Ovehead Transmission System

- 9.1.3. HVDC Underground Transmission System

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Converter Stations

- 9.2.2. Transmission Medium (Cables)

- 9.1. Market Analysis, Insights and Forecast - by Transmission Type

- 10. Netherlands Europe HVDC Cables Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Transmission Type

- 10.1.1. Submarine HVDC Transmission System

- 10.1.2. HVDC Ovehead Transmission System

- 10.1.3. HVDC Underground Transmission System

- 10.2. Market Analysis, Insights and Forecast - by Component

- 10.2.1. Converter Stations

- 10.2.2. Transmission Medium (Cables)

- 10.1. Market Analysis, Insights and Forecast - by Transmission Type

- 11. Rest of Europe Europe HVDC Cables Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Transmission Type

- 11.1.1. Submarine HVDC Transmission System

- 11.1.2. HVDC Ovehead Transmission System

- 11.1.3. HVDC Underground Transmission System

- 11.2. Market Analysis, Insights and Forecast - by Component

- 11.2.1. Converter Stations

- 11.2.2. Transmission Medium (Cables)

- 11.1. Market Analysis, Insights and Forecast - by Transmission Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Honeywell International Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Hitachi Energy Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Toshiba Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Endress+Hauser AG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Mitsubishi Electric Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Eaton Corporation PLC

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Siemens Energy AG

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 General Electric Company

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe HVDC Cables Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe HVDC Cables Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe HVDC Cables Industry Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 2: Europe HVDC Cables Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 3: Europe HVDC Cables Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe HVDC Cables Industry Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 5: Europe HVDC Cables Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 6: Europe HVDC Cables Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe HVDC Cables Industry Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 8: Europe HVDC Cables Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 9: Europe HVDC Cables Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe HVDC Cables Industry Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 11: Europe HVDC Cables Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 12: Europe HVDC Cables Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe HVDC Cables Industry Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 14: Europe HVDC Cables Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 15: Europe HVDC Cables Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe HVDC Cables Industry Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 17: Europe HVDC Cables Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 18: Europe HVDC Cables Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Europe HVDC Cables Industry Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 20: Europe HVDC Cables Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 21: Europe HVDC Cables Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe HVDC Cables Industry?

The projected CAGR is approximately 24.3%.

2. Which companies are prominent players in the Europe HVDC Cables Industry?

Key companies in the market include Honeywell International Inc, Hitachi Energy Ltd, Toshiba Corporation, Endress+Hauser AG, Mitsubishi Electric Corporation, Eaton Corporation PLC, Siemens Energy AG, General Electric Company.

3. What are the main segments of the Europe HVDC Cables Industry?

The market segments include Transmission Type, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.7 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand For Power Quality In Industrial And Manufacturing Sectors4.; Increase In Smart Grid Infrastructure.

6. What are the notable trends driving market growth?

Submarine HVDC Transmission System Type to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Costs Of Power Quality Equipment.

8. Can you provide examples of recent developments in the market?

In February 2022, McDermott International was awarded its largest-ever renewable energy contract from TenneT for the BorWin6 980 MW high-voltage direct current project. The project is for the design, manufacture, installation, and commissioning of an HVDC offshore converter platform located 118 miles offshore Germany on the North Sea Cluster 7 platform.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe HVDC Cables Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe HVDC Cables Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe HVDC Cables Industry?

To stay informed about further developments, trends, and reports in the Europe HVDC Cables Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence