Key Insights

India's onshore wind energy market is experiencing significant expansion, propelled by government mandates for renewable energy and policies designed to mitigate carbon emissions. The market, projected to reach $3.18 billion by 2025, is forecast to grow at a Compound Annual Growth Rate (CAGR) of 7.1% through 2033. Key growth drivers include declining turbine costs, technological enhancements for improved efficiency, and escalating corporate sustainability initiatives. Turbine segments exceeding 3 MW capacity represent a substantial market share (45%), indicating a preference for large-scale projects that optimize economies of scale and energy output. Leading companies such as Suzlon Energy and Tata Power are strategically increasing investments in capacity and technology to leverage this dynamic market. India, within the broader Asia-Pacific region, is a critical hub for this growth due to its extensive land availability for wind farms and government efforts to achieve energy self-sufficiency.

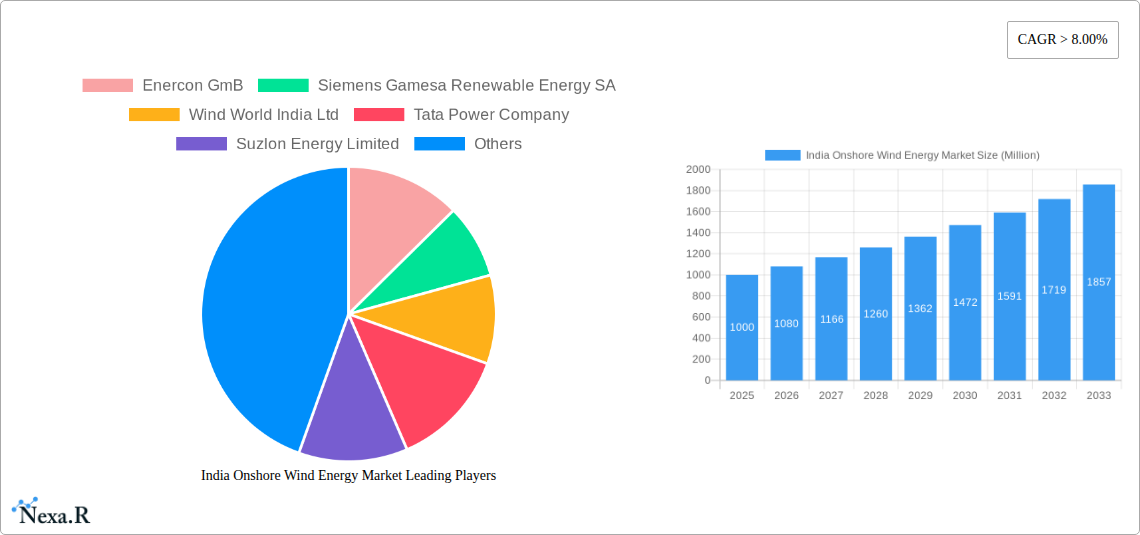

India Onshore Wind Energy Market Market Size (In Billion)

Obstacles to market progress include challenges in land acquisition and grid integration. Furthermore, potential shifts in regulatory frameworks and variability in regional wind resource potential may influence growth consistency. Nevertheless, the long-term outlook for India's onshore wind energy sector remains exceptionally strong, supported by robust policy frameworks, governmental incentives, and the imperative shift towards cleaner energy solutions. This sustained market growth underscores India's dedication to its renewable energy objectives, presenting considerable opportunities for stakeholders in wind technology, project development, and infrastructure. The prevailing trend towards higher-capacity turbines signals a future characterized by more efficient and economical wind power generation, thereby accelerating market expansion.

India Onshore Wind Energy Market Company Market Share

India Onshore Wind Energy Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India onshore wind energy market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is invaluable for investors, industry professionals, and policymakers seeking to understand and capitalize on the burgeoning opportunities within this sector. The report segments the market by turbine capacity: 2-3 MW (55.0%) and >3 MW (45.0%).

India Onshore Wind Energy Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Indian onshore wind energy sector. The report delves into market concentration, identifying key players and their market share. It also explores the impact of technological innovations, such as advancements in turbine design and efficiency, on market growth. Furthermore, the analysis covers the influence of government policies, incentives, and regulatory frameworks on market expansion. The report assesses the presence and impact of competitive product substitutes and analyzes end-user demographics and their energy consumption patterns. Finally, it examines M&A activity within the sector, quantifying deal volumes and their implications for market consolidation.

- Market Concentration: Analysis of market share held by top players (xx%).

- Technological Innovation: Evaluation of advancements in turbine technology and their impact on cost reduction and efficiency improvements.

- Regulatory Framework: Assessment of government policies, incentives, and regulations impacting market growth. (e.g., feed-in tariffs, renewable energy mandates).

- Competitive Substitutes: Analysis of competing renewable energy sources (e.g., solar power) and their market impact.

- M&A Trends: Quantitative analysis of mergers and acquisitions in the sector (xx number of deals in the last 5 years) and their qualitative implications for market structure.

- Innovation Barriers: Discussion on challenges hindering technological adoption and innovation (e.g., high initial investment costs).

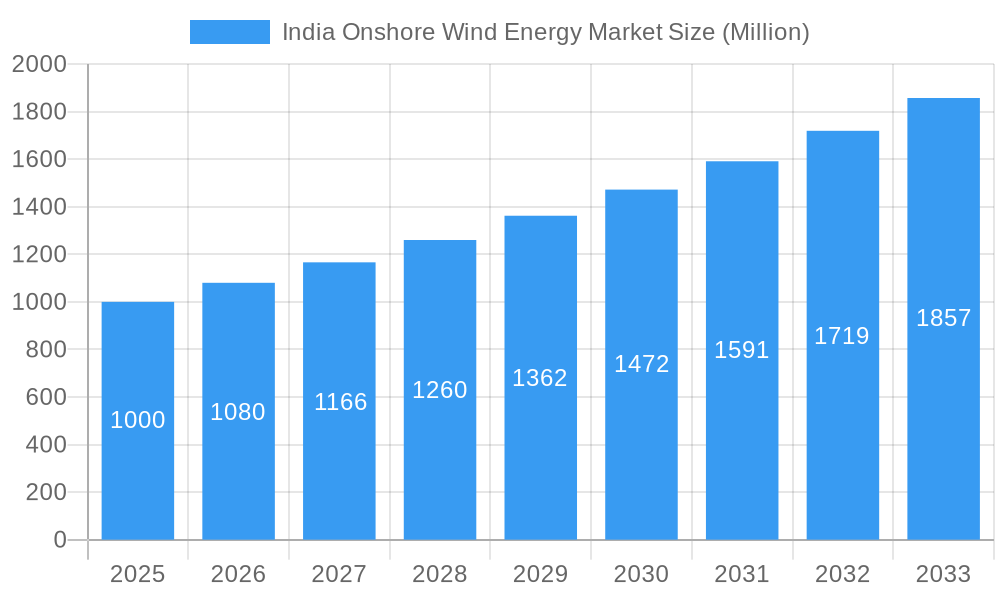

India Onshore Wind Energy Market Growth Trends & Insights

This section provides a detailed analysis of the India onshore wind energy market's historical and projected growth trajectory. Utilizing rigorous data analysis, the report explores market size evolution (in Million units), adoption rates across different regions and segments, and the influence of technological disruptions. It examines shifts in consumer behavior, including increasing demand for clean energy and government initiatives supporting renewable energy adoption. The analysis includes key metrics such as Compound Annual Growth Rate (CAGR) and market penetration to offer granular insights into market dynamics. Specific data points are analyzed and presented to illustrate these trends, giving a comprehensive understanding of historical growth and future projections. Factors influencing growth, including economic growth, policy changes, and technological advancements, are discussed and quantified.

Dominant Regions, Countries, or Segments in India Onshore Wind Energy Market

This section pinpoints the leading region(s) or segment(s) within the Indian onshore wind energy market driving significant growth. A detailed analysis of the 2-3 MW and >3 MW turbine capacity segments is presented, highlighting their respective market shares (55% and 45% respectively). Key factors influencing the dominance of these segments are examined, including economic policies, infrastructural development, and regional energy demands. The analysis incorporates market share data, growth potential projections, and qualitative assessments of market drivers and barriers specific to each region and segment.

- Regional Dominance: Identification of the states/regions with the largest installed capacity and highest growth potential (e.g., Gujarat, Tamil Nadu).

- Segmental Leadership: Detailed analysis of the 2-3 MW and >3 MW turbine capacity segments, including growth drivers and market share breakdown.

- Key Drivers: Examination of factors influencing regional and segmental dominance (e.g., government policies, resource availability, infrastructure).

India Onshore Wind Energy Market Product Landscape

This section describes the range of onshore wind turbines available in the Indian market, highlighting product innovations, applications, and performance metrics. It focuses on the unique selling propositions (USPs) of different turbine models, such as efficiency, reliability, and cost-effectiveness. Technological advancements driving product improvement are analyzed, including the integration of smart technologies and advancements in materials science.

Key Drivers, Barriers & Challenges in India Onshore Wind Energy Market

This section outlines the key factors driving market growth and the challenges hindering its expansion. Growth drivers include increasing government support for renewable energy, falling turbine costs, and rising electricity demand. Challenges include land acquisition issues, grid integration problems, and financing constraints. The analysis provides specific examples and quantifiable impacts where available.

Key Drivers:

- Increasing government support for renewable energy.

- Decreasing turbine costs.

- Rising electricity demand.

Key Challenges:

- Land acquisition difficulties.

- Grid integration complexities. (e.g., xx MW of capacity facing grid integration delays).

- Financing constraints (e.g., xx% of projects facing funding hurdles).

Emerging Opportunities in India Onshore Wind Energy Market

This section highlights emerging trends and opportunities within the Indian onshore wind energy market. It discusses untapped market segments, innovative applications of wind energy, and evolving consumer preferences for sustainable energy solutions. The analysis includes opportunities for technology advancements, policy changes, and market expansion.

Growth Accelerators in the India Onshore Wind Energy Market Industry

This section identifies the catalysts expected to drive long-term growth in the Indian onshore wind energy market. It emphasizes the role of technological breakthroughs, strategic partnerships, and market expansion strategies in boosting market growth. The focus is on sustained growth drivers and their potential impact on future market size.

Key Players Shaping the India Onshore Wind Energy Market Market

- Enercon GmB

- Siemens Gamesa Renewable Energy SA

- Wind World India Ltd

- Tata Power Company

- Suzlon Energy Limited

- Envision Group

- Inox Wind limited

- Vestas Wind Systems AS

- General Electric Company

Notable Milestones in India Onshore Wind Energy Market Sector

- October 2022: Suzlon Group secured a new order to develop 144.9 MW wind power projects in Gujarat and Madhya Pradesh for the Aditya Birla Group, involving 69 x 2.1 MW wind turbines. Expected operation commencement by the end of 2023. This signifies increased market activity and demand for larger capacity turbines.

- May 2022: India's Minister for Power and New & Renewable Energy announced plans for 30,000 MW of offshore wind power capacity. This signals a significant expansion in the broader renewable energy sector and potentially increases onshore wind's competitive position.

- October 2021: GE Renewable Energy secured an 810 MW onshore wind turbine order from JSW Energy Ltd for projects in Tamil Nadu. This highlights significant investment and growth within the Tamil Nadu region and showcases GE's strong market presence.

In-Depth India Onshore Wind Energy Market Market Outlook

The Indian onshore wind energy market is poised for significant growth over the forecast period (2025-2033). Technological advancements, supportive government policies, and increasing demand for clean energy will act as key growth accelerators. Strategic partnerships between domestic and international players will further bolster market expansion, creating significant opportunities for investors and industry participants. The long-term outlook is highly positive, suggesting a considerable increase in installed capacity and market size in the coming years. Further research into specific sub-segments will provide even more granular projections and opportunities for targeted investments.

India Onshore Wind Energy Market Segmentation

- 1. Onshore

- 2. Offshore

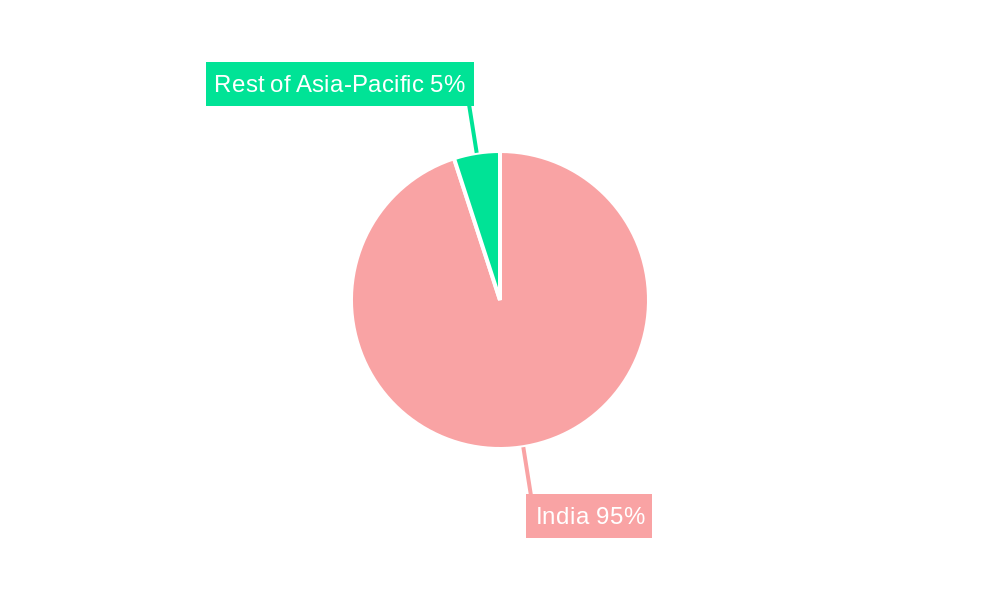

India Onshore Wind Energy Market Segmentation By Geography

- 1. India

India Onshore Wind Energy Market Regional Market Share

Geographic Coverage of India Onshore Wind Energy Market

India Onshore Wind Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Vehicle Ownership4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Onshore Wind Energy is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Onshore Wind Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 5.2. Market Analysis, Insights and Forecast - by Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Enercon GmB

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Siemens Gamesa Renewable Energy SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wind World India Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tata Power Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Suzlon Energy Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Envision Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Inox Wind limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vestas Wind Systems AS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 General Electric Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Enercon GmB

List of Figures

- Figure 1: India Onshore Wind Energy Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Onshore Wind Energy Market Share (%) by Company 2025

List of Tables

- Table 1: India Onshore Wind Energy Market Revenue billion Forecast, by Onshore 2020 & 2033

- Table 2: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Onshore 2020 & 2033

- Table 3: India Onshore Wind Energy Market Revenue billion Forecast, by Offshore 2020 & 2033

- Table 4: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Offshore 2020 & 2033

- Table 5: India Onshore Wind Energy Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Region 2020 & 2033

- Table 7: India Onshore Wind Energy Market Revenue billion Forecast, by Onshore 2020 & 2033

- Table 8: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Onshore 2020 & 2033

- Table 9: India Onshore Wind Energy Market Revenue billion Forecast, by Offshore 2020 & 2033

- Table 10: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Offshore 2020 & 2033

- Table 11: India Onshore Wind Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Onshore Wind Energy Market?

The projected CAGR is approximately 7.1%.

2. Which companies are prominent players in the India Onshore Wind Energy Market?

Key companies in the market include Enercon GmB, Siemens Gamesa Renewable Energy SA, Wind World India Ltd, Tata Power Company, Suzlon Energy Limited, Envision Group, Inox Wind limited, Vestas Wind Systems AS, General Electric Company.

3. What are the main segments of the India Onshore Wind Energy Market?

The market segments include Onshore, Offshore.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.18 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Vehicle Ownership4.; Government Initiatives.

6. What are the notable trends driving market growth?

Onshore Wind Energy is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatile Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

October 2022: Suzlon Group secured new order to develop 144.9 MW wind power projects located at sites in Gujarat and Madhya Pradesh for the Aditya Birla Group. As a part of the contract, the company will install around 69 units of wind turbine generators (Wind Turbines) with a Hybrid Lattice Tubular (HLT) tower with a rated capacity of 2.1 MW each. It is expected to commence operations by the end of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Gigawatte.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Onshore Wind Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Onshore Wind Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Onshore Wind Energy Market?

To stay informed about further developments, trends, and reports in the India Onshore Wind Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence