Key Insights

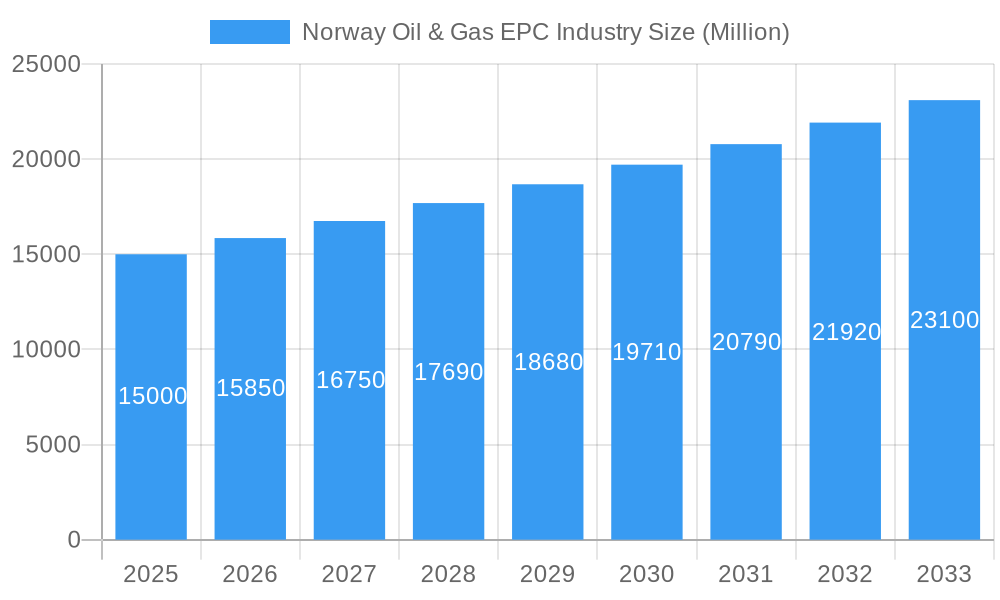

The Norwegian Oil & Gas EPC (Engineering, Procurement, and Construction) industry is experiencing significant expansion, driven by consistent high oil and gas production and substantial investments in infrastructure modernization and new project development. The market is projected to reach 54.49 billion in the base year of 2025, with an estimated Compound Annual Growth Rate (CAGR) of 4.3% through 2033. This robust growth is attributed to increasing global energy demand, ongoing exploration and production activities on the Norwegian Continental Shelf, and supportive government initiatives for energy sector advancement. Key market segments—upstream, midstream, and downstream—are all contributing to this upward trend. Upstream projects focus on maximizing extraction efficiency through advanced technologies, while midstream activities involve significant investments in pipeline development and LNG export infrastructure, leveraging Norway's strategic position. Downstream operations contribute through refinery upgrades and capacity expansions. Leading EPC companies such as Aker Solutions ASA, WorleyParsons Limited, and Aibel AS are strategically positioned to capitalize on these opportunities.

Norway Oil & Gas EPC Industry Market Size (In Billion)

The anticipated market growth presents considerable opportunities for both established and emerging players in the Norwegian Oil & Gas EPC sector. However, industry participants must navigate challenges including fluctuating oil prices, stringent environmental regulations, and the imperative to integrate sustainable practices. The sector's success hinges on its ability to adapt to these challenges while consistently delivering high-quality projects efficiently and within budget. Continued innovation in digitalization and automation will be crucial for EPC companies to enhance competitiveness, improve efficiency, and reduce operational costs across the value chain. Market consolidation is also anticipated as companies aim to expand their capabilities and market share.

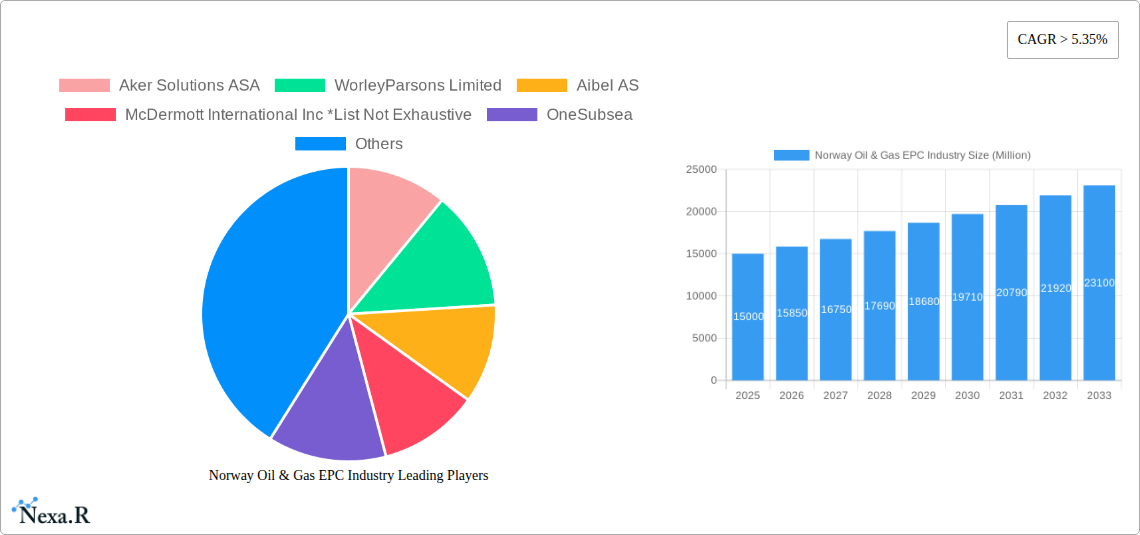

Norway Oil & Gas EPC Industry Company Market Share

This comprehensive report offers an in-depth analysis of the Norway Oil & Gas Engineering, Procurement, and Construction (EPC) industry, covering the period 2019-2033. It examines market dynamics, growth trends, key players, and future opportunities across upstream, midstream, and downstream segments. The report is an essential resource for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on the evolving landscape of Norway's oil and gas sector.

Norway Oil & Gas EPC Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within Norway's Oil & Gas EPC industry. The study period spans from 2019 to 2033, with 2025 as the base year and a forecast period of 2025-2033.

Market Concentration: The Norwegian Oil & Gas EPC market exhibits a moderately concentrated structure, with several major players holding significant market share. Aker Solutions ASA, WorleyParsons Limited, Aibel AS, and McDermott International Inc. are among the leading companies, though the market also includes several smaller specialized firms and international players. The exact market share distribution for 2025 is currently estimated at xx%.

Technological Innovation: Technological advancements, including digitalization, automation, and improved subsea technologies, are driving efficiency gains and cost reductions in EPC projects. However, high initial investment costs and the need for skilled labor can present barriers to wider adoption.

Regulatory Framework: The Norwegian government's stringent environmental regulations and safety standards impact EPC project development and execution. These regulations contribute to higher project costs but also incentivize investment in environmentally friendly technologies.

Competitive Substitutes: Limited direct substitutes exist for traditional EPC services within the Oil & Gas sector; however, alternative project delivery models and increased outsourcing are influencing competition.

End-User Demographics: The primary end-users are major oil and gas operators such as Equinor, Aker BP, and Lundin Energy, alongside a growing number of smaller independent companies.

M&A Trends: The past five years have seen a moderate level of mergers and acquisitions activity within the Norwegian Oil & Gas EPC sector. The total value of M&A deals during the historical period (2019-2024) is estimated at xx billion USD. The frequency of these deals is expected to remain consistent throughout the forecast period, primarily driven by consolidation and expansion strategies.

Norway Oil & Gas EPC Industry Growth Trends & Insights

This section provides a detailed analysis of market size evolution, adoption rates, technological disruptions, and consumer behavior shifts within Norway's Oil & Gas EPC market from 2019-2033. Data for this section is sourced from XXX (replace XXX with your data source).

The Norwegian Oil & Gas EPC market has experienced fluctuating growth in recent years, influenced by global oil and gas prices and government policies. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by increased investment in new oil and gas projects, alongside a growing emphasis on renewable energy integration and carbon capture projects. Market penetration for new technologies like subsea robotics and digital twin platforms will show a notable increase, reaching approximately xx% by 2033. However, fluctuations in energy prices and geopolitical uncertainty could impact growth rates. Analysis indicates a shift in consumer behavior towards demanding more sustainable and efficient EPC solutions, placing pressure on firms to adopt greener operational practices.

Dominant Regions, Countries, or Segments in Norway Oil & Gas EPC Industry

The Norwegian Continental Shelf (NCS) is the dominant region driving growth within the Norwegian Oil & Gas EPC industry. Upstream activities, particularly within the North Sea and Norwegian Sea, contribute significantly to market expansion.

Upstream: The upstream segment holds the largest market share, driven by substantial investments in exploration and production activities. The market size in USD billion for the upstream segment is forecast to reach xx by 2033, from xx in 2025. Upstream Oil and Gas spending in NOK billion in Norway from 2010-2025 has exhibited an upward trend, estimated to reach xx billion NOK by 2025. Production forecasts show xx million barrels of oil equivalent per day by 2033. Key EPC projects, such as the Halten East development, add substantial value to the market.

Midstream: Midstream activities, including pipeline construction and LNG export, also play a crucial role. The midstream market size in USD billion is projected to reach xx by 2033, driven by expansion of existing infrastructure. LNG export in billion cubic meters is expected to reach xx by 2033 from xx in 2025. Key projects include several pipelines connecting offshore fields to onshore processing facilities.

Downstream: The downstream sector, although smaller compared to upstream and midstream, contributes to market growth through refinery upgrades and petrochemical expansions. The downstream market size in USD billion is projected to reach xx by 2033. The Oil Refinery throughput capacity is projected to reach xx thousand barrels per day by 2033.

Norway Oil & Gas EPC Industry Product Landscape

The Norwegian Oil & Gas EPC industry offers a diverse range of products and services, from platform construction and subsea engineering to pipeline installation and LNG facility development. Recent innovations include enhanced digital tools for project management, the implementation of advanced automation techniques, and the adoption of sustainable construction methods and materials. These advancements aim to improve efficiency, safety, and environmental performance. Unique selling propositions often focus on specific niche expertise, innovative technologies, and close collaboration with oil and gas operators.

Key Drivers, Barriers & Challenges in Norway Oil & Gas EPC Industry

Key Drivers:

- High levels of oil and gas production and exploration activity in the NCS.

- Significant government investments in energy infrastructure.

- Ongoing development of new technologies such as carbon capture, utilization and storage (CCUS).

Challenges:

- The fluctuating price of oil and gas significantly impacts investment decisions.

- Stringent environmental regulations may lead to increased project costs and delays.

- Skilled labor shortages can constrain project delivery timelines.

Emerging Opportunities in Norway Oil & Gas EPC Industry

- Growing demand for CCUS and other environmentally friendly technologies.

- Increasing focus on digitalization and automation.

- Potential for expansion into renewable energy projects.

Growth Accelerators in the Norway Oil & Gas EPC Industry Industry

Long-term growth will be fueled by continued investment in new oil and gas developments, coupled with the increasing need to decarbonize the sector. Strategic partnerships between EPC firms and technology providers will also be a key driver. Furthermore, the successful execution of large-scale projects and a commitment to environmental sustainability will be crucial for sustained growth.

Key Players Shaping the Norway Oil & Gas EPC Industry Market

- Aker Solutions ASA

- WorleyParsons Limited

- Aibel AS

- McDermott International Inc

- OneSubsea

- Subsea 7 SA

- John Wood Group PLC

- TechnipFMC PLC

Notable Milestones in Norway Oil & Gas EPC Industry Sector

- May 2022: Equinor and partners announced a USD 940 million plan to develop the Halten East gas and condensate field, signaling a significant investment in new production capacity.

- December 2022: Aker BP and partners announced over USD 20.5 billion in investment for the development of multiple oil and gas fields, indicating a major boost to EPC activity in the coming years.

In-Depth Norway Oil & Gas EPC Industry Market Outlook

The future of the Norwegian Oil & Gas EPC market looks promising, driven by continued investment in both traditional oil and gas projects and the growing emphasis on low-carbon energy solutions. Strategic partnerships and technological advancements, especially in the areas of digitalization, automation, and CCUS, will be key to unlocking further growth and enhancing competitiveness on a global scale. The market is expected to continue to consolidate, with larger players potentially acquiring smaller companies to expand their capabilities and market share.

Norway Oil & Gas EPC Industry Segmentation

- 1. Midstream

- 2. Downstream

- 3. Upstream

Norway Oil & Gas EPC Industry Segmentation By Geography

- 1. Norway

Norway Oil & Gas EPC Industry Regional Market Share

Geographic Coverage of Norway Oil & Gas EPC Industry

Norway Oil & Gas EPC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Improved Viability Of Offshore Oil And Gas Projects

- 3.3. Market Restrains

- 3.3.1. Ban On Offshore Exploration And Production Activities In Multiple Regions

- 3.4. Market Trends

- 3.4.1. Upstream Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Oil & Gas EPC Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Midstream

- 5.2. Market Analysis, Insights and Forecast - by Downstream

- 5.3. Market Analysis, Insights and Forecast - by Upstream

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by Midstream

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aker Solutions ASA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 WorleyParsons Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aibel AS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 McDermott International Inc *List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 OneSubsea

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Subsea 7 SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 John Wood Group PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TechnipFMC PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Aker Solutions ASA

List of Figures

- Figure 1: Norway Oil & Gas EPC Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Norway Oil & Gas EPC Industry Share (%) by Company 2025

List of Tables

- Table 1: Norway Oil & Gas EPC Industry Revenue billion Forecast, by Midstream 2020 & 2033

- Table 2: Norway Oil & Gas EPC Industry Revenue billion Forecast, by Downstream 2020 & 2033

- Table 3: Norway Oil & Gas EPC Industry Revenue billion Forecast, by Upstream 2020 & 2033

- Table 4: Norway Oil & Gas EPC Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Norway Oil & Gas EPC Industry Revenue billion Forecast, by Midstream 2020 & 2033

- Table 6: Norway Oil & Gas EPC Industry Revenue billion Forecast, by Downstream 2020 & 2033

- Table 7: Norway Oil & Gas EPC Industry Revenue billion Forecast, by Upstream 2020 & 2033

- Table 8: Norway Oil & Gas EPC Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Oil & Gas EPC Industry?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Norway Oil & Gas EPC Industry?

Key companies in the market include Aker Solutions ASA, WorleyParsons Limited, Aibel AS, McDermott International Inc *List Not Exhaustive, OneSubsea, Subsea 7 SA, John Wood Group PLC, TechnipFMC PLC.

3. What are the main segments of the Norway Oil & Gas EPC Industry?

The market segments include Midstream, Downstream, Upstream.

4. Can you provide details about the market size?

The market size is estimated to be USD 54.49 billion as of 2022.

5. What are some drivers contributing to market growth?

Improved Viability Of Offshore Oil And Gas Projects.

6. What are the notable trends driving market growth?

Upstream Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

Ban On Offshore Exploration And Production Activities In Multiple Regions.

8. Can you provide examples of recent developments in the market?

In May 2022, Equinor and partners submitted a plan to develop a cluster of gas and condensate discoveries in the Norwegian Sea for USD 940 million. The Halten East contains reserves of around 100 million barrels of oil equivalent, 60% of which is natural gas, and is expected to begin exporting to Europe in 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Oil & Gas EPC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Oil & Gas EPC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Oil & Gas EPC Industry?

To stay informed about further developments, trends, and reports in the Norway Oil & Gas EPC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence