Key Insights

The South Korean oil and gas market is projected to reach $134.55 billion by 2033, expanding at a Compound Annual Growth Rate (CAGR) of 3.5% from the base year 2024. This growth is driven by rising industrial activity, economic expansion, and the nation's strategic emphasis on energy security and diversification. Investments in domestic production and imports are bolstering the sector. However, the market faces headwinds from volatile global energy prices and the accelerating transition towards renewable energy sources and stricter environmental regulations.

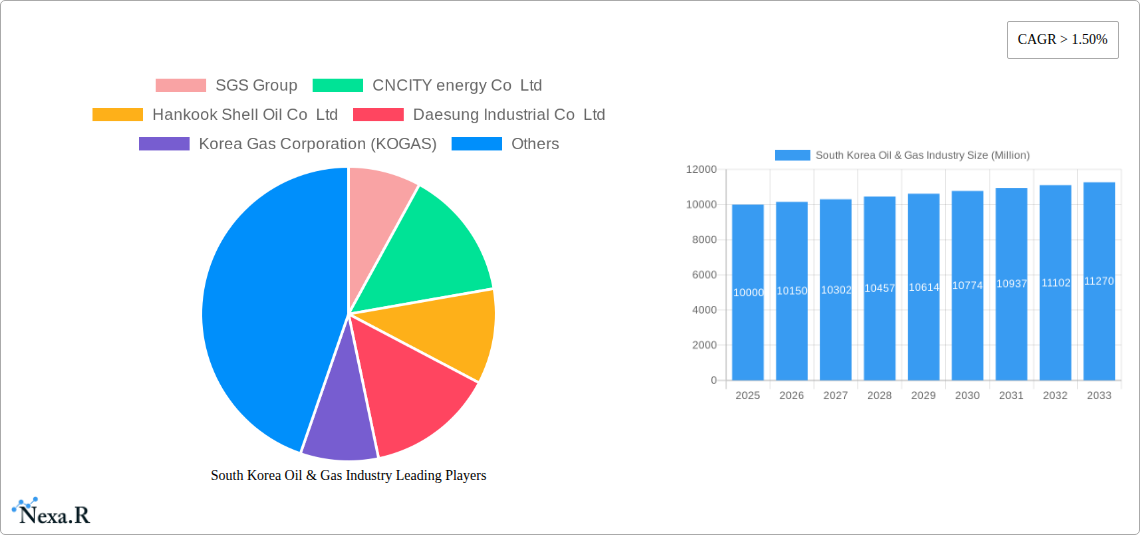

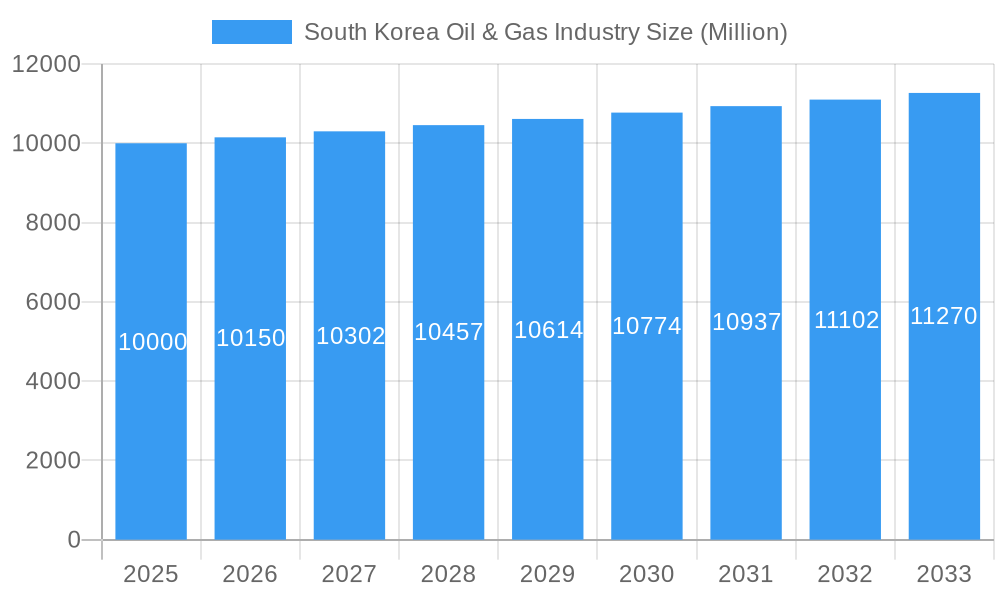

South Korea Oil & Gas Industry Market Size (In Billion)

The South Korean oil and gas market is segmented by end-user, with significant contributions from tanker fleets, container fleets, bulk and general cargo fleets, ferries, and offshore support vessels (OSVs). Key industry players, including SGS Group and CNCITY Energy Co Ltd, shape the competitive landscape. While this analysis focuses on South Korea, global energy trends, geopolitical shifts, and technological innovations significantly influence market dynamics. The robust export-oriented economy supports growth in container fleets, while maritime trade volumes and infrastructure development impact the ferry and OSV segments. The forecast period, 2024-2033, indicates sustained growth, subject to macroeconomic factors and global events.

South Korea Oil & Gas Industry Company Market Share

South Korea Oil & Gas Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the South Korea oil & gas industry, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on the period 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report is essential for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic market. The report covers key segments including Tanker Fleet, Container Fleet, Bulk and General Cargo Fleet, Ferries and OSV, and Others, offering granular insights into market size, growth drivers, and competitive landscapes.

South Korea Oil & Gas Industry Market Dynamics & Structure

The South Korean oil and gas market is characterized by a mix of state-owned enterprises and large private players, resulting in a moderately concentrated market structure. Technological innovation, driven by the need for energy security and decarbonization, is reshaping the industry. Stringent environmental regulations and a push towards renewable energy sources significantly impact market dynamics. Competition from alternative fuels and increasing focus on energy efficiency presents challenges for traditional players.

- Market Concentration: The top 5 players (SK Energy, GS Caltex Corp, S-Oil Corporation, Hyundai Oilbank Co Ltd, and KOGAS) hold approximately xx% of the market share (2024).

- Technological Innovation: Investment in LNG infrastructure and exploration of renewable gas sources (e.g., biomethane) are key innovation drivers.

- Regulatory Framework: Government policies promoting energy efficiency and renewable energy sources influence investment decisions and operational strategies.

- Competitive Product Substitutes: Growing adoption of electric vehicles and renewable energy sources pose a significant threat to the traditional oil and gas market.

- M&A Trends: The past five years have seen xx M&A deals, primarily focused on strategic partnerships and acquisitions of smaller players.

South Korea Oil & Gas Industry Growth Trends & Insights

The South Korean oil and gas market is projected to experience a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by increasing energy demand, particularly from the industrial and transportation sectors. However, the transition towards cleaner energy sources and government regulations promoting renewable energy are expected to moderate this growth rate in the latter half of the forecast period. Market penetration of LNG as a green fuel is accelerating, driven by government initiatives and the 2022 resolution. Consumer behavior is shifting toward greater awareness and demand for sustainability, influencing choices towards cleaner energy options.

Dominant Regions, Countries, or Segments in South Korea Oil & Gas Industry

The transportation sector, particularly the Tanker Fleet segment, currently dominates the South Korean oil & gas market, holding an estimated xx% market share in 2024. This dominance stems from South Korea's significant role in global shipping and the high energy requirements of its large fleet.

- Key Drivers: South Korea's robust maritime industry and export-oriented economy are key factors driving demand in the tanker segment. Government policies related to port infrastructure development further support this segment's growth.

- Growth Potential: Although facing challenges from decarbonization efforts, the Tanker Fleet segment remains a significant growth area, particularly with ongoing investments in energy-efficient vessels.

Other segments like Container Fleet and Bulk and General Cargo Fleet also show significant growth potential, albeit at a slower rate than the Tanker Fleet segment, driven by continuous expansion of international trade.

South Korea Oil & Gas Industry Product Landscape

The South Korean oil & gas market is characterized by a range of refined products, including gasoline, diesel, and jet fuel, with increasing focus on cleaner burning options and LNG. Technological advancements include the adoption of advanced refining technologies to enhance efficiency and product quality. Companies are increasingly focusing on creating high-value-added products and solutions to meet the evolving needs of the market.

Key Drivers, Barriers & Challenges in South Korea Oil & Gas Industry

Key Drivers: Increasing energy demand from a growing economy and industrial sector is a primary driver. Government initiatives promoting the use of LNG as a transitional fuel support market expansion.

Key Challenges: The transition to renewable energy sources presents a major challenge. Stringent environmental regulations and the need to reduce carbon emissions influence investment decisions and operational strategies. The cost of new investments in cleaner technologies and infrastructure poses another hurdle. Fluctuations in global oil and gas prices also represent a significant risk factor.

Emerging Opportunities in South Korea Oil & Gas Industry

The growing demand for cleaner energy solutions, including LNG and biofuels, presents substantial opportunities. Investment in carbon capture and storage technologies and the development of a more robust hydrogen infrastructure offer promising avenues for growth. Exploring opportunities in the production and distribution of biomethane and other renewable gas sources provides further expansion potential.

Growth Accelerators in the South Korea Oil & Gas Industry Industry

Strategic partnerships between domestic players and international energy companies are a major driver of growth. Technological breakthroughs in LNG production, storage, and transportation facilitate market expansion. Government support for infrastructure development is also accelerating market growth. Increased investment in R&D related to cleaner energy solutions further fuels expansion.

Key Players Shaping the South Korea Oil & Gas Industry Market

- SGS Group

- CNCITY energy Co Ltd

- Hankook Shell Oil Co Ltd

- Daesung Industrial Co Ltd

- Korea Gas Corporation (KOGAS)

- Hyundai Oilbank Co Ltd

- Kukdong Oil & Chemicals Co Ltd

- Korea National Oil Corporation (KNOC)

- SK Energy

- GS Caltex Corp

- S-Oil Corporation

Notable Milestones in South Korea Oil & Gas Industry Sector

- July 2021: KOGAS signs a 20-year LNG supply agreement with Qatar for 2 million tons annually starting in 2025.

- January 2022: South Korea designates LNG as a green fuel, impacting green financing, carbon taxes, and the energy mix.

In-Depth South Korea Oil & Gas Industry Market Outlook

The South Korean oil and gas industry is poised for continued growth, albeit at a moderated pace, driven by a combination of factors. While the transition to renewable energy sources will pose ongoing challenges, the increasing adoption of LNG as a transitional fuel and continued investments in energy efficiency will support market expansion. Strategic partnerships, technological innovations, and supportive government policies create a conducive environment for sustained growth in the coming years. The industry will continue to focus on diversification, particularly in exploring and adopting cleaner energy sources and technologies.

South Korea Oil & Gas Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South Korea Oil & Gas Industry Segmentation By Geography

- 1. South Korea

South Korea Oil & Gas Industry Regional Market Share

Geographic Coverage of South Korea Oil & Gas Industry

South Korea Oil & Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Power Demand across Industrial Sector4.; Remote Location of Several Industries and the Unreliability of the Power Supply

- 3.3. Market Restrains

- 3.3.1. 4.; High Capital and Operational Expenditures

- 3.4. Market Trends

- 3.4.1. Downstream segment to dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Oil & Gas Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SGS Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CNCITY energy Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hankook Shell Oil Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Daesung Industrial Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Korea Gas Corporation (KOGAS)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hyundai Oilbank Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kukdong Oil & Chemicals Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Korea National Oil Corporation (KNOC)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SK Energy

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GS Caltex Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 S-Oil Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 SGS Group

List of Figures

- Figure 1: South Korea Oil & Gas Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Korea Oil & Gas Industry Share (%) by Company 2025

List of Tables

- Table 1: South Korea Oil & Gas Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Production Analysis 2020 & 2033

- Table 3: South Korea Oil & Gas Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 4: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Consumption Analysis 2020 & 2033

- Table 5: South Korea Oil & Gas Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: South Korea Oil & Gas Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: South Korea Oil & Gas Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: South Korea Oil & Gas Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 12: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Region 2020 & 2033

- Table 13: South Korea Oil & Gas Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 14: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Production Analysis 2020 & 2033

- Table 15: South Korea Oil & Gas Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 16: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Consumption Analysis 2020 & 2033

- Table 17: South Korea Oil & Gas Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: South Korea Oil & Gas Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: South Korea Oil & Gas Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: South Korea Oil & Gas Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Oil & Gas Industry?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the South Korea Oil & Gas Industry?

Key companies in the market include SGS Group, CNCITY energy Co Ltd, Hankook Shell Oil Co Ltd, Daesung Industrial Co Ltd, Korea Gas Corporation (KOGAS), Hyundai Oilbank Co Ltd, Kukdong Oil & Chemicals Co Ltd, Korea National Oil Corporation (KNOC), SK Energy, GS Caltex Corp, S-Oil Corporation.

3. What are the main segments of the South Korea Oil & Gas Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 134.55 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Power Demand across Industrial Sector4.; Remote Location of Several Industries and the Unreliability of the Power Supply.

6. What are the notable trends driving market growth?

Downstream segment to dominate the market.

7. Are there any restraints impacting market growth?

4.; High Capital and Operational Expenditures.

8. Can you provide examples of recent developments in the market?

In January 2022, the country passed a resolution labelling LNG as a green fuel, as a part of its decarbonisation strategy to achieve a clean energy transition. This move is expected to have an impact on green financing, the future course of carbon taxes/emissions caps, the decommissioning pathway of coal-fired plants and South Korea's future energy mix

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in metric tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Oil & Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Oil & Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Oil & Gas Industry?

To stay informed about further developments, trends, and reports in the South Korea Oil & Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence