Key Insights

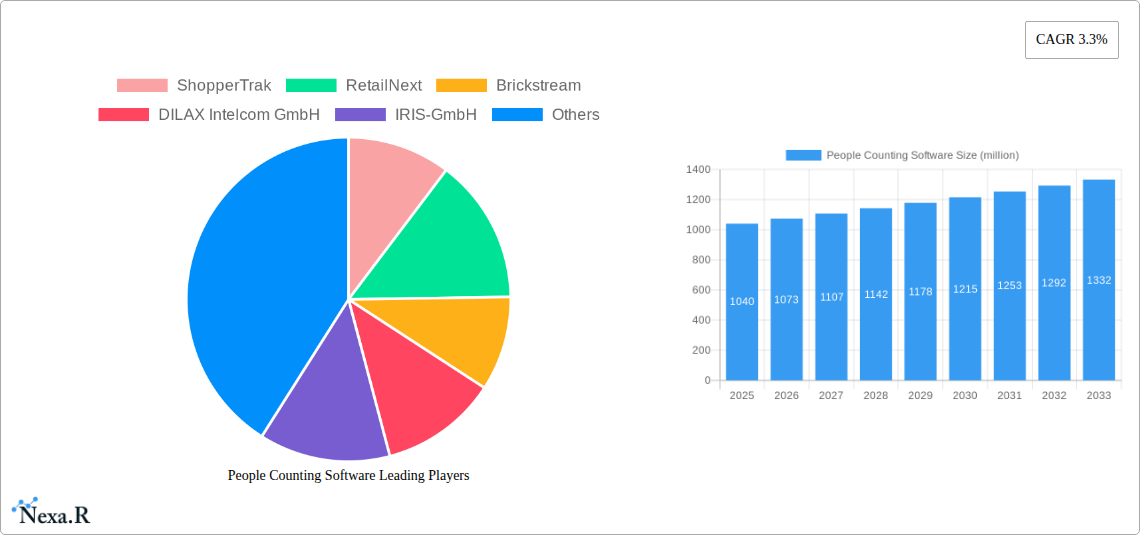

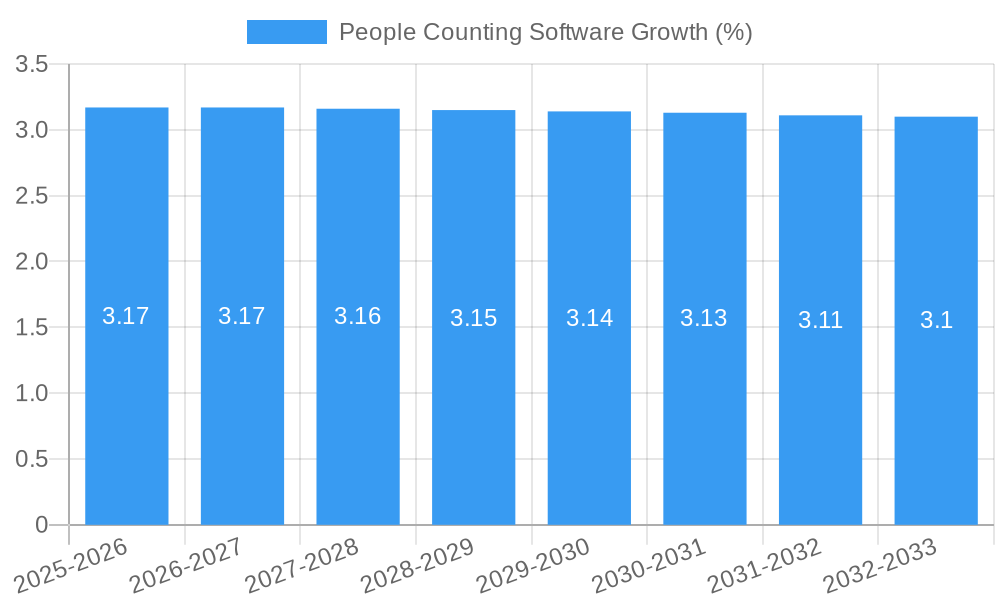

The global People Counting Software market is poised for significant expansion, projected to reach an estimated USD 1040 million in 2025 and exhibit a robust Compound Annual Growth Rate (CAGR) of 3.3% through 2033. This sustained growth is primarily driven by the escalating need for real-time footfall analytics across diverse sectors. Retail continues to be a dominant application, with businesses leveraging people counting solutions to optimize store layouts, manage staffing levels, and enhance customer experiences. The increasing adoption of advanced technologies like Artificial Intelligence (AI) and machine learning within these software solutions is further fueling market momentum. AI-powered analytics provide deeper insights into customer behavior, traffic flow patterns, and dwell times, enabling more precise decision-making. The proliferation of IoT devices and the growing emphasis on data-driven strategies across industries are also instrumental in the market's upward trajectory.

The market is witnessing a strong trend towards more sophisticated and integrated people counting systems. Beyond basic counting, solutions are evolving to offer advanced analytics, including queue management, demographic analysis, and even predictive behavior modeling. The "Type" segment is characterized by a bifurcated market, with IR Beam technology remaining a cost-effective option for straightforward counting, while Thermal Imaging and Video Based systems are gaining traction due to their enhanced accuracy, ability to differentiate age and gender (in some cases), and integration capabilities for richer data extraction. The growth is also propelled by the increasing deployment of these solutions in corporate offices for space utilization and employee tracking, educational institutions for attendance monitoring, and transportation hubs for passenger flow management. While challenges such as privacy concerns and the initial cost of implementation exist, the demonstrable ROI and the competitive advantage derived from accurate footfall data are expected to outweigh these restraints, ensuring continued market expansion.

People Counting Software Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the global People Counting Software market, exploring its intricate dynamics, growth trajectory, and future potential. Leveraging extensive data across the Study Period (2019–2033), with a Base Year (2025) and Forecast Period (2025–2033), this report is essential for industry professionals seeking to understand market segmentation, technological advancements, and competitive landscapes. We delve into key applications including Transportation, Commercial, Corporate and Education, and Others, and analyze dominant technologies such as IR Beam, Thermal Imaging, and Video Based solutions.

People Counting Software Market Dynamics & Structure

The People Counting Software market is characterized by a dynamic interplay of technological innovation, evolving end-user demands, and a competitive environment. Market concentration varies across different technology types and application segments, with Video Based solutions currently holding a significant share due to their advanced analytics capabilities. Technological innovation is primarily driven by the pursuit of higher accuracy, real-time data processing, and integration with other smart building and retail analytics platforms. Regulatory frameworks, while not overly restrictive, are beginning to influence data privacy considerations, particularly in Commercial and Corporate settings. Competitive product substitutes exist, ranging from manual counting methods to simpler sensor technologies, but these often fall short in delivering the granular insights offered by advanced software. End-user demographics are shifting towards organizations seeking data-driven decision-making to optimize operations, enhance customer experience, and improve resource allocation. M&A trends are on the rise as larger technology providers seek to acquire specialized people counting capabilities or integrate them into broader smart city or retail solutions. For instance, an estimated 10-15 M&A deals are anticipated annually during the forecast period, involving players across the value chain. Innovation barriers include the high cost of advanced sensor development and the need for robust data processing infrastructure.

- Market Concentration: Moderate to high in key segments like retail analytics, with emerging players in niche applications.

- Technological Innovation Drivers: AI-powered analytics, edge computing for real-time processing, and integration with IoT ecosystems.

- Regulatory Frameworks: Increasing focus on data privacy and anonymization, especially in public spaces and retail environments.

- Competitive Product Substitutes: Manual counting, basic occupancy sensors, and manual entry systems.

- End-User Demographics: Retailers, public transportation authorities, facility managers, educational institutions, and corporate offices.

- M&A Trends: Strategic acquisitions for technology enhancement and market expansion. Anticipated M&A deal volume: ~12 deals per year.

People Counting Software Growth Trends & Insights

The People Counting Software market is poised for significant expansion, driven by an increasing demand for data-driven operational efficiency and enhanced customer experiences across diverse sectors. The market size is projected to grow from an estimated \$1.5 billion in the Base Year (2025) to over \$4.0 billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 13.5% during the Forecast Period (2025–2033). Adoption rates are accelerating, particularly within the Commercial segment, where retailers are leveraging people counting data to optimize store layouts, staffing levels, and marketing campaigns. Technological disruptions, such as advancements in AI and machine learning algorithms for video analytics, are significantly enhancing the accuracy and analytical capabilities of these systems. Consumer behavior shifts are also playing a crucial role; as consumers become more accustomed to data-driven personalization and seamless experiences, businesses are investing in technologies that can provide these insights. The penetration of advanced people counting solutions is expected to double from approximately 25% in 2025 to over 50% in 2033, especially in developed economies. In the Transportation sector, accurate passenger flow data is vital for managing capacity, improving service frequency, and enhancing security, further fueling adoption. The Corporate and Education segments are increasingly utilizing these solutions for space utilization analysis, optimizing energy consumption, and enhancing campus security. The emergence of cloud-based analytics platforms is also making these solutions more accessible and scalable for businesses of all sizes. The Historical Period (2019–2024) saw foundational growth, with market expansion averaging around 9% CAGR, laying the groundwork for the accelerated growth witnessed in the forecast period. The integration of people counting with footfall analytics, dwell time analysis, and heat mapping is becoming a standard offering, providing a holistic view of customer engagement. The increasing focus on smart city initiatives globally is also a significant growth driver, as urban planners and authorities rely on accurate crowd management and flow data for infrastructure development and public safety.

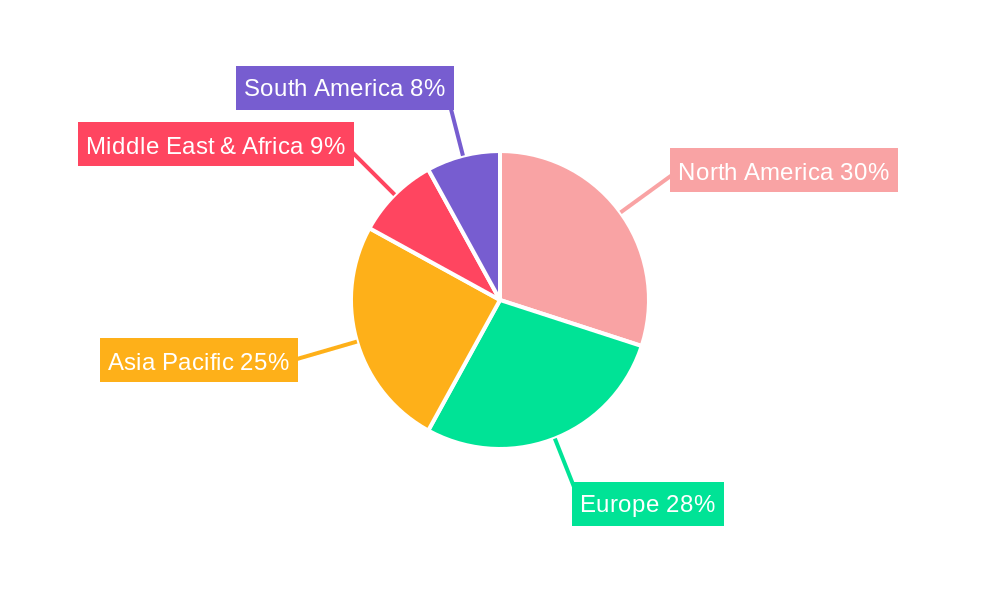

Dominant Regions, Countries, or Segments in People Counting Software

The Commercial application segment stands out as a dominant force in the People Counting Software market, primarily driven by the retail industry's insatiable demand for actionable insights. In 2025, this segment is estimated to account for over 45% of the total market revenue, projected to reach approximately \$675 million. Key drivers for its dominance include the intense competition in retail, the need to understand customer traffic patterns for optimizing store operations, and the growing trend of experiential retail. North America, particularly the United States, is the leading country in this segment, accounting for nearly 30% of global sales in 2025, driven by early adoption of advanced retail technologies and a high concentration of major retail chains. The Video Based type of people counting technology is also a significant contributor to this dominance, offering high accuracy, video analytics capabilities such as demographic analysis, and integration with existing surveillance systems. The market share for Video Based solutions is projected to be around 55% in 2025, expected to grow to 65% by 2033. Europe, with countries like the UK and Germany, follows closely in the Commercial segment, propelled by strong retail infrastructure and a growing interest in smart retail solutions. In terms of growth potential, the Transportation segment is exhibiting remarkable acceleration, with an anticipated CAGR of 15% from 2025 to 2033. This is due to the increasing global focus on efficient public transit systems, the development of smart cities, and the need for accurate passenger flow management. Asia-Pacific is emerging as a high-growth region for Transportation applications, fueled by massive investments in public infrastructure and the rapid urbanization in countries like China and India. Regulatory support for smart city initiatives and technological advancements in sensor technology are further bolstering growth across all segments. The IR Beam technology, while a more established solution, continues to hold a steady market share of approximately 20% due to its cost-effectiveness for basic occupancy counting. However, the market is progressively shifting towards more sophisticated Thermal Imaging and Video Based solutions for richer data analytics.

- Dominant Segment (Application): Commercial, driven by retail analytics needs.

- Leading Region/Country: North America (USA) for Commercial applications.

- Dominant Technology Type: Video Based, offering advanced analytics.

- Key Drivers: Retail competition, smart city initiatives, demand for operational efficiency.

- Growth Potential: High for Transportation applications, especially in emerging economies.

- Market Share (Commercial, 2025): ~45% of total market revenue.

- Market Share (Video Based, 2025): ~55% of technology type revenue.

- CAGR (Transportation, 2025-2033): ~15%.

People Counting Software Product Landscape

The People Counting Software product landscape is rapidly evolving, marked by continuous innovation in accuracy, analytical capabilities, and integration. Leading solutions now offer real-time data streaming, sophisticated AI-powered object detection, and advanced demographic analysis. Video Based systems, for instance, are integrating deep learning algorithms to distinguish between adults and children, identify gender, and even analyze sentiment, providing unparalleled customer insights. Innovations in edge computing are enabling faster, on-device processing, reducing latency and enhancing data security. Thermal Imaging solutions are gaining traction for their ability to provide accurate counts in low-light conditions and their inherent privacy-preserving nature. Performance metrics are increasingly focused on accuracy rates exceeding 98%, with granular data capture on entry/exit counts, dwell times, and queue lengths. Unique selling propositions include seamless integration with POS systems, CRM platforms, and marketing automation tools, creating a comprehensive customer engagement ecosystem. The development of cloud-native platforms further enhances scalability and accessibility for businesses of all sizes.

Key Drivers, Barriers & Challenges in People Counting Software

Key Drivers:

- Retail Analytics Demand: Businesses across retail are increasingly reliant on people counting data for optimizing store performance, inventory management, and customer experience.

- Smart City Initiatives: Governments worldwide are investing in smart city infrastructure, where people counting plays a crucial role in urban planning, public safety, and traffic management.

- Operational Efficiency: Organizations in various sectors are using people counting data to optimize staffing, resource allocation, and space utilization, leading to significant cost savings.

- Technological Advancements: The integration of AI, machine learning, and IoT is enhancing the accuracy, functionality, and analytical capabilities of people counting software.

- Enhanced Customer Experience: Data-driven insights from people counting help businesses understand customer behavior, leading to personalized services and improved engagement.

Barriers & Challenges:

- Initial Investment Costs: High-end people counting systems, particularly those with advanced AI capabilities, can involve significant upfront investment, posing a barrier for smaller businesses.

- Data Privacy Concerns: The collection and analysis of people counting data raise privacy issues, requiring robust anonymization techniques and adherence to regulations like GDPR.

- Integration Complexity: Integrating people counting software with existing IT infrastructure can be complex and resource-intensive, especially for legacy systems.

- Accuracy Limitations in Specific Environments: Challenges remain in achieving consistently high accuracy in crowded, complex, or dimly lit environments.

- Competition from Basic Solutions: The availability of simpler, lower-cost occupancy counting devices can limit the adoption of more sophisticated software solutions in certain market segments.

Emerging Opportunities in People Counting Software

Emerging opportunities in the People Counting Software market lie in the expansion of its application beyond traditional retail and transportation. The Corporate and Education sectors present significant untapped potential for optimizing workspace utilization, managing student traffic flow, and enhancing campus security. The integration of people counting with advanced behavioral analytics, such as gait analysis and emotional detection, is a nascent but promising area for generating deeper, more nuanced insights. Furthermore, the growing trend of "phygital" experiences, blending physical and digital retail environments, opens avenues for people counting data to inform personalized digital content delivery and in-store promotions. The development of privacy-preserving people counting solutions, leveraging techniques like differential privacy and federated learning, will be crucial for unlocking growth in public spaces and highly regulated environments.

Growth Accelerators in the People Counting Software Industry

Several key catalysts are accelerating growth in the People Counting Software industry. Continuous technological breakthroughs in AI and computer vision are driving higher accuracy and more sophisticated analytical capabilities, making solutions more attractive. Strategic partnerships between hardware manufacturers, software developers, and analytics providers are fostering integrated ecosystems that offer comprehensive solutions. The increasing demand for real-time data and predictive analytics is pushing innovation in cloud-based platforms and edge computing. Furthermore, the growing adoption of IoT devices and the push towards smart buildings and smart cities are creating a fertile ground for the widespread implementation of people counting systems. Market expansion strategies, including the penetration into emerging economies and the development of tailored solutions for niche industries, are also significant growth accelerators.

Key Players Shaping the People Counting Software Market

- ShopperTrak

- RetailNext

- Brickstream

- DILAX Intelcom GmbH

- IRIS-GmbH

- Eurotech S.p.A.

- InfraRed Integrated Systems

- Axiomatic Technology

- Hikvision

- Axis Communication AB

- WINNER Technology

- Countwise LLC

- V-Count

- Xovis AG

- IEE S.A.

- HELLA Aglaia Mobile Vision GmbH

Notable Milestones in People Counting Software Sector

- 2019: Increased integration of AI for enhanced object recognition in video-based systems.

- 2020: Significant rise in demand for occupancy monitoring due to public health concerns.

- 2021: Advancements in thermal imaging technology for improved accuracy in various lighting conditions.

- 2022: Growth in cloud-based people counting solutions, offering scalability and remote access.

- 2023: Enhanced focus on privacy-preserving analytics and anonymization techniques.

- 2024: Expansion of people counting applications into corporate and educational settings for space utilization.

- 2025 (Estimated): Development of predictive analytics for crowd management and resource allocation.

In-Depth People Counting Software Market Outlook

The People Counting Software market is projected to experience sustained and accelerated growth, driven by the increasing imperative for data-driven decision-making across a multitude of sectors. The continued evolution of AI and machine learning will unlock more sophisticated analytical capabilities, moving beyond simple counts to predictive insights and behavioral analysis. The ongoing expansion into the Transportation, Corporate and Education, and other application segments, beyond its traditional stronghold in Commercial environments, signifies a broader market acceptance and diversification. Strategic partnerships and the integration of people counting solutions into larger smart building and IoT ecosystems will be crucial for future market expansion. The increasing emphasis on operational efficiency and enhanced customer experiences will continue to fuel investments in these technologies, ensuring a robust outlook for the People Counting Software sector.

People Counting Software Segmentation

-

1. Application

- 1.1. Transportation

- 1.2. Commercial

- 1.3. Corporate and Education

- 1.4. Others

-

2. Type

- 2.1. IR Beam

- 2.2. Thermal Imaging

- 2.3. Video Based

People Counting Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

People Counting Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.3% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global People Counting Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Transportation

- 5.1.2. Commercial

- 5.1.3. Corporate and Education

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. IR Beam

- 5.2.2. Thermal Imaging

- 5.2.3. Video Based

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America People Counting Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Transportation

- 6.1.2. Commercial

- 6.1.3. Corporate and Education

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. IR Beam

- 6.2.2. Thermal Imaging

- 6.2.3. Video Based

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America People Counting Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Transportation

- 7.1.2. Commercial

- 7.1.3. Corporate and Education

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. IR Beam

- 7.2.2. Thermal Imaging

- 7.2.3. Video Based

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe People Counting Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Transportation

- 8.1.2. Commercial

- 8.1.3. Corporate and Education

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. IR Beam

- 8.2.2. Thermal Imaging

- 8.2.3. Video Based

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa People Counting Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Transportation

- 9.1.2. Commercial

- 9.1.3. Corporate and Education

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. IR Beam

- 9.2.2. Thermal Imaging

- 9.2.3. Video Based

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific People Counting Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Transportation

- 10.1.2. Commercial

- 10.1.3. Corporate and Education

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. IR Beam

- 10.2.2. Thermal Imaging

- 10.2.3. Video Based

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ShopperTrak

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 RetailNext

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Brickstream

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DILAX Intelcom GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IRIS-GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Eurotech S.p.A.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 InfraRed Integrated Systems

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Axiomatic Technology

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hikvision

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Axis Communication AB

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 WINNER Technology

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Countwise LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 V-Count

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Xovis AG

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 IEE S.A.

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 HELLA Aglaia Mobile Vision GmbH

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 ShopperTrak

List of Figures

- Figure 1: Global People Counting Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America People Counting Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America People Counting Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America People Counting Software Revenue (million), by Type 2024 & 2032

- Figure 5: North America People Counting Software Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America People Counting Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America People Counting Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America People Counting Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America People Counting Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America People Counting Software Revenue (million), by Type 2024 & 2032

- Figure 11: South America People Counting Software Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America People Counting Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America People Counting Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe People Counting Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe People Counting Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe People Counting Software Revenue (million), by Type 2024 & 2032

- Figure 17: Europe People Counting Software Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe People Counting Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe People Counting Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa People Counting Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa People Counting Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa People Counting Software Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa People Counting Software Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa People Counting Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa People Counting Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific People Counting Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific People Counting Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific People Counting Software Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific People Counting Software Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific People Counting Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific People Counting Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global People Counting Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global People Counting Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global People Counting Software Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global People Counting Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global People Counting Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global People Counting Software Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global People Counting Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global People Counting Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global People Counting Software Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global People Counting Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global People Counting Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global People Counting Software Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global People Counting Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global People Counting Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global People Counting Software Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global People Counting Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global People Counting Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global People Counting Software Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global People Counting Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific People Counting Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the People Counting Software?

The projected CAGR is approximately 3.3%.

2. Which companies are prominent players in the People Counting Software?

Key companies in the market include ShopperTrak, RetailNext, Brickstream, DILAX Intelcom GmbH, IRIS-GmbH, Eurotech S.p.A., InfraRed Integrated Systems, Axiomatic Technology, Hikvision, Axis Communication AB, WINNER Technology, Countwise LLC, V-Count, Xovis AG, IEE S.A., HELLA Aglaia Mobile Vision GmbH.

3. What are the main segments of the People Counting Software?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1040 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "People Counting Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the People Counting Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the People Counting Software?

To stay informed about further developments, trends, and reports in the People Counting Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence