Key Insights

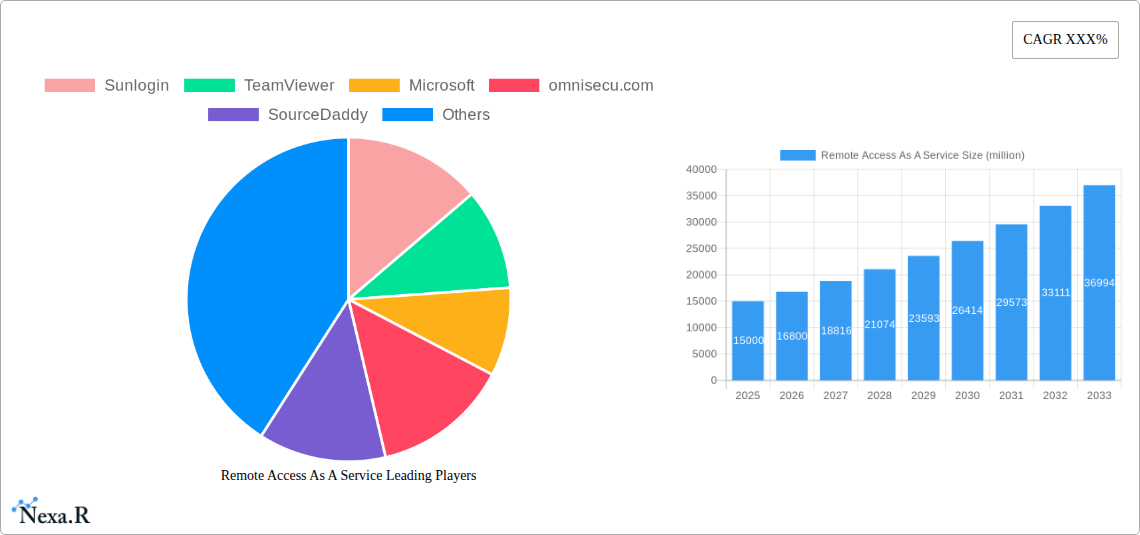

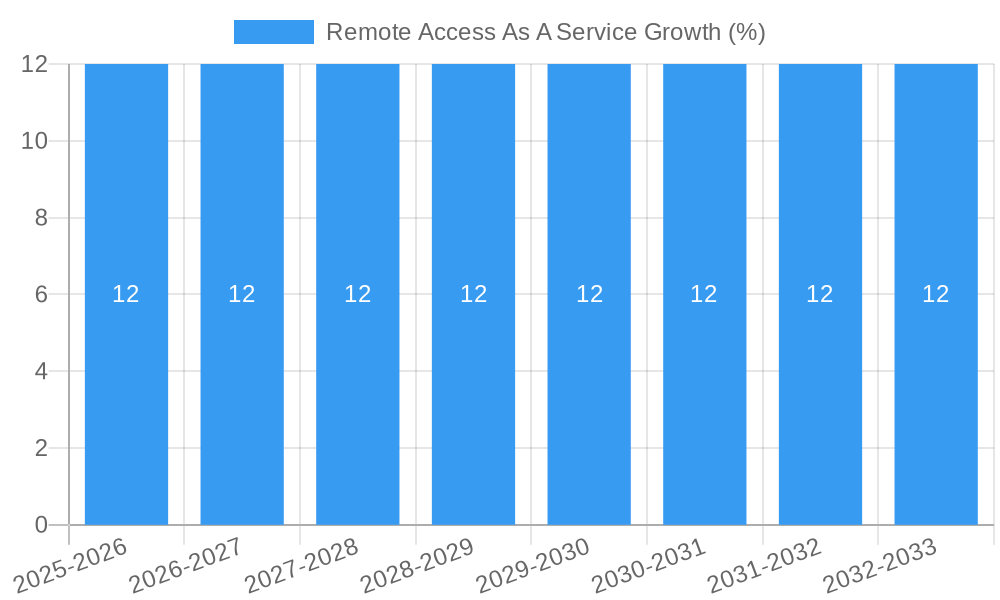

The Remote Access as a Service (RaaS) market is poised for substantial growth, projected to reach an estimated market size of approximately $15,000 million by 2025, with a Compound Annual Growth Rate (CAGR) of around 12% expected to continue through 2033. This expansion is primarily fueled by the increasing demand for seamless file transfer and remote control capabilities across diverse industries. The burgeoning trend of remote and hybrid work models has significantly accelerated the adoption of RaaS solutions, enabling businesses to maintain productivity and operational continuity irrespective of geographical constraints. Furthermore, the growing need for efficient IT support, remote device management, and enhanced cybersecurity measures further propels market expansion. The increasing reliance on cloud-based infrastructure and the development of sophisticated RaaS platforms are also key drivers contributing to this optimistic market outlook.

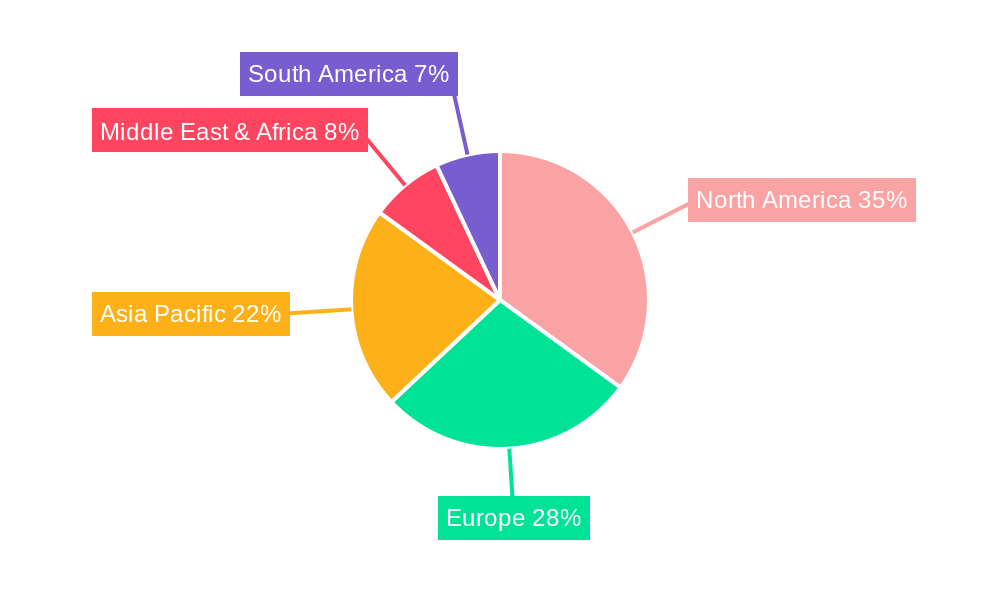

The market is characterized by robust growth across various segments. The application of file transfer and remote control are the dominant forces, with broadband connectivity emerging as the preferred type due to its speed and reliability, though dial-up and modem solutions still hold a niche for specific legacy systems or critical fallback scenarios. Geographically, North America, particularly the United States, is expected to lead the market, owing to its early adoption of technology and a well-established IT infrastructure. Asia Pacific, driven by rapid digital transformation in countries like China and India, and Europe, with its significant presence of technology-forward economies, are also anticipated to witness considerable market penetration. While the market's growth trajectory is impressive, potential restraints such as data security concerns, the need for significant initial investment for some enterprises, and the complexity of integrating RaaS solutions with existing legacy systems could present challenges. However, the continuous innovation in RaaS offerings and the increasing focus on secure, user-friendly interfaces are expected to mitigate these restraints, paving the way for sustained market dominance.

Comprehensive Report: Remote Access As A Service Market Analysis (2019–2033)

This in-depth report provides a definitive analysis of the global Remote Access As A Service (RaaS) market, encompassing market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, opportunities, accelerators, and a detailed overview of key players and notable milestones. With a study period spanning from 2019 to 2033, this report offers unparalleled insights for industry professionals, investors, and strategists seeking to navigate the evolving RaaS ecosystem. All values are presented in million units.

Remote Access As A Service Market Dynamics & Structure

The Remote Access As A Service market exhibits a dynamic structure characterized by a moderate to high level of concentration, with a few dominant players like TeamViewer, Microsoft, and LogMeIn holding significant market share. However, the landscape is continually shaped by rapid technological innovation, particularly in areas like cloud computing, AI-driven automation for troubleshooting, and enhanced cybersecurity protocols, driven by companies such as omnisecu.com and SourceDaddy. Regulatory frameworks, while evolving to address data privacy and security concerns, generally favor market growth by establishing standards for secure remote access solutions. Competitive product substitutes, including traditional VPNs and on-premise remote management tools, are being steadily eroded by the convenience and scalability of RaaS. End-user demographics are increasingly diverse, ranging from small and medium-sized businesses (SMBs) seeking cost-effective IT support to large enterprises requiring secure and efficient remote workforce management. Mergers and acquisitions (M&A) remain a significant trend, with NortonLifeLock Inc. and LapLink actively participating in strategic consolidations to expand their service portfolios and market reach. The annual M&A deal volume is estimated at around $120 million in the base year 2025. Innovation barriers, though present in the form of high development costs for cutting-edge security features, are being overcome by strategic R&D investments and collaborative ventures. The competitive product substitute penetration is projected to decline from 35% in 2019 to 15% by 2033.

- Market Concentration: Moderate to High, dominated by key players.

- Technological Innovation Drivers: Cloud computing, AI automation, advanced cybersecurity.

- Regulatory Frameworks: Evolving to ensure data privacy and security.

- Competitive Product Substitutes: Decreasing relevance of traditional VPNs and on-premise solutions.

- End-User Demographics: Broad spectrum from SMBs to large enterprises.

- M&A Trends: Active consolidation for portfolio expansion and market reach.

Remote Access As A Service Growth Trends & Insights

The global Remote Access As A Service market is poised for significant expansion, driven by escalating demand for flexible work arrangements and the increasing complexity of IT infrastructure. The market size is projected to grow from approximately $1,500 million in 2019 to an estimated $8,500 million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 25% during the historical period. The forecast period, 2025–2033, anticipates a sustained growth trajectory, with the market size expected to reach $22,000 million by 2033. Adoption rates are soaring as organizations recognize the inherent benefits of RaaS, including enhanced productivity, reduced operational costs, and improved disaster recovery capabilities. Technological disruptions, such as the integration of artificial intelligence for predictive maintenance and automated troubleshooting, are further accelerating adoption. Consumer behavior shifts are prominently evident, with a growing preference for seamless, secure, and device-agnostic remote access solutions. The proliferation of remote and hybrid work models is a primary catalyst, pushing the market penetration of RaaS in enterprise environments from 40% in 2019 to an estimated 75% by 2025. The accessibility of RaaS solutions via broadband connections is crucial, with emerging economies rapidly expanding their digital infrastructure, fostering wider adoption. The market penetration of RaaS in SMBs is predicted to rise from 30% in 2019 to 65% by 2025. The average user cost for RaaS solutions is expected to decrease by 15% by 2033 due to increased competition and economies of scale.

Dominant Regions, Countries, or Segments in Remote Access As A Service

North America, particularly the United States, stands as the dominant region in the Remote Access As A Service market, driven by its robust technological infrastructure, high adoption rates of cloud services, and a significant concentration of enterprises embracing remote work policies. The application segment of Remote Control is a primary growth engine, accounting for an estimated 60% of the market share in 2025. This dominance is further bolstered by the prevalence of high-speed broadband internet access, which facilitates seamless and efficient remote operations. Countries like Canada and Mexico also contribute significantly to the regional market's growth. Key drivers in this region include supportive government initiatives promoting digital transformation, substantial investments in cybersecurity solutions to ensure data integrity during remote access, and a proactive approach by businesses to leverage RaaS for enhanced operational efficiency. The market share for Remote Control applications in North America is projected to reach 65% by 2033.

- Leading Region: North America.

- Dominant Application: Remote Control.

- Key Drivers:

- Robust technological infrastructure and cloud adoption.

- Widespread remote and hybrid work models.

- Government initiatives promoting digital transformation.

- High investments in cybersecurity.

- Prevalence of high-speed broadband internet.

- Growth Potential: Significant, with continued innovation and market expansion.

Remote Access As A Service Product Landscape

The RaaS product landscape is characterized by a constant stream of innovations aimed at enhancing security, user experience, and functionality. Leading providers are integrating advanced features such as multi-factor authentication, end-to-end encryption, granular access controls, and AI-powered anomaly detection to safeguard sensitive data. The application segment of File Transfer, while supporting the broader remote access functionality, is seeing improvements in speed and security protocols. Performance metrics are consistently being optimized, with providers focusing on reducing latency and ensuring reliable connectivity for remote users, regardless of their geographical location or network type. Companies like Sunlogin are focusing on delivering intuitive interfaces and cross-platform compatibility, making remote access accessible from a wide array of devices. The integration of remote monitoring and management (RMM) capabilities further enhances the value proposition of RaaS solutions.

Key Drivers, Barriers & Challenges in Remote Access As A Service

Key Drivers: The Remote Access As A Service market is propelled by several potent drivers. The widespread adoption of remote and hybrid work models is a primary catalyst, creating an incessant demand for secure and efficient remote connectivity. Technological advancements in cloud computing and cybersecurity infrastructure enable more robust and scalable RaaS solutions. Furthermore, the need for IT support cost reduction and improved operational efficiency across industries fuels market expansion. The increasing ubiquity of high-speed internet connectivity, particularly broadband, ensures that RaaS solutions are accessible to a broader user base.

Barriers & Challenges: Despite the promising outlook, the RaaS market faces significant challenges. Concerns regarding data security and privacy remain paramount, necessitating continuous investment in advanced encryption and authentication protocols. Regulatory compliance with diverse data protection laws across different regions can pose a hurdle. The integration of RaaS solutions with existing legacy IT systems can be complex and costly. Moreover, the competitive pressure from established technology giants and emerging players can impact pricing strategies and market penetration. Supply chain issues are less of a direct concern for the software-centric RaaS model, but underlying hardware dependencies for network infrastructure could pose indirect challenges.

Emerging Opportunities in Remote Access As A Service

Emerging opportunities in the Remote Access As A Service sector lie in the expanding market for specialized RaaS solutions tailored to specific industries, such as healthcare for remote patient monitoring and diagnostics, and manufacturing for remote industrial control and maintenance. The increasing demand for zero-trust security models presents a significant avenue for innovation, where RaaS providers can develop solutions that continuously verify every access attempt. Untapped markets in developing economies, with their rapidly expanding digital infrastructure, offer substantial growth potential. Furthermore, the integration of Augmented Reality (AR) and Virtual Reality (VR) technologies for remote assistance and training applications represents a frontier for innovative RaaS applications, allowing for more immersive and effective remote support.

Growth Accelerators in the Remote Access As A Service Industry

Several growth accelerators are poised to propel the Remote Access As A Service industry forward. Technological breakthroughs, particularly in AI and machine learning for predictive IT support and automated issue resolution, will significantly enhance the value proposition of RaaS. Strategic partnerships between RaaS providers and cybersecurity firms will bolster trust and security, addressing a key market concern. Market expansion strategies targeting underserved segments, such as educational institutions and government agencies, will unlock new revenue streams. The continued global push towards digital transformation and the normalization of remote work will create a sustained demand for robust RaaS solutions. The development of more integrated platforms that combine remote access with collaboration tools will further solidify RaaS as an indispensable component of modern business operations.

Key Players Shaping the Remote Access As A Service Market

- Sunlogin

- TeamViewer

- Microsoft

- omnisecu.com

- SourceDaddy

- NTT Global Networks

- NortonLifeLock Inc.

- Timbuktu

- LapLink

- Expertcity

- LogMeIn

Notable Milestones in Remote Access As A Service Sector

- 2019: Increased adoption of RaaS driven by growing remote work trends.

- 2020: Surge in demand for RaaS due to global pandemic necessitating widespread remote work. Significant market growth observed.

- 2021: Introduction of enhanced security features and AI-driven automation by key players like Microsoft and TeamViewer.

- 2022: Strategic acquisitions and partnerships aim to expand service offerings and market reach by companies like NortonLifeLock Inc.

- 2023: Growing focus on zero-trust security models within RaaS solutions.

- 2024: Increased adoption of RaaS in specialized industries like healthcare and education.

- 2025 (Estimated): Forecasted market value of $8,500 million.

- 2026-2033: Continued strong growth trajectory driven by ongoing digital transformation and evolving work paradigms.

In-Depth Remote Access As A Service Market Outlook

The future outlook for the Remote Access As A Service market is exceptionally promising, fueled by a confluence of sustained growth accelerators. The ongoing digital transformation initiatives globally, coupled with the permanent shift towards flexible work arrangements, will continue to drive demand for secure and efficient remote access solutions. Technological advancements, particularly in AI-powered automation for IT support and proactive threat detection, will not only enhance user experience but also fortify the security posture of RaaS offerings. Strategic market expansion, targeting nascent and underserved regions, alongside strategic partnerships that foster innovation and broaden service portfolios, will be critical for sustained growth. The RaaS market is projected to be an indispensable component of the future IT infrastructure, enabling seamless connectivity and operational continuity for businesses worldwide.

Remote Access As A Service Segmentation

-

1. Application

- 1.1. File Transfer

- 1.2. Remote Control

-

2. Type

- 2.1. Broadband

- 2.2. Modems & Dial-up

Remote Access As A Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Remote Access As A Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Remote Access As A Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. File Transfer

- 5.1.2. Remote Control

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Broadband

- 5.2.2. Modems & Dial-up

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Remote Access As A Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. File Transfer

- 6.1.2. Remote Control

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Broadband

- 6.2.2. Modems & Dial-up

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Remote Access As A Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. File Transfer

- 7.1.2. Remote Control

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Broadband

- 7.2.2. Modems & Dial-up

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Remote Access As A Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. File Transfer

- 8.1.2. Remote Control

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Broadband

- 8.2.2. Modems & Dial-up

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Remote Access As A Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. File Transfer

- 9.1.2. Remote Control

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Broadband

- 9.2.2. Modems & Dial-up

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Remote Access As A Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. File Transfer

- 10.1.2. Remote Control

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Broadband

- 10.2.2. Modems & Dial-up

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Sunlogin

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TeamViewer

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Microsoft

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 omnisecu.com

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SourceDaddy

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 NTT Global Networks

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NortonLifeLock Inc.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Timbuktu

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 LapLink

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Expertcity

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 LogMeIn

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Sunlogin

List of Figures

- Figure 1: Global Remote Access As A Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Remote Access As A Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Remote Access As A Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Remote Access As A Service Revenue (million), by Type 2024 & 2032

- Figure 5: North America Remote Access As A Service Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Remote Access As A Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Remote Access As A Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Remote Access As A Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Remote Access As A Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Remote Access As A Service Revenue (million), by Type 2024 & 2032

- Figure 11: South America Remote Access As A Service Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Remote Access As A Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Remote Access As A Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Remote Access As A Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Remote Access As A Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Remote Access As A Service Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Remote Access As A Service Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Remote Access As A Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Remote Access As A Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Remote Access As A Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Remote Access As A Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Remote Access As A Service Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Remote Access As A Service Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Remote Access As A Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Remote Access As A Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Remote Access As A Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Remote Access As A Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Remote Access As A Service Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Remote Access As A Service Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Remote Access As A Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Remote Access As A Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Remote Access As A Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Remote Access As A Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Remote Access As A Service Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Remote Access As A Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Remote Access As A Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Remote Access As A Service Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Remote Access As A Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Remote Access As A Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Remote Access As A Service Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Remote Access As A Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Remote Access As A Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Remote Access As A Service Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Remote Access As A Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Remote Access As A Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Remote Access As A Service Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Remote Access As A Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Remote Access As A Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Remote Access As A Service Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Remote Access As A Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Remote Access As A Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Remote Access As A Service?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Remote Access As A Service?

Key companies in the market include Sunlogin, TeamViewer, Microsoft, omnisecu.com, SourceDaddy, NTT Global Networks, NortonLifeLock Inc., Timbuktu, LapLink, Expertcity, LogMeIn.

3. What are the main segments of the Remote Access As A Service?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Remote Access As A Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Remote Access As A Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Remote Access As A Service?

To stay informed about further developments, trends, and reports in the Remote Access As A Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence