Key Insights

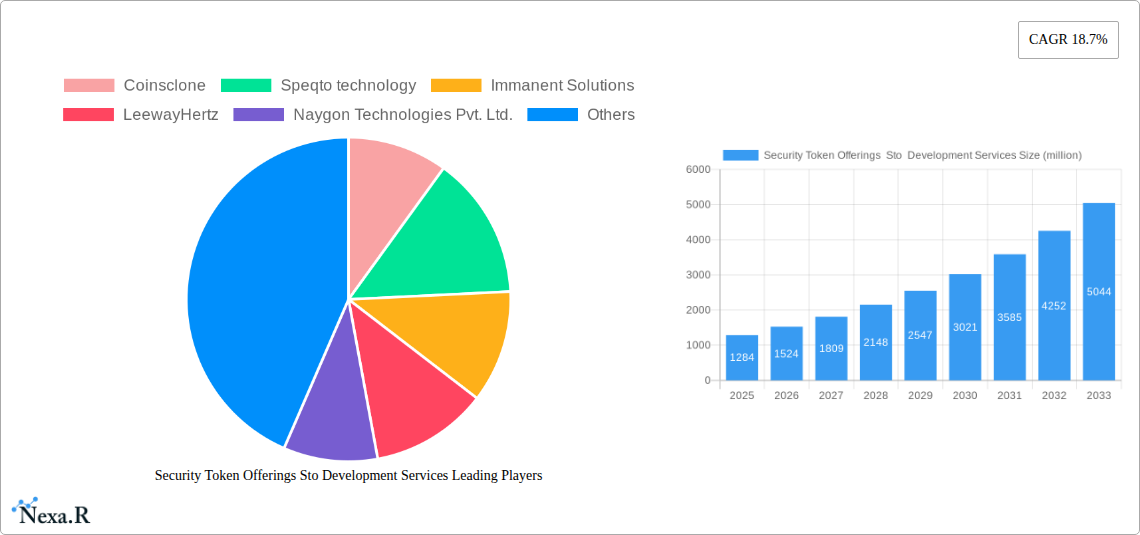

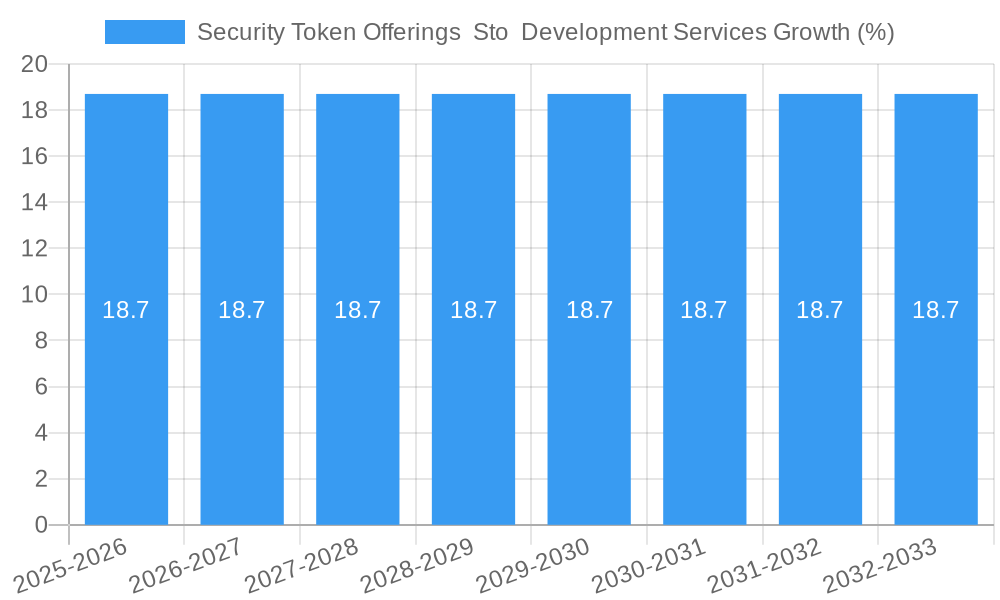

The global market for Security Token Offerings (STO) development services is poised for substantial expansion, projected to reach an estimated value of \$1284 million by 2025, driven by an impressive Compound Annual Growth Rate (CAGR) of 18.7%. This robust growth trajectory, spanning from 2019 to 2033, is fundamentally fueled by the increasing demand for regulated and transparent digital asset offerings across various industries. The core drivers include evolving regulatory frameworks that lend legitimacy to STOs, the inherent advantages of tokenization such as enhanced liquidity, fractional ownership, and reduced transaction costs, and a growing investor appetite for alternative asset classes. The development of asset tokenization, equity tokenization, and debt tokenization services are central to this market's dynamism, catering to a diverse range of asset classes.

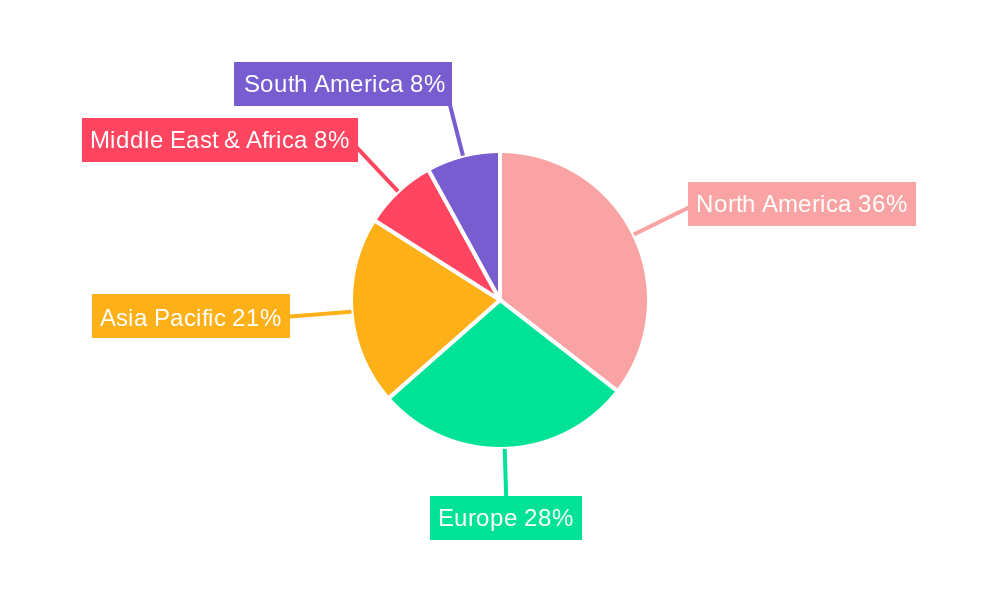

The market is segmented by application into key areas such as Real Estate, Art and Collectibles, Gaming and Entertainment, and Healthcare and Biotech, with "Other" applications also contributing to growth. Real estate tokenization, for instance, is democratizing access to property investment, while the art and collectibles sector is leveraging STOs for provenance and fractional ownership. In the healthcare and biotech space, STOs are being explored for funding research and development. Geographically, North America is anticipated to lead the market due to early adoption and a favorable regulatory environment, followed by Europe and the Asia Pacific region, which is witnessing rapid technological integration. Key players like Coinsclone, Speqto Technology, and ScienceSoft are at the forefront of providing these specialized development services, fostering innovation and enabling businesses to navigate the complexities of STO issuance. Challenges such as varying global regulations and a need for greater investor education are present but are being actively addressed as the market matures.

This in-depth report provides a definitive analysis of the global Security Token Offerings (STO) Development Services market, spanning from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study offers unparalleled insights into market dynamics, growth trends, regional dominance, product innovation, key players, and future opportunities within this rapidly evolving sector. We leverage extensive market research and proprietary data to deliver actionable intelligence for stakeholders in the blockchain and financial technology industries.

Security Token Offerings Sto Development Services Market Dynamics & Structure

The Security Token Offerings (STO) Development Services market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and increasing institutional adoption. Market concentration is moderate, with a growing number of specialized development firms emerging to cater to the demand for compliant and robust STO platforms. Technological innovation is primarily driven by advancements in blockchain protocols, smart contract security, and decentralized finance (DeFi) integrations, aiming to enhance transparency, efficiency, and investor accessibility. Regulatory frameworks are a critical factor, with jurisdictions worldwide developing guidelines for tokenized securities, influencing market entry and operational strategies. Competitive product substitutes include traditional crowdfunding, IPOs, and initial coin offerings (ICOs), though STOs offer distinct advantages in terms of liquidity, fractional ownership, and regulatory compliance. End-user demographics are broadening from early-stage startups to established corporations seeking alternative capital raising and asset management solutions. Mergers and acquisitions (M&A) trends are nascent but expected to accelerate as larger financial institutions and technology providers seek to integrate STO capabilities.

- Market Concentration: Moderate, with a rising number of specialized STO development service providers.

- Technological Innovation Drivers: Enhanced blockchain security, smart contract auditing, cross-chain interoperability, and integration with traditional financial systems.

- Regulatory Frameworks: Evolving global regulations are creating a more predictable environment for STO development and issuance.

- Competitive Product Substitutes: Traditional IPOs, crowdfunding, and other digital asset offerings.

- End-User Demographics: Expanding from startups to enterprises, investment funds, and asset managers.

- M&A Trends: Expected to increase as the market matures and consolidates.

Security Token Offerings Sto Development Services Growth Trends & Insights

The global Security Token Offerings (STO) Development Services market is poised for substantial expansion, driven by a confluence of factors that are reshaping capital markets. The market size evolution is projected to witness a significant upward trajectory, moving from an estimated $500 million in 2025 to over $5,000 million by 2033, reflecting a Compound Annual Growth Rate (CAGR) of approximately 25%. This robust growth is underpinned by increasing adoption rates of tokenized securities across various asset classes, signaling a fundamental shift in how assets are created, traded, and managed. Technological disruptions are playing a pivotal role, with the continuous refinement of blockchain technology leading to more secure, scalable, and cost-effective STO solutions. Decentralized identity solutions and advanced smart contract capabilities are enhancing investor trust and operational efficiency. Consumer behavior shifts are also contributing to this growth, as a new generation of investors and asset holders become more comfortable with digital assets and seek the transparency and accessibility that STOs provide. The demand for fractional ownership of high-value assets, such as real estate and art, is a key driver, making previously illiquid assets accessible to a broader investor base. Furthermore, the ability of STOs to offer greater liquidity for private company shares and other investment vehicles is attracting significant interest from both issuers and investors. The regulatory clarity emerging in key markets is also a critical enabler, reducing uncertainty and fostering greater institutional participation. As the market matures, we anticipate a surge in hybrid models that blend traditional finance with blockchain-based solutions, further accelerating the adoption of STOs. The inherent benefits of STOs, including lower issuance costs, faster settlement times, and global reach, are becoming increasingly apparent to businesses and investors alike. The market is also benefiting from the growing recognition of security tokens as a legitimate and regulated form of digital asset, distinct from speculative cryptocurrencies. This distinction is crucial for attracting institutional capital and for building a sustainable ecosystem for tokenized securities. The development of secondary markets for security tokens will be a critical factor in unlocking their full liquidity potential, further driving demand for STO development services.

Dominant Regions, Countries, or Segments in Security Token Offerings Sto Development Services

The Security Token Offerings (STO) Development Services market exhibits distinct regional and segmental dominance, driven by regulatory environments, technological infrastructure, and investor appetite. The United States is emerging as a dominant region, largely due to its evolving regulatory clarity and a robust ecosystem of technology providers and financial institutions actively exploring and implementing STO solutions. Countries like Switzerland and Singapore are also significant hubs, offering favorable regulatory frameworks and attracting innovative projects.

Within the Application segment, Real Estate is a primary driver of market growth. The ability to tokenize fractional ownership of properties, enhance liquidity, and streamline property transactions through smart contracts is attracting substantial investment. This segment is projected to account for approximately 35% of the STO development services market by 2025, with a market share projected to reach $1,750 million. Art and Collectibles represent another rapidly growing application, democratizing access to high-value art and rare collectibles for a wider investor base, with an estimated market share of 15% ($750 million).

In terms of Type, Asset Token Development holds a commanding position. This encompasses the tokenization of tangible and intangible assets, including real estate, commodities, and intellectual property. The flexibility and broad applicability of asset tokenization make it the most sought-after service, with an estimated market share of 45% ($2,250 million) in 2025. Equity Token Development is also a significant segment, enabling companies to tokenize their shares, offering a more liquid and accessible alternative to traditional equity offerings. This segment is estimated to capture 30% of the market ($1,500 million). Debt Token Development is a growing area, facilitating the tokenization of debt instruments, providing efficient fundraising mechanisms for borrowers and diversified investment opportunities for lenders. This segment accounts for an estimated 25% of the market ($1,250 million).

- Dominant Region: United States, followed by Switzerland and Singapore.

- Key Application Drivers: Real Estate (estimated 35% market share, $1,750 million in 2025) and Art and Collectibles (estimated 15% market share, $750 million in 2025).

- Dominant Type: Asset Token Development (estimated 45% market share, $2,250 million in 2025), followed by Equity Token Development (estimated 30% market share, $1,500 million in 2025) and Debt Token Development (estimated 25% market share, $1,250 million in 2025).

- Factors for Dominance: Regulatory clarity, technological infrastructure, investor interest, and economic policies.

Security Token Offerings Sto Development Services Product Landscape

The product landscape for Security Token Offerings (STO) Development Services is characterized by increasingly sophisticated and comprehensive solutions designed to facilitate the entire lifecycle of a security token. This includes robust platforms for token creation, smart contract auditing, compliance management, and investor onboarding. Innovations focus on enhancing security features, ensuring regulatory adherence across multiple jurisdictions, and providing seamless integration with existing financial infrastructure. Performance metrics are heavily influenced by transaction speed, gas fees, security protocols, and the ability to support complex financial instruments. Unique selling propositions often revolve around specialized compliance modules, advanced analytics dashboards for issuers and investors, and customizable token features tailored to specific asset classes. Technological advancements are rapidly pushing the boundaries of what is possible, enabling features like automated dividend distribution, compliance-based trading restrictions, and secure digital asset custody.

Key Drivers, Barriers & Challenges in Security Token Offerings Sto Development Services

The Security Token Offerings (STO) Development Services market is propelled by several key drivers. The increasing demand for liquidity in traditionally illiquid assets, such as real estate and fine art, is a significant catalyst. Technological advancements in blockchain and smart contract capabilities offer more efficient and transparent fundraising and investment mechanisms. Regulatory clarity in key jurisdictions is reducing uncertainty and fostering institutional adoption. The potential for lower issuance costs compared to traditional IPOs also attracts businesses.

However, the market faces significant barriers and challenges. Regulatory fragmentation across different countries creates complexity for global STO issuances. The perceived technical complexity and the need for specialized expertise can be a deterrent for some potential issuers. Security concerns and the risk of smart contract vulnerabilities necessitate rigorous auditing and robust security measures. Market education and investor awareness are still developing, requiring efforts to build trust and understanding in tokenized securities.

Emerging Opportunities in Security Token Offerings Sto Development Services

Emerging opportunities in the Security Token Offerings (STO) Development Services sector are vast and varied. The expansion of STOs into new asset classes, such as renewable energy credits, carbon offsets, and intellectual property rights, presents significant untapped markets. The development of sophisticated decentralized exchanges (DEXs) and regulated security token trading platforms will unlock greater liquidity and secondary market opportunities, driving demand for compliant tokenization services. Furthermore, the integration of STOs with evolving decentralized finance (DeFi) protocols offers innovative avenues for yield generation and asset management. Evolving consumer preferences for more transparent, accessible, and democratized investment opportunities are also creating fertile ground for STO adoption.

Growth Accelerators in the Security Token Offerings Sto Development Services Industry

Several catalysts are accelerating long-term growth within the Security Token Offerings (STO) Development Services industry. Technological breakthroughs in scalability, interoperability, and zero-knowledge proofs are enhancing the efficiency and security of STO platforms. Strategic partnerships between blockchain development firms, financial institutions, and regulatory bodies are crucial for fostering ecosystem development and building trust. Market expansion strategies, including targeting emerging economies and developing robust legal frameworks, will unlock new investor bases and issuer opportunities. The increasing institutional adoption and the growing number of successful STO issuances are creating positive network effects, further validating the model and attracting more participants.

Key Players Shaping the Security Token Offerings Sto Development Services Market

- Coinsclone

- Speqto technology

- Immanent Solutions

- LeewayHertz

- Naygon Technologies Pvt. Ltd.

- ScienceSoft

- Antier

- Blockchain App Factory

- Innowise

- Oodles Technologies

- OrangeMantra

- Developcoins

- Infinite Block Tech

- Beleaf

- Technoloader

Notable Milestones in Security Token Offerings Sto Development Services Sector

- 2019: Emergence of regulatory-compliant STO frameworks in leading jurisdictions, spurring early adoption.

- 2020: Increased institutional interest and pilot programs for tokenizing real estate and private equity.

- 2021: Advancements in smart contract security auditing and development tools, enhancing platform reliability.

- 2022: Growth in specialized STO development companies offering end-to-end solutions.

- 2023: Significant increase in the volume of equity and asset-backed security tokens issued globally.

- 2024: Expansion of STO applications into art, collectibles, and gaming assets.

In-Depth Security Token Offerings Sto Development Services Market Outlook

- 2019: Emergence of regulatory-compliant STO frameworks in leading jurisdictions, spurring early adoption.

- 2020: Increased institutional interest and pilot programs for tokenizing real estate and private equity.

- 2021: Advancements in smart contract security auditing and development tools, enhancing platform reliability.

- 2022: Growth in specialized STO development companies offering end-to-end solutions.

- 2023: Significant increase in the volume of equity and asset-backed security tokens issued globally.

- 2024: Expansion of STO applications into art, collectibles, and gaming assets.

In-Depth Security Token Offerings Sto Development Services Market Outlook

The future outlook for the Security Token Offerings (STO) Development Services market is exceptionally promising, driven by continued technological innovation and a maturing regulatory environment. Growth accelerators, including the development of more user-friendly platforms, enhanced interoperability between different blockchains, and the creation of robust secondary trading markets, will be instrumental in driving widespread adoption. Strategic partnerships and a focus on investor education will further solidify STOs as a mainstream capital-raising and investment mechanism. The market is poised for significant expansion as more enterprises and investors recognize the inherent advantages of security tokens in terms of efficiency, transparency, and accessibility. This presents substantial opportunities for stakeholders to capitalize on the transformative potential of tokenized assets.

Security Token Offerings Sto Development Services Segmentation

-

1. Application

- 1.1. Real Estate

- 1.2. Art and Collectibles

- 1.3. Gaming and Entertainment

- 1.4. Healthcare and Biotech

- 1.5. Other

-

2. Type

- 2.1. Asset Token Development

- 2.2. Equity Token Development

- 2.3. Debt Token Development

Security Token Offerings Sto Development Services Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Security Token Offerings Sto Development Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.7% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Security Token Offerings Sto Development Services Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Real Estate

- 5.1.2. Art and Collectibles

- 5.1.3. Gaming and Entertainment

- 5.1.4. Healthcare and Biotech

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Asset Token Development

- 5.2.2. Equity Token Development

- 5.2.3. Debt Token Development

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Security Token Offerings Sto Development Services Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Real Estate

- 6.1.2. Art and Collectibles

- 6.1.3. Gaming and Entertainment

- 6.1.4. Healthcare and Biotech

- 6.1.5. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Asset Token Development

- 6.2.2. Equity Token Development

- 6.2.3. Debt Token Development

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Security Token Offerings Sto Development Services Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Real Estate

- 7.1.2. Art and Collectibles

- 7.1.3. Gaming and Entertainment

- 7.1.4. Healthcare and Biotech

- 7.1.5. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Asset Token Development

- 7.2.2. Equity Token Development

- 7.2.3. Debt Token Development

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Security Token Offerings Sto Development Services Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Real Estate

- 8.1.2. Art and Collectibles

- 8.1.3. Gaming and Entertainment

- 8.1.4. Healthcare and Biotech

- 8.1.5. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Asset Token Development

- 8.2.2. Equity Token Development

- 8.2.3. Debt Token Development

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Security Token Offerings Sto Development Services Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Real Estate

- 9.1.2. Art and Collectibles

- 9.1.3. Gaming and Entertainment

- 9.1.4. Healthcare and Biotech

- 9.1.5. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Asset Token Development

- 9.2.2. Equity Token Development

- 9.2.3. Debt Token Development

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Security Token Offerings Sto Development Services Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Real Estate

- 10.1.2. Art and Collectibles

- 10.1.3. Gaming and Entertainment

- 10.1.4. Healthcare and Biotech

- 10.1.5. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Asset Token Development

- 10.2.2. Equity Token Development

- 10.2.3. Debt Token Development

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Coinsclone

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Speqto technology

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Immanent Solutions

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LeewayHertz

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Naygon Technologies Pvt. Ltd.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ScienceSoft

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Antier

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Blockchain App Factory

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Innowise

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Oodles Technologies

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 OrangeMantra

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Developcoins

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Infinite Block Tech

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Beleaf

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Technoloader

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Coinsclone

List of Figures

- Figure 1: Global Security Token Offerings Sto Development Services Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Security Token Offerings Sto Development Services Revenue (million), by Application 2024 & 2032

- Figure 3: North America Security Token Offerings Sto Development Services Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Security Token Offerings Sto Development Services Revenue (million), by Type 2024 & 2032

- Figure 5: North America Security Token Offerings Sto Development Services Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Security Token Offerings Sto Development Services Revenue (million), by Country 2024 & 2032

- Figure 7: North America Security Token Offerings Sto Development Services Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Security Token Offerings Sto Development Services Revenue (million), by Application 2024 & 2032

- Figure 9: South America Security Token Offerings Sto Development Services Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Security Token Offerings Sto Development Services Revenue (million), by Type 2024 & 2032

- Figure 11: South America Security Token Offerings Sto Development Services Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Security Token Offerings Sto Development Services Revenue (million), by Country 2024 & 2032

- Figure 13: South America Security Token Offerings Sto Development Services Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Security Token Offerings Sto Development Services Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Security Token Offerings Sto Development Services Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Security Token Offerings Sto Development Services Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Security Token Offerings Sto Development Services Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Security Token Offerings Sto Development Services Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Security Token Offerings Sto Development Services Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Security Token Offerings Sto Development Services Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Security Token Offerings Sto Development Services Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Security Token Offerings Sto Development Services Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Security Token Offerings Sto Development Services Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Security Token Offerings Sto Development Services Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Security Token Offerings Sto Development Services Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Security Token Offerings Sto Development Services Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Security Token Offerings Sto Development Services Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Security Token Offerings Sto Development Services Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Security Token Offerings Sto Development Services Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Security Token Offerings Sto Development Services Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Security Token Offerings Sto Development Services Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Security Token Offerings Sto Development Services Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Security Token Offerings Sto Development Services Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Security Token Offerings Sto Development Services Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Security Token Offerings Sto Development Services Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Security Token Offerings Sto Development Services Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Security Token Offerings Sto Development Services Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Security Token Offerings Sto Development Services Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Security Token Offerings Sto Development Services Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Security Token Offerings Sto Development Services Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Security Token Offerings Sto Development Services Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Security Token Offerings Sto Development Services Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Security Token Offerings Sto Development Services Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Security Token Offerings Sto Development Services Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Security Token Offerings Sto Development Services Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Security Token Offerings Sto Development Services Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Security Token Offerings Sto Development Services Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Security Token Offerings Sto Development Services Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Security Token Offerings Sto Development Services Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Security Token Offerings Sto Development Services Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Security Token Offerings Sto Development Services Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Security Token Offerings Sto Development Services?

The projected CAGR is approximately 18.7%.

2. Which companies are prominent players in the Security Token Offerings Sto Development Services?

Key companies in the market include Coinsclone, Speqto technology, Immanent Solutions, LeewayHertz, Naygon Technologies Pvt. Ltd., ScienceSoft, Antier, Blockchain App Factory, Innowise, Oodles Technologies, OrangeMantra, Developcoins, Infinite Block Tech, Beleaf, Technoloader.

3. What are the main segments of the Security Token Offerings Sto Development Services?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1284 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Security Token Offerings Sto Development Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Security Token Offerings Sto Development Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Security Token Offerings Sto Development Services?

To stay informed about further developments, trends, and reports in the Security Token Offerings Sto Development Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence