Key Insights

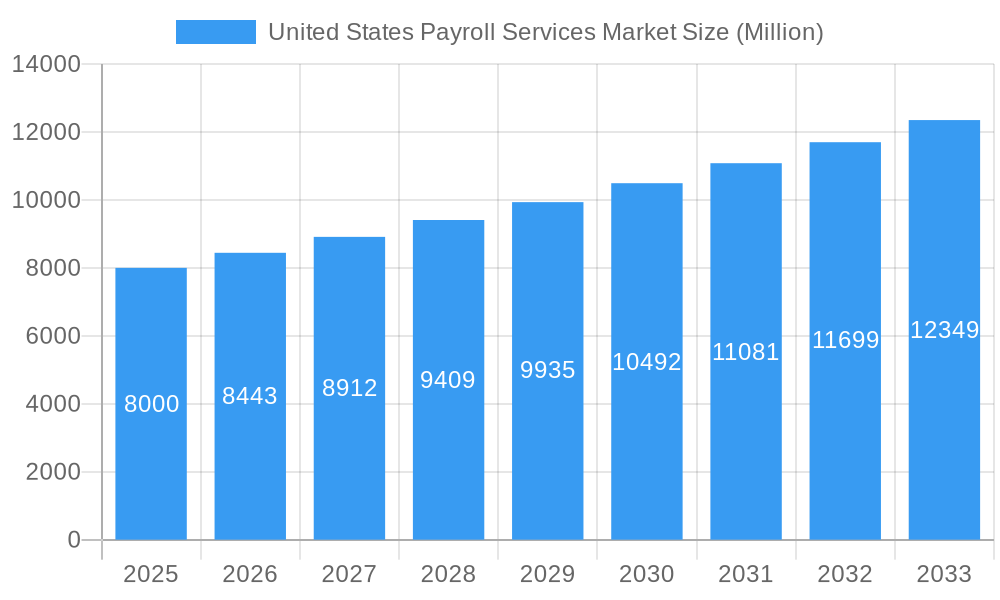

The United States payroll services market, valued at approximately $8 billion in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 5.54% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of cloud-based payroll solutions offers businesses enhanced scalability, cost-effectiveness, and improved data security, contributing significantly to market growth. Furthermore, the rising demand for automation and streamlined HR processes, particularly among small and medium-sized enterprises (SMEs), is driving the demand for comprehensive payroll services that integrate seamlessly with other HR functions. Stringent government regulations surrounding payroll compliance and the need to avoid costly penalties further incentivize businesses to outsource their payroll functions to specialized providers. The competitive landscape is characterized by a mix of established players like ADP and Paychex, alongside newer, tech-focused companies such as Gusto and OnPay, catering to diverse market segments and offering various service levels. The market's growth trajectory is also influenced by ongoing technological advancements like AI and machine learning, which promise to further automate payroll processes and enhance accuracy.

United States Payroll Services Market Market Size (In Billion)

Despite the positive outlook, the market faces certain challenges. Integration complexities with existing HR systems and the need for continuous software updates to maintain compliance can pose obstacles for some businesses. Furthermore, security concerns related to sensitive employee data remain a crucial factor that must be addressed through robust security measures by payroll service providers. Competition from smaller, niche players offering specialized services also presents a dynamic competitive environment. The market segmentation is primarily driven by company size (SMEs vs. large enterprises), industry vertical, and the type of payroll services offered (e.g., full-service vs. self-service). This segmentation underscores the importance of tailored solutions to meet the specific needs of diverse business clients. The continued focus on innovation, robust security measures, and competitive pricing strategies will be key for players seeking sustained growth in this competitive yet promising market.

United States Payroll Services Market Company Market Share

United States Payroll Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Payroll Services Market, covering market dynamics, growth trends, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report delves into various market segments and key players, offering valuable insights for industry professionals, investors, and strategic decision-makers. The market is projected to reach xx Million by 2033, showcasing robust growth potential.

United States Payroll Services Market Dynamics & Structure

The US payroll services market is characterized by a blend of established giants and emerging agile players. Market concentration is moderate, with a few dominant players holding significant shares, but a competitive landscape fueled by technological innovation and evolving customer needs. Regulatory frameworks, including compliance with federal and state labor laws, play a crucial role in shaping market dynamics. The market witnesses continuous product innovation, with companies vying to offer advanced features like integrated HR solutions, automated tax calculations, and seamless mobile accessibility. Mergers and acquisitions (M&A) activity is frequent, reflecting strategic consolidation and expansion efforts by major players.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Technological Innovation: Cloud-based solutions, AI-driven automation, and integrated HR platforms are key drivers.

- Regulatory Landscape: Compliance with federal and state regulations (e.g., FLSA, ACA) significantly impacts operational costs and strategies.

- Competitive Substitutes: Smaller businesses might opt for DIY solutions or less comprehensive services.

- End-User Demographics: The market caters to businesses of all sizes, from small and medium-sized enterprises (SMEs) to large corporations.

- M&A Trends: The past five years have witnessed xx M&A deals, indicating strategic consolidation and expansion within the sector.

United States Payroll Services Market Growth Trends & Insights

The US payroll services market exhibits consistent growth, driven by factors like increasing digitization, the rising adoption of cloud-based solutions, and the expanding need for efficient and compliant payroll processing across various industries. The market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth reflects increasing demand for advanced payroll solutions, particularly among SMEs seeking streamlined HR and payroll management. Technological disruptions, such as the integration of AI and machine learning, are further accelerating market expansion. Consumer behavior shifts towards greater reliance on automated solutions and mobile accessibility also contribute to market growth.

Dominant Regions, Countries, or Segments in United States Payroll Services Market

The U.S. payroll services market exhibits robust growth across diverse regions, with certain areas experiencing accelerated dynamism. California, Texas, and New York consistently lead as major market players due to their substantial business populations and complex regulatory landscapes demanding sophisticated payroll solutions. Significant industry-specific growth is observed in technology, healthcare, and finance, driven by expansive workforces and intricate compensation structures. Beyond these leading states, regional variations exist, influenced by factors such as business density, technological infrastructure, and the prevalence of specific industries. For instance, states with a higher concentration of small and medium-sized enterprises (SMEs) may see stronger demand for affordable, user-friendly solutions, while states with large, established corporations might favor comprehensive, integrated platforms.

- Key Drivers: Robust economic growth in key states, escalating regulatory compliance needs, expansion of businesses within high-growth sectors, and increasing demand for specialized payroll services catering to niche industries.

- Dominance Factors: High concentrations of businesses, advanced technological infrastructure, robust regulatory frameworks, and the presence of established payroll service providers significantly contribute to market share dominance. Access to skilled labor and a supportive business environment also play a crucial role.

- Growth Potential: Significant untapped potential exists in rural areas and among smaller businesses seeking cost-effective and user-friendly payroll solutions. Furthermore, the increasing adoption of remote work models and the gig economy present new opportunities for specialized payroll solutions designed to accommodate these evolving workforce dynamics.

United States Payroll Services Market Product Landscape

The market offers a wide array of payroll solutions, ranging from basic payroll processing services to integrated HR and benefits administration platforms. Product innovation focuses on enhancing automation, streamlining compliance, and improving user experience through mobile accessibility and intuitive interfaces. Key features include self-service portals, automated tax calculations, time and attendance tracking, and robust reporting capabilities. Many providers are integrating their solutions with other business applications, such as accounting software, to create seamless workflows.

Key Drivers, Barriers & Challenges in United States Payroll Services Market

Key Drivers:

- Increasing adoption of cloud-based solutions for enhanced scalability and accessibility.

- Rising demand for integrated HR and payroll management systems.

- Growing regulatory requirements necessitating accurate and compliant payroll processing.

Challenges:

- Maintaining data security and privacy in compliance with stringent regulations like GDPR and CCPA.

- Intense competition from both established players and emerging fintech companies.

- The need for constant adaptation to evolving regulatory landscapes and technological advancements impacting compliance and operational costs. This impacts operational efficiency and necessitates constant investment in compliance measures, resulting in an estimated annual cost increase of xx Million for the industry.

Emerging Opportunities in United States Payroll Services Market

- Expansion into underserved markets, including micro-businesses and freelancers.

- Development of specialized solutions catering to specific industry needs.

- Integration with emerging technologies like blockchain for enhanced security and transparency.

Growth Accelerators in the United States Payroll Services Market Industry

Strategic partnerships and acquisitions continue to reshape the landscape, driving innovation and market expansion. Technological breakthroughs in AI and machine learning are automating processes, improving accuracy, and reducing costs. Market expansion into new sectors and geographies is expected to further accelerate growth.

Key Players Shaping the United States Payroll Services Market Market

- ADP (Automatic Data Processing)

- Paychex

- Gusto

- Intuit (QuickBooks)

- TriNet

- Paycor

- Zenefits

- SurePayroll

- OnPay

- Square Payroll

- List Not Exhaustive

Notable Milestones in United States Payroll Services Market Sector

- June 2023: UKG Inc. acquires Immedis, expanding its global payroll capabilities.

- April 2024: Everee partners with NextCrew to streamline payroll for staffing firms and temporary employees.

In-Depth United States Payroll Services Market Market Outlook

The US payroll services market is poised for sustained growth, driven by technological advancements, increasing regulatory complexities, and the evolving needs of businesses across various sectors. Strategic partnerships, technological innovations, and expansion into untapped markets present significant opportunities for both established players and new entrants. The market's future potential is substantial, indicating continued expansion and the emergence of innovative solutions shaping the future of payroll processing in the United States.

United States Payroll Services Market Segmentation

-

1. Type

- 1.1. Small-size Company

- 1.2. Mid-size Company

- 1.3. Large Enterprises

-

2. End User

- 2.1. Healthcare

- 2.2. Manufacturing

- 2.3. Retail

- 2.4. IT

- 2.5. Finance

- 2.6. Professional Services

United States Payroll Services Market Segmentation By Geography

- 1. United States

United States Payroll Services Market Regional Market Share

Geographic Coverage of United States Payroll Services Market

United States Payroll Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Complexity of Payroll Regulations; Rise of Gig Economy

- 3.3. Market Restrains

- 3.3.1. Increasing Complexity of Payroll Regulations; Rise of Gig Economy

- 3.4. Market Trends

- 3.4.1. Rise of Gig Economy Influencing US Payroll Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Payroll Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Small-size Company

- 5.1.2. Mid-size Company

- 5.1.3. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Healthcare

- 5.2.2. Manufacturing

- 5.2.3. Retail

- 5.2.4. IT

- 5.2.5. Finance

- 5.2.6. Professional Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ADP (Automatic Data Processing)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Paychex

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gusto

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Intuit (QuickBooks)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TriNet

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Paycor

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zenefits

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SurePayroll

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 OnPay

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Square Payroll**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ADP (Automatic Data Processing)

List of Figures

- Figure 1: United States Payroll Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Payroll Services Market Share (%) by Company 2025

List of Tables

- Table 1: United States Payroll Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: United States Payroll Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: United States Payroll Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: United States Payroll Services Market Volume Billion Forecast, by End User 2020 & 2033

- Table 5: United States Payroll Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United States Payroll Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: United States Payroll Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: United States Payroll Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: United States Payroll Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: United States Payroll Services Market Volume Billion Forecast, by End User 2020 & 2033

- Table 11: United States Payroll Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States Payroll Services Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Payroll Services Market?

The projected CAGR is approximately 5.54%.

2. Which companies are prominent players in the United States Payroll Services Market?

Key companies in the market include ADP (Automatic Data Processing), Paychex, Gusto, Intuit (QuickBooks), TriNet, Paycor, Zenefits, SurePayroll, OnPay, Square Payroll**List Not Exhaustive.

3. What are the main segments of the United States Payroll Services Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 8 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Complexity of Payroll Regulations; Rise of Gig Economy.

6. What are the notable trends driving market growth?

Rise of Gig Economy Influencing US Payroll Services.

7. Are there any restraints impacting market growth?

Increasing Complexity of Payroll Regulations; Rise of Gig Economy.

8. Can you provide examples of recent developments in the market?

April 2024: Everee, a prominent payroll firm known for its instant payment solutions, joined forces with NextCrew. This collaboration aims to revolutionize payroll processes, ensuring swift and seamless payments for workers. By integrating Everee's cutting-edge payroll tech with NextCrew's comprehensive staffing platform, the partnership promises to elevate the payroll experience for both staffing firms and their temporary employees.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Payroll Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Payroll Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Payroll Services Market?

To stay informed about further developments, trends, and reports in the United States Payroll Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence