Key Insights

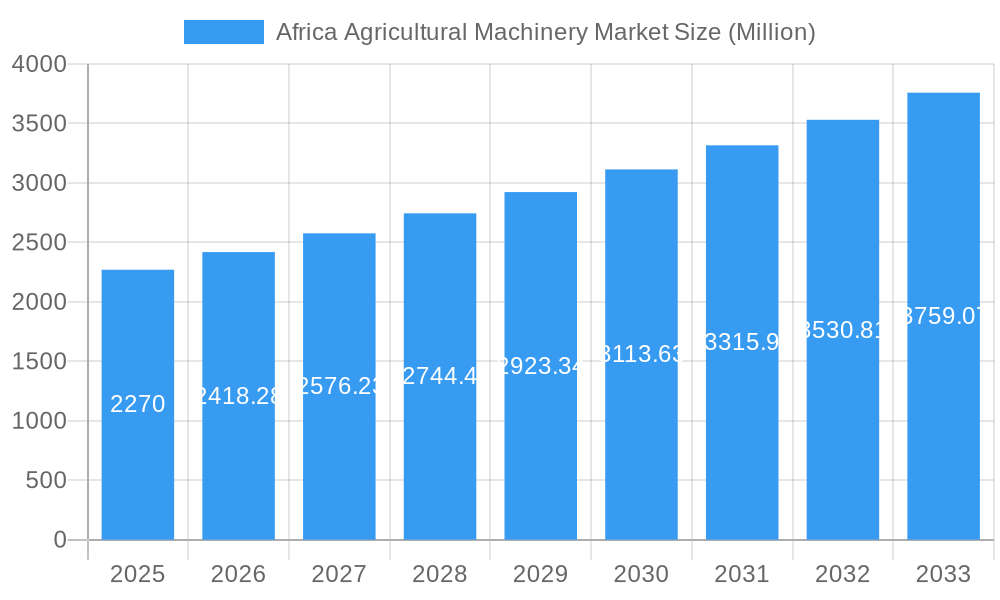

The Africa Agricultural Machinery Market, valued at $2.27 billion in 2025, is projected to experience robust growth, driven by several key factors. Increasing government initiatives promoting mechanization in agriculture across various African nations are a primary driver. These initiatives often include subsidies, training programs, and improved access to financing for farmers seeking to upgrade their equipment. Furthermore, the rising demand for food security and the expansion of large-scale commercial farming are significantly boosting the market. The shift towards higher-yield crops and improved farming practices necessitates the adoption of sophisticated agricultural machinery, contributing to market growth. Finally, technological advancements in machinery, such as precision farming technologies and automation, are improving efficiency and productivity, making these tools more attractive to farmers. This is further augmented by improved infrastructure and better access to credit in several key regions.

Africa Agricultural Machinery Market Market Size (In Billion)

However, market growth is not without challenges. High initial investment costs for advanced machinery present a significant barrier to entry for many smallholder farmers who represent a large portion of the agricultural landscape in Africa. Furthermore, the lack of skilled technicians and maintenance infrastructure in certain areas can hinder the adoption and efficient operation of these machines. Uneven distribution of income, coupled with infrastructural limitations in some regions, also acts as a constraint. Despite these challenges, the market is expected to maintain a Compound Annual Growth Rate (CAGR) of 6.40% from 2025 to 2033, fueled by the increasing adoption of mechanization in key agricultural sectors. The market segmentation reveals substantial demand across various machinery types, including tractors, planting and fertilizing equipment, and harvesting machinery, reflecting the diverse agricultural needs across the continent. Key players like John Deere, Mahindra & Mahindra, and AGCO are strategically positioned to capitalize on this growth.

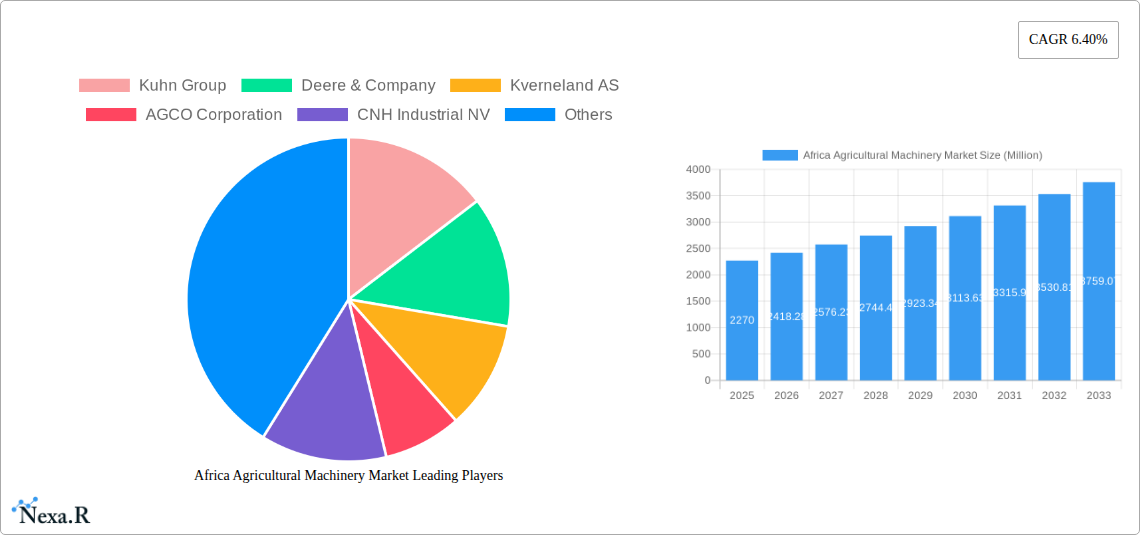

Africa Agricultural Machinery Market Company Market Share

Africa Agricultural Machinery Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Africa Agricultural Machinery Market, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on both the parent market (Agricultural Machinery) and child markets (specific machinery types), this report offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand and capitalize on the opportunities within this dynamic sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Market values are presented in million units.

Africa Agricultural Machinery Market Dynamics & Structure

The African agricultural machinery market is characterized by a moderately fragmented landscape with a mix of international and local players. Market concentration is relatively low, with no single dominant player controlling a significant market share. However, this is expected to change in the coming years with increased investment and consolidation. Technological innovation, while present, faces barriers including limited access to technology, high initial investment costs, and lack of skilled labor to operate and maintain advanced machinery. Regulatory frameworks vary across countries, impacting market entry and operation. Competition from substitute technologies (e.g., manual labor, traditional methods) remains a significant factor. The end-user demographic is primarily smallholder farmers, though large-scale commercial farms are becoming increasingly important. M&A activity remains moderate but is anticipated to rise given the growth prospects.

- Market Concentration: Low to Moderate (xx%)

- Innovation Drivers: Government initiatives, technological advancements in precision agriculture.

- Regulatory Frameworks: Varied across countries, impacting market access.

- Competitive Product Substitutes: Manual labor, traditional farming practices.

- End-User Demographics: Predominantly smallholder farmers, increasing commercial farm adoption.

- M&A Trends: Moderate activity, projected increase in the forecast period.

Africa Agricultural Machinery Market Growth Trends & Insights

The African agricultural machinery market exhibits robust growth, driven by factors such as increasing agricultural production, rising government investments in agricultural modernization, and expanding commercial farming operations. The market size experienced a CAGR of xx% during the historical period (2019-2024) and is projected to reach xx million units by 2025, further expanding at a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the adoption of precision farming techniques and automation, are driving improvements in efficiency and productivity, leading to higher adoption rates. Shifting consumer behaviors, including a growing preference for higher-quality machinery and improved after-sales service, also shape market dynamics. The penetration of mechanized farming continues to increase, albeit at a varying pace depending on the region and country. Market penetration for tractors, for example, is projected to increase from xx% to xx% in the forecast period.

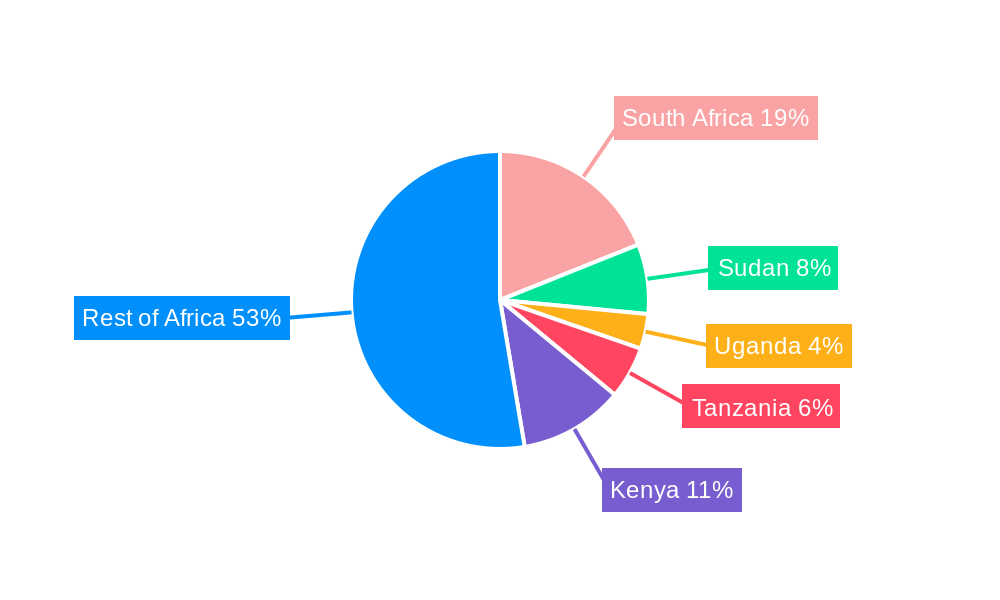

Dominant Regions, Countries, or Segments in Africa Agricultural Machinery Market

While market growth is prevalent across Africa, certain regions and segments demonstrate faster expansion. East Africa and Southern Africa are currently the leading regions, driven by factors such as supportive government policies, increased investments in agricultural infrastructure, and relatively higher commercial farming activity. Within product types, tractors and planting and fertilizing machinery represent the largest segments due to their widespread utility and high demand across different farming scales. The South African market holds the largest share among countries owing to its relatively advanced agricultural sector and stronger economic standing. Key drivers for growth in dominant regions and segments include:

- East Africa: Government investment in agricultural development, rising commercial farming.

- Southern Africa: Established agricultural sector, advanced infrastructure in certain areas.

- Tractors: High demand for land preparation and cultivation.

- Planting & Fertilizing Machinery: Increased focus on improved yields and resource efficiency.

Africa Agricultural Machinery Market Product Landscape

The market offers a wide array of agricultural machinery, encompassing tractors, plowing and cultivating equipment, planting and fertilizing machines, harvesting equipment, haying and forage machinery, irrigation systems, and other specialized tools. Recent innovations focus on enhancing efficiency, fuel efficiency, precision, and automation. Products are designed to cater to the diverse needs of different farm sizes and crops, emphasizing features such as ease of use, affordability, and durability. Manufacturers are increasingly incorporating technologies such as GPS guidance, sensors, and data analytics for better farm management and higher yields.

Key Drivers, Barriers & Challenges in Africa Agricultural Machinery Market

Key Drivers:

- Growing investment in agricultural infrastructure.

- Government incentives and subsidies to promote mechanization.

- Rising demand for food security and increased agricultural output.

- Expansion of commercial farming operations.

Key Challenges:

- High initial cost of machinery, impacting affordability for smallholder farmers.

- Limited access to financing and credit facilities.

- Inadequate infrastructure (e.g., poor roads, unreliable electricity) hindering machine deployment.

- Lack of skilled labor to operate and maintain advanced machinery. The impact of these challenges is estimated to reduce market growth by approximately xx% annually.

Emerging Opportunities in Africa Agricultural Machinery Market

The market presents numerous opportunities. Untapped markets in West and Central Africa offer significant growth potential. Innovative applications of technology, such as drone-based spraying and remote sensing, offer efficiency gains. The increasing focus on sustainable farming practices creates opportunities for eco-friendly machinery and solutions. Growing demand for customized machinery to suit specific crop needs and local conditions also presents a viable opportunity.

Growth Accelerators in the Africa Agricultural Machinery Market Industry

Technological breakthroughs, particularly in precision agriculture and automation, will be central to driving market growth. Strategic partnerships between equipment manufacturers, financial institutions, and agricultural extension services can enhance accessibility and affordability. Expansion of distribution networks and robust after-sales service will build trust and increase market penetration. Government initiatives and private sector investment in agricultural infrastructure further act as catalysts for accelerated growth.

Key Players Shaping the Africa Agricultural Machinery Market Market

- Kuhn Group

- Deere & Company

- Kverneland AS

- AGCO Corporation

- CNH Industrial NV

- Mahindra & Mahindra Ltd

- Tractors and Farm Equipment Limited (TAFE)

- Claas KGaA mbH

- Kubota Agricultural Machinery

- Lindsay Corporation

- Escorts Group

- J C Bamford Excavators Limited

Notable Milestones in Africa Agricultural Machinery Sector

- May 2022: AGCO introduced new Fendt One tractor models and Fendt Ideal Combine 10T at NAMPO, boosting efficiency and lowering maintenance costs for farmers.

- May 2022: Bridgestone entered the South African agricultural market with high-performance tires for tractors and combine harvesters, enhancing operational capabilities.

- August 2022: The DSI and TIA provided two cotton baler machines to South African farmers, modernizing cotton production.

In-Depth Africa Agricultural Machinery Market Outlook

The Africa agricultural machinery market holds immense potential. Continued investment in agricultural infrastructure, technological advancements, and supportive government policies will drive long-term growth. Strategic partnerships and the development of innovative financial solutions to increase accessibility and affordability will be crucial in unlocking the market’s full potential. Focusing on sustainable and climate-resilient solutions will attract further investment and strengthen market expansion. The market is poised for significant expansion, driven by the increasing demand for food security and modernization of farming practices across the continent.

Africa Agricultural Machinery Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Africa Agricultural Machinery Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Agricultural Machinery Market Regional Market Share

Geographic Coverage of Africa Agricultural Machinery Market

Africa Agricultural Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Legalization of Cannabis; Growing Focus on Health Benefits of Cannabis

- 3.3. Market Restrains

- 3.3.1. Lack of Data on Dosages and Results; Lack of Access to Financial Assistance

- 3.4. Market Trends

- 3.4.1. Increasing Focus on Sustainable Mechanization

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Agricultural Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kuhn Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Deere & Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kverneland AS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AGCO Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CNH Industrial NV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mahindra & Mahindra Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tractors and Farm Equipment Limited (TAFE)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Claas KGaA mbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kubota Agricultural Machinery

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lindsay Corporatio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Escorts Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 J C Bamford Excavators Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Kuhn Group

List of Figures

- Figure 1: Africa Agricultural Machinery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Agricultural Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Agricultural Machinery Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 3: Africa Agricultural Machinery Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Africa Agricultural Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Africa Agricultural Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Africa Agricultural Machinery Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Africa Agricultural Machinery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Region 2020 & 2033

- Table 13: Africa Agricultural Machinery Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 15: Africa Agricultural Machinery Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Africa Agricultural Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Africa Agricultural Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Africa Agricultural Machinery Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Africa Agricultural Machinery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 25: Nigeria Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nigeria Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 27: South Africa Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Africa Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 29: Egypt Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Egypt Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 31: Kenya Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Kenya Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 33: Ethiopia Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Ethiopia Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 35: Morocco Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Morocco Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 37: Ghana Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Ghana Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 39: Algeria Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Algeria Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 41: Tanzania Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Tanzania Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 43: Ivory Coast Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Ivory Coast Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Agricultural Machinery Market?

The projected CAGR is approximately 6.40%.

2. Which companies are prominent players in the Africa Agricultural Machinery Market?

Key companies in the market include Kuhn Group, Deere & Company, Kverneland AS, AGCO Corporation, CNH Industrial NV, Mahindra & Mahindra Ltd, Tractors and Farm Equipment Limited (TAFE), Claas KGaA mbH, Kubota Agricultural Machinery, Lindsay Corporatio, Escorts Group, J C Bamford Excavators Limited.

3. What are the main segments of the Africa Agricultural Machinery Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Legalization of Cannabis; Growing Focus on Health Benefits of Cannabis.

6. What are the notable trends driving market growth?

Increasing Focus on Sustainable Mechanization.

7. Are there any restraints impacting market growth?

Lack of Data on Dosages and Results; Lack of Access to Financial Assistance.

8. Can you provide examples of recent developments in the market?

August 2022: As part of plans to support and boost the cotton industry in South Africa, the Department of Science and Innovation (DSI) and its entity, the Technology Innovation Agency(TIA), have together supplied farmers with two cotton baler machines to put an end to manual cotton baling.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Agricultural Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Agricultural Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Agricultural Machinery Market?

To stay informed about further developments, trends, and reports in the Africa Agricultural Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence