Key Insights

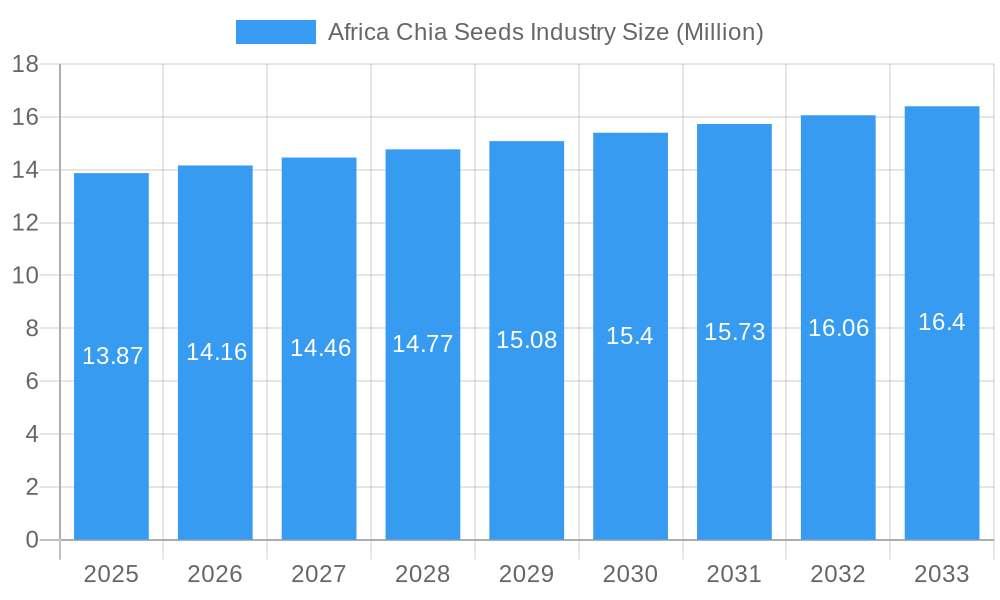

The African chia seed market is poised for steady growth, projected to reach $13.87 million by 2025, with a Compound Annual Growth Rate (CAGR) of 2.10% through 2033. This expansion is driven by an increasing consumer awareness of chia seeds' nutritional benefits, including their high omega-3 fatty acid content, fiber, and antioxidants. The rising demand for superfoods and plant-based diets across Africa, coupled with a growing emphasis on healthy lifestyles, are significant catalysts for market expansion. Furthermore, expanding cultivation areas and improved agricultural practices in key African nations are contributing to a more stable and accessible supply chain, further bolstering market confidence. The market is segmenting across production, consumption, import/export, and pricing trends, indicating a maturing industry with diverse opportunities for stakeholders.

Africa Chia Seeds Industry Market Size (In Million)

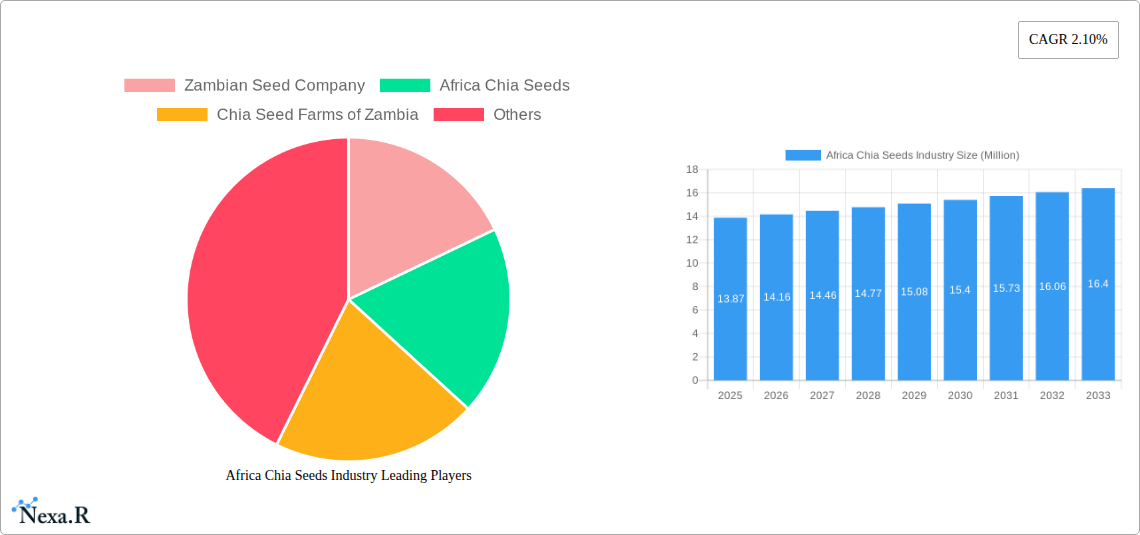

While the market is experiencing positive momentum, certain factors could influence its trajectory. Challenges related to agricultural infrastructure, particularly in remote regions, and potential price volatility due to supply-demand imbalances could present headwinds. However, the inherent demand for nutrient-dense foods, coupled with increasing export potential to global markets seeking sustainable and ethically sourced ingredients, is expected to outweigh these restraints. Key players like Zambian Seed Company, Africa Chia Seeds, and Chia Seed Farms of Zambia are actively involved in shaping the market landscape through innovation and strategic expansion. The market's regional dynamics, with significant activity anticipated in Uganda, Kenya, South Africa, Tanzania, and the broader Southern African region, highlight diverse growth pockets and opportunities for targeted market penetration.

Africa Chia Seeds Industry Company Market Share

Africa Chia Seeds Industry: Market Dynamics & Structure

The Africa Chia Seeds Industry is characterized by a dynamic interplay of burgeoning production capabilities and evolving consumer demand for healthy food ingredients. Market concentration is gradually shifting as new players emerge, primarily driven by increasing investments in agricultural technology and the growing recognition of chia seeds' nutritional benefits across global markets. Regulatory frameworks, while still developing in some regions, are becoming more standardized, facilitating cross-border trade and investment. Competitive product substitutes, such as flaxseeds and hemp seeds, present a constant challenge, necessitating strategic differentiation and value-added product development. End-user demographics are expanding beyond traditional health-conscious consumers to include mainstream food manufacturers and individuals seeking functional foods and dietary supplements. Mergers and acquisitions (M&A) are anticipated to play a significant role in consolidating market share and expanding operational reach.

- Market Concentration: Currently experiencing moderate concentration, with a trend towards increased fragmentation due to the entry of small and medium-sized enterprises (SMEs). Projections indicate further consolidation driven by strategic acquisitions and partnerships.

- Technological Innovation Drivers: Advancements in seed cultivation techniques, improved harvesting machinery, and efficient processing technologies are key innovation drivers. The adoption of precision agriculture and sustainable farming practices is also gaining momentum, aiming to boost yields and quality.

- Regulatory Frameworks: Harmonization of food safety standards and organic certification processes across African nations is crucial. Government support for agricultural exports and investment incentives are also significant factors.

- Competitive Product Substitutes: Flaxseeds and hemp seeds offer comparable nutritional profiles and are priced competitively, posing a threat to market share. The industry must focus on unique selling propositions of chia seeds, such as omega-3 content and versatility.

- End-User Demographics: Growing demand from the food and beverage sector for functional ingredients, the expanding nutraceutical and dietary supplement markets, and increasing consumer awareness of superfoods are key demographic shifts.

- M&A Trends: Expected to rise as larger companies seek to secure supply chains and expand their presence in high-growth regions. Anticipated M&A deal volumes are projected to increase by approximately 15% over the next five years.

Africa Chia Seeds Industry Growth Trends & Insights

The Africa Chia Seeds Industry is poised for significant expansion, driven by a confluence of factors that are reshaping its market trajectory. From 2019 to 2033, the industry is anticipated to witness robust growth, reflecting a strong compound annual growth rate (CAGR) of xx%. This upward trend is underpinned by an increasing global demand for nutrient-dense superfoods, with chia seeds consistently ranking high on consumer preference lists due to their exceptional omega-3 fatty acid content, fiber, and protein. African producers are increasingly leveraging advanced agricultural techniques and sustainable farming practices to enhance crop yields and improve seed quality, thereby meeting the stringent requirements of international markets. The adoption rate of chia cultivation is escalating across the continent, propelled by favorable climatic conditions in key regions and the potential for high returns on investment.

Technological disruptions are playing a pivotal role in optimizing the entire value chain, from seed breeding and cultivation to processing and packaging. Innovations in drought-resistant seed varieties, precision irrigation systems, and automated harvesting equipment are contributing to greater efficiency and reduced operational costs. Furthermore, advancements in food processing technologies are enabling the development of a wider array of chia-based products, including chia flours, oils, and functional food ingredients, catering to diverse consumer needs and preferences.

Consumer behavior shifts are a primary growth driver. There's a pronounced move towards healthier eating habits, with consumers actively seeking out natural and minimally processed foods. This paradigm shift has led to a surge in the demand for chia seeds in various applications, including breakfast cereals, smoothies, baked goods, and dietary supplements. The growing awareness of the health benefits associated with chia consumption, such as improved digestive health, cardiovascular support, and enhanced satiety, is further fueling market penetration. The industry is also experiencing a rise in direct-to-consumer (DTC) sales models and e-commerce platforms, which are broadening market access and facilitating direct engagement with end consumers. This evolving landscape presents a fertile ground for sustained growth and innovation within the Africa Chia Seeds Industry.

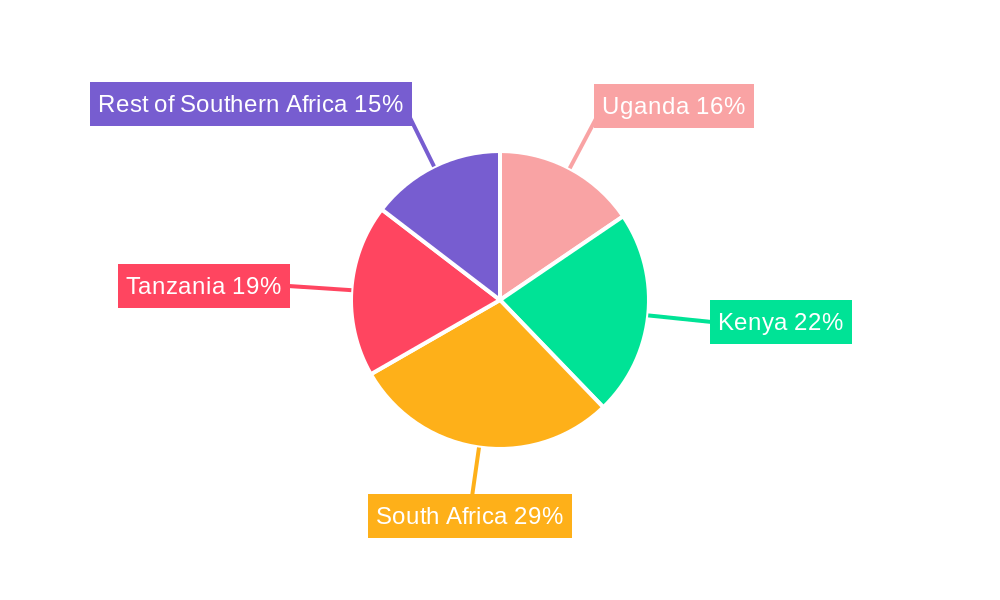

Dominant Regions, Countries, or Segments in Africa Chia Seeds Industry

The Africa Chia Seeds Industry’s dominance is primarily dictated by its production capacity, consumption patterns, and its role in the global import and export markets. Within the Production Analysis, Zambia has emerged as a frontrunner, driven by its favorable agro-climatic conditions, fertile land, and government initiatives promoting agricultural diversification and export-oriented farming. Companies like Zambian Seed Company and Chia Seed Farms of Zambia are instrumental in bolstering production volumes, utilizing advanced agricultural technologies and sustainable farming practices to achieve higher yields and superior seed quality. The country’s strategic focus on high-value crops like chia seeds has positioned it as a key supplier for the global market.

In terms of Consumption Analysis, the demand within Africa is steadily growing, primarily fueled by a rising middle class with increasing disposable incomes and a greater awareness of health and wellness. Major urban centers are witnessing a significant uptake of chia seeds in dietary supplements and functional food products. However, the largest portion of chia seed consumption remains concentrated in international markets, making Africa a crucial export hub.

The Import Market Analysis (Value & Volume) reveals that while Africa is a net exporter of chia seeds, there are specific niche markets within the continent that import processed chia products or specific varieties to meet specialized dietary needs. However, the overall import volume is significantly lower than its export volume. Conversely, the Export Market Analysis (Value & Volume) showcases Africa's immense strength. Countries like Zambia, Ethiopia, and Kenya are leading exporters, supplying significant volumes to Europe, North America, and Asia. The high demand for organic and ethically sourced chia seeds from developed economies further solidifies Africa's position as a vital export destination. The value of these exports is substantial, contributing significantly to foreign exchange earnings for these nations.

Analyzing the Price Trend Analysis, prices are largely influenced by global supply and demand dynamics, quality of produce, and certifications (e.g., organic). African producers are increasingly able to command premium prices for high-quality, sustainably grown chia seeds. Fluctuations are often tied to harvest yields and international market sentiment. The Industry Developments section further highlights the impact of strategic investments in infrastructure, research and development, and quality control measures in fostering the growth of dominant regions. For instance, investments in cold chain logistics and processing facilities in Zambia have been critical in enhancing its export capabilities.

- Dominant Region: Southern Africa, with Zambia leading in production and export.

- Key Drivers for Production Dominance (Zambia):

- Favorable agro-climatic conditions for chia cultivation.

- Government support for agricultural exports and investment incentives.

- Presence of key players like Zambian Seed Company and Chia Seed Farms of Zambia.

- Adoption of advanced cultivation and sustainable farming techniques.

- Consumption Insights: Growing domestic demand for health foods, coupled with significant export markets.

- Export Leadership: Driven by demand for organic and high-quality chia seeds from international markets.

- Price Influences: Global supply/demand, quality, organic certification, and harvest yields.

Africa Chia Seeds Industry Product Landscape

The Africa Chia Seeds Industry's product landscape is characterized by its focus on the raw, whole seed, which is highly valued for its exceptional nutritional profile. However, there's a growing diversification into value-added products that cater to specific market needs and enhance consumer convenience. Key innovations revolve around the extraction of chia oil, rich in omega-3 fatty acids, and the milling of chia seeds into fine powders or flours, which are ideal for baking and as nutritional supplements. Performance metrics are primarily benchmarked against nutritional content – specifically, high concentrations of alpha-linolenic acid (ALA), dietary fiber, and protein. Unique selling propositions include its hydrophilic nature, allowing it to absorb significant amounts of liquid, making it a popular ingredient for thickening and gelling applications in beverages and desserts. Technological advancements are focused on improving extraction efficiencies for chia oil and developing cost-effective methods for producing high-quality chia flour with extended shelf life.

Key Drivers, Barriers & Challenges in Africa Chia Seeds Industry

Key Drivers:

- Rising Global Health Consciousness: Increasing consumer awareness of the health benefits of chia seeds, particularly their omega-3 fatty acid and fiber content, is a primary growth driver. This fuels demand from the nutraceutical and functional food sectors.

- Nutritional Superiority: Chia seeds are recognized as a superfood, offering a comprehensive nutrient profile, which makes them a preferred choice for health-conscious individuals and for fortification in various food products.

- Agricultural Advancements & Favorable Climates: Improvements in seed varieties, cultivation techniques, and the availability of suitable climatic conditions in many African regions enhance production efficiency and yield.

- Government Support & Export Incentives: Policies promoting agricultural exports and providing incentives for growers and processors are crucial for market expansion.

Barriers & Challenges:

- Supply Chain Inefficiencies: Inadequate infrastructure, including storage, transportation, and processing facilities, can lead to post-harvest losses and impact the quality and competitiveness of African chia seeds.

- Market Access & Volatility: Fluctuations in global commodity prices and intense competition from established producers in other regions can create price volatility and challenge market penetration.

- Regulatory Hurdles & Quality Standards: Meeting diverse international food safety standards and obtaining certifications (e.g., organic, non-GMO) can be complex and costly for smaller producers.

- Climate Change & Water Scarcity: Droughts and unpredictable weather patterns pose a significant risk to agricultural production, potentially impacting supply consistency and increasing cultivation costs.

- Pest and Disease Management: Effective control of pests and diseases without compromising organic certifications requires significant investment in research and sustainable management practices.

Emerging Opportunities in Africa Chia Seeds Industry

Emerging opportunities in the Africa Chia Seeds Industry lie in the development of specialized, value-added products and the expansion into untapped niche markets. The growing trend of plant-based diets and the demand for protein-rich alternatives present a significant opportunity for chia seed derivatives and ingredients. Furthermore, exploring innovative applications in the cosmetic and pharmaceutical industries, leveraging chia seed oil's beneficial properties, could open new revenue streams. The increasing demand for ethically sourced and traceable food products also provides a platform for African producers to highlight their commitment to sustainable agriculture and fair labor practices. Strategic partnerships with international food manufacturers for product development and co-branding initiatives will be crucial in capitalizing on these emerging trends.

Growth Accelerators in the Africa Chia Seeds Industry Industry

Long-term growth for the Africa Chia Seeds Industry will be significantly accelerated by a multi-pronged approach focusing on technological breakthroughs, strategic market expansion, and enhanced value chain integration. Investment in research and development to create climate-resilient, high-yield chia seed varieties will be a critical growth accelerator. Furthermore, fostering strategic partnerships between African producers and international food and beverage companies will drive demand for specialized chia ingredients and products. Market expansion efforts will focus on penetrating emerging economies with growing health-conscious populations and increasing disposable incomes. Streamlining supply chains through improved logistics, advanced processing technologies, and direct sourcing models will enhance efficiency and reduce costs, making African chia seeds more competitive globally.

Key Players Shaping the Africa Chia Seeds Industry Market

- Zambian Seed Company

- Africa Chia Seeds

- Chia Seed Farms of Zambia

Notable Milestones in Africa Chia Seeds Industry Sector

- 2019: Increased adoption of improved irrigation techniques in Zambia, leading to a xx% rise in chia seed yields.

- 2020: Launch of organic certification programs in key East African countries, boosting export potential for premium chia seeds.

- 2021: Significant investment in processing infrastructure in Zambia by private sector players, enhancing capacity by xx%.

- 2022: Growing demand for chia seeds in Europe for plant-based protein products, driving a xx% increase in African exports to the region.

- 2023: Introduction of new drought-tolerant chia seed varieties by research institutions in Southern Africa, mitigating climate change impacts.

- 2024: Emergence of new export markets in Southeast Asia, showing a xx% year-on-year growth in demand for African chia seeds.

- 2025 (Estimated): Projected xx% increase in global chia seed consumption, with Africa expected to account for a significant portion of supply growth.

In-Depth Africa Chia Seeds Industry Market Outlook

The Africa Chia Seeds Industry is projected to experience substantial growth, driven by escalating global demand for nutrient-rich foods and the continent's increasing production capabilities. Key growth accelerators include the development of advanced seed technologies, fostering strategic alliances with international buyers, and expanding into new geographic markets, particularly in Asia and the Middle East. Emphasis on value-added processing, such as chia oil extraction and chia flour production, will unlock new revenue streams and enhance profitability. Streamlining the supply chain through investments in logistics and processing infrastructure will be paramount in ensuring consistent quality and competitive pricing. The industry's outlook is robust, with significant potential for further expansion and market leadership in the global chia seed arena.

Africa Chia Seeds Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Africa Chia Seeds Industry Segmentation By Geography

- 1. Uganda

- 2. Kenya

- 3. South Africa

- 4. Tanzania

- 5. Rest of South Africa

Africa Chia Seeds Industry Regional Market Share

Geographic Coverage of Africa Chia Seeds Industry

Africa Chia Seeds Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Protein-based Vegan Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Chia Seeds Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Uganda

- 5.6.2. Kenya

- 5.6.3. South Africa

- 5.6.4. Tanzania

- 5.6.5. Rest of South Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Uganda Africa Chia Seeds Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Kenya Africa Chia Seeds Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. South Africa Africa Chia Seeds Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Tanzania Africa Chia Seeds Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Rest of South Africa Africa Chia Seeds Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Zambian Seed Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Africa Chia Seeds

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Chia Seed Farms of Zambia

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.1 Zambian Seed Company

List of Figures

- Figure 1: Africa Chia Seeds Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Chia Seeds Industry Share (%) by Company 2025

List of Tables

- Table 1: Africa Chia Seeds Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Africa Chia Seeds Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 3: Africa Chia Seeds Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Africa Chia Seeds Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Africa Chia Seeds Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Africa Chia Seeds Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Africa Chia Seeds Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Africa Chia Seeds Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Africa Chia Seeds Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Africa Chia Seeds Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Africa Chia Seeds Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Africa Chia Seeds Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 13: Africa Chia Seeds Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: Africa Chia Seeds Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 15: Africa Chia Seeds Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Africa Chia Seeds Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Africa Chia Seeds Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Africa Chia Seeds Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Africa Chia Seeds Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Africa Chia Seeds Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Africa Chia Seeds Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Africa Chia Seeds Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Africa Chia Seeds Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Africa Chia Seeds Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 25: Africa Chia Seeds Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Africa Chia Seeds Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 27: Africa Chia Seeds Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 28: Africa Chia Seeds Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 29: Africa Chia Seeds Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 30: Africa Chia Seeds Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 31: Africa Chia Seeds Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 32: Africa Chia Seeds Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 33: Africa Chia Seeds Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 34: Africa Chia Seeds Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 35: Africa Chia Seeds Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Africa Chia Seeds Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 37: Africa Chia Seeds Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 38: Africa Chia Seeds Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 39: Africa Chia Seeds Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 40: Africa Chia Seeds Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 41: Africa Chia Seeds Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 42: Africa Chia Seeds Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Africa Chia Seeds Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Africa Chia Seeds Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 45: Africa Chia Seeds Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 46: Africa Chia Seeds Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 47: Africa Chia Seeds Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Africa Chia Seeds Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 49: Africa Chia Seeds Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 50: Africa Chia Seeds Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 51: Africa Chia Seeds Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 52: Africa Chia Seeds Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 53: Africa Chia Seeds Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 54: Africa Chia Seeds Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Africa Chia Seeds Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Africa Chia Seeds Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 57: Africa Chia Seeds Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 58: Africa Chia Seeds Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 59: Africa Chia Seeds Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Africa Chia Seeds Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 61: Africa Chia Seeds Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 62: Africa Chia Seeds Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 63: Africa Chia Seeds Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 64: Africa Chia Seeds Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 65: Africa Chia Seeds Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 66: Africa Chia Seeds Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 67: Africa Chia Seeds Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 68: Africa Chia Seeds Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 69: Africa Chia Seeds Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 70: Africa Chia Seeds Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 71: Africa Chia Seeds Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Africa Chia Seeds Industry Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Chia Seeds Industry?

The projected CAGR is approximately 2.10%.

2. Which companies are prominent players in the Africa Chia Seeds Industry?

Key companies in the market include Zambian Seed Company, Africa Chia Seeds , Chia Seed Farms of Zambia.

3. What are the main segments of the Africa Chia Seeds Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives.

6. What are the notable trends driving market growth?

Increasing Demand for Protein-based Vegan Food.

7. Are there any restraints impacting market growth?

Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Chia Seeds Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Chia Seeds Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Chia Seeds Industry?

To stay informed about further developments, trends, and reports in the Africa Chia Seeds Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence