Key Insights

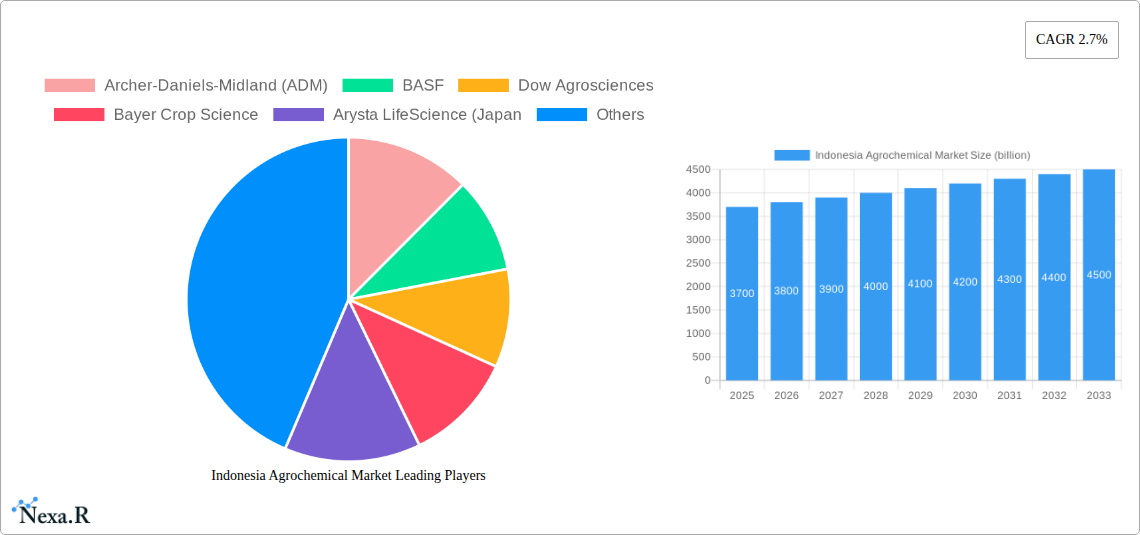

The Indonesian agrochemical market is poised for steady growth, estimated at USD 3.7 billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of 2.7% through 2033. This growth is underpinned by increasing agricultural productivity demands, driven by a burgeoning population and a strategic focus on food security. Key drivers include the adoption of advanced farming techniques, the need to combat evolving pest and disease challenges, and supportive government initiatives aimed at modernizing the agricultural sector. The market is experiencing a significant trend towards more sustainable and environmentally friendly agrochemical solutions, including biopesticides and precision agriculture technologies. This shift is a response to growing consumer awareness regarding food safety and environmental impact, compelling manufacturers to invest in research and development of eco-conscious products. The expansion of cultivated land for key crops and the ongoing efforts to enhance crop yields per hectare further bolster demand for a range of agrochemical products.

Indonesia Agrochemical Market Market Size (In Billion)

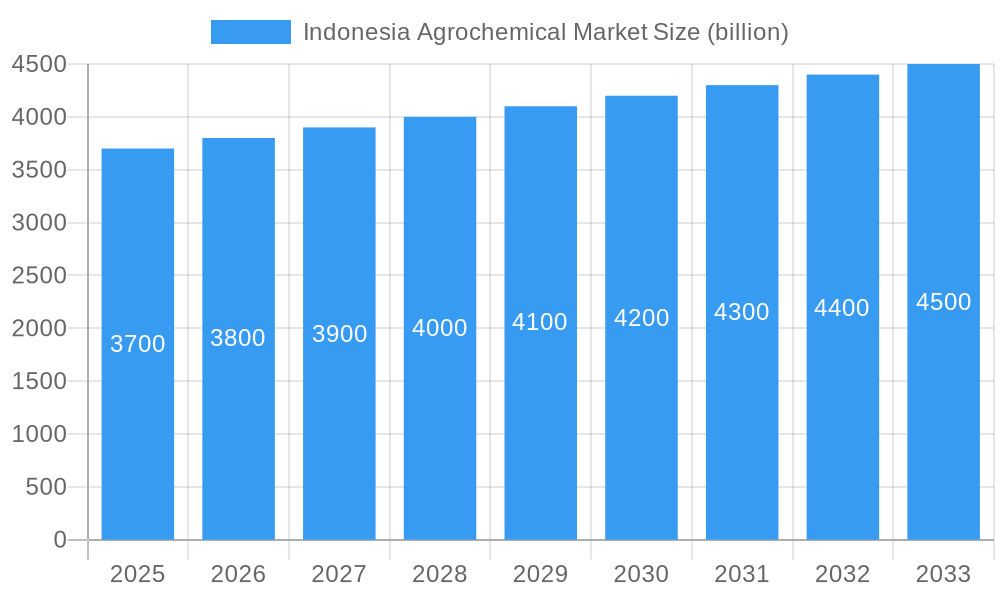

Despite the positive outlook, the market faces certain restraints, primarily revolving around the increasing cost of raw materials and the fluctuating prices of finished agrochemical products, which can impact farmer affordability. Regulatory hurdles and the need for stringent compliance with environmental and health standards also present challenges for market players. However, the dynamic nature of the Indonesian agricultural landscape, characterized by a diverse range of crops and regional farming practices, offers significant opportunities. Major companies like Archer-Daniels-Midland (ADM), BASF, Bayer Crop Science, and Syngenta AG are actively engaged in this market, offering a comprehensive portfolio of herbicides, insecticides, fungicides, and fertilizers. Production and consumption analyses reveal a robust demand across various segments, with import and export activities playing a crucial role in meeting domestic needs and accessing international markets. The price trend analysis indicates a general upward trajectory, influenced by input costs and market demand.

Indonesia Agrochemical Market Company Market Share

This in-depth report provides a definitive analysis of the Indonesia agrochemical market, exploring its current landscape and future trajectory. With a detailed study period from 2019 to 2033, including a base and estimated year of 2025, and a forecast period of 2025–2033, this report offers unparalleled insights into market dynamics, growth trends, and key players. Dive into granular data on production analysis, consumption analysis, import market analysis (value & volume), export market analysis (value & volume), and price trend analysis, all presented with values in billions of units for clarity.

Indonesia Agrochemical Market Market Dynamics & Structure

The Indonesian agrochemical market is characterized by a moderate concentration of key players, with a continuous drive towards technological innovation to enhance crop yields and sustainability. Regulatory frameworks, while evolving, play a crucial role in shaping market access and product approval processes for pesticides, herbicides, fungicides, and fertilizers. The presence of competitive product substitutes, including organic farming solutions and integrated pest management (IPM) strategies, necessitates ongoing innovation from agrochemical manufacturers. End-user demographics are primarily driven by the vast smallholder farmer base and large-scale plantation operations, influencing product demand and application methods. Mergers and acquisitions (M&A) are a notable trend, with companies strategically consolidating to expand their product portfolios and market reach.

- Market Concentration: Dominated by a few global giants and significant domestic producers, leading to a competitive yet consolidated landscape.

- Technological Innovation Drivers: Focus on precision agriculture, biopesticides, and eco-friendly formulations to address environmental concerns and improve efficacy.

- Regulatory Frameworks: Strict adherence to national and international standards for product safety, efficacy, and environmental impact.

- Competitive Product Substitutes: Growing adoption of biological controls and sustainable farming practices presents both a challenge and an opportunity for innovation.

- End-User Demographics: Diverse user base ranging from individual farmers to large agribusinesses, requiring tailored product solutions and support.

- M&A Trends: Strategic acquisitions and partnerships aimed at acquiring new technologies, expanding distribution networks, and gaining market share.

Indonesia Agrochemical Market Growth Trends & Insights

The Indonesia agrochemical market is projected to experience robust growth, driven by increasing demand for food security, rising agricultural productivity, and the adoption of advanced farming techniques. The market size is expected to evolve significantly, with adoption rates of modern agrochemicals steadily climbing across various crop segments. Technological disruptions, such as the development of advanced formulations and digital farming solutions, are poised to reshape the industry. Consumer behavior shifts, influenced by growing awareness of sustainable agriculture and food safety, are pushing manufacturers towards greener and more efficient product offerings. The overall CAGR is anticipated to reflect a dynamic expansion, with market penetration deepening as farmers embrace innovative solutions.

XXX is instrumental in delivering a comprehensive analysis of these evolving trends, highlighting the impact of technological advancements and shifting consumer preferences on the overall market growth trajectory. The report details how innovations in crop protection and crop enhancement are directly influencing market penetration and overall agricultural output in Indonesia.

Dominant Regions, Countries, or Segments in Indonesia Agrochemical Market

Java emerges as the dominant region within the Indonesia agrochemical market, driven by its high agricultural density, advanced farming practices, and significant contribution to national food production. The consumption analysis in Java showcases a strong demand for a wide array of agrochemicals, including herbicides, insecticides, and fertilizers, to support its intensive farming operations. Economic policies promoting agricultural modernization and robust infrastructure further bolster its leading position.

- Production Analysis: While distributed across various islands, key production hubs for specific agrochemicals are strategically located based on raw material availability and industrial infrastructure.

- Consumption Analysis: Java leads due to its large and diverse agricultural land use, encompassing rice cultivation, horticulture, and commercial plantations. The parent market of agricultural inputs experiences its highest demand here.

- Import Market Analysis (Value & Volume): Significant imports cater to the demand for specialized agrochemicals not readily produced domestically. The child market of specific active ingredients and formulations shows strong import figures.

- Export Market Analysis (Value & Volume): Indonesia's agrochemical exports, though smaller than imports, focus on niche products and regional markets, contributing to its overall trade balance.

- Price Trend Analysis: Prices are influenced by global commodity prices, local currency fluctuations, and domestic supply-demand dynamics, with Java often setting regional price benchmarks.

Indonesia Agrochemical Market Product Landscape

The Indonesia agrochemical market is witnessing a surge in innovative product development, focusing on enhanced efficacy, environmental safety, and targeted applications. Advanced pesticides and herbicides with novel active ingredients are being introduced to combat resistant pests and weeds, while innovative fungicides offer broader spectrum disease control. The performance metrics are improving with products offering longer residual activity and reduced application rates. Unique selling propositions often lie in the development of biopesticides and seed treatments that align with sustainable agriculture principles. Technological advancements are leading to the creation of more user-friendly formulations, including water-dispersible granules (WDGs) and suspension concentrates (SCs), improving ease of application and safety for farmers.

Key Drivers, Barriers & Challenges in Indonesia Agrochemical Market

Key Drivers:

- Growing food demand: Increasing population and rising per capita income necessitate higher agricultural output, driving the need for effective crop protection and enhancement.

- Government support for agriculture: Initiatives promoting modern farming techniques and technological adoption create a favorable environment for agrochemical use.

- Technological advancements: Development of new, more effective, and environmentally friendly agrochemical products.

- Expansion of commercial agriculture: Growth in large-scale plantations for palm oil, rubber, and other export commodities fuels demand for specialized agrochemicals.

Barriers & Challenges:

- Regulatory complexities: Navigating stringent registration processes and evolving environmental regulations can be a significant hurdle for new product introductions.

- Counterfeit products: The prevalence of substandard and counterfeit agrochemicals undermines market integrity and farmer trust.

- Farmer education and awareness: Ensuring proper application techniques and understanding the benefits of integrated pest management requires continuous educational efforts.

- Supply chain disruptions: Logistical challenges in remote areas and dependence on imported raw materials can impact availability and cost.

- Environmental concerns: Increasing scrutiny over the environmental impact of agrochemicals drives demand for sustainable alternatives and stricter usage guidelines.

Emerging Opportunities in Indonesia Agrochemical Market

Emerging opportunities in the Indonesia agrochemical market lie in the growing demand for biological agrochemicals and bio-stimulants as sustainable alternatives. The untapped potential in smallholder farmer segments through accessible product packaging and localized advisory services presents a significant growth avenue. Innovative applications of drone technology for precise pesticide application and the development of digital farming platforms offering tailored agronomic advice are also promising areas. Furthermore, the increasing focus on resilience against climate change is creating opportunities for agrochemicals that enhance crop tolerance to drought and extreme weather conditions.

Growth Accelerators in the Indonesia Agrochemical Market Industry

Long-term growth in the Indonesia agrochemical market will be significantly accelerated by continued technological breakthroughs in product development, particularly in the realm of precision agriculture and biopesticides. Strategic partnerships between global manufacturers and local distributors are crucial for expanding market reach and ensuring product accessibility across the archipelago. Furthermore, aggressive market expansion strategies targeting underutilized agricultural regions and specific crop segments will unlock new growth frontiers. The increasing adoption of digital tools for farm management and data-driven decision-making will also act as a powerful catalyst for sustained growth.

Key Players Shaping the Indonesia Agrochemical Market Market

- Archer-Daniels-Midland (ADM)

- BASF

- Dow Agrosciences

- Bayer Crop Science

- Arysta LifeScience

- FMC Corporation

- Yara International

- PT Pupuk Iskandar Muda (PIM)

- Syngenta AG

- Corteva Agriscience

Notable Milestones in Indonesia Agrochemical Market Sector

- March 2022: Provivi and Syngenta Crop Protection commercialized the Nelvium, a new mating disruption solution, to effectively and more safely control detrimental pests in rice. While pheromones have been utilized in agriculture for more than 30 years as a pest control method, this will be the first time this innovation has been applied to rice in Indonesia.

- October 2021: BASF launched BASF Sahabat Planters, a new mobile app designed for plantation managers and staff to easily find solutions to common agronomic problems, access multimedia-based learning materials, weather prediction, and more efficiently deliver and document staff training and development required by relevant certification groups such as the Roundtable on Sustainable Palm Oil (RSPO) and Forest Stewardship Council (FSC).

In-Depth Indonesia Agrochemical Market Market Outlook

The Indonesia agrochemical market is poised for sustained growth, fueled by a confluence of factors including robust agricultural demand and increasing adoption of advanced farming technologies. Strategic investments in research and development, particularly in sustainable agrochemical solutions and precision agriculture tools, will be pivotal. Expansion into niche markets and the development of tailored solutions for diverse crop types and regional conditions will further solidify growth. The market outlook suggests a dynamic environment where innovation, strategic partnerships, and a commitment to sustainability will drive future success, presenting significant opportunities for stakeholders.

Indonesia Agrochemical Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Indonesia Agrochemical Market Segmentation By Geography

- 1. Indonesia

Indonesia Agrochemical Market Regional Market Share

Geographic Coverage of Indonesia Agrochemical Market

Indonesia Agrochemical Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns

- 3.3. Market Restrains

- 3.3.1. High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 3.4. Market Trends

- 3.4.1. The Need for Increased Land Productivity is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Agrochemical Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Archer-Daniels-Midland (ADM)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BASF

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dow Agrosciences

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bayer Crop Science

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Arysta LifeScience (Japan

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FMC Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yara International

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Pupuk Iskandar Muda (PIM)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Syngenta AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Corteva Agriscience

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Archer-Daniels-Midland (ADM)

List of Figures

- Figure 1: Indonesia Agrochemical Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Indonesia Agrochemical Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Agrochemical Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Indonesia Agrochemical Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Indonesia Agrochemical Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Indonesia Agrochemical Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Indonesia Agrochemical Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Indonesia Agrochemical Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Indonesia Agrochemical Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Indonesia Agrochemical Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Indonesia Agrochemical Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Indonesia Agrochemical Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Indonesia Agrochemical Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Indonesia Agrochemical Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Agrochemical Market?

The projected CAGR is approximately 2.7%.

2. Which companies are prominent players in the Indonesia Agrochemical Market?

Key companies in the market include Archer-Daniels-Midland (ADM), BASF, Dow Agrosciences, Bayer Crop Science, Arysta LifeScience (Japan, FMC Corporation, Yara International, PT Pupuk Iskandar Muda (PIM), Syngenta AG, Corteva Agriscience.

3. What are the main segments of the Indonesia Agrochemical Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns.

6. What are the notable trends driving market growth?

The Need for Increased Land Productivity is Driving the Market.

7. Are there any restraints impacting market growth?

High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants.

8. Can you provide examples of recent developments in the market?

March 2022: Provivi and Syngenta Crop Protection commercialized the Nelvium, a new mating disruption solution, to effectively and more safely control detrimental pests in rice. While pheromones have been utilized in agriculture for more than 30 years as a pest control method, this will be the first time this innovation has been applied to rice in Indonesia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Agrochemical Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Agrochemical Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Agrochemical Market?

To stay informed about further developments, trends, and reports in the Indonesia Agrochemical Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence