Key Insights

The European micronutrient fertilizer market is set for substantial growth, with an estimated market size of $0.71 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 7.1%. This expansion is driven by heightened farmer awareness of micronutrients' crucial role in boosting crop yield, quality, and resilience. The increasing need to address soil deficiencies, optimize nutrient absorption, and meet evolving crop nutritional demands in intensive farming fuels this demand. Moreover, a growing commitment to sustainable agriculture and minimizing environmental impact encourages the adoption of specialized micronutrient fertilizers for efficient nutrient utilization and reduced losses. Supportive regulatory frameworks for soil health and precision agriculture also contribute to market expansion.

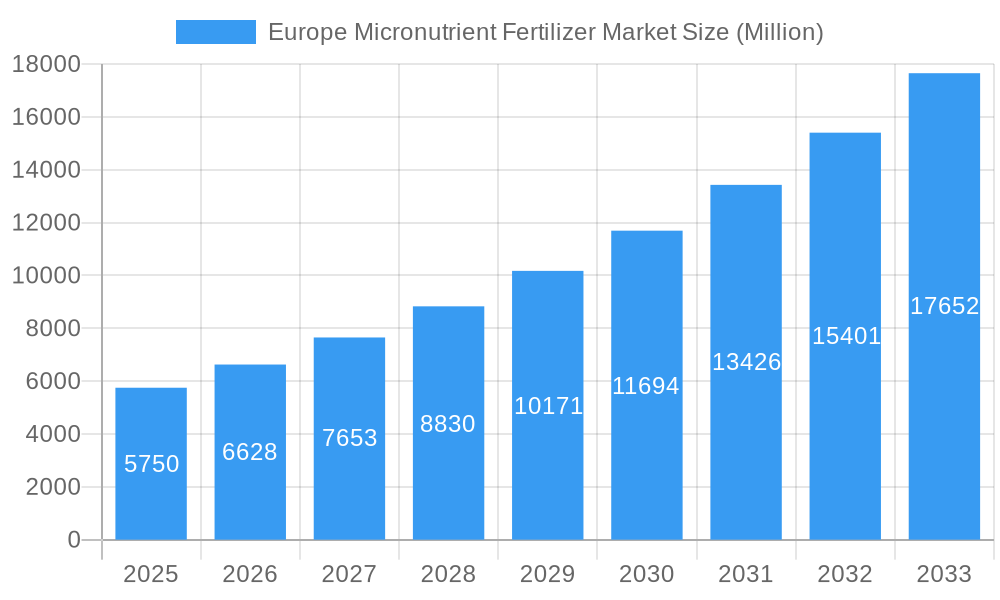

Europe Micronutrient Fertilizer Market Market Size (In Million)

Innovation and strategic collaborations define the European market landscape. Production trends highlight a focus on advanced micronutrient fertilizer formulations, such as chelated and complex types, for improved bioavailability and efficacy. Consumption is shifting towards targeted micronutrient application based on specific soil analyses and crop requirements across key European regions like the United Kingdom, Germany, France, and Spain. While strong growth drivers exist, potential challenges include volatile raw material costs and the necessity for enhanced farmer education on optimal micronutrient fertilizer usage. Nevertheless, prevailing trends in precision farming, organic agriculture, and the cultivation of high-value crops strongly support sustained market growth and innovation within the European micronutrient fertilizer sector.

Europe Micronutrient Fertilizer Market Company Market Share

Europe Micronutrient Fertilizer Market: Growth Drivers, Trends, and Competitive Landscape (2019-2033)

This comprehensive report delves into the dynamic Europe Micronutrient Fertilizer Market, offering an in-depth analysis of market drivers, segmentation, regional dominance, product innovations, and the competitive landscape. Covering a study period from 2019 to 2033, with a base and estimated year of 2025, this report provides critical insights for stakeholders seeking to understand and capitalize on the evolving demands for enhanced crop nutrition across Europe. We explore parent and child market dynamics, presenting all values in Million units.

Europe Micronutrient Fertilizer Market Market Dynamics & Structure

The Europe Micronutrient Fertilizer Market is characterized by a moderately concentrated structure, with key players like Yara International AS, Fertiberia, and COMPO EXPERT (now part of Grupa Azoty) holding significant market shares. Technological innovation is a primary driver, fueled by the demand for specialized and efficient micronutrient delivery systems that enhance crop yield and quality while minimizing environmental impact. Regulatory frameworks, including the EU's Fertilising Products Regulation (FPR), are shaping product development and market access, encouraging the adoption of safer and more sustainable fertilizer solutions. Competitive product substitutes include traditional macro-fertilizers, but the distinct benefits of micronutrients in addressing specific plant deficiencies create a strong market niche. End-user demographics are diverse, encompassing large-scale commercial farms, organic growers, and specialty crop producers, each with varying needs and purchasing behaviors. Mergers and acquisitions (M&A) are an ongoing trend, as evidenced by the August 2021 merger of COMPO EXPERT into Grupa Azoty, aimed at consolidating market position and expanding product portfolios.

- Market Concentration: Moderate, with a few dominant players.

- Technological Innovation: Focus on chelated micronutrients, nano-fertilizers, and bio-stimulant integrations.

- Regulatory Frameworks: EU Fertilising Products Regulation (FPR) driving compliance and innovation.

- Competitive Substitutes: Primarily macro-fertilizers, but niche demand for micronutrients remains strong.

- End-User Demographics: Commercial agriculture, organic farming, horticulture, and public green spaces.

- M&A Trends: Consolidation for market share and portfolio expansion.

Europe Micronutrient Fertilizer Market Growth Trends & Insights

The Europe Micronutrient Fertilizer Market is poised for robust growth, projected to expand significantly from its current standing. This expansion is driven by an increasing awareness among European farmers regarding the crucial role of micronutrients in optimizing crop health, resilience, and yield. Rising demand for high-value crops and the increasing adoption of precision agriculture techniques are further propelling market penetration. Technological disruptions, such as the development of slow-release and fortified micronutrient fertilizers, are enhancing their efficiency and reducing application frequency, appealing to a cost-conscious and environmentally aware farming community. Consumer behavior shifts towards sustainably produced food are indirectly influencing fertilizer choices, pushing for products that support healthier soil and reduced environmental footprint. The market size evolution is directly linked to increased crop production demands and the ongoing efforts to combat nutrient deficiencies in European soils, which can limit crop potential. The compound annual growth rate (CAGR) for the forecast period is estimated to be xx%, reflecting a sustained upward trajectory.

- Market Size Evolution: Significant growth driven by increased crop production demands and nutrient deficiency correction.

- Adoption Rates: Steadily increasing across various agricultural segments due to improved awareness and efficacy.

- Technological Disruptions: Innovations in slow-release and fortified micronutrient formulations.

- Consumer Behavior Shifts: Indirect influence through demand for sustainably produced food.

- Market Penetration: Growing as farmers recognize the ROI of micronutrient application.

- CAGR (2025-2033): xx% (predicted)

Dominant Regions, Countries, or Segments in Europe Micronutrient Fertilizer Market

Within the Europe Micronutrient Fertilizer Market, Western Europe consistently emerges as the dominant region, driven by advanced agricultural practices, strong economic policies supporting innovation, and well-established infrastructure for fertilizer distribution and application. Countries like Germany, France, the Netherlands, and the United Kingdom are at the forefront of micronutrient fertilizer adoption.

Production Analysis: Production is concentrated in countries with strong chemical manufacturing bases and access to raw materials, notably Germany and Spain. These nations leverage advanced production technologies to meet the growing demand for a wide array of micronutrient fertilizers.

Consumption Analysis: The consumption analysis highlights France and Germany as leading consumers, owing to their large agricultural sectors and high adoption rates of advanced farming techniques. Intensive farming practices aimed at maximizing yield for both domestic consumption and export contribute to this demand.

Import Market Analysis (Value & Volume): The import market is significant, with countries lacking extensive domestic production capacity relying on imports. The Netherlands and Belgium play a crucial role as import hubs and re-exporters, facilitating the flow of micronutrient fertilizers across the continent. Key imports include chelated micronutrients and specialty formulations, valued at approximately $XXX Million and with a volume of xx Million tonnes in 2025.

Export Market Analysis (Value & Volume): Major European producers like Spain and Germany are also significant exporters, supplying micronutrient fertilizers to non-EU markets and within Europe. Exports of key micronutrients, such as iron, zinc, and manganese, are estimated at $XXX Million and xx Million tonnes in 2025.

Price Trend Analysis: Price trends are influenced by raw material costs, energy prices, regulatory compliance, and the competitive landscape. Chelated micronutrients typically command a premium over their inorganic counterparts due to their superior bioavailability and efficacy.

Key Drivers of Dominance:

- Economic Policies: Government subsidies and incentives for sustainable agriculture.

- Infrastructure: Well-developed logistics and distribution networks.

- Technological Adoption: High uptake of precision farming and smart agriculture technologies.

- Agricultural Intensity: Focus on maximizing yield and crop quality.

- Market Share: Western European countries hold the largest market share due to advanced agricultural economies.

- Growth Potential: Continued growth expected due to ongoing agricultural modernization and environmental regulations.

Europe Micronutrient Fertilizer Market Product Landscape

The product landscape of the Europe Micronutrient Fertilizer Market is characterized by a surge in innovative formulations designed for enhanced efficacy and environmental sustainability. Chelated micronutrients, such as EDTA, DTPA, and EDDHA chelates of iron, zinc, manganese, and copper, remain pivotal due to their superior solubility and plant uptake, especially in challenging soil conditions like alkaline and calcareous soils. The market also witnesses the increasing development of nano-chelated micronutrients, offering improved bioavailability and reduced application rates. Bio-stimulant integrated micronutrient fertilizers are gaining traction, combining essential nutrients with organic compounds to boost plant metabolism and stress tolerance. The progressive biodegradability of products, like Tradecorp's IsliFe 8.2, is a key unique selling proposition, appealing to environmentally conscious farmers. Technological advancements are focused on creating customized blends tailored to specific crop needs and soil types, optimizing nutrient delivery and maximizing crop performance.

Key Drivers, Barriers & Challenges in Europe Micronutrient Fertilizer Market

Key Drivers:

- Increasing demand for higher crop yields and quality: Essential for meeting growing food security needs.

- Growing awareness of micronutrient deficiencies: Farmers recognize the impact on plant health and productivity.

- Advancements in fertilizer technology: Development of more efficient and bioavailable formulations.

- Stringent environmental regulations: Promoting the use of specialized fertilizers with reduced environmental impact.

- Growth of organic and sustainable agriculture: Driving demand for micronutrient inputs in these sectors.

Key Barriers & Challenges:

- High cost of specialized micronutrient fertilizers: Can be a deterrent for smaller farms.

- Lack of farmer education and awareness: In some regions, understanding the benefits of micronutrients is still developing.

- Complex regulatory landscape: Navigating diverse regulations across different European countries can be challenging.

- Supply chain disruptions: Global events can impact the availability and cost of raw materials.

- Competitive pressure from generic alternatives: While less effective, they can pose a price challenge.

- Soil variability and micronutrient interactions: Ensuring correct application and managing complex soil chemistry requires expertise.

Emerging Opportunities in Europe Micronutrient Fertilizer Market

Emerging opportunities in the Europe Micronutrient Fertilizer Market lie in the development and adoption of novel delivery systems and integrated nutrient management solutions. The increasing popularity of vertical farming and controlled environment agriculture presents a significant untapped market for highly precise and efficient micronutrient formulations. Furthermore, the growing demand for organic and residue-free produce is spurring innovation in bio-based micronutrient fertilizers and soil amendments. The integration of digital agriculture platforms and AI-driven soil analysis tools offers opportunities for personalized micronutrient recommendations, enhancing precision application and maximizing return on investment for farmers. The development of micronutrient fertilizers tailored for specific climate challenges, such as drought or salinity stress, will also open new avenues.

Growth Accelerators in the Europe Micronutrient Fertilizer Market Industry

Growth in the Europe Micronutrient Fertilizer Market is being significantly accelerated by ongoing technological breakthroughs in nutrient encapsulation and controlled-release mechanisms, ensuring sustained nutrient availability and minimizing losses. Strategic partnerships between fertilizer manufacturers and agricultural technology providers are creating synergistic ecosystems that deliver comprehensive crop nutrition solutions. Market expansion strategies focusing on emerging markets within Eastern Europe, where agricultural modernization is gaining momentum, represent another key accelerator. The increasing emphasis on soil health and regenerative agriculture practices is creating a sustained demand for micronutrient fertilizers that contribute to a balanced and thriving soil microbiome.

Key Players Shaping the Europe Micronutrient Fertilizer Market Market

- Verdesian Life Sciences

- Fertiberia

- AGLUKON Spezialduenger GmbH & Co

- Sociedad Quimica y Minera de Chile SA

- Kingenta Ecological Engineering Group Co Ltd

- Haifa Group Ltd

- Compo Expert GmbH

- Trade Corporation International

- Yara International AS

- Valagro

Notable Milestones in Europe Micronutrient Fertilizer Market Sector

- August 2021: COMPO EXPERT got merged into Grupa Azoty, a largest nitrogen fertilizer manufacturing company in Europe, to develop their business.

- February 2020: Valagro announced Yaxe®, a joint venture with e-Novia, the Enterprises Factory based in Milan, Italy. The new venture is focused on innovative digital solutions in agriculture to help optimize crop inputs and resources at the farm level.

- July 2019: Tradecorp released highly efficient iron chelate with progressive biodegradability IsliFe 8.2, a new solution to identify and correct iron deficiencies even under unfavourable conditions such as calcareous and alkaline soils as well as extreme PH ranges.

In-Depth Europe Micronutrient Fertilizer Market Market Outlook

The future outlook for the Europe Micronutrient Fertilizer Market is exceptionally promising, fueled by a confluence of factors driving sustained growth. The increasing adoption of precision agriculture and digital farming technologies will enable more targeted and efficient application of micronutrients, maximizing their impact and minimizing waste. Continuous innovation in bio-fortification and the development of plant-specific nutrient formulations will cater to the evolving demands for healthier and more resilient crops. Furthermore, the growing emphasis on sustainable land management and soil health will solidify the indispensable role of micronutrient fertilizers in modern European agriculture. Strategic collaborations and market expansion into regions with developing agricultural sectors present significant opportunities for stakeholders to capitalize on the increasing global demand for enhanced crop nutrition.

Europe Micronutrient Fertilizer Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Micronutrient Fertilizer Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Micronutrient Fertilizer Market Regional Market Share

Geographic Coverage of Europe Micronutrient Fertilizer Market

Europe Micronutrient Fertilizer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Zinc is the largest segment by Product.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Micronutrient Fertilizer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Verdesian Life Sciences

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fertiberia

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AGLUKON Spezialduenger GmbH & Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sociedad Quimica y Minera de Chile SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kingenta Ecological Engineering Group Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Haifa Group Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Compo Expert GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trade Corporation International

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Yara International AS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Valagro

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Verdesian Life Sciences

List of Figures

- Figure 1: Europe Micronutrient Fertilizer Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Micronutrient Fertilizer Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Micronutrient Fertilizer Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Micronutrient Fertilizer Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Micronutrient Fertilizer Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Micronutrient Fertilizer Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Micronutrient Fertilizer Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Micronutrient Fertilizer Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Europe Micronutrient Fertilizer Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Micronutrient Fertilizer Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Micronutrient Fertilizer Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Micronutrient Fertilizer Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Micronutrient Fertilizer Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Micronutrient Fertilizer Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Micronutrient Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Micronutrient Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Europe Micronutrient Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Micronutrient Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Micronutrient Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Micronutrient Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Micronutrient Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Micronutrient Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Micronutrient Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Micronutrient Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Micronutrient Fertilizer Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Micronutrient Fertilizer Market?

The projected CAGR is approximately 7.1%.

2. Which companies are prominent players in the Europe Micronutrient Fertilizer Market?

Key companies in the market include Verdesian Life Sciences, Fertiberia, AGLUKON Spezialduenger GmbH & Co, Sociedad Quimica y Minera de Chile SA, Kingenta Ecological Engineering Group Co Ltd, Haifa Group Ltd, Compo Expert GmbH, Trade Corporation International, Yara International AS, Valagro.

3. What are the main segments of the Europe Micronutrient Fertilizer Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.71 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Zinc is the largest segment by Product..

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

August 2021: COMPO EXPERT got merged into Groupa Azoty a largest nitrogen fertilizer manufacturing company in europe to devolop their business.February 2020: Valagro, announced Yaxe®, a joint venture with e-Novia, the Enterprises Factory based in Milan, Italy. The new venture is focused on innovative digital solutions in agriculture to help optimize crop inputs and resources at the farm level.July 2019: Tradecorp released highly efficient iron chelate with progressive biodegradability IsliFe 8.2, a new solution to identify and correct iron deficiencies even under unfavourable conditions such as calcsreous and alkaline soils as well as extreeme PH ranges.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Micronutrient Fertilizer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Micronutrient Fertilizer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Micronutrient Fertilizer Market?

To stay informed about further developments, trends, and reports in the Europe Micronutrient Fertilizer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence