Key Insights

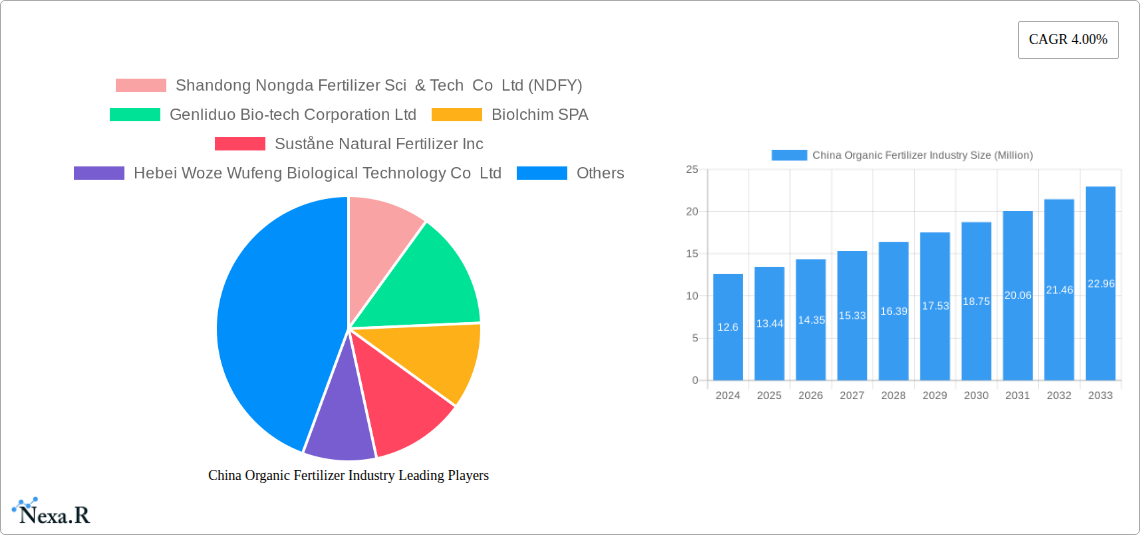

The China Organic Fertilizer Industry is poised for substantial expansion, with a projected market size of $12.6 million in 2024, driven by a robust Compound Annual Growth Rate (CAGR) of 6.7%. This growth trajectory is primarily fueled by increasing consumer demand for healthier food products and a heightened awareness of environmental sustainability. As China continues to prioritize ecological agriculture and reduce its reliance on chemical fertilizers, the organic fertilizer sector is witnessing a surge in innovation and adoption. The market is segmented into production, consumption, import, export, and price trends, all contributing to a dynamic landscape. Key drivers include government support for sustainable farming practices, the rising adoption of organic farming methods, and a growing preference for premium, chemical-free produce among the Chinese populace. Furthermore, advancements in bio-fertilizer technologies are expanding the product portfolio and enhancing the efficacy of organic alternatives, making them increasingly competitive against conventional options.

China Organic Fertilizer Industry Market Size (In Million)

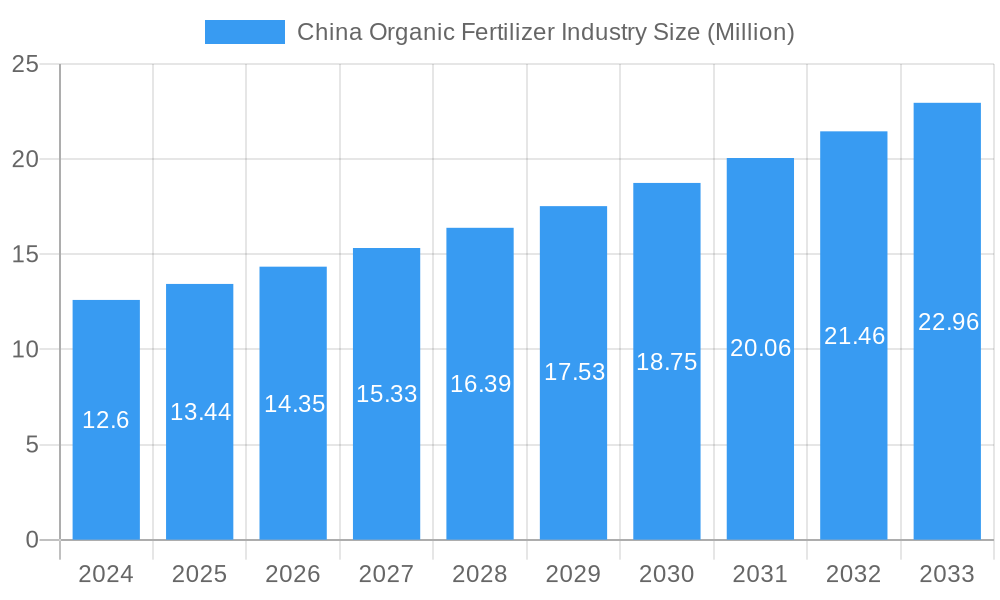

The industry's expansion is also characterized by significant import and export activities, reflecting global interest in China's agricultural output and the growing demand for specialized organic inputs. While the market benefits from strong drivers, potential restraints such as the higher initial cost of organic fertilizers compared to synthetic counterparts and the need for farmer education on optimal application techniques present challenges. However, the overarching trend towards a circular economy and a greater emphasis on soil health are expected to propel the market forward. Leading companies like Shandong Nongda Fertilizer Sci & Tech Co Ltd (NDFY), Genliduo Bio-tech Corporation Ltd, and Biolchim SPA are at the forefront of this growth, investing in research and development and expanding their production capacities to meet the escalating demand. The regional focus on China highlights its pivotal role as both a producer and consumer within this burgeoning market.

China Organic Fertilizer Industry Company Market Share

Report Title: China Organic Fertilizer Industry: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the China Organic Fertilizer Industry, a rapidly expanding sector driven by increasing agricultural sustainability demands, government support, and a growing consumer preference for organic produce. The study covers a significant period, from 2019 to 2033, with a detailed base year analysis for 2025 and a robust forecast period from 2025 to 2033. We explore both the parent and child market segments, providing granular insights for industry professionals, investors, and policymakers. All values are presented in million units for clear quantitative assessment.

China Organic Fertilizer Industry Market Dynamics & Structure

The China organic fertilizer market exhibits moderate to high concentration, with a few leading players dominating the landscape. Shandong Nongda Fertilizer Sci & Tech Co Ltd (NDFY) and Genliduo Bio-tech Corporation Ltd are prominent domestic manufacturers. International players like Biolchim SPA and Suståne Natural Fertilizer Inc. are also present, contributing to a competitive environment. Technological innovation is a key driver, with advancements in fermentation, microbial inoculants, and nutrient management technologies enhancing product efficacy and environmental friendliness. Regulatory frameworks, including government subsidies and certifications for organic products, are increasingly supportive, fostering market growth. Competitive product substitutes include synthetic fertilizers, though the environmental and health benefits of organic alternatives are gaining traction. End-user demographics are shifting, with a growing segment of environmentally conscious farmers and agricultural cooperatives actively seeking sustainable solutions. Mergers and acquisitions (M&A) are on the rise as larger companies consolidate their market position and acquire innovative technologies.

- Market Concentration: Dominated by key domestic and international players.

- Technological Innovation: Focus on microbial solutions, nutrient efficiency, and waste valorization.

- Regulatory Frameworks: Supportive government policies, organic certifications, and potential import/export regulations.

- Competitive Substitutes: Gradual shift from synthetic to organic fertilizers due to sustainability concerns.

- End-User Demographics: Increasing demand from large-scale agricultural operations and organic farming initiatives.

- M&A Trends: Consolidation and strategic acquisitions to enhance market reach and technological capabilities.

China Organic Fertilizer Industry Growth Trends & Insights

The China organic fertilizer industry is projected for substantial growth, driven by a confluence of factors that are reshaping agricultural practices and consumer preferences. The market size evolution is a testament to the increasing adoption rates of organic fertilizers, which have moved from niche applications to mainstream agricultural inputs. This transition is fueled by a growing awareness of soil health, environmental sustainability, and the desire to produce safer food products. Technological disruptions are playing a pivotal role, with innovations in bio-fertilizers, composted organic matter, and slow-release nutrient formulations enhancing the effectiveness and application of organic inputs. Consumer behavior shifts are profoundly impacting the industry, as demand for organic produce escalates, creating a direct pull for organic farming methods and, consequently, organic fertilizers. Government initiatives aimed at promoting sustainable agriculture and reducing chemical fertilizer usage are further accelerating this trend. The forecast period anticipates a Compound Annual Growth Rate (CAGR) of approximately 9.5% for the China organic fertilizer market, reaching an estimated market value of $15,800 million by 2033, up from an estimated $7,500 million in 2025. Market penetration is expected to rise from 25% in 2025 to over 40% by 2033, signifying a significant shift in agricultural input usage.

Dominant Regions, Countries, or Segments in China Organic Fertilizer Industry

The Production Analysis segment is experiencing dominance in regions with strong agricultural output and a well-established industrial base for fertilizer manufacturing. Shandong province, a major agricultural hub in China, is a leading region for organic fertilizer production, benefiting from access to raw materials and a large domestic market. The Consumption Analysis segment is also heavily influenced by agricultural intensity and the adoption of sustainable farming practices. Provinces like Jiangsu, Zhejiang, and Guangdong, with their high-value agriculture and increasing demand for premium organic produce, are significant consumption centers. The Import Market Analysis (Value & Volume) is relatively smaller but crucial for specialized organic inputs or research-driven formulations. While domestic production is robust, certain advanced microbial strains or specific organic nutrient sources might be imported. Key drivers for import growth include the need for advanced biological solutions and the expansion of organic farming in higher-value crop sectors. Conversely, the Export Market Analysis (Value & Volume) is steadily growing, particularly for cost-effective and basic organic fertilizer formulations to Southeast Asian and African markets, attracted by their developing agricultural sectors and demand for affordable soil enhancers. The Price Trend Analysis indicates a gradual upward trend for organic fertilizers, reflecting rising raw material costs, increased R&D investment, and the premium value associated with organic certification. However, price competitiveness remains a factor, especially when compared to heavily subsidized synthetic fertilizers. Market share within the production segment is estimated to be around 30% for the top three domestic players in 2025, with potential for further consolidation. The growth potential in consumption is particularly high in regions that are actively promoting green agriculture and eco-tourism, driven by a growing middle class that prioritizes healthy food options.

China Organic Fertilizer Industry Product Landscape

The China organic fertilizer product landscape is characterized by innovation in bio-fertilizers, including microbial inoculants and nutrient-solubilizing agents that enhance soil fertility and plant growth. Composted organic matter, derived from agricultural waste and animal manure, remains a foundational product. Emerging innovations focus on slow-release formulations, enhancing nutrient use efficiency and minimizing environmental runoff. The unique selling propositions lie in improved soil health, increased crop yields, and reduced reliance on synthetic chemicals. Technological advancements include the development of specific microbial strains tailored for different soil types and crops, as well as bio-pesticides integrated into organic fertilizer formulations. The estimated market value for these innovative products is projected to grow by 15% annually through the forecast period.

Key Drivers, Barriers & Challenges in China Organic Fertilizer Industry

The China organic fertilizer industry is propelled by several key drivers. Growing government support for sustainable agriculture, including subsidies and tax incentives, significantly boosts adoption. Increasing consumer demand for organic and residue-free food products creates a strong market pull. Environmental concerns regarding soil degradation and water pollution from synthetic fertilizers are pushing farmers towards organic alternatives. Technological advancements in bio-fertilizers and composting further enhance product efficacy.

However, the industry faces several barriers and challenges. The higher initial cost of organic fertilizers compared to conventional synthetic options can be a deterrent for some farmers. Inconsistent product quality and efficacy due to variations in raw materials and production processes remain a concern. Inadequate farmer education and awareness regarding the benefits and proper application of organic fertilizers limit their widespread adoption. Supply chain complexities and logistical challenges in collecting and processing organic waste materials can also impede growth.

Emerging Opportunities in China Organic Fertilizer Industry

Emerging opportunities in the China organic fertilizer industry lie in the untapped potential of smart farming technologies, where precision application of organic fertilizers can be optimized. The development of customized organic fertilizer blends tailored to specific crop needs and soil conditions presents a significant niche. Furthermore, the growing interest in circular economy principles offers opportunities for greater valorization of agricultural and food processing waste into high-value organic fertilizers. Expansion into developing agricultural regions within China, as well as export markets with a rising demand for sustainable inputs, represents further growth potential. The increasing demand for organic inputs in horticulture and specialty crop cultivation also opens new avenues.

Growth Accelerators in the China Organic Fertilizer Industry Industry

Several catalysts are accelerating long-term growth in the China organic fertilizer industry. Technological breakthroughs in microbial fermentation and nutrient encapsulation are leading to more potent and efficient organic fertilizers. Strategic partnerships between fertilizer manufacturers, agricultural research institutions, and technology providers are fostering innovation and market penetration. Government initiatives focused on promoting soil health management and reducing chemical fertilizer usage are creating a favorable policy environment. Furthermore, the expansion of organic certification schemes and consumer awareness campaigns are reinforcing the value proposition of organic farming.

Key Players Shaping the China Organic Fertilizer Industry Market

- Shandong Nongda Fertilizer Sci & Tech Co Ltd (NDFY)

- Genliduo Bio-tech Corporation Ltd

- Biolchim SPA

- Suståne Natural Fertilizer Inc

- Hebei Woze Wufeng Biological Technology Co Ltd

- Binzhou Jingyang Biological Fertilizer Co Ltd

- Qingdao Future Group

Notable Milestones in China Organic Fertilizer Industry Sector

- 2019: Increased government focus on sustainable agriculture leading to new policy frameworks.

- 2020: Significant rise in consumer demand for organic food products post-pandemic, boosting organic fertilizer market.

- 2021: Launch of new microbial fertilizer technologies with enhanced nutrient utilization.

- 2022: Consolidation within the industry through strategic mergers and acquisitions.

- 2023: Expansion of organic certification programs, increasing market transparency.

- 2024: Growing investment in R&D for advanced composting and waste-to-fertilizer solutions.

In-Depth China Organic Fertilizer Industry Market Outlook

The China organic fertilizer industry is poised for sustained growth, driven by a strong foundation of supportive policies, evolving consumer preferences, and continuous technological innovation. The market outlook is exceptionally positive, with accelerating adoption rates and an increasing market share for organic alternatives. Growth accelerators, such as advancements in bio-fertilizer technology and strategic market expansions, are expected to further fuel this trajectory. Strategic opportunities lie in capitalizing on the growing demand for eco-friendly agricultural solutions, exploring untapped regional markets, and fostering stronger collaborations across the value chain to enhance product efficacy and accessibility. The industry's commitment to soil health and environmental sustainability positions it as a critical component of China's future agricultural landscape.

China Organic Fertilizer Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

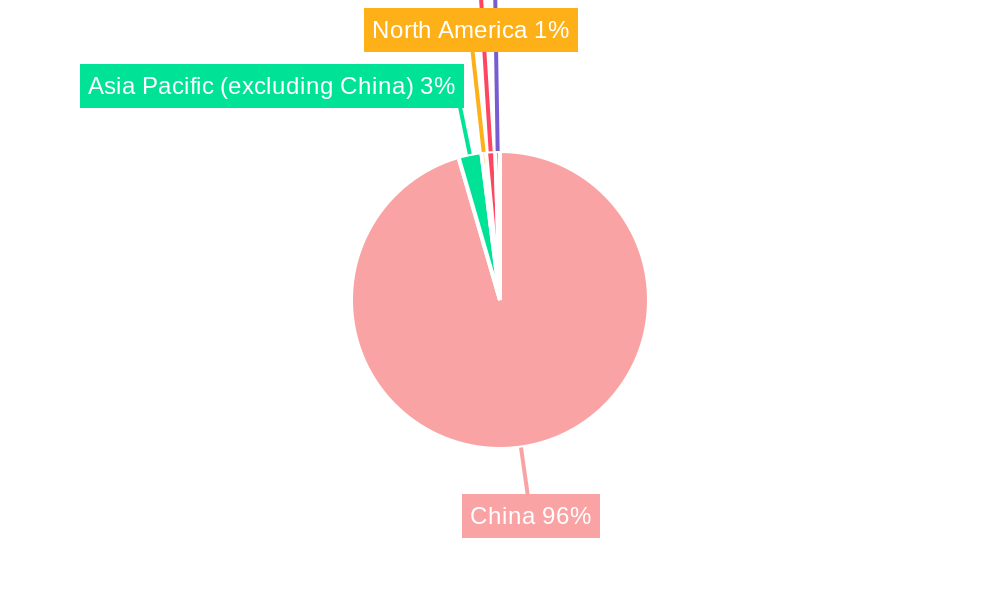

China Organic Fertilizer Industry Segmentation By Geography

- 1. China

China Organic Fertilizer Industry Regional Market Share

Geographic Coverage of China Organic Fertilizer Industry

China Organic Fertilizer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns

- 3.3. Market Restrains

- 3.3.1. High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 3.4. Market Trends

- 3.4.1. Increased Food Demand and Need for Increased Agricultural Food Productivity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Organic Fertilizer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shandong Nongda Fertilizer Sci & Tech Co Ltd (NDFY)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Genliduo Bio-tech Corporation Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Biolchim SPA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Suståne Natural Fertilizer Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hebei Woze Wufeng Biological Technology Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Binzhou Jingyang Biological Fertilizer Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Qingdao Future Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Shandong Nongda Fertilizer Sci & Tech Co Ltd (NDFY)

List of Figures

- Figure 1: China Organic Fertilizer Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: China Organic Fertilizer Industry Share (%) by Company 2025

List of Tables

- Table 1: China Organic Fertilizer Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: China Organic Fertilizer Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: China Organic Fertilizer Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: China Organic Fertilizer Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: China Organic Fertilizer Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: China Organic Fertilizer Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: China Organic Fertilizer Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: China Organic Fertilizer Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: China Organic Fertilizer Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: China Organic Fertilizer Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: China Organic Fertilizer Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: China Organic Fertilizer Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Organic Fertilizer Industry?

The projected CAGR is approximately 13%.

2. Which companies are prominent players in the China Organic Fertilizer Industry?

Key companies in the market include Shandong Nongda Fertilizer Sci & Tech Co Ltd (NDFY), Genliduo Bio-tech Corporation Ltd, Biolchim SPA, Suståne Natural Fertilizer Inc, Hebei Woze Wufeng Biological Technology Co Ltd, Binzhou Jingyang Biological Fertilizer Co Ltd, Qingdao Future Group.

3. What are the main segments of the China Organic Fertilizer Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns.

6. What are the notable trends driving market growth?

Increased Food Demand and Need for Increased Agricultural Food Productivity.

7. Are there any restraints impacting market growth?

High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Organic Fertilizer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Organic Fertilizer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Organic Fertilizer Industry?

To stay informed about further developments, trends, and reports in the China Organic Fertilizer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence