Key Insights

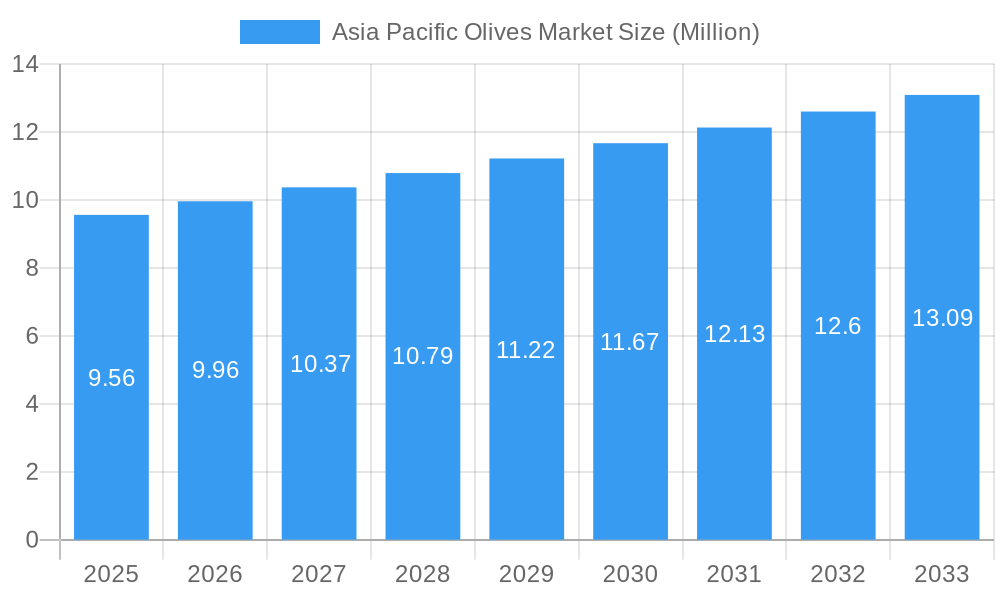

The Asia Pacific olives market is poised for robust growth, projected to reach USD 9.56 billion by 2025. This expansion is driven by an increasing consumer preference for healthy and natural food products, particularly in emerging economies like China and India. The rising awareness of the health benefits associated with olive oil, such as its rich antioxidant content and positive impact on cardiovascular health, is a significant catalyst. Furthermore, the growing adoption of Western culinary trends and the expansion of the food service industry are fueling demand for olives and olive oil across the region. We anticipate a Compound Annual Growth Rate (CAGR) of 4.20% over the forecast period, underscoring the market's sustained upward trajectory. Key segments including edible olives, olive oil for culinary use, and to a lesser extent, olive oil for cosmetic and pharmaceutical applications, will all contribute to this growth. The increasing disposable incomes in countries like Japan and Australia are also contributing to higher per capita consumption of premium food products, including olives.

Asia Pacific Olives Market Market Size (In Million)

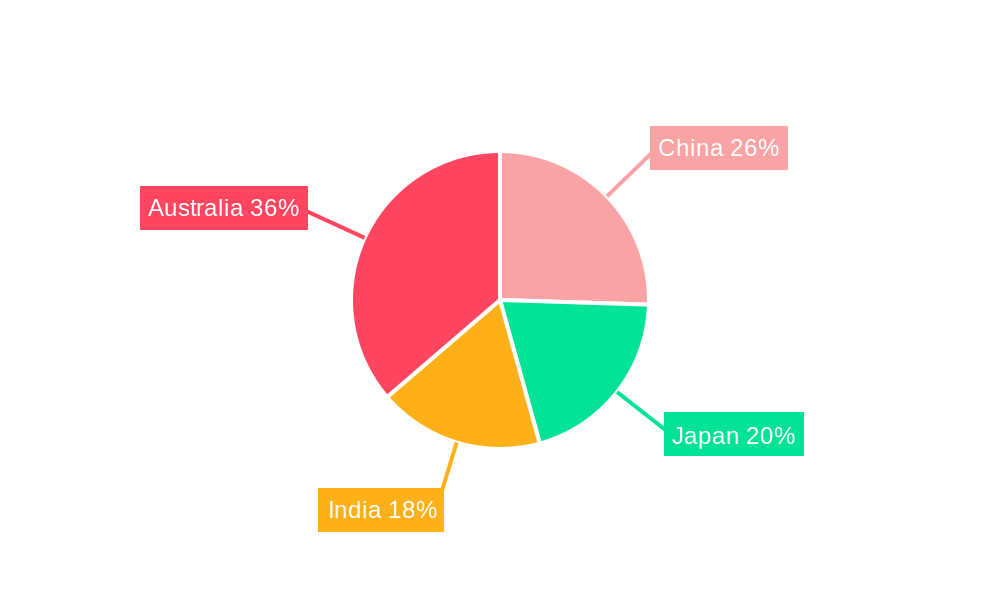

The market dynamics are characterized by a growing emphasis on premiumization and product innovation. Companies are focusing on introducing a wider range of olive oil varietals, flavored oils, and high-quality table olives to cater to evolving consumer tastes. Supply chain enhancements and strategic partnerships are crucial for companies operating in this space to ensure consistent availability and quality. While the market presents significant opportunities, challenges such as fluctuating raw material prices and intense competition from established global players need to be navigated. However, the strong underlying demand, coupled with supportive government initiatives promoting agricultural development and healthy eating, provides a favorable outlook. Australia is expected to maintain its position as a key producer and exporter, while China and India represent substantial untapped consumption markets with immense growth potential. The market is characterized by a blend of traditional agricultural practices and modern processing techniques, with a continuous drive towards sustainability and traceability.

Asia Pacific Olives Market Company Market Share

Asia Pacific Olives Market: Comprehensive Report Description

This report provides an in-depth analysis of the Asia Pacific Olives Market, covering production, consumption, trade, pricing, and industry developments from 2019 to 2033. With a base year of 2025 and a forecast period of 2025-2033, this study is an essential resource for industry professionals seeking to understand market dynamics, growth trends, and competitive landscapes. Leveraging high-traffic keywords such as "Asia Pacific olives," "olive oil market Asia," "table olives APAC," "olive production," "olive consumption," and "olive oil imports," this report ensures maximum search engine visibility and engagement. We dissect both parent and child markets, offering granular insights into specific product categories and regional variations. All quantitative values are presented in Million units for clarity and comparability.

Asia Pacific Olives Market Market Dynamics & Structure

The Asia Pacific olives market is characterized by a moderate to moderately concentrated market structure, with a few key global players establishing a significant presence alongside a growing number of regional and local producers. Technological innovation drivers are primarily focused on improving cultivation techniques, such as precision agriculture and advanced irrigation systems, to enhance yield and quality in diverse climatic conditions. Furthermore, innovations in olive oil extraction and processing technologies are crucial for meeting stringent quality standards and catering to premium segments. Regulatory frameworks, while varied across countries, are increasingly aligning with international food safety and quality standards, influencing production and trade practices. Competitive product substitutes, primarily other edible oils like sunflower oil, soybean oil, and coconut oil, pose a constant challenge, particularly in price-sensitive segments. End-user demographics are shifting, with a growing middle class and increasing health consciousness driving demand for extra virgin olive oil and other premium olive products. Mergers and acquisitions (M&A) trends are indicative of consolidation efforts and strategic expansion by larger entities to gain market share and access new distribution channels. For instance, the past five years have seen an estimated 3-5 significant M&A deals focused on acquiring established brands or expanding production capacities in key emerging markets within the region. Innovation barriers include the high initial investment required for modern olive cultivation and processing facilities, as well as complex and inconsistent regulatory approvals across different APAC nations.

Asia Pacific Olives Market Growth Trends & Insights

The Asia Pacific Olives Market is poised for robust growth, with a projected Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period of 2025-2033. This expansion is fueled by a confluence of evolving consumer preferences, increasing disposable incomes, and a growing awareness of the health benefits associated with olive oil and olives. Market size evolution indicates a significant upward trajectory, moving from an estimated USD 5,500 Million in 2025 to over USD 9,800 Million by 2033. Adoption rates for olive oil, particularly extra virgin olive oil, are steadily increasing as consumers seek healthier alternatives to traditional cooking oils. This shift is further amplified by the rising popularity of Mediterranean and Western dietary patterns across the region. Technological disruptions are playing a pivotal role, with advancements in vertical farming and hydroponic cultivation showing promise for overcoming land constraints and optimizing water usage in olive production. Furthermore, the development of sophisticated cold-pressing techniques is enhancing the quality and flavor profiles of olive oils, catering to the discerning palates of APAC consumers. Consumer behavior shifts are evident in the growing demand for organic and sustainably sourced olive products, as well as a rising interest in specialty olive oils with distinct flavor profiles and origins. The market penetration of olive oil is still relatively low compared to Western markets, presenting substantial untapped potential for market expansion. The increasing penetration of e-commerce platforms is also facilitating wider accessibility to a diverse range of olive products, further stimulating consumption. The demand for table olives, both for direct consumption and culinary applications, is also on an upward trend, driven by the growing popularity of tapas culture and the incorporation of olives into various ethnic cuisines.

Dominant Regions, Countries, or Segments in Asia Pacific Olives Market

The Consumption Analysis: segment is currently the most dominant driver of growth in the Asia Pacific Olives Market, with China emerging as the leading country in terms of sheer volume and value. This dominance is propelled by several key drivers, including a burgeoning middle class with increasing disposable incomes and a growing awareness of the health benefits associated with olive oil consumption, particularly extra virgin olive oil. Furthermore, the rapidly expanding food service industry in China, encompassing restaurants and catering services, significantly contributes to the demand for olive oil as a cooking and finishing ingredient.

- Key Drivers in China's Consumption Dominance:

- Economic Policies: Favorable trade policies and reduced import tariffs on olive oil have made it more accessible to a wider consumer base.

- Infrastructure Development: Advanced logistics and cold chain infrastructure ensure the quality and freshness of imported olive oil reach consumers efficiently.

- Health Consciousness: A growing health-conscious population actively seeks out premium food products perceived as healthier, with olive oil fitting this criterion perfectly.

- Westernization of Diets: The increasing adoption of Western culinary practices and dietary habits naturally incorporates olive oil.

While China leads in consumption, the Import Market Analysis (Value & Volume) also highlights the significant role of countries like Japan and South Korea. These nations have a more mature understanding of olive oil and a higher per capita consumption, driving substantial import volumes of high-quality extra virgin olive oil. Their demand is characterized by a preference for premium and organic variants.

The Production Analysis: segment, while still nascent in comparison to traditional olive-producing regions globally, is witnessing nascent growth in countries like Australia. Australian producers are focusing on high-quality, niche markets, often exporting to other APAC countries. However, production volumes are not yet sufficient to meet regional demand, making imports crucial.

The Price Trend Analysis: is closely linked to global supply and demand dynamics, as well as currency fluctuations. Prices for premium extra virgin olive oil in the APAC region are generally higher than in Western markets due to import costs, shipping, and regional markups. However, as domestic production capabilities improve and competition intensifies, price stabilization and potential reductions are anticipated in the coming years.

The Export Market Analysis (Value & Volume): for olives and olive products originating within the APAC region is currently limited. Australia is the primary exporter, but its volumes are modest. The primary export flow is from traditional olive-producing countries like Spain, Italy, and Greece into the APAC market.

The overall dominance is thus concentrated in consumption, particularly driven by China's rapidly growing demand, supported by robust import volumes from countries with established olive oil cultures.

Asia Pacific Olives Market Product Landscape

The Asia Pacific Olives Market product landscape is evolving rapidly, with a strong emphasis on extra virgin olive oil (EVOO), driven by increasing consumer awareness of its health benefits and superior taste. Innovations are focused on enhancing product quality, including advanced extraction techniques like cold-pressing to preserve nutrients and flavor, and the development of organic and sustainably sourced options. Specialty olive oils, such as those infused with unique flavors or originating from specific appellations, are gaining traction. Performance metrics like acidity levels (below 0.8% for EVOO) and peroxide values are critical for quality assurance. Unique selling propositions often revolve around traceability, origin certification, and premium packaging. Technological advancements in shelf-life extension and tamper-evident packaging are also crucial for maintaining product integrity during transit and in diverse climatic conditions across the region.

Key Drivers, Barriers & Challenges in Asia Pacific Olives Market

Key Drivers: The Asia Pacific Olives Market is propelled by several key drivers. Increasing health consciousness among consumers, driven by the recognized health benefits of olive oil, is a primary catalyst. The growing disposable income and expanding middle class in emerging economies like China and India are enabling greater purchasing power for premium food products. The Westernization of dietary habits and the rising popularity of Mediterranean cuisine further stimulate demand. Technological advancements in cultivation and processing are improving yield and quality, making production more efficient.

Barriers & Challenges: Significant barriers and challenges hinder market growth. High import duties and complex trade regulations in some APAC countries increase costs and limit market access. Inadequate awareness and education about the quality and benefits of different grades of olive oil, especially in developing markets, can lead to consumer confusion. Price sensitivity among a large segment of the population makes it difficult to compete with cheaper vegetable oils. Climate change and water scarcity pose significant challenges to olive cultivation in certain regions. Supply chain inefficiencies and the need for cold chain logistics can impact product quality and increase costs. Furthermore, intense competition from established vegetable oil producers and the prevalence of adulterated or counterfeit olive oil products erode consumer trust. The predicted impact of these challenges could lead to a reduction in market share for lower-quality olive oils by 5-10% if quality control and consumer education initiatives are not adequately addressed.

Emerging Opportunities in Asia Pacific Olives Market

Emerging opportunities in the Asia Pacific Olives Market are vast and varied. Untapped markets in Southeast Asian countries like Vietnam and Indonesia represent significant growth potential as incomes rise and health awareness increases. Innovative applications beyond cooking, such as in the cosmetics and pharmaceutical industries for their antioxidant and moisturizing properties, offer new revenue streams. Evolving consumer preferences for functional foods and premium, health-oriented products present opportunities for specialized olive oil variants, including those fortified with vitamins or possessing specific functional attributes. The growth of the e-commerce sector provides a direct channel for producers to reach consumers, bypassing traditional distribution complexities. Furthermore, the development of olive-based functional beverages and food supplements catering to the growing wellness trend is a promising avenue.

Growth Accelerators in the Asia Pacific Olives Market Industry

Several growth accelerators are set to propel the Asia Pacific Olives Market forward. Technological breakthroughs in olive cultivation, such as climate-resilient varietals and precision farming techniques, will enhance production efficiency and sustainability, leading to an estimated 15% increase in yield per hectare in optimized regions over the next decade. Strategic partnerships between global olive producers and local distributors will facilitate market entry and expand distribution networks into previously inaccessible areas. Government initiatives promoting healthy eating and agricultural development, where present, can further stimulate demand and local production. The increasing adoption of digital marketing and e-commerce platforms will enable wider consumer reach and direct engagement, accelerating market penetration. Expansion into value-added products, such as marinated olives, olive-based spreads, and cosmetic ingredients, will diversify revenue streams and cater to evolving consumer demands.

Key Players Shaping the Asia Pacific Olives Market Market

- Grupo Ybarra

- NutraSource

- Olivado Olive Oil

- Aceites del Sur

- Deoleo

- High Country Olives

- Olive Pitto Group

- Sovena Group

- Cobram Estate Olives

- Sabina Olive Group

Notable Milestones in Asia Pacific Olives Market Sector

- 2019: Increased investment in Australian olive groves, signaling a commitment to higher quality production for regional export.

- 2020: Launch of new olive oil brands in China targeting the premium segment, indicating growing consumer sophistication.

- 2021: Several APAC countries reviewed and updated their food safety regulations to align with international olive oil standards.

- 2022: Significant growth in online sales of olive oil across major APAC markets, driven by e-commerce expansion.

- 2023: Introduction of novel olive oil extraction technologies in select APAC processing facilities, enhancing product quality and yield.

- 2024 (Estimated): Expansion of olive cultivation trials in non-traditional climates within the APAC region, exploring new production possibilities.

In-Depth Asia Pacific Olives Market Market Outlook

The Asia Pacific Olives Market is characterized by strong future potential, with growth accelerators pointing towards sustained expansion. Strategic opportunities lie in capitalizing on the burgeoning health and wellness trend through premium, organic, and functional olive oil offerings. Continued investment in production technology and agricultural innovation will be crucial for meeting rising demand and improving cost-competitiveness. Expanding distribution networks, particularly through e-commerce and partnerships with local food retailers, will be key to penetrating diverse consumer segments. The outlook suggests a market that will increasingly value quality, provenance, and health benefits, paving the way for significant growth in the coming years.

Asia Pacific Olives Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia Pacific Olives Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

Asia Pacific Olives Market Regional Market Share

Geographic Coverage of Asia Pacific Olives Market

Asia Pacific Olives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards

- 3.4. Market Trends

- 3.4.1. Middle East Countries are the Major Producer

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Olives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.6.2. Japan

- 5.6.3. India

- 5.6.4. Australia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. China Asia Pacific Olives Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Japan Asia Pacific Olives Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. India Asia Pacific Olives Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Australia Asia Pacific Olives Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Grupo Ybarra

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 NutraSource

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Olivado Olive Oil

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Aceites del Sur

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Deoleo

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 High Country Olives

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Olive Pitto Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Sovena Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Cobram Estate Olives

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Sabina Olive Group

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Grupo Ybarra

List of Figures

- Figure 1: Asia Pacific Olives Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Olives Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Olives Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Asia Pacific Olives Market Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 3: Asia Pacific Olives Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Asia Pacific Olives Market Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Asia Pacific Olives Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Asia Pacific Olives Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Asia Pacific Olives Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Asia Pacific Olives Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Asia Pacific Olives Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Asia Pacific Olives Market Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Asia Pacific Olives Market Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Asia Pacific Olives Market Volume Kiloton Forecast, by Region 2020 & 2033

- Table 13: Asia Pacific Olives Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: Asia Pacific Olives Market Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 15: Asia Pacific Olives Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Asia Pacific Olives Market Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Asia Pacific Olives Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Asia Pacific Olives Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Asia Pacific Olives Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Asia Pacific Olives Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Asia Pacific Olives Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Asia Pacific Olives Market Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Asia Pacific Olives Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Asia Pacific Olives Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 25: Asia Pacific Olives Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Asia Pacific Olives Market Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 27: Asia Pacific Olives Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 28: Asia Pacific Olives Market Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 29: Asia Pacific Olives Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 30: Asia Pacific Olives Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 31: Asia Pacific Olives Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 32: Asia Pacific Olives Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 33: Asia Pacific Olives Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 34: Asia Pacific Olives Market Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 35: Asia Pacific Olives Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Asia Pacific Olives Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 37: Asia Pacific Olives Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 38: Asia Pacific Olives Market Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 39: Asia Pacific Olives Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 40: Asia Pacific Olives Market Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 41: Asia Pacific Olives Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 42: Asia Pacific Olives Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Asia Pacific Olives Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Asia Pacific Olives Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 45: Asia Pacific Olives Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 46: Asia Pacific Olives Market Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 47: Asia Pacific Olives Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Asia Pacific Olives Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 49: Asia Pacific Olives Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 50: Asia Pacific Olives Market Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 51: Asia Pacific Olives Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 52: Asia Pacific Olives Market Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 53: Asia Pacific Olives Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 54: Asia Pacific Olives Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Asia Pacific Olives Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Asia Pacific Olives Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 57: Asia Pacific Olives Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 58: Asia Pacific Olives Market Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 59: Asia Pacific Olives Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Asia Pacific Olives Market Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Olives Market?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the Asia Pacific Olives Market?

Key companies in the market include Grupo Ybarra , NutraSource, Olivado Olive Oil , Aceites del Sur , Deoleo , High Country Olives, Olive Pitto Group , Sovena Group , Cobram Estate Olives , Sabina Olive Group .

3. What are the main segments of the Asia Pacific Olives Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives.

6. What are the notable trends driving market growth?

Middle East Countries are the Major Producer.

7. Are there any restraints impacting market growth?

Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Olives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Olives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Olives Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Olives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence