Key Insights

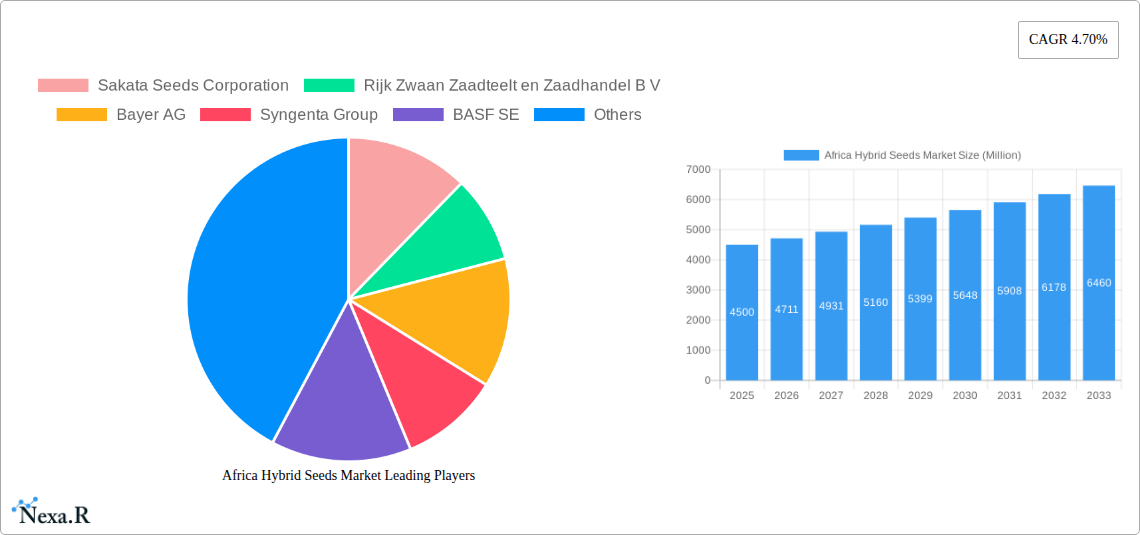

The African hybrid seeds market is poised for robust expansion, projected to reach a significant market size of approximately USD 4,500 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 4.70% through 2033. This growth is primarily fueled by increasing governmental focus on food security, the imperative to boost agricultural productivity across the continent, and the adoption of advanced farming techniques. The demand for higher yielding and climate-resilient seed varieties is paramount, driven by a growing population and the need to mitigate the impacts of unpredictable weather patterns. Furthermore, the increasing adoption of modern farming practices, including mechanization and improved irrigation systems, directly correlates with the uptake of hybrid seeds that are optimized for these conditions.

Africa Hybrid Seeds Market Market Size (In Billion)

Key growth drivers include advancements in breeding technologies, such as the development of herbicide-tolerant and insect-resistant hybrids, which offer farmers better crop protection and reduced input costs. The diversification of crop types, with a particular surge in demand for hybrid varieties of oilseeds, grains, cereals, and vegetables, is also contributing significantly to market expansion. While the market benefits from these tailwinds, certain restraints may include the initial cost of hybrid seeds for smallholder farmers and the need for robust extension services to educate farmers on their optimal use. Geographically, Africa, with its diverse agricultural landscape and specific regional needs, presents a dynamic market. Countries like Nigeria, South Africa, and Kenya are emerging as significant consumers, reflecting their substantial agricultural sectors and ongoing efforts to modernize farming.

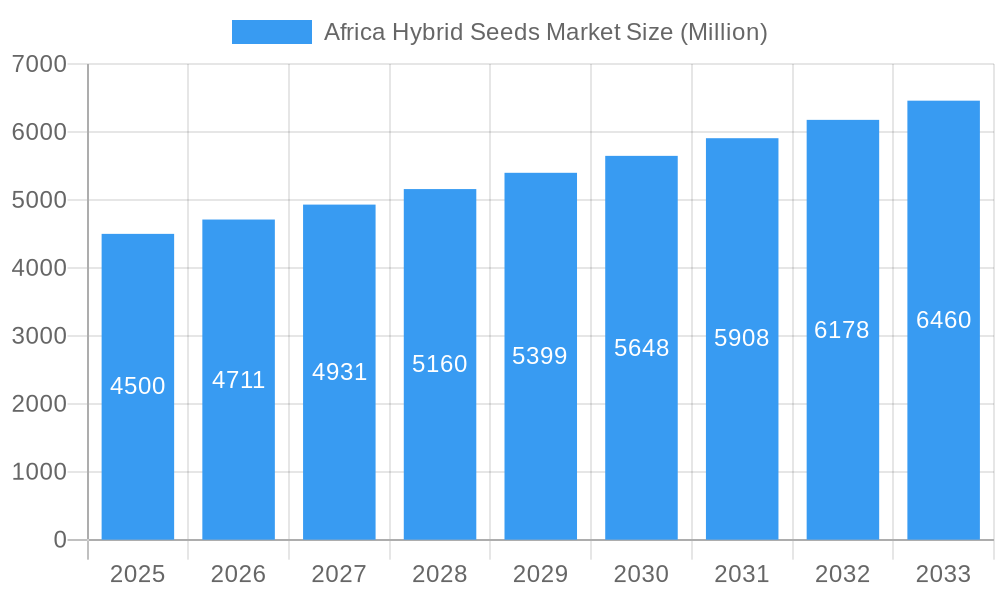

Africa Hybrid Seeds Market Company Market Share

This comprehensive report delves into the dynamic Africa Hybrid Seeds Market, a critical sector poised for significant expansion driven by the increasing demand for food security and enhanced agricultural productivity across the continent. The market analysis spans from 2019 to 2033, with a base year of 2025, offering detailed insights into historical trends, current market size, and future projections. We examine key market drivers, evolving breeding technologies, diverse crop applications, and the competitive landscape shaped by industry giants and emerging players. This report is an essential resource for stakeholders seeking to understand the opportunities and challenges within Africa's rapidly evolving agricultural seed sector, with all values presented in Million units.

Africa Hybrid Seeds Market Market Dynamics & Structure

The Africa Hybrid Seeds Market exhibits a moderately concentrated structure, with a few dominant players controlling a significant share of the market due to their extensive research and development capabilities and established distribution networks. Technological innovation remains a paramount driver, with continuous advancements in breeding technology, particularly in developing herbicide tolerant hybrids and insect resistant hybrids, significantly boosting crop yields and resilience. Regulatory frameworks across different African nations, while evolving, can present both opportunities and challenges, impacting seed registration, import/export, and intellectual property rights. Competitive product substitutes, primarily conventional open-pollinated varieties, are gradually being phased out as farmers recognize the superior performance of hybrids. End-user demographics are diverse, ranging from smallholder farmers to large commercial agricultural enterprises, each with distinct needs and adoption rates for hybrid seeds. Mergers and acquisitions (M&A) are a notable trend, with major companies strategically acquiring smaller entities to expand their product portfolios and geographical reach.

- Market Concentration: Dominated by key multinational corporations with strong R&D investments and established market presence.

- Technological Innovation: Driven by the development of advanced hybrids offering enhanced disease resistance, pest tolerance, and herbicide adaptability.

- Regulatory Landscape: Influenced by varying national agricultural policies and seed certification standards.

- Competitive Dynamics: Shift towards hybrid seeds over conventional varieties due to demonstrable yield advantages.

- M&A Activity: Strategic acquisitions aimed at consolidating market share and diversifying product offerings.

Africa Hybrid Seeds Market Growth Trends & Insights

The Africa Hybrid Seeds Market is on a robust growth trajectory, projected to expand at a significant Compound Annual Growth Rate (CAGR) of approximately xx% between 2025 and 2033. This expansion is fueled by a confluence of factors, including the growing African population, which necessitates increased food production to ensure food security, and the rising adoption rates of high-yielding hybrid seeds among farmers seeking to improve their livelihoods. Technological disruptions, such as advancements in marker-assisted selection and genomic sequencing, are accelerating the development of superior seed varieties tailored to diverse African agro-climatic conditions. Consumer behavior shifts are also playing a crucial role, with an increasing demand for staple crops and high-value vegetables, directly influencing the demand for specific hybrid seed types. The market penetration of hybrid seeds is steadily increasing, particularly in regions with more developed agricultural infrastructure and supportive government policies. The transition from traditional farming methods to modern agricultural practices, empowered by hybrid seed technology, is a defining trend. Early adoption by large-scale commercial farms is paving the way for broader acceptance among smallholder farmers, driven by demonstrations of improved yields and profitability. The investment in agricultural research and development by both public and private sectors is a key indicator of the market's positive outlook. Furthermore, the increasing availability of financing options and extension services aimed at promoting hybrid seed adoption is contributing to sustained market growth. The focus on climate-resilient crops, developed through hybrid breeding, is also gaining prominence, addressing the challenges posed by unpredictable weather patterns.

Dominant Regions, Countries, or Segments in Africa Hybrid Seeds Market

Within the Africa Hybrid Seeds Market, row crops emerge as the dominant segment, primarily driven by the widespread cultivation of grains & cereals, oilseeds, and fiber crops across the continent. Countries like Nigeria, South Africa, Kenya, and Ethiopia are leading the charge in hybrid seed adoption, bolstered by favorable government initiatives, significant agricultural land availability, and a growing farmer base increasingly aware of the benefits of hybrid technology.

Dominant Crop Type: Row Crops (Millions of Units)

- Grains & Cereals (XX Million Units): Staple crops like Maize (a significant portion of Forage Crops and Grains & Cereals are often grouped here in agricultural economics, and considering the prompt structure, we will interpret it to reflect this common agricultural grouping) and Rice form the backbone of food security and therefore see substantial investment in hybrid seed development and adoption.

- Oilseeds (XX Million Units): Soybean and sunflower cultivation is on the rise, driven by demand for edible oils and animal feed.

- Fiber Crops (XX Million Units): Cotton remains a vital cash crop in many African economies, with hybrid varieties offering improved fiber quality and yield.

Dominant Breeding Technology: Hybrids (XX Million Units)

- Non-Transgenic Hybrids (XX Million Units): The primary focus for many African markets, offering yield advantages without the complexities of GMO regulations in some regions.

- Herbicide Tolerant Hybrids (XX Million Units): Gaining traction for their ability to simplify weed management and reduce labor costs.

- Insect Resistant Hybrids (XX Million Units): Crucial for combating prevalent pests that significantly reduce crop yields.

Dominant Cultivation Mechanism: Open Field (XX Million Units)

- The vast majority of agricultural land in Africa is utilized for open-field cultivation, making it the largest segment by volume. While protected cultivation is growing, its market share remains considerably smaller.

Key Drivers of Dominance:

- Economic Policies: Supportive government policies, including subsidies for improved seeds and investment in agricultural research, are instrumental in driving adoption. For instance, initiatives aimed at boosting food production in countries like Nigeria have directly translated into increased demand for hybrid seeds.

- Infrastructure Development: Improvements in rural infrastructure, such as better road networks and access to agricultural extension services, facilitate the distribution and adoption of hybrid seeds.

- Growing Population & Food Demand: The rapidly expanding population across Africa necessitates a substantial increase in food production, making hybrid seeds a crucial tool for meeting this demand.

- Farmer Education & Awareness: Increased outreach programs and farmer field schools are educating farmers about the benefits of hybrid seeds, leading to higher uptake.

- Climate Change Adaptation: The development of hybrid varieties that are more resilient to drought, heat, and disease is becoming increasingly important, making them a preferred choice in the face of climate variability.

Africa Hybrid Seeds Market Product Landscape

The Africa Hybrid Seeds Market is characterized by a diverse product portfolio focused on delivering enhanced crop performance. Key innovations include the development of Non-Transgenic Hybrids that offer significant yield improvements and disease resistance, alongside specialized Herbicide Tolerant Hybrids and Insect Resistant Hybrids designed to address specific agronomic challenges. These seeds are crucial for a wide array of row crops, including high-yielding varieties of grains & cereals like rice and wheat, oilseeds such as soybean and sunflower, and essential fiber crops like cotton. In the vegetable segment, advancements have led to hybrid varieties of Solanaceae (tomato, chili) and Brassicas (cabbage, cauliflower) with improved shelf life, nutritional content, and disease resistance. Performance metrics such as increased yield potential, reduced input requirements (pesticides, herbicides), and enhanced resilience to environmental stresses are the unique selling propositions of these advanced hybrid seeds.

Key Drivers, Barriers & Challenges in Africa Hybrid Seeds Market

Key Drivers:

- Food Security Imperative: The urgent need to feed a growing population is the primary driver for increased adoption of high-yielding hybrid seeds.

- Government Support & Policies: National agricultural policies and investments in R&D and farmer education are crucial catalysts.

- Technological Advancements: Ongoing innovation in breeding techniques leads to superior seed varieties with enhanced traits.

- Increasing Farmer Awareness: Better understanding of the benefits of hybrid seeds is driving demand.

- Climate Change Resilience: Development of drought-tolerant and disease-resistant hybrids addresses environmental challenges.

Key Barriers & Challenges:

- High Seed Costs: The initial cost of hybrid seeds can be a barrier for smallholder farmers.

- Inadequate Distribution Networks: Reaching remote rural areas with quality seeds remains a challenge.

- Intellectual Property Rights Enforcement: Protecting hybrid seed technology from counterfeiting and unauthorized use.

- Limited Access to Credit: Farmers often struggle to secure financing for purchasing improved seed varieties.

- Pest and Disease Outbreaks: New or evolving pest and disease pressures can impact hybrid seed performance.

- Suboptimal Agronomic Practices: Lack of proper knowledge regarding planting density, fertilizer application, and pest management can limit the full potential of hybrid seeds.

Emerging Opportunities in Africa Hybrid Seeds Market

Emerging opportunities in the Africa Hybrid Seeds Market lie in the untapped potential of underutilized crops, such as indigenous vegetables and neglected pulses, for which hybrid varieties could significantly boost production and farmer income. The growing consumer demand for nutritionally enhanced seeds presents an avenue for developing bio-fortified hybrid varieties. Furthermore, the expansion of precision agriculture technologies integrated with hybrid seed offerings can unlock new efficiencies for farmers. The increasing focus on sustainable and climate-smart agriculture creates a demand for hybrid seeds that are not only high-yielding but also environmentally friendly. Strategic partnerships between seed companies, research institutions, and local farmer cooperatives are crucial for developing and disseminating tailored hybrid seed solutions for specific African agro-ecological zones.

Growth Accelerators in the Africa Hybrid Seeds Market Industry

Long-term growth in the Africa Hybrid Seeds Market will be significantly accelerated by breakthroughs in genetic engineering and biotechnology, enabling the development of even more resilient and productive seed varieties. Strategic partnerships and collaborations between multinational seed corporations and local African companies will foster knowledge transfer, build robust distribution channels, and ensure the development of seeds tailored to local needs. Market expansion strategies focused on reaching unserved rural populations through innovative delivery models and farmer financing schemes will be pivotal. Continued government investment in agricultural infrastructure, research, and extension services will create a more conducive environment for hybrid seed adoption and market growth.

Key Players Shaping the Africa Hybrid Seeds Market Market

- Sakata Seeds Corporation

- Rijk Zwaan Zaadteelt en Zaadhandel B V

- Bayer AG

- Syngenta Group

- BASF SE

- Groupe Limagrain

- Takii and Co Ltd

- Advanta Seeds - UPL

- Enza Zaden

- Corteva Agriscience

Notable Milestones in Africa Hybrid Seeds Market Sector

- July 2023: BASF expanded its Xitavo soybean seed portfolio with the addition of its 11 new high-yielding varieties for the 2024 growing season, featuring the Enlist E3 technology to combat difficult weeds.

- July 2023: Takii Seeds introduced a new variety of winter carrots called Fuyu Chiaki. These carrots are well-adapted to winter conditions and exhibit good cold resistance. Additionally, they can thrive in a wide range of soils, making them a versatile choice for farmers.

- July 2023: Enza Zaden introduced new lettuce varieties that exhibit high resistance to three new Bermian races, namely, Bl: 38EU, Bl: 39EU, and Bl: 40EU. The new lettuce varieties not only offer high resistance to these races but also have the capability to grow in various soil types while still achieving high yields.

In-Depth Africa Hybrid Seeds Market Market Outlook

The Africa Hybrid Seeds Market is poised for continued robust growth, driven by the pressing need for food security and enhanced agricultural productivity. Strategic investments in R&D will continue to yield advanced hybrid varieties, addressing challenges like climate change and pest resistance. The expansion of market reach through innovative distribution and farmer financing models will be crucial. Emerging opportunities in nutritionally enhanced seeds and precision agriculture integration promise further market diversification. The industry's outlook is highly positive, with a significant potential for hybrid seeds to revolutionize African agriculture and contribute substantially to economic development.

Africa Hybrid Seeds Market Segmentation

-

1. Breeding Technology

-

1.1. Hybrids

- 1.1.1. Non-Transgenic Hybrids

- 1.1.2. Herbicide Tolerant Hybrids

- 1.1.3. Insect Resistant Hybrids

- 1.2. Open Pollinated Varieties & Hybrid Derivatives

-

1.1. Hybrids

-

2. Cultivation Mechanism

- 2.1. Open Field

- 2.2. Protected Cultivation

-

3. Crop Type

-

3.1. Row Crops

-

3.1.1. Fiber Crops

- 3.1.1.1. Cotton

- 3.1.1.2. Other Fiber Crops

-

3.1.2. Forage Crops

- 3.1.2.1. Alfalfa

- 3.1.2.2. Forage Corn

- 3.1.2.3. Forage Sorghum

- 3.1.2.4. Other Forage Crops

-

3.1.3. Grains & Cereals

- 3.1.3.1. Rice

- 3.1.3.2. Wheat

- 3.1.3.3. Other Grains & Cereals

-

3.1.4. Oilseeds

- 3.1.4.1. Canola, Rapeseed & Mustard

- 3.1.4.2. Soybean

- 3.1.4.3. Sunflower

- 3.1.4.4. Other Oilseeds

- 3.1.5. Pulses

-

3.1.1. Fiber Crops

-

3.2. Vegetables

-

3.2.1. Brassicas

- 3.2.1.1. Cabbage

- 3.2.1.2. Carrot

- 3.2.1.3. Cauliflower & Broccoli

- 3.2.1.4. Other Brassicas

-

3.2.2. Cucurbits

- 3.2.2.1. Cucumber & Gherkin

- 3.2.2.2. Pumpkin & Squash

- 3.2.2.3. Other Cucurbits

-

3.2.3. Roots & Bulbs

- 3.2.3.1. Garlic

- 3.2.3.2. Onion

- 3.2.3.3. Potato

- 3.2.3.4. Other Roots & Bulbs

-

3.2.4. Solanaceae

- 3.2.4.1. Chilli

- 3.2.4.2. Eggplant

- 3.2.4.3. Tomato

- 3.2.4.4. Other Solanaceae

-

3.2.5. Unclassified Vegetables

- 3.2.5.1. Asparagus

- 3.2.5.2. Lettuce

- 3.2.5.3. Okra

- 3.2.5.4. Peas

- 3.2.5.5. Spinach

- 3.2.5.6. Other Unclassified Vegetables

-

3.2.1. Brassicas

-

3.1. Row Crops

-

4. Breeding Technology

-

4.1. Hybrids

- 4.1.1. Non-Transgenic Hybrids

- 4.1.2. Herbicide Tolerant Hybrids

- 4.1.3. Insect Resistant Hybrids

- 4.2. Open Pollinated Varieties & Hybrid Derivatives

-

4.1. Hybrids

-

5. Cultivation Mechanism

- 5.1. Open Field

- 5.2. Protected Cultivation

-

6. Crop Type

-

6.1. Row Crops

-

6.1.1. Fiber Crops

- 6.1.1.1. Cotton

- 6.1.1.2. Other Fiber Crops

-

6.1.2. Forage Crops

- 6.1.2.1. Alfalfa

- 6.1.2.2. Forage Corn

- 6.1.2.3. Forage Sorghum

- 6.1.2.4. Other Forage Crops

-

6.1.3. Grains & Cereals

- 6.1.3.1. Rice

- 6.1.3.2. Wheat

- 6.1.3.3. Other Grains & Cereals

-

6.1.4. Oilseeds

- 6.1.4.1. Canola, Rapeseed & Mustard

- 6.1.4.2. Soybean

- 6.1.4.3. Sunflower

- 6.1.4.4. Other Oilseeds

- 6.1.5. Pulses

-

6.1.1. Fiber Crops

-

6.2. Vegetables

-

6.2.1. Brassicas

- 6.2.1.1. Cabbage

- 6.2.1.2. Carrot

- 6.2.1.3. Cauliflower & Broccoli

- 6.2.1.4. Other Brassicas

-

6.2.2. Cucurbits

- 6.2.2.1. Cucumber & Gherkin

- 6.2.2.2. Pumpkin & Squash

- 6.2.2.3. Other Cucurbits

-

6.2.3. Roots & Bulbs

- 6.2.3.1. Garlic

- 6.2.3.2. Onion

- 6.2.3.3. Potato

- 6.2.3.4. Other Roots & Bulbs

-

6.2.4. Solanaceae

- 6.2.4.1. Chilli

- 6.2.4.2. Eggplant

- 6.2.4.3. Tomato

- 6.2.4.4. Other Solanaceae

-

6.2.5. Unclassified Vegetables

- 6.2.5.1. Asparagus

- 6.2.5.2. Lettuce

- 6.2.5.3. Okra

- 6.2.5.4. Peas

- 6.2.5.5. Spinach

- 6.2.5.6. Other Unclassified Vegetables

-

6.2.1. Brassicas

-

6.1. Row Crops

Africa Hybrid Seeds Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Hybrid Seeds Market Regional Market Share

Geographic Coverage of Africa Hybrid Seeds Market

Africa Hybrid Seeds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Hybrid Seeds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 5.1.1. Hybrids

- 5.1.1.1. Non-Transgenic Hybrids

- 5.1.1.2. Herbicide Tolerant Hybrids

- 5.1.1.3. Insect Resistant Hybrids

- 5.1.2. Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1. Hybrids

- 5.2. Market Analysis, Insights and Forecast - by Cultivation Mechanism

- 5.2.1. Open Field

- 5.2.2. Protected Cultivation

- 5.3. Market Analysis, Insights and Forecast - by Crop Type

- 5.3.1. Row Crops

- 5.3.1.1. Fiber Crops

- 5.3.1.1.1. Cotton

- 5.3.1.1.2. Other Fiber Crops

- 5.3.1.2. Forage Crops

- 5.3.1.2.1. Alfalfa

- 5.3.1.2.2. Forage Corn

- 5.3.1.2.3. Forage Sorghum

- 5.3.1.2.4. Other Forage Crops

- 5.3.1.3. Grains & Cereals

- 5.3.1.3.1. Rice

- 5.3.1.3.2. Wheat

- 5.3.1.3.3. Other Grains & Cereals

- 5.3.1.4. Oilseeds

- 5.3.1.4.1. Canola, Rapeseed & Mustard

- 5.3.1.4.2. Soybean

- 5.3.1.4.3. Sunflower

- 5.3.1.4.4. Other Oilseeds

- 5.3.1.5. Pulses

- 5.3.1.1. Fiber Crops

- 5.3.2. Vegetables

- 5.3.2.1. Brassicas

- 5.3.2.1.1. Cabbage

- 5.3.2.1.2. Carrot

- 5.3.2.1.3. Cauliflower & Broccoli

- 5.3.2.1.4. Other Brassicas

- 5.3.2.2. Cucurbits

- 5.3.2.2.1. Cucumber & Gherkin

- 5.3.2.2.2. Pumpkin & Squash

- 5.3.2.2.3. Other Cucurbits

- 5.3.2.3. Roots & Bulbs

- 5.3.2.3.1. Garlic

- 5.3.2.3.2. Onion

- 5.3.2.3.3. Potato

- 5.3.2.3.4. Other Roots & Bulbs

- 5.3.2.4. Solanaceae

- 5.3.2.4.1. Chilli

- 5.3.2.4.2. Eggplant

- 5.3.2.4.3. Tomato

- 5.3.2.4.4. Other Solanaceae

- 5.3.2.5. Unclassified Vegetables

- 5.3.2.5.1. Asparagus

- 5.3.2.5.2. Lettuce

- 5.3.2.5.3. Okra

- 5.3.2.5.4. Peas

- 5.3.2.5.5. Spinach

- 5.3.2.5.6. Other Unclassified Vegetables

- 5.3.2.1. Brassicas

- 5.3.1. Row Crops

- 5.4. Market Analysis, Insights and Forecast - by Breeding Technology

- 5.4.1. Hybrids

- 5.4.1.1. Non-Transgenic Hybrids

- 5.4.1.2. Herbicide Tolerant Hybrids

- 5.4.1.3. Insect Resistant Hybrids

- 5.4.2. Open Pollinated Varieties & Hybrid Derivatives

- 5.4.1. Hybrids

- 5.5. Market Analysis, Insights and Forecast - by Cultivation Mechanism

- 5.5.1. Open Field

- 5.5.2. Protected Cultivation

- 5.6. Market Analysis, Insights and Forecast - by Crop Type

- 5.6.1. Row Crops

- 5.6.1.1. Fiber Crops

- 5.6.1.1.1. Cotton

- 5.6.1.1.2. Other Fiber Crops

- 5.6.1.2. Forage Crops

- 5.6.1.2.1. Alfalfa

- 5.6.1.2.2. Forage Corn

- 5.6.1.2.3. Forage Sorghum

- 5.6.1.2.4. Other Forage Crops

- 5.6.1.3. Grains & Cereals

- 5.6.1.3.1. Rice

- 5.6.1.3.2. Wheat

- 5.6.1.3.3. Other Grains & Cereals

- 5.6.1.4. Oilseeds

- 5.6.1.4.1. Canola, Rapeseed & Mustard

- 5.6.1.4.2. Soybean

- 5.6.1.4.3. Sunflower

- 5.6.1.4.4. Other Oilseeds

- 5.6.1.5. Pulses

- 5.6.1.1. Fiber Crops

- 5.6.2. Vegetables

- 5.6.2.1. Brassicas

- 5.6.2.1.1. Cabbage

- 5.6.2.1.2. Carrot

- 5.6.2.1.3. Cauliflower & Broccoli

- 5.6.2.1.4. Other Brassicas

- 5.6.2.2. Cucurbits

- 5.6.2.2.1. Cucumber & Gherkin

- 5.6.2.2.2. Pumpkin & Squash

- 5.6.2.2.3. Other Cucurbits

- 5.6.2.3. Roots & Bulbs

- 5.6.2.3.1. Garlic

- 5.6.2.3.2. Onion

- 5.6.2.3.3. Potato

- 5.6.2.3.4. Other Roots & Bulbs

- 5.6.2.4. Solanaceae

- 5.6.2.4.1. Chilli

- 5.6.2.4.2. Eggplant

- 5.6.2.4.3. Tomato

- 5.6.2.4.4. Other Solanaceae

- 5.6.2.5. Unclassified Vegetables

- 5.6.2.5.1. Asparagus

- 5.6.2.5.2. Lettuce

- 5.6.2.5.3. Okra

- 5.6.2.5.4. Peas

- 5.6.2.5.5. Spinach

- 5.6.2.5.6. Other Unclassified Vegetables

- 5.6.2.1. Brassicas

- 5.6.1. Row Crops

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sakata Seeds Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rijk Zwaan Zaadteelt en Zaadhandel B V

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bayer AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Syngenta Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BASF SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Groupe Limagrain

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Takii and Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Advanta Seeds - UPL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Enza Zaden

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Corteva Agriscience

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sakata Seeds Corporation

List of Figures

- Figure 1: Africa Hybrid Seeds Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Africa Hybrid Seeds Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Hybrid Seeds Market Revenue undefined Forecast, by Breeding Technology 2020 & 2033

- Table 2: Africa Hybrid Seeds Market Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 3: Africa Hybrid Seeds Market Revenue undefined Forecast, by Cultivation Mechanism 2020 & 2033

- Table 4: Africa Hybrid Seeds Market Volume Kiloton Forecast, by Cultivation Mechanism 2020 & 2033

- Table 5: Africa Hybrid Seeds Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 6: Africa Hybrid Seeds Market Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 7: Africa Hybrid Seeds Market Revenue undefined Forecast, by Breeding Technology 2020 & 2033

- Table 8: Africa Hybrid Seeds Market Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 9: Africa Hybrid Seeds Market Revenue undefined Forecast, by Cultivation Mechanism 2020 & 2033

- Table 10: Africa Hybrid Seeds Market Volume Kiloton Forecast, by Cultivation Mechanism 2020 & 2033

- Table 11: Africa Hybrid Seeds Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 12: Africa Hybrid Seeds Market Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 13: Africa Hybrid Seeds Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 14: Africa Hybrid Seeds Market Volume Kiloton Forecast, by Region 2020 & 2033

- Table 15: Africa Hybrid Seeds Market Revenue undefined Forecast, by Breeding Technology 2020 & 2033

- Table 16: Africa Hybrid Seeds Market Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 17: Africa Hybrid Seeds Market Revenue undefined Forecast, by Cultivation Mechanism 2020 & 2033

- Table 18: Africa Hybrid Seeds Market Volume Kiloton Forecast, by Cultivation Mechanism 2020 & 2033

- Table 19: Africa Hybrid Seeds Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 20: Africa Hybrid Seeds Market Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 21: Africa Hybrid Seeds Market Revenue undefined Forecast, by Breeding Technology 2020 & 2033

- Table 22: Africa Hybrid Seeds Market Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 23: Africa Hybrid Seeds Market Revenue undefined Forecast, by Cultivation Mechanism 2020 & 2033

- Table 24: Africa Hybrid Seeds Market Volume Kiloton Forecast, by Cultivation Mechanism 2020 & 2033

- Table 25: Africa Hybrid Seeds Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 26: Africa Hybrid Seeds Market Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 27: Africa Hybrid Seeds Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Africa Hybrid Seeds Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 29: Nigeria Africa Hybrid Seeds Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Nigeria Africa Hybrid Seeds Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 31: South Africa Africa Hybrid Seeds Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: South Africa Africa Hybrid Seeds Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 33: Egypt Africa Hybrid Seeds Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Egypt Africa Hybrid Seeds Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 35: Kenya Africa Hybrid Seeds Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Kenya Africa Hybrid Seeds Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 37: Ethiopia Africa Hybrid Seeds Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Ethiopia Africa Hybrid Seeds Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 39: Morocco Africa Hybrid Seeds Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Morocco Africa Hybrid Seeds Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 41: Ghana Africa Hybrid Seeds Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Ghana Africa Hybrid Seeds Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 43: Algeria Africa Hybrid Seeds Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Algeria Africa Hybrid Seeds Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 45: Tanzania Africa Hybrid Seeds Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Tanzania Africa Hybrid Seeds Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 47: Ivory Coast Africa Hybrid Seeds Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Ivory Coast Africa Hybrid Seeds Market Volume (Kiloton) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Hybrid Seeds Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Africa Hybrid Seeds Market?

Key companies in the market include Sakata Seeds Corporation, Rijk Zwaan Zaadteelt en Zaadhandel B V, Bayer AG, Syngenta Group, BASF SE, Groupe Limagrain, Takii and Co Ltd, Advanta Seeds - UPL, Enza Zaden, Corteva Agriscience.

3. What are the main segments of the Africa Hybrid Seeds Market?

The market segments include Breeding Technology, Cultivation Mechanism, Crop Type, Breeding Technology, Cultivation Mechanism, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

July 2023: BASF expanded its Xitavo soybean seed portfolio with the addition of its 11 new high-yielding varieties for the 2024 growing season, featuring the Enlist E3 technology to combat difficult weeds.July 2023: Takii Seeds introduced a new variety of winter carrots called Fuyu Chiaki. These carrots are well-adapted to winter conditions and exhibit good cold resistance. Additionally, they can thrive in a wide range of soils, making them a versatile choice for farmers.July 2023: Enza Zaden introduced new lettuce varieties that exhibit high resistance to three new Bermian races, namely, Bl: 38EU, Bl: 39EU, and Bl: 40EU. The new lettuce varieties not only offer high resistance to these races but also have the capability to grow in various soil types while still achieving high yields.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Hybrid Seeds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Hybrid Seeds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Hybrid Seeds Market?

To stay informed about further developments, trends, and reports in the Africa Hybrid Seeds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence