Key Insights

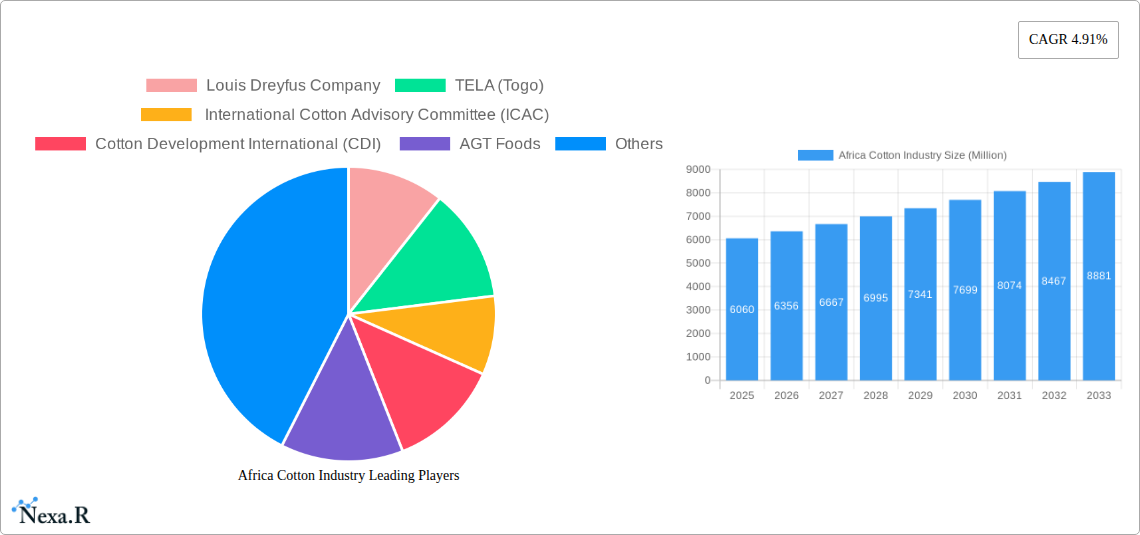

The African cotton industry is poised for significant expansion, with a current market size estimated at USD 6.06 billion. This robust growth is projected to continue at a Compound Annual Growth Rate (CAGR) of 4.91% over the forecast period of 2025-2033. This upward trajectory is primarily fueled by increasing global demand for cotton textiles, driven by a growing population and rising disposable incomes, particularly in emerging economies. Furthermore, advancements in agricultural technology, improved farming practices, and supportive government initiatives aimed at boosting cotton production in key African nations are acting as significant catalysts. The continent's favorable climate and abundant arable land offer a strong foundation for cotton cultivation, positioning Africa as a crucial player in the global cotton supply chain. Innovations in ginning and processing, coupled with a focus on sustainable and ethical sourcing, are also contributing to the industry's positive outlook.

Africa Cotton Industry Market Size (In Billion)

Despite the promising growth, the African cotton industry faces certain challenges. Price volatility in the global commodity market, coupled with unpredictable weather patterns and the impact of climate change, can affect production yields and profitability. Additionally, logistical hurdles, including inadequate infrastructure for transportation and storage, can increase operational costs and hinder market access. However, ongoing investments in infrastructure development, coupled with initiatives to enhance farmer training and access to modern farming inputs, are gradually mitigating these restraints. The industry is also witnessing a trend towards greater vertical integration, with companies investing in the entire value chain from seed to finished textile, aiming to enhance efficiency and capture more value. Key players such as Louis Dreyfus Company, Cargill, and Archer Daniels Midland Company (ADM) are actively involved in this dynamic market, further driving innovation and competition.

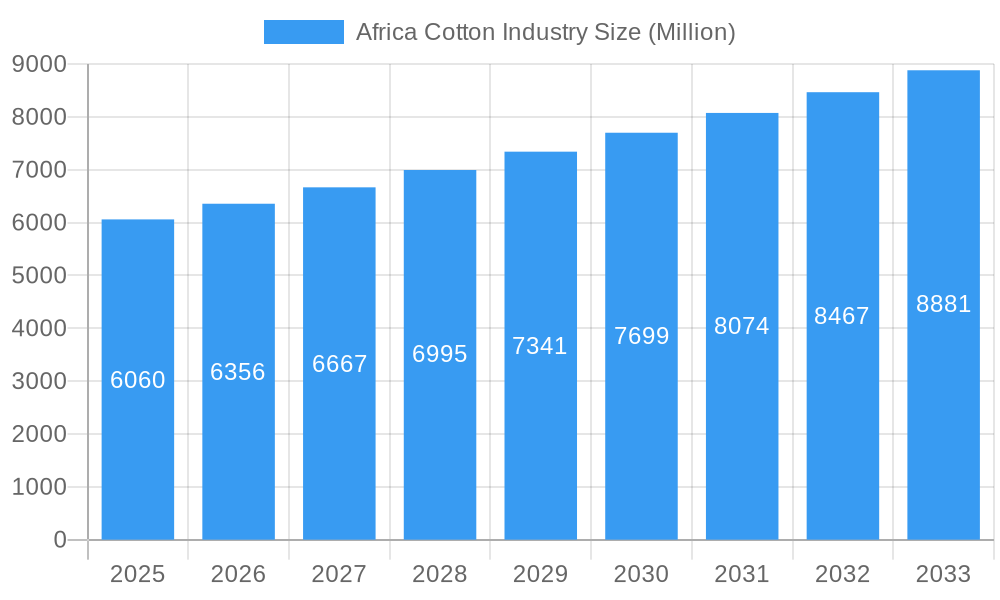

Africa Cotton Industry Company Market Share

This in-depth report provides a definitive analysis of the Africa Cotton Industry, offering critical insights into market dynamics, growth drivers, segmentation, and future potential. Leveraging high-traffic keywords such as "African cotton," "cotton production Africa," "cotton consumption Africa," "cotton exports Africa," and "sustainable cotton Africa," this report is optimized for maximum search engine visibility, catering to industry professionals, investors, and policymakers seeking to understand this vital sector. We dissect the parent and child market, providing a granular view of opportunities within the broader African cotton landscape, with all values presented in million units.

Africa Cotton Industry Market Dynamics & Structure

The Africa Cotton Industry is characterized by a moderately concentrated market, with several dominant players like Louis Dreyfus Company, Cargill, and Archer Daniels Midland Company (ADM) holding significant influence. Technological innovation, particularly in sustainable farming practices and yield improvement, acts as a key driver, alongside evolving regulatory frameworks aimed at promoting fair trade and environmental responsibility. The growing demand for ethically sourced and sustainable cotton from global apparel brands is shaping consumer preferences and influencing production standards. Competition from synthetic fibers and other natural fibers presents a constant challenge, necessitating continuous innovation and differentiation. Mergers and acquisitions (M&A) are observed as companies seek to consolidate their market position and expand their operational reach across key producing nations. The industry faces innovation barriers related to access to advanced agricultural technologies and infrastructure development in remote farming regions. The market share of key players is influenced by their ability to secure long-term contracts and adapt to changing global demand.

- Market Concentration: Moderate, with key multinational corporations and regional cooperatives playing significant roles.

- Technological Innovation: Focus on climate-resilient crop varieties, precision agriculture, and traceability solutions.

- Regulatory Frameworks: Increasing emphasis on sustainable sourcing standards, organic certification, and fair labor practices.

- Competitive Product Substitutes: Synthetic fibers (polyester, nylon) and other natural fibers (linen, bamboo) pose ongoing competition.

- End-User Demographics: Primarily driven by the global apparel and textile industries, with a growing segment focused on sustainable and traceable fashion.

- M&A Trends: Strategic acquisitions aimed at expanding supply chain control and market access.

Africa Cotton Industry Growth Trends & Insights

The Africa Cotton Industry is poised for significant growth, driven by an increasing global demand for natural fibers and a concerted push towards sustainable sourcing. The market size is projected to expand considerably over the forecast period (2025–2033), supported by a steady rise in cotton production across key African nations. Adoption rates of improved farming techniques and higher-yielding seed varieties are expected to accelerate, leading to enhanced productivity. Technological disruptions, including the integration of digital tools for farm management and supply chain traceability, are revolutionizing operations. Consumer behavior shifts towards conscious consumption and a preference for ethically produced goods are directly impacting demand for African cotton, particularly those adhering to sustainability certifications like Cotton made in Africa (CmiA). The industry's market penetration is set to deepen as more countries invest in cotton value chain development and as international brands increasingly seek diversified and sustainable supply sources. The compound annual growth rate (CAGR) is anticipated to be robust, reflecting the sector's expanding economic significance and its role in supporting rural livelihoods.

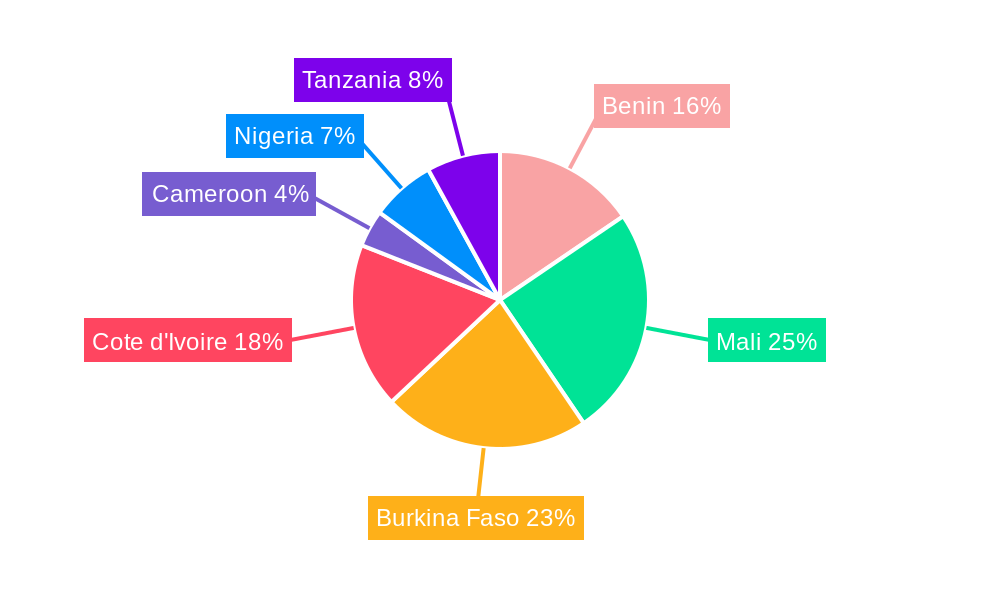

Dominant Regions, Countries, or Segments in Africa Cotton Industry

The Export Market Analysis (Value & Volume) segment is a dominant force driving growth in the Africa Cotton Industry. West African nations, particularly Ivory Coast, stand out as leading contributors to the global cotton supply. This dominance is fueled by a combination of favorable agro-climatic conditions, a well-established cotton cultivation infrastructure, and supportive government policies. The International Cotton Advisory Committee (ICAC) consistently highlights the region's substantial contribution to global cotton trade volumes.

Key Drivers for Export Dominance:

- Favorable Climate and Soil Conditions: Ideal for high-quality cotton cultivation.

- Government Policies and Subsidies: Initiatives aimed at boosting production and export competitiveness. For instance, France's pledge of 68.5 million euros (USD 83.04 million) to boost sustainable cotton in Ivory Coast demonstrates significant government support.

- Established Infrastructure: Developed logistics networks, including ports and transportation, facilitate efficient export.

- Large Farmer Base: A significant number of smallholder farmers are engaged in cotton production, ensuring substantial output.

- International Market Demand: Growing global appetite for raw cotton, particularly from Asia.

Market Share and Growth Potential: Ivory Coast, along with other West African countries like Burkina Faso and Mali, consistently account for a substantial percentage of Africa's total cotton exports, contributing billions of dollars annually to the regional economy. The ongoing investment in sustainable practices and farmer training, as exemplified by programs like Cotton made in Africa (CmiA), further enhances the marketability and value of African cotton exports, securing strong growth potential. The CmiA program's recognition by the German Green Button standard and Cradle to Cradle Certified validates the quality and sustainability of African cotton, attracting premium pricing and increasing demand from international brands.

Africa Cotton Industry Product Landscape

The Africa Cotton Industry is characterized by the production of both conventional and increasingly, sustainably certified cotton varieties. Innovations are focused on developing higher-yielding, pest-resistant seeds, and promoting climate-smart agricultural practices to enhance fiber quality and resilience. Key applications span the entire textile value chain, from yarn and fabric manufacturing to finished apparel and home textiles. Performance metrics are increasingly evaluated based on fiber strength, staple length, and purity, alongside crucial sustainability indicators. Unique selling propositions are emerging from the traceable and ethical sourcing of cotton, particularly from programs like Cotton made in Africa (CmiA), which is gaining traction among environmentally conscious brands and consumers. Technological advancements in ginning and processing are also contributing to improved output and quality.

Key Drivers, Barriers & Challenges in Africa Cotton Industry

Key Drivers: The Africa Cotton Industry is propelled by several significant forces. The growing global demand for natural and sustainable fibers, coupled with increasing awareness of the environmental impact of synthetic materials, provides a robust market pull. Government initiatives and international development programs aimed at bolstering agricultural productivity and supporting farmer livelihoods are crucial accelerators. Furthermore, the rising adoption of sustainable certifications like Cotton made in Africa (CmiA) enhances market access and premium pricing opportunities. Technological advancements in seed genetics and farming techniques also contribute to increased yields and improved fiber quality.

Barriers & Challenges: Despite the growth potential, the industry faces substantial challenges. Inadequate access to finance and credit for smallholder farmers can hinder investment in modern equipment and improved practices. Volatile global commodity prices and unpredictable weather patterns due to climate change pose significant risks to production and farmer incomes. Inefficient supply chains, poor infrastructure, and limited access to modern processing facilities can impact the quality and competitiveness of African cotton. Regulatory hurdles and the need for greater capacity building in sustainable farming and marketing practices also present ongoing challenges, potentially impacting export volumes and value.

Emerging Opportunities in Africa Cotton Industry

Emerging opportunities in the Africa Cotton Industry are diverse and promising. The increasing global preference for traceable and sustainably produced cotton presents a significant avenue for growth, with programs like Cotton made in Africa (CmiA) poised to capture a larger market share. There is an untapped potential in developing the midstream and downstream cotton value chain within Africa itself, fostering local textile manufacturing and job creation. Innovative financing models for farmers and the adoption of digital technologies for enhanced supply chain transparency and efficiency represent further opportunities. The growing demand for organic and fair-trade certified cotton also opens new market segments, attracting premium prices.

Growth Accelerators in the Africa Cotton Industry Industry

Several key catalysts are accelerating growth within the Africa Cotton Industry. Strategic partnerships between international apparel brands and African cotton producers, such as the one between LPP and Cotton made in Africa (CmiA), are driving demand for certified cotton and providing financial stability to farmers. Significant foreign direct investment, exemplified by France's commitment to boosting sustainable cotton in Ivory Coast, is crucial for infrastructure development and technological adoption. The continuous development and dissemination of climate-resilient cotton varieties and improved agronomic practices are enhancing productivity and sustainability. Market expansion strategies by key players, focusing on diversifying supply chains and meeting the evolving demands of global consumers, are also crucial growth accelerators.

Key Players Shaping the Africa Cotton Industry Market

- Louis Dreyfus Company

- TELA (Togo)

- International Cotton Advisory Committee (ICAC)

- Cotton Development International (CDI)

- AGT Foods

- SIAT (Cote d'Ivoire)

- Bunge Limited

- GIZ

- Cargill

- Archer Daniels Midland Company (ADM)

Notable Milestones in Africa Cotton Industry Sector

- October 2022: The Cotton made in Africa (CmiA) program, run by the Aid by Trade Foundation, received official recognition by the German Green Button standard as a sustainable natural fiber and was confirmed as an accredited source of raw materials by Cradle to Cradle Certified. This is likely to further boost CmiA uptake volumes through demand from existing and new program partners and apparel brands and retailers.

- January 2022: The Polish clothing company LPP partnered with Cotton made in Africa (CmiA). Under this agreement, LPP contracted the purchase of cotton that complies with the CmiA standard, with the quantity sufficient to produce as many as 60 million products with a 95 to 100 percent share of this raw material.

- April 2021: France pledged to invest in boosting sustainable cotton in Ivory Coast. France's development agency committed to investing 68.5 million euros (USD 83.04 million) over the next five years to boost cotton production in Ivory Coast, targeting 120,000 cotton farmers in the country's northern region and increasing revenue in the cotton sector.

In-Depth Africa Cotton Industry Market Outlook

The Africa Cotton Industry presents a robust outlook for sustained growth, underpinned by increasing global demand for sustainable and ethically sourced raw materials. The CmiA program's continued success and expanding partnerships with international brands will be pivotal in driving demand for certified African cotton. Investments in agricultural technology and infrastructure, coupled with supportive government policies, will further enhance production efficiency and competitiveness. Emerging opportunities in value-added processing and local textile manufacturing offer significant potential for economic diversification and job creation across the continent. The industry is well-positioned to capitalize on evolving consumer preferences for transparency and sustainability, solidifying its role as a vital contributor to both the global textile supply chain and African economic development.

Africa Cotton Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Africa Cotton Industry Segmentation By Geography

- 1. Benin

- 2. Mali

- 3. Burkina Faso

- 4. C

- 5. Cameroon

- 6. Nigeria

- 7. Tanzania

Africa Cotton Industry Regional Market Share

Geographic Coverage of Africa Cotton Industry

Africa Cotton Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Climatic Conditions; Blooming Export Opportunities

- 3.3. Market Restrains

- 3.3.1. High Adoption Cost of Modern Technology; Increasing Insect Infestations

- 3.4. Market Trends

- 3.4.1. Increasing Demand for African Cotton in Textile Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Benin

- 5.6.2. Mali

- 5.6.3. Burkina Faso

- 5.6.4. C

- 5.6.5. Cameroon

- 5.6.6. Nigeria

- 5.6.7. Tanzania

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Benin Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Mali Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Burkina Faso Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. C Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Cameroon Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Nigeria Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 11.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 11.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 11.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 11.1. Market Analysis, Insights and Forecast - by Production Analysis

- 12. Tanzania Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Production Analysis

- 12.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 12.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 12.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 12.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 12.1. Market Analysis, Insights and Forecast - by Production Analysis

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Louis Dreyfus Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 TELA (Togo)

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 International Cotton Advisory Committee (ICAC)

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Cotton Development International (CDI)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 AGT Foods

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 SIAT (Cote d'Ivoire)

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Bunge Limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 GIZ

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Cargill

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Archer Daniels Midland Company (ADM)

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Louis Dreyfus Company

List of Figures

- Figure 1: Africa Cotton Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Cotton Industry Share (%) by Company 2025

List of Tables

- Table 1: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 3: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Africa Cotton Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Africa Cotton Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 13: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 15: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Africa Cotton Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Africa Cotton Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 25: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 27: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 28: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 29: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 30: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 31: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 32: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 33: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 34: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 35: Africa Cotton Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Africa Cotton Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 37: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 38: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 39: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 40: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 41: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 42: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 45: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 46: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 47: Africa Cotton Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Africa Cotton Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 49: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 50: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 51: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 52: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 53: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 54: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 57: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 58: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 59: Africa Cotton Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Africa Cotton Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 61: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 62: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 63: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 64: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 65: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 66: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 67: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 68: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 69: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 70: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 71: Africa Cotton Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Africa Cotton Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 73: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 74: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 75: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 76: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 77: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 78: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 79: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 80: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 81: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 82: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 83: Africa Cotton Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 84: Africa Cotton Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 85: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 86: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 87: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 88: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 89: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 90: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 91: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 92: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 93: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 94: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 95: Africa Cotton Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 96: Africa Cotton Industry Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Cotton Industry?

The projected CAGR is approximately 4.91%.

2. Which companies are prominent players in the Africa Cotton Industry?

Key companies in the market include Louis Dreyfus Company, TELA (Togo) , International Cotton Advisory Committee (ICAC) , Cotton Development International (CDI) , AGT Foods, SIAT (Cote d'Ivoire) , Bunge Limited , GIZ , Cargill , Archer Daniels Midland Company (ADM) .

3. What are the main segments of the Africa Cotton Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Favorable Climatic Conditions; Blooming Export Opportunities.

6. What are the notable trends driving market growth?

Increasing Demand for African Cotton in Textile Industry.

7. Are there any restraints impacting market growth?

High Adoption Cost of Modern Technology; Increasing Insect Infestations.

8. Can you provide examples of recent developments in the market?

October 2022: The Cotton made in Africa (CmiA) program run by the Aid by Trade Foundation received official recognition by the German Green Button standard as a sustainable natural fiber,' and was confirmed as an accredited source of raw materials by Cradle to Cradle Certified. It is likely to further boost CmiA uptake volumes through demand from existing and new program partners and apparel brands and retailers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Cotton Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Cotton Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Cotton Industry?

To stay informed about further developments, trends, and reports in the Africa Cotton Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence