Key Insights

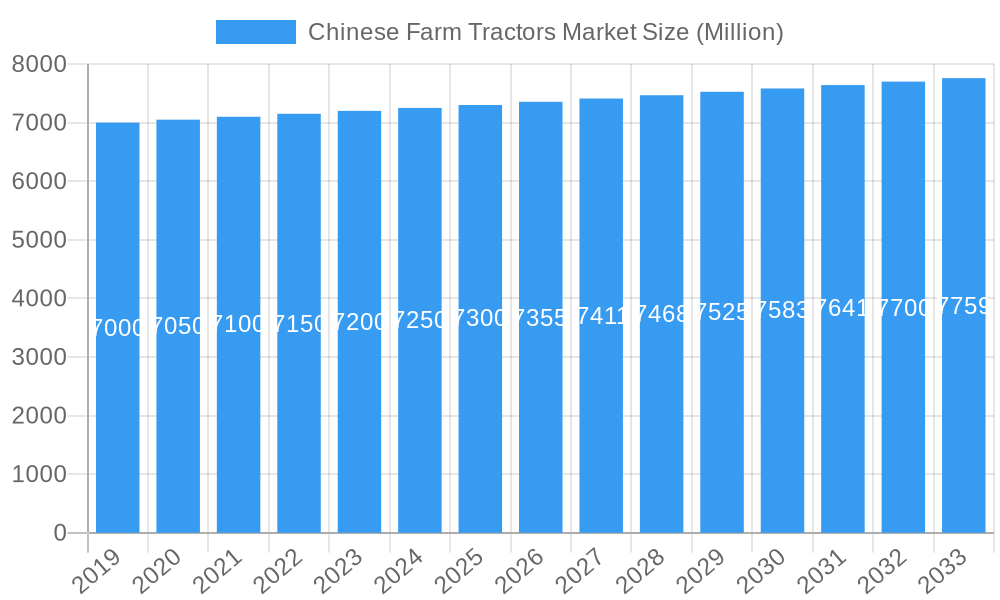

The Chinese farm tractor market is a significant global player, projected to reach a market size of approximately $7,500 million by 2025, with a modest Compound Annual Growth Rate (CAGR) of 1.50% for the forecast period of 2025-2033. This steady, albeit slow, growth indicates a mature market experiencing incremental advancements and evolving demands. The primary drivers for this market include the ongoing modernization of agricultural practices in China, the need for increased efficiency in food production to meet a growing population, and government initiatives aimed at supporting agricultural mechanization and rural development. These factors are fostering sustained demand for farm tractors, particularly those equipped with advanced features and designed for greater fuel efficiency and reduced environmental impact.

Chinese Farm Tractors Market Market Size (In Billion)

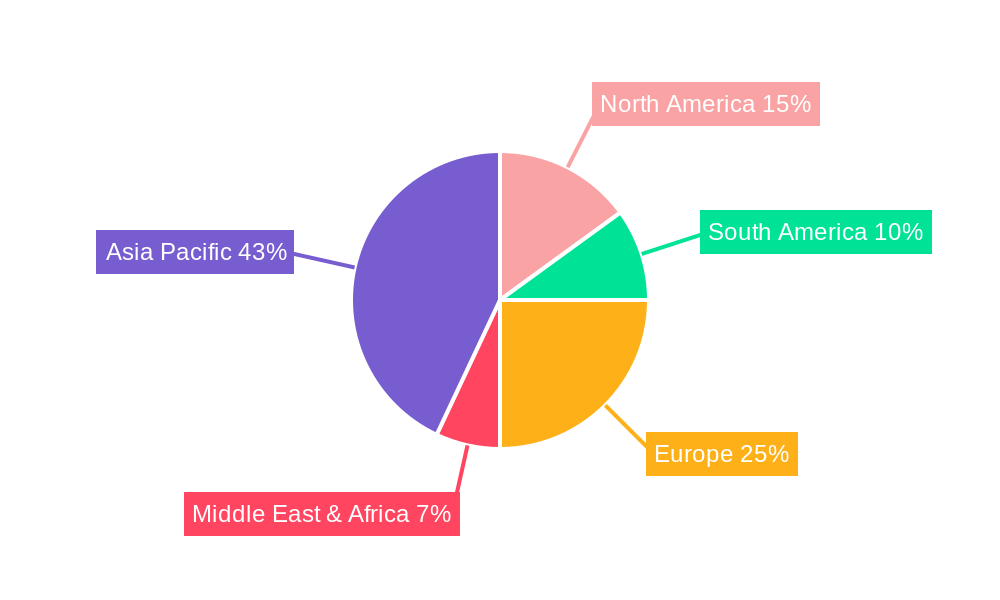

Despite the established nature of the market, several factors present challenges to more robust growth. Stricter emission regulations are requiring manufacturers to invest in cleaner technologies, thereby increasing production costs. Furthermore, the high initial investment for advanced tractors can be a barrier for smaller farmers. The market is characterized by intense competition among both domestic and international players, leading to price pressures. Nonetheless, emerging trends such as the adoption of smart farming technologies, including GPS-guided tractors and precision agriculture solutions, are creating niche opportunities for innovation and growth. The dominance of Asia Pacific in regional market share underscores the importance of China's domestic demand, with significant contributions expected from major players like Deere & Company and domestic giants such as Shandong Shifeng.

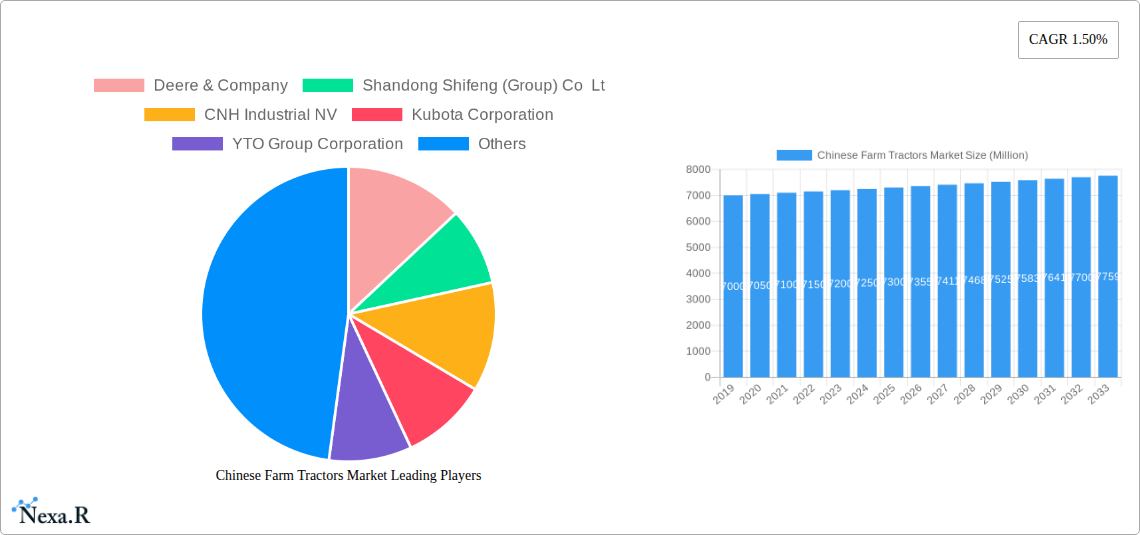

Chinese Farm Tractors Market Company Market Share

Chinese Farm Tractors Market: Comprehensive Report 2019–2033

This in-depth report provides a definitive analysis of the Chinese farm tractors market, encompassing production, consumption, imports, exports, price trends, and key industry developments from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this research offers granular insights into market dynamics, growth trajectories, and competitive landscapes. We present all values in Million units, crucial for understanding the scale of this vital agricultural sector. Discover the intricate interplay of parent and child markets, with a focus on the broader agricultural machinery ecosystem and the specialized farm tractor segment, to gain a holistic view of market opportunities.

Chinese Farm Tractors Market Market Dynamics & Structure

The Chinese farm tractors market is characterized by a moderate to high market concentration, with a few dominant players like Shandong Shifeng (Group) Co Lt, YTO Group Corporation, and Deere & Company holding significant market shares. Technological innovation is a primary driver, fueled by government initiatives promoting smart agriculture and mechanization. Regulatory frameworks, including subsidies for agricultural machinery and environmental standards, significantly influence market entry and product development. Competitive product substitutes, such as older tractor models and alternative farm machinery, exist but are increasingly outpaced by advancements in efficiency and automation. End-user demographics are shifting, with a growing demand for higher horsepower, technologically advanced tractors among large-scale agricultural enterprises and a continued need for basic models in smaller holdings. Mergers and acquisitions (M&A) are active, aimed at consolidating market positions, acquiring new technologies, and expanding product portfolios. For instance, the joint venture between International Tractors (ITL) and Shandong Luyu Heavy Industry signifies a strategic move to capture market share and enhance product offerings. While the market is robust, innovation barriers include the high cost of research and development for advanced technologies and the need for extensive field testing to ensure reliability in diverse agricultural conditions across China. The overall market size is projected to reach approximately 750,000 units in 2025, with substantial growth anticipated in the coming decade.

- Market Concentration: Dominated by key domestic and international players, indicating intense competition.

- Technological Innovation: Driven by smart agriculture, automation, and eco-friendly technologies like hydrogen fuel cells.

- Regulatory Frameworks: Government subsidies, environmental regulations, and policies promoting mechanization play a crucial role.

- Competitive Product Substitutes: Emerging alternative technologies and older, less efficient tractor models.

- End-User Demographics: Diversified, from large agribusinesses demanding high-tech solutions to small farmers requiring cost-effective options.

- M&A Trends: Strategic acquisitions and joint ventures to expand market reach and technological capabilities.

- Innovation Barriers: High R&D costs, long product development cycles, and the need for robust field validation.

Chinese Farm Tractors Market Growth Trends & Insights

The Chinese farm tractors market is poised for sustained growth, driven by a confluence of factors including government support for agricultural modernization, increasing farm sizes, and the adoption of advanced farming techniques. The market size is expected to evolve from an estimated 700,000 units in 2024 to over 850,000 units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 2.5%. Adoption rates for higher horsepower and technologically sophisticated tractors are on the rise, particularly in regions undergoing significant agricultural restructuring. Technological disruptions, such as the integration of GPS, precision farming technologies, and the development of smart, autonomous tractors, are reshaping the industry landscape. Consumer behavior is shifting towards prioritizing efficiency, fuel economy, and reduced labor requirements. The demand for electric and hybrid tractors is also emerging, albeit at an early stage, reflecting a growing awareness of environmental sustainability. The penetration of advanced agricultural machinery, including sophisticated farm tractors, is projected to increase significantly as the government continues to prioritize food security and agricultural productivity. The market is also influenced by evolving trade dynamics and domestic manufacturing capabilities, with a focus on localized production and supply chain resilience. Insights suggest that manufacturers focusing on versatile, fuel-efficient, and smart-enabled tractors will experience the most robust growth.

Dominant Regions, Countries, or Segments in Chinese Farm Tractors Market

The Chinese farm tractors market exhibits distinct regional dominance and segment leadership across various analyses.

Production Analysis: The North China region, encompassing provinces like Hebei, Shandong, and Henan, is the dominant force in farm tractor production. This dominance is driven by:

- Established Manufacturing Hubs: These provinces have a long-standing history of heavy industry and agricultural machinery manufacturing, with well-developed industrial parks and a skilled workforce.

- Proximity to Raw Materials and Supply Chains: Access to steel, components, and a robust network of suppliers facilitates efficient and cost-effective production.

- Government Support and Incentives: Provincial governments often offer incentives for manufacturing and technological upgrades in the agricultural machinery sector. Shandong, in particular, is a powerhouse for tractor manufacturing, hosting major players like Shandong Shifeng (Group) Co Lt and Shandong Wuzheng Group Co Ltd.

Consumption Analysis: North China and Northeast China emerge as the leading regions for farm tractor consumption. This is primarily due to:

- Vast Agricultural Land: These regions comprise the majority of China's arable land, particularly for staple crops like corn and soybeans, requiring significant mechanization.

- Larger Farm Holdings: The trend towards larger, more consolidated agricultural operations necessitates the use of more powerful and efficient tractors.

- Government Focus on Mechanization: Policies aimed at modernizing agriculture heavily target these key grain-producing regions.

Import Market Analysis (Value & Volume): While China is a major producer, the import market is significant for higher-end, specialized, and technologically advanced tractors that domestic manufacturers may not yet fully produce at scale. Key importing regions often align with areas experiencing rapid agricultural modernization.

- Value: Imports are led by regions with a higher adoption of premium brands and advanced features, often driven by large corporate farms and research institutions.

- Volume: While overall import volume might be lower than domestic production, specific types of tractors, such as high-horsepower or specialized vineyard tractors, contribute to import statistics. Eastern China and Coastal Provinces often see higher import volumes due to their economic dynamism and access to international trade routes.

Export Market Analysis (Value & Volume): China's export market for farm tractors is substantial, with Southeast Asia and Africa being the primary destinations for both volume and value.

- Volume: Cost-effectiveness and a wide range of models make Chinese tractors competitive in developing agricultural economies. Provinces with strong manufacturing bases, particularly in Eastern China, are significant export hubs.

- Value: While volume is high, the average value per unit in exports is generally lower than that of premium imported tractors. However, the growing demand for reliable and affordable machinery in emerging markets fuels this segment.

Price Trend Analysis: Price trends are influenced by production costs, raw material prices (steel, engine components), technological advancements, and government subsidies.

- Domestic Production: Prices for tractors produced domestically, especially from large manufacturers like YTO Group Corporation and Shandong Shifeng (Group) Co Lt, are generally more competitive, reflecting economies of scale and localized supply chains.

- Imports: Imported tractors, such as those from Deere & Company and Kubota Corporation, command premium prices due to their advanced technology, brand reputation, and higher manufacturing standards.

- Segmented Pricing: Tractors are priced across a wide spectrum, from basic utility models (under 30 horsepower) to high-horsepower, smart tractors, catering to different farm sizes and operational needs. The overall price trend indicates a gradual increase driven by technological upgrades and rising production costs, offset partially by government subsidies and competitive pressures.

Chinese Farm Tractors Market Product Landscape

The Chinese farm tractors market is characterized by a diverse product landscape catering to a wide array of agricultural needs. Innovations are increasingly focused on enhancing efficiency, reducing operational costs, and integrating smart technologies. Key product advancements include the development of fuel-efficient diesel engines, the introduction of CVT (Continuously Variable Transmission) systems for smoother operation, and the integration of precision farming capabilities like GPS guidance and auto-steering. Furthermore, the market is witnessing the emergence of smart tractors, exemplified by China's first 5G smart hydrogen fuel cell electric tractor, ET504-H, which boasts self-driving modes and remote control capabilities. Performance metrics such as horsepower range from compact utility tractors suitable for small farms to high-horsepower models essential for large-scale mechanized operations. Unique selling propositions often revolve around reliability, affordability, and increasing technological sophistication, with manufacturers striving to balance traditional strengths with cutting-edge innovations.

Key Drivers, Barriers & Challenges in Chinese Farm Tractors Market

Key Drivers:

- Government Policies and Subsidies: Strong government backing for agricultural mechanization, food security initiatives, and direct subsidies for tractor purchases are primary growth accelerators. For example, policies promoting large-scale farming and modern agricultural practices directly boost demand for advanced tractors.

- Increasing Farm Mechanization: China's ongoing drive to improve agricultural efficiency and reduce labor dependency fuels the demand for tractors of all types.

- Technological Advancements: The integration of smart farming technologies, automation, and improved fuel efficiency makes tractors more attractive to farmers seeking higher productivity and reduced operating costs.

- Growing Demand for High-Horsepower Tractors: As farm sizes increase and land consolidation progresses, there's a rising demand for more powerful tractors capable of handling larger implements and covering more acreage.

Barriers & Challenges:

- High Initial Investment Cost: Advanced tractors, especially those with smart features, can be expensive, posing a barrier for smallholder farmers.

- Infrastructure and Maintenance Support: In some rural areas, the availability of skilled technicians for maintenance and repair of complex machinery can be limited.

- Rural Income Fluctuations: Farmer income can be susceptible to weather patterns and market prices, impacting their ability to invest in new machinery.

- Competition from Used Tractors: A robust market for used tractors can sometimes divert demand from new tractor sales.

- Environmental Regulations: Stricter emission standards can increase manufacturing costs and necessitate R&D for cleaner engine technologies.

Emerging Opportunities in the Chinese Farm Tractors Market Industry

Emerging opportunities in the Chinese farm tractors market are driven by the rapid evolution of agricultural technology and changing consumer preferences. The increasing focus on sustainable agriculture presents a significant opportunity for manufacturers of electric and hybrid tractors, as well as those incorporating advanced fuel-efficient technologies. The development and deployment of autonomous and semi-autonomous tractors, powered by AI and advanced robotics, represent a major growth frontier, particularly for large-scale agricultural enterprises. Furthermore, the expansion of precision agriculture services, where tractors are equipped with sensors and data analytics capabilities, opens avenues for value-added services and integrated farm management solutions. Untapped markets in less developed agricultural regions within China, coupled with the potential for export growth to other developing nations, also represent substantial opportunities for market expansion.

Growth Accelerators in the Chinese Farm Tractors Market Industry

Several catalysts are accelerating long-term growth in the Chinese farm tractors market. Technological breakthroughs, such as the advancement of AI in autonomous driving systems and the successful integration of 5G technology for remote monitoring and control, are revolutionizing tractor capabilities and efficiency. Strategic partnerships and joint ventures, like the one between International Tractors (ITL) and Shandong Luyu Heavy Industry, are crucial for expanding market reach, sharing technological expertise, and optimizing production. Market expansion strategies, including the development of specialized tractors for niche crops and diverse terrains, cater to a broader spectrum of agricultural needs. The ongoing push for smart and green agriculture by the Chinese government, coupled with increased investment in agricultural research and development, further fuels innovation and adoption of advanced tractor technologies, solidifying China's position as a global leader in agricultural mechanization.

Key Players Shaping the Chinese Farm Tractors Market Market

- Deere & Company

- Shandong Shifeng (Group) Co Lt

- CNH Industrial NV

- Kubota Corporation

- YTO Group Corporation

- Tractors and Farm Equipment Limited

- Shandong Wuzheng Group Co Ltd

- AGCO Corporation

Notable Milestones in Chinese Farm Tractors Market Sector

- June 2020: The National Institute of Agro-machinery Innovation and Creation (CHIAIC) in Luoyang launched China's first 5G smart hydrogen fuel cell electric tractor, the ET504-H, featuring 5G communication, self-driving mode, and remote control capabilities, enhancing operational reliability and efficiency.

- October 2019: International Tractors (ITL) announced a joint venture with Shandong Luyu Heavy Industry Co. This collaboration aims to expand ITL's product line and offer its tractors in the Chinese market, while also producing engines for wheel loader applications.

In-Depth Chinese Farm Tractors Market Market Outlook

The Chinese farm tractors market is on a robust growth trajectory, propelled by significant technological advancements and strategic market initiatives. The increasing adoption of smart agriculture, including the integration of AI, 5G connectivity, and autonomous driving capabilities, is set to redefine operational efficiency and productivity in the agricultural sector. Government support through subsidies and policy directives aimed at modernizing farming practices will continue to be a major growth accelerator. Furthermore, the development of sustainable and eco-friendly tractor technologies, such as hydrogen fuel cell and electric powertrains, aligns with global environmental goals and presents substantial opportunities. Strategic collaborations and the pursuit of higher-horsepower, multi-functional tractors will cater to the evolving needs of China's large agricultural base. The market outlook is highly positive, indicating sustained demand and innovation throughout the forecast period.

Chinese Farm Tractors Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Chinese Farm Tractors Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Chinese Farm Tractors Market Regional Market Share

Geographic Coverage of Chinese Farm Tractors Market

Chinese Farm Tractors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Brazilian Farm Structure and Consolidation of Smaller Farms; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. High Cost of Equipment and Price Sensitivity; Data Privacy Concerns

- 3.4. Market Trends

- 3.4.1. Growing Preference For Farm Mechanization

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Chinese Farm Tractors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Chinese Farm Tractors Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Chinese Farm Tractors Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Chinese Farm Tractors Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Chinese Farm Tractors Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Chinese Farm Tractors Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Deere & Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shandong Shifeng (Group) Co Lt

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CNH Industrial NV

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kubota Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 YTO Group Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tractors and Farm Equipment Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shandong Wuzheng Group Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AGCO Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Deere & Company

List of Figures

- Figure 1: Global Chinese Farm Tractors Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Chinese Farm Tractors Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 3: North America Chinese Farm Tractors Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Chinese Farm Tractors Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 5: North America Chinese Farm Tractors Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Chinese Farm Tractors Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Chinese Farm Tractors Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Chinese Farm Tractors Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Chinese Farm Tractors Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Chinese Farm Tractors Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Chinese Farm Tractors Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Chinese Farm Tractors Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Chinese Farm Tractors Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Chinese Farm Tractors Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 15: South America Chinese Farm Tractors Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Chinese Farm Tractors Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 17: South America Chinese Farm Tractors Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Chinese Farm Tractors Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Chinese Farm Tractors Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Chinese Farm Tractors Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Chinese Farm Tractors Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Chinese Farm Tractors Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Chinese Farm Tractors Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Chinese Farm Tractors Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Chinese Farm Tractors Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Chinese Farm Tractors Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 27: Europe Chinese Farm Tractors Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Chinese Farm Tractors Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Chinese Farm Tractors Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Chinese Farm Tractors Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Chinese Farm Tractors Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Chinese Farm Tractors Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Chinese Farm Tractors Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Chinese Farm Tractors Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Chinese Farm Tractors Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Chinese Farm Tractors Market Revenue (undefined), by Country 2025 & 2033

- Figure 37: Europe Chinese Farm Tractors Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Chinese Farm Tractors Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Chinese Farm Tractors Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Chinese Farm Tractors Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Chinese Farm Tractors Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Chinese Farm Tractors Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Chinese Farm Tractors Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Chinese Farm Tractors Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Chinese Farm Tractors Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Chinese Farm Tractors Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Chinese Farm Tractors Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Chinese Farm Tractors Market Revenue (undefined), by Country 2025 & 2033

- Figure 49: Middle East & Africa Chinese Farm Tractors Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Chinese Farm Tractors Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Chinese Farm Tractors Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Chinese Farm Tractors Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Chinese Farm Tractors Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Chinese Farm Tractors Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Chinese Farm Tractors Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Chinese Farm Tractors Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Chinese Farm Tractors Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Chinese Farm Tractors Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Chinese Farm Tractors Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Chinese Farm Tractors Market Revenue (undefined), by Country 2025 & 2033

- Figure 61: Asia Pacific Chinese Farm Tractors Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: United States Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Canada Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Mexico Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: Brazil Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Argentina Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Germany Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: France Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Italy Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Spain Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Russia Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Benelux Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Nordics Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: Turkey Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Israel Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: GCC Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: North Africa Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: South Africa Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Chinese Farm Tractors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 58: China Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 59: India Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: Japan Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 61: South Korea Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 63: Oceania Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Chinese Farm Tractors Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chinese Farm Tractors Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Chinese Farm Tractors Market?

Key companies in the market include Deere & Company, Shandong Shifeng (Group) Co Lt, CNH Industrial NV, Kubota Corporation, YTO Group Corporation, Tractors and Farm Equipment Limited, Shandong Wuzheng Group Co Ltd, AGCO Corporation.

3. What are the main segments of the Chinese Farm Tractors Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Brazilian Farm Structure and Consolidation of Smaller Farms; Technological Advancements.

6. What are the notable trends driving market growth?

Growing Preference For Farm Mechanization.

7. Are there any restraints impacting market growth?

High Cost of Equipment and Price Sensitivity; Data Privacy Concerns.

8. Can you provide examples of recent developments in the market?

June 2020: The National Institute of Agro-machinery Innovation and Creation (CHIAIC) in Luoyang in the central province of Henan, launched China's first 5G smart hydrogen fuel cell electric tractor shall be useful in agricultural operations. Sporting a futuristic appearance, the new model ET504-H tractor adopts 5G mobile communication technology, has a self-driving mode, and can be remotely controlled. Also, with 5G technology, ET504-H is able to monitor the real-time running status of the vehicle as well as the surrounding working environment, which will effectively improve the reliability of the operation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chinese Farm Tractors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chinese Farm Tractors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chinese Farm Tractors Market?

To stay informed about further developments, trends, and reports in the Chinese Farm Tractors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence