Key Insights

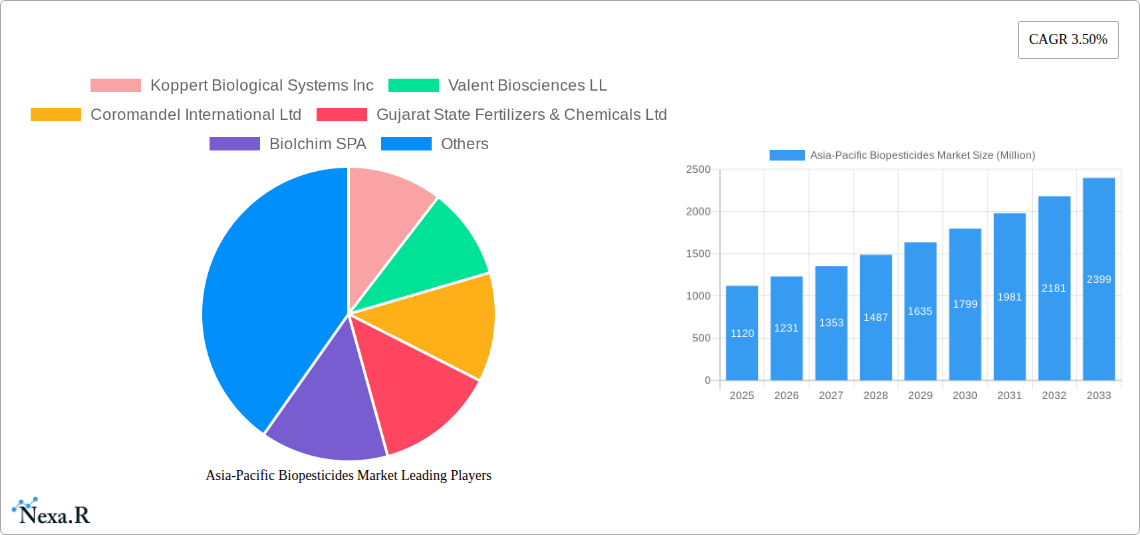

The Asia-Pacific Biopesticides Market is poised for substantial growth, projected to reach an estimated USD 1.12 billion in 2025. This expansion is driven by a confluence of factors, including increasing consumer demand for organically grown produce, growing awareness of the environmental and health risks associated with conventional chemical pesticides, and supportive government initiatives promoting sustainable agriculture across the region. The market is expected to witness a Compound Annual Growth Rate (CAGR) of 9.95% during the forecast period of 2019-2033, indicating a robust and sustained upward trajectory. Key drivers include the rising adoption of integrated pest management (IPM) strategies, the need to comply with stringent international food safety regulations, and advancements in biopesticide formulation and efficacy, making them more competitive against synthetic alternatives.

Asia-Pacific Biopesticides Market Market Size (In Billion)

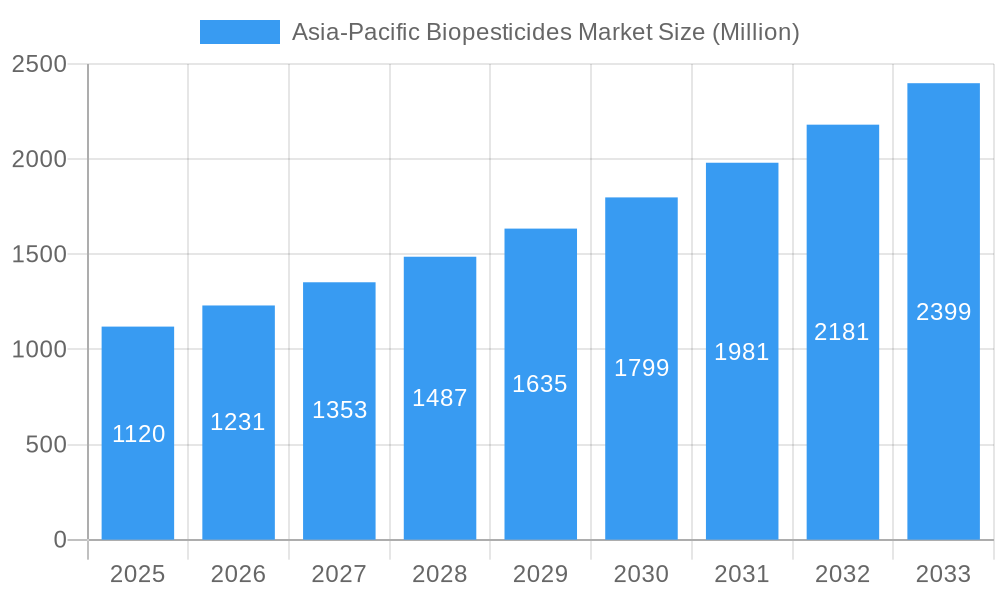

Further bolstering this growth are the significant trends observed in the Asia-Pacific agricultural sector. The increasing prevalence of pest resistance to chemical pesticides necessitates the development and adoption of alternative solutions like biopesticides. Moreover, the burgeoning organic food market in countries like China, India, and Southeast Asian nations is a primary catalyst. While challenges such as the higher initial cost of some biopesticides, limited farmer awareness in certain sub-regions, and the need for specialized application knowledge exist, they are being addressed through targeted research and development, farmer education programs, and the expansion of distribution networks. The competitive landscape features prominent players like Koppert Biological Systems Inc. and Valent Biosciences LLC, alongside significant regional contributions from companies such as Coromandel International Ltd. and Gujarat State Fertilizers & Chemicals Ltd., highlighting a dynamic market environment.

Asia-Pacific Biopesticides Market Company Market Share

This in-depth report offers a detailed analysis of the Asia-Pacific Biopesticides Market, providing critical insights for stakeholders in the agriculture, biotechnology, and chemical industries. Covering a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, this report delves into market dynamics, growth trends, regional dominance, product landscapes, key drivers, barriers, and emerging opportunities. With a focus on high-traffic keywords such as "biopesticides," "Asia-Pacific agriculture," "biological pest control," and "sustainable farming," this report is optimized for maximum search engine visibility and engagement with industry professionals seeking the latest market intelligence.

Asia-Pacific Biopesticides Market Market Dynamics & Structure

The Asia-Pacific biopesticides market is characterized by a dynamic interplay of factors shaping its competitive landscape. Market concentration is moderate, with a growing number of established players and new entrants vying for market share. Technological innovation is a significant driver, with continuous research and development focused on enhancing efficacy, shelf-life, and application methods of biopesticide formulations. Robust regulatory frameworks are evolving across the region, often favoring the adoption of sustainable agricultural practices, which indirectly boosts the biopesticides sector. Competitive product substitutes, primarily conventional synthetic pesticides, still hold a significant market share, though increasing consumer demand for organic produce and government initiatives promoting eco-friendly agriculture are gradually shifting the balance. End-user demographics are broad, encompassing large-scale commercial farms, smallholder farmers, and organic produce cultivators, each with unique adoption drivers and barriers. Mergers and acquisitions (M&A) are becoming increasingly prevalent as companies seek to consolidate their market position, expand their product portfolios, and achieve economies of scale. For instance, the merger between Liberty Pesticides and Fertilizers Limited (LPFL) and Coromandel SQM (India) Private Limited (CSQM) is poised to expand Coromandel International Ltd.'s biopesticides offerings. Similarly, the merger of Andermatt Biocontrol AG with Andermatt Group AG aims to streamline management and enhance operational efficiency.

- Market Concentration: Moderate, with increasing fragmentation and consolidation efforts.

- Technological Innovation: Driven by R&D in formulation, efficacy, and delivery systems for bio-insecticides, bio-fungicides, and bio-herbicides.

- Regulatory Frameworks: Increasingly supportive of biopesticide adoption due to environmental concerns and sustainable agriculture mandates.

- Competitive Substitutes: Synthetic pesticides remain a key competitor, but market share is gradually shifting.

- End-User Demographics: Diverse, from large agribusinesses to small organic farms.

- M&A Trends: Significant activity as companies seek strategic advantages, portfolio expansion, and market consolidation.

Asia-Pacific Biopesticides Market Growth Trends & Insights

The Asia-Pacific biopesticides market is experiencing robust growth, fueled by a confluence of evolving agricultural practices, increasing environmental consciousness, and supportive government policies. The market size has witnessed a significant upward trajectory, with projections indicating sustained expansion throughout the forecast period. Adoption rates for biopesticides are steadily increasing as farmers recognize their benefits, including reduced environmental impact, improved soil health, and lower risks of pest resistance compared to conventional pesticides. Technological disruptions are playing a pivotal role, with advancements in microbial fermentation, genetic engineering of beneficial microorganisms, and formulation techniques enhancing the effectiveness and scalability of biopesticide production. Consumer behavior shifts, particularly the growing demand for organic and residue-free food products, are a major catalyst for biopesticide adoption. This burgeoning demand translates into a higher market penetration for bio-insecticides, bio-fungicides, and bio-nematicides across various crop types, from cereals and fruits to vegetables and ornamentals. The compound annual growth rate (CAGR) is expected to remain strong, driven by innovation, strategic partnerships, and a concerted effort towards sustainable agricultural ecosystems. The estimated market size is anticipated to reach xx billion units by 2025, with continuous growth projected.

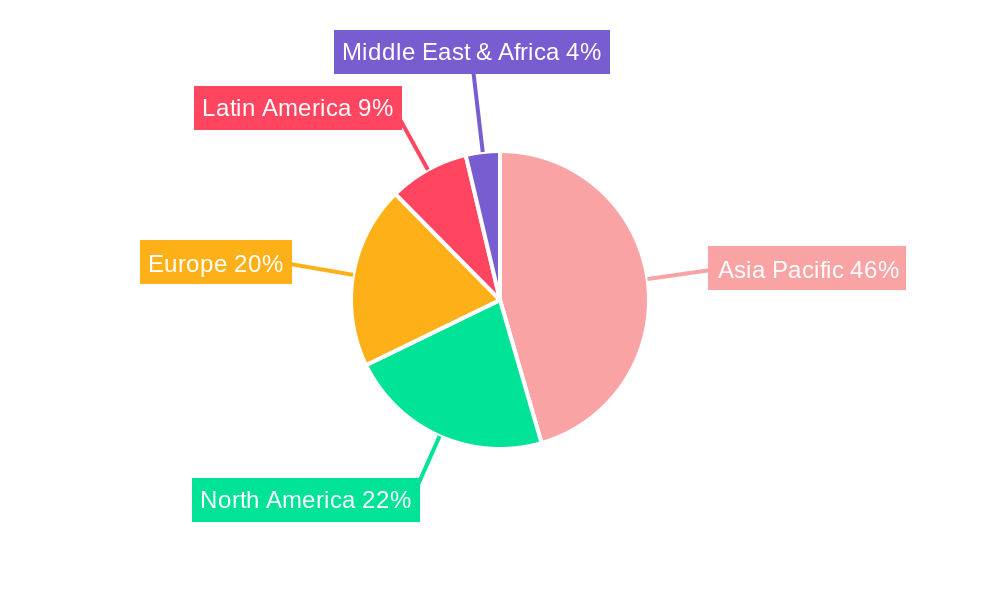

Dominant Regions, Countries, or Segments in Asia-Pacific Biopesticides Market

The Asia-Pacific biopesticides market's dominance is multifaceted, with specific regions, countries, and segments exhibiting significant growth and influence. In terms of Production Analysis, China and India stand out as major production hubs due to their established chemical industries, access to raw materials, and large agricultural sectors. Their production capabilities for both bio-insecticides and bio-fungicides are substantial.

For Consumption Analysis, countries with large agricultural footprints and a growing emphasis on sustainable farming practices lead the pack. India, China, Australia, and Southeast Asian nations such as Vietnam and Thailand are key consumers. The increasing awareness of health and environmental impacts associated with synthetic pesticides is driving higher adoption rates in these regions.

The Import Market Analysis (Value & Volume) highlights countries that rely on external suppliers for specialized biopesticide products or advanced formulations. Australia and certain Southeast Asian countries often exhibit significant import volumes, seeking novel solutions to manage diverse pest challenges. The value of imports is further influenced by the technological sophistication and brand reputation of the imported biopesticides.

Conversely, the Export Market Analysis (Value & Volume) is dominated by countries with strong manufacturing capabilities and a competitive pricing strategy. India, with its robust pharmaceutical and chemical export infrastructure, is a significant exporter of biopesticides. China also plays a crucial role in the global export market, catering to a wide range of demand.

The Price Trend Analysis indicates a gradual convergence towards more competitive pricing as production scales increase and R&D costs are amortized. However, premium pricing for highly effective and specialized biopesticides, particularly those with unique formulations or application benefits, continues to persist.

Dominant Segments:

- By Product Type: Bio-insecticides currently hold the largest market share due to their broad-spectrum efficacy and established applications in pest management. Bio-fungicides are rapidly gaining traction due to the increasing incidence of crop diseases.

- By Application: The fruit and vegetable segment represents a dominant application area, driven by the high demand for residue-free produce and stringent quality standards. The cereal and grain segment is also a significant consumer, particularly with the increasing focus on sustainable intensification of agriculture.

Economic policies promoting organic farming, coupled with robust agricultural infrastructure and accessible distribution channels, are key drivers of dominance in these regions and segments.

Asia-Pacific Biopesticides Market Product Landscape

The Asia-Pacific biopesticides market is marked by continuous product innovation, with a growing array of bio-insecticides, bio-fungicides, bio-nematicides, and bio-herbicides gaining traction. Key product innovations focus on enhancing the efficacy and shelf-life of microbial and botanical-based formulations. Applications are expanding across a wide range of crops, including fruits, vegetables, cereals, and plantation crops. Performance metrics are increasingly being benchmarked against synthetic alternatives, with a focus on comparable or superior pest control and improved crop health outcomes. Unique selling propositions often lie in the specificity of the biopesticide, its minimal impact on beneficial insects, and its compatibility with integrated pest management (IPM) programs. Technological advancements in fermentation processes and formulation technologies are enabling the development of more stable and user-friendly biopesticide products.

Key Drivers, Barriers & Challenges in Asia-Pacific Biopesticides Market

The Asia-Pacific biopesticides market is propelled by several key drivers, including the escalating demand for organic and sustainably produced food, increasing awareness of the environmental and health risks associated with synthetic pesticides, and supportive government initiatives and subsidies for eco-friendly agricultural practices. Technological advancements in formulation and delivery systems are also enhancing the efficacy and market acceptance of biopesticides.

However, the market faces significant barriers and challenges. The relatively higher initial cost of some biopesticides compared to conventional alternatives can be a deterrent for price-sensitive farmers. A lack of awareness and technical expertise among farmers regarding the proper application and efficacy of biopesticides also presents a hurdle. Stringent and varied regulatory approval processes across different countries can lead to lengthy registration times and increased development costs. Furthermore, supply chain issues, including the limited shelf-life of certain biopesticides and the need for specific storage conditions, can impact their availability and effectiveness. Competitive pressures from well-established synthetic pesticide manufacturers also remain a challenge.

Emerging Opportunities in Asia-Pacific Biopesticides Market

Emerging opportunities in the Asia-Pacific biopesticides market are significant and diverse. The growing trend towards precision agriculture and smart farming presents opportunities for integrated biopesticide application systems, enhancing targeted pest control and resource efficiency. The development of novel biopesticide formulations targeting specific resistant pest strains offers a significant untapped market. Evolving consumer preferences for certified organic and sustainably grown produce continue to drive demand, creating opportunities for biopesticide manufacturers to cater to this expanding niche. Furthermore, exploring applications in non-agricultural sectors, such as public health vector control and forest pest management, represents a promising avenue for market diversification.

Growth Accelerators in the Asia-Pacific Biopesticides Market Industry

Several catalysts are accelerating the growth of the Asia-Pacific biopesticides market. Technological breakthroughs in the discovery and application of new microbial strains and botanical extracts are expanding the product portfolio and efficacy. Strategic partnerships between biopesticide companies, research institutions, and agricultural conglomerates are fostering innovation and accelerating market penetration. Government initiatives, including R&D funding, tax incentives for biopesticide manufacturers, and promotional campaigns for sustainable agriculture, are creating a conducive environment for market expansion. Furthermore, the increasing global focus on climate change mitigation and sustainable development goals indirectly fuels the demand for bio-based pest management solutions.

Key Players Shaping the Asia-Pacific Biopesticides Market Market

- Koppert Biological Systems Inc

- Valent Biosciences LLC

- Coromandel International Ltd

- Gujarat State Fertilizers & Chemicals Ltd

- Biolchim SPA

- IPL Biologicals Limited

- T Stanes and Company Limited

- Biobest Group NV

- Henan Jiyuan Baiyun Industry Co Ltd

- Andermatt Group AG

Notable Milestones in Asia-Pacific Biopesticides Market Sector

- April 2022: Coromandel International Ltd. approved the merger between Liberty Pesticides and Fertilizers Limited (LPFL) and Coromandel SQM (India) Private Limited (CSQM), aiming to expand its biopesticides product portfolio.

- January 2022: Andermatt Group AG announced the merger of Andermatt Biocontrol AG with Andermatt Group AG, simplifying its structure and enhancing management effectiveness.

In-Depth Asia-Pacific Biopesticides Market Market Outlook

The Asia-Pacific biopesticides market is poised for substantial future growth, driven by a robust combination of factors. Continued innovation in product development, particularly in microbial and botanical formulations, will broaden the scope of applications and enhance efficacy. Strategic alliances and collaborations among key players, alongside significant investments in R&D, will accelerate the introduction of novel solutions. Government support through favorable policies, subsidies, and promotional programs for sustainable agriculture will continue to be a critical growth enabler. The increasing consumer preference for residue-free and organic produce will create sustained demand, making biopesticides an integral part of future agricultural practices across the region. The market is expected to witness a steady increase in market penetration, transforming pest management strategies and contributing to a more sustainable agricultural ecosystem.

Asia-Pacific Biopesticides Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia-Pacific Biopesticides Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Biopesticides Market Regional Market Share

Geographic Coverage of Asia-Pacific Biopesticides Market

Asia-Pacific Biopesticides Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Biofungicides is the largest Form

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Biopesticides Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Koppert Biological Systems Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Valent Biosciences LL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Coromandel International Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gujarat State Fertilizers & Chemicals Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Biolchim SPA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IPL Biologicals Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 T Stanes and Company Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Biobest Group NV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Henan Jiyuan Baiyun Industry Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Andermatt Group AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Koppert Biological Systems Inc

List of Figures

- Figure 1: Asia-Pacific Biopesticides Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Biopesticides Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Japan Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: South Korea Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: India Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Australia Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: New Zealand Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Indonesia Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Malaysia Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Singapore Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Thailand Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Vietnam Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Philippines Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Biopesticides Market?

The projected CAGR is approximately 9.95%.

2. Which companies are prominent players in the Asia-Pacific Biopesticides Market?

Key companies in the market include Koppert Biological Systems Inc, Valent Biosciences LL, Coromandel International Ltd, Gujarat State Fertilizers & Chemicals Ltd, Biolchim SPA, IPL Biologicals Limited, T Stanes and Company Limited, Biobest Group NV, Henan Jiyuan Baiyun Industry Co Ltd, Andermatt Group AG.

3. What are the main segments of the Asia-Pacific Biopesticides Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Biofungicides is the largest Form.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

April 2022: The company approved the merger between Liberty Pesticides and Fertilizers Limited (LPFL) and Coromandel SQM (India) Private Limited (CSQM) (wholly-owned subsidiaries), which came into effect on April 01, 2021. This merger is anticipated to expand the company's product portfolio, including its biopesticides, in the long run.January 2022: The company announced the merger of Andermatt Biocontrol AG with Andermatt Group AG. After the merger, all companies report directly to Andermatt Group AG, increasing the effectiveness of the management and simplifying the company's structure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Biopesticides Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Biopesticides Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Biopesticides Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Biopesticides Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence