Key Insights

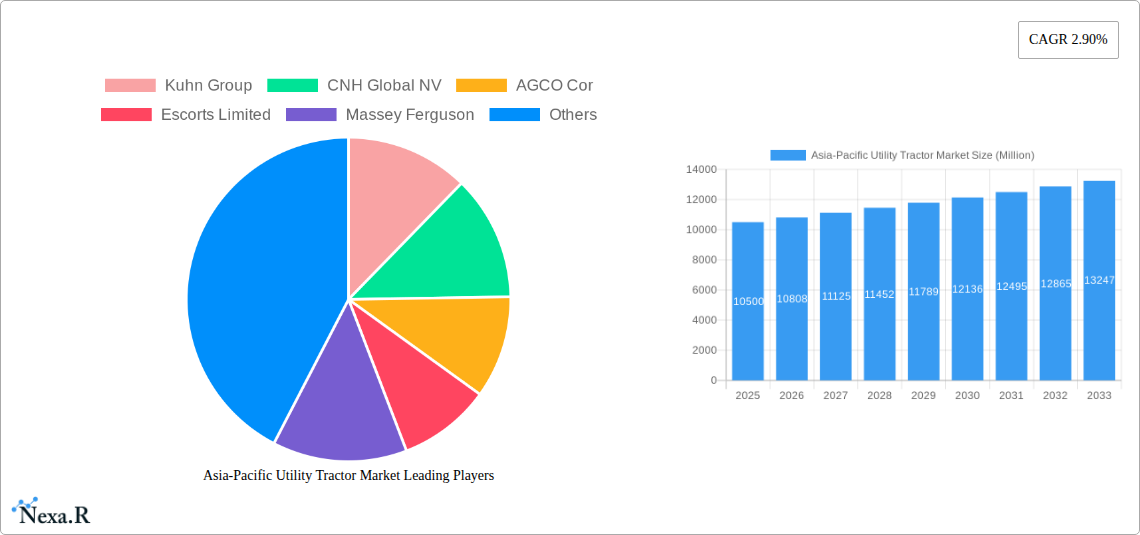

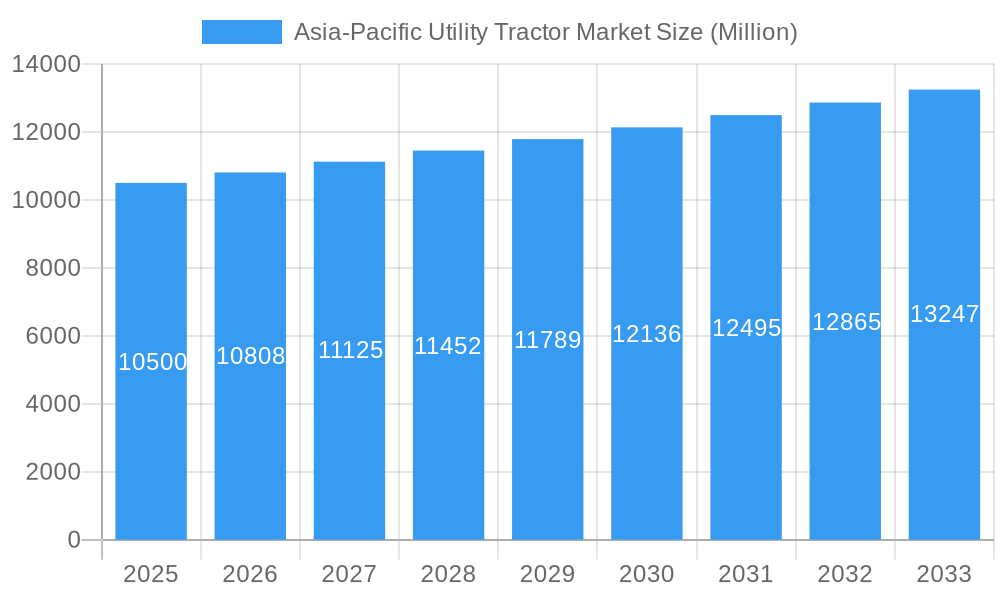

The Asia-Pacific utility tractor market is poised for steady expansion, driven by increasing agricultural mechanization and the growing demand for efficient farming solutions. With an estimated market size of approximately USD 10,500 million, the sector is projected to grow at a Compound Annual Growth Rate (CAGR) of 2.90% from 2025 to 2033, reaching an estimated USD 12,260 million by the end of the forecast period. This growth is fueled by government initiatives promoting modern agriculture, particularly in emerging economies like India and Vietnam, where adoption of advanced machinery is crucial for boosting crop yields and reducing labor dependency. The region's diverse agricultural landscape, ranging from smallholder farms to large-scale operations, necessitates a variety of utility tractor models, further stimulating market demand. The increasing focus on sustainable farming practices and the adoption of smart agriculture technologies are also expected to play a significant role in shaping market trends, leading to higher demand for fuel-efficient and technologically advanced utility tractors.

Asia-Pacific Utility Tractor Market Market Size (In Billion)

The competitive landscape of the Asia-Pacific utility tractor market is characterized by the presence of both global heavyweights and strong regional players. Companies such as Mahindra & Mahindra Ltd., Escorts Limited, and International Tractors Limited hold significant sway due to their established distribution networks and understanding of local farming needs. However, international brands like John Deere, CNH Global NV, and AGCO Corp are actively expanding their footprint, introducing innovative products and focusing on after-sales services to capture market share. Key market restraints include the high initial cost of utility tractors, particularly for small and marginal farmers, and the limited access to credit facilities in some regions. Furthermore, the availability of skilled labor for operating and maintaining advanced machinery remains a challenge. Despite these hurdles, the overall outlook for the Asia-Pacific utility tractor market remains positive, with a continuous shift towards higher horsepower tractors and specialized variants to meet the evolving demands of modern agriculture.

Asia-Pacific Utility Tractor Market Company Market Share

This report offers an in-depth analysis of the Asia-Pacific Utility Tractor Market, providing critical insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, opportunities, and the competitive environment. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this research is indispensable for stakeholders seeking to understand and capitalize on the evolving utility tractor sector in the region. The report meticulously analyzes both parent and child market segments, offering a holistic view of the industry's potential. All values are presented in Million units.

Asia-Pacific Utility Tractor Market Market Dynamics & Structure

The Asia-Pacific utility tractor market is characterized by a dynamic interplay of factors influencing its structure and growth trajectory. Market concentration varies across different sub-regions, with established players holding significant shares in developed agricultural economies, while emerging markets see a rise in localized manufacturers and increased competition. Technological innovation acts as a primary driver, fueled by the demand for more efficient, sustainable, and technologically advanced machinery. Advancements in precision agriculture, GPS integration, and automation are transforming farming practices, necessitating the adoption of sophisticated utility tractors.

- Market Concentration: The market exhibits moderate to high concentration in key economies like China and India, with a few major global and regional manufacturers dominating sales. However, fragmentation is observed in smaller Southeast Asian nations.

- Technological Innovation Drivers: Increasing adoption of smart farming technologies, demand for fuel-efficient engines, and government initiatives promoting agricultural modernization are key innovation drivers. The development of electric and hybrid utility tractors is also gaining traction.

- Regulatory Frameworks: Government policies supporting agricultural mechanization, subsidies for tractor purchases, and emission standards significantly impact market dynamics. Environmental regulations are increasingly influencing product development.

- Competitive Product Substitutes: While direct substitutes are limited, advancements in alternative farming equipment and rental services present indirect competition. The rising use of multi-purpose agricultural machinery also influences demand for specialized utility tractors.

- End-User Demographics: The market caters to a diverse range of end-users, from smallholder farmers to large agricultural corporations and government-backed initiatives. Shifting demographics and rural-to-urban migration also influence the need for labor-saving machinery.

- M&A Trends: Mergers and acquisitions are prevalent as companies seek to expand their product portfolios, gain access to new markets, and leverage technological synergies. This trend is particularly active among major global players seeking to strengthen their presence in the rapidly growing Asia-Pacific region. For instance, recent M&A activities have focused on acquiring companies with expertise in smart farming technologies and electric powertrains.

Asia-Pacific Utility Tractor Market Growth Trends & Insights

The Asia-Pacific utility tractor market is poised for robust growth, driven by a confluence of economic, technological, and demographic factors. The increasing adoption of mechanization in agriculture across developing economies within the region is a significant catalyst, enhancing productivity and efficiency for farmers. As countries like India and China continue to invest heavily in modernizing their agricultural sectors, the demand for reliable and advanced utility tractors is expected to surge. This trend is further amplified by government initiatives promoting agricultural development and providing financial incentives for farmers to upgrade their equipment.

The market size evolution is projected to show a healthy CAGR, reflecting the increasing penetration of utility tractors in traditional farming practices. Technological disruptions are playing a pivotal role, with manufacturers increasingly integrating smart farming capabilities into their offerings. This includes GPS guidance systems, data analytics for optimized crop management, and autonomous features that reduce reliance on manual labor, a growing concern due to rural-to-urban migration. Consumer behavior shifts are also evident, with farmers now prioritizing tractors that offer fuel efficiency, lower maintenance costs, and enhanced operator comfort, alongside powerful performance. The growing emphasis on sustainable agriculture is also spurring demand for eco-friendly models, including electric and hybrid utility tractors, although their market penetration is still in its nascent stages.

Furthermore, the expansion of the agricultural sector to accommodate a growing population and meet rising food demands necessitates greater efficiency, which utility tractors directly address. The increasing disposable income of farmers in many Asia-Pacific countries also contributes to their ability to invest in advanced machinery. The competitive landscape is intensifying, with both global giants and regional players vying for market share. This competition often leads to product differentiation through innovation and cost-effectiveness, further stimulating market growth. The rising awareness about the benefits of mechanization among smaller farmers, aided by extension services and demonstration farms, is also a key growth accelerator. The projected market penetration rates indicate a significant opportunity for widespread adoption across diverse agricultural landscapes.

Dominant Regions, Countries, or Segments in Asia-Pacific Utility Tractor Market

The Asia-Pacific utility tractor market's dominance is primarily driven by a few key regions and countries, each with unique contributing factors. China and India consistently emerge as the largest markets, accounting for a substantial portion of both production and consumption. Their dominance is rooted in their vast agricultural landmass, large farming populations, and significant government focus on agricultural modernization and food security.

- Production Analysis: China leads in the production of utility tractors, supported by a robust manufacturing base, extensive supply chains, and competitive labor costs. India follows closely, with its domestic manufacturers significantly contributing to the overall production volume.

- China's production is estimated at xx Million units in 2025, driven by large-scale manufacturing facilities and a focus on both domestic demand and exports.

- India's production stands at xx Million units in 2025, with a strong emphasis on catering to the needs of small and marginal farmers.

- Consumption Analysis: Both China and India are also the largest consumers of utility tractors, owing to their massive agricultural sectors. The growing need for increased farm efficiency and mechanization to boost crop yields fuels this demand.

- China's consumption is projected at xx Million units in 2025, driven by large-scale farming operations and government subsidies.

- India's consumption is estimated at xx Million units in 2025, reflecting the widespread adoption of tractors by millions of farmers.

- Import Market Analysis (Value & Volume): While China and India are major producers, certain specialized models or components might be imported. However, their overall import volume for utility tractors is relatively lower compared to their production and consumption.

- Import Volume (China): xx Million units in 2025.

- Import Value (China): $xxx Million in 2025.

- Import Volume (India): xx Million units in 2025.

- Import Value (India): $xxx Million in 2025.

- Export Market Analysis (Value & Volume): China is a significant exporter of utility tractors, supplying to various developing nations. India also exports a notable volume, particularly to neighboring countries and parts of Africa.

- Export Volume (China): xx Million units in 2025.

- Export Value (China): $xxx Million in 2025.

- Export Volume (India): xx Million units in 2025.

- Export Value (India): $xxx Million in 2025.

- Price Trend Analysis: The price trend in China and India is influenced by intense domestic competition, government policies, and the availability of a wide range of models, from basic to technologically advanced. Entry-level tractors remain affordable, while sophisticated models command higher prices.

- Average Price (China): $xxx per unit in 2025.

- Average Price (India): $xxx per unit in 2025.

- Industry Developments: Government initiatives like subsidies for farm mechanization, the promotion of cooperative farming, and investments in rural infrastructure are key drivers. The increasing adoption of precision agriculture technologies in these dominant countries is also shaping the product landscape and market demand. The development of smaller, more maneuverable tractors suitable for diverse terrains and farming needs is also a notable trend.

Asia-Pacific Utility Tractor Market Product Landscape

The product landscape of the Asia-Pacific utility tractor market is characterized by a focus on efficiency, durability, and increasingly, technological integration. Manufacturers are offering a wide spectrum of models, ranging from compact utility tractors suitable for small landholdings and specialized tasks like landscaping and horticulture, to more powerful machines designed for heavier agricultural operations. Key innovations include enhanced fuel efficiency through advanced engine technologies, improved operator comfort with ergonomic cabin designs, and integrated GPS and telemetry systems for precision farming applications. The development of versatile implements that can be easily attached and detached further enhances the utility of these tractors.

Key Drivers, Barriers & Challenges in Asia-Pacific Utility Tractor Market

Key Drivers:

The Asia-Pacific utility tractor market is propelled by several strong drivers. The primary force is the increasing need for agricultural mechanization to boost food production and address labor shortages due to rural-to-urban migration. Government initiatives promoting agricultural development, including subsidies and financial aid for tractor purchases in countries like India and China, significantly stimulate demand. The growing adoption of precision agriculture techniques, demanding more technologically advanced and efficient tractors, is another critical driver. Furthermore, rising farm incomes and a growing awareness among farmers about the benefits of mechanization in terms of productivity and profitability are accelerating market growth.

Barriers & Challenges:

Despite the growth potential, the market faces significant challenges. High upfront costs of advanced utility tractors can be a major barrier for smallholder farmers with limited capital. The underdeveloped rural infrastructure in some parts of the region, including poor road connectivity and lack of adequate service centers, can hinder sales and after-sales support. Fluctuations in agricultural commodity prices and the impact of adverse weather conditions can affect farmers' purchasing power. Intense competition from both established global players and a growing number of local manufacturers can lead to price wars, impacting profit margins. Regulatory hurdles related to emissions standards and import/export policies in various countries can also pose challenges. Supply chain disruptions, particularly for critical components, can affect production and timely delivery.

Emerging Opportunities in Asia-Pacific Utility Tractor Market

Emerging opportunities in the Asia-Pacific utility tractor market lie in the growing demand for specialized compact utility tractors catering to horticulture, landscaping, and small-scale urban farming. The increasing adoption of electric and hybrid utility tractors, driven by environmental concerns and government incentives for green technology, presents a significant untapped market. Furthermore, the expansion of precision agriculture technologies, including GPS-guided tractors and data analytics platforms, offers opportunities for value-added services and integrated solutions. The untapped potential in less mechanized Southeast Asian countries, coupled with increasing foreign investment in agriculture, signals promising growth avenues for manufacturers and suppliers.

Growth Accelerators in the Asia-Pacific Utility Tractor Market Industry

Several catalysts are accelerating long-term growth in the Asia-Pacific utility tractor market. Technological breakthroughs, such as the development of AI-powered autonomous tractors and advanced sensor technologies, are set to revolutionize farming practices. Strategic partnerships between tractor manufacturers and technology providers are fostering innovation and the creation of integrated smart farming solutions. Market expansion strategies targeting underserved rural communities and emerging economies within the region are crucial for sustained growth. The increasing focus on sustainable agriculture and the development of fuel-efficient and environmentally friendly tractor models will further drive adoption.

Key Players Shaping the Asia-Pacific Utility Tractor Market Market

- Kuhn Group

- CNH Global NV

- AGCO Corp

- Escorts Limited

- Massey Ferguson

- Deere & Company

- International Tractors Limited

- Mahindra & Mahindra Ltd

- Claas KGaA mbH

- Kubota Agricultural Machinery

- Yanmar Co Ltd

Notable Milestones in Asia-Pacific Utility Tractor Market Sector

- 2019/2020: Increased focus on emission reduction technologies in new tractor models across major manufacturers.

- 2020/2021: Launch of new compact utility tractor series targeting niche applications in horticulture and landscaping.

- 2021/2022: Several major players announce strategic investments in R&D for electric and hybrid tractor prototypes.

- 2022/2023: Introduction of advanced GPS and telematics systems as standard features in mid-range utility tractors.

- 2023/2024: Significant increase in M&A activities, with larger companies acquiring smaller tech-focused firms to enhance smart farming capabilities.

In-Depth Asia-Pacific Utility Tractor Market Market Outlook

The Asia-Pacific utility tractor market is projected for sustained and significant growth, fueled by a strong emphasis on agricultural modernization and food security. The increasing adoption of advanced technologies, coupled with favorable government policies and a growing awareness among farmers, will continue to drive demand. Opportunities in emerging economies and the growing interest in sustainable farming practices will further shape the market. Manufacturers focusing on innovation, cost-effectiveness, and comprehensive after-sales support are best positioned to capitalize on the vast potential of this dynamic region. The market is expected to see continued evolution with greater integration of digital solutions and a move towards more eco-friendly machinery.

Asia-Pacific Utility Tractor Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia-Pacific Utility Tractor Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Utility Tractor Market Regional Market Share

Geographic Coverage of Asia-Pacific Utility Tractor Market

Asia-Pacific Utility Tractor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization

- 3.3. Market Restrains

- 3.3.1. Heavy Initial Procurement Cost and High Expenditure on Maintenance

- 3.4. Market Trends

- 3.4.1. Increasing Cost of Farm Labour

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Utility Tractor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kuhn Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CNH Global NV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AGCO Cor

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Escorts Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Massey Ferguson

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Deere & Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 International Tractors Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mahindra & Mahindra Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Claas KGaA mbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kubota Agricultural Machinery

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Yanmar Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Kuhn Group

List of Figures

- Figure 1: Asia-Pacific Utility Tractor Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Utility Tractor Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Japan Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: South Korea Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: India Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Australia Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: New Zealand Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Indonesia Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Malaysia Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Singapore Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Thailand Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Vietnam Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Philippines Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Utility Tractor Market?

The projected CAGR is approximately 3.9%.

2. Which companies are prominent players in the Asia-Pacific Utility Tractor Market?

Key companies in the market include Kuhn Group, CNH Global NV, AGCO Cor, Escorts Limited, Massey Ferguson, Deere & Company, International Tractors Limited, Mahindra & Mahindra Ltd, Claas KGaA mbH, Kubota Agricultural Machinery, Yanmar Co Ltd.

3. What are the main segments of the Asia-Pacific Utility Tractor Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization.

6. What are the notable trends driving market growth?

Increasing Cost of Farm Labour.

7. Are there any restraints impacting market growth?

Heavy Initial Procurement Cost and High Expenditure on Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Utility Tractor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Utility Tractor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Utility Tractor Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Utility Tractor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence