Key Insights

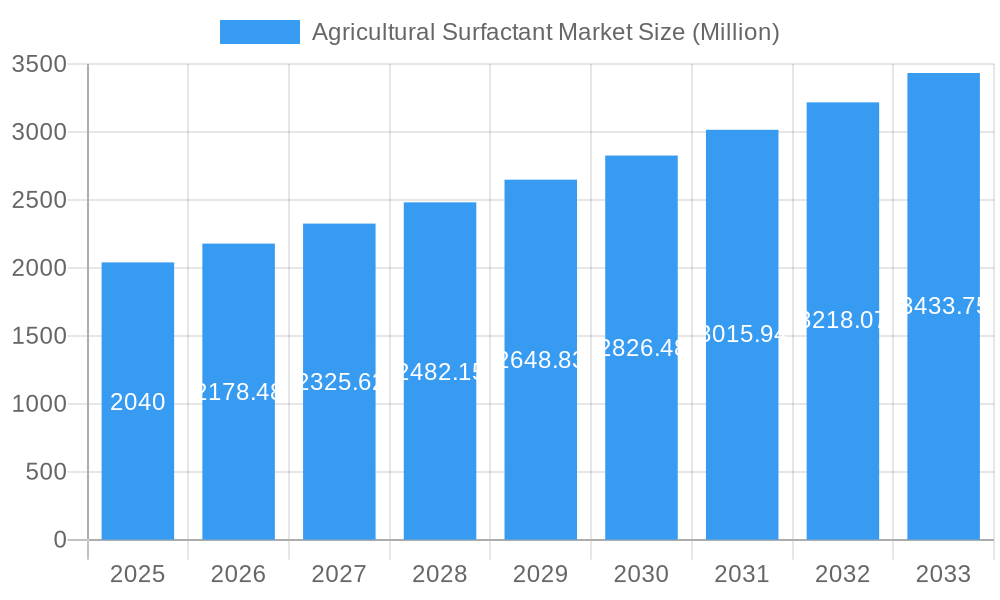

The global Agricultural Surfactant Market is poised for significant expansion, projected to reach a market size of 2.04 Billion USD by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 6.70%. This impressive growth trajectory is underpinned by the increasing demand for enhanced crop protection solutions and the imperative to maximize agricultural yields in the face of a growing global population and limited arable land. Agricultural surfactants play a crucial role in improving the efficacy of pesticides, herbicides, and fertilizers by enhancing their spreading, wetting, and penetration capabilities on plant surfaces. This leads to more efficient application of active ingredients, reducing the overall quantity needed and consequently lowering environmental impact and farmer costs. The market is witnessing a strong surge in demand for eco-friendly and bio-based surfactants, reflecting a broader industry shift towards sustainability.

Agricultural Surfactant Market Market Size (In Billion)

Key drivers propelling this market forward include advancements in formulation technologies, the development of novel surfactant chemistries that offer superior performance, and the increasing adoption of precision agriculture practices. These practices leverage data-driven insights to optimize resource allocation, including the precise application of crop protection products, where surfactants are integral. Furthermore, government initiatives promoting sustainable agriculture and the need to combat pest resistance are also contributing to the market's positive outlook. While the market presents substantial opportunities, certain factors such as fluctuating raw material prices and stringent regulatory landscapes in some regions could pose challenges. However, the overarching trend indicates a sustained and dynamic growth period for agricultural surfactants as they become indispensable tools for modern, efficient, and sustainable farming.

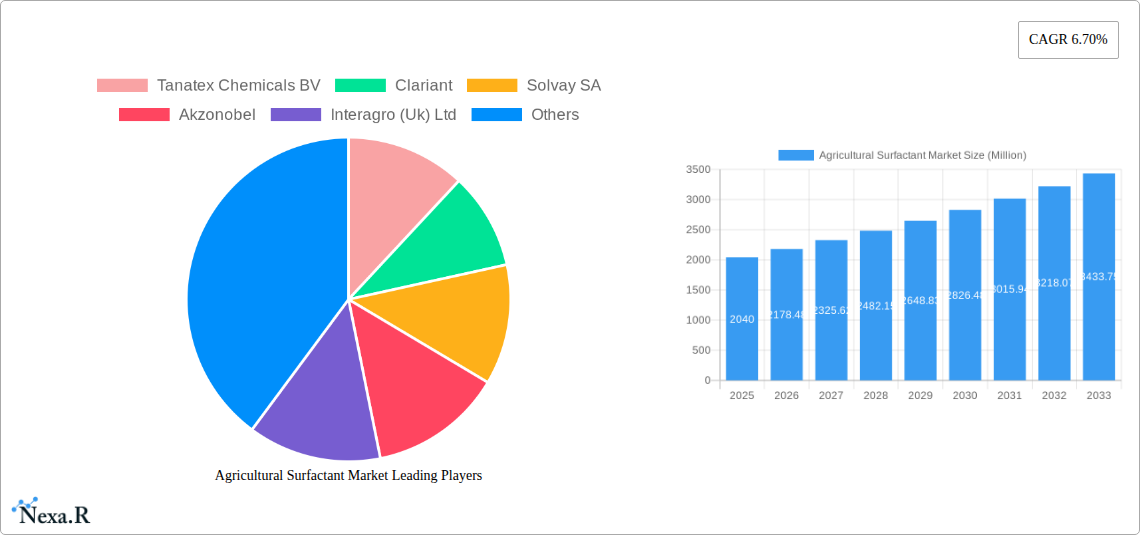

Agricultural Surfactant Market Company Market Share

This in-depth agricultural surfactant market report provides a 360-degree view of the global market, meticulously analyzing key trends, growth drivers, and the competitive landscape from 2019 to 2033, with a base and estimated year of 2025. Our comprehensive analysis covers parent and child market segments, offering unparalleled insights for industry professionals seeking to capitalize on the burgeoning demand for advanced crop protection and enhancement solutions. With a focus on crop protection chemicals, adjuvants, and pesticide formulations, this report is optimized with high-traffic keywords such as agricultural surfactants market size, agricultural surfactants market share, and agricultural surfactants market forecast to maximize search engine visibility and attract relevant industry stakeholders. Discover key production and consumption analyses, import/export market dynamics, and intricate price trend analyses, all presented with clear, concise data in million units for easy comprehension.

Agricultural Surfactant Market Market Dynamics & Structure

The agricultural surfactant market is characterized by a moderate to high level of concentration, with key players investing heavily in research and development to introduce novel, high-performance products. Technological innovation is a primary driver, focusing on creating bio-based, eco-friendly surfactants that enhance the efficacy of pesticides and fertilizers while minimizing environmental impact. Regulatory frameworks, particularly concerning pesticide registration and environmental safety, significantly influence market entry and product development strategies. Competitive product substitutes, such as alternative adjuvant technologies and integrated pest management approaches, necessitate continuous innovation from surfactant manufacturers. End-user demographics, primarily large-scale commercial farms and contract growers, are increasingly demanding cost-effective and sustainable solutions. Merger and acquisition (M&A) trends are evident as established companies seek to expand their product portfolios and geographical reach.

- Market Concentration: Dominated by a few key global players, with significant regional fragmentation.

- Technological Innovation Drivers: Development of low-foaming, rainfast, and drift-reduction surfactants; emphasis on biodegradability and reduced ecotoxicity.

- Regulatory Frameworks: Stringent regulations in North America and Europe drive demand for compliant and sustainable surfactant solutions.

- Competitive Product Substitutes: Integrated pest management (IPM) strategies and bio-pesticides present a growing challenge.

- End-User Demographics: Increasing demand from large agricultural enterprises for precision agriculture solutions.

- M&A Trends: Strategic acquisitions to gain access to new technologies and expand market presence.

Agricultural Surfactant Market Growth Trends & Insights

The agricultural surfactant market is poised for robust expansion, driven by the escalating global demand for food and the increasing need for efficient crop protection and yield enhancement. Our analysis leverages extensive data to forecast a significant CAGR (Compound Annual Growth Rate) for the agricultural surfactant market, indicating substantial growth over the forecast period. The adoption rates of advanced agricultural practices, coupled with the growing awareness among farmers about the benefits of surfactants in improving the performance of agrochemicals, are key contributors to this upward trajectory. Technological disruptions, such as the development of nano-surfactants and smart formulations that respond to environmental cues, are expected to revolutionize crop management. Consumer behavior shifts, emphasizing the demand for sustainably produced food, are also indirectly fueling the market as farmers seek to optimize resource utilization and reduce the environmental footprint of their operations. The market penetration of specialized surfactants designed for specific crop types and application methods is also on the rise, indicating a move towards more tailored agricultural solutions.

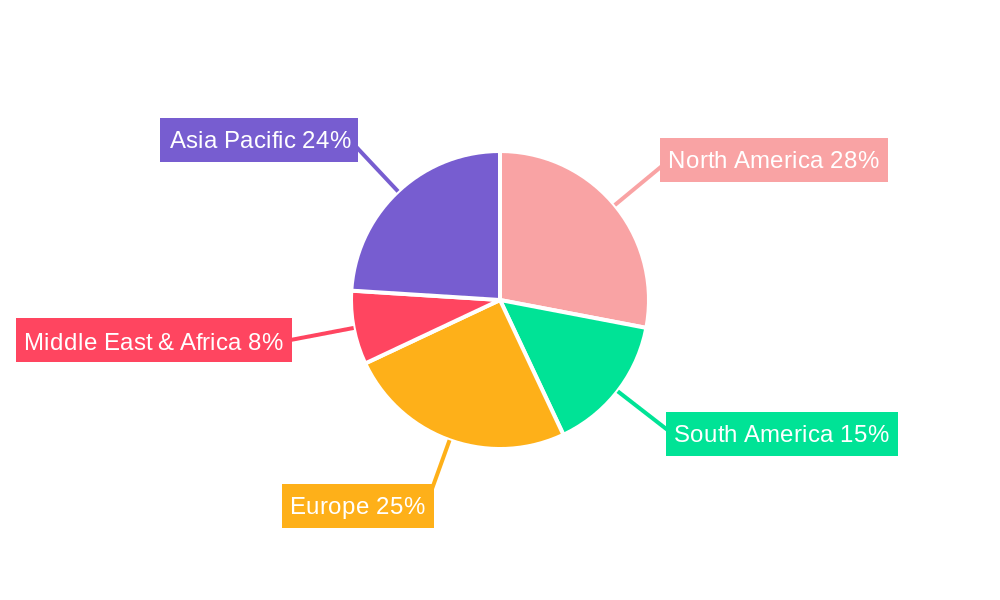

Dominant Regions, Countries, or Segments in Agricultural Surfactant Market

North America currently dominates the agricultural surfactant market owing to its advanced agricultural infrastructure, high adoption rate of modern farming techniques, and substantial investments in agrochemical research and development. The United States, in particular, plays a pivotal role, driven by its large-scale commercial farming operations and stringent regulations that promote the use of effective and compliant crop protection agents. Asia Pacific, however, presents the most significant growth potential, fueled by rapid population growth, increasing disposable incomes, and government initiatives aimed at boosting agricultural productivity. Countries like China and India are key contributors to this surge, with expanding arable land and a growing focus on improving crop yields through the adoption of advanced agricultural inputs. The production analysis in these regions is characterized by a mix of multinational corporations and burgeoning local manufacturers, while consumption analysis reflects the diverse needs of smallholder farms to large agribusinesses. The import market analysis (value & volume) for agricultural surfactants is robust in regions with a deficit in domestic production, while the export market analysis (value & volume) is led by countries with established manufacturing capabilities and strong R&D support. Price trend analysis indicates a gradual upward trend, influenced by raw material costs, technological advancements, and demand-supply dynamics.

- Leading Region: North America, with significant contributions from the United States.

- Growth Potential Region: Asia Pacific, driven by increasing agricultural output and rising demand for enhanced crop yields.

- Key Drivers in North America: Advanced agricultural practices, strong R&D focus, and regulatory push for efficient crop protection.

- Key Drivers in Asia Pacific: Population growth, government support for agriculture, and increasing adoption of modern farming techniques.

- Production Hubs: Significant production facilities in North America, Europe, and emerging hubs in Asia Pacific.

- Consumption Centers: Widespread consumption across all major agricultural economies, with a concentrated demand from large-scale farming operations.

- Import/Export Dynamics: Trade flows driven by regional production capacities and demand for specialized surfactant formulations.

Agricultural Surfactant Market Product Landscape

The agricultural surfactant market's product landscape is diverse and continuously evolving, with a strong emphasis on developing innovative formulations that enhance the efficacy of pesticides, herbicides, and fertilizers. Key product categories include non-ionic, anionic, cationic, and amphoteric surfactants, each offering distinct functionalities. Innovations are focused on creating surfactants that improve spray droplet adhesion, reduce spray drift, enhance leaf penetration, and promote better active ingredient solubility and dispersion. Performance metrics are continuously being improved, with a focus on biodegradability, low toxicity, and compatibility with a wider range of agrochemical formulations. Unique selling propositions revolve around environmental sustainability and enhanced crop protection efficiency, catering to the growing demand for eco-friendly agricultural solutions.

Key Drivers, Barriers & Challenges in Agricultural Surfactant Market

The agricultural surfactant market is propelled by several key drivers, including the increasing global population demanding higher food production, the necessity for optimized crop yields, and the growing adoption of advanced agricultural technologies that necessitate effective adjuvant use. Furthermore, government initiatives promoting sustainable agriculture and integrated pest management indirectly boost demand for efficient surfactants.

Conversely, the market faces significant barriers and challenges. Fluctuations in raw material prices, particularly for petroleum-based feedstocks, can impact production costs and market pricing. Stringent regulatory approvals for new surfactant formulations in various regions can lead to extended development timelines and increased costs. Intense competition from established players and the emergence of alternative crop enhancement technologies also pose challenges, requiring continuous innovation and competitive pricing strategies. Supply chain disruptions, as witnessed in recent global events, can also impede the availability and distribution of essential raw materials and finished products.

Emerging Opportunities in Agricultural Surfactant Market

Emerging opportunities within the agricultural surfactant market lie in the development and adoption of bio-based and biodegradable surfactants derived from renewable resources, catering to the growing demand for sustainable agricultural practices. Untapped markets in developing economies with expanding agricultural sectors present significant growth potential. Innovative applications, such as the use of surfactants in precision agriculture for targeted delivery of crop protection agents and in the formulation of biopesticides and biostimulants, offer substantial avenues for market expansion. Evolving consumer preferences for organically grown produce are also driving demand for more environmentally benign agricultural inputs, including naturally derived surfactants.

Growth Accelerators in the Agricultural Surfactant Market Industry

Long-term growth in the agricultural surfactant market is being accelerated by significant technological breakthroughs, including advancements in nanotechnology for enhanced delivery systems and the development of smart surfactants that respond to environmental conditions. Strategic partnerships between agrochemical manufacturers and surfactant suppliers are crucial for co-developing innovative solutions tailored to specific crop needs and regional requirements. Market expansion strategies, particularly focusing on emerging economies with a burgeoning agricultural sector, are also vital growth accelerators. Investment in research and development to create more efficient, cost-effective, and environmentally sustainable surfactant formulations will continue to drive market expansion and solidify competitive advantages.

Key Players Shaping the Agricultural Surfactant Market Market

- Tanatex Chemicals BV

- Clariant

- Solvay SA

- Akzonobel

- Interagro (Uk) Ltd

- Brandt Consolidated Inc

- Garrco Products Inc

- Lamberti SPA

- Kao Corporation

- Helena Chemical Company

- Air Products and Chemicals

- Nufarm Limited

- Wilbur-Ellis Company

- Huntsman

- Corteva Agriscience

- Croda International PLC

- Evonik Industries

- BASF SE

Notable Milestones in Agricultural Surfactant Market Sector

- March 2022: Dow announced a new product extension of VORASURF™ Silicone Surfactants to support the growing demand for enhanced energy efficiency and sustainable solutions in the rigid polyurethane foam market, with a specific focus on spray and construction applications.

- September 2021: BASF increased prices for non-ionic surfactants due to increasing demand in the agricultural input sector, including herbicides and insecticides.

- March 2021: BASF signed two distinct partnership agreements to expand its leading position in the bio-based surfactants and actives market.

In-Depth Agricultural Surfactant Market Market Outlook

The future outlook for the agricultural surfactant market is exceptionally promising, driven by an confluence of factors that underscore its critical role in modern agriculture. Growth accelerators such as the increasing global food demand, coupled with the imperative for sustainable and efficient farming practices, will continue to propel market expansion. Strategic opportunities abound in the development of sophisticated, bio-derived surfactants and in catering to the burgeoning needs of emerging economies. The market's capacity for innovation, particularly in areas like precision agriculture and enhanced formulation technologies, positions it for sustained and significant growth, promising substantial returns for stakeholders who can adeptly navigate its evolving landscape.

Agricultural Surfactant Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Agricultural Surfactant Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Agricultural Surfactant Market Regional Market Share

Geographic Coverage of Agricultural Surfactant Market

Agricultural Surfactant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization

- 3.3. Market Restrains

- 3.3.1. Heavy Initial Procurement Cost and High Expenditure on Maintenance

- 3.4. Market Trends

- 3.4.1. Rising Demand for Food and Shrinking Land Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Agricultural Surfactant Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Agricultural Surfactant Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Agricultural Surfactant Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Agricultural Surfactant Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Agricultural Surfactant Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Agricultural Surfactant Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tanatex Chemicals BV

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clariant

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Solvay SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Akzonobel

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Interagro (Uk) Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Brandt Consolidated Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Garrco Products Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lamberti SPA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kao Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Helena Chemical Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Air Products and Chemicals

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Nufarm Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Wilbur-Ellis Company

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Huntsman

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Corteva Agriscience

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Croda International PLC

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Evonik Industries

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 BASF SE

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Tanatex Chemicals BV

List of Figures

- Figure 1: Global Agricultural Surfactant Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Agricultural Surfactant Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Agricultural Surfactant Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Agricultural Surfactant Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Agricultural Surfactant Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Agricultural Surfactant Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Agricultural Surfactant Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Agricultural Surfactant Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Agricultural Surfactant Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Agricultural Surfactant Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Agricultural Surfactant Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Agricultural Surfactant Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Agricultural Surfactant Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Agricultural Surfactant Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America Agricultural Surfactant Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Agricultural Surfactant Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America Agricultural Surfactant Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Agricultural Surfactant Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Agricultural Surfactant Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Agricultural Surfactant Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Agricultural Surfactant Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Agricultural Surfactant Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Agricultural Surfactant Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Agricultural Surfactant Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Agricultural Surfactant Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Agricultural Surfactant Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe Agricultural Surfactant Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Agricultural Surfactant Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Agricultural Surfactant Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Agricultural Surfactant Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Agricultural Surfactant Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Agricultural Surfactant Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Agricultural Surfactant Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Agricultural Surfactant Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Agricultural Surfactant Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Agricultural Surfactant Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe Agricultural Surfactant Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Agricultural Surfactant Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Agricultural Surfactant Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Agricultural Surfactant Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Agricultural Surfactant Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Agricultural Surfactant Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Agricultural Surfactant Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Agricultural Surfactant Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Agricultural Surfactant Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Agricultural Surfactant Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Agricultural Surfactant Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Agricultural Surfactant Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa Agricultural Surfactant Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Agricultural Surfactant Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Agricultural Surfactant Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Agricultural Surfactant Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Agricultural Surfactant Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Agricultural Surfactant Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Agricultural Surfactant Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Agricultural Surfactant Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Agricultural Surfactant Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Agricultural Surfactant Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Agricultural Surfactant Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Agricultural Surfactant Market Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific Agricultural Surfactant Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Agricultural Surfactant Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Agricultural Surfactant Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Agricultural Surfactant Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Agricultural Surfactant Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Agricultural Surfactant Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Agricultural Surfactant Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Agricultural Surfactant Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Agricultural Surfactant Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Agricultural Surfactant Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Agricultural Surfactant Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Agricultural Surfactant Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Agricultural Surfactant Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Agricultural Surfactant Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Agricultural Surfactant Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Agricultural Surfactant Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Agricultural Surfactant Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Agricultural Surfactant Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Agricultural Surfactant Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Agricultural Surfactant Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Agricultural Surfactant Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Agricultural Surfactant Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Agricultural Surfactant Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Agricultural Surfactant Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Agricultural Surfactant Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Agricultural Surfactant Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Agricultural Surfactant Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Agricultural Surfactant Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Agricultural Surfactant Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Agricultural Surfactant Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Agricultural Surfactant Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global Agricultural Surfactant Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Agricultural Surfactant Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Agricultural Surfactant Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Agricultural Surfactant Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Agricultural Surfactant Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Agricultural Surfactant Market Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Agricultural Surfactant Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Agricultural Surfactant Market?

The projected CAGR is approximately 6.70%.

2. Which companies are prominent players in the Agricultural Surfactant Market?

Key companies in the market include Tanatex Chemicals BV, Clariant, Solvay SA, Akzonobel, Interagro (Uk) Ltd, Brandt Consolidated Inc, Garrco Products Inc, Lamberti SPA, Kao Corporation, Helena Chemical Company, Air Products and Chemicals, Nufarm Limited, Wilbur-Ellis Company, Huntsman, Corteva Agriscience, Croda International PLC, Evonik Industries, BASF SE.

3. What are the main segments of the Agricultural Surfactant Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization.

6. What are the notable trends driving market growth?

Rising Demand for Food and Shrinking Land Driving the Market.

7. Are there any restraints impacting market growth?

Heavy Initial Procurement Cost and High Expenditure on Maintenance.

8. Can you provide examples of recent developments in the market?

March 2022 - Dow announced a new product extension of VORASURF™ Silicone Surfactants to support the growing demand for enhanced energy efficiency and sustainable solutions in the rigid polyurethane foam market, with a specific focus on spray and construction applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Agricultural Surfactant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Agricultural Surfactant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Agricultural Surfactant Market?

To stay informed about further developments, trends, and reports in the Agricultural Surfactant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence