Key Insights

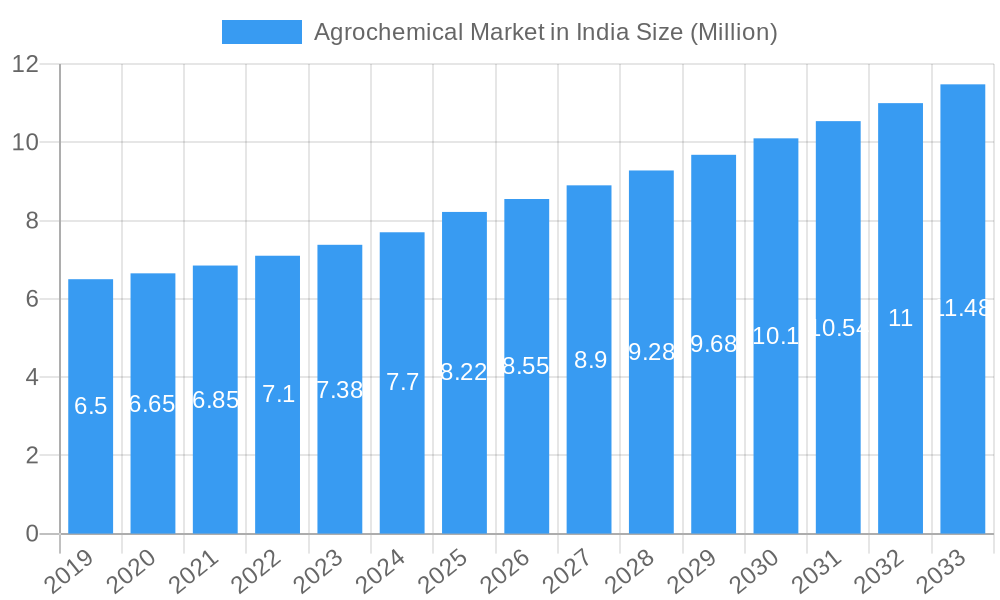

The Indian agrochemical market is poised for significant growth, projected to reach an estimated USD 8.22 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 4.00% anticipated throughout the forecast period. This expansion is primarily driven by a confluence of factors critical to India's agricultural sector. A rapidly growing population necessitates increased food production, thereby amplifying the demand for crop protection solutions and yield enhancement products. Government initiatives aimed at modernizing agriculture, coupled with the increasing adoption of advanced farming practices and technologies by farmers, are further fueling market expansion. Furthermore, the rising awareness among farmers regarding the benefits of integrated pest management (IPM) and the use of efficient agrochemicals for sustainable agriculture contributes to market momentum. The market's trajectory will also be shaped by the introduction of innovative and eco-friendly agrochemical formulations designed to meet evolving regulatory standards and consumer preferences for safer food production.

Agrochemical Market in India Market Size (In Million)

The market is segmented across crucial areas including production, consumption, imports, exports, and price trends, each offering unique insights into the sector's dynamics. Production analysis will reveal the domestic manufacturing capabilities and potential for expansion. Consumption patterns will highlight regional demand variations and the adoption rates of different agrochemical categories. Import and export data will underscore India's position in the global agrochemical trade, indicating areas of strength and potential reliance on international markets. Price trend analysis will be instrumental in understanding the cost dynamics and their impact on farmer affordability and market competitiveness. Key players such as Bayer Crop Science, Syngenta AG, UPL Limited, and Indian Farmer Fertilizer Cooperative are expected to play a pivotal role in shaping market strategies through innovation, product development, and strategic collaborations, further bolstering the market's overall growth trajectory and its contribution to India's agricultural self-sufficiency and economic development.

Agrochemical Market in India Company Market Share

Comprehensive Agrochemical Market Report: India (2019-2033)

This in-depth report provides a definitive analysis of the Indian Agrochemical Market, covering market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, opportunities, growth accelerators, leading players, and notable milestones. With a study period extending from 2019 to 2033, a base year of 2025, and an estimated year of 2025, this report offers a robust forecast for the 2025-2033 period, building upon historical data from 2019-2024. All values are presented in Million Units for precise industry understanding.

Agrochemical Market in India Market Dynamics & Structure

The Indian Agrochemical Market is characterized by a moderately concentrated structure, with a few dominant global and domestic players holding significant market share. Technological innovation is a key driver, fueled by the need for higher crop yields and sustainable farming practices. The regulatory framework, evolving to support farmer welfare and environmental protection, influences product development and market entry. Competitive product substitutes, including biopesticides and integrated pest management (IPM) strategies, are gaining traction, posing a challenge to traditional chemical agrochemicals. End-user demographics are diverse, ranging from smallholder farmers to large agricultural corporations, each with distinct needs and purchasing behaviors. Mergers and acquisitions (M&A) are a recurring trend as companies seek to expand their product portfolios, market reach, and technological capabilities.

- Market Concentration: Dominated by a blend of multinational corporations and strong domestic manufacturers, leading to strategic competition.

- Technological Innovation Drivers: Emphasis on developing novel formulations, bio-based solutions, and precision agriculture technologies to enhance efficacy and reduce environmental impact.

- Regulatory Frameworks: Stringent registration processes and evolving policies around residue limits and environmental safety are shaping product development and market access.

- Competitive Product Substitutes: Growing adoption of biopesticides, biofertilizers, and precision farming techniques presents a shift in market dynamics.

- End-User Demographics: Farmers' increasing awareness of sustainable practices and demand for cost-effective, high-yield solutions.

- M&A Trends: Strategic acquisitions and partnerships to consolidate market share, acquire new technologies, and expand geographical presence.

Agrochemical Market in India Growth Trends & Insights

The Indian Agrochemical Market is poised for significant expansion, driven by a confluence of factors including a burgeoning population, increasing demand for food security, and government initiatives promoting agricultural productivity. The market size is projected to witness robust growth, with adoption rates of advanced agrochemical solutions steadily increasing as farmers recognize their benefits in terms of crop protection and yield enhancement. Technological disruptions, such as the development of precision spraying equipment and the integration of data analytics in farming, are revolutionizing the application and effectiveness of agrochemicals. Consumer behavior shifts towards more sustainable and residue-free produce are also influencing product demand, encouraging innovation in eco-friendly agrochemical solutions. The CAGR for the forecast period is anticipated to be substantial, reflecting the dynamic nature and inherent potential of this sector. Market penetration of specialized agrochemicals is expected to rise as awareness and accessibility improve.

Dominant Regions, Countries, or Segments in Agrochemical Market in India

The Indian Agrochemical Market's dominance is most pronounced in the Consumption Analysis segment, primarily driven by the vast agricultural landmass and the critical need for crop protection and yield enhancement across diverse agro-climatic zones. Key drivers of this dominance include supportive government policies aimed at bolstering agricultural output, such as subsidies for fertilizers and crop protection chemicals, and the increasing adoption of modern farming techniques by a growing number of farmers. Economic policies that favor agricultural development and investments in rural infrastructure further facilitate the widespread use of agrochemicals.

- Production Analysis: While domestic production is robust, it often focuses on intermediate chemicals or formulations. Major production hubs are concentrated in states with established chemical industries.

- Consumption Analysis: This segment represents the largest share of the market, with states like Uttar Pradesh, Maharashtra, Rajasthan, and Punjab being major consumers due to their extensive agricultural land and diverse crop cultivation. The demand for insecticides, herbicides, and fungicides is particularly high.

- Import Market Analysis (Value & Volume): India relies on imports for certain specialized active ingredients and advanced formulations. Countries like China and Europe are significant import partners. The import market is crucial for bridging supply gaps and accessing cutting-edge agrochemical technologies.

- Export Market Analysis (Value & Volume): India is emerging as a significant exporter of generic agrochemicals and formulations, particularly to developing nations in Asia and Africa. Competitive pricing and manufacturing capabilities contribute to its growing export market share.

- Price Trend Analysis: Price trends are influenced by global raw material costs, domestic supply-demand dynamics, government policies, and currency fluctuations. Seasonal demand and competitive pressures also play a crucial role.

Agrochemical Market in India Product Landscape

The Indian Agrochemical Market is witnessing a dynamic product landscape characterized by continuous innovation in crop protection and enhancement solutions. This includes the development of more potent and targeted insecticides to combat evolving pest resistance, advanced herbicides for effective weed management in various crops, and innovative fungicides that offer broader spectrum disease control. Furthermore, the market is seeing a surge in the introduction of bio-pesticides and bio-stimulants, driven by the growing demand for sustainable agricultural practices. These novel products offer improved efficacy, reduced environmental impact, and enhanced crop quality, catering to the evolving needs of Indian farmers.

Key Drivers, Barriers & Challenges in Agrochemical Market in India

Key Drivers:

- Increasing Food Demand: A rising population necessitates enhanced agricultural productivity, driving the demand for effective agrochemicals.

- Government Support: Policies promoting agricultural modernization, subsidies, and farmer welfare schemes act as significant catalysts.

- Technological Advancements: Innovations in product formulation and application technologies improve efficiency and efficacy.

- Favorable Climate Conditions: Diverse agro-climatic zones support a wide range of crops, requiring varied crop protection solutions.

Barriers & Challenges:

- High Input Costs: Volatility in raw material prices and rising manufacturing expenses can impact affordability.

- Regulatory Hurdles: Stringent registration processes and evolving environmental regulations can delay product launches.

- Awareness and Education: Ensuring widespread adoption requires continuous farmer education on product usage and best practices.

- Climate Change and Pest Resistance: Increasingly unpredictable weather patterns and evolving pest resistance necessitate constant innovation and adaptation.

- Supply Chain Disruptions: Global and local supply chain issues can affect the availability and timely delivery of agrochemicals.

Emerging Opportunities in Agrochemical Market in India

Emerging opportunities in the Indian Agrochemical Market lie in the growing demand for biological agrochemicals and precision farming solutions. The increasing awareness among farmers regarding sustainable agriculture and the need for residue-free produce is driving the adoption of bio-pesticides, bio-fertilizers, and bio-stimulants. Furthermore, the integration of digital technologies in agriculture, such as drone-based spraying, soil sensors, and data analytics for pest and disease management, presents a significant growth avenue. Untapped markets in less developed agricultural regions and the development of customized agrochemical solutions for niche crops also offer substantial potential for market expansion.

Growth Accelerators in the Agrochemical Market in India Industry

Technological breakthroughs in the development of novel active ingredients and advanced formulation technologies are key growth accelerators for the Agrochemical Market in India. Strategic partnerships and collaborations between domestic and international players are enabling the introduction of cutting-edge products and the expansion of market reach. Market expansion strategies, including the development of localized product portfolios catering to specific regional needs and crop types, are also crucial. Furthermore, the government's continued focus on enhancing agricultural productivity through various schemes and incentives provides a sustained impetus for market growth.

Key Players Shaping the Agrochemical Market in India Market

- Dhanuka Agritech

- Nagarjuna Fertilizers and Chemicals Limited

- Deepak Fertilizers

- Rastriya Chemicals and Fertilizers Ltd

- YARA International

- Indian Farmer Fertilizer Cooperative

- UPL Limited

- Potash Corporation of Saskatchewan

- Bayer Crop Science

- BASF SE

- TATA Rallies

- National Fertilizers Limited

- Sumitomo Chemical India Ltd

- Crystal Crop Protection Limited

- Syngenta AG

- Coromandel International Limited

Notable Milestones in Agrochemical Market in India Sector

- March 2022: FMC India Introduced Corprima, a New Insecticide for Tomato & Okra Crops. Corprima is a novel insecticide that provides higher pest control and improved flower and fruit retention, resulting in larger, higher-quality harvests.

- February 2022: Crystal Crop Protection Limited launched its new product HOLA, a post-emergent herbicide to protect sugarcane crops from weeds across the country.

- March 2021: FMC Corporation collaborated on a long-term strategic partnership with UPL Limited to supply Rynaxypr active (insecticide) for use in its product formulations.

In-Depth Agrochemical Market in India Market Outlook

The Indian Agrochemical Market is set for a robust and sustainable growth trajectory, driven by increasing agricultural mechanization, a growing emphasis on crop yield optimization, and the persistent need for effective pest and disease management. The ongoing integration of digital technologies and the expanding adoption of bio-rational solutions will further shape the market landscape. Strategic collaborations and a continuous pipeline of innovative product launches are expected to fuel market expansion, creating significant opportunities for stakeholders. The market's future outlook is characterized by a strong potential for both domestic consumption and increased export capabilities, positioning India as a key player in the global agrochemical arena.

Agrochemical Market in India Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Agrochemical Market in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

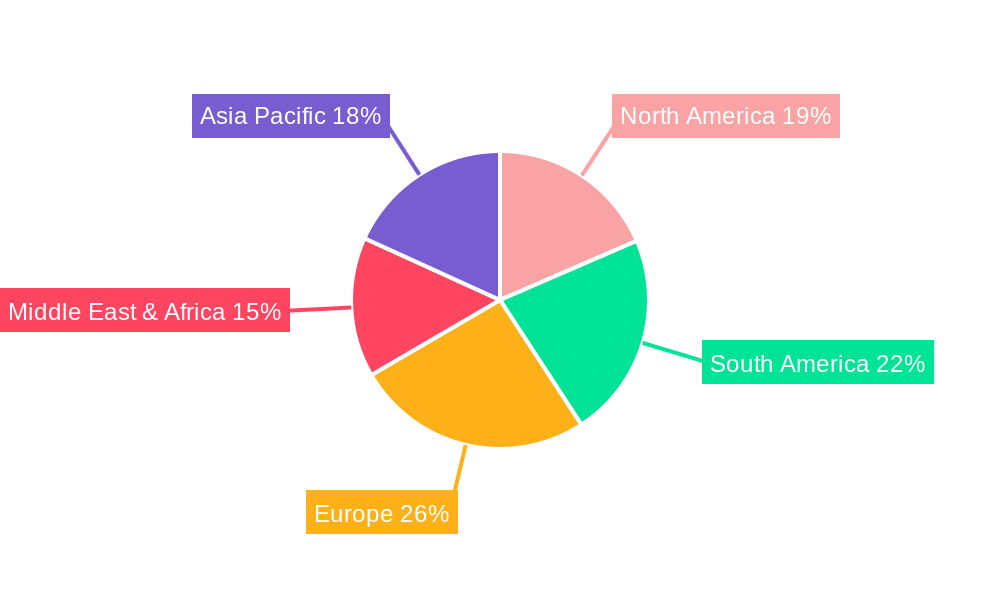

Agrochemical Market in India Regional Market Share

Geographic Coverage of Agrochemical Market in India

Agrochemical Market in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns

- 3.3. Market Restrains

- 3.3.1. High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 3.4. Market Trends

- 3.4.1. Increasing Population Leads to Increased Food Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Agrochemical Market in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Agrochemical Market in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Agrochemical Market in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Agrochemical Market in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Agrochemical Market in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Agrochemical Market in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dhanuka Agritech

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nagarjuna Fertilizers and Chemicals Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Deepak Fertilizers

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rastriya Chemicals and Fertilizers Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 YARA International

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Indian Farmer Fertilizer Cooperative

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 UPL Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Potash Corporation of Saskatchewan

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bayer Crop Science

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BASF SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 TATA Rallies

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 National Fertilizers Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sumitomo Chemical India Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Crystal Crop Protection Limite

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Syngenta AG

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Coromandel International Limited

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Dhanuka Agritech

List of Figures

- Figure 1: Global Agrochemical Market in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Agrochemical Market in India Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Agrochemical Market in India Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Agrochemical Market in India Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Agrochemical Market in India Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Agrochemical Market in India Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Agrochemical Market in India Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Agrochemical Market in India Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Agrochemical Market in India Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Agrochemical Market in India Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Agrochemical Market in India Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Agrochemical Market in India Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Agrochemical Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Agrochemical Market in India Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America Agrochemical Market in India Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Agrochemical Market in India Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America Agrochemical Market in India Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Agrochemical Market in India Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Agrochemical Market in India Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Agrochemical Market in India Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Agrochemical Market in India Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Agrochemical Market in India Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Agrochemical Market in India Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Agrochemical Market in India Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Agrochemical Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Agrochemical Market in India Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe Agrochemical Market in India Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Agrochemical Market in India Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Agrochemical Market in India Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Agrochemical Market in India Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Agrochemical Market in India Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Agrochemical Market in India Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Agrochemical Market in India Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Agrochemical Market in India Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Agrochemical Market in India Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Agrochemical Market in India Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe Agrochemical Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Agrochemical Market in India Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Agrochemical Market in India Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Agrochemical Market in India Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Agrochemical Market in India Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Agrochemical Market in India Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Agrochemical Market in India Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Agrochemical Market in India Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Agrochemical Market in India Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Agrochemical Market in India Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Agrochemical Market in India Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Agrochemical Market in India Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa Agrochemical Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Agrochemical Market in India Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Agrochemical Market in India Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Agrochemical Market in India Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Agrochemical Market in India Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Agrochemical Market in India Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Agrochemical Market in India Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Agrochemical Market in India Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Agrochemical Market in India Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Agrochemical Market in India Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Agrochemical Market in India Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Agrochemical Market in India Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific Agrochemical Market in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Agrochemical Market in India Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Agrochemical Market in India Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Agrochemical Market in India Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Agrochemical Market in India Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Agrochemical Market in India Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Agrochemical Market in India Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Agrochemical Market in India Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Agrochemical Market in India Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Agrochemical Market in India Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Agrochemical Market in India Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Agrochemical Market in India Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Agrochemical Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Agrochemical Market in India Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Agrochemical Market in India Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Agrochemical Market in India Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Agrochemical Market in India Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Agrochemical Market in India Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Agrochemical Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Agrochemical Market in India Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Agrochemical Market in India Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Agrochemical Market in India Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Agrochemical Market in India Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Agrochemical Market in India Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Agrochemical Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Agrochemical Market in India Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Agrochemical Market in India Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Agrochemical Market in India Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Agrochemical Market in India Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Agrochemical Market in India Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Agrochemical Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global Agrochemical Market in India Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Agrochemical Market in India Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Agrochemical Market in India Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Agrochemical Market in India Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Agrochemical Market in India Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Agrochemical Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Agrochemical Market in India Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Agrochemical Market in India?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the Agrochemical Market in India?

Key companies in the market include Dhanuka Agritech, Nagarjuna Fertilizers and Chemicals Limited, Deepak Fertilizers, Rastriya Chemicals and Fertilizers Ltd, YARA International, Indian Farmer Fertilizer Cooperative, UPL Limited, Potash Corporation of Saskatchewan, Bayer Crop Science, BASF SE, TATA Rallies, National Fertilizers Limited, Sumitomo Chemical India Ltd, Crystal Crop Protection Limite, Syngenta AG, Coromandel International Limited.

3. What are the main segments of the Agrochemical Market in India?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns.

6. What are the notable trends driving market growth?

Increasing Population Leads to Increased Food Demand.

7. Are there any restraints impacting market growth?

High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants.

8. Can you provide examples of recent developments in the market?

March 2022: FMC India Introduced Corprima,' a New Insecticide for Tomato & Okra Crops. Corprima is a novel insecticide that provides higher pest control and improved flower and fruit retention, resulting in larger, higher-quality harvests.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Agrochemical Market in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Agrochemical Market in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Agrochemical Market in India?

To stay informed about further developments, trends, and reports in the Agrochemical Market in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence