Key Insights

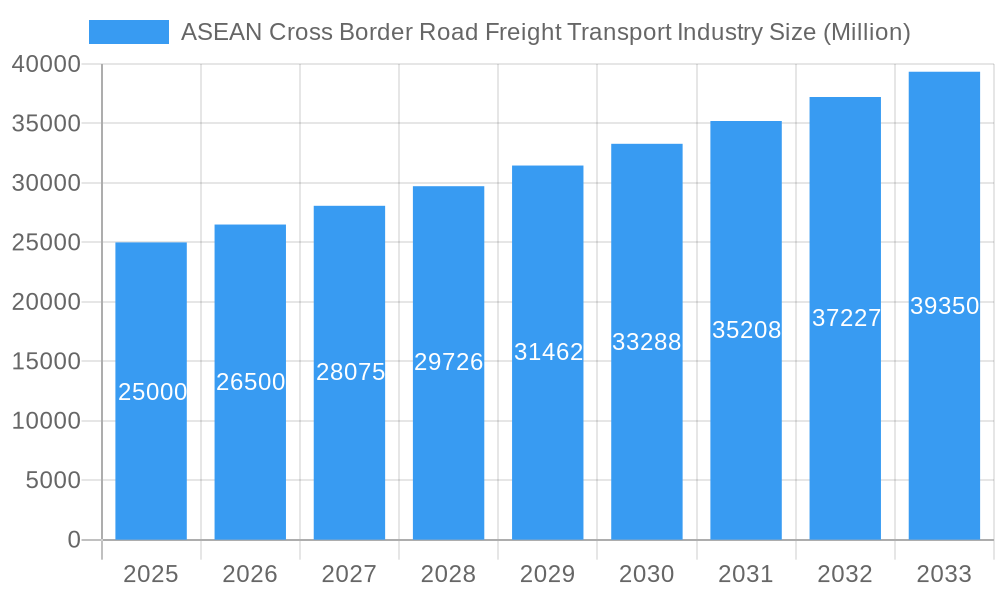

The ASEAN Cross-Border Road Freight Transport market, valued at approximately $282.7 billion in 2025, is poised for substantial expansion. This growth is fueled by increasing intra-ASEAN trade, burgeoning e-commerce, and critical infrastructure enhancements. A projected Compound Annual Growth Rate (CAGR) of 6% from 2025 to 2033 underscores this significant market trajectory. Key growth drivers include the escalating demand for efficient and cost-effective logistics, particularly for time-sensitive cargo. Government-led initiatives promoting regional economic integration and optimizing cross-border logistics, such as simplified customs procedures, further accelerate this expansion. However, market participants must navigate challenges including varied infrastructure quality, differing regulatory landscapes, and potential geopolitical or environmental disruptions.

ASEAN Cross Border Road Freight Transport Industry Market Size (In Billion)

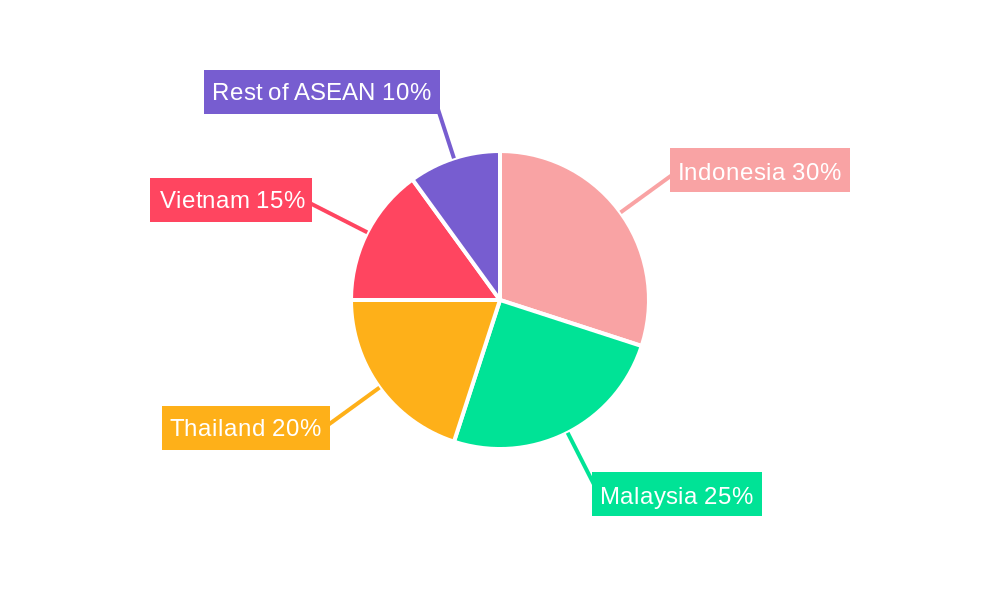

Dominant demand for cross-border road freight originates from the manufacturing, construction, and oil & gas sectors. Key national markets within ASEAN include Indonesia, Malaysia, Thailand, and Vietnam, driven by robust manufacturing capabilities and strategic locations. The competitive environment comprises established global logistics providers and agile regional players, presenting a dynamic landscape with opportunities for diverse market participants. The forecast period (2025-2033) anticipates sustained growth, propelled by expanding e-commerce, evolving supply chain sophistication, and ongoing efforts to enhance regional connectivity. This necessitates strategic adaptation for logistics providers to meet evolving market demands.

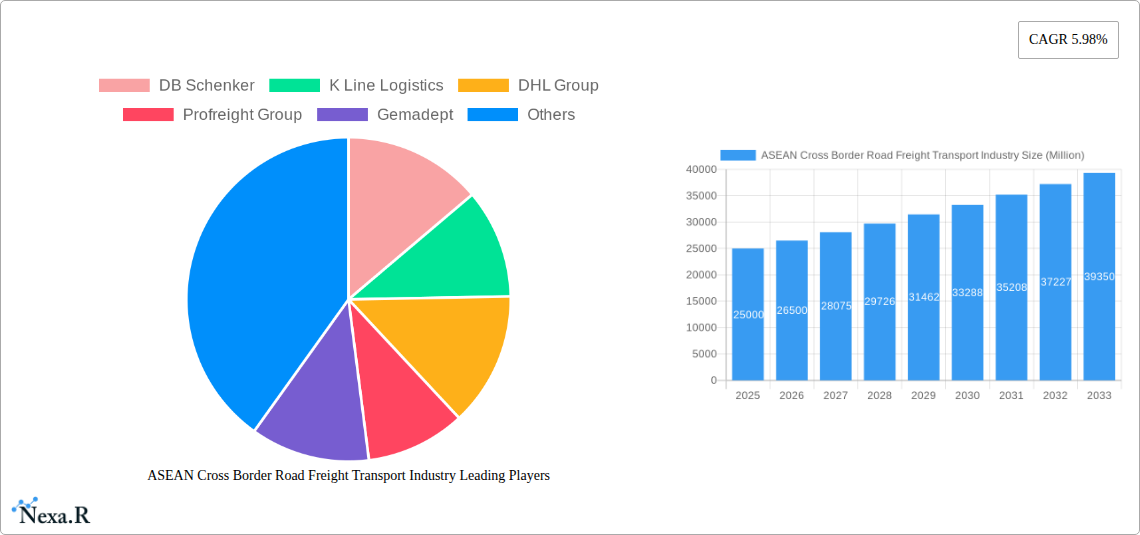

ASEAN Cross Border Road Freight Transport Industry Company Market Share

ASEAN Cross Border Road Freight Transport Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the ASEAN cross-border road freight transport industry, covering market dynamics, growth trends, dominant players, and future outlook. With a focus on key segments including Agriculture, Fishing, and Forestry; Construction; Manufacturing; Oil and Gas; Mining and Quarrying; Wholesale and Retail Trade; and Others, across Indonesia, Malaysia, Thailand, Vietnam, and the Rest of ASEAN, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033.

ASEAN Cross Border Road Freight Transport Industry Market Dynamics & Structure

This section analyzes the market concentration, technological innovation, regulatory landscape, competitive dynamics, end-user demographics, and M&A activities within the ASEAN cross-border road freight transport sector. The market is characterized by a mix of large multinational corporations and smaller regional players. Market concentration is moderate, with the top five players holding an estimated xx% market share in 2025.

- Market Concentration: Moderate, top 5 players holding xx% market share (2025).

- Technological Innovation: Increasing adoption of telematics, GPS tracking, and route optimization software. Barriers include high initial investment costs and lack of digital infrastructure in some areas.

- Regulatory Framework: Varying regulations across ASEAN countries create complexities for cross-border operations. Harmonization efforts are ongoing but face challenges.

- Competitive Product Substitutes: Rail and sea freight offer alternatives for bulk transport, posing a competitive pressure.

- End-User Demographics: Growth driven by rising e-commerce, manufacturing expansion, and infrastructure development.

- M&A Trends: A moderate level of M&A activity is observed, with xx deals recorded between 2019 and 2024. Consolidation is expected to continue as larger players seek to expand their reach.

ASEAN Cross Border Road Freight Transport Industry Growth Trends & Insights

The ASEAN cross-border road freight transport market has witnessed significant growth in recent years, driven by expanding economies, rising e-commerce, and increased intra-regional trade. The market size is projected to reach xx million units by 2025, expanding at a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by increasing demand for efficient and reliable transportation solutions across borders. Technological disruptions, such as the adoption of autonomous vehicles and digital logistics platforms, are expected to further reshape the industry landscape. Consumer behavior is shifting towards greater demand for transparency, traceability, and faster delivery times.

Dominant Regions, Countries, or Segments in ASEAN Cross Border Road Freight Transport Industry

Indonesia and Vietnam are projected to be the leading markets, driven by robust economic growth and expanding manufacturing sectors. The manufacturing segment holds the largest share of the market, followed by the wholesale and retail trade sector. This dominance is primarily attributed to a high volume of goods transported.

Key Drivers:

- Indonesia: Strong economic growth, expanding infrastructure, and increasing manufacturing activity.

- Vietnam: Rapid industrialization, foreign direct investment inflows, and a burgeoning e-commerce sector.

- Manufacturing Segment: High volume of goods transported, supporting manufacturing and export activities.

- Wholesale and Retail Trade: Growing e-commerce penetration and increased consumer demand.

Dominance Factors: Market share (Indonesia: xx%, Vietnam: xx%), high growth potential, and favorable government policies.

ASEAN Cross Border Road Freight Transport Industry Product Landscape

The industry features a range of services, including full-truckload (FTL), less-than-truckload (LTL), and specialized transport solutions for various goods. Recent product innovations include the implementation of advanced tracking systems, optimized routing software, and temperature-controlled transport for sensitive goods. These advancements aim to improve efficiency, transparency, and security in cross-border shipments.

Key Drivers, Barriers & Challenges in ASEAN Cross Border Road Freight Transport Industry

Key Drivers: Rising e-commerce, industrialization, and government initiatives promoting regional trade integration. Examples include the ASEAN Economic Community (AEC) and various infrastructure development projects.

Key Challenges: Infrastructure limitations (poor road conditions in certain areas), varying regulations across countries, and bureaucratic hurdles, leading to increased transportation time and costs. These challenges can reduce efficiency and increase transportation costs by xx%.

Emerging Opportunities in ASEAN Cross Border Road Freight Transport Industry

Untapped opportunities lie in the expansion of last-mile delivery services, particularly in rural areas. Growth potential is also significant in the development of specialized transport solutions for specific industries (e.g., cold chain logistics for perishable goods). Furthermore, leveraging technology for enhanced supply chain visibility and efficiency presents significant opportunities.

Growth Accelerators in the ASEAN Cross Border Road Freight Transport Industry Industry

Technological advancements, including autonomous vehicles and IoT-enabled logistics, will significantly accelerate growth. Strategic partnerships between logistics providers and technology companies will also play a vital role. Furthermore, government initiatives supporting infrastructure development and trade facilitation will contribute to industry expansion.

Key Players Shaping the ASEAN Cross Border Road Freight Transport Industry Market

- DB Schenker

- K Line Logistics

- DHL Group

- Profreight Group

- Gemadept

- MOL Logistics

- Overland Total Logistic

- Konoike Group

- Yatfai Group

- Tiong Nam Logistics

- Kerry Logistics Network Limited

Notable Milestones in ASEAN Cross Border Road Freight Transport Industry Sector

- June 2023: DHL Express deploys 24 electric vans in Jakarta and Bandung, furthering its commitment to sustainable logistics.

- June 2023: Chery Malaysia partners with Tiong Nam Logistics for spare parts warehousing and transportation.

- May 2023: Kerry Express partners with All Speedy Co. to expand its services to 7-Eleven branches nationwide.

In-Depth ASEAN Cross Border Road Freight Transport Industry Market Outlook

The ASEAN cross-border road freight transport market is poised for continued robust growth, driven by ongoing economic expansion, infrastructure development, and technological innovation. Strategic partnerships, investments in technology, and focus on sustainability will be crucial for success in this dynamic market. The market's future potential is significant, with continued expansion expected across all major segments and countries.

ASEAN Cross Border Road Freight Transport Industry Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

ASEAN Cross Border Road Freight Transport Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

ASEAN Cross Border Road Freight Transport Industry Regional Market Share

Geographic Coverage of ASEAN Cross Border Road Freight Transport Industry

ASEAN Cross Border Road Freight Transport Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America ASEAN Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Agriculture, Fishing, and Forestry

- 6.1.2. Construction

- 6.1.3. Manufacturing

- 6.1.4. Oil and Gas, Mining and Quarrying

- 6.1.5. Wholesale and Retail Trade

- 6.1.6. Others

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America ASEAN Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Agriculture, Fishing, and Forestry

- 7.1.2. Construction

- 7.1.3. Manufacturing

- 7.1.4. Oil and Gas, Mining and Quarrying

- 7.1.5. Wholesale and Retail Trade

- 7.1.6. Others

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe ASEAN Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Agriculture, Fishing, and Forestry

- 8.1.2. Construction

- 8.1.3. Manufacturing

- 8.1.4. Oil and Gas, Mining and Quarrying

- 8.1.5. Wholesale and Retail Trade

- 8.1.6. Others

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa ASEAN Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Agriculture, Fishing, and Forestry

- 9.1.2. Construction

- 9.1.3. Manufacturing

- 9.1.4. Oil and Gas, Mining and Quarrying

- 9.1.5. Wholesale and Retail Trade

- 9.1.6. Others

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific ASEAN Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Agriculture, Fishing, and Forestry

- 10.1.2. Construction

- 10.1.3. Manufacturing

- 10.1.4. Oil and Gas, Mining and Quarrying

- 10.1.5. Wholesale and Retail Trade

- 10.1.6. Others

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 K Line Logistics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DHL Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Profreight Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Gemadept

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MOL Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Overland Total Logistic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Konoike Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Yatfai Grou

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tiong Nam Logistics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Kerry Logistics Network Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Global ASEAN Cross Border Road Freight Transport Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America ASEAN Cross Border Road Freight Transport Industry Revenue (billion), by End User Industry 2025 & 2033

- Figure 3: North America ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 4: North America ASEAN Cross Border Road Freight Transport Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America ASEAN Cross Border Road Freight Transport Industry Revenue (billion), by End User Industry 2025 & 2033

- Figure 7: South America ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 8: South America ASEAN Cross Border Road Freight Transport Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: South America ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe ASEAN Cross Border Road Freight Transport Industry Revenue (billion), by End User Industry 2025 & 2033

- Figure 11: Europe ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 12: Europe ASEAN Cross Border Road Freight Transport Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa ASEAN Cross Border Road Freight Transport Industry Revenue (billion), by End User Industry 2025 & 2033

- Figure 15: Middle East & Africa ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 16: Middle East & Africa ASEAN Cross Border Road Freight Transport Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific ASEAN Cross Border Road Freight Transport Industry Revenue (billion), by End User Industry 2025 & 2033

- Figure 19: Asia Pacific ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 20: Asia Pacific ASEAN Cross Border Road Freight Transport Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 4: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 9: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 14: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 25: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 33: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Cross Border Road Freight Transport Industry?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the ASEAN Cross Border Road Freight Transport Industry?

Key companies in the market include DB Schenker, K Line Logistics, DHL Group, Profreight Group, Gemadept, MOL Logistics, Overland Total Logistic, Konoike Group, Yatfai Grou, Tiong Nam Logistics, Kerry Logistics Network Limited.

3. What are the main segments of the ASEAN Cross Border Road Freight Transport Industry?

The market segments include End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 282.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

June 2023: DHL Express has geared up to electrify its last-mile delivery fleet by deploying 24 electric vans in Jakarta and Bandung. The new electric vehicles will join the existing fleet which includes four electric vans and six electric bikes serving areas in Jakarta and Surabaya.June 2023: Chery Malaysia signed a logistic services agreement with Tiong Nam Logistics Holdings Berhad, which is responsible for spare parts warehousing and transportation logistics services. Tiong Nam Logistics has obtained the rights to handle Chery’s spare parts warehousing and transportation in Malaysia, including heavy-duty vehicle models such as TIGGO 8 PRO and OMODA5.May 2023: Kerry Express (KEX),has announced a partnership with All Speedy Co, a subsidiary of CP All, to extend its services to 7-Eleven branches across the country. This cooperation between Kerry Express and All Speedy is aimed at increasing the availability of their express parcel delivery service by leveraging the extensive nationwide network of 7-Eleven outlets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Cross Border Road Freight Transport Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Cross Border Road Freight Transport Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Cross Border Road Freight Transport Industry?

To stay informed about further developments, trends, and reports in the ASEAN Cross Border Road Freight Transport Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence