Key Insights

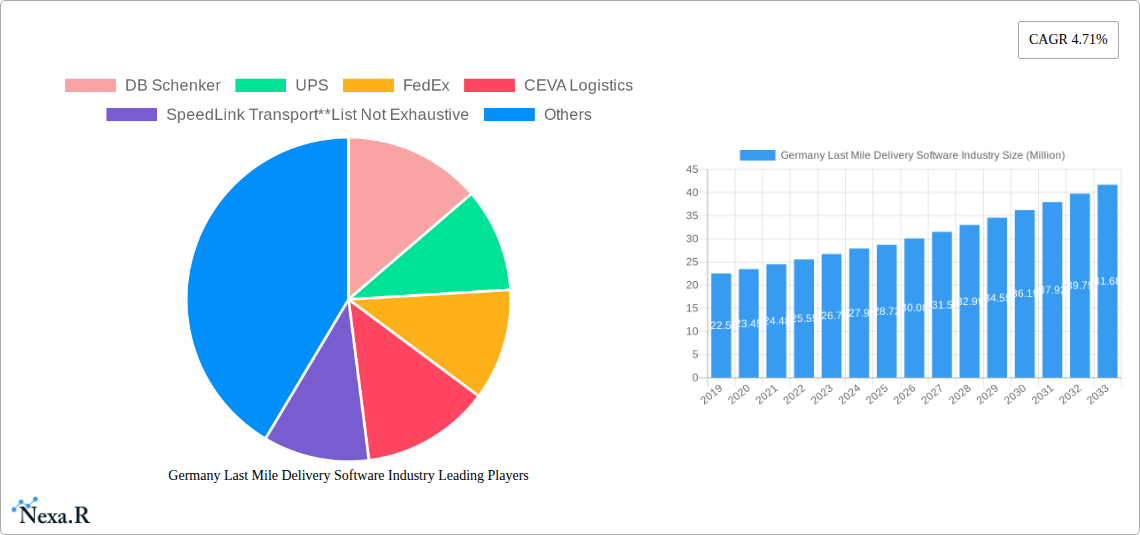

The German last mile delivery software market is poised for significant expansion, projected to reach €28.72 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 4.71% expected to propel it through 2033. This dynamic growth is primarily driven by the escalating demand for efficient, cost-effective, and transparent delivery solutions across various business models. The burgeoning e-commerce sector, coupled with a growing consumer expectation for faster and more reliable deliveries, forms a core pillar of this market expansion. Furthermore, advancements in technology, including real-time tracking, route optimization, and automated dispatch systems, are instrumental in enhancing operational efficiency for logistics providers. The increasing adoption of these software solutions by businesses of all sizes, from large enterprises to small and medium-sized businesses (SMBs), underscores their critical role in streamlining last mile logistics and improving customer satisfaction. The study period from 2019 to 2033, with 2025 as the base and estimated year, highlights a sustained upward trajectory fueled by these powerful market forces.

Germany Last Mile Delivery Software Industry Market Size (In Million)

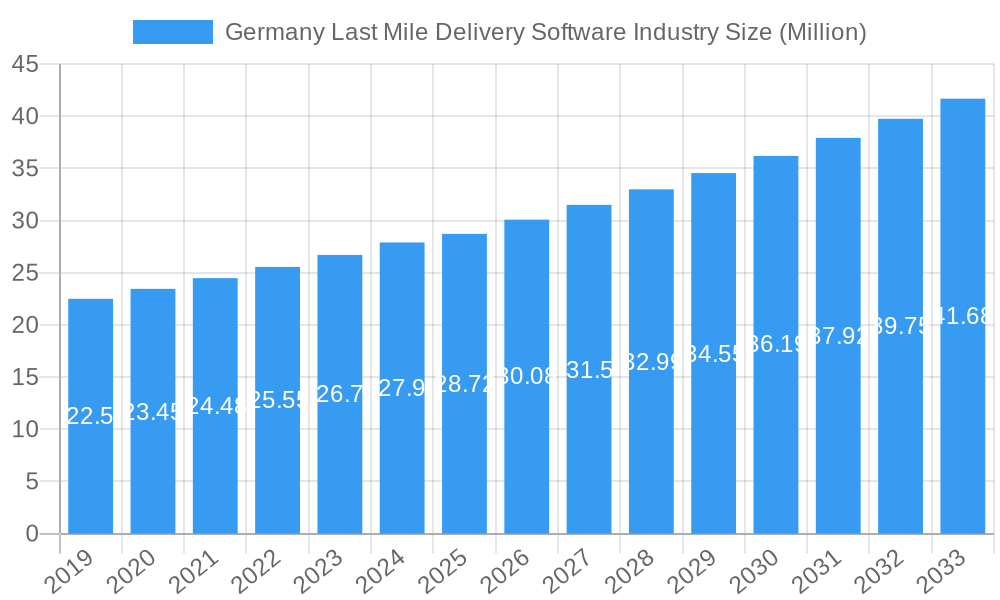

While the market benefits from strong drivers, certain factors present challenges. Increased operational costs associated with fuel price volatility and labor shortages in the logistics sector can potentially restrain the pace of growth. However, the inherent value proposition of last mile delivery software—reducing delivery times, optimizing fuel consumption through intelligent routing, and improving driver productivity—effectively mitigates these restraints. The market's segmentation into B2B, B2C, and C2C further illustrates its broad applicability, with each segment contributing to the overall demand for sophisticated delivery management tools. Key players like DB Schenker, UPS, FedEx, and Deutsche Post DHL are at the forefront, investing heavily in technological innovation and service enhancement to capture market share within Germany and beyond. The focus remains on developing agile, scalable, and integrated software solutions that can adapt to the evolving landscape of modern logistics.

Germany Last Mile Delivery Software Industry Company Market Share

Germany Last Mile Delivery Software Industry: Market Dynamics, Growth Trends, and Future Outlook (2019–2033)

This comprehensive report provides an in-depth analysis of the Germany Last Mile Delivery Software Industry, offering critical insights into market dynamics, growth trajectories, and future potential. With a focus on high-traffic keywords such as "last mile delivery software Germany," "logistics technology Germany," "e-commerce delivery solutions," and "B2B/B2C last mile," this report is optimized for search engine visibility and tailored to engage industry professionals. Covering the Study Period 2019–2033, with Base Year 2025 and Forecast Period 2025–2033, it delivers quantitative and qualitative data essential for strategic decision-making. This report explores both parent and child market segments within the Germany Last Mile Delivery Software Industry, providing a holistic view of this rapidly evolving sector.

Germany Last Mile Delivery Software Industry Market Dynamics & Structure

The Germany Last Mile Delivery Software Industry is characterized by a moderately concentrated market, driven by significant technological innovation and evolving regulatory landscapes. Key drivers of innovation include the demand for real-time tracking, route optimization, and enhanced customer communication. Major technology players are investing heavily in AI and machine learning to improve efficiency and predict delivery times. Competitive product substitutes are emerging from integrated logistics platforms and advanced analytics tools, forcing established software providers to continually innovate. End-user demographics are increasingly sophisticated, with businesses demanding seamless integration and greater control over their delivery operations. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with larger players acquiring innovative startups to expand their service portfolios and market reach. For instance, the acquisition of specialized route optimization software by established logistics management systems is a common strategy. Barriers to innovation include the high cost of R&D and the challenge of integrating disparate legacy systems within existing logistics infrastructure. Current market share for leading providers is estimated to be around 40-50% collectively, with significant fragmentation among smaller, specialized software vendors.

- Market Concentration: Moderate, with a few key players holding significant market share but a growing number of niche providers.

- Technological Innovation Drivers: Real-time tracking, AI-powered route optimization, predictive analytics, and customer self-service portals.

- Regulatory Frameworks: Increasing focus on emission reduction and data privacy, influencing software features and operational strategies.

- Competitive Product Substitutes: Integrated ERP systems with logistics modules, standalone route optimization tools, and advanced telematics solutions.

- End-User Demographics: Growing demand for efficient, transparent, and sustainable delivery solutions from e-commerce businesses, retailers, and manufacturers.

- M&A Trends: Strategic acquisitions of innovative startups by larger logistics software providers to enhance capabilities and expand market footprint. An estimated 5-10 M&A deals focusing on last-mile technology occurred in the historical period.

Germany Last Mile Delivery Software Industry Growth Trends & Insights

The Germany Last Mile Delivery Software Industry is poised for substantial growth, driven by the relentless expansion of e-commerce and increasing consumer expectations for faster and more reliable deliveries. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 12-15% over the forecast period. Adoption rates for advanced last-mile delivery software are steadily rising as businesses recognize the critical role of efficient logistics in customer satisfaction and operational cost reduction. Technological disruptions, such as the integration of IoT devices for real-time asset monitoring and the development of autonomous delivery solutions, are set to redefine the industry. Consumer behavior shifts are a significant catalyst, with a growing preference for same-day delivery, scheduled delivery slots, and eco-friendly delivery options. These preferences necessitate sophisticated software capabilities for dynamic route planning, flexible scheduling, and real-time communication. The penetration of specialized last-mile software solutions is estimated to have reached 60-65% in major urban areas during the base year. The market is further segmented into various service types, including B2B, B2C, and C2C, with B2C representing the largest and fastest-growing segment due to the booming online retail sector. The increasing adoption of cloud-based solutions is also democratizing access to advanced features, enabling smaller businesses to compete effectively. Furthermore, the integration of advanced analytics allows for better demand forecasting and inventory management, directly impacting last-mile efficiency. The continuous evolution of delivery models, including parcel lockers and crowdsourced delivery, also fuels the demand for adaptable and intelligent software platforms. The German government's initiatives to promote sustainable logistics are also indirectly encouraging the adoption of software that optimizes routes and reduces mileage. This dynamic interplay of technological advancement, evolving consumer demands, and supportive policies is creating a fertile ground for the sustained growth of the Germany Last Mile Delivery Software Industry.

Dominant Regions, Countries, or Segments in Germany Last Mile Delivery Software Industry

Within the Germany Last Mile Delivery Software Industry, the Business-to-Consumer (B2C) segment demonstrably leads market growth, fueled by the explosive expansion of e-commerce and evolving consumer expectations for rapid, convenient, and transparent deliveries. This dominance is underpinned by several critical factors that create a powerful growth engine. Economically, Germany's robust consumer spending power and high internet penetration rates translate into a massive volume of online purchases, directly driving the demand for efficient B2C last-mile solutions. Infrastructure plays a crucial role; while Germany boasts excellent transportation networks, optimizing the "final mile" in densely populated urban areas and reaching dispersed rural communities requires sophisticated software for route planning, dispatch management, and proof of delivery. The market share of B2C deliveries within the overall last-mile software market is estimated to be around 70-75%.

- Dominant Segment: Business-to-Consumer (B2C)

- Key Drivers:

- E-commerce Boom: Continuous growth in online retail, particularly for fashion, electronics, and groceries.

- Consumer Expectations: Demand for same-day delivery, scheduled delivery windows, and real-time tracking.

- Urbanization: Increasing population density in cities necessitates efficient and agile last-mile operations.

- Digitalization: Widespread adoption of smartphones for order tracking and communication.

- Market Share & Growth Potential: The B2C segment is expected to maintain its dominant position, with an estimated CAGR of 13-16% over the forecast period. Its market share within the last-mile software landscape is substantial and projected to increase further.

- Key Drivers:

The Business-to-Business (B2B) segment also represents a significant portion of the market, with a steady growth rate driven by the need for efficient supply chain management, just-in-time deliveries, and specialized logistics for industries like manufacturing, pharmaceuticals, and automotive. B2B solutions often involve complex integrations with enterprise resource planning (ERP) systems and a focus on bulk deliveries and optimized fleet management. The Customer-to-Customer (C2C) segment, while smaller, is gaining traction through peer-to-peer delivery platforms and online marketplaces that facilitate the transfer of goods between individuals. The market share for B2B is estimated to be around 20-25%, and C2C is approximately 5%. Regions like North Rhine-Westphalia and Bavaria, with their high population density and economic activity, are key hubs for last-mile delivery operations, driving demand for advanced software solutions.

Germany Last Mile Delivery Software Industry Product Landscape

The product landscape of the Germany Last Mile Delivery Software Industry is characterized by a proliferation of innovative features and functionalities aimed at optimizing every aspect of the final delivery leg. Core offerings include advanced route optimization algorithms that dynamically adjust to traffic conditions and delivery priorities, significantly reducing transit times and fuel consumption. Real-time GPS tracking and visibility dashboards provide both businesses and end-consumers with up-to-the-minute information on package status. Electronic proof of delivery (ePOD) solutions, often integrated with mobile applications, ensure secure and documented handovers. Predictive analytics for demand forecasting and delivery time estimation are becoming standard. Unique selling propositions often lie in the software's modularity, allowing businesses to customize solutions to their specific needs, and its seamless integration capabilities with existing ERP, CRM, and warehouse management systems. Technological advancements are also focusing on sustainability features, such as eco-friendly route planning and carbon footprint tracking.

Key Drivers, Barriers & Challenges in Germany Last Mile Delivery Software Industry

Key Drivers:

- E-commerce Growth: The persistent surge in online retail is the primary engine, demanding efficient and scalable last-mile solutions.

- Technological Advancements: AI, IoT, and big data analytics are enabling smarter route optimization, predictive delivery, and enhanced visibility.

- Consumer Expectations: Growing demand for speed, convenience, and real-time updates necessitates sophisticated software.

- Sustainability Initiatives: Regulations and consumer pressure are driving the adoption of software that optimizes routes for reduced emissions.

- Globalization and Cross-border E-commerce: Increasing international trade amplifies the complexity and need for integrated delivery software.

Barriers & Challenges:

- High Implementation Costs: Significant upfront investment in software and integration can be a barrier for smaller businesses.

- Infrastructure Limitations: Congested urban areas and fragmented rural delivery networks pose logistical challenges.

- Data Security and Privacy Concerns: Handling sensitive customer and delivery data requires robust security protocols, which can be complex to implement.

- Integration with Legacy Systems: Many established logistics companies operate with older systems, making seamless integration of new software challenging.

- Skilled Workforce Shortage: A lack of trained personnel to manage and operate advanced logistics software can hinder adoption.

- Regulatory Compliance: Navigating evolving regulations related to emissions, labor laws, and data protection adds complexity. The cost of non-compliance can be significant.

Emerging Opportunities in Germany Last Mile Delivery Software Industry

Emerging opportunities in the Germany Last Mile Delivery Software Industry are centered around hyper-personalization, sustainable logistics, and the integration of emerging technologies. There is a significant untapped market for specialized software catering to niche industries with unique delivery requirements, such as pharmaceuticals or high-value goods. The growing demand for "green logistics" presents an opportunity for software that optimizes for reduced carbon footprints, electric vehicle fleet management, and consolidated deliveries. Further integration of AI for predictive maintenance of delivery fleets and autonomous delivery solutions, though still nascent, represents a long-term growth avenue. The rise of the "gig economy" in logistics also opens doors for platforms that efficiently manage and dispatch freelance couriers. The development of blockchain-based solutions for enhanced supply chain transparency and security is another promising area.

Growth Accelerators in the Germany Last Mile Delivery Software Industry Industry

Several key catalysts are accelerating the growth of the Germany Last Mile Delivery Software Industry. The continuous digital transformation across all sectors of the economy is a fundamental driver, pushing businesses to seek more efficient and integrated logistics solutions. Strategic partnerships between software providers and logistics companies are crucial for co-developing tailored solutions and expanding market reach. Furthermore, the ongoing investment in smart city initiatives and urban logistics projects by governmental bodies creates an environment conducive to the adoption of advanced delivery technologies. The increasing focus on data analytics for operational improvement and customer insights is also a significant growth accelerator, enabling companies to refine their strategies and enhance service offerings. The development and adoption of APIs for seamless integration with e-commerce platforms are also expanding the addressable market.

Key Players Shaping the Germany Last Mile Delivery Software Industry Market

- DB Schenker

- UPS

- FedEx

- CEVA Logistics

- SpeedLink Transport

- General Logistics Systems

- Rhenus Logistics

- DPD Group

- JJX Logistics

- Deutsche Post DHL

- DSV

Notable Milestones in Germany Last Mile Delivery Software Industry Sector

- June 2023: DODO extended its Same-Day Delivery (SDS) service to Germany, reinforcing the long-term viability of Same-Day and Last-Mile Delivery. This expansion highlights the increasing demand and market readiness for rapid delivery solutions.

- January 2023: The investment firm Ivanhoé Cambridge completed the acquisition of a first-of-its-kind last-mile logistical facility in Munich. This acquisition, involving a substantial property size and expansion potential, underscores the growing investor confidence in the German last-mile logistics infrastructure and the software that underpins it.

In-Depth Germany Last Mile Delivery Software Industry Market Outlook

The future outlook for the Germany Last Mile Delivery Software Industry remains exceptionally bright, propelled by a confluence of robust market drivers. The ongoing digital transformation and the insatiable appetite of consumers for swift and convenient deliveries will continue to fuel demand for sophisticated software solutions. Growth accelerators such as strategic collaborations between technology providers and logistics giants, alongside government support for sustainable logistics and smart urban infrastructure, will foster an environment ripe for innovation and expansion. The increasing adoption of AI for predictive analytics, autonomous delivery vehicles, and advanced route optimization will not only enhance operational efficiency but also unlock new service paradigms. Businesses that leverage these advancements to offer personalized, eco-friendly, and transparent last-mile experiences are poised to gain a significant competitive advantage. The market is expected to witness further consolidation and the emergence of specialized solutions catering to evolving industry needs, solidifying Germany's position as a leader in innovative logistics technology.

Germany Last Mile Delivery Software Industry Segmentation

-

1. Service

- 1.1. B2B (Business-to-Business)

- 1.2. B2C (Business-to-Consumer)

- 1.3. C2C (Customer-to-Customer)

Germany Last Mile Delivery Software Industry Segmentation By Geography

- 1. Germany

Germany Last Mile Delivery Software Industry Regional Market Share

Geographic Coverage of Germany Last Mile Delivery Software Industry

Germany Last Mile Delivery Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.71% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise In eCommerce; Rise In Urbanization

- 3.3. Market Restrains

- 3.3.1. The Risk of Package Theft or Damage; Cost Efficiency

- 3.4. Market Trends

- 3.4.1. Growth in E-commerce is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Last Mile Delivery Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. B2B (Business-to-Business)

- 5.1.2. B2C (Business-to-Consumer)

- 5.1.3. C2C (Customer-to-Customer)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 UPS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FedEx

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CEVA Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SpeedLink Transport**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 General Logistics Systems

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rhenes Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DPD Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 JJX Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Deutsche Post DHL

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DSV

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Germany Last Mile Delivery Software Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Last Mile Delivery Software Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Last Mile Delivery Software Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Germany Last Mile Delivery Software Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Germany Last Mile Delivery Software Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 4: Germany Last Mile Delivery Software Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Last Mile Delivery Software Industry?

The projected CAGR is approximately 4.71%.

2. Which companies are prominent players in the Germany Last Mile Delivery Software Industry?

Key companies in the market include DB Schenker, UPS, FedEx, CEVA Logistics, SpeedLink Transport**List Not Exhaustive, General Logistics Systems, Rhenes Logistics, DPD Group, JJX Logistics, Deutsche Post DHL, DSV.

3. What are the main segments of the Germany Last Mile Delivery Software Industry?

The market segments include Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise In eCommerce; Rise In Urbanization.

6. What are the notable trends driving market growth?

Growth in E-commerce is Driving the Market.

7. Are there any restraints impacting market growth?

The Risk of Package Theft or Damage; Cost Efficiency.

8. Can you provide examples of recent developments in the market?

Jun 2023: DODO extended its Same-Day Delivery (SDS) service to Germany, reinforcing the long-term viability of Same-Day and Last-Mile Delivery.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Last Mile Delivery Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Last Mile Delivery Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Last Mile Delivery Software Industry?

To stay informed about further developments, trends, and reports in the Germany Last Mile Delivery Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence