Key Insights

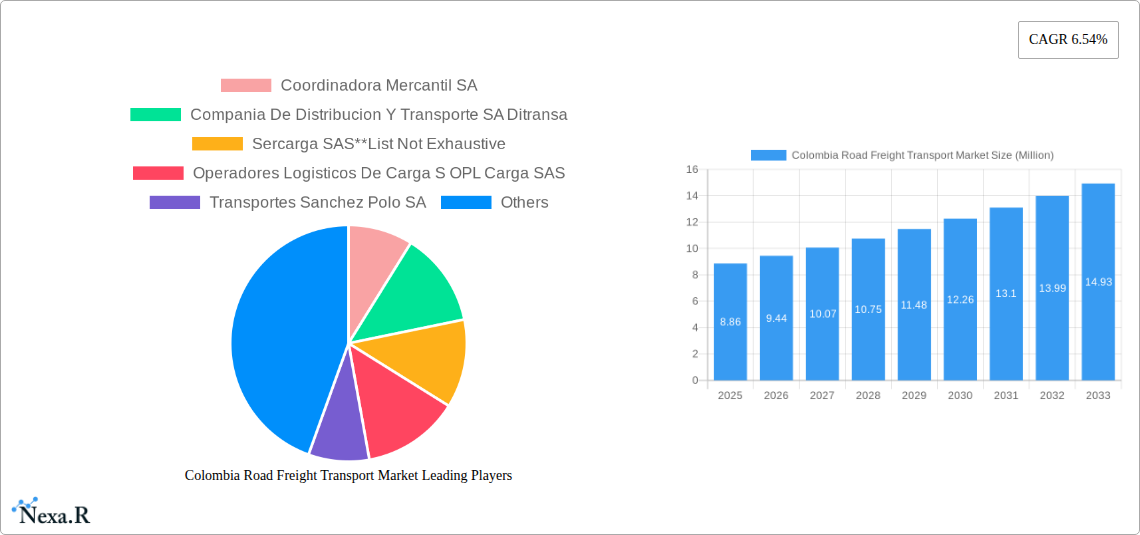

The Colombia Road Freight Transport Market is poised for robust growth, with a current market size estimated at $8.86 million in 2025, and projected to expand at a Compound Annual Growth Rate (CAGR) of 6.54% through 2033. This upward trajectory is driven by an increasing demand for efficient logistics solutions across various industries. The construction sector, a significant contributor, is experiencing a boom fueled by infrastructure development projects and a growing housing market. Similarly, the oil and gas sector, alongside quarrying operations, demands substantial road freight for the transportation of raw materials and equipment, further propelling market expansion. The agricultural industry, a cornerstone of the Colombian economy, also relies heavily on road transport for the timely delivery of produce to markets, contributing to the sustained demand for freight services.

Colombia Road Freight Transport Market Market Size (In Million)

Further fueling this market expansion are emerging trends such as the increasing adoption of technology to optimize logistics operations, including real-time tracking and route optimization software, leading to enhanced efficiency and reduced transit times. The growth of e-commerce in Colombia also necessitates more sophisticated and widespread road freight networks to facilitate last-mile delivery. While the market is largely dominated by Full Truckload (FTL) services, the increasing volume of smaller shipments and the need for cost-effective solutions are gradually increasing the significance of Less Than Truckload (LTL) services. Key players like Coordinadora Mercantil SA, Compania De Distribucion Y Transporte SA Ditransa, and Sercarga SAS are at the forefront of addressing these evolving market needs. However, challenges such as an aging road infrastructure in certain regions and fluctuating fuel prices can pose potential restraints to the market's overall growth, requiring strategic planning and investment from stakeholders.

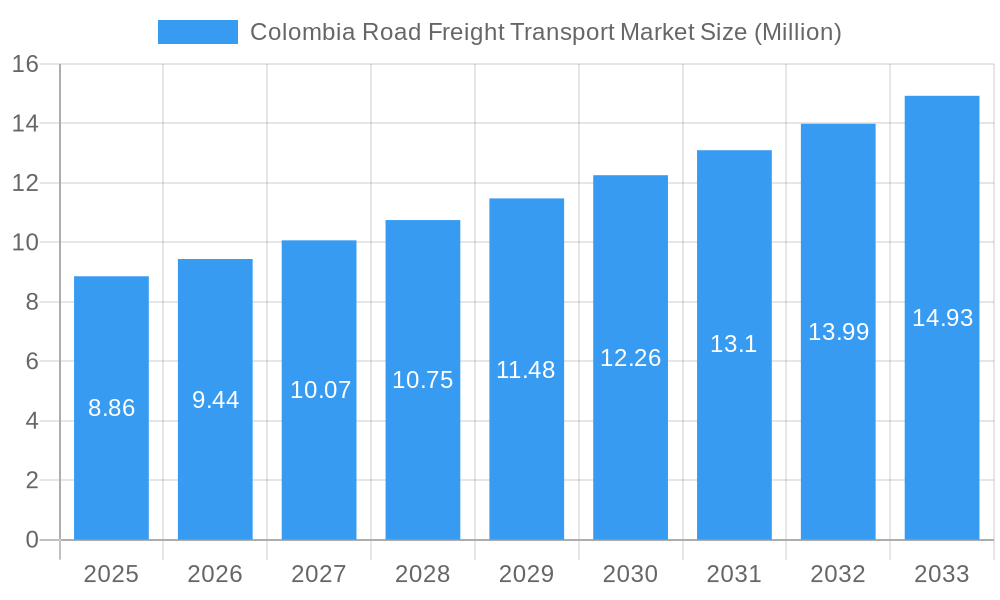

Colombia Road Freight Transport Market Company Market Share

This in-depth report provides an exhaustive analysis of the Colombia road freight transport market, offering critical insights into market dynamics, growth trends, regional dominance, and the competitive landscape. Covering the Study Period: 2019–2033, with Base Year: 2025, Estimated Year: 2025, and Forecast Period: 2025–2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within Colombia's burgeoning logistics sector.

Colombia Road Freight Transport Market Market Dynamics & Structure

The Colombia road freight transport market is characterized by a moderate level of market concentration, with a few key players holding significant market share, alongside a multitude of smaller operators. Technological innovation is increasingly driving efficiency and service offerings, particularly in route optimization, fleet management, and real-time tracking solutions. Regulatory frameworks, while evolving, continue to influence operational costs and compliance requirements. Competitive product substitutes, though limited in the core road freight sector, include rail and maritime transport for specific long-haul routes and bulk cargo. End-user demographics are diverse, with a growing demand from the Construction, Oil and Gas and Quarrying, Agriculture, Fishing, and Forestry, Manufacturing and Automotive, and Distributive Trade sectors. Mergers and acquisitions (M&A) are a notable trend, aimed at consolidating market presence, expanding service portfolios, and achieving economies of scale. For instance, the historical period of 2019-2024 has witnessed several strategic acquisitions as larger firms seek to integrate smaller, specialized operators, thereby enhancing their network coverage and operational capabilities.

- Market Concentration: Dominated by a blend of large, established companies and a fragmented base of smaller logistics providers.

- Technological Innovation: Driven by advancements in GPS tracking, telematics, fleet management software, and AI-powered route optimization.

- Regulatory Landscape: Evolving environmental regulations and road infrastructure investments are key influencing factors.

- End-User Diversification: Demand is significantly shaped by the growth trajectories of key industries like manufacturing, retail, and infrastructure development.

- M&A Activity: Focus on market consolidation, service diversification, and enhanced operational efficiencies.

Colombia Road Freight Transport Market Growth Trends & Insights

The Colombia road freight transport market is poised for substantial growth, driven by robust economic expansion and increasing trade volumes. The market size evolution indicates a consistent upward trajectory, fueled by the country's strategic position as a regional logistics hub and ongoing government initiatives to improve infrastructure. Adoption rates for advanced logistics technologies are accelerating as companies seek to optimize their supply chains and reduce operational costs. Technological disruptions, such as the integration of IoT devices for enhanced cargo visibility and predictive maintenance for fleets, are transforming the sector. Consumer behavior shifts, including the rise of e-commerce, are creating new demand patterns for faster, more reliable, and flexible delivery services, particularly for Less Than Truckload (LTL) shipments. The Compound Annual Growth Rate (CAGR) is projected to be strong throughout the forecast period, reflecting increasing industrial output and domestic consumption. Market penetration is deepening as logistics providers expand their networks and offer specialized services tailored to the unique needs of various industries.

Dominant Regions, Countries, or Segments in Colombia Road Freight Transport Market

Within the Colombia road freight transport market, the Distributive Trade segment emerges as a dominant driver of growth. This segment's expansion is intrinsically linked to the burgeoning retail sector, the increasing influence of e-commerce, and the evolving consumer demand for a wide array of goods. Key drivers include robust domestic consumption, significant investments in retail infrastructure, and a growing middle class. The Manufacturing and Automotive sector also plays a crucial role, demanding efficient and timely transportation of raw materials, components, and finished products across the country. Economic policies that promote industrial growth and trade liberalization further bolster this segment.

Distributive Trade:

- Market Share: Accounts for a significant portion of overall freight volume due to its broad reach and continuous demand.

- Growth Potential: Fueled by e-commerce expansion and the increasing sophistication of retail supply chains.

- Key Drivers: Urbanization, rising disposable incomes, and the demand for last-mile delivery solutions.

Manufacturing and Automotive:

- Market Share: High demand for inbound and outbound logistics, especially for time-sensitive components and finished goods.

- Growth Potential: Tied to the country's industrial development and export ambitions.

- Key Drivers: Government incentives for manufacturing, increasing vehicle sales, and the need for specialized transportation for automotive parts.

The dominance of these segments is further amplified by the continued reliance on Full Truckload (FTL) services for bulk transportation of goods within these sectors, alongside a growing demand for Less Than Truckload (LTL) for more diversified and fragmented distribution networks.

Colombia Road Freight Transport Market Product Landscape

The product landscape in the Colombia road freight transport market is characterized by the evolution of vehicle types and the innovative integration of technology into service offerings. Fleet modernization is a key trend, with investments in fuel-efficient trucks and specialized trailers to meet diverse cargo requirements. Service innovations focus on enhanced visibility, with real-time GPS tracking and IoT sensors providing clients with unprecedented insight into their shipments' whereabouts and condition. Performance metrics are increasingly tied to delivery speed, reliability, and the ability to handle specialized cargo, such as temperature-sensitive goods. Unique selling propositions often revolve around dedicated fleet management, customized routing solutions, and integrated logistics services that extend beyond mere transportation.

Key Drivers, Barriers & Challenges in Colombia Road Freight Transport Market

Key Drivers: The Colombia road freight transport market is propelled by strong economic growth, increasing industrial production, and a burgeoning e-commerce sector demanding efficient logistics. Government investments in infrastructure development, such as road network upgrades, are crucial for improving accessibility and reducing transit times. Technological adoption, including advanced fleet management and tracking systems, is enhancing operational efficiency. Favorable trade policies and the country's strategic location also contribute significantly to market growth.

Key Barriers & Challenges: Significant challenges include the country's vast and sometimes challenging topography, which can increase transit times and operational costs. An aging fleet in some segments requires substantial investment in modernization. Regulatory hurdles, including varying regional compliance standards and bureaucratic processes, can impede smoother operations. Intense competition from a fragmented market can lead to price pressures. Furthermore, the need for enhanced security measures to prevent cargo theft and ensure supply chain integrity remains a persistent concern.

Emerging Opportunities in Colombia Road Freight Transport Market

Emerging opportunities in the Colombia road freight transport market lie in the growing demand for specialized logistics services, such as cold chain transportation for pharmaceuticals and perishable agricultural products. The continued expansion of e-commerce presents significant opportunities for last-mile delivery solutions and optimized urban logistics. Untapped markets in remote regions, coupled with government initiatives to improve connectivity, offer potential for network expansion. Innovative applications of technology, including autonomous vehicle testing and the use of AI for demand forecasting, are poised to reshape the industry.

Growth Accelerators in the Colombia Road Freight Transport Market Industry

Long-term growth in the Colombia road freight transport market is being accelerated by strategic partnerships between logistics providers and large-scale industries, fostering integrated supply chain solutions. Technological breakthroughs in telematics and data analytics are enabling greater predictive capabilities and operational efficiencies. Government-led infrastructure projects, such as the expansion of major highways and ports, will significantly reduce transit times and improve connectivity, acting as major growth catalysts. The increasing adoption of sustainable logistics practices, driven by both regulatory pressure and corporate social responsibility, is also creating new avenues for innovation and market differentiation.

Key Players Shaping the Colombia Road Freight Transport Market Market

- Coordinadora Mercantil SA

- Compania De Distribucion Y Transporte SA Ditransa

- Sercarga SAS

- Operadores Logisticos De Carga S OPL Carga SAS

- Transportes Sanchez Polo SA

- Logistica Transporte Y Servicios Asociados SAS

- TCC SAS

- Cooperativa Santandereana De Transportadores Limitada

- Transportes Vigia Sociedad Por Acciones Simplificada SAS

- Transportes Montejo SAS

Notable Milestones in Colombia Road Freight Transport Market Sector

- 2020: Increased adoption of digital platforms for freight booking and management in response to supply chain disruptions.

- 2021: Significant investments in fleet modernization with a focus on fuel efficiency and emission reduction technologies.

- 2022: Expansion of specialized logistics services, including temperature-controlled transport for the pharmaceutical and food industries.

- 2023: Growth in M&A activities as larger players consolidate market share and expand service offerings.

- 2024: Enhanced focus on last-mile delivery solutions driven by the continued surge in e-commerce.

In-Depth Colombia Road Freight Transport Market Market Outlook

The Colombia road freight transport market is set for a period of sustained growth, driven by ongoing economic development, robust industrial activity, and the significant expansion of e-commerce. Strategic opportunities abound for companies that can leverage advanced technologies for enhanced efficiency and customer service. The continued focus on infrastructure development will further solidify Colombia's position as a key logistics hub in the region. The market's future will be shaped by an increasing demand for specialized, sustainable, and technologically advanced logistics solutions, presenting a fertile ground for innovation and strategic investment.

Colombia Road Freight Transport Market Segmentation

-

1. End User

- 1.1. Construction

- 1.2. Oil and Gas and Quarrying

- 1.3. Agriculture, Fishing, and Forestry

- 1.4. Manufacturing and Automotive

- 1.5. Distributive Trade

- 1.6. Other End Users (Pharmaceutical and Healthcare)

-

2. Vehicle Type

- 2.1. Less Than Truckload (LTL)

- 2.2. Full Truckload (FTL)

Colombia Road Freight Transport Market Segmentation By Geography

- 1. Colombia

Colombia Road Freight Transport Market Regional Market Share

Geographic Coverage of Colombia Road Freight Transport Market

Colombia Road Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity

- 3.3. Market Restrains

- 3.3.1. 4.; Logistics Integration In Last-mile Delivery

- 3.4. Market Trends

- 3.4.1. Rising Investment in the Transport and Logistics Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Colombia Road Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Construction

- 5.1.2. Oil and Gas and Quarrying

- 5.1.3. Agriculture, Fishing, and Forestry

- 5.1.4. Manufacturing and Automotive

- 5.1.5. Distributive Trade

- 5.1.6. Other End Users (Pharmaceutical and Healthcare)

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Less Than Truckload (LTL)

- 5.2.2. Full Truckload (FTL)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Colombia

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Coordinadora Mercantil SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Compania De Distribucion Y Transporte SA Ditransa

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sercarga SAS**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Operadores Logisticos De Carga S OPL Carga SAS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Transportes Sanchez Polo SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Logistica Transporte Y Servicios Asociados SAS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TCC SAS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cooperativa Santandereana De Transportadores Limitada

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Transportes Vigia Sociedad Por Acciones Simplificada SAS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Transportes Montejo SAS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Coordinadora Mercantil SA

List of Figures

- Figure 1: Colombia Road Freight Transport Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Colombia Road Freight Transport Market Share (%) by Company 2025

List of Tables

- Table 1: Colombia Road Freight Transport Market Revenue Million Forecast, by End User 2020 & 2033

- Table 2: Colombia Road Freight Transport Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Colombia Road Freight Transport Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Colombia Road Freight Transport Market Revenue Million Forecast, by End User 2020 & 2033

- Table 5: Colombia Road Freight Transport Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Colombia Road Freight Transport Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Colombia Road Freight Transport Market?

The projected CAGR is approximately 6.54%.

2. Which companies are prominent players in the Colombia Road Freight Transport Market?

Key companies in the market include Coordinadora Mercantil SA, Compania De Distribucion Y Transporte SA Ditransa, Sercarga SAS**List Not Exhaustive, Operadores Logisticos De Carga S OPL Carga SAS, Transportes Sanchez Polo SA, Logistica Transporte Y Servicios Asociados SAS, TCC SAS, Cooperativa Santandereana De Transportadores Limitada, Transportes Vigia Sociedad Por Acciones Simplificada SAS, Transportes Montejo SAS.

3. What are the main segments of the Colombia Road Freight Transport Market?

The market segments include End User, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.86 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity.

6. What are the notable trends driving market growth?

Rising Investment in the Transport and Logistics Sector.

7. Are there any restraints impacting market growth?

4.; Logistics Integration In Last-mile Delivery.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Colombia Road Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Colombia Road Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Colombia Road Freight Transport Market?

To stay informed about further developments, trends, and reports in the Colombia Road Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence