Key Insights

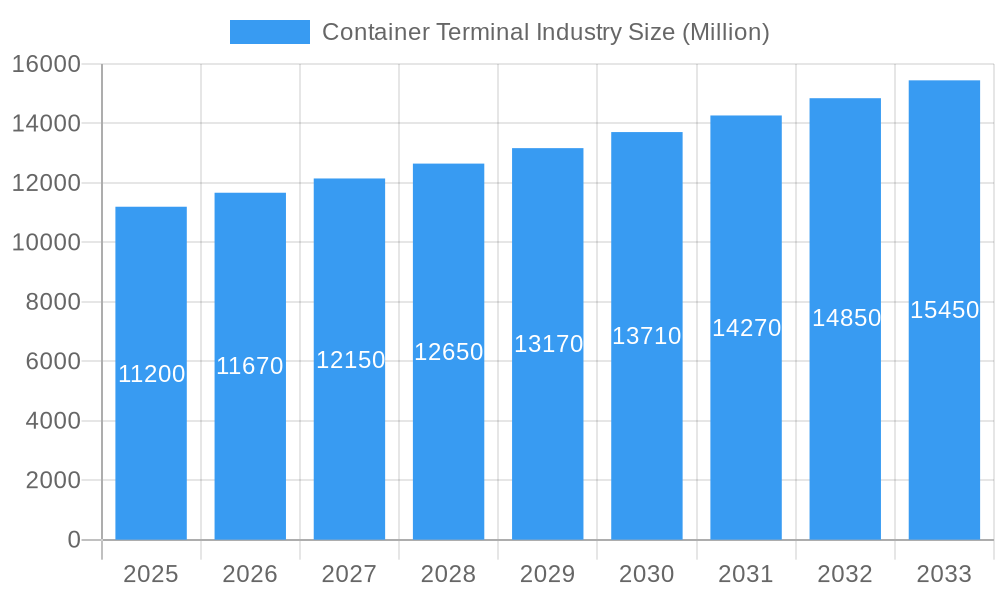

The global Container Terminal Industry is poised for robust growth, projected to reach an estimated $11.2 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.1% anticipated to extend through 2033. This expansion is primarily fueled by the escalating volume of global trade, the increasing efficiency demands within supply chains, and the continuous expansion of shipping capacities worldwide. Key drivers include the ongoing investment in port infrastructure modernization, the adoption of advanced technologies like automation and digitalization to enhance operational efficiency, and the growing importance of strategic location and connectivity in global logistics networks. The industry is witnessing a significant trend towards larger vessel sizes, necessitating deeper berths and more advanced handling equipment. Furthermore, there's a growing emphasis on integrated logistics solutions, where container terminals serve as crucial hubs for multimodal transportation, connecting sea, rail, and road networks. Emerging markets in Asia Pacific and the Middle East are expected to contribute significantly to this growth, driven by their expanding economies and strategic positions in key shipping lanes.

Container Terminal Industry Market Size (In Billion)

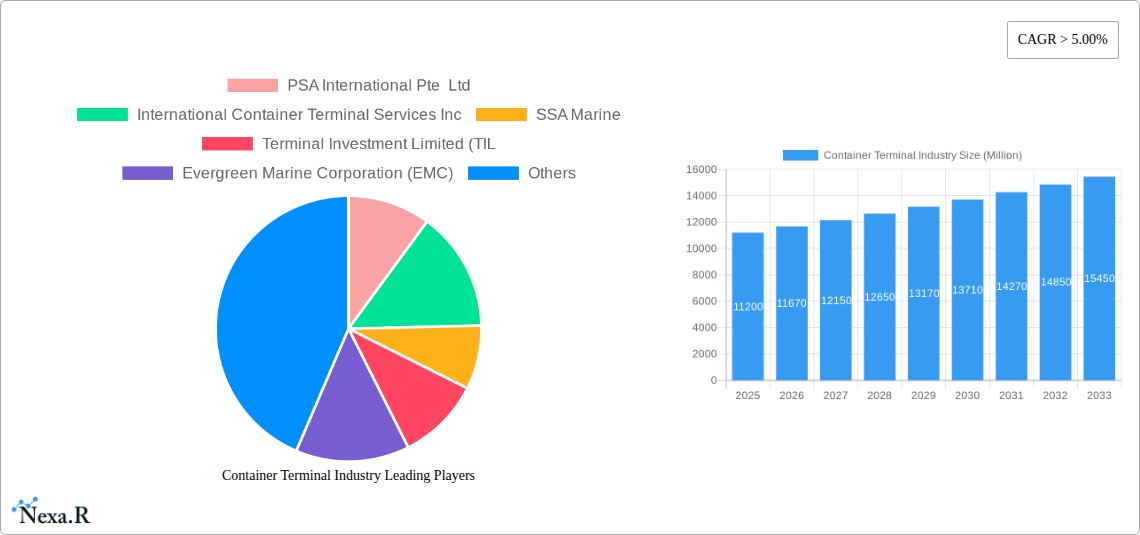

Despite this positive outlook, the industry faces certain restraints that could influence its trajectory. Fluctuations in global economic conditions, geopolitical uncertainties, and trade protectionism can impact trade volumes and, consequently, container throughput. Rising operational costs, including labor, energy, and environmental compliance, also present a challenge. Regulatory changes concerning environmental sustainability and port security can necessitate substantial investments. However, these challenges also present opportunities for innovation and differentiation. The market is segmented by service, with Stevedoring and Cargo Handling & Transportation forming the core offerings, supported by "Others" encompassing ancillary services. Cargo types are dominated by Crude Oil, Dry Cargo, and Other Liquid Cargo, reflecting the diverse nature of global trade. Leading companies like PSA International, ICTSI, SSA Marine, and DP World are actively investing in technology and capacity expansion to capitalize on these growth opportunities and navigate the evolving landscape of the container terminal industry.

Container Terminal Industry Company Market Share

This in-depth report provides a definitive analysis of the global Container Terminal Industry, offering crucial insights for stakeholders navigating this dynamic sector. Covering the historical period of 2019-2024 and projecting growth through 2033, with a base and estimated year of 2025, this report delves into market dynamics, growth trends, regional dominance, product innovation, key drivers, challenges, emerging opportunities, and a comprehensive player landscape. Essential for industry professionals, investors, and strategic planners, this report equips you with the intelligence needed to capitalize on the evolving container terminal market. The global market size is projected to reach $150 billion by 2025, with a projected CAGR of 5.2% through 2033.

Container Terminal Industry Market Dynamics & Structure

The container terminal industry exhibits a moderately concentrated market structure, with a few global giants dominating key regions. Technological innovation, particularly in automation, AI-driven logistics, and sustainable infrastructure, is a primary driver, aimed at enhancing efficiency and reducing operational costs. Regulatory frameworks, including environmental standards and trade policies, significantly influence terminal operations and investment decisions. While direct competitive product substitutes are limited due to the specialized nature of port infrastructure, alternative logistics models and inland transportation solutions present indirect competition. End-user demographics are primarily shipping lines and cargo owners, with evolving demands for faster turnaround times and integrated supply chain solutions. Mergers and acquisitions (M&A) remain a significant trend, driven by the pursuit of economies of scale, geographic expansion, and enhanced service offerings. For instance, the acquisition of smaller regional operators by larger entities has been prevalent, consolidating market share and streamlining operations. Key M&A deals in the past five years have cumulatively been valued at over $25 billion. Barriers to innovation include the substantial capital investment required for new technologies, the long lifespan of existing infrastructure, and the need for skilled labor to manage advanced systems.

- Market Concentration: Dominated by a few large players, but with opportunities for regional specialists.

- Technological Drivers: Automation, AI, digitalization, and green technologies are key innovation areas.

- Regulatory Impact: Environmental regulations and trade agreements shape operational strategies.

- End-User Needs: Demand for speed, efficiency, and integrated logistics solutions is growing.

- M&A Activity: A consistent strategy for growth and market consolidation, with estimated deal volumes averaging $5 billion annually.

Container Terminal Industry Growth Trends & Insights

The container terminal industry is experiencing robust growth, fueled by increasing global trade volumes and the rise of mega-ships. The market size is anticipated to grow from an estimated $130 billion in 2024 to over $150 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 5.2% during the forecast period of 2025-2033. Adoption rates for advanced technologies like automated stacking cranes and robotic yard operations are steadily increasing, driven by the need to optimize throughput and reduce labor costs. Technological disruptions, such as the implementation of blockchain for supply chain transparency and the integration of IoT for real-time cargo tracking, are transforming operational efficiencies. Consumer behavior shifts, influenced by e-commerce growth and the demand for faster delivery, are putting pressure on terminal operators to expedite cargo handling and improve connectivity. This translates to increased demand for technologically advanced, strategically located terminals capable of handling larger vessel capacities efficiently. The adoption rate of automation in developed markets is projected to reach 60% by 2030.

- Market Size Evolution: Consistent upward trajectory driven by global trade expansion.

- Adoption Rates: Increasing adoption of automation and digital solutions for operational enhancements.

- Technological Disruptions: Blockchain, IoT, and AI are reshaping supply chain integration and efficiency.

- Consumer Behavior Shifts: E-commerce and demand for speed are influencing terminal operational requirements.

- Market Penetration: Significant growth potential in emerging economies and specialized cargo handling.

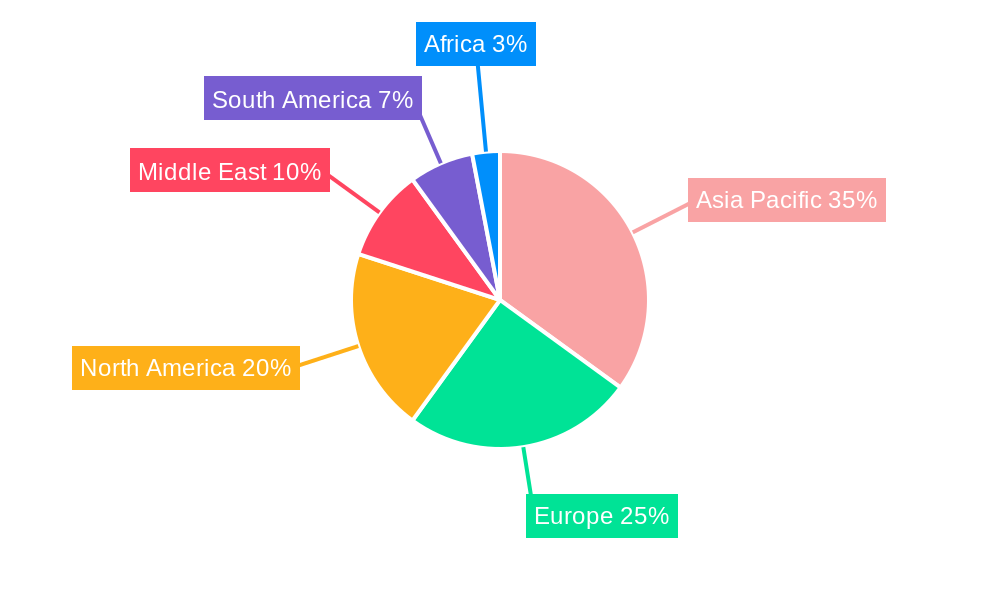

Dominant Regions, Countries, or Segments in Container Terminal Industry

The Asia-Pacific region stands as the dominant force in the global container terminal industry, driven by its central role in international trade and manufacturing. Countries like China, with its extensive coastline and massive port infrastructure, lead in throughput capacity and investment. The segment of Cargo Handling & Transportation within the broader service offerings is paramount, as efficient movement of containers from vessel to land and vice-versa is the core function. Among cargo types, Dry Cargo, primarily consisting of manufactured goods and raw materials in containerized form, represents the largest volume and revenue driver. Key drivers for this dominance include China's manufacturing prowess, robust trade agreements within ASEAN, and ongoing infrastructure development projects across the region, such as the Belt and Road Initiative. Southeast Asian nations are also significant contributors, leveraging their strategic locations for transshipment. The market share of Asia-Pacific in global container throughput is estimated to be over 60%.

- Leading Region: Asia-Pacific, particularly China, due to its manufacturing and trade volumes.

- Dominant Segment: Cargo Handling & Transportation, the core service of container terminals.

- Key Cargo Type: Dry Cargo (manufactured goods, raw materials) forms the bulk of containerized freight.

- Drivers of Dominance:

- Economic Policies: Pro-trade policies and significant government investment in port infrastructure.

- Infrastructure: Advanced port facilities, including deep-water berths and efficient hinterland connectivity.

- Manufacturing Hub: Centrality of the region in global manufacturing supply chains.

- Trade Growth: Consistent growth in international containerized trade originating from and destined for the region.

Container Terminal Industry Product Landscape

The "products" within the container terminal industry are primarily sophisticated operational systems and integrated service offerings. Innovations focus on optimizing terminal efficiency and cargo flow. This includes advancements in Automated Guided Vehicles (AGVs), automated stacking cranes (ASCs), and intelligent terminal operating systems (TOS) that leverage AI for predictive analytics and real-time decision-making. Applications range from enhanced vessel loading/unloading speed to improved yard management and reduced dwell times. Performance metrics emphasize increased TEU (Twenty-foot Equivalent Unit) handling capacity, reduced turnaround times for vessels, and minimized operational errors. Unique selling propositions revolve around cutting-edge automation, seamless integration with supply chain partners, and a strong commitment to sustainability through reduced emissions and energy-efficient operations.

Key Drivers, Barriers & Challenges in Container Terminal Industry

The container terminal industry is propelled by several key drivers, including the persistent growth in global trade, necessitating increased port capacity and efficiency. Technological advancements in automation and digitalization are crucial for enhancing productivity and reducing operational costs. Furthermore, the expansion of e-commerce and the demand for faster delivery times put pressure on terminals to streamline operations. Strategic investments in port infrastructure and favorable government policies supporting international trade also act as significant growth accelerators.

Conversely, the industry faces substantial barriers and challenges. The immense capital investment required for terminal development and technological upgrades is a primary restraint. Supply chain disruptions, geopolitical instability, and fluctuating global economic conditions can significantly impact cargo volumes and revenue. Stringent environmental regulations and the need for sustainable practices also present compliance challenges. Moreover, competition from other ports and evolving shipping line alliances can impact market share and profitability.

- Key Drivers:

- Global trade growth

- Technological advancements (automation, digitalization)

- E-commerce expansion

- Infrastructure investment

- Supportive trade policies

- Barriers & Challenges:

- High capital investment requirements

- Supply chain disruptions and geopolitical instability

- Environmental regulations and sustainability demands

- Intense competition

- Labor union negotiations and workforce training

Emerging Opportunities in Container Terminal Industry

Emerging opportunities in the container terminal industry lie in the development of smart ports, leveraging IoT and big data analytics for enhanced operational visibility and efficiency. The growing demand for cold chain logistics presents a specialized segment with significant growth potential, requiring specialized infrastructure and handling capabilities. Furthermore, the increasing focus on sustainability is creating opportunities for terminals to invest in green technologies, such as shore power for vessels and the use of renewable energy sources, which can attract environmentally conscious shipping lines. Expansion into emerging markets with developing trade infrastructure also offers substantial untapped potential.

- Smart Ports: IoT, AI, and big data for optimized operations.

- Cold Chain Logistics: Growing demand for specialized temperature-controlled cargo handling.

- Green Technologies: Investment in sustainable practices and renewable energy solutions.

- Emerging Market Expansion: Tapping into underdeveloped trade routes and port infrastructure.

Growth Accelerators in the Container Terminal Industry Industry

Several catalysts are accelerating long-term growth in the container terminal industry. The continued globalization of supply chains and the expansion of international trade routes are foundational. Strategic partnerships between terminal operators, shipping lines, and logistics providers are crucial for creating integrated networks and improving service offerings. Furthermore, the ongoing technological revolution, particularly in autonomous systems and data-driven optimization, is set to unlock new levels of efficiency and capacity. Market expansion strategies, including the development of new terminal facilities in strategic locations and the enhancement of existing infrastructure to accommodate larger vessels, are also key growth accelerators.

Key Players Shaping the Container Terminal Industry Market

- PSA International Pte Ltd

- International Container Terminal Services Inc

- SSA Marine

- Terminal Investment Limited (TIL)

- Evergreen Marine Corporation (EMC)

- Hutchison Port Holdings Trust

- APM Terminals Management BV

- Dubai Ports World (DPW)

- DP World PLC

- China Merchants Port Holdings Co Ltd

- Eurogate Container Terminal Ltd

- AP Moller Maersk

Notable Milestones in Container Terminal Industry Sector

- June 2022: AP Mollar Maersk announced expansion in New Zealand with the launch of 'Maersk Coastal Connect', a new dedicated coastal service to enhance supply chain resilience and vessel schedule reliability. The service deploys two 2,500 TEU vessels weekly, calling at Timaru, Lyttelton, Nelson, Auckland, and Tauranga, significantly boosting North-South connectivity.

- June 2022: TecPlata S.A. (International Container Terminal Services, Inc. business unit in Argentina) entered an agreement with Vessel S.A. for a new weekly feeder service between La Plata Port and Montevideo, Uruguay. This service expands TecPlata's reach to new markets and enhances its existing connections to Brazil and Asia.

In-Depth Container Terminal Industry Market Outlook

The future outlook for the container terminal industry is exceptionally promising, driven by sustained global trade growth and ongoing technological advancements. Strategic investments in automation, digitalization, and sustainable practices are set to define the competitive landscape. Opportunities abound for terminal operators that can offer integrated logistics solutions and adapt to evolving customer demands for speed and efficiency. The expansion of emerging markets and the continuous need for efficient cargo handling will fuel demand for advanced terminal operations. Companies focusing on innovation, strategic partnerships, and operational excellence will be best positioned to capitalize on the significant future market potential.

Container Terminal Industry Segmentation

-

1. Service

- 1.1. Stevedoring

- 1.2. Cargo Handling & Transportation

- 1.3. Others

-

2. Cargo Type

- 2.1. Crude Oil

- 2.2. Dry Cargo

- 2.3. Other Liquid Cargo

Container Terminal Industry Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Singapore

- 3.5. Malaysia

- 3.6. South Korea

- 3.7. Australia

- 3.8. Rest Of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. UAE

- 6.1. Saudi Arabia

- 6.2. South Africa

- 6.3. Rest of Middle East

Container Terminal Industry Regional Market Share

Geographic Coverage of Container Terminal Industry

Container Terminal Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in global trade activites; Increase in infrastrustrure and construction

- 3.3. Market Restrains

- 3.3.1. Long distances and sometimes difficult terrain can contribute to increased transportation costs

- 3.4. Market Trends

- 3.4.1. Rise in Container Seaborne Trade is a Major Driver

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Container Terminal Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Stevedoring

- 5.1.2. Cargo Handling & Transportation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Crude Oil

- 5.2.2. Dry Cargo

- 5.2.3. Other Liquid Cargo

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. UAE

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Container Terminal Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Stevedoring

- 6.1.2. Cargo Handling & Transportation

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Cargo Type

- 6.2.1. Crude Oil

- 6.2.2. Dry Cargo

- 6.2.3. Other Liquid Cargo

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe Container Terminal Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Stevedoring

- 7.1.2. Cargo Handling & Transportation

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Cargo Type

- 7.2.1. Crude Oil

- 7.2.2. Dry Cargo

- 7.2.3. Other Liquid Cargo

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Pacific Container Terminal Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Stevedoring

- 8.1.2. Cargo Handling & Transportation

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Cargo Type

- 8.2.1. Crude Oil

- 8.2.2. Dry Cargo

- 8.2.3. Other Liquid Cargo

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. South America Container Terminal Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Stevedoring

- 9.1.2. Cargo Handling & Transportation

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Cargo Type

- 9.2.1. Crude Oil

- 9.2.2. Dry Cargo

- 9.2.3. Other Liquid Cargo

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Middle East Container Terminal Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Stevedoring

- 10.1.2. Cargo Handling & Transportation

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Cargo Type

- 10.2.1. Crude Oil

- 10.2.2. Dry Cargo

- 10.2.3. Other Liquid Cargo

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. UAE Container Terminal Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service

- 11.1.1. Stevedoring

- 11.1.2. Cargo Handling & Transportation

- 11.1.3. Others

- 11.2. Market Analysis, Insights and Forecast - by Cargo Type

- 11.2.1. Crude Oil

- 11.2.2. Dry Cargo

- 11.2.3. Other Liquid Cargo

- 11.1. Market Analysis, Insights and Forecast - by Service

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 PSA International Pte Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 International Container Terminal Services Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 SSA Marine

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Terminal Investment Limited (TIL

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Evergreen Marine Corporation (EMC)

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Hutchison Port Holdings Trust

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 APM Terminals Management BV**List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Dubai Ports World (DPW)

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 DP World PLC

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 China Merchants Port Holdings Co Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Eurogate Container Terminal Ltd

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 AP Moller Maersk

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 PSA International Pte Ltd

List of Figures

- Figure 1: Global Container Terminal Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Container Terminal Industry Revenue (undefined), by Service 2025 & 2033

- Figure 3: North America Container Terminal Industry Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America Container Terminal Industry Revenue (undefined), by Cargo Type 2025 & 2033

- Figure 5: North America Container Terminal Industry Revenue Share (%), by Cargo Type 2025 & 2033

- Figure 6: North America Container Terminal Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Container Terminal Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Container Terminal Industry Revenue (undefined), by Service 2025 & 2033

- Figure 9: Europe Container Terminal Industry Revenue Share (%), by Service 2025 & 2033

- Figure 10: Europe Container Terminal Industry Revenue (undefined), by Cargo Type 2025 & 2033

- Figure 11: Europe Container Terminal Industry Revenue Share (%), by Cargo Type 2025 & 2033

- Figure 12: Europe Container Terminal Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Container Terminal Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Container Terminal Industry Revenue (undefined), by Service 2025 & 2033

- Figure 15: Asia Pacific Container Terminal Industry Revenue Share (%), by Service 2025 & 2033

- Figure 16: Asia Pacific Container Terminal Industry Revenue (undefined), by Cargo Type 2025 & 2033

- Figure 17: Asia Pacific Container Terminal Industry Revenue Share (%), by Cargo Type 2025 & 2033

- Figure 18: Asia Pacific Container Terminal Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Container Terminal Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Container Terminal Industry Revenue (undefined), by Service 2025 & 2033

- Figure 21: South America Container Terminal Industry Revenue Share (%), by Service 2025 & 2033

- Figure 22: South America Container Terminal Industry Revenue (undefined), by Cargo Type 2025 & 2033

- Figure 23: South America Container Terminal Industry Revenue Share (%), by Cargo Type 2025 & 2033

- Figure 24: South America Container Terminal Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Container Terminal Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Container Terminal Industry Revenue (undefined), by Service 2025 & 2033

- Figure 27: Middle East Container Terminal Industry Revenue Share (%), by Service 2025 & 2033

- Figure 28: Middle East Container Terminal Industry Revenue (undefined), by Cargo Type 2025 & 2033

- Figure 29: Middle East Container Terminal Industry Revenue Share (%), by Cargo Type 2025 & 2033

- Figure 30: Middle East Container Terminal Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East Container Terminal Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: UAE Container Terminal Industry Revenue (undefined), by Service 2025 & 2033

- Figure 33: UAE Container Terminal Industry Revenue Share (%), by Service 2025 & 2033

- Figure 34: UAE Container Terminal Industry Revenue (undefined), by Cargo Type 2025 & 2033

- Figure 35: UAE Container Terminal Industry Revenue Share (%), by Cargo Type 2025 & 2033

- Figure 36: UAE Container Terminal Industry Revenue (undefined), by Country 2025 & 2033

- Figure 37: UAE Container Terminal Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Container Terminal Industry Revenue undefined Forecast, by Service 2020 & 2033

- Table 2: Global Container Terminal Industry Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 3: Global Container Terminal Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Container Terminal Industry Revenue undefined Forecast, by Service 2020 & 2033

- Table 5: Global Container Terminal Industry Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 6: Global Container Terminal Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: US Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Container Terminal Industry Revenue undefined Forecast, by Service 2020 & 2033

- Table 11: Global Container Terminal Industry Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 12: Global Container Terminal Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: UK Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Russia Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Container Terminal Industry Revenue undefined Forecast, by Service 2020 & 2033

- Table 20: Global Container Terminal Industry Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 21: Global Container Terminal Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: India Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: China Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Japan Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Singapore Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Malaysia Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: South Korea Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Australia Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Rest Of Asia Pacific Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Global Container Terminal Industry Revenue undefined Forecast, by Service 2020 & 2033

- Table 31: Global Container Terminal Industry Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 32: Global Container Terminal Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 33: Brazil Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Argentina Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Global Container Terminal Industry Revenue undefined Forecast, by Service 2020 & 2033

- Table 37: Global Container Terminal Industry Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 38: Global Container Terminal Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 39: Global Container Terminal Industry Revenue undefined Forecast, by Service 2020 & 2033

- Table 40: Global Container Terminal Industry Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 41: Global Container Terminal Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Saudi Arabia Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Africa Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Rest of Middle East Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Container Terminal Industry?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Container Terminal Industry?

Key companies in the market include PSA International Pte Ltd, International Container Terminal Services Inc, SSA Marine, Terminal Investment Limited (TIL, Evergreen Marine Corporation (EMC), Hutchison Port Holdings Trust, APM Terminals Management BV**List Not Exhaustive, Dubai Ports World (DPW), DP World PLC, China Merchants Port Holdings Co Ltd, Eurogate Container Terminal Ltd, AP Moller Maersk.

3. What are the main segments of the Container Terminal Industry?

The market segments include Service, Cargo Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increase in global trade activites; Increase in infrastrustrure and construction.

6. What are the notable trends driving market growth?

Rise in Container Seaborne Trade is a Major Driver.

7. Are there any restraints impacting market growth?

Long distances and sometimes difficult terrain can contribute to increased transportation costs.

8. Can you provide examples of recent developments in the market?

On 15 June 2022, One of the leading player, AP Mollar Maersk announced it's expansion in New Zealand. Maersk is launching a new dedicated New Zealand coastal service - 'Maersk Coastal Connect', to enable a more resilient New Zealand supply chain and improve vessel schedule reliability. By deploying two 2,500 TEU container vessels, Maersk Nadi and Maersk Nansha on a weekly basis, five main ports in New Zealand, namely Timaru, Lyttelton, Nelson, Auckland and Tauranga will be called respectively in the service rotation, enhancing connectivity and providing easy access to Maersk's global network. The combined North to South and South to North capacity will reach 250,000 TEU each year. Maersk Coastal Connect will start on the 12th of July 2022. The service will be operated with New Zealand crew to support the local community and ensure continued to investment in New Zealand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Container Terminal Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Container Terminal Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Container Terminal Industry?

To stay informed about further developments, trends, and reports in the Container Terminal Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence