Key Insights

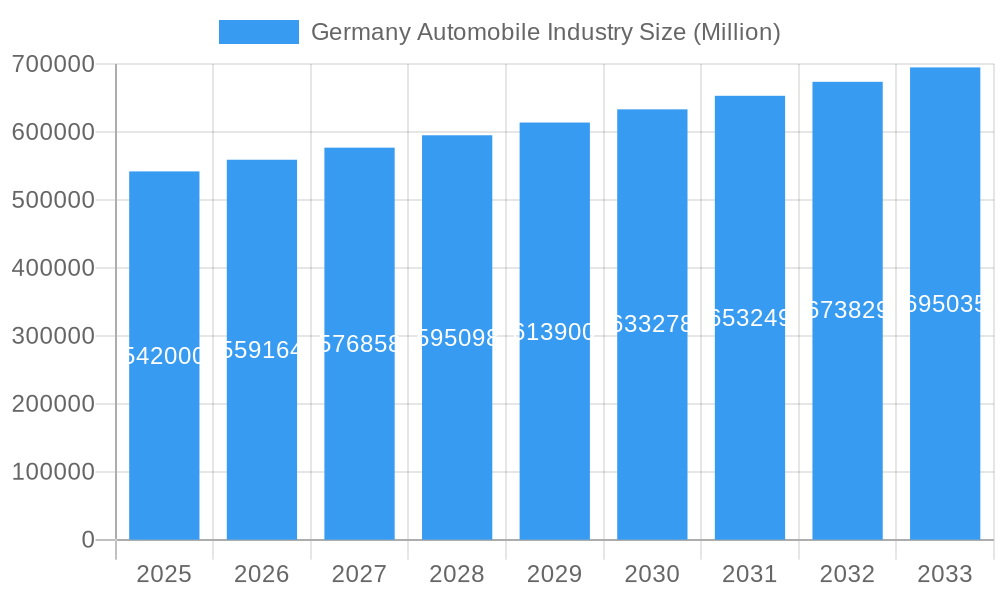

The German automobile industry is poised for significant growth, with an estimated market size of $542 billion in 2025. This growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of 3.2% from 2019 to 2033. The sector's robust performance is being driven by several key factors, including the increasing demand for electric vehicles (EVs) and the continuous innovation in automotive technology, such as advanced driver-assistance systems (ADAS) and in-car connectivity. Furthermore, the extensive aftermarket service sector, encompassing vehicle maintenance, repair, and the supply of auto components, plays a crucial role in sustaining market value. The logistical backbone supporting this vast industry, including transportation and warehousing of finished vehicles and components, is also a significant contributor, with major players like DB Schenker, DHL Post, and Kuehne + Nagel International AG actively shaping this segment.

Germany Automobile Industry Market Size (In Billion)

Despite the strong growth trajectory, the German automotive market faces certain restraints that could influence its pace. Intensifying competition, both from established global manufacturers and emerging EV startups, presents a constant challenge. Regulatory pressures related to emissions standards and the transition to sustainable mobility also require substantial investment and adaptation from manufacturers. However, the industry's inherent resilience, coupled with strong government support for innovation and the electrification of transport, is expected to mitigate these challenges. The market is segmented into finished vehicles, auto components, and various services including transportation, warehousing, and other related offerings. The dominant presence of established logistics giants like Dachser, Rhenus Logistics, and DSV Panalpina highlights the critical importance of efficient supply chain management within the German automotive landscape, ensuring a steady flow of goods and services.

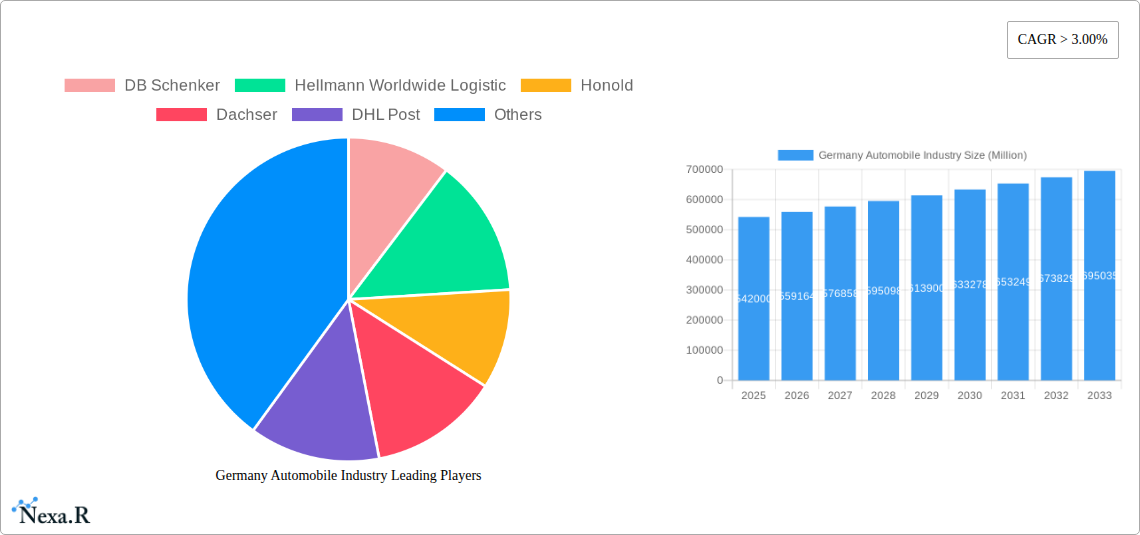

Germany Automobile Industry Company Market Share

Germany Automobile Industry: Comprehensive Market Analysis and Forecast (2019-2033)

This in-depth report provides a definitive analysis of the Germany automobile industry, meticulously examining market dynamics, growth trends, and future opportunities. Leveraging extensive data from the study period 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, this report offers unparalleled insights into the evolving landscape of German automotive logistics, auto component manufacturing, and vehicle services. We present a detailed breakdown of the parent market – the broader German automotive sector – and its crucial child markets, including finished vehicle logistics and auto component supply chains. This report is essential for automotive manufacturers, logistics providers, supply chain managers, investors, and industry stakeholders seeking to understand and capitalize on the immense potential of the German car market and its associated industries.

Germany Automobile Industry Market Dynamics & Structure

The Germany automobile industry is characterized by a highly competitive yet innovation-driven market structure. High barriers to entry, stemming from significant capital investment requirements and stringent quality standards, contribute to a moderate market concentration, with established players holding substantial market share. Technological innovation is a primary driver, fueled by substantial R&D expenditure on electric vehicles (EVs), autonomous driving technology, and advanced manufacturing processes. Regulatory frameworks, including emission standards and safety regulations, play a pivotal role in shaping product development and market access. While direct product substitutes are limited within the core automotive manufacturing, competitive pressures arise from evolving mobility solutions and the increasing demand for services. End-user demographics are shifting towards a greater appreciation for sustainability, connectivity, and personalized mobility experiences. Mergers and acquisitions (M&A) remain a strategic tool for companies seeking to enhance market position, acquire new technologies, or achieve economies of scale within the German auto sector.

- Market Concentration: Dominated by a few key OEMs, but with a diverse supplier and logistics network.

- Technological Innovation: Focus on electrification, digitalization, and sustainable manufacturing.

- Regulatory Frameworks: Stringent emission targets (e.g., Euro 7) and safety standards influence product cycles.

- Competitive Product Substitutes: Increasing competition from shared mobility services and alternative transportation modes.

- End-User Demographics: Growing demand for eco-friendly vehicles, smart features, and flexible ownership models.

- M&A Trends: Strategic acquisitions aimed at securing supply chains, expanding technological capabilities, and entering new market segments.

Germany Automobile Industry Growth Trends & Insights

The Germany automobile industry is projected to experience robust growth throughout the forecast period, driven by a confluence of technological advancements, shifting consumer preferences, and supportive economic policies. Market size evolution is anticipated to be significantly influenced by the accelerated adoption of electric vehicles (EVs), which are increasingly becoming the preferred choice for consumers seeking sustainable and cost-effective transportation. This trend is further bolstered by government incentives and expanding charging infrastructure. Automotive component manufacturers are witnessing a surge in demand for specialized parts that support EV powertrains, battery technology, and advanced driver-assistance systems (ADAS). The logistics segment, particularly finished vehicle logistics and warehousing for automotive parts, is adapting to the complexities of EV distribution and the growing e-commerce demand for automotive accessories. Technological disruptions, such as the integration of AI and IoT in manufacturing and supply chain management, are enhancing efficiency and reducing operational costs. Consumer behavior is shifting towards valuing connectivity, digital services, and personalized in-car experiences, prompting manufacturers to invest heavily in software development and user interface design. The CAGR for the German automotive sector is estimated to be in the range of 5.5% to 7.0% over the forecast period. Market penetration of EVs is expected to exceed 40% by 2030.

Dominant Regions, Countries, or Segments in Germany Automobile Industry

Within the expansive Germany automobile industry, the Finished Vehicle Logistics (FVL) segment is emerging as a pivotal driver of market growth. This segment encompasses the intricate network of transportation, warehousing, and distribution of new and used vehicles from manufacturing plants to dealerships and end-consumers. The increasing global demand for German-made vehicles, coupled with the complex logistical challenges associated with transporting high-value assets, positions FVL for substantial expansion. The Auto Component segment, particularly for electric vehicle (EV) components such as batteries, powertrains, and advanced electronics, also exhibits remarkable growth potential. These components are critical for the ongoing transition to sustainable mobility. Transportation services remain the backbone of the FVL segment, utilizing specialized carriers and multimodal solutions to ensure timely and secure delivery. Warehousing facilities are crucial for managing inventory, performing pre-delivery inspections, and facilitating efficient distribution.

- Finished Vehicle Logistics (FVL):

- Key Drivers: Growing export market for German vehicles, increasing complexity of global supply chains, demand for specialized transport solutions.

- Market Share: Expected to capture a significant portion of the automotive services market.

- Growth Potential: High, driven by OEM expansion and evolving distribution strategies.

- Auto Component (EV-focused):

- Key Drivers: Rapid EV adoption, government incentives for sustainable mobility, technological advancements in battery and powertrain technology.

- Market Share: Steadily increasing, becoming a cornerstone of the automotive supply chain.

- Growth Potential: Exceptional, fueled by the global shift towards electrification.

- Transportation Services:

- Key Drivers: Essential for FVL and component distribution, integration of digital tracking and optimization.

- Market Share: Integral to all automotive value chain activities.

- Growth Potential: Steady, aligned with overall industry growth and efficiency improvements.

- Warehousing:

- Key Drivers: Inventory management, quality control, efficient distribution hubs for components and finished vehicles.

- Market Share: Significant role in supply chain optimization.

- Growth Potential: Moderate to high, driven by the need for sophisticated logistics infrastructure.

Germany Automobile Industry Product Landscape

The Germany automobile industry is renowned for its sophisticated product innovations, focusing on performance, safety, and sustainability. Key product developments revolve around advanced electric vehicle (EV) platforms, featuring enhanced battery technology for increased range and faster charging. The integration of cutting-edge driver-assistance systems (ADAS) and infotainment technologies is transforming the in-car experience, prioritizing connectivity and user-centric design. Performance metrics for new vehicles emphasize improved energy efficiency, reduced emissions, and a superior driving dynamic. Unique selling propositions include German engineering precision, premium build quality, and advanced safety features, making German automobiles highly sought after globally. Technological advancements in lightweight materials, intelligent manufacturing, and digital services are continuously shaping the product landscape, ensuring German automotive products remain at the forefront of innovation.

Key Drivers, Barriers & Challenges in Germany Automobile Industry

The Germany automobile industry is propelled by several key drivers including strong government support for electric vehicles (EVs) and sustainable mobility, a highly skilled workforce, and continuous investment in research and development for innovative technologies like autonomous driving. The robust export market for German vehicles also acts as a significant growth accelerator.

However, the industry faces substantial barriers and challenges. Supply chain disruptions, particularly concerning semiconductor availability and raw material sourcing for batteries, continue to pose significant risks. Stringent regulatory hurdles, especially concerning evolving emission standards and data privacy for connected vehicles, can impact production timelines and costs. Intense competitive pressures from global manufacturers and new market entrants, particularly in the EV segment, demand constant innovation and cost optimization. The high cost of developing and implementing new technologies, coupled with the significant investment required for retooling manufacturing facilities for EVs, presents a substantial financial challenge.

Emerging Opportunities in Germany Automobile Industry

Emerging opportunities within the Germany automobile industry lie in the rapid expansion of the electric vehicle (EV) ecosystem. This includes the growing demand for advanced EV battery technology, charging infrastructure solutions, and integrated energy management systems. The digitalization of automotive services presents fertile ground for innovations in connected car technologies, over-the-air updates, and personalized mobility platforms. Furthermore, the development of sustainable materials and circular economy principles within automotive manufacturing and recycling offers significant potential. The burgeoning market for mobility-as-a-service (MaaS) platforms, which integrate various transportation modes, also presents new avenues for growth and strategic partnerships.

Growth Accelerators in the Germany Automobile Industry Industry

Several catalysts are accelerating growth in the Germany Automobile Industry. The accelerating global shift towards electrification, driven by environmental concerns and government mandates, is a primary growth accelerator, pushing demand for electric vehicle (EV) components and related infrastructure. Technological breakthroughs in battery density, charging speed, and autonomous driving capabilities are further fueling innovation and market expansion. Strategic partnerships between established OEMs, technology providers, and logistics companies are crucial for developing integrated mobility solutions and optimizing supply chains. Market expansion strategies, particularly in emerging economies and the continuous enhancement of premium vehicle segments, are also contributing to sustained growth.

Key Players Shaping the Germany Automobile Industry Market

- DB Schenker

- Hellmann Worldwide Logistic

- Honold

- Dachser

- DHL Post

- Kuehne + Nagel International AG

- Rhenus Logistics

- Geodis

- DSV Panalpina

- Rudolph Logistics Group

Notable Milestones in Germany Automobile Industry Sector

- October 2023: AD Ports Group (ADX: ADPORTS) announced its subsidiary, Noatum, will acquire Sesé Auto Logistics for EUR 81 million, bolstering Finished Vehicles Logistics (FVL) capabilities, expected to complete by Q1 2024.

- February 2023: Samvardhana Motherson Automotive Systems Group BV (SMRPBV), a subsidiary of Samvardhana Motherson International (SAMIL), agreed to acquire SAS Autosystemtechnik GmbH (Germany) from Faurecia. SAS is a key provider of automotive assembly and logistics services.

In-Depth Germany Automobile Industry Market Outlook

The Germany Automobile Industry is poised for substantial future growth, driven by an unwavering commitment to technological innovation and sustainable mobility. The ongoing transition to electric vehicles (EVs), supported by robust government incentives and consumer demand, will continue to shape the market. Opportunities abound in advanced auto component manufacturing, particularly for EV batteries and autonomous driving systems. The logistics sector, encompassing finished vehicle logistics and specialized warehousing, will see increased demand for efficient and sustainable solutions. Strategic collaborations and investments in digitalization will be crucial for navigating evolving consumer preferences and competitive landscapes. The industry's focus on R&D, coupled with Germany's strong manufacturing prowess, positions it to maintain its leadership in the global automotive market.

Germany Automobile Industry Segmentation

-

1. Type

- 1.1. Finished Vehicle

- 1.2. Auto Component

-

2. Service

- 2.1. Transportation

- 2.2. Warehous

- 2.3. Other Services

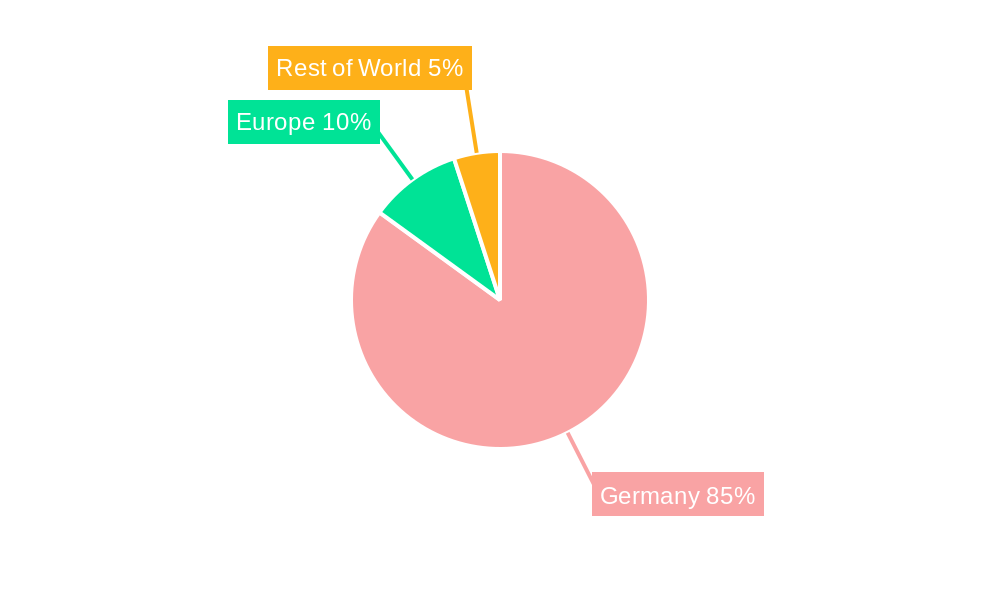

Germany Automobile Industry Segmentation By Geography

- 1. Germany

Germany Automobile Industry Regional Market Share

Geographic Coverage of Germany Automobile Industry

Germany Automobile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Cost Constraints4.; Infrastructure Accessibility

- 3.4. Market Trends

- 3.4.1. Automotive Exports driving logistics market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Automobile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Finished Vehicle

- 5.1.2. Auto Component

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Transportation

- 5.2.2. Warehous

- 5.2.3. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hellmann Worldwide Logistic

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Honold

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dachser

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DHL Post

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kuehne + Nagel International AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rhenus Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Geodis**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DSV Panalpina

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rudolph Logistics Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Germany Automobile Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Germany Automobile Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Automobile Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Germany Automobile Industry Revenue undefined Forecast, by Service 2020 & 2033

- Table 3: Germany Automobile Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Germany Automobile Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Germany Automobile Industry Revenue undefined Forecast, by Service 2020 & 2033

- Table 6: Germany Automobile Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Automobile Industry?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the Germany Automobile Industry?

Key companies in the market include DB Schenker, Hellmann Worldwide Logistic, Honold, Dachser, DHL Post, Kuehne + Nagel International AG, Rhenus Logistics, Geodis**List Not Exhaustive, DSV Panalpina, Rudolph Logistics Group.

3. What are the main segments of the Germany Automobile Industry?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Automotive Exports driving logistics market.

7. Are there any restraints impacting market growth?

4.; Cost Constraints4.; Infrastructure Accessibility.

8. Can you provide examples of recent developments in the market?

October 2023: AD Ports Group (ADX: ADPORTS), one of the world's premier facilitator of logistics, industry, and trade, announces that Noatum, which now leads its Logistics Cluster operations, has signed the agreement for the acquisition of the 100% equity ownership of Sesé Auto Logistics, the Finished Vehicles Logistics (FVL) business of Grupo Logístico Sesé, for a total purchase consideration (Enterprise Value - EV) of EUR 81 million. The transaction is expected to be completed by Q1 2024, subject to regulatory approvals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Automobile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Automobile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Automobile Industry?

To stay informed about further developments, trends, and reports in the Germany Automobile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence