Key Insights

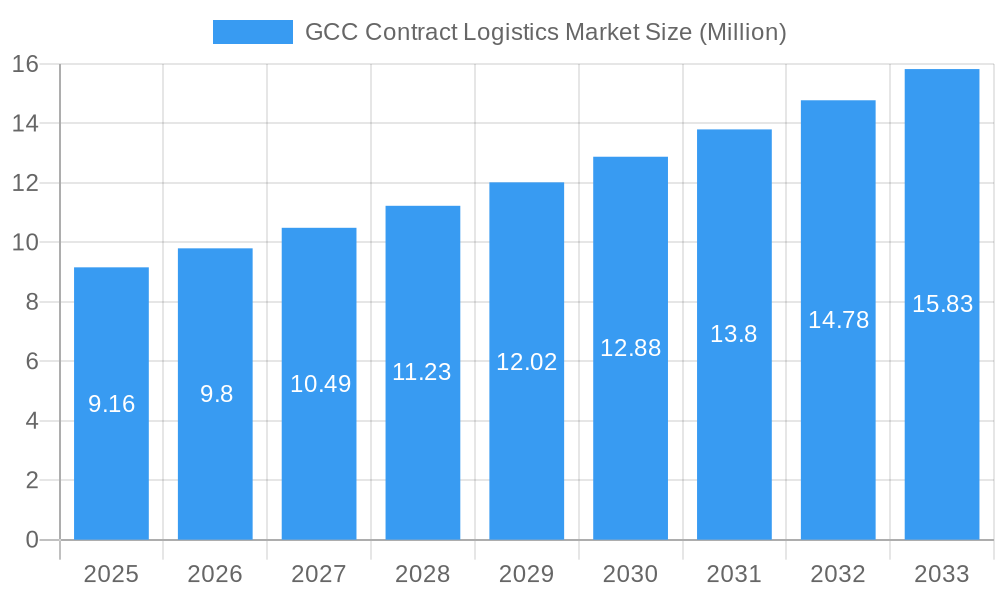

The GCC contract logistics market is poised for significant expansion, projected to reach approximately USD 9.16 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.00% expected throughout the forecast period of 2025-2033. This growth trajectory indicates a dynamic and evolving landscape for logistics providers within the region. A primary driver for this expansion is the increasing adoption of outsourced logistics solutions by businesses seeking to optimize their supply chains, reduce operational costs, and enhance efficiency. Sectors such as manufacturing, automotive, and consumer goods and retail are at the forefront of this trend, recognizing the strategic advantage of partnering with specialized contract logistics companies. The region's ongoing economic diversification initiatives and substantial investments in infrastructure development further bolster the demand for sophisticated warehousing, transportation, and inventory management services.

GCC Contract Logistics Market Market Size (In Million)

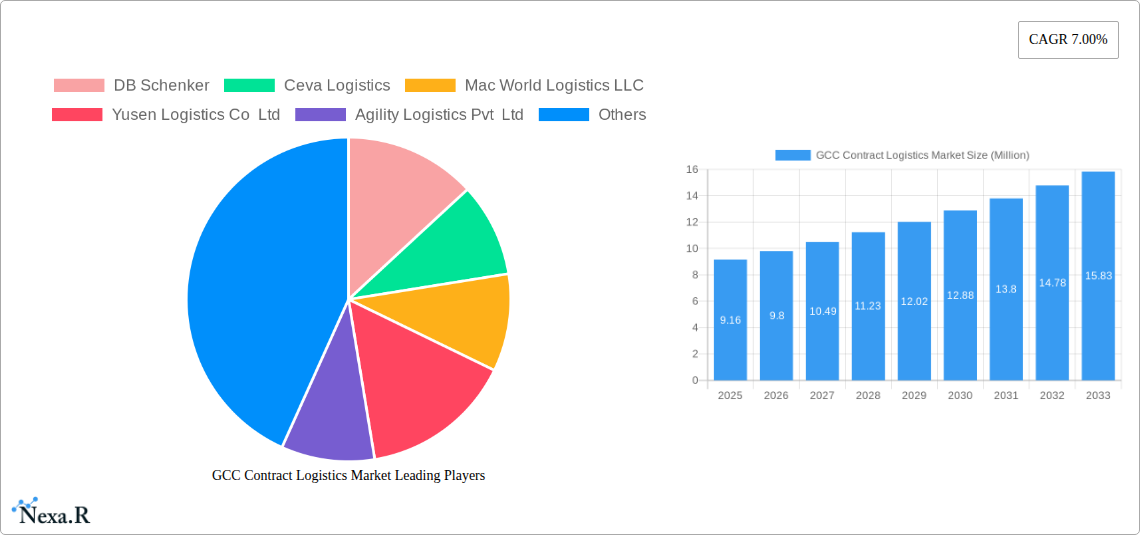

Emerging trends shaping the GCC contract logistics market include the integration of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) to enable real-time tracking, predictive analytics, and automated operations. The growing e-commerce penetration across the GCC is also a significant catalyst, necessitating faster delivery times and more efficient last-mile logistics. However, challenges such as the scarcity of skilled labor, fluctuating fuel prices, and evolving regulatory frameworks could present hurdles to sustained growth. Despite these potential restraints, the overarching positive market sentiment, driven by strong economic fundamentals and a commitment to digital transformation, suggests a promising outlook for the GCC contract logistics sector, with companies like Deutsche Post DHL Group, DB Schenker, and CEVA Logistics actively participating in this burgeoning market.

GCC Contract Logistics Market Company Market Share

GCC Contract Logistics Market Report: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a detailed examination of the GCC Contract Logistics Market, encompassing a comprehensive analysis of its structure, growth trends, dominant segments, and key players. With a study period spanning from 2019 to 2033, and a base year of 2025, this report offers actionable insights for stakeholders navigating the dynamic Middle East logistics industry. Discover the intricate interplay of insourced vs. outsourced logistics, the pivotal role of end-user sectors like Manufacturing & Automotive, Consumer Goods & Retail, High-tech, and Healthcare & Pharmaceuticals, and the strategic impact of industry developments. Unlock the potential of the GCC supply chain solutions market and understand the drivers behind its robust expansion. The GCC freight forwarding market and the broader GCC warehousing market are also thoroughly explored within this analysis.

GCC Contract Logistics Market Market Dynamics & Structure

The GCC Contract Logistics Market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. However, the competitive landscape is evolving due to increasing demand for integrated supply chain management in the GCC and technological advancements. Innovation is largely driven by the adoption of automation, AI-powered analytics for route optimization, and the expansion of e-commerce logistics solutions, directly impacting GCC warehouse automation and GCC last-mile delivery services. Regulatory frameworks are generally supportive, with governments investing heavily in infrastructure development, such as new ports and roads, to facilitate trade and logistics operations across the Middle East logistics sector. Competitive product substitutes are limited within the core contract logistics offering, but indirect competition arises from in-house logistics capabilities and advancements in freight forwarding technologies. End-user demographics are shifting, with a growing demand for specialized logistics services tailored to the needs of the GCC e-commerce logistics and GCC cold chain logistics sectors. Mergers and acquisitions (M&A) are a significant trend, with larger players acquiring smaller, specialized providers to expand their service portfolios and geographical reach. For instance, M&A activity in the GCC 3PL market is expected to continue as companies seek to consolidate their positions and enhance operational efficiencies.

- Market Concentration: Moderately concentrated, with key players dominating a significant portion of the market.

- Technological Innovation Drivers: Automation, AI for route optimization, big data analytics, and cloud-based logistics platforms.

- Regulatory Frameworks: Supportive government policies fostering infrastructure development and trade facilitation.

- Competitive Product Substitutes: Limited for core contract logistics, but in-house solutions and technological advancements in related sectors present indirect competition.

- End-User Demographics: Growing demand for specialized services in e-commerce, cold chain, and healthcare logistics.

- M&A Trends: Active M&A landscape, driven by consolidation, service expansion, and market share acquisition in the GCC logistics and warehousing market.

GCC Contract Logistics Market Growth Trends & Insights

The GCC Contract Logistics Market is poised for substantial growth, driven by an evolving economic landscape and increasing demand for efficient supply chain solutions. The market size has witnessed consistent expansion, fueled by the burgeoning GCC retail logistics sector and the accelerating adoption of outsourced logistics services. Technological disruptions, including the integration of IoT for real-time tracking and visibility, the implementation of blockchain for enhanced transparency, and the rise of autonomous vehicles in the GCC automotive logistics segment, are fundamentally reshaping operational models. Consumer behavior shifts, particularly the exponential growth of e-commerce and the subsequent demand for faster, more reliable delivery services, are significant catalysts for growth in the GCC e-commerce fulfillment market. Furthermore, the region's focus on economic diversification and infrastructure development, as outlined in initiatives like Saudi Vision 2030, is creating a fertile ground for contract logistics providers. The adoption rates of advanced logistics technologies are steadily increasing, with companies recognizing the competitive advantage gained through digital transformation and automation in GCC warehousing and distribution.

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033, reaching an estimated market size of USD XXXX Million by 2033. This impressive growth is underpinned by several key trends:

- Surging E-commerce Penetration: The rapid growth of online retail across the GCC necessitates sophisticated GCC fulfillment center services and efficient GCC last-mile delivery solutions. This surge directly translates into increased demand for contract logistics providers who can manage inventory, warehousing, and distribution effectively.

- Infrastructure Development Projects: Significant investments in new ports, airports, and road networks across countries like the UAE, Saudi Arabia, and Qatar are enhancing connectivity and reducing transit times, making the region more attractive for global logistics companies and supporting the expansion of the GCC shipping and logistics market.

- Economic Diversification Initiatives: Governments are actively promoting non-oil sectors, leading to growth in manufacturing, high-tech, and healthcare industries, all of which are major consumers of contract logistics services, particularly within the GCC medical logistics and GCC industrial logistics spheres.

- Technological Advancements and Digitalization: The adoption of technologies such as AI, IoT, big data analytics, and automation in warehousing and transportation is improving efficiency, reducing costs, and enhancing service quality, driving the evolution of the GCC cold chain logistics market and other specialized segments.

- Growing Demand for Outsourced Logistics: Companies are increasingly recognizing the cost-effectiveness and operational efficiencies gained by outsourcing their logistics functions to specialized third-party logistics (3PL) providers, thereby expanding the GCC 3PL market. This trend is particularly pronounced in sectors requiring specialized handling and storage, such as GCC pharmaceutical logistics.

The market penetration of advanced contract logistics solutions is expected to deepen as businesses continue to prioritize agility, cost optimization, and enhanced customer service. The convergence of these factors paints a robust picture for the future of the GCC Contract Logistics Market.

Dominant Regions, Countries, or Segments in GCC Contract Logistics Market

The GCC Contract Logistics Market is experiencing significant growth, with the United Arab Emirates (UAE) emerging as the dominant country due to its strategic location, robust infrastructure, and business-friendly environment. The UAE's position as a major trade and re-export hub for the MENA region, coupled with its continuous investments in state-of-the-art logistics facilities and advanced GCC warehousing solutions, provides a strong foundation for contract logistics providers. The consumer goods and retail segment is a primary driver of market growth within the UAE, fueled by a large expatriate population, high disposable incomes, and the booming e-commerce sector. The GCC e-commerce logistics demand in the UAE is particularly high, necessitating efficient GCC fulfillment center services and advanced GCC last-mile delivery capabilities.

Beyond the UAE, Saudi Arabia is rapidly gaining prominence, driven by ambitious economic diversification plans like Vision 2030, which include massive investments in logistics infrastructure and the development of new industrial zones. The manufacturing and automotive segment in Saudi Arabia is a significant contributor to contract logistics demand, requiring specialized handling and storage solutions for raw materials, components, and finished goods. The Kingdom's ongoing projects related to the development of new ports, airports, and economic cities are creating immense opportunities for GCC industrial logistics and GCC freight forwarding services.

The Outsourced segment within the GCC Contract Logistics Market is projected to dominate over the Insourced segment. This is attributed to the increasing complexity of supply chains, the desire for cost optimization, and the need for specialized expertise that third-party logistics (3PL) providers can offer. Businesses across various end-user sectors, from high-tech companies requiring secure storage and distribution for sensitive equipment to healthcare and pharmaceuticals demanding stringent cold chain management and regulatory compliance for GCC medical logistics, are increasingly opting for outsourced solutions. The flexibility and scalability offered by outsourced logistics enable companies to adapt quickly to market fluctuations and focus on their core competencies.

Key drivers for the dominance of these regions and segments include:

- Strategic Geographic Location: The UAE's role as a gateway to emerging markets in Africa and Asia.

- World-Class Infrastructure: Advanced ports, airports, and road networks in both the UAE and Saudi Arabia supporting seamless GCC shipping and logistics.

- Government Support and Investment: Significant public and private sector investments in logistics infrastructure and policies designed to attract foreign investment.

- Booming E-commerce Sector: Rapid growth in online retail driving demand for efficient GCC fulfillment and GCC last-mile delivery.

- Economic Diversification: Focus on developing non-oil sectors, leading to increased manufacturing, industrial, and high-tech activities requiring specialized logistics.

- Demand for Specialized Services: Growing need for GCC cold chain logistics, GCC pharmaceutical logistics, and other sector-specific solutions.

- Cost-Effectiveness and Efficiency: The inherent advantages of outsourcing logistics operations to specialized 3PL providers for optimizing GCC warehouse operations and supply chain management.

The growth potential within these dominant regions and segments is substantial, indicating a promising future for the GCC Contract Logistics Market.

GCC Contract Logistics Market Product Landscape

The GCC Contract Logistics Market landscape is characterized by a growing array of sophisticated solutions designed to enhance efficiency, reduce costs, and improve visibility across the supply chain. Leading contract logistics providers are investing heavily in technological advancements, offering integrated services that span warehousing, transportation management, freight forwarding, and value-added services such as kitting, assembly, and reverse logistics. Innovations in GCC warehouse automation, including automated storage and retrieval systems (AS/RS), robotic process automation (RPA) for administrative tasks, and advanced inventory management software, are transforming operational capabilities. The application of Artificial Intelligence (AI) and Machine Learning (ML) is enhancing predictive analytics for demand forecasting, route optimization in GCC last-mile delivery, and proactive risk management within the GCC supply chain solutions ecosystem.

Performance metrics are increasingly focused on key performance indicators (KPIs) such as on-time delivery rates, order accuracy, inventory turnover, and cost per unit handled. Unique selling propositions often revolve around specialized expertise in specific sectors like GCC cold chain logistics and GCC pharmaceutical logistics, offering temperature-controlled storage and adherence to stringent regulatory requirements. Furthermore, providers are differentiating themselves through the development of integrated digital platforms that offer end-to-end supply chain visibility and real-time data analytics, empowering clients with better decision-making capabilities in the GCC freight forwarding market. The evolution of the GCC warehousing market is also seeing a rise in smart warehousing solutions, optimizing space utilization and operational workflows.

Key Drivers, Barriers & Challenges in GCC Contract Logistics Market

Key Drivers:

The GCC Contract Logistics Market is propelled by several key factors. The strategic geographic location of the GCC countries, serving as a vital trade corridor between Asia, Europe, and Africa, is a primary driver for enhanced GCC shipping and logistics. Significant government investments in world-class infrastructure, including ports, airports, and road networks, are creating a highly efficient ecosystem for GCC freight forwarding and GCC warehousing. The burgeoning e-commerce sector across the region fuels demand for sophisticated GCC fulfillment center services and accelerated GCC last-mile delivery solutions. Furthermore, economic diversification initiatives, particularly in Saudi Arabia and the UAE, are fostering growth in manufacturing, high-tech, and healthcare sectors, all of which rely heavily on specialized GCC contract logistics and GCC supply chain solutions. The increasing trend of outsourcing logistics operations to specialized 3PL providers seeking cost efficiencies and operational expertise also significantly boosts the GCC 3PL market.

Barriers & Challenges:

Despite the robust growth, the market faces several barriers and challenges. A significant challenge is the shortage of skilled labor within the logistics sector, particularly for operating advanced technologies in GCC warehouse automation. Regulatory complexities and evolving customs procedures across different GCC countries can create administrative hurdles for seamless cross-border operations. Intense competition within the GCC Contract Logistics Market can lead to price pressures and necessitate continuous investment in technology and service innovation to maintain market share. Supply chain disruptions, whether due to geopolitical events or global economic volatility, pose a constant threat, requiring robust risk management strategies. The initial investment required for adopting advanced technologies like AI and automation in GCC warehousing and distribution can also be a barrier for smaller players.

Emerging Opportunities in GCC Contract Logistics Market

Emerging opportunities in the GCC Contract Logistics Market are abundant, driven by evolving consumer demands and strategic regional development. The exponential growth of GCC e-commerce logistics presents a significant opportunity for specialized fulfillment and last-mile delivery services. The increasing demand for GCC cold chain logistics, particularly for pharmaceuticals and perishables, is creating a niche for providers with temperature-controlled infrastructure and expertise. Furthermore, the region's commitment to sustainability is opening doors for green logistics solutions, including the adoption of electric vehicles and eco-friendly warehousing practices in the GCC warehousing market. The development of new economic zones and industrial cities across the GCC countries is creating a strong demand for integrated GCC industrial logistics and specialized GCC manufacturing logistics support. As the region continues to position itself as a global trade hub, opportunities for advanced GCC freight forwarding and end-to-end GCC supply chain solutions will continue to expand.

Growth Accelerators in the GCC Contract Logistics Market Industry

Several catalysts are accelerating long-term growth in the GCC Contract Logistics Market. The ongoing digital transformation, marked by the widespread adoption of AI, IoT, and blockchain technology, is significantly enhancing efficiency, visibility, and predictive capabilities across GCC logistics and warehousing. Strategic partnerships and joint ventures between local and international logistics players are fostering knowledge transfer and expanding service offerings, contributing to the growth of the GCC 3PL market. Market expansion strategies, including the development of new logistics hubs and the increasing focus on cross-border trade facilitation, are further propelling the sector. The continuous investment in infrastructure development by GCC governments, aimed at establishing the region as a global logistics powerhouse, provides a fundamental accelerant for the entire GCC shipping and logistics ecosystem. These combined efforts are creating a dynamic and rapidly evolving GCC Contract Logistics Market.

Key Players Shaping the GCC Contract Logistics Market Market

- DB Schenker

- Ceva Logistics

- Mac World Logistics LLC

- Yusen Logistics Co Ltd

- Agility Logistics Pvt Ltd

- Almajdouie Logistics Co LLC

- Gulf Warehousing Company QPSC (GWC)

- Hellmann Worldwide Logistics GmbH & Co KG

- Al Futtaim Logistics

- Al Naboodah Group Enterprises Hala Supply Chain Services

- Mohebi Logistics

- Integrated National Logistics

- Global Shipping & Logistics

- United Parcel Service Inc

- Globus Logistics

- Al-Jabri Logistics

- LSC Logistics and Warehousing Co

- Deutsche Post DHL Group (DHL Supply Chain)

- 6 3 Other Companies (Key Information/Overview)

Notable Milestones in GCC Contract Logistics Market Sector

- March 2023: Kuwaiti logistics specialist Agility has formed a joint venture with the development arm of Hassan Allam Holding to build and run warehouses in Egypt. The venture, Yanmu, is due to open its first logistics park in August with an initial investment of about USD 100 million, Agility said in a stock market filing. The development, a 270,000sq m site about 10 miles from Cairo airport, will be part-financed by equity and debt, enhancing Agility's presence in a key emerging market and impacting the broader MENA logistics sector.

- February 2023: Denmark-headquartered DSV has already expanded in Bahrain three times. Now, the logistics company is planning a fourth expansion to further service Gulf markets. The new facility in Bahrain represents an USD 18m investment by DSV, and is the company's second expansion in the country in just three years, underscoring DSV's commitment to strengthening its GCC Contract Logistics Market footprint and operational capacity in the region.

In-Depth GCC Contract Logistics Market Market Outlook

The GCC Contract Logistics Market is projected for sustained and robust growth, driven by the region's strategic vision for economic diversification and its unparalleled position as a global trade nexus. Key growth accelerators include the relentless digital transformation, with advanced technologies like AI and IoT revolutionizing GCC warehouse operations and enhancing GCC last-mile delivery efficiency. Strategic alliances and expansions by major players in the GCC 3PL market are consolidating the competitive landscape and expanding service portfolios. The continuous development of world-class logistics infrastructure, coupled with supportive government policies, is creating a highly favorable environment for GCC shipping and logistics. Opportunities in specialized segments like GCC cold chain logistics and GCC pharmaceutical logistics are particularly promising, aligning with the region's growing healthcare and food security priorities. The GCC Contract Logistics Market is thus set to witness significant expansion, offering substantial opportunities for stakeholders to capitalize on evolving market dynamics and emerging consumer preferences for seamless GCC supply chain solutions.

GCC Contract Logistics Market Segmentation

-

1. Type

- 1.1. Insourced

- 1.2. Outsourced

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Consumer Goods and Retail

- 2.3. High-tech

- 2.4. Healthcare and Pharmaceuticals

- 2.5. Other End Users

GCC Contract Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

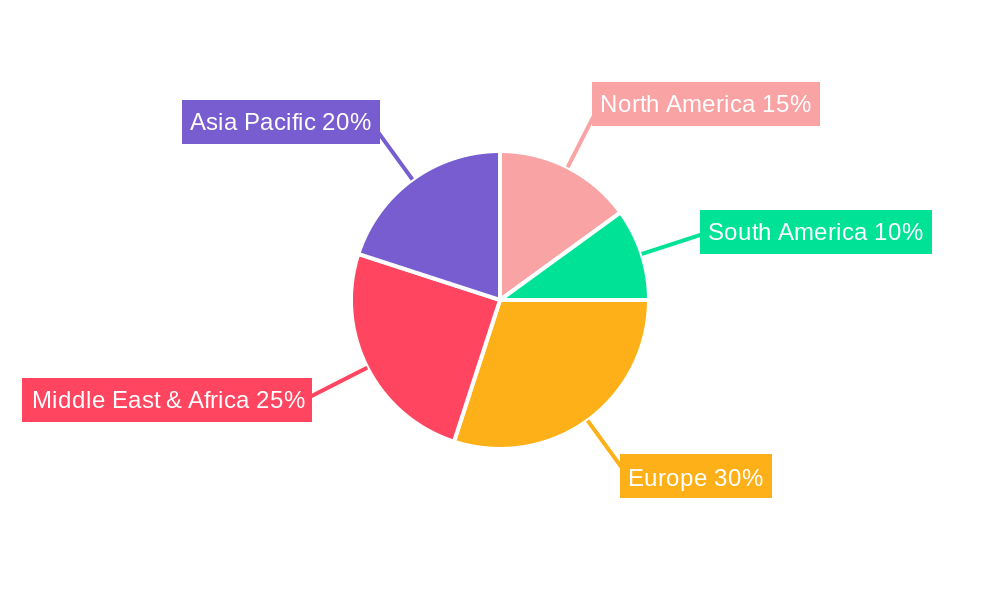

GCC Contract Logistics Market Regional Market Share

Geographic Coverage of GCC Contract Logistics Market

GCC Contract Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase in Trade Activities4.; Growth in the manufacturing industry

- 3.3. Market Restrains

- 3.3.1. 4.; Regulatory Challenges

- 3.4. Market Trends

- 3.4.1. Growth in E-commerce Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insourced

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Consumer Goods and Retail

- 5.2.3. High-tech

- 5.2.4. Healthcare and Pharmaceuticals

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America GCC Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Insourced

- 6.1.2. Outsourced

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Manufacturing and Automotive

- 6.2.2. Consumer Goods and Retail

- 6.2.3. High-tech

- 6.2.4. Healthcare and Pharmaceuticals

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America GCC Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Insourced

- 7.1.2. Outsourced

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Manufacturing and Automotive

- 7.2.2. Consumer Goods and Retail

- 7.2.3. High-tech

- 7.2.4. Healthcare and Pharmaceuticals

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe GCC Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Insourced

- 8.1.2. Outsourced

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Manufacturing and Automotive

- 8.2.2. Consumer Goods and Retail

- 8.2.3. High-tech

- 8.2.4. Healthcare and Pharmaceuticals

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa GCC Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Insourced

- 9.1.2. Outsourced

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Manufacturing and Automotive

- 9.2.2. Consumer Goods and Retail

- 9.2.3. High-tech

- 9.2.4. Healthcare and Pharmaceuticals

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific GCC Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Insourced

- 10.1.2. Outsourced

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Manufacturing and Automotive

- 10.2.2. Consumer Goods and Retail

- 10.2.3. High-tech

- 10.2.4. Healthcare and Pharmaceuticals

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ceva Logistics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mac World Logistics LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Yusen Logistics Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Agility Logistics Pvt Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Almajdouie Logistics Co LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gulf Warehousing Company QPSC (GWC)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hellmann Worldwide Logistics GmbH & Co KG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Al Futtaim Logistics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Al Naboodah Group Enterprises Hala Supply Chain Services Mohebi Logistics Integrated National Logistics Global Shipping & Logistics United Parcel Service Inc Globus Logistics Al-Jabri Logistics LSC Logistics and Warehousing Co

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Deutsche Post DHL Group (DHL Supply Chain)*6 3 Other Companies (Key Information/Overview)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Global GCC Contract Logistics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America GCC Contract Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America GCC Contract Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America GCC Contract Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America GCC Contract Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America GCC Contract Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America GCC Contract Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America GCC Contract Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 9: South America GCC Contract Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America GCC Contract Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 11: South America GCC Contract Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: South America GCC Contract Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America GCC Contract Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe GCC Contract Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe GCC Contract Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe GCC Contract Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 17: Europe GCC Contract Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Europe GCC Contract Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe GCC Contract Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa GCC Contract Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa GCC Contract Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa GCC Contract Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Middle East & Africa GCC Contract Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East & Africa GCC Contract Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa GCC Contract Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific GCC Contract Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific GCC Contract Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific GCC Contract Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 29: Asia Pacific GCC Contract Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Asia Pacific GCC Contract Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific GCC Contract Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Contract Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global GCC Contract Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global GCC Contract Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global GCC Contract Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global GCC Contract Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global GCC Contract Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global GCC Contract Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global GCC Contract Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global GCC Contract Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global GCC Contract Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global GCC Contract Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Global GCC Contract Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global GCC Contract Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global GCC Contract Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 30: Global GCC Contract Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global GCC Contract Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global GCC Contract Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 39: Global GCC Contract Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Contract Logistics Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the GCC Contract Logistics Market?

Key companies in the market include DB Schenker, Ceva Logistics, Mac World Logistics LLC, Yusen Logistics Co Ltd, Agility Logistics Pvt Ltd, Almajdouie Logistics Co LLC, Gulf Warehousing Company QPSC (GWC), Hellmann Worldwide Logistics GmbH & Co KG, Al Futtaim Logistics, Al Naboodah Group Enterprises Hala Supply Chain Services Mohebi Logistics Integrated National Logistics Global Shipping & Logistics United Parcel Service Inc Globus Logistics Al-Jabri Logistics LSC Logistics and Warehousing Co, Deutsche Post DHL Group (DHL Supply Chain)*6 3 Other Companies (Key Information/Overview).

3. What are the main segments of the GCC Contract Logistics Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.16 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase in Trade Activities4.; Growth in the manufacturing industry.

6. What are the notable trends driving market growth?

Growth in E-commerce Driving the Market.

7. Are there any restraints impacting market growth?

4.; Regulatory Challenges.

8. Can you provide examples of recent developments in the market?

March 2023: Kuwaiti logistics specialist Agility has formed a joint venture with the development arm of Hassan Allam Holding to build and run warehouses in Egypt. The venture, Yanmu, is due to open its first logistics park in August with an initial investment of about USD 100 million, Agility said in a stock market filing. The development, a 270,000sq m site about 10 miles from Cairo airport, will be part-financed by equity and debt.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Contract Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Contract Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Contract Logistics Market?

To stay informed about further developments, trends, and reports in the GCC Contract Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence