Key Insights

The Asia Pacific finished vehicle logistics market is poised for significant expansion, propelled by the region's dynamic automotive sector. With a projected Compound Annual Growth Rate (CAGR) of 6.2%, the market is forecast to reach $172.3 billion by 2025. Key growth catalysts include escalating vehicle production and sales, expanding global automotive trade, the burgeoning e-commerce landscape for automotive parts, and the increasing demand for sophisticated logistics solutions for finished vehicle transportation. The market is segmented by activity, including rail, road, air, and sea transport, warehousing, and value-added services, as well as by logistics service, encompassing inbound, outbound, reverse, and aftermarket operations. While China and Japan lead due to their established manufacturing bases, emerging economies such as India, Indonesia, and Thailand are rapidly gaining prominence through increased domestic production and exports. Infrastructure development, fluctuating fuel prices, and the imperative for sustainable logistics present ongoing challenges.

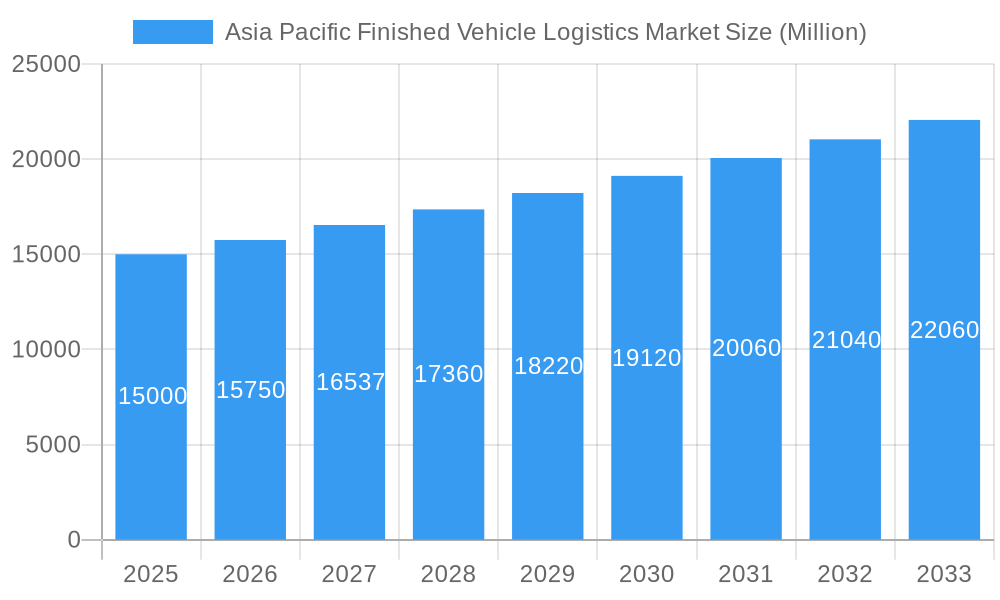

Asia Pacific Finished Vehicle Logistics Market Market Size (In Billion)

Strategic initiatives, including mergers, acquisitions, and technological advancements in tracking and route optimization, are pivotal for market players. The competitive arena features global leaders and specialized regional providers. Beyond 2025, sustained economic growth and automotive industry advancements in the Asia Pacific will likely drive market expansion, potentially surpassing the initial CAGR. While maritime transport remains dominant, the increasing focus on speed and efficiency will elevate the utilization of rail and road for time-sensitive deliveries. Value-added services, such as pre-delivery inspections, are anticipated to grow, enhancing market complexity and value. The continuous expansion of e-commerce and aftermarket segments will further stimulate demand for efficient reverse logistics. Governmental impetus towards sustainability and emission reduction will steer innovation in eco-friendly transportation and warehousing solutions.

Asia Pacific Finished Vehicle Logistics Market Company Market Share

Asia Pacific Finished Vehicle Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia Pacific Finished Vehicle Logistics market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is invaluable for industry professionals, investors, and strategists seeking to navigate this dynamic market. The market size is projected to reach xx Million units by 2033.

Asia Pacific Finished Vehicle Logistics Market Dynamics & Structure

This section delves into the intricate structure of the Asia Pacific Finished Vehicle Logistics market, analyzing its concentration, innovation drivers, regulatory environment, competitive landscape, and market evolution. The report offers a detailed assessment of mergers and acquisitions (M&A) activity, providing quantitative insights into market share distribution amongst key players and qualitative factors impacting innovation within the sector.

- Market Concentration: The market exhibits a [High/Medium/Low] level of concentration, with [Percentage]% controlled by the top 5 players.

- Technological Innovation: Technological advancements such as AI-powered route optimization, blockchain for enhanced transparency, and automation in warehousing are driving significant efficiency gains and reshaping market dynamics. However, high initial investment costs present a barrier for smaller players.

- Regulatory Landscape: Varying regulatory frameworks across the Asia Pacific region impact operational costs and compliance requirements. The report examines the impact of these regulations on market growth.

- Competitive Substitutes: [Describe substitute logistics solutions and their market impact]

- End-User Demographics: The report analyses the changing demographics of end-users (automotive manufacturers, dealerships, etc.) and their influence on logistics demand.

- M&A Trends: The report documents [Number] M&A deals within the Asia Pacific Finished Vehicle Logistics market between 2019 and 2024, with a focus on strategic rationale and their impact on market consolidation.

Asia Pacific Finished Vehicle Logistics Market Growth Trends & Insights

The Asia Pacific Finished Vehicle Logistics market is poised for significant expansion, propelled by a confluence of evolving economic landscapes, rapid technological advancements, and shifting consumer expectations across diverse automotive segments. This analysis delves into the intricate growth trajectory, encompassing market valuation, the disruptive influence of emerging technologies, profound changes in consumer purchasing habits, and the varying adoption rates of new solutions across key sub-sectors. Leveraging a comprehensive blend of proprietary data, rigorous industry analysis, and expert forecasts, this report quantifies the market's expansion through precise Compound Annual Growth Rate (CAGR) projections and market penetration figures. We explore the dynamic interplay between prevailing macroeconomic conditions, cutting-edge technological innovations, and the ever-evolving preferences of the automotive consumer, offering a holistic perspective on the primary catalysts fueling market growth. The Asia Pacific Finished Vehicle Logistics market is projected to witness a robust CAGR of approximately [Insert Specific CAGR]% during the forecast period spanning from 2025 to 2033, reflecting strong underlying growth potential.

Dominant Regions, Countries, or Segments in Asia Pacific Finished Vehicle Logistics Market

This segment identifies the leading regions, countries, and market segments within the Asia Pacific Finished Vehicle Logistics market, focusing on their contribution to overall market growth. The analysis considers factors such as economic policies, infrastructure development, and market size for each region and segment.

- Leading Regions: [Identify the leading region(s) and provide rationale, e.g., China due to robust automotive manufacturing and expanding infrastructure]. China is projected to hold a [Percentage]% market share by 2033.

- Leading Countries: [Analyze leading countries within the region – China, Japan, India, Australia, etc., and quantify their respective market shares. Include projected growth rates].

- Leading Segments (Activity): [Analyze the market share and growth potential of each activity segment: Transport (Rail, Road, Air, Sea), Warehouse, Value Added Services. Highlight the fastest-growing segment and reasons for its dominance.]

- Leading Segments (Logistics Service): [Analyze Inbound, Outbound, and Others (Reverse and Aftermarket) logistics services. Highlight the segment with the highest market share and potential for growth.]

Asia Pacific Finished Vehicle Logistics Market Product Landscape

This section offers a detailed examination of the innovations, diverse applications, and performance benchmarks defining the product and service offerings within the Asia Pacific Finished Vehicle Logistics market. We highlight the unique selling propositions (USPs) and pioneering technological advancements that are reshaping the logistics ecosystem, with a particular focus on how these developments enhance operational efficiency, optimize cost structures, and improve overall service delivery. The escalating adoption of advanced technologies, such as IoT-enabled real-time tracking and predictive analytics platforms, is dramatically improving cargo visibility, minimizing transit times, and enabling proactive issue resolution, thereby setting new industry standards for reliability and responsiveness.

Key Drivers, Barriers & Challenges in Asia Pacific Finished Vehicle Logistics Market

This section meticulously identifies and scrutinizes the principal factors that are propelling growth alongside the significant impediments and complexities confronting the Asia Pacific Finished Vehicle Logistics market.

Key Drivers:

- Sustained and robust growth in automotive production and sales across key Asia Pacific economies.

- The burgeoning influence of e-commerce, necessitating more sophisticated and agile last-mile delivery solutions for vehicles and related products.

- Strategic and ongoing investments in critical infrastructure development, including the enhancement of road networks, expansion of port facilities, and the modernization of intermodal transportation hubs.

- Increasing demand for specialized logistics services catering to the unique needs of Electric Vehicles (EVs), including charging infrastructure considerations and battery handling protocols.

Key Barriers & Challenges:

- Vulnerability to supply chain disruptions stemming from geopolitical uncertainties, trade policy shifts, and regional instability.

- The imperative to comply with increasingly stringent environmental regulations and the accelerated transition towards sustainable and low-emission logistics practices.

- Intense market competition from both established global players and agile, emerging regional providers, leading to significant pricing pressures and a need for continuous innovation to maintain competitive advantage. This competitive landscape is estimated to impact profit margins by approximately [Insert Percentage]% by 2030, necessitating strategic cost management and value-added service offerings.

- The complexity of navigating diverse regulatory frameworks and customs procedures across multiple countries within the region.

Emerging Opportunities in Asia Pacific Finished Vehicle Logistics Market

This section highlights emerging trends and opportunities within the Asia Pacific Finished Vehicle Logistics market, including untapped market segments, innovative applications, and shifts in consumer preferences. The growth of electric vehicles and the associated changes in logistics requirements present significant opportunities.

Growth Accelerators in the Asia Pacific Finished Vehicle Logistics Market Industry

The long-term growth trajectory of the Asia Pacific Finished Vehicle Logistics market will be significantly shaped by ongoing strategic investments in pioneering technological advancements, the forging of robust partnerships between leading logistics providers and automotive manufacturers, and the strategic expansion into new, high-growth, and currently underserved markets within the region. A paramount focus on sustainability, including ambitious initiatives aimed at reducing carbon footprints and enhancing the efficiency of fuel consumption, will also serve as a critical determinant of future development and competitive differentiation.

Key Players Shaping the Asia Pacific Finished Vehicle Logistics Market Market

- EZ Logistics

- EKOL Logistics

- APL Logistics

- DHL

- Yusen Logistics

- Kühne + Nagel

- VASCOR Logistics

- CEVA Logistics

- GEFCO

- DSV

Notable Milestones in Asia Pacific Finished Vehicle Logistics Market Sector

- September 2022: DHL Supply Chain solidified its commitment to the Indian market by announcing a substantial investment of EUR 500 million over a five-year period. This significant capital injection is earmarked for expanding its operational capacity, enhancing its logistics infrastructure, and broadening its market reach across the subcontinent.

- January 2023: In a strategic move to bolster its capabilities in Northern Taiwan, DHL Supply Chain invested EUR 10 million (approximately NTD 320 million) to upgrade and expand its existing facilities. This expansion is specifically designed to cater to the specialized logistics demands of the Life Sciences, Healthcare, and Consumer (LSHC) sectors, as well as the rapidly growing semiconductor industry.

- [Add a new milestone here if available, e.g., a company launching an innovative service, a new strategic partnership, or a significant market entry.]

In-Depth Asia Pacific Finished Vehicle Logistics Market Outlook

The Asia Pacific Finished Vehicle Logistics market is poised for robust growth over the forecast period, driven by a confluence of factors including rising automotive production, expanding e-commerce, and advancements in logistics technology. Strategic partnerships, investments in sustainable solutions, and focus on enhancing supply chain resilience will be crucial for success. The market presents significant opportunities for both established players and new entrants seeking to capitalize on its growth potential.

Asia Pacific Finished Vehicle Logistics Market Segmentation

-

1. Activity

- 1.1. Transport (Rail, Road, Air, Sea)

- 1.2. Warehouse

- 1.3. Value Added Services

-

2. Logistics Service

- 2.1. Inbound

- 2.2. Outbound

- 2.3. Others ( Reverse and Aftermarket)

Asia Pacific Finished Vehicle Logistics Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Finished Vehicle Logistics Market Regional Market Share

Geographic Coverage of Asia Pacific Finished Vehicle Logistics Market

Asia Pacific Finished Vehicle Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The rise in online shopping and consumer demand for fast delivery; Rise in cross-border trade activities

- 3.3. Market Restrains

- 3.3.1. Poor infrastructure and higher logistics costs

- 3.4. Market Trends

- 3.4.1. Rise in Automotive Logistics Outsourcing in the Asia Pacific Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Finished Vehicle Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Activity

- 5.1.1. Transport (Rail, Road, Air, Sea)

- 5.1.2. Warehouse

- 5.1.3. Value Added Services

- 5.2. Market Analysis, Insights and Forecast - by Logistics Service

- 5.2.1. Inbound

- 5.2.2. Outbound

- 5.2.3. Others ( Reverse and Aftermarket)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Activity

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 EZ Logistics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EKOL Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 APL Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DHL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yusen Logistics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kuhene + Nagel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 VASCOR Logistics**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CEVA Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GEFCO

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DSV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 EZ Logistics

List of Figures

- Figure 1: Asia Pacific Finished Vehicle Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Finished Vehicle Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Finished Vehicle Logistics Market Revenue billion Forecast, by Activity 2020 & 2033

- Table 2: Asia Pacific Finished Vehicle Logistics Market Revenue billion Forecast, by Logistics Service 2020 & 2033

- Table 3: Asia Pacific Finished Vehicle Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Finished Vehicle Logistics Market Revenue billion Forecast, by Activity 2020 & 2033

- Table 5: Asia Pacific Finished Vehicle Logistics Market Revenue billion Forecast, by Logistics Service 2020 & 2033

- Table 6: Asia Pacific Finished Vehicle Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Finished Vehicle Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Finished Vehicle Logistics Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Asia Pacific Finished Vehicle Logistics Market?

Key companies in the market include EZ Logistics, EKOL Logistics, APL Logistics, DHL, Yusen Logistics, Kuhene + Nagel, VASCOR Logistics**List Not Exhaustive, CEVA Logistics, GEFCO, DSV.

3. What are the main segments of the Asia Pacific Finished Vehicle Logistics Market?

The market segments include Activity, Logistics Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 172.3 billion as of 2022.

5. What are some drivers contributing to market growth?

The rise in online shopping and consumer demand for fast delivery; Rise in cross-border trade activities.

6. What are the notable trends driving market growth?

Rise in Automotive Logistics Outsourcing in the Asia Pacific Region.

7. Are there any restraints impacting market growth?

Poor infrastructure and higher logistics costs.

8. Can you provide examples of recent developments in the market?

January 2023: DHL Supply Chain has disclosed its five-year plans for facility growth in Northern Taiwan. The investment of EUR 10 million (NTD 320 million) would expand DHL Supply Chain's market reach and meet the logistics needs of the LSHC and semiconductor industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Finished Vehicle Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Finished Vehicle Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Finished Vehicle Logistics Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Finished Vehicle Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence