Key Insights

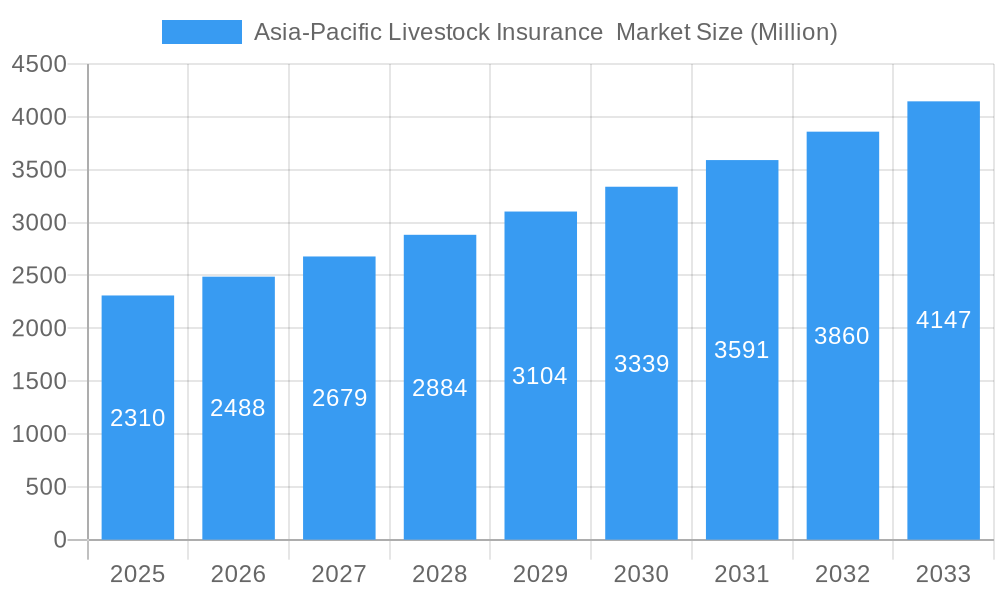

The Asia-Pacific livestock insurance market, valued at $2.31 billion in 2025, is projected to experience robust growth, driven by increasing livestock farming and rising awareness of the economic vulnerability of farmers to disease outbreaks, natural disasters, and fluctuating market prices. The 7.76% CAGR from 2025 to 2033 indicates a significant expansion of the market, reaching an estimated $4.5 billion by 2033. This growth is fueled by several factors. Government initiatives promoting livestock insurance schemes in several APAC countries are creating a more favorable regulatory landscape. Furthermore, technological advancements, such as mobile-based insurance platforms and improved data analytics for risk assessment, are enhancing accessibility and efficiency. The increasing adoption of precision livestock farming techniques also contributes to better risk management and increased demand for tailored insurance products. However, challenges remain, including limited insurance penetration in rural areas, lack of awareness among farmers about the benefits of livestock insurance, and complexities in accurate risk assessment due to diverse farming practices and climatic conditions across the region.

Asia-Pacific Livestock Insurance Market Market Size (In Billion)

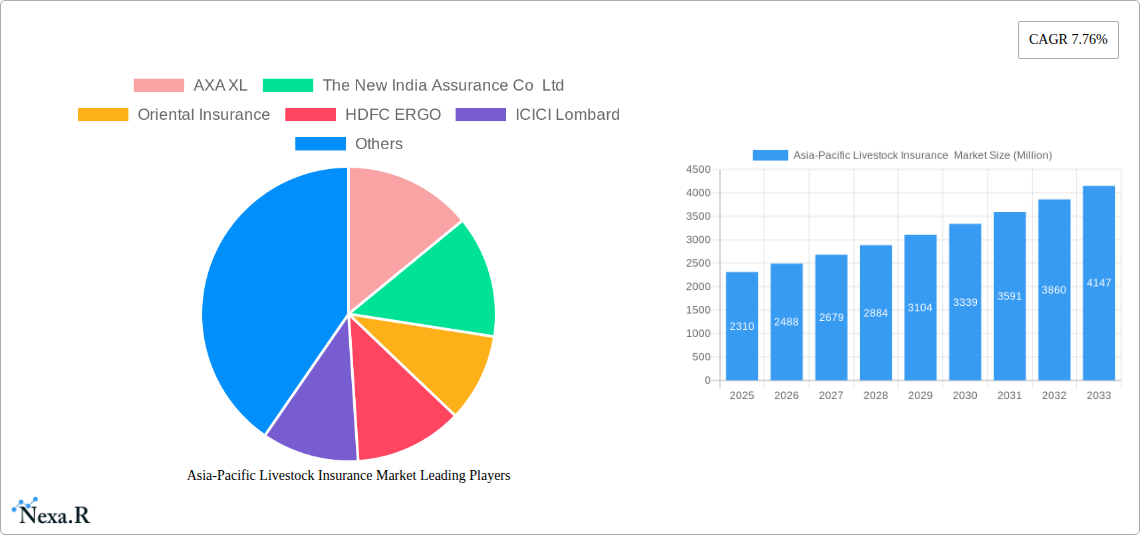

The competitive landscape features both global players like AXA XL, Chubb, and Zurich Insurance PLC, alongside regional insurers such as The New India Assurance Co Ltd, Oriental Insurance, HDFC ERGO, ICICI Lombard, Reliance General Insurance, and Royal Sundaram. These companies are continuously innovating their product offerings to meet the evolving needs of livestock farmers. The market is segmented based on livestock type (e.g., poultry, cattle, swine), insurance type (e.g., mortality, morbidity, theft), and geographical distribution across various countries within the Asia-Pacific region. Future market growth will be influenced by the success of government subsidies, advancements in technology, and effective risk mitigation strategies implemented by insurance providers to reach and educate a broader farmer base. Addressing the challenges of limited access and awareness will be key to unlocking the full potential of the Asia-Pacific livestock insurance market.

Asia-Pacific Livestock Insurance Market Company Market Share

Asia-Pacific Livestock Insurance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific livestock insurance market, encompassing market dynamics, growth trends, regional dominance, product landscape, key challenges, emerging opportunities, and prominent players. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report is crucial for investors, insurers, policymakers, and industry professionals seeking to understand and capitalize on the evolving landscape of livestock insurance across the Asia-Pacific region. The market is segmented by livestock type (e.g., cattle, poultry, pigs), insurance type (e.g., mortality, morbidity, theft), and country. The total market value is projected to reach xx Million by 2033.

Asia-Pacific Livestock Insurance Market Dynamics & Structure

The Asia-Pacific livestock insurance market is characterized by a moderately fragmented structure, with a few large multinational players and numerous regional and local insurers competing for market share. Market concentration is relatively low, with no single dominant player holding a significant majority. Technological innovation, particularly in data analytics and remote sensing, is driving the development of more precise and efficient insurance products. However, barriers to innovation include limited data availability in some regions and a lack of technological infrastructure in others. Regulatory frameworks vary significantly across countries, influencing product offerings and market penetration. Competitive product substitutes include informal risk-sharing mechanisms and self-insurance. The end-user demographic is primarily composed of smallholder farmers, though larger commercial farms are also significant customers. M&A activity in the sector has been moderate, with a focus on strategic partnerships and acquisitions to expand geographical reach and product offerings. Over the past five years, approximately xx M&A deals were recorded, resulting in a xx% market share shift amongst the top 5 players.

- Market Concentration: Low, with no single dominant player.

- Technological Innovation: Driven by data analytics and remote sensing.

- Regulatory Frameworks: Vary widely across the region.

- Competitive Substitutes: Informal risk-sharing, self-insurance.

- End-User Demographics: Predominantly smallholder farmers.

- M&A Activity: Moderate, with a focus on strategic expansion.

Asia-Pacific Livestock Insurance Market Growth Trends & Insights

The Asia-Pacific livestock insurance market has witnessed significant growth over the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is primarily driven by increasing livestock ownership, rising awareness of the benefits of insurance, government initiatives promoting agricultural insurance, and improvements in data collection and risk assessment technologies. Market penetration remains relatively low, especially in developing countries, indicating significant untapped potential. Technological disruptions, such as the adoption of digital platforms and mobile technologies for policy sales and claims processing, are transforming the market. Consumer behavior is shifting towards a preference for more comprehensive and customized insurance products that address specific risks faced by livestock farmers. By 2033, the market is projected to reach xx Million, reflecting a CAGR of xx% during the forecast period (2025-2033). This growth trajectory is expected to be propelled by increasing government support for the sector and a growing adoption of parametric insurance solutions.

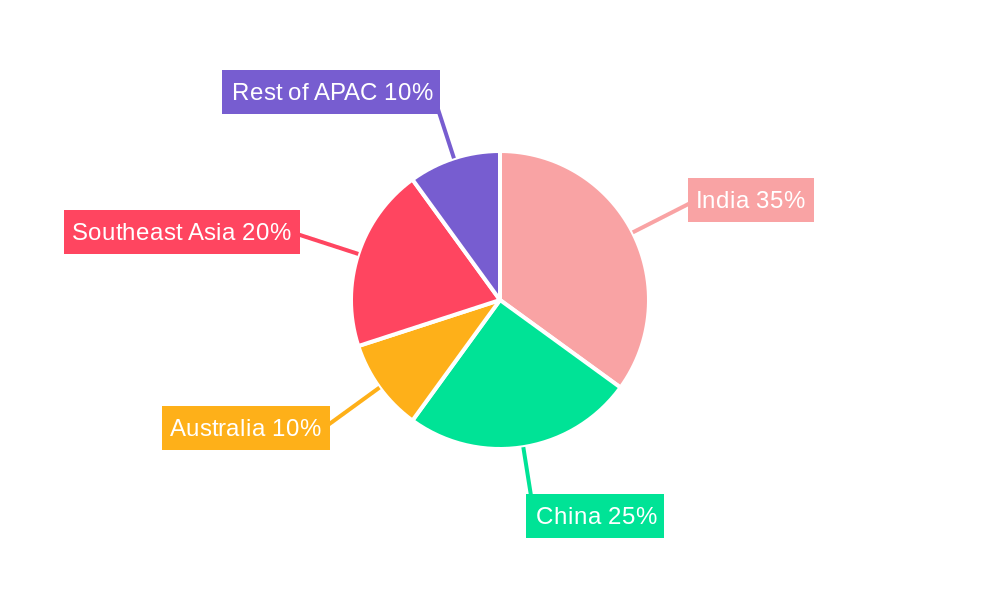

Dominant Regions, Countries, or Segments in Asia-Pacific Livestock Insurance Market

India and China dominate the Asia-Pacific livestock insurance market, representing a combined market share of xx%. Several factors contribute to their dominance:

- India: Large livestock population, supportive government policies (like Pradhan Mantri Fasal Bima Yojana's expansion into livestock), and increasing awareness among farmers. AIC's initiatives, particularly "Saral Krishi Bima," have accelerated growth.

- China: Large-scale livestock operations and growing government focus on agricultural risk management.

Other significant markets include Australia, Indonesia, and Vietnam. Growth in these countries is driven by factors such as rising per capita income, increasing demand for livestock products, and government efforts to improve agricultural insurance penetration.

- Key Drivers (India): Large livestock population, government support (AIC's initiatives), growing farmer awareness.

- Key Drivers (China): Large-scale farming, government focus on risk management.

- Other Key Markets: Australia, Indonesia, Vietnam.

Asia-Pacific Livestock Insurance Market Product Landscape

The livestock insurance product landscape is evolving, with increasing diversification in coverage options. Traditional mortality and morbidity insurance is complemented by emerging products covering theft, disease outbreaks, and weather-related risks. Parametric insurance, based on pre-defined triggers like rainfall or temperature, is gaining traction due to its simplicity and efficiency. Technological advancements like IoT sensors and drone imagery are enabling more accurate risk assessment and claims processing, leading to improved product design and risk management. Unique selling propositions include customized coverage tailored to specific livestock types and farming practices, coupled with integrated risk management solutions offered by some insurers.

Key Drivers, Barriers & Challenges in Asia-Pacific Livestock Insurance Market

Key Drivers:

- Increasing livestock production and value.

- Growing awareness of risk management among farmers.

- Government initiatives promoting agricultural insurance.

- Technological advancements in risk assessment and claims processing.

Key Challenges:

- Low insurance penetration, particularly among smallholder farmers.

- Data scarcity and information asymmetry regarding livestock risks.

- Regulatory and infrastructural limitations in some regions.

- High administrative costs and operational complexities. These factors have resulted in a xx% gap between insured and uninsured livestock in the region.

Emerging Opportunities in Asia-Pacific Livestock Insurance Market

- Expansion into underserved markets (e.g., rural areas).

- Development of innovative insurance products tailored to specific livestock types and farming practices.

- Leveraging technology to improve risk assessment, claims processing, and customer engagement.

- Growing demand for parametric and index-based insurance.

Growth Accelerators in the Asia-Pacific Livestock Insurance Market Industry

The long-term growth of the Asia-Pacific livestock insurance market is expected to be driven by continued technological advancements, particularly in the areas of data analytics and remote sensing. Strategic partnerships between insurers, technology providers, and government agencies will play a crucial role in improving data availability, product development, and market penetration. Expansion into new markets and the development of customized insurance products targeting specific livestock types and farming practices will also contribute to market growth. Government support through subsidies and promotional campaigns will remain an important catalyst for market expansion.

Key Players Shaping the Asia-Pacific Livestock Insurance Market Market

- AXA XL

- The New India Assurance Co Ltd

- Oriental Insurance

- HDFC ERGO

- ICICI Lombard

- Chubb

- QBE Insurance Group

- Zurich Insurance PLC

- Reliance General Insurance

- Royal Sundaram

Notable Milestones in Asia-Pacific Livestock Insurance Market Sector

- May 2024: Bangladesh launches an online cattle identification and registration system (BINLI), enhancing data availability and facilitating insurance product development. Expected to register 50,000 cattle by 2025.

- April 2023: The Agriculture Insurance Company of India Limited (AIC) expands into livestock insurance with products like 'Saral Krishi Bima' and 'Sampoorna Pasudhan Kavach,' broadening coverage and increasing market penetration.

In-Depth Asia-Pacific Livestock Insurance Market Market Outlook

The Asia-Pacific livestock insurance market is poised for sustained growth over the forecast period, driven by a confluence of factors including increasing livestock production, rising farmer awareness, technological advancements, and supportive government policies. Strategic partnerships and the development of innovative products tailored to the unique needs of livestock farmers will play a key role in unlocking the significant untapped potential in the region. The market's future success will depend on addressing challenges related to data scarcity, infrastructure gaps, and regulatory complexities. However, the overall outlook remains positive, with significant opportunities for both established and new market entrants.

Asia-Pacific Livestock Insurance Market Segmentation

-

1. Coverage

- 1.1. Mortality

- 1.2. Revenue

- 1.3. Other Types of Coverages

-

2. Animal Type

- 2.1. Bovine

- 2.2. Swine

- 2.3. Other Animal Types

-

3. Distribution

- 3.1. Direct Sales

- 3.2. Agent & Brokers

- 3.3. Bancassurance

- 3.4. Other Distribution Modes

Asia-Pacific Livestock Insurance Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Livestock Insurance Market Regional Market Share

Geographic Coverage of Asia-Pacific Livestock Insurance Market

Asia-Pacific Livestock Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. APAC Governments Enhance Livestock Insurance Schemes to Bolster Agricultural Resilience; Mitigating Climate Risks in Agriculture

- 3.3. Market Restrains

- 3.3.1. APAC Governments Enhance Livestock Insurance Schemes to Bolster Agricultural Resilience; Mitigating Climate Risks in Agriculture

- 3.4. Market Trends

- 3.4.1. APAC Governments Enhance Livestock Insurance Schemes to Bolster Agricultural Resilience

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Livestock Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 5.1.1. Mortality

- 5.1.2. Revenue

- 5.1.3. Other Types of Coverages

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Bovine

- 5.2.2. Swine

- 5.2.3. Other Animal Types

- 5.3. Market Analysis, Insights and Forecast - by Distribution

- 5.3.1. Direct Sales

- 5.3.2. Agent & Brokers

- 5.3.3. Bancassurance

- 5.3.4. Other Distribution Modes

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AXA XL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The New India Assurance Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Oriental Insurance

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 HDFC ERGO

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ICICI Lombard

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chubb

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 QBE Insurance Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zurich Insurance PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Reliance General Insurance

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Royal Sundaram

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 AXA XL

List of Figures

- Figure 1: Asia-Pacific Livestock Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Livestock Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 2: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Coverage 2020 & 2033

- Table 3: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 4: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Animal Type 2020 & 2033

- Table 5: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Distribution 2020 & 2033

- Table 6: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Distribution 2020 & 2033

- Table 7: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 10: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Coverage 2020 & 2033

- Table 11: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 12: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Animal Type 2020 & 2033

- Table 13: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Distribution 2020 & 2033

- Table 14: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Distribution 2020 & 2033

- Table 15: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: China Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: China Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Japan Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: South Korea Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: India Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Australia Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: New Zealand Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: New Zealand Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Indonesia Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Indonesia Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Malaysia Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Malaysia Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Singapore Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Singapore Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Thailand Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Thailand Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Vietnam Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Vietnam Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Philippines Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Philippines Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Livestock Insurance Market?

The projected CAGR is approximately 7.76%.

2. Which companies are prominent players in the Asia-Pacific Livestock Insurance Market?

Key companies in the market include AXA XL, The New India Assurance Co Ltd, Oriental Insurance, HDFC ERGO, ICICI Lombard, Chubb, QBE Insurance Group, Zurich Insurance PLC, Reliance General Insurance, Royal Sundaram.

3. What are the main segments of the Asia-Pacific Livestock Insurance Market?

The market segments include Coverage, Animal Type, Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.31 Million as of 2022.

5. What are some drivers contributing to market growth?

APAC Governments Enhance Livestock Insurance Schemes to Bolster Agricultural Resilience; Mitigating Climate Risks in Agriculture.

6. What are the notable trends driving market growth?

APAC Governments Enhance Livestock Insurance Schemes to Bolster Agricultural Resilience.

7. Are there any restraints impacting market growth?

APAC Governments Enhance Livestock Insurance Schemes to Bolster Agricultural Resilience; Mitigating Climate Risks in Agriculture.

8. Can you provide examples of recent developments in the market?

May 2024: Bangladesh launched an online cattle identification and registration system. The system allows customers to access detailed information about their livestock via barcode scanning. By 2025, 50,000 cattle are expected to be registered, each tagged with a barcode. The Bangladesh Integrated Network for Livestock Information (BINLI) is led by the Department of Livestock Services under the Livestock and Dairy Development Project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Livestock Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Livestock Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Livestock Insurance Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Livestock Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence