Key Insights

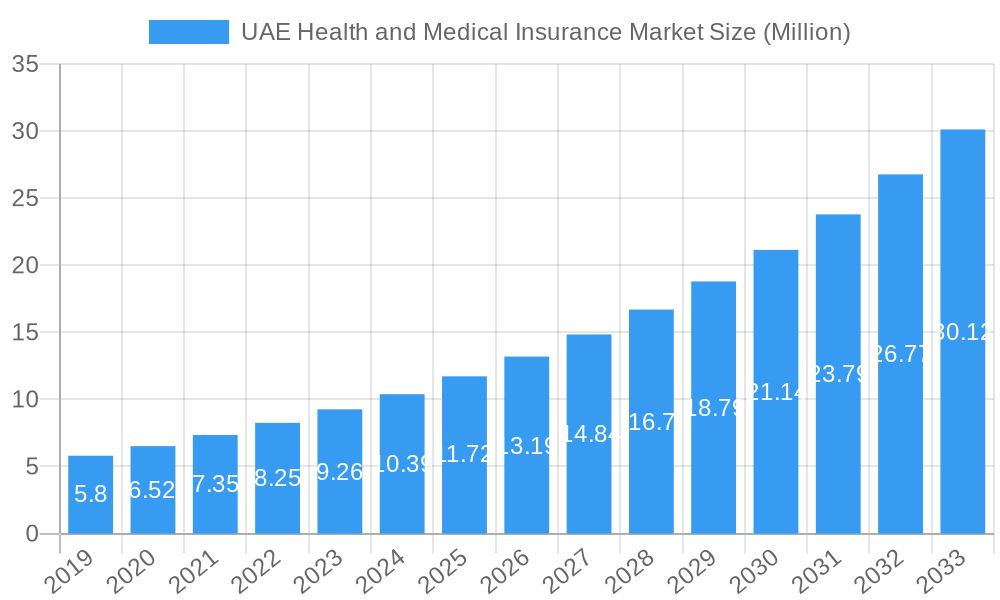

The UAE Health and Medical Insurance Market is poised for significant expansion, projected to reach a substantial market size of USD 10.51 billion by 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 12.38%, indicating a dynamic and thriving sector. A primary driver of this impressive trajectory is the increasing awareness and prioritization of health and well-being among the UAE population, coupled with proactive government initiatives aimed at enhancing healthcare accessibility and quality. The mandatory health insurance laws implemented across various emirates, particularly Dubai and Abu Dhabi, have been instrumental in propelling market demand for both individual and group health insurance plans. Furthermore, the continuous expansion of healthcare infrastructure, including the establishment of advanced medical facilities and the integration of cutting-edge medical technologies, further fuels the need for comprehensive insurance coverage. This surge in demand is also influenced by the rising prevalence of lifestyle-related diseases and an aging demographic, necessitating greater financial protection against escalating medical expenses.

UAE Health and Medical Insurance Market Market Size (In Million)

The market is segmented across various dimensions, reflecting diverse consumer needs and provider landscapes. In terms of product type, both Single/Individual Health Insurance and Group Health Insurance segments are experiencing robust demand, with group insurance benefiting from employer mandates and corporate wellness programs. The provider landscape is characterized by a healthy interplay between Public/Social Health Insurance schemes and Private Health Insurance providers, each catering to different segments of the population and offering varied coverage options. Distribution channels are evolving, with a noticeable shift towards Online Sales and Digital platforms, alongside the traditional reliance on Agents, Brokers, and Banks. This diversification in distribution strategies is crucial for reaching a wider audience and improving policy accessibility. Key players such as DAMAN Health Insurance, Orient Insurance, and AXA Gulf Insurance are actively shaping the competitive environment through innovative product offerings and strategic partnerships, aiming to capture a larger share of this burgeoning market. The market's growth is further supported by a favorable economic environment and a strategic focus on developing a world-class healthcare ecosystem.

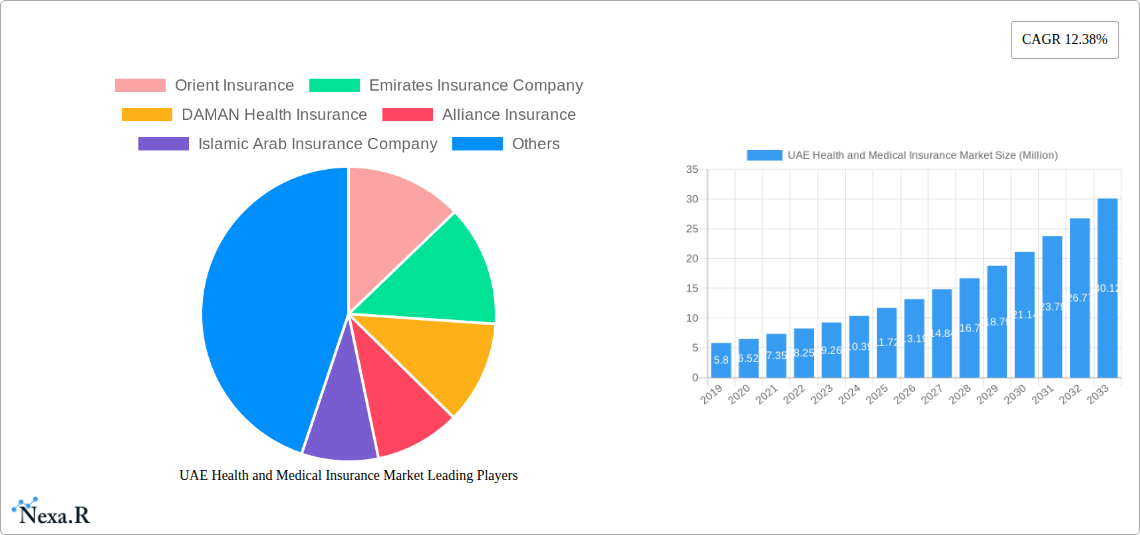

UAE Health and Medical Insurance Market Company Market Share

UAE Health and Medical Insurance Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides an unparalleled analysis of the UAE Health and Medical Insurance Market. Covering the study period of 2019 to 2033, with a base year of 2025, this research delves into market dynamics, growth trends, segmentation, and the competitive landscape of health insurance in the United Arab Emirates. We present a detailed forecast for the forecast period of 2025-2033, building upon historical data from 2019-2024. This report is an essential resource for insurers, reinsurers, brokers, policymakers, investors, and technology providers seeking to understand and capitalize on the burgeoning opportunities within the UAE health insurance sector.

UAE Health and Medical Insurance Market Market Dynamics & Structure

The UAE Health and Medical Insurance Market is characterized by a moderately consolidated structure, with key players like Orient Insurance, Emirates Insurance Company, DAMAN Health Insurance, Alliance Insurance, Islamic Arab Insurance Company, Oman Insurance Company, AXA Gulf Insurance, Abu Dhabi National Insurance Company, Ras Al Khaimah National Insurance Company, Al Buhaira National Insurance Company, Dubai Islamic Insurance and Reinsurance Co, and Al Ain Al Ahilia Insurance Company holding significant market shares. Technological innovation is a major driver, particularly in digitalizing claims processing, policy management, and customer service through insurtech solutions. Regulatory frameworks, such as mandatory health insurance laws in Dubai and Abu Dhabi, continue to shape market penetration and product development. Competitive product substitutes are emerging in the form of wellness programs and preventive care solutions offered by non-traditional providers. End-user demographics are increasingly influenced by a growing expatriate population, a rising awareness of health and wellness, and an aging populace, all contributing to a rising demand for comprehensive health coverage. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their reach, diversify their offerings, and achieve economies of scale within this dynamic market. The market is projected to see increased M&A activity as larger entities acquire smaller specialized providers to enhance their digital capabilities and customer base.

- Market Concentration: Moderately consolidated, with top players commanding significant market share.

- Technological Innovation Drivers: Insurtech adoption, AI for risk assessment, digital claims processing, and telemedicine integration.

- Regulatory Frameworks: Mandatory health insurance laws in key emirates are a primary growth catalyst.

- Competitive Product Substitutes: Wellness programs, corporate health initiatives, and digital health platforms.

- End-User Demographics: Growing expatriate population, aging demographic, and increased health consciousness.

- M&A Trends: Consolidation for market expansion and acquisition of technological capabilities.

UAE Health and Medical Insurance Market Growth Trends & Insights

The UAE Health and Medical Insurance Market is poised for robust growth, driven by a confluence of factors including rising healthcare expenditure, increasing mandatory health insurance coverage mandates, and a growing demand for specialized medical services. The market size is projected to witness a significant upward trajectory, with an estimated Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period. Adoption rates for health insurance policies are steadily climbing, buoyed by increased awareness of financial protection against escalating medical costs. Technological disruptions are revolutionizing the industry, with the integration of artificial intelligence (AI) for fraud detection and underwriting, the proliferation of telehealth services, and the adoption of blockchain for secure data management. Consumer behavior shifts are evident, with a growing preference for personalized plans, seamless digital customer journeys, and a greater emphasis on preventive care and mental well-being benefits. The market penetration is expected to deepen significantly as more individuals and small to medium-sized enterprises (SMEs) are brought under the purview of mandatory insurance schemes. Insurers are increasingly leveraging data analytics to understand consumer needs and tailor product offerings, leading to a more customer-centric approach. The emphasis on value-added services, such as access to a wider network of healthcare providers and wellness programs, is becoming a key differentiator in attracting and retaining customers. The expanding infrastructure of healthcare facilities across the UAE further supports this growth by ensuring a robust network for policyholders. The estimated market size for the base year 2025 is projected to be in the range of $25,000 Million.

Dominant Regions, Countries, or Segments in UAE Health and Medical Insurance Market

Within the UAE Health and Medical Insurance Market, Dubai consistently emerges as the dominant region, propelled by its status as a global business hub, a magnet for expatriates, and its proactive regulatory environment. The emirate's commitment to mandatory health insurance, encompassing both individuals and employees, has fostered a pervasive demand for comprehensive coverage. The Group Health Insurance segment, driven by the large corporate presence and stringent employer mandates, represents a significant portion of the market share. This segment's dominance is further amplified by the sheer volume of employees working in various sectors across Dubai. Another critical segment driving growth is Private Health Insurance, catering to both expatriates and affluent local populations seeking higher standards of care and a wider choice of providers beyond public offerings. The Brokers distribution channel plays a pivotal role in this dominance, acting as crucial intermediaries connecting insurers with corporate clients and individuals, offering expert advice and customized solutions. The economic policies of Dubai, focused on economic diversification and attracting foreign investment, indirectly fuel the demand for health insurance by supporting business growth and employment. Furthermore, the robust infrastructure of world-class hospitals and specialized clinics in Dubai ensures that the insurance coverage translates into accessible and quality healthcare services for policyholders, reinforcing the appeal and necessity of health insurance. The market share of Group Health Insurance is estimated to be around 65% in the base year of 2025.

- Dominant Region: Dubai, due to its economic strength, expatriate population, and regulatory mandates.

- Dominant Product Type: Group Health Insurance, driven by corporate employment and mandatory coverage.

- Dominant Provider Type: Private Health Insurance, catering to diverse needs and service expectations.

- Dominant Distribution Channel: Brokers, facilitating access and customization for corporate and individual clients.

- Key Drivers: Proactive economic policies, strong business infrastructure, and mandatory insurance laws.

UAE Health and Medical Insurance Market Product Landscape

The UAE Health and Medical Insurance Market product landscape is evolving rapidly, with insurers focusing on innovation to meet diverse consumer needs. Beyond standard hospitalization and outpatient cover, there is a growing emphasis on comprehensive plans that include critical illness coverage, maternity benefits, and international coverage. Single/Individual Health Insurance products are becoming more granular, offering tiered options with varying deductibles and co-payments to cater to different budgets. Technological advancements are enabling the creation of personalized insurance products, leveraging data analytics to assess individual health risks and offer tailored premiums. The integration of telemedicine services as a core benefit is a key innovation, providing convenient access to medical consultations. Performance metrics are increasingly focused on customer satisfaction, claims settlement efficiency, and the breadth of the healthcare network provided. Unique selling propositions often revolve around enhanced wellness programs, preventive care benefits, and digital platforms for policy management and claims submission.

Key Drivers, Barriers & Challenges in UAE Health and Medical Insurance Market

The UAE Health and Medical Insurance Market is propelled by significant drivers, including the government's continuous push for universal health coverage, a growing expatriate population requiring robust insurance solutions, and an increasing awareness among individuals about the importance of financial protection against healthcare costs. Technological advancements, such as AI and data analytics, are also acting as powerful catalysts for innovation and efficiency within the sector.

However, the market faces notable barriers and challenges. These include the increasing cost of healthcare services, which puts pressure on premium affordability, and the potential for adverse selection in the individual insurance segment. Regulatory hurdles, such as evolving compliance requirements and the need for constant adaptation to new mandates, can also pose challenges for insurers. Furthermore, intense competition among established players and the emergence of new insurtech startups necessitates continuous innovation and strategic pricing to maintain market share. Supply chain issues related to the availability of specialized medical professionals and equipment can indirectly impact the cost and accessibility of healthcare, influencing insurance claims and pricing.

Emerging Opportunities in UAE Health and Medical Insurance Market

Emerging opportunities within the UAE Health and Medical Insurance Market lie in the burgeoning demand for specialized insurance products addressing niche health concerns, such as mental health and chronic disease management. The increasing adoption of wearable technology and health tracking devices presents a significant opportunity for personalized wellness programs and data-driven insurance models. Untapped markets, particularly among SMEs and lower-income segments of the population, can be targeted with more affordable and accessible insurance plans. Innovative applications of AI and machine learning for predictive health analytics and personalized patient care pathways offer immense potential for both insurers and healthcare providers to collaborate and enhance service delivery. The evolving consumer preference for digital-first solutions also opens avenues for direct-to-consumer online insurance platforms and mobile-based health management tools.

Growth Accelerators in the UAE Health and Medical Insurance Market Industry

Several catalysts are accelerating long-term growth in the UAE Health and Medical Insurance Market. Technological breakthroughs in telemedicine and remote patient monitoring are expanding the reach of healthcare services and making them more accessible, thereby increasing demand for related insurance coverage. Strategic partnerships between insurance companies and healthcare providers, as well as technology firms, are fostering innovative service delivery models and improving the overall customer experience. Market expansion strategies, including the development of specialized insurance products for specific demographics or health conditions, are also contributing to sustained growth. The increasing focus on preventive healthcare and wellness initiatives, often integrated into insurance plans, is shifting the paradigm towards proactive health management, leading to reduced long-term healthcare costs and greater customer engagement.

Key Players Shaping the UAE Health and Medical Insurance Market Market

- Orient Insurance

- Emirates Insurance Company

- DAMAN Health Insurance

- Alliance Insurance

- Islamic Arab Insurance Company

- Oman Insurance Company

- AXA Gulf Insurance

- Abu Dhabi National Insurance Company

- Ras Al Khaimah National Insurance Company

- Al Buhaira National Insurance Company

- Dubai Islamic Insurance and Reinsurance Co

- Al Ain Al Ahilia Insurance Company

Notable Milestones in UAE Health and Medical Insurance Market Sector

- January 2023: Dubai National Insurance (DNI) partnered with Takalam, a UAE-based online counseling platform, to offer integrated mental well-being services as part of DNI packages, enhancing access to mental health professionals.

- December 2022: Turtlefin, an insurtech platform, partnered with The Continental Group, a UAE insurance intermediary, to provide its software-as-a-service modules, enabling seamless proposal customization and information access for distribution teams.

In-Depth UAE Health and Medical Insurance Market Market Outlook

The UAE Health and Medical Insurance Market is set for continued expansion, fueled by a favorable regulatory environment and a growing emphasis on comprehensive healthcare access. Future market potential is significantly enhanced by the ongoing digital transformation, with insurtech innovations expected to streamline operations, personalize offerings, and improve customer engagement. Strategic opportunities include further development of preventive health and wellness programs integrated into insurance policies, catering to an increasingly health-conscious population. Collaborations between insurers, healthcare providers, and technology companies will be crucial in creating integrated health ecosystems. The market is poised to benefit from increased penetration into underserved segments and the development of innovative products that address emerging health trends, ensuring sustained growth and value creation for all stakeholders.

UAE Health and Medical Insurance Market Segmentation

-

1. Product Type

- 1.1. Single/Individual Health Insurance

- 1.2. Group Health Insurance

-

2. Provider

- 2.1. Public/ Social Health Insurance

- 2.2. Private Health Insurance

-

3. Distribution Channel

- 3.1. Agents

- 3.2. Brokers

- 3.3. Banks

- 3.4. Online Sales

- 3.5. Other Distribution Channels

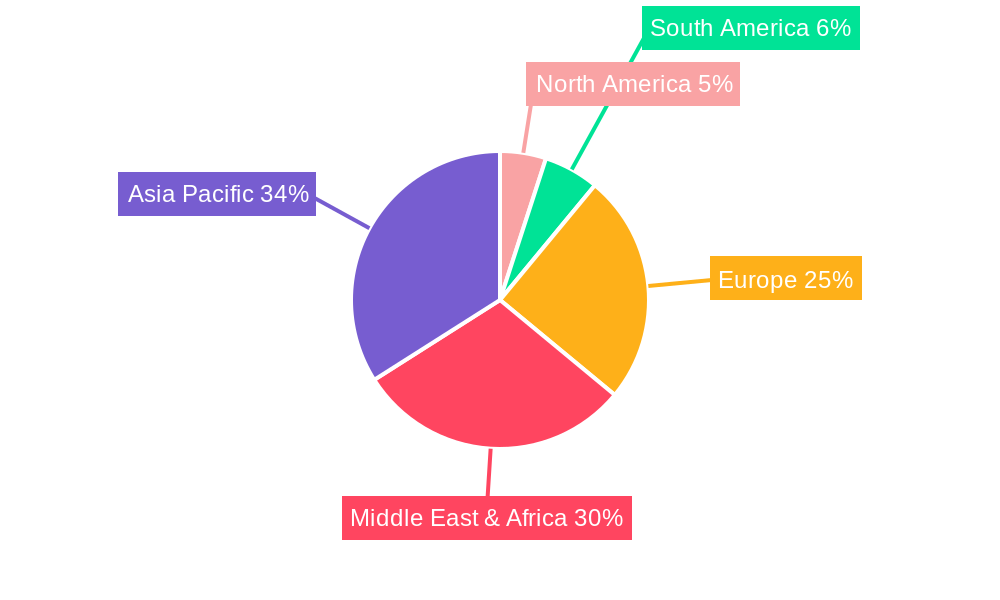

UAE Health and Medical Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Health and Medical Insurance Market Regional Market Share

Geographic Coverage of UAE Health and Medical Insurance Market

UAE Health and Medical Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digitalization is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Economic Disparities are Restraining the Market

- 3.4. Market Trends

- 3.4.1. National Insurance Companies are Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Health and Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Single/Individual Health Insurance

- 5.1.2. Group Health Insurance

- 5.2. Market Analysis, Insights and Forecast - by Provider

- 5.2.1. Public/ Social Health Insurance

- 5.2.2. Private Health Insurance

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Agents

- 5.3.2. Brokers

- 5.3.3. Banks

- 5.3.4. Online Sales

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America UAE Health and Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Single/Individual Health Insurance

- 6.1.2. Group Health Insurance

- 6.2. Market Analysis, Insights and Forecast - by Provider

- 6.2.1. Public/ Social Health Insurance

- 6.2.2. Private Health Insurance

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Agents

- 6.3.2. Brokers

- 6.3.3. Banks

- 6.3.4. Online Sales

- 6.3.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America UAE Health and Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Single/Individual Health Insurance

- 7.1.2. Group Health Insurance

- 7.2. Market Analysis, Insights and Forecast - by Provider

- 7.2.1. Public/ Social Health Insurance

- 7.2.2. Private Health Insurance

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Agents

- 7.3.2. Brokers

- 7.3.3. Banks

- 7.3.4. Online Sales

- 7.3.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe UAE Health and Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Single/Individual Health Insurance

- 8.1.2. Group Health Insurance

- 8.2. Market Analysis, Insights and Forecast - by Provider

- 8.2.1. Public/ Social Health Insurance

- 8.2.2. Private Health Insurance

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Agents

- 8.3.2. Brokers

- 8.3.3. Banks

- 8.3.4. Online Sales

- 8.3.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa UAE Health and Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Single/Individual Health Insurance

- 9.1.2. Group Health Insurance

- 9.2. Market Analysis, Insights and Forecast - by Provider

- 9.2.1. Public/ Social Health Insurance

- 9.2.2. Private Health Insurance

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Agents

- 9.3.2. Brokers

- 9.3.3. Banks

- 9.3.4. Online Sales

- 9.3.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific UAE Health and Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Single/Individual Health Insurance

- 10.1.2. Group Health Insurance

- 10.2. Market Analysis, Insights and Forecast - by Provider

- 10.2.1. Public/ Social Health Insurance

- 10.2.2. Private Health Insurance

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Agents

- 10.3.2. Brokers

- 10.3.3. Banks

- 10.3.4. Online Sales

- 10.3.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Orient Insurance

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Emirates Insurance Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DAMAN Health Insurance

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Alliance Insurance

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Islamic Arab Insurance Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Oman Insurance Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AXA Gulf Insurance

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Abu Dhabi National Insurance Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ras Al Khaimah National Insurance Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Al Buhaira National Insurance Company**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dubai Islamic Insurance and Reinsurance Co

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Al Ain Al Ahilia Insurance Company

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Orient Insurance

List of Figures

- Figure 1: Global UAE Health and Medical Insurance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UAE Health and Medical Insurance Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America UAE Health and Medical Insurance Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America UAE Health and Medical Insurance Market Revenue (Million), by Provider 2025 & 2033

- Figure 5: North America UAE Health and Medical Insurance Market Revenue Share (%), by Provider 2025 & 2033

- Figure 6: North America UAE Health and Medical Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America UAE Health and Medical Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America UAE Health and Medical Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America UAE Health and Medical Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America UAE Health and Medical Insurance Market Revenue (Million), by Product Type 2025 & 2033

- Figure 11: South America UAE Health and Medical Insurance Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South America UAE Health and Medical Insurance Market Revenue (Million), by Provider 2025 & 2033

- Figure 13: South America UAE Health and Medical Insurance Market Revenue Share (%), by Provider 2025 & 2033

- Figure 14: South America UAE Health and Medical Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: South America UAE Health and Medical Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America UAE Health and Medical Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America UAE Health and Medical Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe UAE Health and Medical Insurance Market Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Europe UAE Health and Medical Insurance Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Europe UAE Health and Medical Insurance Market Revenue (Million), by Provider 2025 & 2033

- Figure 21: Europe UAE Health and Medical Insurance Market Revenue Share (%), by Provider 2025 & 2033

- Figure 22: Europe UAE Health and Medical Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Europe UAE Health and Medical Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe UAE Health and Medical Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe UAE Health and Medical Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa UAE Health and Medical Insurance Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East & Africa UAE Health and Medical Insurance Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East & Africa UAE Health and Medical Insurance Market Revenue (Million), by Provider 2025 & 2033

- Figure 29: Middle East & Africa UAE Health and Medical Insurance Market Revenue Share (%), by Provider 2025 & 2033

- Figure 30: Middle East & Africa UAE Health and Medical Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa UAE Health and Medical Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa UAE Health and Medical Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa UAE Health and Medical Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific UAE Health and Medical Insurance Market Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Asia Pacific UAE Health and Medical Insurance Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Asia Pacific UAE Health and Medical Insurance Market Revenue (Million), by Provider 2025 & 2033

- Figure 37: Asia Pacific UAE Health and Medical Insurance Market Revenue Share (%), by Provider 2025 & 2033

- Figure 38: Asia Pacific UAE Health and Medical Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific UAE Health and Medical Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific UAE Health and Medical Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific UAE Health and Medical Insurance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 3: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 7: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 13: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 14: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 21: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 33: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 34: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 43: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 44: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Health and Medical Insurance Market?

The projected CAGR is approximately 12.38%.

2. Which companies are prominent players in the UAE Health and Medical Insurance Market?

Key companies in the market include Orient Insurance, Emirates Insurance Company, DAMAN Health Insurance, Alliance Insurance, Islamic Arab Insurance Company, Oman Insurance Company, AXA Gulf Insurance, Abu Dhabi National Insurance Company, Ras Al Khaimah National Insurance Company, Al Buhaira National Insurance Company**List Not Exhaustive, Dubai Islamic Insurance and Reinsurance Co, Al Ain Al Ahilia Insurance Company.

3. What are the main segments of the UAE Health and Medical Insurance Market?

The market segments include Product Type, Provider, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Digitalization is Driving the Market.

6. What are the notable trends driving market growth?

National Insurance Companies are Dominating the Market.

7. Are there any restraints impacting market growth?

Economic Disparities are Restraining the Market.

8. Can you provide examples of recent developments in the market?

January 2023: Dubai National Insurance (DNI), an Insurance company in the UAE, has entered into a strategic partnership with Takalam, a UAE-based online counseling platform for mental well-being. With this partnership, individuals, as part of their DNI package, will be offered private and easy access to mental health professionals, tools, and solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Health and Medical Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Health and Medical Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Health and Medical Insurance Market?

To stay informed about further developments, trends, and reports in the UAE Health and Medical Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence