Key Insights

The Asia Pacific Venture Capital market is projected for substantial growth, with an estimated Compound Annual Growth Rate (CAGR) of 10.8%. This expansion is driven by a vibrant startup ecosystem, accelerated by technological advancements, widespread digital transformation, and a growing cohort of skilled entrepreneurs. Government initiatives, including grants and tax incentives, alongside a young, populous demographic with increasing disposable income, are key growth catalysts. Despite potential regulatory and economic challenges, the market is poised for expansion. Leading venture capital firms such as East Ventures, 500 Durian, SG Innovate, Sequoia Capital, Insignia Ventures Partners, Wavemaker Partners, Global Founders Capital, and SEEDS Capital are actively investing in diverse sectors including fintech, e-commerce, healthcare, and renewable energy, reflecting market segmentation across funding stages and industry verticals.

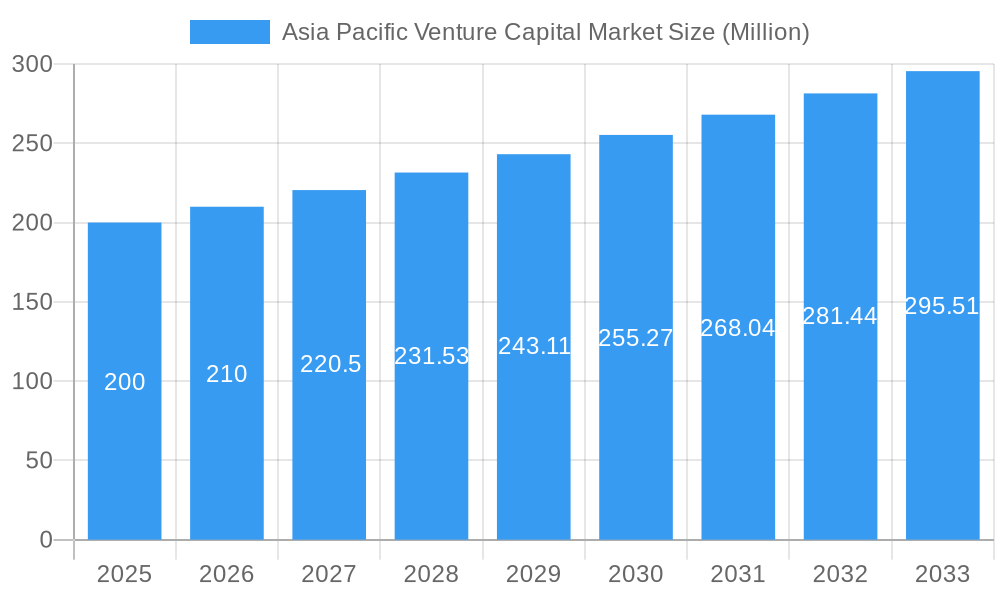

Asia Pacific Venture Capital Market Market Size (In Billion)

With a projected market size of 352.4 billion in the base year 2024, the Asia Pacific Venture Capital market demonstrates significant growth potential. The presence of prominent venture capital firms highlights strong investor confidence and sustained interest in the region's innovation landscape. The forecast period (2024-2033) is expected to see intensified competition among venture capitalists, with a heightened focus on identifying and nurturing high-growth potential startups. This competitive environment will foster innovation and drive further market expansion, attracting both regional and international investors seeking attractive returns in this rapidly evolving market. Strategic collaborations and mergers and acquisitions will also be instrumental in shaping the market's future trajectory.

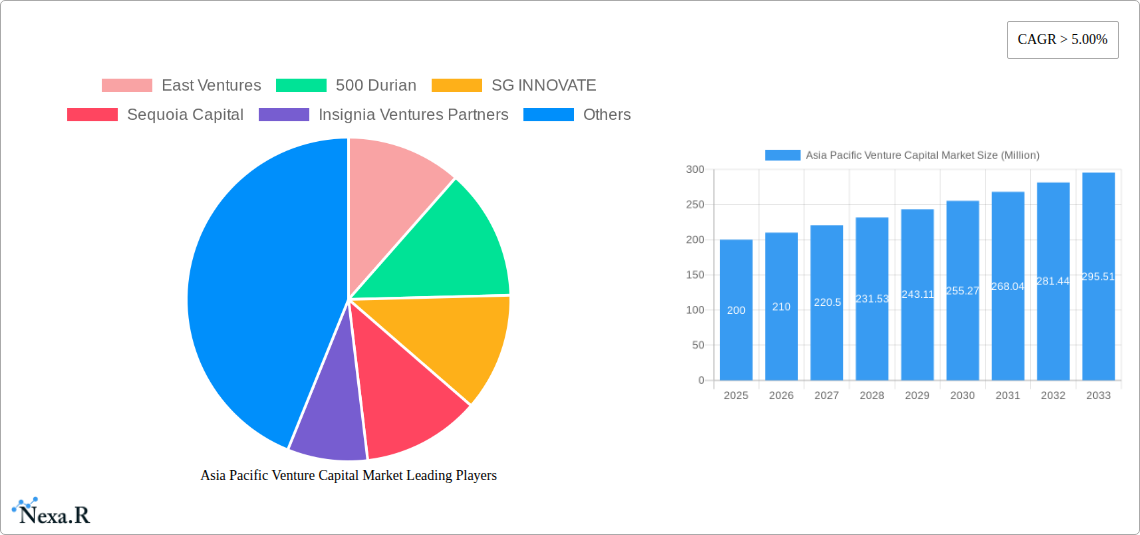

Asia Pacific Venture Capital Market Company Market Share

Asia Pacific Venture Capital Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia Pacific Venture Capital market, offering invaluable insights for investors, entrepreneurs, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a robust understanding of the market's historical performance, current state, and future trajectory. The report covers key segments, dominant players, and emerging opportunities, providing crucial data for strategic decision-making.

Asia Pacific Venture Capital Market Dynamics & Structure

This section analyzes the Asia Pacific venture capital market's structure and dynamics, encompassing market concentration, technological innovation drivers, regulatory landscapes, competitive substitutes, end-user demographics, and merger & acquisition (M&A) trends. The market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. However, the presence of numerous smaller firms fosters competition and innovation.

Key Aspects:

- Market Concentration: The top 5 firms hold an estimated xx% market share in 2025, indicating moderate concentration with ample room for growth for smaller players.

- Technological Innovation: Rapid advancements in fintech, e-commerce, and AI are driving substantial investment activity. The increasing adoption of cloud technologies and big data analytics are further accelerating innovation.

- Regulatory Frameworks: Varying regulatory environments across the Asia-Pacific region impact investment strategies. Simplifying regulatory processes and promoting a more consistent regulatory framework could boost investment flows.

- Competitive Substitutes: Alternative financing options like angel investors and private equity pose some competition but largely coexist, catering to different funding needs.

- End-User Demographics: Startups across diverse sectors, including technology, healthcare, and consumer goods, constitute the primary end-users of venture capital. The increasing number of technology-focused startups significantly influences investment patterns.

- M&A Trends: The number of M&A deals increased by xx% from 2021 to 2022, driven by consolidation among venture capital firms and strategic acquisitions of promising startups. The total value of M&A deals in 2024 was estimated at xx Million.

Asia Pacific Venture Capital Market Growth Trends & Insights

This section leverages extensive data analysis to dissect the market size evolution, adoption rates, technological disruptions, and shifting consumer behavior impacting the Asia Pacific venture capital market. The market has experienced robust growth, fueled by increasing entrepreneurial activity and abundant capital availability.

- Market Size Evolution: The market size increased from xx Million in 2019 to xx Million in 2024, exhibiting a CAGR of xx%. The forecast period (2025-2033) projects continued growth, driven by factors such as increased digitalization and government support for startups.

- Adoption Rates: Venture capital adoption among startups continues to rise, particularly in rapidly growing economies within the region. Increased awareness of venture capital benefits and a growing entrepreneurial ecosystem are key contributors.

- Technological Disruptions: Emerging technologies like blockchain, artificial intelligence, and the metaverse are reshaping investment strategies and creating new investment opportunities.

- Consumer Behavior Shifts: Changing consumer preferences towards digital services and sustainable products are influencing investment decisions, with increased capital flowing towards companies aligning with these trends.

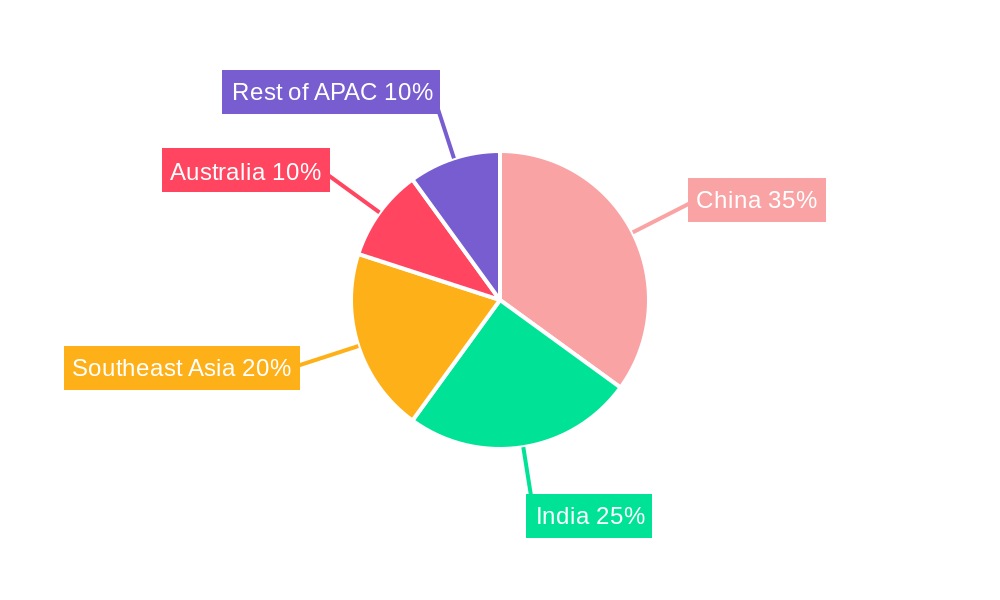

Dominant Regions, Countries, or Segments in Asia Pacific Venture Capital Market

This section pinpoints the leading regions, countries, or segments driving market growth, offering a detailed breakdown of dominance factors.

- India and China: These two countries are the dominant forces in the Asia Pacific venture capital market, accounting for approximately xx% of the total market share in 2024. Their massive populations, burgeoning technology sectors, and supportive government policies contribute to their dominance.

- Key Drivers:

- Strong Economic Growth: Rapid economic expansion in these nations creates favorable conditions for startup growth and attracts significant investment.

- Favorable Government Policies: Government initiatives designed to promote entrepreneurship and innovation stimulate venture capital activity.

- Technological Advancements: Rapid technological advancements in key sectors like fintech and e-commerce create a fertile ground for innovative startups.

- Expanding Middle Class: A growing middle class increases consumer spending and expands market opportunities for startups.

Other countries like Singapore, Australia, and South Korea also show significant growth potential, attracting considerable venture capital investments.

Asia Pacific Venture Capital Market Product Landscape

The Asia Pacific venture capital market's product landscape is dynamic, characterized by diverse investment strategies, funding stages (seed, Series A, etc.), and industry focus. Firms differentiate themselves through specialized expertise, network access, and value-added services beyond capital provision, including mentorship, strategic guidance, and market entry support. Technological advancements in portfolio management and due diligence processes enhance efficiency and risk mitigation.

Key Drivers, Barriers & Challenges in Asia Pacific Venture Capital Market

Key Drivers:

- Technological advancements driving innovation in various sectors.

- Growing number of startups and entrepreneurial activity.

- Increasing government support for entrepreneurship and innovation.

- Abundant capital availability from both domestic and international investors.

Key Challenges:

- Regulatory inconsistencies across the region create uncertainties for investors.

- Geopolitical risks and economic volatility can negatively impact investment decisions.

- Competition for promising startups is intense, leading to higher valuations and potential risks. The competition resulted in approximately xx% decline in investment in some sectors in 2023.

- Limited access to funding for startups in certain sectors or geographical locations.

Emerging Opportunities in Asia Pacific Venture Capital Market

Untapped market segments, especially in Southeast Asia and smaller economies, present significant opportunities. Increased focus on sustainable technologies and socially responsible investments aligns with growing consumer preferences. The rising adoption of digital technologies creates openings in fintech, e-commerce, and AI-related sectors.

Growth Accelerators in the Asia Pacific Venture Capital Market Industry

Technological breakthroughs, strategic partnerships between venture capital firms and corporations, and market expansion into underpenetrated regions act as key growth catalysts. Collaborative initiatives fostering innovation and knowledge sharing are also expected to accelerate long-term growth in the industry.

Key Players Shaping the Asia Pacific Venture Capital Market Market

- East Ventures

- 500 Durian

- SG INNOVATE

- Sequoia Capital

- Insignia Ventures Partners

- Wavemaker Partners

- Global Founders Capital

- SEEDS Capital

- List Not Exhaustive

Notable Milestones in Asia Pacific Venture Capital Market Sector

- December 2021: Razorpay Software Private Limited (India) secured USD 375 million in funding, reaching a USD 7.5 billion valuation.

- March 2022: XPeng (China) launched Rockets Capital, a USD 200 million fund focused on frontier technology and electric vehicles.

In-Depth Asia Pacific Venture Capital Market Outlook

The Asia Pacific venture capital market shows significant promise. Continued economic growth, technological advancements, and supportive government policies create a favorable environment for sustained expansion. Strategic investments in emerging technologies and untapped markets will be crucial for realizing the market's full potential. Further consolidation among venture capital firms and increased cross-border investment activity are anticipated.

Asia Pacific Venture Capital Market Segmentation

-

1. Industry/ Sector

- 1.1. Fintech

- 1.2. Logistics and Logitech

- 1.3. Healthcare

- 1.4. IT

- 1.5. Education and Edtech

- 1.6. Others

-

2. stage

- 2.1. Early Stage

- 2.2. Growth and Expansion

- 2.3. Late Stage

Asia Pacific Venture Capital Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Venture Capital Market Regional Market Share

Geographic Coverage of Asia Pacific Venture Capital Market

Asia Pacific Venture Capital Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Asia’s booming Internet & Fintech economy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Venture Capital Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Industry/ Sector

- 5.1.1. Fintech

- 5.1.2. Logistics and Logitech

- 5.1.3. Healthcare

- 5.1.4. IT

- 5.1.5. Education and Edtech

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by stage

- 5.2.1. Early Stage

- 5.2.2. Growth and Expansion

- 5.2.3. Late Stage

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Industry/ Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 East Ventures

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 500 Durian

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SG INNOVATE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sequoia Capital

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Insignia Ventures Partners

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wavemaker Partners

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Global Founders Capital

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SEEDS Capital**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 East Ventures

List of Figures

- Figure 1: Asia Pacific Venture Capital Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Venture Capital Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Venture Capital Market Revenue billion Forecast, by Industry/ Sector 2020 & 2033

- Table 2: Asia Pacific Venture Capital Market Revenue billion Forecast, by stage 2020 & 2033

- Table 3: Asia Pacific Venture Capital Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Venture Capital Market Revenue billion Forecast, by Industry/ Sector 2020 & 2033

- Table 5: Asia Pacific Venture Capital Market Revenue billion Forecast, by stage 2020 & 2033

- Table 6: Asia Pacific Venture Capital Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Venture Capital Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Venture Capital Market?

The projected CAGR is approximately 10.8%.

2. Which companies are prominent players in the Asia Pacific Venture Capital Market?

Key companies in the market include East Ventures, 500 Durian, SG INNOVATE, Sequoia Capital, Insignia Ventures Partners, Wavemaker Partners, Global Founders Capital, SEEDS Capital**List Not Exhaustive.

3. What are the main segments of the Asia Pacific Venture Capital Market?

The market segments include Industry/ Sector, stage.

4. Can you provide details about the market size?

The market size is estimated to be USD 352.4 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Asia’s booming Internet & Fintech economy.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2022, the China-based XPeng led an investment into a new fund of around USD 200 million. The fund is focused on backing up frontier technology startups and electric vehicle production. The fund is named as Rockets Capital and includes capital investors such as eGarden, IDG Capital, 5Y Capital, Sequioa China, and GGV Capital.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Venture Capital Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Venture Capital Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Venture Capital Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Venture Capital Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence