Key Insights

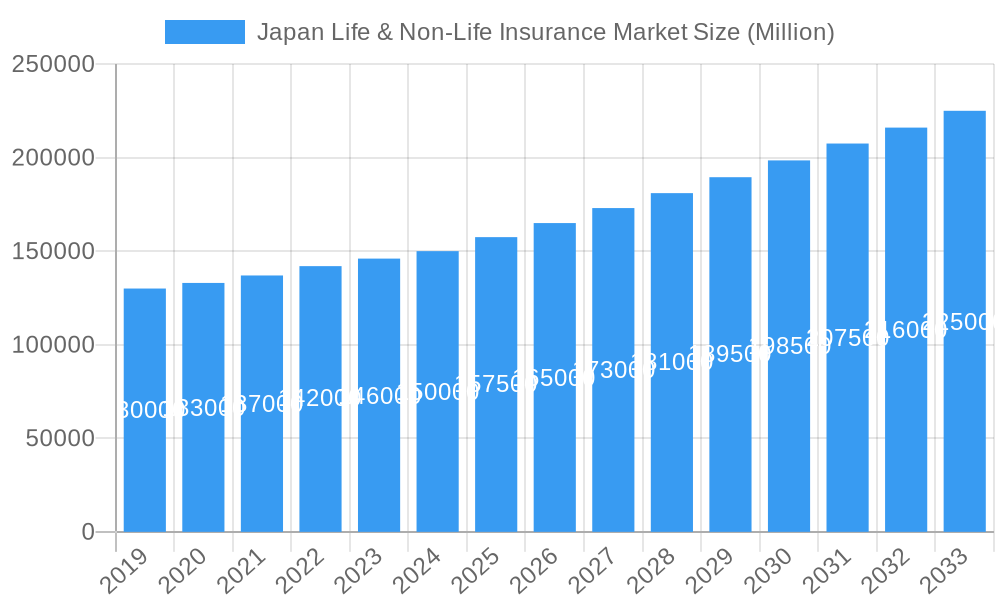

The Japan Life & Non-Life Insurance Market is projected for substantial growth, fueled by demographic shifts, evolving consumer demands, and technological integration. The market, currently valued at 238.3 million, is forecast to achieve a Compound Annual Growth Rate (CAGR) of 3.14% from the base year 2025 through 2033. This expansion is significantly influenced by an aging population, increasing demand for life insurance solutions focused on retirement planning and wealth transfer. Concurrently, heightened awareness of financial risks and the widespread adoption of digital channels are driving the uptake of non-life insurance, including health, property, and cyber coverage. The recent historical period (2019-2024) demonstrated steady market expansion from an estimated value of 197.5 million to the current 238.3 million, reflecting resilience. The market is anticipated to reach 254.0 million in 2025, with a projected increase of 15.7 million in the subsequent year.

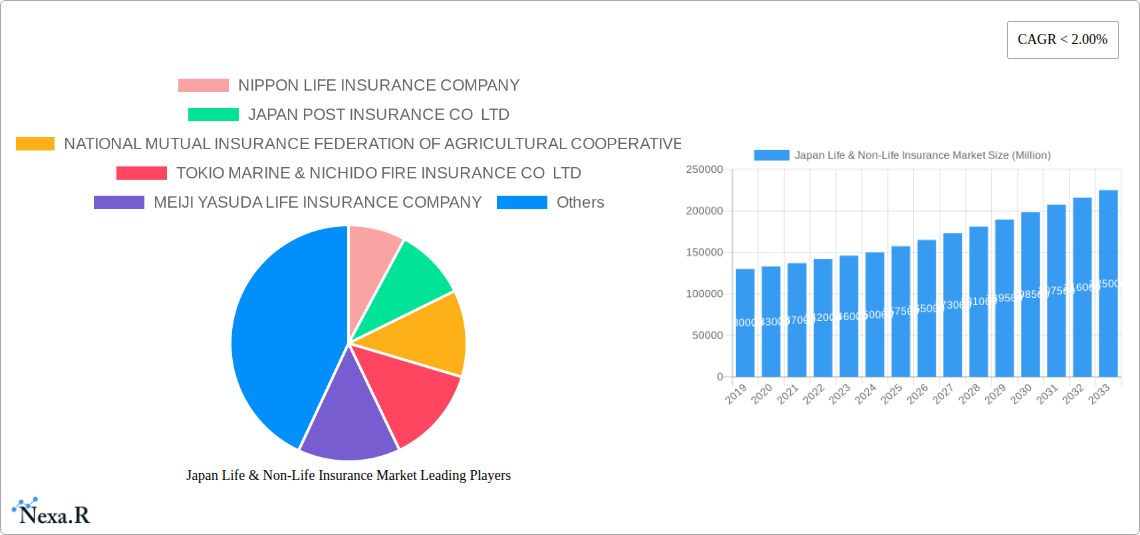

Japan Life & Non-Life Insurance Market Market Size (In Million)

The strategic environment of the Japan Life & Non-Life Insurance Market is defined by accelerating digitalization, product innovation, and a strong emphasis on customer-centricity. Insurers are prioritizing InsurTech investments to optimize operations, improve underwriting precision, and deliver personalized insurance offerings. The proliferation of digital platforms and mobile applications is revolutionizing distribution, enhancing accessibility and convenience. Furthermore, a growing focus on Environmental, Social, and Governance (ESG) principles is shaping product development, with a notable rise in demand for sustainable insurance products. Government initiatives promoting financial literacy and security are expected to further catalyze market dynamism and innovation, reinforcing robust future growth prospects. The projected CAGR of 3.14% from 2025 to 2033 supports an anticipated market valuation of approximately 303.7 million by 2033.

Japan Life & Non-Life Insurance Market Company Market Share

Japan Life & Non-Life Insurance Market: Comprehensive Market Analysis & Forecast (2019-2033)

This report offers an in-depth analysis of the Japan Life & Non-Life Insurance Market, encompassing both parent and child market segments. With a detailed study period from 2019 to 2033, a base year of 2025, and an estimated year also of 2025, this comprehensive report provides critical insights into market dynamics, growth trends, regional dominance, product innovations, key drivers, barriers, opportunities, and the competitive landscape. All values are presented in Million units.

Japan Life & Non-Life Insurance Market Market Dynamics & Structure

The Japan Life & Non-Life Insurance Market is characterized by a moderately concentrated structure, with several large, established players holding significant market share. Key companies like NIPPON LIFE INSURANCE COMPANY, JAPAN POST INSURANCE CO LTD, and TOKIO MARINE & NICHIDO FIRE INSURANCE CO LTD dominate, but smaller, specialized insurers are also present. Technological innovation is a significant driver, with increasing adoption of InsurTech solutions, AI-powered underwriting, and digital customer interfaces transforming operations. The regulatory framework, overseen by bodies like the Financial Services Agency (FSA), focuses on consumer protection, solvency requirements, and market fairness, influencing product development and distribution strategies. Competitive product substitutes, such as alternative investment products and savings plans, pose a continuous challenge. End-user demographics are evolving, with an aging population demanding different types of insurance products and a growing tech-savvy younger generation expecting digital-first experiences. Mergers & Acquisitions (M&A) are also a notable trend, driven by a desire for market consolidation, economies of scale, and expanded product portfolios.

- Market Concentration: Dominated by top players, but with room for niche specialists.

- Technological Innovation: Driven by InsurTech, AI, and digitalization.

- Regulatory Framework: Strong consumer protection and solvency focus.

- Competitive Substitutes: Investment products and savings plans.

- End-User Demographics: Aging population needs and digital preferences of younger generations.

- M&A Trends: Driven by consolidation and portfolio expansion.

Japan Life & Non-Life Insurance Market Growth Trends & Insights

The Japan Life & Non-Life Insurance Market is poised for sustained growth, fueled by a combination of evolving consumer needs, technological advancements, and an increasingly complex economic landscape. The market size is projected to experience a healthy CAGR of approximately 4.5% over the forecast period (2025-2033), driven by increasing awareness of risk management and the demand for comprehensive financial security. Adoption rates for digital insurance solutions are rapidly increasing, with a significant shift towards online policy management, claims processing, and customer service. Technological disruptions, such as the integration of IoT devices for usage-based insurance in the non-life sector and AI for personalized life insurance product recommendations, are reshaping the industry. Consumer behavior is shifting towards a greater emphasis on value-added services, preventative care integrated into health insurance, and flexible policy options. The market penetration for life insurance stands at an estimated 45.2% of the population, while non-life insurance penetration is at 68.9%, with significant room for growth, especially in specialized non-life segments. The historical period (2019-2024) saw steady, albeit slower, growth, laying the foundation for the accelerated expansion anticipated in the coming years.

Dominant Regions, Countries, or Segments in Japan Life & Non-Life Insurance Market

Within the Japan Life & Non-Life Insurance Market, Life Insurance, particularly the Individual Life Insurance segment, is a dominant force driving market growth. This dominance is attributed to several key factors, including the deeply ingrained cultural emphasis on long-term financial planning and provision for dependents in Japan. The aging population further amplifies the demand for life insurance products, including annuities and critical illness coverage, to secure retirement and healthcare needs.

The Agency Channel remains a cornerstone of distribution for life insurance, with experienced agents providing personalized advice and building trusted relationships with clients. While Direct Channels and Banks are gaining traction, especially for simpler products and younger demographics, the complexity and emotional nature of life insurance decisions often necessitate human interaction.

In the Non-Life Insurance sector, Motor Insurance represents a significant market, driven by high vehicle ownership rates and mandatory insurance regulations. However, Other Non-Life Insurance segments, encompassing property insurance, travel insurance, and specialized business insurance, are exhibiting robust growth due to increasing awareness of diverse risks and the availability of tailored solutions.

- Dominant Insurance Type: Life Insurance (Individual segment leading).

- Key Drivers for Life Insurance: Long-term financial planning culture, aging population, demand for retirement and healthcare solutions.

- Dominant Distribution Channel (Life): Agency Channel, complemented by Direct and Banks.

- Significant Non-Life Segment: Motor Insurance, with growing potential in "Others."

- Growth Potential in Non-Life: Diversified risks driving demand for specialized policies.

- Market Share: Individual Life Insurance accounts for an estimated 35.8% of the total market, while Motor Insurance holds 22.1%.

Japan Life & Non-Life Insurance Market Product Landscape

The product landscape within the Japan Life & Non-Life Insurance Market is evolving towards greater customization and technological integration. Life insurance products are increasingly incorporating riders for critical illness, long-term care, and accidental death benefits, offering comprehensive protection. Non-life offerings are seeing innovations like usage-based insurance (UBI) for vehicles, leveraging telematics to offer personalized premiums based on driving behavior. Property insurance products are adapting to the risks associated with natural disasters, with enhanced coverage options becoming more prevalent. The application of AI in risk assessment and personalized product recommendations is a key technological advancement, enabling insurers to tailor policies to individual needs and preferences more effectively.

Key Drivers, Barriers & Challenges in Japan Life & Non-Life Insurance Market

Key Drivers:

- Aging Population: A significant driver for life insurance, annuities, and long-term care products.

- Technological Advancements: InsurTech adoption, AI, and data analytics improving efficiency and customer experience.

- Growing Awareness of Risk Management: Increased understanding of the need for financial security against various life events and disasters.

- Favorable Regulatory Environment: Supportive policies aimed at promoting financial inclusion and market stability.

- Low Interest Rate Environment: Encouraging demand for life insurance as a savings and investment tool.

Key Barriers & Challenges:

- Low Interest Rate Environment: Can compress profit margins for insurers, especially in long-term life products.

- Stiff Competition: Intense rivalry among established players and the emergence of new InsurTech firms.

- Customer Inertia: Resistance to switching providers or adopting new insurance products.

- Evolving Regulatory Landscape: Compliance costs and the need for continuous adaptation to new rules.

- Cybersecurity Threats: Protecting sensitive customer data from breaches.

- Supply Chain Issues (Indirect): Potential impact on the availability of certain insured goods or services, indirectly affecting demand for related insurance.

Emerging Opportunities in Japan Life & Non-Life Insurance Market

Emerging opportunities in the Japan Life & Non-Life Insurance Market lie in the development of innovative health and wellness insurance products that integrate preventative care and digital health platforms. The Insuretech space offers significant potential for new business models, personalized digital customer journeys, and the use of big data analytics for hyper-targeted product offerings. Tapping into the gig economy and freelance workforce with flexible, on-demand insurance solutions presents an untapped market. Furthermore, there is a growing demand for sustainable and ESG-focused insurance products, aligning with increasing corporate and consumer environmental consciousness. The elderly care insurance segment, beyond traditional life insurance, also holds substantial promise.

Growth Accelerators in the Japan Life & Non-Life Insurance Market Industry

Several catalysts are accelerating long-term growth in the Japan Life & Non-Life Insurance Market. The continued integration of Artificial Intelligence (AI) and Machine Learning (ML) is optimizing underwriting, claims processing, and fraud detection, leading to greater efficiency and cost savings. Strategic partnerships between traditional insurers and FinTech/InsurTech startups are fostering innovation and expanding service offerings. Data analytics capabilities are enabling insurers to gain deeper insights into customer behavior, leading to the development of highly personalized and value-driven products. Market expansion strategies, including the development of new product lines that cater to niche markets and emerging risks, are also critical growth accelerators.

Key Players Shaping the Japan Life & Non-Life Insurance Market Market

- NIPPON LIFE INSURANCE COMPANY

- JAPAN POST INSURANCE CO LTD

- NATIONAL MUTUAL INSURANCE FEDERATION OF AGRICULTURAL COOPERATIVES

- TOKIO MARINE & NICHIDO FIRE INSURANCE CO LTD

- MEIJI YASUDA LIFE INSURANCE COMPANY

- DAI-ICHI LIFE INSURANCE COMPANY LIMITED

- SUMITOMO LIFE INSURANCE COMPANY

- SOMPO JAPAN NIPPONKOA INSURANCE INC

- GIBRALTAR LIFE INSURANCE CO LTD

- AFLAC LIFE INSURANCE JAPAN LT

Notable Milestones in Japan Life & Non-Life Insurance Market Sector

- 2019: Increased regulatory focus on data privacy and cybersecurity measures.

- 2020: Accelerated adoption of digital channels for sales and customer service due to pandemic.

- 2021: Introduction of new health insurance products focusing on mental wellness and preventative care.

- 2022: Growing investment in InsurTech solutions for automation and personalized customer experiences.

- 2023: M&A activities aimed at consolidating market share and expanding product portfolios in both life and non-life segments.

- 2024: Enhanced focus on ESG (Environmental, Social, and Governance) factors in product development and investment strategies.

In-Depth Japan Life & Non-Life Insurance Market Market Outlook

The outlook for the Japan Life & Non-Life Insurance Market remains robust, driven by powerful growth accelerators such as advanced AI integration, strategic FinTech collaborations, and a sophisticated approach to data analytics for product personalization. The market is expected to witness significant expansion as insurers continue to innovate, offering comprehensive and tailored solutions that address the evolving needs of a diverse customer base. The proactive development of new product lines catering to niche segments and emerging risks will further fuel this growth trajectory, solidifying Japan's position as a dynamic and forward-thinking insurance market.

Japan Life & Non-Life Insurance Market Segmentation

-

1. Insurance type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-life Insurance

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Others

-

1.1. Life Insurance

-

2. Channel of Distribution

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Other Channels of Distribution

Japan Life & Non-Life Insurance Market Segmentation By Geography

- 1. Japan

Japan Life & Non-Life Insurance Market Regional Market Share

Geographic Coverage of Japan Life & Non-Life Insurance Market

Japan Life & Non-Life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase in Number of Individual Insurance Policies and Policies in Force

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-life Insurance

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Others

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other Channels of Distribution

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NIPPON LIFE INSURANCE COMPANY

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JAPAN POST INSURANCE CO LTD

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NATIONAL MUTUAL INSURANCE FEDERATION OF AGRICULTURAL COOPERATIVES

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TOKIO MARINE & NICHIDO FIRE INSURANCE CO LTD

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MEIJI YASUDA LIFE INSURANCE COMPANY

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DAI-ICHI LIFE INSURANCE COMPANY LIMITED

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SUMITOMO LIFE INSURANCE COMPANY

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SOMPO JAPAN NIPPONKOA INSURANCE INC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GIBRALTAR LIFE INSURANCE CO LTD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AFLAC LIFE INSURANCE JAPAN LT

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 NIPPON LIFE INSURANCE COMPANY

List of Figures

- Figure 1: Japan Life & Non-Life Insurance Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Japan Life & Non-Life Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Life & Non-Life Insurance Market Revenue million Forecast, by Insurance type 2020 & 2033

- Table 2: Japan Life & Non-Life Insurance Market Revenue million Forecast, by Channel of Distribution 2020 & 2033

- Table 3: Japan Life & Non-Life Insurance Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Japan Life & Non-Life Insurance Market Revenue million Forecast, by Insurance type 2020 & 2033

- Table 5: Japan Life & Non-Life Insurance Market Revenue million Forecast, by Channel of Distribution 2020 & 2033

- Table 6: Japan Life & Non-Life Insurance Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Life & Non-Life Insurance Market?

The projected CAGR is approximately 3.14%.

2. Which companies are prominent players in the Japan Life & Non-Life Insurance Market?

Key companies in the market include NIPPON LIFE INSURANCE COMPANY, JAPAN POST INSURANCE CO LTD, NATIONAL MUTUAL INSURANCE FEDERATION OF AGRICULTURAL COOPERATIVES, TOKIO MARINE & NICHIDO FIRE INSURANCE CO LTD, MEIJI YASUDA LIFE INSURANCE COMPANY, DAI-ICHI LIFE INSURANCE COMPANY LIMITED, SUMITOMO LIFE INSURANCE COMPANY, SOMPO JAPAN NIPPONKOA INSURANCE INC, GIBRALTAR LIFE INSURANCE CO LTD, AFLAC LIFE INSURANCE JAPAN LT.

3. What are the main segments of the Japan Life & Non-Life Insurance Market?

The market segments include Insurance type, Channel of Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD 238.3 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase in Number of Individual Insurance Policies and Policies in Force.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Life & Non-Life Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Life & Non-Life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Life & Non-Life Insurance Market?

To stay informed about further developments, trends, and reports in the Japan Life & Non-Life Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence