Key Insights

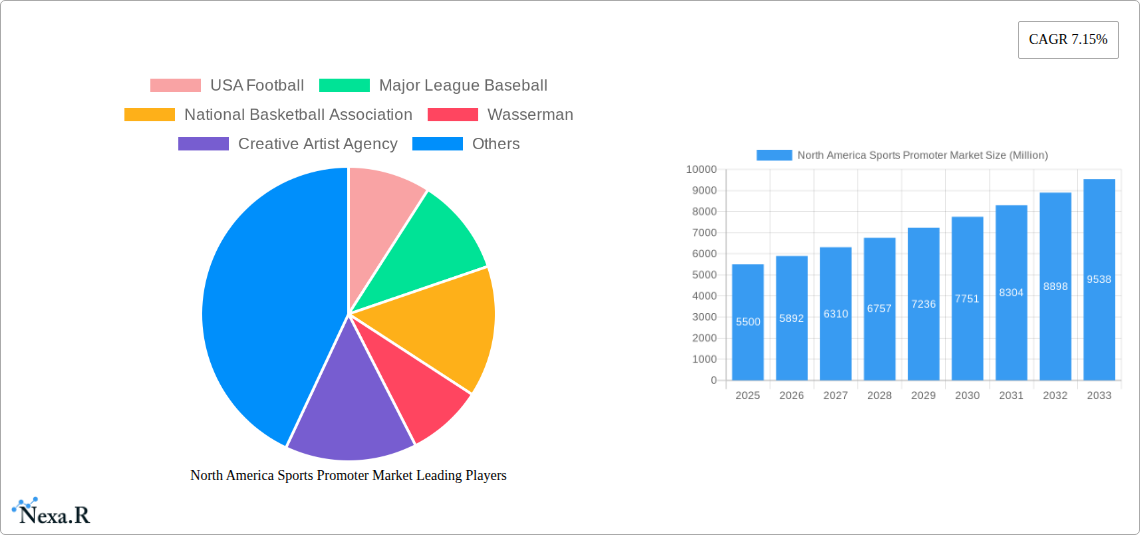

The North America Sports Promoter Market is forecast to reach $9.5 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 6.5% through 2033. Growth is propelled by escalating media rights, increasing demand for live sports, and the growing impact of sponsorships and merchandising. The sustained popularity of major sports like football, basketball, and baseball drives fan engagement and promoter revenue. The increasing professionalization of sports across all levels necessitates sophisticated promotion and management, further boosting market demand. Digital media and broadcasting platforms are expanding the reach and commercial viability of sports properties. Strong consumer spending on entertainment and a cultural appreciation for athletic competition across the United States, Canada, and Mexico underpin market growth.

North America Sports Promoter Market Market Size (In Billion)

The market's diverse revenue streams include substantial media rights from broadcasting networks and streaming services, merchandising (apparel, memorabilia) capitalizing on fan loyalty, ticket sales for live events, and vital sponsorships from corporations seeking engaged audiences. Key players such as USA Football, Major League Baseball, the National Basketball Association, and sports agencies like Wasserman and Creative Artist Agency are shaping this dynamic market. Enduring brands like Nike, Adidas, and Fanatics significantly contribute through merchandise and sponsorships, highlighting the interconnectedness of sports promotion and related industries.

North America Sports Promoter Market Company Market Share

Gain strategic insights into the North America Sports Promoter Market. This comprehensive report, covering 2019-2033 with a base year of 2025, analyzes market dynamics, growth trends, dominant regions, product landscapes, key players, and pivotal industry milestones. It offers granular data on market segments including Football, Basketball, Baseball, Hockey, and Other Types, along with revenue streams such as Media Rights, Merchandising, Tickets, and Sponsorship, and end-users like Individual and Companies. All values are presented in billion units.

North America Sports Promoter Market Market Dynamics & Structure

The North America Sports Promoter Market is characterized by a moderately concentrated structure, driven by a few dominant leagues and promotional bodies. Technological innovation is a significant driver, with advancements in broadcasting, fan engagement platforms, and data analytics continuously reshaping how sports are promoted and consumed. Regulatory frameworks, while generally supportive of the industry, can influence broadcasting rights, player contracts, and sponsorship regulations. Competitive product substitutes, such as esports and other entertainment options, pose a continuous challenge, necessitating innovative promotional strategies to maintain fan interest. End-user demographics are diverse, ranging from passionate individual fans to large corporations seeking sponsorship opportunities, each with unique engagement drivers. Merger and acquisition (M&A) trends indicate a consolidation phase, with larger entities acquiring smaller promoters or technology providers to expand their reach and offerings.

- Market Concentration: Dominated by major professional sports leagues and established promoters, but with room for specialized niche players.

- Technological Innovation: Driven by AI in analytics, immersive fan experiences (AR/VR), and advanced digital marketing.

- Regulatory Impact: Licensing, broadcasting rights, and labor laws significantly influence promotional activities.

- Competitive Substitutes: Rise of esports, streaming services, and other entertainment forms demand constant innovation.

- M&A Trends: Strategic acquisitions aimed at expanding media rights, digital platforms, and global reach.

North America Sports Promoter Market Growth Trends & Insights

The North America Sports Promoter Market is experiencing robust growth, fueled by escalating media rights deals, increasing sponsorship investments, and a sustained passion for live sports. The adoption rate of digital platforms for promotion and fan engagement is exceptionally high, with promoters leveraging social media, streaming services, and dedicated apps to reach wider audiences. Technological disruptions, including the integration of AI for personalized fan experiences and blockchain for ticketing and merchandise authenticity, are actively reshaping consumer behavior. Fans are increasingly seeking more interactive and personalized engagement, driving demand for innovative content and direct communication channels. The market size is projected to expand significantly, with a Compound Annual Growth Rate (CAGR) that reflects the industry's resilience and adaptability. Market penetration is deep, with almost every demographic group actively participating as consumers or beneficiaries of sports promotion.

The evolution of revenue streams is a critical insight, with media rights continuing to be a dominant force, supplemented by substantial growth in digital advertising and e-commerce related to fan merchandise. Sponsorships are also diversifying, with non-traditional brands entering the sports arena, seeking to connect with specific fan bases. This dynamic shift is underpinned by a deep understanding of consumer behavior, where emotional connection to teams and athletes plays a pivotal role in driving spending. The report details how promoters are adapting to changing consumption patterns, including the rise of cord-cutting and the demand for on-demand sports content. This necessitates agile strategies that can capitalize on emerging platforms and monetize fan engagement across multiple touchpoints. The projected growth trajectory indicates a sustained upward trend, driven by a combination of organic expansion and strategic diversification of promotional activities.

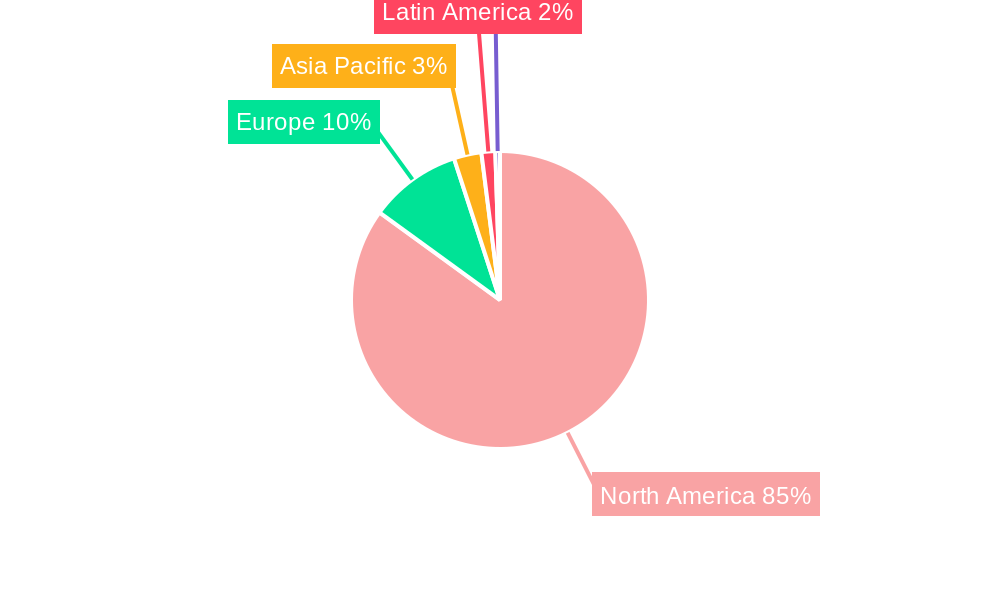

Dominant Regions, Countries, or Segments in North America Sports Promoter Market

The United States stands as the undisputed dominant country within the North America Sports Promoter Market, largely due to its massive consumer base, highly developed sports infrastructure, and the presence of the world's most lucrative professional sports leagues. Basketball and Baseball have historically held significant market share in terms of revenue and fan engagement, driven by established leagues like the NBA and MLB. However, Football (American Football) boasts unparalleled viewership and sponsorship value, particularly through the NFL, making it a primary growth engine. The Media Rights segment is the most significant revenue source nationally, with broadcasting deals for major leagues commanding billions of dollars annually. This is closely followed by Sponsorship revenue, where companies invest heavily to associate their brands with popular teams and athletes.

The dominance of these segments is further amplified by robust economic policies that support entertainment and advertising industries, along with continuous investment in state-of-the-art sports infrastructure across the country. The "Individual" end-user segment, comprising millions of passionate sports fans, is the primary consumer of tickets, merchandise, and broadcast subscriptions, driving substantial economic activity. Companies, as the other end-user segment, contribute significantly through sponsorships, advertising, and corporate hospitality, further solidifying the market's economic power. The market share for these dominant segments is expected to remain high throughout the forecast period, although emerging trends like the growth of niche sports and the increasing influence of digital media could lead to gradual shifts. The potential for growth in other types of sports and the diversification of revenue sources beyond traditional streams are key areas to watch for future market expansion.

North America Sports Promoter Market Product Landscape

The product landscape within the North America Sports Promoter Market is characterized by an increasing emphasis on digital experiences and personalized fan engagement. Promoters are innovating beyond traditional ticket sales and merchandise to offer a spectrum of digital products and services. This includes premium content subscriptions, interactive fantasy sports platforms, augmented reality (AR) fan experiences at venues, and immersive virtual reality (VR) viewing options. Performance metrics focus on user engagement, subscription conversion rates, and data monetization. Unique selling propositions often revolve around exclusive access to athletes, behind-the-scenes content, and gamified fan interactions that foster a deeper connection with sports properties. Technological advancements in AI-powered content personalization and sophisticated data analytics are crucial in tailoring these offerings to individual fan preferences, driving higher satisfaction and loyalty.

Key Drivers, Barriers & Challenges in North America Sports Promoter Market

Key Drivers:

- Massive Fanbase & Passion: Deep-rooted cultural appreciation for sports in North America fuels consistent demand for live events and related content.

- Lucrative Media Rights Deals: Escalating broadcasting agreements for major leagues are a primary revenue generator and growth catalyst.

- Strong Sponsorship Market: Corporations continuously invest in sports sponsorships to reach targeted demographics and enhance brand visibility.

- Technological Advancements: Innovations in digital streaming, fan engagement platforms, and data analytics enable wider reach and deeper interaction.

Key Barriers & Challenges:

- Increasing Competition: Rise of esports and other entertainment options demands continuous innovation to retain audience attention.

- Rising Fan Expectations: Demand for personalized content, immersive experiences, and direct athlete interaction presents a continuous challenge.

- Economic Volatility: Potential recessions or economic downturns can impact disposable income for tickets, merchandise, and subscriptions.

- Regulatory Hurdles: Evolving regulations around data privacy, broadcasting rights, and sports betting can create complexities.

Emerging Opportunities in North America Sports Promoter Market

Emerging opportunities in the North America Sports Promoter Market lie in the continued expansion of niche sports, the monetization of fan data through advanced analytics, and the integration of emerging technologies like Web3 for unique fan experiences and digital collectibles. The growth of women's professional sports presents a significant untapped market with a highly engaged and growing fanbase. Furthermore, the increasing demand for sustainable and socially responsible sports promotions offers avenues for brands to connect with conscious consumers. Developing more personalized and interactive fan journeys through AI and immersive technologies will be crucial for capturing and retaining the attention of younger demographics.

Growth Accelerators in the North America Sports Promoter Market Industry

Growth accelerators for the North America Sports Promoter Market industry are primarily driven by strategic partnerships, technological breakthroughs, and innovative market expansion strategies. The increasing involvement of technology giants in sports broadcasting and fan engagement is a significant catalyst. Furthermore, the diversification of revenue streams beyond traditional media rights and sponsorships, such as through e-commerce, gaming, and NFT-based fan tokens, is fueling accelerated growth. The development of new fan engagement platforms that foster community and interactive experiences is also crucial. Finally, strategic expansion into emerging markets and the promotion of underrepresented sports are vital for long-term sustainable growth.

Key Players Shaping the North America Sports Promoter Market Market

- USA Football

- Major League Baseball

- National Basketball Association

- Wasserman

- Creative Artist Agency

- Nike

- ESPN

- Adidas

- Under Armour

- Fanatics

Notable Milestones in North America Sports Promoter Market Sector

- August 2023: FOX Sports successfully secured the US broadcasting rights for the Saudi Pro League; with this deal, FOX Sports will likely be the official broadcaster of the Saudi Pro League in the United States for the entirety of the season, with rights ending in May 2024.

- July 2023: AT&T signed a multiyear sponsorship extension with Major League Soccer, the Mexican Football Federation (FMF), and the Leagues Cup. AT&T is an American brand and corporation providing long-distance telephone and other telecommunication services. This partnership extension is expected to allow AT&T to leverage its expertise in innovation and technology to deepen engagement for the next generation of fans.

In-Depth North America Sports Promoter Market Market Outlook

The North America Sports Promoter Market is poised for sustained and significant growth, propelled by an evolving technological landscape and a deeply entrenched fan culture. The ongoing digital transformation, encompassing advancements in AI-driven analytics, immersive AR/VR experiences, and personalized content delivery, will continue to redefine fan engagement and monetization strategies. The market will witness further diversification of revenue streams, with a stronger emphasis on e-commerce, gaming integrations, and the innovative application of blockchain technology for digital collectibles and fan ownership models. Strategic partnerships between sports organizations, media companies, and technology providers will be critical for unlocking new avenues of growth and expanding market reach. This forward-looking outlook underscores the dynamic and resilient nature of the North American sports promotion industry, promising substantial opportunities for stakeholders.

North America Sports Promoter Market Segmentation

-

1. type

- 1.1. Football

- 1.2. Basketball

- 1.3. Baseball

- 1.4. Hockey

- 1.5. Other Types

-

2. Revenue Source

- 2.1. Media Rights

- 2.2. Merchandising

- 2.3. Tickets

- 2.4. Sponsorship

-

3. End User

- 3.1. Individual

- 3.2. Companies

North America Sports Promoter Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Sports Promoter Market Regional Market Share

Geographic Coverage of North America Sports Promoter Market

North America Sports Promoter Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digital Media Tools increasing brand promotion and marketing opportunity; Rising Competition among the businesses for Sponsorship in Leagues

- 3.3. Market Restrains

- 3.3.1. Digital Media Tools increasing brand promotion and marketing opportunity; Rising Competition among the businesses for Sponsorship in Leagues

- 3.4. Market Trends

- 3.4.1. Increasing Number Of Digital Channels Raising Market Size

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Sports Promoter Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by type

- 5.1.1. Football

- 5.1.2. Basketball

- 5.1.3. Baseball

- 5.1.4. Hockey

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Revenue Source

- 5.2.1. Media Rights

- 5.2.2. Merchandising

- 5.2.3. Tickets

- 5.2.4. Sponsorship

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Individual

- 5.3.2. Companies

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 USA Football

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Major League Baseball

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 National Basketball Association

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wasserman

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Creative Artist Agency

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nike

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ESPN

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Adidas

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Under Armour

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fanatics**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 USA Football

List of Figures

- Figure 1: North America Sports Promoter Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Sports Promoter Market Share (%) by Company 2025

List of Tables

- Table 1: North America Sports Promoter Market Revenue billion Forecast, by type 2020 & 2033

- Table 2: North America Sports Promoter Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 3: North America Sports Promoter Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: North America Sports Promoter Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Sports Promoter Market Revenue billion Forecast, by type 2020 & 2033

- Table 6: North America Sports Promoter Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 7: North America Sports Promoter Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: North America Sports Promoter Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Sports Promoter Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Sports Promoter Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Sports Promoter Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Sports Promoter Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the North America Sports Promoter Market?

Key companies in the market include USA Football, Major League Baseball, National Basketball Association, Wasserman, Creative Artist Agency, Nike, ESPN, Adidas, Under Armour, Fanatics**List Not Exhaustive.

3. What are the main segments of the North America Sports Promoter Market?

The market segments include type, Revenue Source, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Digital Media Tools increasing brand promotion and marketing opportunity; Rising Competition among the businesses for Sponsorship in Leagues.

6. What are the notable trends driving market growth?

Increasing Number Of Digital Channels Raising Market Size.

7. Are there any restraints impacting market growth?

Digital Media Tools increasing brand promotion and marketing opportunity; Rising Competition among the businesses for Sponsorship in Leagues.

8. Can you provide examples of recent developments in the market?

August 2023: FOX Sports successfully secured the US broadcasting rights for the Saudi Pro League; with this deal, FOX Sports will likely be the official broadcaster of the Saudi Pro League in the United States for the entirety of the season, with rights ending in May 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Sports Promoter Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Sports Promoter Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Sports Promoter Market?

To stay informed about further developments, trends, and reports in the North America Sports Promoter Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence