Key Insights

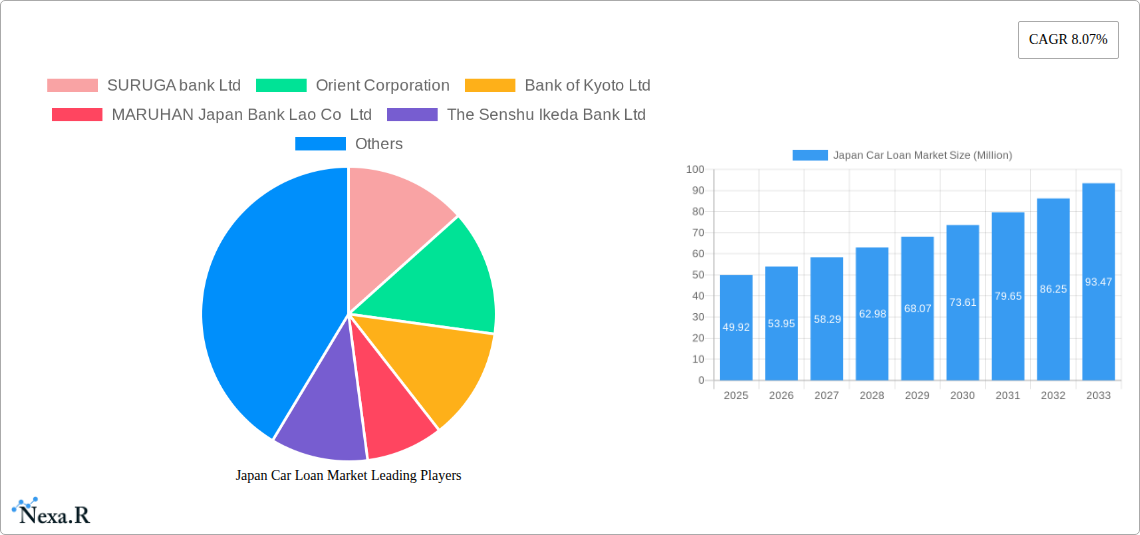

The Japan Car Loan Market is poised for robust growth, with an estimated market size of approximately $49.92 million in 2025, driven by a healthy Compound Annual Growth Rate (CAGR) of 8.07%. This expansion is underpinned by several key factors. A significant driver is the increasing demand for both new and used vehicles across passenger and commercial segments, fueled by a resilient economy and evolving consumer preferences for personal mobility. The prevalence of flexible financing options offered by a diverse range of providers, including traditional banks, Non-Banking Financial Companies (NBFCs), credit unions, and increasingly, innovative Fintech players, further stimulates market activity. These providers are actively competing to offer attractive loan terms, catering to a wide spectrum of customer needs in terms of loan tenure, from short-term (<3 years) to longer-term (>5 years) options. The ongoing technological advancements within the financial sector are also playing a crucial role, with digital platforms streamlining the loan application and approval processes, making car financing more accessible and efficient for a broader consumer base.

Japan Car Loan Market Market Size (In Million)

Further analysis indicates that while the market is experiencing strong momentum, certain restraints could temper its full potential. These include evolving regulatory landscapes surrounding lending practices and the potential impact of economic downturns on consumer spending power, which could affect loan uptake. However, the market's inherent resilience, coupled with the continuous introduction of innovative financial products and services, is expected to navigate these challenges effectively. Key players such as SURUGA Bank Ltd, Orient Corporation, and Toyota Financial Services Corporation are actively shaping the market through strategic initiatives and product development. The concentration of market activity within Japan suggests a deeply entrenched automotive culture and a well-established financial ecosystem supporting vehicle acquisition. The forecast period from 2025 to 2033 is expected to witness sustained growth, driven by an anticipated increase in vehicle ownership and the continued adaptation of financial institutions to meet the dynamic demands of Japanese consumers seeking car loans.

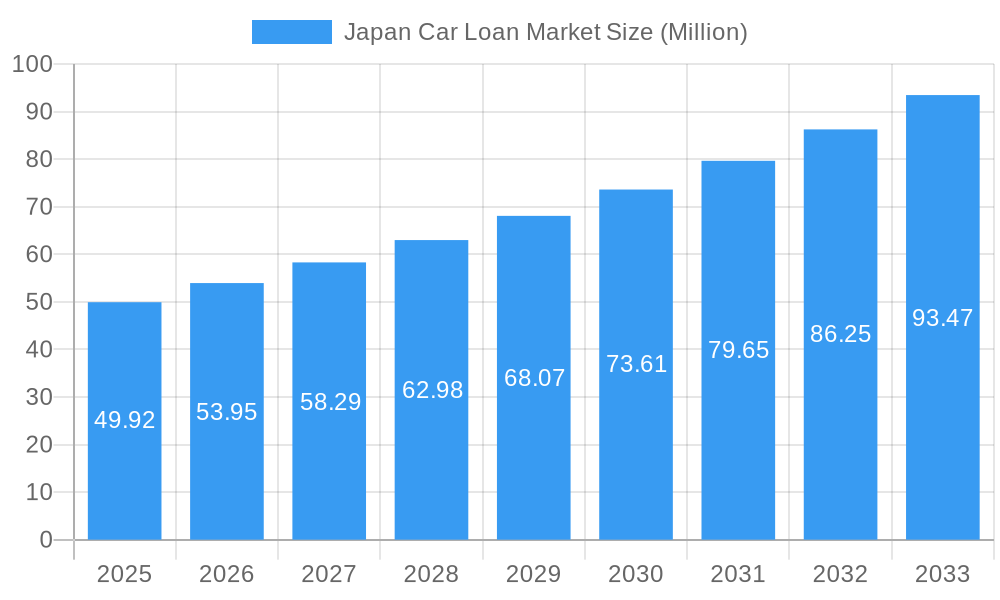

Japan Car Loan Market Company Market Share

Comprehensive Japan Car Loan Market Report: Dynamics, Trends, and Future Outlook (2019–2033)

This in-depth Japan car loan market report provides an indispensable analysis of the automotive financing landscape in Japan. Covering the historical period of 2019–2024, a base year of 2025, and a comprehensive forecast period from 2025–2033, this report offers critical insights into market dynamics, growth trends, regional dominance, product innovation, key players, and future opportunities within the Japanese auto finance sector. Designed for industry professionals, financial institutions, automotive manufacturers, and investors, this report leverages high-traffic keywords such as Japan car financing, auto loan Japan, Japanese vehicle loans, car credit Japan, and automotive lending Japan to ensure maximum search engine visibility. We delve into both the parent Japan car loan market and its granular child markets, providing a holistic view of this dynamic industry. All quantitative values are presented in Million units for clarity.

Japan Car Loan Market Market Dynamics & Structure

The Japan car loan market exhibits a moderately concentrated structure, characterized by the significant presence of established financial institutions and the growing influence of Non-Banking Financial Companies (NBFCs) and emerging fintech players. Technological innovation, particularly in digital lending platforms and AI-driven credit assessment, is a key driver, aiming to streamline the application and approval process for car loans in Japan. Regulatory frameworks, overseen by bodies like the Financial Services Agency (FSA), ensure market stability and consumer protection, though evolving compliance requirements can present barriers to entry for new participants. Competitive product substitutes include leasing options and peer-to-peer lending platforms, intensifying the need for competitive interest rates and flexible repayment terms on Japanese auto financing. End-user demographics are shifting, with an increasing demand for personalized loan products catering to diverse income levels and life stages. Mergers and acquisitions (M&A) are a notable trend, as larger entities seek to expand their market share and technological capabilities. For instance, ongoing consolidation within the banking sector can lead to strategic acquisitions of auto loan portfolios.

- Market Concentration: Dominated by major banks, with increasing participation from NBFCs and fintech startups.

- Technological Innovation: Focus on digital platforms, AI for risk assessment, and blockchain for enhanced security.

- Regulatory Frameworks: Governed by the FSA, ensuring transparency and consumer protection, with evolving compliance mandates.

- Competitive Substitutes: Automotive leasing, P2P lending, and personal loans offer alternative financing solutions.

- End-User Demographics: Catering to a broad range of consumers, from first-time buyers to fleet operators, with evolving preferences for digital and flexible solutions.

- M&A Trends: Strategic acquisitions aimed at market consolidation and capability enhancement.

Japan Car Loan Market Growth Trends & Insights

The Japan car loan market is poised for robust growth, driven by an increasing demand for personal mobility and the sustained popularity of automotive ownership. Market size evolution is directly correlated with new vehicle sales and the used car market's performance, both of which are influenced by economic conditions and consumer confidence. Adoption rates for digital loan applications are rapidly increasing, reflecting a broader societal shift towards online transactions and the convenience of accessing car credit Japan remotely. Technological disruptions, such as the integration of big data analytics and machine learning in credit scoring, are enhancing efficiency and reducing turnaround times for loan approvals. Consumer behavior shifts are evident in a growing preference for flexible loan tenures and competitive interest rates, with a particular emphasis on tailored financing solutions for diverse vehicle types, including passenger vehicle loans Japan and commercial vehicle financing Japan. The average loan amount is also seeing an upward trend, influenced by the increasing cost of new vehicles and the demand for advanced features. The projected Compound Annual Growth Rate (CAGR) for the forecast period is estimated to be around 6.5%, indicating a healthy expansion trajectory for the automotive lending Japan sector.

Dominant Regions, Countries, or Segments in Japan Car Loan Market

Within the Japan car loan market, the Passenger Vehicle segment consistently drives market growth, accounting for approximately 85% of all automotive financing. This dominance is further amplified by the New Vehicles ownership category, which garners around 60% of the market share, reflecting a strong consumer preference for acquiring the latest models with attractive financing packages. Banks remain the leading provider type, holding a substantial market share of approximately 70%, owing to their established trust, extensive branch networks, and comprehensive financial product offerings. However, NBFCs are rapidly gaining ground, particularly in catering to segments with specific credit needs or offering more agile lending processes. The 3-5 Years tenure segment is the most popular, with 55% of borrowers opting for this repayment period, balancing affordability with manageable debt.

- Vehicle Type Dominance:

- Passenger Vehicle: Represents the largest share due to widespread personal mobility needs and family transportation.

- Commercial Vehicle: Accounts for a smaller but significant portion, driven by logistics and business expansion.

- Ownership Dominance:

- New Vehicles: Preferred by consumers seeking the latest technology, warranty benefits, and potentially lower initial interest rates.

- Used Vehicles: Offers a more affordable entry point, attracting a considerable segment of budget-conscious buyers.

- Provider Type Dominance:

- Banks: The primary lenders, benefiting from a strong reputation and diversified financial services.

- NBFCs: Growing in influence with specialized loan products and faster processing times.

- Credit Unions: Serve specific communities with tailored offerings.

- Other Provider Types (Fintech Companies): Emerging as disruptors with innovative digital solutions.

- Tenure Dominance:

- 3-5 Years: The most favored tenure, offering a balance between monthly payment affordability and total interest paid.

- Less than Three Years: Appeals to borrowers who prefer quicker debt repayment.

- More Than 5 Years: Utilized for higher-value vehicles or by those prioritizing lower monthly installments.

Japan Car Loan Market Product Landscape

The Japan car loan market is witnessing a surge in product innovations focused on enhancing customer experience and accessibility. Lenders are increasingly offering digital car loan applications, enabling swift pre-approvals and customized loan structuring. Advanced analytics are being employed to develop personalized loan packages, factoring in individual credit profiles and vehicle preferences. Applications span from standard financing for new and used passenger cars to specialized loans for commercial vehicles and electric mobility solutions. Performance metrics like reduced processing times (down to hours from days), competitive Annual Percentage Rates (APRs) ranging from 2.5% to 8.0%, and flexible repayment schedules are becoming key differentiators. Unique selling propositions include bundled insurance options, trade-in value financing, and seamless integration with dealership platforms. Technological advancements in AI-powered risk assessment are allowing for broader credit access and more accurate pricing of risk for Japanese car financing.

Key Drivers, Barriers & Challenges in Japan Car Loan Market

Key Drivers:

- Growing Demand for Personal Mobility: A persistent societal value placed on private vehicle ownership in Japan.

- Economic Stability: Relatively stable economic conditions and consumer income levels support purchasing power.

- Technological Advancements: Digitalization and AI are streamlining loan processes and enhancing accessibility.

- Government Incentives: Potential for government support for eco-friendly vehicles can indirectly boost loan demand.

- Expansion of Used Car Market: Providing more affordable entry points for a wider consumer base seeking car finance Japan.

Key Barriers & Challenges:

- Strict Lending Regulations: Japan's robust regulatory environment can lead to lengthy approval processes and higher compliance costs for lenders, impacting the speed of automotive lending Japan.

- Aging Population: A demographic shift can impact the overall demand for new car purchases and associated loans.

- Intense Competition: The presence of numerous banks, NBFCs, and emerging fintech companies leads to price sensitivity and pressure on profit margins for car loans Japan.

- Economic Downturns: Any significant economic recession could lead to reduced consumer spending and increased loan defaults.

- Cybersecurity Risks: The increasing reliance on digital platforms necessitates robust cybersecurity measures to protect sensitive financial data.

Emerging Opportunities in Japan Car Loan Market

Emerging opportunities in the Japan car loan market lie in the burgeoning demand for electric vehicles (EVs) and hybrid cars, presenting a niche for specialized EV car loans Japan with attractive rates and potential government subsidies. The used car market continues to offer untapped potential, especially for streamlined online financing solutions that cater to budget-conscious buyers. Furthermore, partnerships between financial institutions and automotive dealerships are creating integrated platforms for seamless Japanese vehicle loans acquisition at the point of sale. The rise of fintech companies is paving the way for innovative loan products, such as pay-as-you-drive financing and flexible subscription-based models, aligning with evolving consumer preferences.

Growth Accelerators in the Japan Car Loan Market Industry

Growth in the Japan car loan market is being significantly accelerated by several key factors. The continuous evolution of digital lending technologies, including AI-powered credit scoring and blockchain for transaction security, is enhancing operational efficiency and customer accessibility. Strategic partnerships between traditional banks and innovative fintech firms are expanding the reach of automotive lending Japan and introducing novel product offerings. Furthermore, the growing consumer interest in sustainable mobility is fueling demand for financing solutions for electric and hybrid vehicles, creating a substantial growth avenue. Market expansion strategies, including aggressive marketing campaigns and the introduction of loyalty programs, are also playing a crucial role in capturing a larger market share.

Key Players Shaping the Japan Car Loan Market Market

- SURUGA bank Ltd

- Orient Corporation

- Bank of Kyoto Ltd

- MARUHAN Japan Bank Lao Co Ltd

- The Senshu Ikeda Bank Ltd

- Toyota Financial Services Corporation

- The Kinokuni Shinkin Bank

- Sompo Japan Insurance Inc

- AK Kogyo Co Ltd

- The 77 bank Ltd

Notable Milestones in Japan Car Loan Market Sector

- July 2023: A Japanese prime auto loan issuer successfully raised USD 251.6 million in U.S. ABS through OSCAR US Funding XV LLC, issuing three classes of notes with final maturities between 2024 and 2027, indicating strong investor confidence in Japanese auto finance assets.

- June 2023: Mitsubishi UFJ Financial Group's agreement to acquire Indonesian auto loan provider Mandala Multifinance for USD 467 million highlights a broader trend of Japanese financial institutions expanding their presence in Asian automotive financing markets to tap into emerging middle-class consumers.

In-Depth Japan Car Loan Market Market Outlook

The Japan car loan market is projected to experience sustained and robust growth, driven by technological innovation, evolving consumer preferences, and strategic market expansions. Key growth accelerators include the increasing adoption of digital lending platforms, the development of specialized financing for electric vehicles, and strategic collaborations between financial institutions and automotive players. The market outlook is positive, with opportunities for lenders to enhance customer engagement through personalized loan products and flexible repayment structures. Continued investment in AI and big data analytics will further refine risk assessment and operational efficiency, paving the way for greater market penetration and profitability in the Japanese auto finance sector through 2033.

Japan Car Loan Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicle

- 1.2. Commercial Vehicle

-

2. Ownership

- 2.1. New Vehicles

- 2.2. Used Vehicles

-

3. Provider Type

- 3.1. Banks

- 3.2. NBFCs (Non Banking Financials Companies)

- 3.3. Credit Unions

- 3.4. Other Provider Types (Fintech Companies)

-

4. Tenure

- 4.1. Less than Three Years

- 4.2. 3-5 Years

- 4.3. More Than 5 Years

Japan Car Loan Market Segmentation By Geography

- 1. Japan

Japan Car Loan Market Regional Market Share

Geographic Coverage of Japan Car Loan Market

Japan Car Loan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Demand for Vehicles

- 3.3. Market Restrains

- 3.3.1. Increasing Consumer Demand for Vehicles

- 3.4. Market Trends

- 3.4.1. Passenger Cars in Japan Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Car Loan Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicle

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Ownership

- 5.2.1. New Vehicles

- 5.2.2. Used Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Provider Type

- 5.3.1. Banks

- 5.3.2. NBFCs (Non Banking Financials Companies)

- 5.3.3. Credit Unions

- 5.3.4. Other Provider Types (Fintech Companies)

- 5.4. Market Analysis, Insights and Forecast - by Tenure

- 5.4.1. Less than Three Years

- 5.4.2. 3-5 Years

- 5.4.3. More Than 5 Years

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SURUGA bank Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Orient Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bank of Kyoto Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MARUHAN Japan Bank Lao Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Senshu Ikeda Bank Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Toyota Financial Services Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Kinokuni Shinkin Bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sompo Japan Insurance Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AK Kogyo Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The 77 bank Ltd **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SURUGA bank Ltd

List of Figures

- Figure 1: Japan Car Loan Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Car Loan Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Car Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Japan Car Loan Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Japan Car Loan Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 4: Japan Car Loan Market Volume Billion Forecast, by Ownership 2020 & 2033

- Table 5: Japan Car Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 6: Japan Car Loan Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 7: Japan Car Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 8: Japan Car Loan Market Volume Billion Forecast, by Tenure 2020 & 2033

- Table 9: Japan Car Loan Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Japan Car Loan Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Japan Car Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 12: Japan Car Loan Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 13: Japan Car Loan Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 14: Japan Car Loan Market Volume Billion Forecast, by Ownership 2020 & 2033

- Table 15: Japan Car Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 16: Japan Car Loan Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 17: Japan Car Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 18: Japan Car Loan Market Volume Billion Forecast, by Tenure 2020 & 2033

- Table 19: Japan Car Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Japan Car Loan Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Car Loan Market?

The projected CAGR is approximately 8.07%.

2. Which companies are prominent players in the Japan Car Loan Market?

Key companies in the market include SURUGA bank Ltd, Orient Corporation, Bank of Kyoto Ltd, MARUHAN Japan Bank Lao Co Ltd, The Senshu Ikeda Bank Ltd, Toyota Financial Services Corporation, The Kinokuni Shinkin Bank, Sompo Japan Insurance Inc, AK Kogyo Co Ltd, The 77 bank Ltd **List Not Exhaustive.

3. What are the main segments of the Japan Car Loan Market?

The market segments include Vehicle Type, Ownership, Provider Type, Tenure.

4. Can you provide details about the market size?

The market size is estimated to be USD 49.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Demand for Vehicles.

6. What are the notable trends driving market growth?

Passenger Cars in Japan Market.

7. Are there any restraints impacting market growth?

Increasing Consumer Demand for Vehicles.

8. Can you provide examples of recent developments in the market?

July 2023: Japanese prime auto loan issuer was to raise USD 251.6 million in U.S. ABS. OSCAR US Funding XV LLC is issuing three classes of notes totaling USD 251.6 million for OSCAR US 2023-1 with final maturities ranging from 2024 to 2027.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Car Loan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Car Loan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Car Loan Market?

To stay informed about further developments, trends, and reports in the Japan Car Loan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence