Key Insights

The German travel insurance market is projected for substantial growth, with a Compound Annual Growth Rate (CAGR) of 15.4%. This dynamic sector is expected to reach a market size of 26788.56 million Euros by the base year 2025. Key growth catalysts include increasing international travel by German citizens and heightened awareness of comprehensive travel protection benefits. Rising disposable incomes, a growing senior travel segment, and increased international student programs further bolster market expansion. Evolving travel regulations and the prevalence of unforeseen events, such as medical emergencies and trip cancellations, are driving demand for robust travel insurance solutions. The market is characterized by a strong preference for personalized insurance options, with significant demand for both single-trip and annual multi-trip policies.

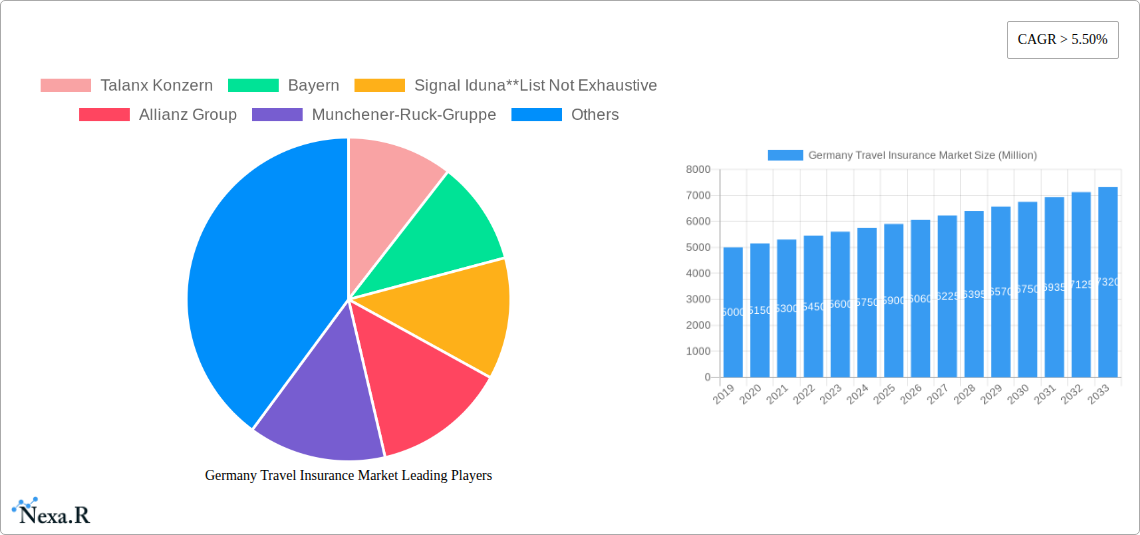

Germany Travel Insurance Market Market Size (In Billion)

Distribution channels for the German travel insurance market are diverse. Traditional insurance intermediaries and companies remain dominant, complemented by the growing influence of banks and insurance brokers offering bundled travel insurance. Insurance aggregators are also transforming consumer purchasing behavior by enhancing price transparency and competition. A notable trend is the increasing demand for digitized insurance processes, including online policy acquisition, claims management, and customer support, reflecting evolving consumer expectations. While the market outlook is highly positive, driven by a resilient travel industry and enhanced risk mitigation awareness, intense price competition and evolving regulatory frameworks may present challenges.

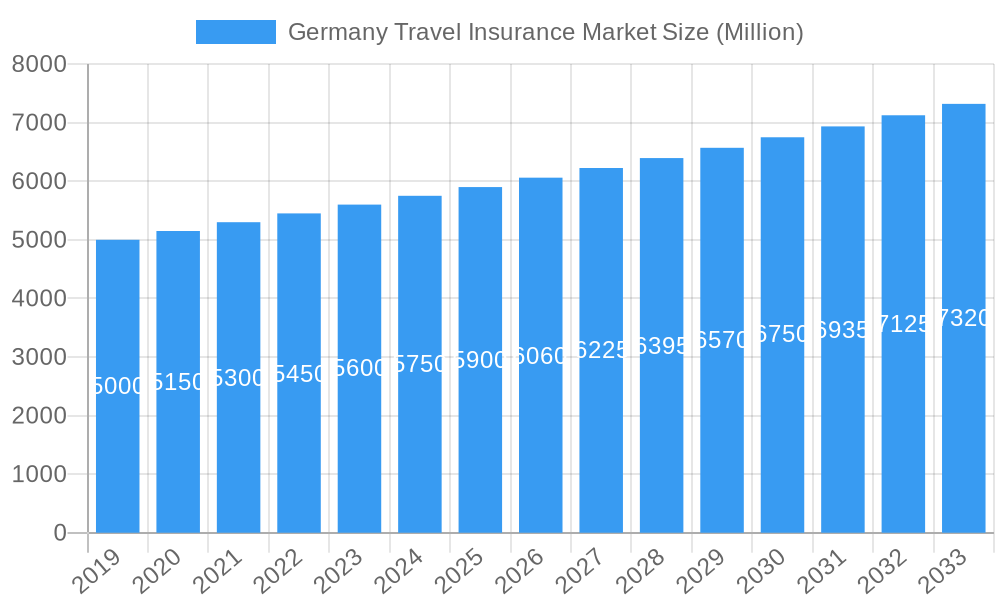

Germany Travel Insurance Market Company Market Share

Germany Travel Insurance Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a detailed analysis of the Germany travel insurance market, exploring its dynamics, growth trends, key players, and future potential. Covering the period from 2019 to 2033, with a base year of 2025, this report offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand the evolving landscape of travel protection in Germany. Leveraging high-traffic keywords such as Germany travel insurance, travel insurance Germany, single trip travel insurance, annual multi trip travel insurance, and travel insurance intermediaries, this report ensures maximum search engine visibility and industry relevance.

Germany Travel Insurance Market Market Dynamics & Structure

The Germany travel insurance market is characterized by a moderate to high concentration, with a few key players dominating a significant portion of the market share. Technological innovation is a primary driver, with advancements in digital platforms, AI-powered underwriting, and streamlined claims processing enhancing customer experience and operational efficiency. Regulatory frameworks, overseen by bodies like BaFin, are crucial in ensuring consumer protection and market stability, often influencing product development and distribution strategies. Competitive product substitutes, such as credit card travel insurance benefits or standalone travel cancellation plans, pose a challenge by offering alternative protection layers. End-user demographics, including a growing senior citizen segment seeking comprehensive medical coverage and family travelers prioritizing peace of mind, shape demand for specific policy features. Mergers and acquisitions (M&A) activity, while not as frequent as in some other financial sectors, plays a role in market consolidation and expansion. For instance, the ongoing integration of digital solutions and partnerships with travel service providers represent significant strategic moves.

- Market Concentration: Dominated by a few large insurers, but with increasing room for specialized providers.

- Technological Innovation: Focus on online sales platforms, mobile claims, and personalized policy offerings.

- Regulatory Framework: Stringent compliance requirements ensuring consumer trust and fair practices.

- Competitive Substitutes: Credit card benefits and standalone cancellation products offer alternative coverages.

- End-User Demographics: Rising demand from senior citizens for health coverage and family travelers for comprehensive protection.

- M&A Trends: Strategic acquisitions aimed at expanding digital capabilities and customer reach.

Germany Travel Insurance Market Growth Trends & Insights

The Germany travel insurance market is projected to witness robust growth throughout the forecast period. This expansion is fueled by increasing travel propensity, a heightened awareness of travel risks, and evolving consumer preferences for comprehensive protection. The market size is expected to grow from an estimated $XXX Million in 2025 to $XXX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX%. The adoption rate of travel insurance is steadily increasing as travelers recognize its indispensability for both domestic and international journeys. Technological disruptions, particularly the digital transformation of insurance distribution, are profoundly impacting market penetration. Online aggregators and direct-to-consumer platforms are making travel insurance more accessible and comparable, driving consumer behavior shifts towards informed purchasing decisions. The shift towards personalized insurance products, catering to specific travel needs and risk profiles, is another significant trend. For example, policies offering extended medical coverage for adventure sports or specific provisions for remote work travel are gaining traction. Furthermore, the increasing prevalence of global health concerns continues to underscore the importance of robust travel medical insurance, a core component of the Germany travel insurance sector. The recovery of the global tourism sector post-pandemic also acts as a significant growth accelerant, directly translating into higher demand for travel protection products. The integration of AI for risk assessment and claims processing is also enhancing efficiency and customer satisfaction, further contributing to positive market sentiment and growth projections.

Dominant Regions, Countries, or Segments in Germany Travel Insurance Market

The Germany travel insurance market exhibits dominance across several key segments, each driven by distinct factors. In terms of Coverage Type, Annual Multi Trip Travel Insurance is a significant growth driver, particularly among frequent travelers, business professionals, and families who undertake multiple trips annually. This segment offers convenience and cost-effectiveness compared to purchasing single-trip policies repeatedly. The Distribution Channel segment sees Insurance Intermediaries and Insurance Companies holding substantial market share, leveraging established customer relationships and expertise. However, Insurance Aggregators are rapidly gaining prominence due to their ability to offer price comparisons and a wide array of options, appealing to cost-conscious consumers. For End Users, Family Travelers represent a major segment, prioritizing comprehensive coverage that includes medical emergencies, trip cancellations, and lost baggage for all family members. The Senior Citizen segment is also crucial, with a growing demand for specialized policies offering extensive medical coverage, pre-existing condition inclusions, and repatriation services, reflecting the increasing life expectancy and global travel trends among this demographic. Economic policies that encourage outbound tourism and robust infrastructure supporting travel services also indirectly boost market growth. The increasing affordability of travel, coupled with a growing middle class, further fuels demand across these segments.

- Coverage Type Dominance:

- Annual Multi Trip Travel Insurance: Driven by frequent travelers and families seeking cost-effectiveness and convenience.

- Distribution Channel Influence:

- Insurance Intermediaries & Insurance Companies: Strong existing customer bases and expert advice.

- Insurance Aggregators: Rapidly growing due to price transparency and diverse product offerings.

- End User Segments:

- Family Travelers: High demand for comprehensive, all-inclusive protection.

- Senior Citizens: Growing demand for specialized medical coverage and repatriation services.

Germany Travel Insurance Market Product Landscape

The product landscape within the Germany travel insurance market is evolving to meet diverse consumer needs. Innovations focus on providing comprehensive coverage for various travel scenarios. Key product offerings include Single Trip Travel Insurance, ideal for occasional travelers, and Annual Multi Trip Travel Insurance, catering to frequent flyers. Advanced policies now incorporate broader medical coverage, including for pre-existing conditions and specific activities like adventure sports. Digital platforms enable personalized policy customization, allowing users to select add-ons for cancellation, baggage protection, and even specific destination risks. Performance metrics such as rapid claims processing and clear policy documentation are becoming crucial differentiators.

Key Drivers, Barriers & Challenges in Germany Travel Insurance Market

Key Drivers:

- Increasing Travel Frequency: A growing appetite for both domestic and international travel, especially post-pandemic, directly fuels demand for travel insurance.

- Heightened Awareness of Travel Risks: Global events, health concerns, and geopolitical uncertainties have increased consumer understanding of the need for comprehensive protection.

- Technological Advancements: Digitalization of sales and claims processes enhances accessibility and customer experience, driving adoption.

- Aging Population & Senior Travel: The growing senior demographic, with increased disposable income and leisure time, seeks robust medical coverage for international trips.

Barriers & Challenges:

- Price Sensitivity: Consumers often view travel insurance as an additional cost and may opt for cheaper or no coverage, especially for short trips.

- Market Saturation and Competition: Intense competition from established insurers and new entrants can lead to price wars and pressure on margins.

- Complex Policy Wording: Jargon-filled policies can lead to misunderstandings and disputes, impacting customer satisfaction and trust.

- Regulatory Compliance: Navigating and adhering to evolving insurance regulations requires significant investment and resources.

- Economic Downturns: Recessions can lead to reduced travel spending, consequently impacting the demand for travel insurance.

Emerging Opportunities in Germany Travel Insurance Market

Emerging opportunities in the Germany travel insurance market lie in catering to niche travel segments and leveraging technological advancements. The rise of remote work and digital nomadism presents an opportunity for specialized policies covering extended stays, health emergencies in remote locations, and liability. The growing interest in sustainable and eco-tourism could also drive demand for policies that offer coverage for carbon offsetting or support for eco-friendly travel disruptions. Furthermore, partnerships with travel technology providers, such as booking platforms and airlines, can offer integrated insurance solutions at the point of sale, capturing a wider customer base. The development of AI-powered personalized insurance products, which dynamically adjust coverage based on real-time risk assessments, also holds significant potential.

Growth Accelerators in the Germany Travel Insurance Market Industry

Several catalysts are accelerating growth in the Germany travel insurance market. The ongoing recovery and expansion of global tourism activities are a primary driver, directly translating into increased demand for travel protection. Strategic partnerships between insurance companies and travel agencies, airlines, and online travel agents (OTAs) are crucial for expanding reach and integrating insurance offerings seamlessly into the travel booking process. Technological breakthroughs in digital underwriting and claims management are streamlining operations, improving customer experience, and reducing costs, thereby making travel insurance more attractive. Furthermore, an increasing focus on consumer education regarding the benefits and importance of travel insurance is fostering greater market penetration. The development of flexible and customizable policy options, tailored to diverse travel needs, is also a significant growth accelerator.

Key Players Shaping the Germany Travel Insurance Market Market

- Talanx Konzern

- Allianz Group

- Munchener-Ruck-Gruppe

- AXA Konzern AG

- R+V Konzern

- Huk-Coburg

- Generali Deutschland AG

- Bayern

- Signal Iduna

Notable Milestones in Germany Travel Insurance Market Sector

- May 2022: Allianz Global Investors ('AllianzGI') entered into a memorandum of understanding ('MOU') with Voya Financial, indicating strategic realignments and potential for enhanced investment capabilities that could impact financial backing for insurance products.

- March 2022: Allianz Real Estate announced the acquisition of a multi-family residential asset portfolio in Tokyo, reflecting the company's broader financial strength and investment strategies that can support its insurance operations.

In-Depth Germany Travel Insurance Market Market Outlook

The Germany travel insurance market is poised for sustained growth, driven by a combination of favorable macro-economic trends and evolving consumer behavior. The increasing interconnectedness of the world and the persistent desire for travel experiences, coupled with a greater awareness of potential disruptions, will continue to fuel demand for comprehensive travel protection. Strategic alliances and technological innovations will be pivotal in enhancing accessibility, affordability, and the overall value proposition of travel insurance products. The market is expected to witness greater specialization, with insurers offering tailored solutions for diverse traveler profiles, including adventure enthusiasts, business travelers, and extended-stay tourists. A focus on seamless digital journeys, from policy purchase to claims settlement, will be critical for insurers to maintain a competitive edge and capitalize on the latent demand within this dynamic sector.

Germany Travel Insurance Market Segmentation

-

1. Coverage Type

- 1.1. Single Trip Travel Insurance

- 1.2. Annual Multi Trip Travel Insurance

-

2. Distribution Channel

- 2.1. Insurance Intermediaries

- 2.2. Insurance Companies

- 2.3. Banks

- 2.4. Insurance Brokers

- 2.5. Insurance Aggregators

-

3. End User

- 3.1. Senior Citizens

- 3.2. Education Travelers

- 3.3. Family Travelers

- 3.4. Others

Germany Travel Insurance Market Segmentation By Geography

- 1. Germany

Germany Travel Insurance Market Regional Market Share

Geographic Coverage of Germany Travel Insurance Market

Germany Travel Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digitalization is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Economic Disparities are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Robust Automotive Market will Augment the Multiple Trip Travel Insurance Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coverage Type

- 5.1.1. Single Trip Travel Insurance

- 5.1.2. Annual Multi Trip Travel Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Insurance Intermediaries

- 5.2.2. Insurance Companies

- 5.2.3. Banks

- 5.2.4. Insurance Brokers

- 5.2.5. Insurance Aggregators

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Senior Citizens

- 5.3.2. Education Travelers

- 5.3.3. Family Travelers

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Coverage Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Talanx Konzern

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayern

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Signal Iduna**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Allianz Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Munchener-Ruck-Gruppe

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AXA Konzern AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 R+V Konzern

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Huk-Coburg

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Generali Deutschland AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Talanx Konzern

List of Figures

- Figure 1: Germany Travel Insurance Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Germany Travel Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Travel Insurance Market Revenue million Forecast, by Coverage Type 2020 & 2033

- Table 2: Germany Travel Insurance Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Germany Travel Insurance Market Revenue million Forecast, by End User 2020 & 2033

- Table 4: Germany Travel Insurance Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Germany Travel Insurance Market Revenue million Forecast, by Coverage Type 2020 & 2033

- Table 6: Germany Travel Insurance Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Germany Travel Insurance Market Revenue million Forecast, by End User 2020 & 2033

- Table 8: Germany Travel Insurance Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Travel Insurance Market?

The projected CAGR is approximately 15.4%.

2. Which companies are prominent players in the Germany Travel Insurance Market?

Key companies in the market include Talanx Konzern, Bayern, Signal Iduna**List Not Exhaustive, Allianz Group, Munchener-Ruck-Gruppe, AXA Konzern AG, R+V Konzern, Huk-Coburg, Generali Deutschland AG.

3. What are the main segments of the Germany Travel Insurance Market?

The market segments include Coverage Type, Distribution Channel, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 26788.56 million as of 2022.

5. What are some drivers contributing to market growth?

Digitalization is Driving the Market.

6. What are the notable trends driving market growth?

Robust Automotive Market will Augment the Multiple Trip Travel Insurance Demand.

7. Are there any restraints impacting market growth?

Economic Disparities are Restraining the Market.

8. Can you provide examples of recent developments in the market?

On 17th May 2022, Allianz Global Investors ('AllianzGI') had entered into a memorandum of understanding ('MOU') with Voya Financial relating to a strategic partnership whereby AllianzGI would transfer selected investment teams and assets comprising most of its US business ('AGI US') to Voya Investment Management ('Voya IM') in return for an up to 24% equity stake in the enlarged asset manager.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Travel Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Travel Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Travel Insurance Market?

To stay informed about further developments, trends, and reports in the Germany Travel Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence