Key Insights

The Czech Republic Life Annuity Insurance Market is set for significant expansion, projected at a market size of 1.5 billion in the base year 2024. This growth is fueled by heightened retirement planning awareness and the sustained demand for guaranteed income amidst economic shifts. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 4% from 2024 to 2033, reaching an estimated 1.5 billion by the forecast period's end. Key drivers include an aging demographic seeking secure retirement options and supportive regulatory frameworks promoting long-term savings. Enhanced financial literacy is also empowering informed decisions regarding future financial security, increasing annuity product adoption.

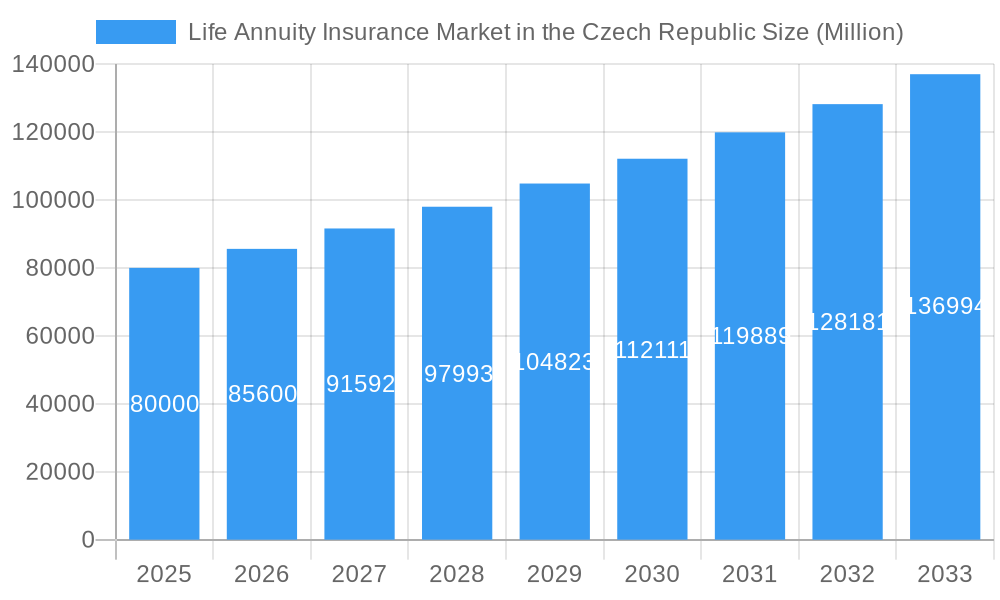

Life Annuity Insurance Market in the Czech Republic Market Size (In Billion)

The market's trajectory from 2019 to 2024 demonstrates consistent upward momentum. As the market matures, expect increased product innovation, with insurers offering more adaptable and tailored annuity solutions. This includes a rise in hybrid products combining guaranteed income with market-linked returns, appealing to individuals seeking a balance between security and growth. The robust Czech financial sector and a generally risk-averse populace further support the demand for stable income solutions, positioning life annuity insurance as a vital component of retirement planning. This projected growth signifies a healthy and dynamic market, reflecting a societal move towards proactive financial management for later life.

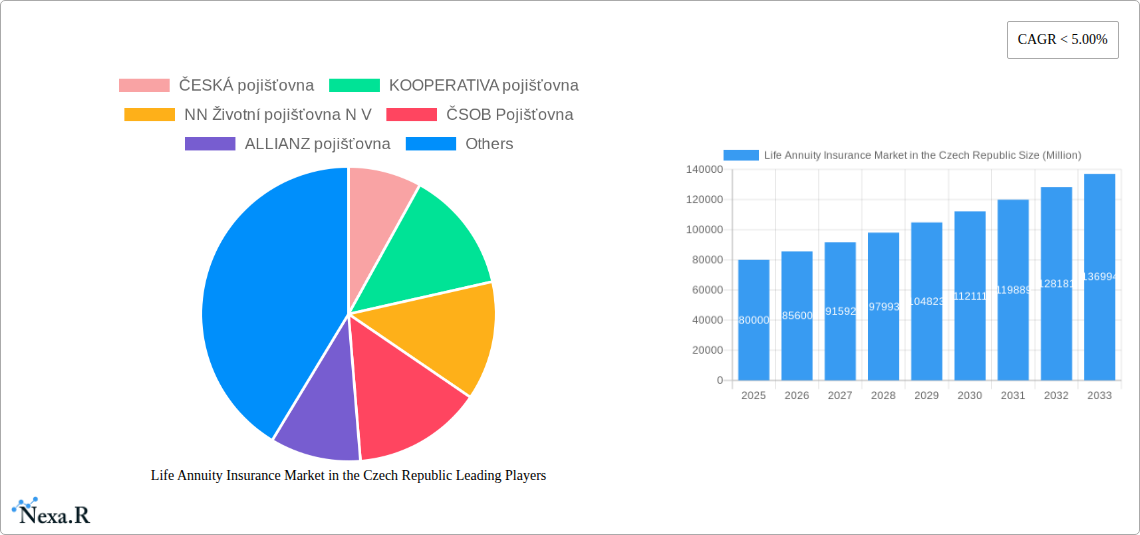

Life Annuity Insurance Market in the Czech Republic Company Market Share

Life Annuity Insurance Market in the Czech Republic: Comprehensive Market Analysis and Future Outlook (2019-2033)

This in-depth report provides a strategic overview of the Life Annuity Insurance Market in the Czech Republic, offering critical insights into market dynamics, growth drivers, competitive landscape, and future projections. Spanning the historical period of 2019-2024, with a base year of 2025 and a forecast period extending to 2033, this analysis is designed for industry professionals seeking to understand and capitalize on opportunities within this vital sector. We delve into both the parent market for life insurance and the specific child market of annuities, offering a nuanced perspective on market evolution and investment potential. All monetary values are presented in Million units.

Life Annuity Insurance Market in the Czech Republic Market Dynamics & Structure

The Life Annuity Insurance Market in the Czech Republic is characterized by a moderately concentrated structure, with a few key players holding significant market share. Technological innovation is increasingly a driver, particularly in digitalizing customer onboarding, claims processing, and product development, aiming to enhance customer experience and operational efficiency. Regulatory frameworks, overseen by bodies like the Czech National Bank (CNB), play a crucial role in shaping product offerings and ensuring solvency, impacting market concentration and fostering a stable yet competitive environment.

- Market Concentration: Dominated by established insurers, with a trend towards consolidation. The top 5 companies are estimated to hold over 65% of the market share.

- Technological Innovation Drivers: Digital transformation initiatives, AI-powered risk assessment, and blockchain for secure record-keeping are emerging as key innovation areas. Barriers to adoption include legacy system integration and the need for skilled IT professionals.

- Regulatory Frameworks: Strict adherence to Solvency II directives and consumer protection laws influence product design and pricing, ensuring market stability but also imposing compliance costs.

- Competitive Product Substitutes: While traditional life insurance products are primary substitutes, the growing popularity of investment funds, real estate, and pension savings plans presents alternative wealth accumulation avenues for consumers, indirectly impacting annuity demand.

- End-User Demographics: The aging population is a significant demographic driver, increasing demand for retirement income solutions. Younger demographics are more attuned to digital solutions and flexible product offerings.

- M&A Trends: The past five years have seen a few strategic acquisitions and mergers, driven by the pursuit of market consolidation and expanded product portfolios, with an estimated 3-5 significant M&A deals annually.

Life Annuity Insurance Market in the Czech Republic Growth Trends & Insights

The Life Annuity Insurance Market in the Czech Republic is poised for sustained growth, fueled by evolving consumer needs and a supportive economic environment. The market size is projected to expand significantly as an increasing number of individuals recognize the importance of securing their financial future post-retirement. Adoption rates are expected to climb, driven by enhanced awareness of long-term financial planning and the appeal of guaranteed income streams offered by annuities. Technological disruptions are not only streamlining operations but also creating new avenues for product innovation, such as personalized annuity plans tailored to individual risk appetites and income needs. This evolution in product design, coupled with a growing comfort level among consumers with digital channels for financial services, is reshaping consumer behavior shifts.

The market size for life annuity insurance in the Czech Republic has witnessed a steady increase, moving from an estimated 3,500 Million in 2019 to approximately 4,800 Million in 2024. The CAGR during this historical period was around 6.2%. Looking ahead, the market is forecasted to grow at a CAGR of approximately 7.5% from 2025 to 2033. This upward trajectory is underpinned by several factors. Firstly, the market penetration of annuity products, though still lower than in some Western European countries, is on an increasing trend. As of 2024, penetration is estimated at around 18%, with projections to reach over 25% by 2033. This growth is largely attributed to demographic shifts, with a growing segment of the population approaching retirement age and actively seeking reliable income solutions.

Furthermore, technological advancements are playing a pivotal role. Insurers are investing heavily in digital platforms that simplify the application process, offer transparent product comparisons, and provide personalized financial advice. This digital-first approach is crucial in attracting younger generations who are accustomed to online services. Innovations in data analytics allow for more accurate risk assessment and the development of bespoke annuity products that cater to diverse financial goals, including variable annuities linked to market performance and phased withdrawal options.

Consumer behavior shifts are also notable. There is a growing preference for financial products that offer security and predictability in an increasingly uncertain economic landscape. Annuities, with their promise of guaranteed income, directly address this need. Moreover, an increasing focus on financial literacy and proactive retirement planning is encouraging individuals to explore annuity options earlier in their careers. The shift from a purely savings-oriented mindset to a more income-focused approach for retirement is a significant trend that augments the demand for life annuity products. The government's pension reforms and the encouragement of private pension savings further bolster the market, creating a more favorable ecosystem for annuity providers.

Dominant Regions, Countries, or Segments in Life Annuity Insurance Market in the Czech Republic

The Life Annuity Insurance Market in the Czech Republic exhibits distinct dominance across various segments, with Life Insurance (Individual) standing out as the primary driver of market growth. This segment benefits from a confluence of factors, including a growing awareness of personal financial planning, increased disposable income among the working population, and the inherent need for long-term financial security post-retirement. The Channel of distribution through Banks also plays a crucial role, leveraging established customer relationships and trust to offer annuity products as part of broader financial advisory services.

Dominant Segment: Life Insurance (Individual)

- Market Share: This segment is estimated to account for approximately 70% of the total life annuity market revenue in 2025.

- Key Drivers: Rising individual financial literacy, increasing demand for personalized retirement income solutions, and the desire for guaranteed financial stability in later life. Economic policies encouraging private savings also contribute significantly.

- Growth Potential: Strong demographic trends, particularly the aging population, ensure sustained demand. Innovations in flexible payout options and index-linked annuities are further enhancing its appeal.

Significant Distribution Channel: Banks

- Market Share: Banks are projected to facilitate around 40% of new annuity sales in 2025, acting as crucial intermediaries.

- Dominance Factors: Existing customer base, established trust, and the ability to offer bundled financial solutions (e.g., mortgages, savings accounts, and life insurance). Banks are well-positioned to provide holistic financial advice that often includes annuity recommendations.

- Strategic Importance: Insurers heavily rely on bank partnerships for market reach, particularly in urban centers where bank penetration is high.

Emerging Segments: Group Life Insurance and Direct Channels

- Group Life Insurance: While smaller, this segment is growing, particularly within large corporations that offer annuity plans as part of employee benefits and retirement packages.

- Direct Channels: Digital platforms and direct-to-consumer marketing are gaining traction, especially among younger, tech-savvy consumers, offering a more accessible and potentially cost-effective route to purchasing annuities.

Influence of Non-Life Insurance: While not directly part of the annuity market, the health of the Non-Life Insurance sector, particularly Home and Motor insurance, indirectly reflects the overall economic stability and consumer confidence, which can influence discretionary spending on long-term financial products like annuities. A strong economy supporting these sectors often correlates with a more robust demand for life insurance products.

Life Annuity Insurance Market in the Czech Republic Product Landscape

The Life Annuity Insurance Market in the Czech Republic is evolving with a focus on enhanced customer-centricity and product innovation. Traditional fixed annuities, providing guaranteed, predictable income streams, remain a cornerstone, appealing to risk-averse individuals seeking stability in retirement. However, the landscape is expanding to include more sophisticated options like variable annuities, where payouts are linked to underlying investment performance, offering the potential for higher returns but with increased market risk. Unit-linked annuities, combining insurance coverage with investment components, are also gaining traction. Product applications are diverse, ranging from immediate annuities for instant income generation to deferred annuities that allow for a period of accumulation before payouts commence. Performance metrics are increasingly being benchmarked against inflation and market benchmarks, with a growing emphasis on transparency in fees and charges.

Key Drivers, Barriers & Challenges in Life Annuity Insurance Market in the Czech Republic

The Life Annuity Insurance Market in the Czech Republic is propelled by several key drivers, primarily the aging demographic and an increasing societal emphasis on retirement planning. Government initiatives promoting private pension savings and the search for stable, guaranteed income streams in an era of low interest rates for traditional savings accounts further fuel market expansion. Technological advancements in digital onboarding and personalized financial advisory also act as significant growth accelerators.

- Key Drivers:

- Aging population and increased life expectancy.

- Growing awareness of retirement planning needs.

- Low interest rate environment for conventional savings.

- Government policies encouraging private pension accumulation.

- Technological adoption for enhanced customer experience.

However, the market faces significant barriers and challenges. Low financial literacy regarding complex annuity products can deter potential customers. Regulatory hurdles and the associated compliance costs for insurers can impact product affordability. Intense competitive pressures from other savings and investment vehicles, such as mutual funds and real estate, also pose a restraint. Furthermore, economic downturns and inflation can erode the real value of guaranteed annuity payments, creating a perception of risk.

- Key Barriers & Challenges:

- Limited financial literacy among consumers.

- Stringent regulatory compliance requirements.

- Competition from alternative investment products.

- Perceived complexity and lack of flexibility in some annuity products.

- Economic volatility and inflation impacting real returns.

Emerging Opportunities in Life Annuity Insurance Market in the Czech Republic

Emerging opportunities in the Czech Life Annuity Insurance Market lie in catering to evolving consumer preferences for greater flexibility and personalization. The development of hybrid products that combine guaranteed income with investment options, allowing for participation in market growth while offering a safety net, presents a significant avenue. Untapped markets within younger demographics who can be educated on long-term financial planning and the benefits of early annuity investments offer substantial growth potential. Furthermore, leveraging advanced data analytics to create bespoke annuity solutions tailored to specific life stages and risk appetites, alongside exploring new distribution channels like FinTech partnerships, are promising strategies for market expansion.

Growth Accelerators in the Life Annuity Insurance Market in the Czech Republic Industry

Several catalysts are driving long-term growth in the Life Annuity Insurance Market in the Czech Republic. Technological breakthroughs, particularly in AI and big data analytics, are enabling more sophisticated product development, personalized customer engagement, and efficient risk management. Strategic partnerships between insurance companies, banks, and FinTech firms are crucial for expanding distribution reach and offering integrated financial solutions. Market expansion strategies, including the development of innovative annuity products that address emerging needs like long-term care financing or inflation protection, will further accelerate growth. Educational initiatives aimed at improving financial literacy regarding retirement planning will also play a vital role in stimulating demand.

Key Players Shaping the Life Annuity Insurance Market in the Czech Republic Market

The Life Annuity Insurance Market in the Czech Republic is shaped by a combination of domestic and international insurers. Key players include:

- ČESKÁ pojišťovna

- KOOPERATIVA pojišťovna

- NN Životní pojišťovna N V

- ČSOB Pojišťovna

- ALLIANZ pojišťovna

- SLAVIA pojišťovna

- UNIQA pojišťovna

- BNP Paribas Cardif Pojišťovna

- MetLife Europe

- AXA pojišťovn

Notable Milestones in Life Annuity Insurance Market in the Czech Republic Sector

- 2019: Introduction of new flexible annuity products catering to diverse retirement income needs.

- 2020: Increased adoption of digital platforms for sales and customer service, accelerated by pandemic-related shifts.

- 2021: Regulatory updates focusing on enhanced consumer protection and transparency in annuity products.

- 2022: Strategic partnerships between insurers and FinTech companies to streamline annuity sales.

- 2023: Growth in demand for hybrid annuity products offering a blend of guaranteed and market-linked returns.

- 2024: Focus on personalized annuity solutions driven by advanced data analytics and customer segmentation.

In-Depth Life Annuity Insurance Market in the Czech Republic Market Outlook

The future outlook for the Life Annuity Insurance Market in the Czech Republic is robust, driven by the persistent need for secure retirement income solutions and an increasingly sophisticated consumer base. Growth accelerators such as technological innovation, strategic collaborations, and the development of tailored annuity products will continue to propel the market forward. The aging demographic remains a fundamental driver, ensuring sustained demand for products that provide financial stability. Strategic opportunities lie in further enhancing product flexibility, improving financial literacy through targeted education campaigns, and expanding distribution networks, particularly through digital channels and partnerships. The market is expected to witness continuous evolution, with a strong emphasis on customer-centricity and innovation to meet the diverse financial aspirations of Czech citizens.

Life Annuity Insurance Market in the Czech Republic Segmentation

-

1. Insurance Type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life Insurance

- 1.2.1. Home

- 1.2.2. Motor

-

1.1. Life Insurance

-

2. Channel of distribution

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Others

Life Annuity Insurance Market in the Czech Republic Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

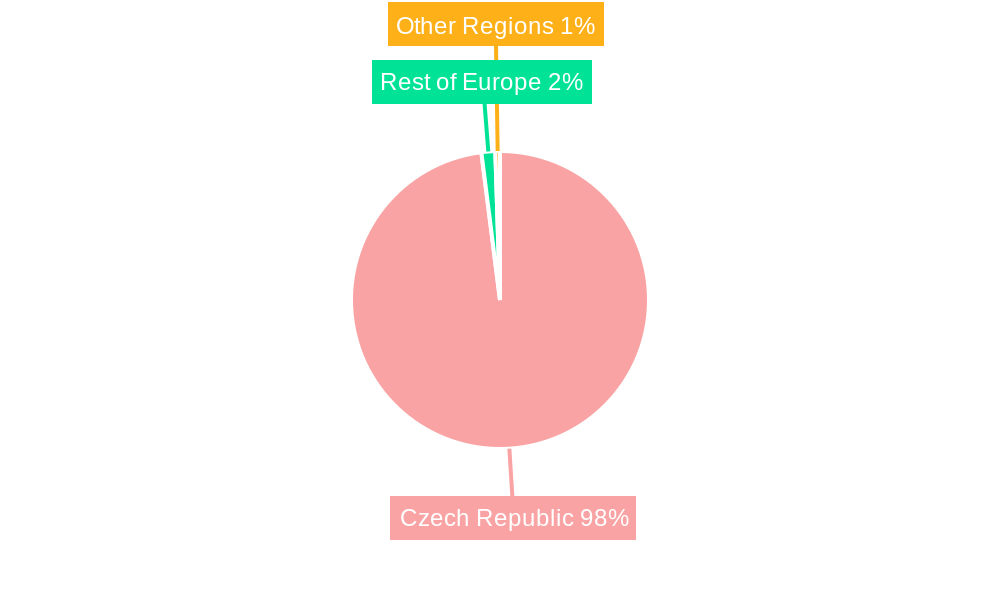

Life Annuity Insurance Market in the Czech Republic Regional Market Share

Geographic Coverage of Life Annuity Insurance Market in the Czech Republic

Life Annuity Insurance Market in the Czech Republic REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Few Companies Captures Major Market Share in Czech Republic Insurance Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Life Annuity Insurance Market in the Czech Republic Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life Insurance

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Channel of distribution

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. North America Life Annuity Insurance Market in the Czech Republic Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6.1.1. Life Insurance

- 6.1.1.1. Individual

- 6.1.1.2. Group

- 6.1.2. Non-Life Insurance

- 6.1.2.1. Home

- 6.1.2.2. Motor

- 6.1.1. Life Insurance

- 6.2. Market Analysis, Insights and Forecast - by Channel of distribution

- 6.2.1. Direct

- 6.2.2. Agency

- 6.2.3. Banks

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7. South America Life Annuity Insurance Market in the Czech Republic Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7.1.1. Life Insurance

- 7.1.1.1. Individual

- 7.1.1.2. Group

- 7.1.2. Non-Life Insurance

- 7.1.2.1. Home

- 7.1.2.2. Motor

- 7.1.1. Life Insurance

- 7.2. Market Analysis, Insights and Forecast - by Channel of distribution

- 7.2.1. Direct

- 7.2.2. Agency

- 7.2.3. Banks

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8. Europe Life Annuity Insurance Market in the Czech Republic Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8.1.1. Life Insurance

- 8.1.1.1. Individual

- 8.1.1.2. Group

- 8.1.2. Non-Life Insurance

- 8.1.2.1. Home

- 8.1.2.2. Motor

- 8.1.1. Life Insurance

- 8.2. Market Analysis, Insights and Forecast - by Channel of distribution

- 8.2.1. Direct

- 8.2.2. Agency

- 8.2.3. Banks

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9. Middle East & Africa Life Annuity Insurance Market in the Czech Republic Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9.1.1. Life Insurance

- 9.1.1.1. Individual

- 9.1.1.2. Group

- 9.1.2. Non-Life Insurance

- 9.1.2.1. Home

- 9.1.2.2. Motor

- 9.1.1. Life Insurance

- 9.2. Market Analysis, Insights and Forecast - by Channel of distribution

- 9.2.1. Direct

- 9.2.2. Agency

- 9.2.3. Banks

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 10. Asia Pacific Life Annuity Insurance Market in the Czech Republic Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Insurance Type

- 10.1.1. Life Insurance

- 10.1.1.1. Individual

- 10.1.1.2. Group

- 10.1.2. Non-Life Insurance

- 10.1.2.1. Home

- 10.1.2.2. Motor

- 10.1.1. Life Insurance

- 10.2. Market Analysis, Insights and Forecast - by Channel of distribution

- 10.2.1. Direct

- 10.2.2. Agency

- 10.2.3. Banks

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Insurance Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ČESKÁ pojišťovna

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 KOOPERATIVA pojišťovna

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NN Životní pojišťovna N V

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ČSOB Pojišťovna

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ALLIANZ pojišťovna

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SLAVIA pojišťovna

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 UNIQA pojišťovna

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BNP Paribas Cardif Pojišťovna

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MetLife Europe

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 AXA pojišťovn

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ČESKÁ pojišťovna

List of Figures

- Figure 1: Global Life Annuity Insurance Market in the Czech Republic Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Life Annuity Insurance Market in the Czech Republic Revenue (billion), by Insurance Type 2025 & 2033

- Figure 3: North America Life Annuity Insurance Market in the Czech Republic Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 4: North America Life Annuity Insurance Market in the Czech Republic Revenue (billion), by Channel of distribution 2025 & 2033

- Figure 5: North America Life Annuity Insurance Market in the Czech Republic Revenue Share (%), by Channel of distribution 2025 & 2033

- Figure 6: North America Life Annuity Insurance Market in the Czech Republic Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Life Annuity Insurance Market in the Czech Republic Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Life Annuity Insurance Market in the Czech Republic Revenue (billion), by Insurance Type 2025 & 2033

- Figure 9: South America Life Annuity Insurance Market in the Czech Republic Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 10: South America Life Annuity Insurance Market in the Czech Republic Revenue (billion), by Channel of distribution 2025 & 2033

- Figure 11: South America Life Annuity Insurance Market in the Czech Republic Revenue Share (%), by Channel of distribution 2025 & 2033

- Figure 12: South America Life Annuity Insurance Market in the Czech Republic Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Life Annuity Insurance Market in the Czech Republic Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Life Annuity Insurance Market in the Czech Republic Revenue (billion), by Insurance Type 2025 & 2033

- Figure 15: Europe Life Annuity Insurance Market in the Czech Republic Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 16: Europe Life Annuity Insurance Market in the Czech Republic Revenue (billion), by Channel of distribution 2025 & 2033

- Figure 17: Europe Life Annuity Insurance Market in the Czech Republic Revenue Share (%), by Channel of distribution 2025 & 2033

- Figure 18: Europe Life Annuity Insurance Market in the Czech Republic Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Life Annuity Insurance Market in the Czech Republic Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Life Annuity Insurance Market in the Czech Republic Revenue (billion), by Insurance Type 2025 & 2033

- Figure 21: Middle East & Africa Life Annuity Insurance Market in the Czech Republic Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 22: Middle East & Africa Life Annuity Insurance Market in the Czech Republic Revenue (billion), by Channel of distribution 2025 & 2033

- Figure 23: Middle East & Africa Life Annuity Insurance Market in the Czech Republic Revenue Share (%), by Channel of distribution 2025 & 2033

- Figure 24: Middle East & Africa Life Annuity Insurance Market in the Czech Republic Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Life Annuity Insurance Market in the Czech Republic Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Life Annuity Insurance Market in the Czech Republic Revenue (billion), by Insurance Type 2025 & 2033

- Figure 27: Asia Pacific Life Annuity Insurance Market in the Czech Republic Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 28: Asia Pacific Life Annuity Insurance Market in the Czech Republic Revenue (billion), by Channel of distribution 2025 & 2033

- Figure 29: Asia Pacific Life Annuity Insurance Market in the Czech Republic Revenue Share (%), by Channel of distribution 2025 & 2033

- Figure 30: Asia Pacific Life Annuity Insurance Market in the Czech Republic Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Life Annuity Insurance Market in the Czech Republic Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Life Annuity Insurance Market in the Czech Republic Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 2: Global Life Annuity Insurance Market in the Czech Republic Revenue billion Forecast, by Channel of distribution 2020 & 2033

- Table 3: Global Life Annuity Insurance Market in the Czech Republic Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Life Annuity Insurance Market in the Czech Republic Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 5: Global Life Annuity Insurance Market in the Czech Republic Revenue billion Forecast, by Channel of distribution 2020 & 2033

- Table 6: Global Life Annuity Insurance Market in the Czech Republic Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Life Annuity Insurance Market in the Czech Republic Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 11: Global Life Annuity Insurance Market in the Czech Republic Revenue billion Forecast, by Channel of distribution 2020 & 2033

- Table 12: Global Life Annuity Insurance Market in the Czech Republic Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Life Annuity Insurance Market in the Czech Republic Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 17: Global Life Annuity Insurance Market in the Czech Republic Revenue billion Forecast, by Channel of distribution 2020 & 2033

- Table 18: Global Life Annuity Insurance Market in the Czech Republic Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Life Annuity Insurance Market in the Czech Republic Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 29: Global Life Annuity Insurance Market in the Czech Republic Revenue billion Forecast, by Channel of distribution 2020 & 2033

- Table 30: Global Life Annuity Insurance Market in the Czech Republic Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Life Annuity Insurance Market in the Czech Republic Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 38: Global Life Annuity Insurance Market in the Czech Republic Revenue billion Forecast, by Channel of distribution 2020 & 2033

- Table 39: Global Life Annuity Insurance Market in the Czech Republic Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Life Annuity Insurance Market in the Czech Republic Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Life Annuity Insurance Market in the Czech Republic?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Life Annuity Insurance Market in the Czech Republic?

Key companies in the market include ČESKÁ pojišťovna, KOOPERATIVA pojišťovna, NN Životní pojišťovna N V, ČSOB Pojišťovna, ALLIANZ pojišťovna, SLAVIA pojišťovna, UNIQA pojišťovna, BNP Paribas Cardif Pojišťovna, MetLife Europe, AXA pojišťovn.

3. What are the main segments of the Life Annuity Insurance Market in the Czech Republic?

The market segments include Insurance Type, Channel of distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.5 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Few Companies Captures Major Market Share in Czech Republic Insurance Industry:.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Life Annuity Insurance Market in the Czech Republic," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Life Annuity Insurance Market in the Czech Republic report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Life Annuity Insurance Market in the Czech Republic?

To stay informed about further developments, trends, and reports in the Life Annuity Insurance Market in the Czech Republic, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence